Fill Out Your Cashiers Check Pdf Form

Navigating the nuances of banking forms can be challenging, but understanding the Cashier’s Check PDF form can make the process straightforward. This essential document is tied to First Service Federal Credit Union and serves as an affidavit for members who need to report a lost, misplaced, or stolen cashier's check. Completing this form requires not only careful attention to detail but also the validation of a Notary Public, underscoring its importance in safeguarding your financial interests. Key elements include specifying the cashier's check number, account details, and the name to whom the check was made payable. The form also includes a sworn declaration affirming that the member has not benefited from the proceeds of the lost check. This is particularly important when trying to void a check that may be floating out in the system. Engaging with this process, members can ensure their assertions hold weight and take the necessary steps to prevent unauthorized access to their funds.

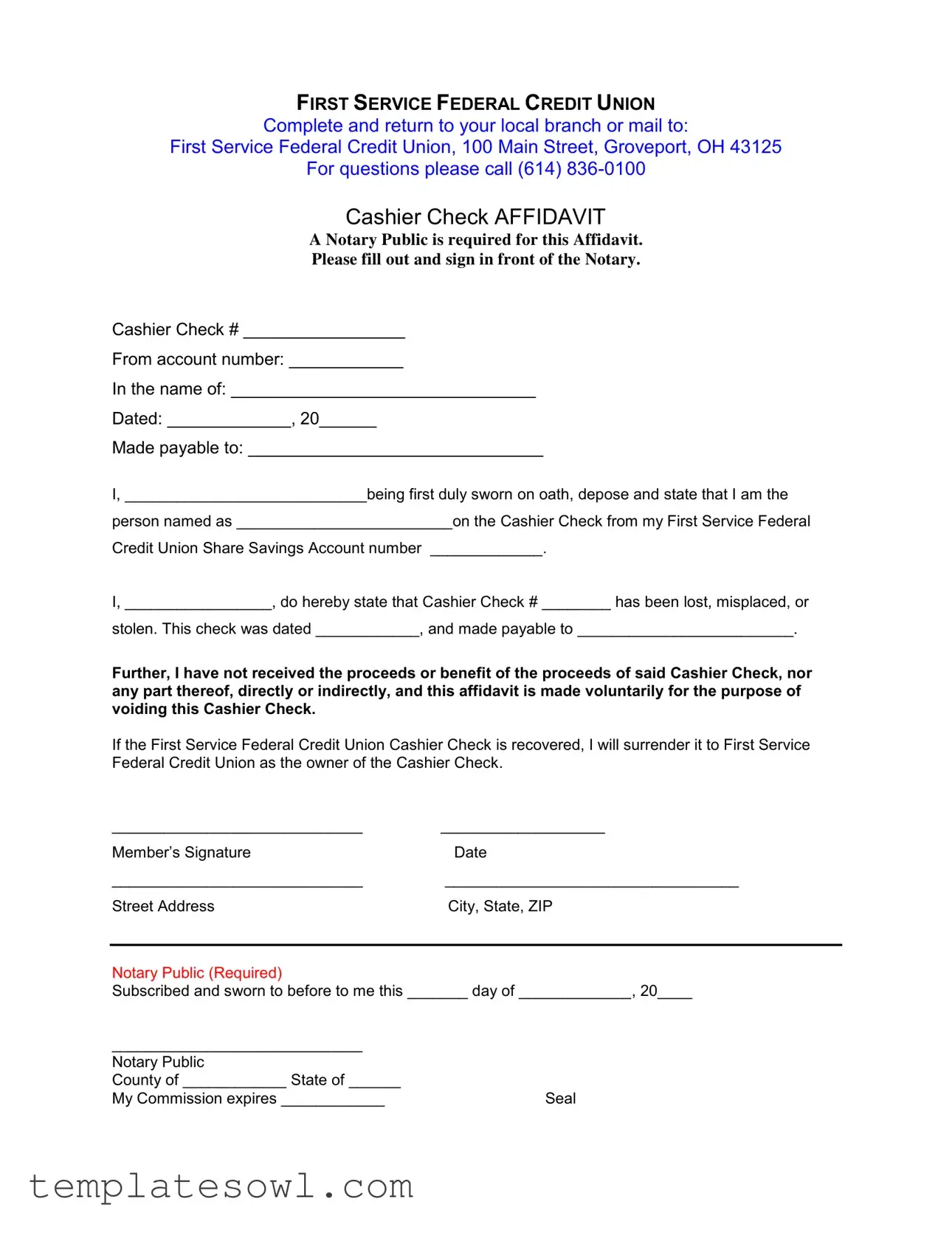

Cashiers Check Pdf Example

FIRST SERVICE FEDERAL CREDIT UNION

Complete and return to your local branch or mail to:

First Service Federal Credit Union, 100 Main Street, Groveport, OH 43125

For questions please call (614)

Cashier Check AFFIDAVIT

A Notary Public is required for this Affidavit.

Please fill out and sign in front of the Notary.

Cashier Check # _________________

From account number: ____________

In the name of: ________________________________

Dated: _____________, 20______

Made payable to: _______________________________

I, ____________________________being first duly sworn on oath, depose and state that I am the

person named as _________________________on the Cashier Check from my First Service Federal

Credit Union Share Savings Account number _____________.

I, _________________, do hereby state that Cashier Check # ________ has been lost, misplaced, or

stolen. This check was dated ____________, and made payable to _________________________.

Further, I have not received the proceeds or benefit of the proceeds of said Cashier Check, nor any part thereof, directly or indirectly, and this affidavit is made voluntarily for the purpose of voiding this Cashier Check.

If the First Service Federal Credit Union Cashier Check is recovered, I will surrender it to First Service Federal Credit Union as the owner of the Cashier Check.

_____________________________ |

___________________ |

Member’s Signature |

Date |

_____________________________ |

__________________________________ |

Street Address |

City, State, ZIP |

Notary Public (Required)

Subscribed and sworn to before to me this _______ day of _____________, 20____

_____________________________ |

|

Notary Public |

|

County of ____________ State of ______ |

|

My Commission expires ____________ |

Seal |

Form Characteristics

| Fact Name | Description |

|---|---|

| Issuing Institution | The Cashier Check is issued by First Service Federal Credit Union, which is located at 100 Main Street, Groveport, OH 43125. |

| Notary Requirement | To finalize the Affidavit, it is necessary to have it signed in the presence of a Notary Public, ensuring the authenticity of the statements made. |

| Affidavit Purpose | The purpose of the Affidavit is to declare that the Cashier Check has been lost, misplaced, or stolen, enabling the account holder to void the check. |

| Governing Laws | This Cashier Check and its associated affidavit are governed by the laws of the State of Ohio, which regulate banking and financial transactions. |

Guidelines on Utilizing Cashiers Check Pdf

Filling out the Cashier Check PDF form is an essential step in addressing the situation where a check has been lost, misplaced, or stolen. After you complete the form and have it notarized, you will return it to your local branch or mail it to the provided address. The following steps will guide you through the process of filling out this form correctly.

- Start by gathering any necessary information, including your account number and details about the cashier's check.

- Open the Cashier Check PDF form on your device.

- Locate the section labeled "Cashier Check #" and fill in the number of the lost check.

- In the "From account number" field, enter your First Service Federal Credit Union account number.

- Write your name in the "In the name of" section.

- Date the form by entering today’s date in the "Dated" field.

- Next, fill in the "Made payable to" section with the name of the payee or entity the check was originally issued to.

- In the statement "I, ____________________________being first duly sworn on oath," write your full name.

- For the statement "on the Cashier Check from my First Service Federal Credit Union Share Savings Account number," fill in your account number again.

- In the statement, "I, ________________," add your name again.

- For "Cashier Check # ________," write the check number of the missing or stolen check again.

- Fill in the date the check was issued in "This check was dated ____________." Be mindful to match the original issue date.

- In the "made payable to" line, write the same name you used earlier.

- In the final section about receiving proceeds, affirm that you have not received any part of the proceeds from this check.

- Sign the form in the designated area labeled "Member's Signature" and date it.

- Provide your street address, city, state, and ZIP code in the appropriate fields.

- Find a Notary Public to witness your signature. They will need to fill out their section on the form for it to be valid.

- Confirm that the Notary Public has properly signed and stamped the document before you submit it.

What You Should Know About This Form

What is a Cashier's Check?

A cashier's check is a check guaranteed by a bank. The bank draws the check on its own funds and signs it, ensuring that the amount is available. This type of check offers reliable payment and is often used in transactions where a guaranteed form of payment is required.

Why would I need to complete a Cashier's Check PDF form?

You need to complete this form to request a cashier's check from First Service Federal Credit Union. It provides necessary information such as the check number, your account details, and the payee's name. Proper completion ensures swift processing of your request.

What should I fill out in the Cashier's Check PDF form?

In the form, you will need to enter the cashier's check number, your account number, your name, the date, and the payee's name. Make sure to provide all necessary details accurately to avoid any delays in processing your request.

What happens if my Cashier's Check is lost or stolen?

If your cashier's check is lost or stolen, you must complete the affidavit section of the Cashier's Check PDF form. This affidavit requires you to swear under oath that the check has been lost, misplaced, or stolen, and you have not benefited from it in any way.

Is a notary public required for the affidavit?

Yes, a notary public must witness your completion of the affidavit. You must fill out and sign the affidavit in front of the notary, who will then provide their official seal and signature to verify that you have provided accurate information under oath.

What should I do if I recover my Cashier's Check?

If you recover your cashier's check after submitting the affidavit, you must surrender it to First Service Federal Credit Union. This step is crucial because the credit union needs to confirm the check’s status and prevent any double payment.

Can I complete the Cashier's Check PDF form online?

The form can typically be downloaded and filled out online. However, you will need to print it to sign the affidavit in front of a notary as electronic signatures are usually not accepted for this purpose.

How do I submit the Cashier's Check PDF form?

You can submit the completed form by either returning it to your local branch or mailing it to First Service Federal Credit Union at the specified address: 100 Main Street, Groveport, OH 43125. Ensure you send it through a reliable method to track delivery.

What if I have additional questions about the Cashier's Check?

If you have further questions, you can call First Service Federal Credit Union at (614) 836-0100. Customer service representatives are available to assist you with any inquiries regarding the cashier's check or form completion.

Common mistakes

Completing the Cashier Check PDF form correctly is essential for ensuring that transactions proceed smoothly. However, many individuals make significant mistakes that can lead to delays or even denial of requests. Here are seven common errors to avoid when filling out this important form.

One prevalent mistake is leaving critical fields blank. The form requires various pieces of information, like the cashier check number, account number, and the name of the individual. Omitting any of this information can hinder the processing of your request. Always double-check your form to ensure these elements are complete.

Another frequent error is not using a clear and legible handwriting. If the information is difficult to read, it may lead to confusion and inaccuracies in processing the request. Using a printed format or carefully written text can help alleviate this issue. Taking the time to write clearly will save effort down the line.

People often forget the importance of the notary section. This affidavit requires a notary public's signature, but many forget to have it notarized before submission. It is essential to complete this portion properly, as failure to do so invalidates the document. Make it a priority to arrange for notarization when filling out the form.

Some individuals ignore the need to provide accurate dates. The form calls for precise information, including the date the check was lost or stolen. Using incorrect dates can result in confusion or the potential rejection of the request. Always verify that the dates match your situation.

Another oversight occurs when individuals fail to sign the affidavit. It may seem trivial, but an unsigned affidavit is not a legal document. Ensure that your signature is included and that the date of signing is clear. This small detail is crucial for the validity of the affidavit.

Incorrectly stating the payee's name on the form can also pose a significant problem. The name must match what is recorded at the financial institution. A minor spelling error or incorrect name can result in delays or complications in processing the check. Verifying this information ahead of time can prevent issues.

Finally, forgetting to include contact information for follow-up is a common mistake. Including your current address and phone number allows the credit union to reach you if further questions or issues arise. This step is often overlooked but is essential for efficient communication and resolution.

By paying attention to these areas, individuals can better ensure that their Cashier Check PDF form is completed accurately and effectively. Avoiding these pitfalls will make for a smoother experience in resolving banking matters.

Documents used along the form

This document serves as a guide to other forms and documents that may be necessary in conjunction with the Cashier's Check form. Understanding these related documents can provide clarity and ensure that all necessary steps are taken in a timely manner. Below is a list of commonly used forms that may accompany or follow the Cashier's Check process.

- Affidavit of Loss: This document allows a person to officially declare that a cashier's check has been lost, stolen, or destroyed. It usually requires notarization and serves as evidence when requesting a replacement check.

- Replacement Check Request Form: When a cashier's check has been reported lost or stolen, this form initiates the process for issuing a new check. The requester must provide details about the original check.

- Identification Verification Form: Financial institutions often require this form to verify the identity of individuals requesting the issuance of a new cashier's check. It may ask for personal identification details.

- Bank Account Statement: This statement provides a record of all transactions associated with an account. It may be required to establish ownership of the original cashier's check.

- Power of Attorney: If someone is acting on behalf of another person in financial matters, a power of attorney form may be necessary. This document allows the appointed individual to handle transactions related to the cashier's check.

- Request for Investigation Form: In cases where a cashier's check is suspected to have been fraudulently issued, this form can be submitted to the bank for further investigation.

- Transfer of Ownership Form: If a cashier's check is being reissued in the name of a different individual, this form will establish the change of ownership and must be completed properly.

- Customer Information Update Form: Should any personal details have changed since opening the account, this form will help ensure that the bank has the most current information on file.

- Privacy Notice Acknowledgment: Financial institutions are required to provide privacy notices to their account holders. Acknowledgment of receipt may be required when dealing with cashier's checks.

- Dispute Resolution Form: Should there be any disputes regarding the status or validity of a cashier's check, this form outlines the steps for resolving any issues with the bank.

Each one of these documents plays a vital role in the process associated with cashier's checks. Being well-informed can lead to a smoother experience, whether you are replacing a lost check, disputing an issue, or handling financial transactions on behalf of someone else. It is always advisable to keep records and seek guidance whenever necessary.

Similar forms

The Cashier's Check PDF form shares similarities with various other financial documents. Here are four documents that resemble the Cashier's Check and explain how:

- Money Order: A money order is a prepaid financial instrument used to pay for goods and services. Like a cashier's check, it guarantees payment, as the funds are drawn from the purchaser’s account at the moment of purchase. Both documents serve as secure methods of payment.

- Bank Draft: A bank draft is also a payment method issued by a bank on behalf of a payer, similar to a cashier’s check. It is prepaid and guarantees that the funds will be available. Both documents offer security for the payee, as they are backed by the bank’s funds.

- Certified Check: A certified check is a personal check that a bank guarantees. After verifying that the payer has sufficient funds, the bank sets aside the amount for the check. Like the cashier's check, it provides assurance to the recipient that the payment will go through.

- Affidavit of Lost Check: This document outlines the details of a lost or stolen check. While it is not a payment method itself, it serves a similar purpose when the original payment instrument, like a cashier's check, cannot be located. The affidavit allows the issuer to void the original check and may lead to reissuance.

Dos and Don'ts

When filling out the Cashier Check PDF form, there are several important dos and don'ts to keep in mind. Follow these guidelines to ensure your form is completed correctly.

- Do use clear and legible handwriting when filling out the form.

- Do double-check all account numbers and personal information for accuracy.

- Do sign the affidavit in front of a Notary Public.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank; fill in all sections.

- Don't rush the process; take your time to ensure everything is correct.

Misconceptions

Understanding cashier's checks is essential for anyone using this financial instrument. Here are ten misconceptions about the Cashier’s Check PDF form:

- Cashier's checks can be created without a bank's involvement. Many believe they can write a cashier's check themselves. In reality, these checks must be issued by a bank to guarantee the funds.

- Cashier's checks are the same as personal checks. While both can authorize payments, a cashier's check is backed by the bank's funds. This makes it more secure than a personal check.

- A notary is optional for the Cashier Check Affidavit. Some think having a notary is unnecessary. However, the form explicitly requires notarization to validate the affidavit.

- There is no need to report a lost or stolen cashier's check. People often assume that simply filling out the affidavit is enough. It is also important to notify the issuing bank to prevent potential fraud.

- Cashier's checks never expire. Many individuals think these checks remain valid indefinitely. In fact, banks may have policies that void checks after a certain period, typically six months to a year.

- All cashier's checks can be cashed anywhere. While they are widely accepted, certain institutions may refuse them. It is advisable to check the cashing policy of the receiving bank.

- There are no fees associated with cashier's checks. Some people believe this service is free. Banks often charge a fee for issuing a cashier's check, so checking with the bank beforehand is wise.

- Cashier's checks provide 100% fraud protection. While they are secure, they are not foolproof. Scammers may produce counterfeit cashier's checks, so verify the source before accepting one.

- Filling out the affidavit means the issue is resolved. Some think that completing the affidavit will automatically cancel the check. It’s essential to follow additional steps with the bank for full resolution.

- The information on a cashier's check does not need to be exact. A common misconception is that minor errors can be overlooked. Accuracy is critical; any discrepancies can lead to issues in cashing or resolving claims.

Awareness of these misconceptions helps ensure a smoother experience when dealing with cashier's checks and the relevant forms.

Key takeaways

Filling out and using the Cashier Check PDF form requires attention to detail and understanding of the process. Here are the key takeaways to consider:

- Complete the Form Accurately: Ensure all fields, such as your name, account number, and details about the cashier's check, are filled out correctly.

- Notary Requirement: A Notary Public must witness your signature on the affidavit. This adds legitimacy to your claim about the lost check.

- Provide Specific Details: When stating that the cashier's check is lost, be specific about the date it was issued and the name it was made payable to.

- Signing Voluntarily: Acknowledge that the affidavit is made voluntarily, which implies that you are aware of the implications of claiming a lost check.

- Recovery Protocol: If the cashier's check is found after you have submitted your affidavit, you must return it to the credit union immediately.

- Keep Copies: Always retain a copy of the completed affidavit and any correspondence with First Service Federal Credit Union for your records.

Following these steps will help ensure a smooth process when dealing with lost cashier's checks.

Browse Other Templates

Rehabilitation Authorization Form,Vocational Training Certification,Veteran Educational Enrollment Document,Training Program Authorization Form,VA Rehabilitation Program Application,Veteran Status Certification Form,Chapter 31 Enrollment Certificatio - Additional documentation may be attached to support course enrollment claims.

Af Form 422 Medical Clearance - The AF 1466 serves to protect the health and safety of all family members during military assignments.

VA Education Program Change Request,Veterans Training Program Modification Form,Change of Educational Benefits Application,VA Program Transition Form,Request for Training Program Adjustment,Veteran's Educational Change Form,Application for Program Ch - Part III requires you to set up direct deposit for your educational benefits.