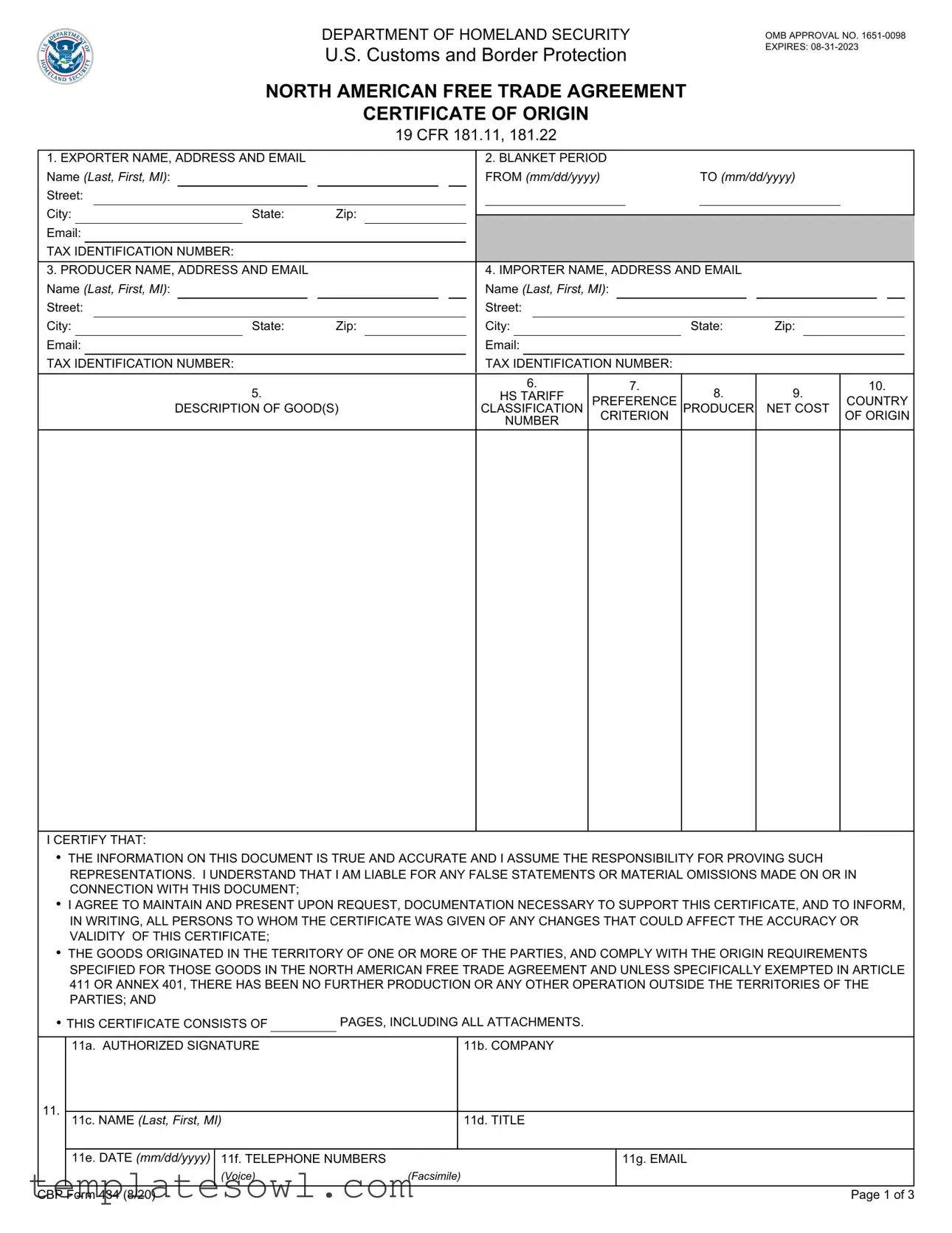

Fill Out Your Cbp 434 Form

The CBP Form 434, also known as the North American Free Trade Agreement (NAFTA) Certificate of Origin, serves a critical role in facilitating trade between the United States, Canada, and Mexico. This form is designed to allow exporters to claim preferential tariff treatment for goods moving across the borders of these countries. It requires detailed information, including the names and addresses of exporters, producers, and importers, along with their tax identification numbers. The form also includes fields for describing the goods, their tariff classification, and the criteria that qualify the goods as originating from NAFTA countries. Importantly, this certificate must be accurate and complete at the time of importation to avoid penalties. The exporter certifies the truthfulness of the information provided, which places significant responsibility on them to maintain and present supporting documentation upon request. Additionally, the CBP Form 434 aims to streamline the verification process, encouraging the efficient movement of goods, while ensuring compliance with NAFTA’s rules of origin. By having this certificate in hand, businesses can make the most of trade opportunities available under NAFTA provisions.

Cbp 434 Example

DEPARTMENT OF HOMELAND SECURITY

U.S. Customs and Border Protection

NORTH AMERICAN FREE TRADE AGREEMENT

CERTIFICATE OF ORIGIN

19 CFR 181.11, 181.22

OMB APPROVAL NO.

1. EXPORTER NAME, ADDRESS AND EMAIL |

|

|

|

|

|

|

|

2. BLANKET PERIOD |

|

|

|

|

|

|

|

|

|

||||||||||||

Name (Last, First, MI): |

|

|

|

|

|

|

|

|

|

FROM (mm/dd/yyyy) |

|

TO (mm/dd/yyyy) |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City: |

State: |

Zip: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Email: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

TAX IDENTIFICATION NUMBER: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

3. PRODUCER NAME, ADDRESS AND EMAIL |

|

|

|

|

|

|

|

4. IMPORTER NAME, ADDRESS AND EMAIL |

|

|

|

|

|

|

|||||||||||||||

Name (Last, First, MI): |

|

|

|

|

|

|

|

|

|

Name (Last, First, MI): |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Street: |

|

|

|

|

|

|

|

|

|

Street: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

City: |

State: |

Zip: |

|

City: |

|

|

|

State: |

Zip: |

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Email: |

|

|

|

|

|

|

|

|

|

Email: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

TAX IDENTIFICATION NUMBER: |

|

|

|

|

|

|

|

|

|

TAX IDENTIFICATION NUMBER: |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

|

|

|

|

|

|

|

6. |

7. |

8. |

|

9. |

10. |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

HS TARIFF |

PREFERENCE |

|

COUNTRY |

|||||||||||||

|

|

|

DESCRIPTION OF GOOD(S) |

CLASSIFICATION |

PRODUCER |

NET COST |

|||||||||||||||||||||||

|

|

|

CRITERION |

OF ORIGIN |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I CERTIFY THAT:

•THE INFORMATION ON THIS DOCUMENT IS TRUE AND ACCURATE AND I ASSUME THE RESPONSIBILITY FOR PROVING SUCH REPRESENTATIONS. I UNDERSTAND THAT I AM LIABLE FOR ANY FALSE STATEMENTS OR MATERIAL OMISSIONS MADE ON OR IN CONNECTION WITH THIS DOCUMENT;

•I AGREE TO MAINTAIN AND PRESENT UPON REQUEST, DOCUMENTATION NECESSARY TO SUPPORT THIS CERTIFICATE, AND TO INFORM, IN WRITING, ALL PERSONS TO WHOM THE CERTIFICATE WAS GIVEN OF ANY CHANGES THAT COULD AFFECT THE ACCURACY OR VALIDITY OF THIS CERTIFICATE;

•THE GOODS ORIGINATED IN THE TERRITORY OF ONE OR MORE OF THE PARTIES, AND COMPLY WITH THE ORIGIN REQUIREMENTS SPECIFIED FOR THOSE GOODS IN THE NORTH AMERICAN FREE TRADE AGREEMENT AND UNLESS SPECIFICALLY EXEMPTED IN ARTICLE 411 OR ANNEX 401, THERE HAS BEEN NO FURTHER PRODUCTION OR ANY OTHER OPERATION OUTSIDE THE TERRITORIES OF THE PARTIES; AND

• THIS CERTIFICATE CONSISTS OF

11a. AUTHORIZED SIGNATURE

11.

11c. NAME (Last, First, MI)

11e. DATE (mm/dd/yyyy) 11f. TELEPHONE NUMBERS |

11g. EMAIL |

(Voice)(Facsimile)

CBP Form 434 (8/20) |

Page 1 of 3 |

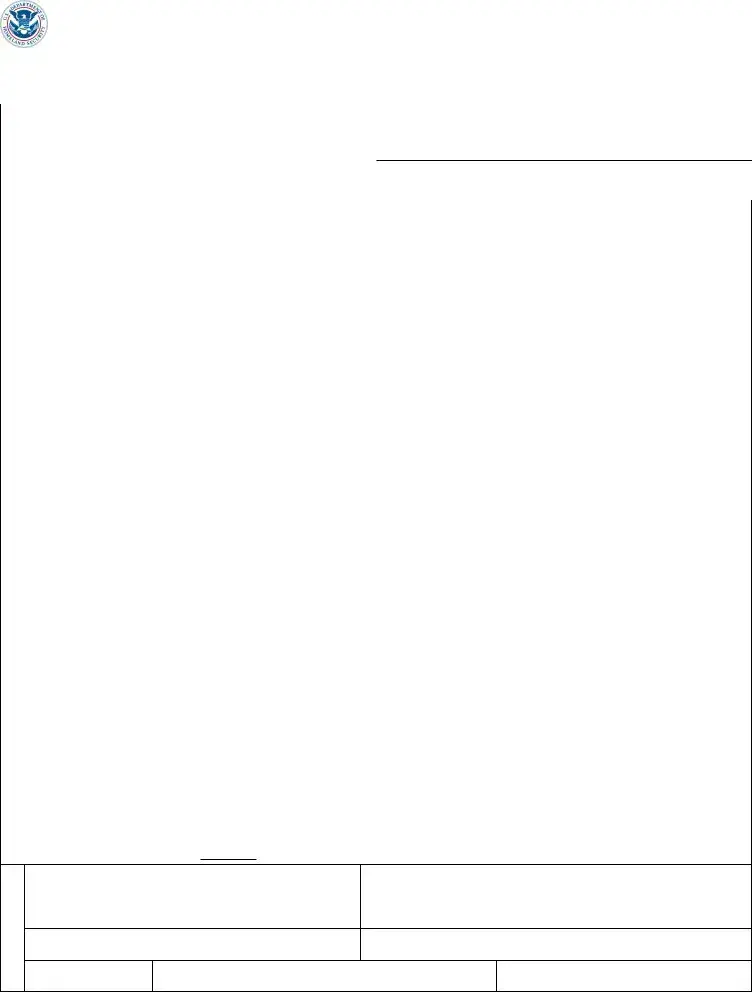

CONTINUATION SHEET

5. |

6. |

7. |

8. |

9. |

10. |

|

HS TARIFF |

PREFERENCE |

COUNTRY |

||||

DESCRIPTION OF GOOD(S) |

CLASSIFICATION |

PRODUCER |

NET COST |

|||

CRITERION |

OF ORIGIN |

|||||

|

NUMBER |

|

|

|

|

|

|

|

|

|

|

|

CBP Form 434 (8/20) |

Page 2 of 3 |

PAPERWORK REDUCTION ACT STATEMENT: An agency may not conduct or sponsor an information collection and a person is not required to respond to this information unless it displays a current valid OMB control number and an expiration date. The control number for this collection is

NORTH AMERICAN FREE TRADE AGREEMENT CERTIFICATE OF ORIGIN INSTRUCTIONS

For purposes of obtaining preferential tariff treatment, this document must be completed legibly and in full by the exporter and be in the possession of the importer at the time the declaration is made. This document may also be completed voluntarily by the producer for use by the exporter. Please print or type:

FIELD 1: State the full legal name, address (including country), email and legal tax identification number of the exporter. Legal taxation number is: in Canada, employer number or importer/exporter number assigned by Revenue Canada; in Mexico, federal taxpayer's registry number (RFC); and in the United States, employer's identification number or Social Security Number.

FIELD 2: Complete field if the Certificate covers multiple shipments of identical goods as described in Field #5 that are imported into a NAFTA country for a specified period of up to one year (the blanket period). "FROM" is the date upon which Certificate becomes applicable to the good covered by the blanket Certificate (it may be prior to the date of signing this Certificate). "TO" is the date upon which the blanket period expires. The importation of a good for which preferential treatment is claimed based on this Certificate must occur between these dates.

FIELD 3: State the full legal name, address (including country), email and legal tax identification number, as defined in Field #1, of the producer. If more than one producer's good is included on the Certificate, attach a list of additional producers, including the legal name, address (including country) and legal tax identification number,

FIELD 4: State the full legal name, address (including country), email and legal tax identification number, as defined in Field #1, of the importer. If the importer is not known, state "UNKNOWN"; if multiple importers, state "VARIOUS".

FIELD 5: Provide a full description of each good. The description should be sufficient to relate it to the invoice description and to the Harmonized System (H.S.) description of the good. If the Certificate covers a single shipment of a good, include the invoice number as shown on the commercial invoice. If not known, indicate another unique reference number, such as the shipping order number.

FIELD 6: For each good described in Field #5, identify the H.S. tariff classification to six digits. If the good is subject to a specific rule of origin in Annex 401 that requires eight digits, identify to eight digits, using the H.S. tariff classification of the country into whose territory the good is imported.

FIELD 7: For each good described in Field #5, state which criterion (A through F) is applicable. The rules of origin are contained in Chapter Four and Annex 401. Additional rules are described in Annex 703.2 (certain agricultural goods), Annex

Preference Criteria

AThe good is "wholly obtained or produced entirely" in the territory of one or more of the NAFTA countries as referenced in Article 415. Note: The purchase of a good in the territory does not necessarily render it "wholly obtained or produced". If the good is an agricultural good, see also criterion F and Annex 703.2. (Reference: Article 401(a) and 415).

BThe good is produced entirely in the territory of one or more of the NAFTA countries and satisfies the specific rule of origin, set out in Annex 401, that applies to its tariff classification. The rule may include a tariff classification change, regional

CThe good is produced entirely in the territory of one or more of the NAFTA countries exclusively from originating materials. Under this criterion, one or more of the materials may not fall within the definition of "wholly produced or obtained", as set out in article 415. All materials used in the production of the good must qualify as "originating" by meeting the rules of Article 401(a) through (d). If the good is an agricultural good, see also criterion F and Annex 703.2. Reference: Article 401(c).

DGoods are produced in the territory of one or more of the NAFTA countries but do not meet the applicable rule of origin, set out in Annex 401, because certain

1.The good was imported into the territory of a NAFTA country in an unassembled or disassembled form but was classified as an assembled good, pursuant to H.S. General Rule of Interpretation 2(a), or

2.The good incorporated one or more

NOTE: This criterion does not apply to Chapters 61 through 63 of H.S. (REFERENCE: ARTICLE 401(D)).

ECertain automatic data processing goods and their parts, specified in Annex 308.1, that do not originate in the territory are considered originating upon importation into the territory of a NAFTA country from the territory of another NAFTA country when the

FThe good is an originating agricultural good under preference criterion A, B, or C above and is not subject to a quantitative restriction in the importing NAFTA country because it is a "qualifying good" as defined in Annex 703.2, Section A or B (please specify). A good listed in Appendix 703.2B.7 is also exempt from quantitative restrictions and is eligible for NAFTA preferential tariff treatment if it meets the definition of "qualifying good" in Section A of Annex 703.2. NOTE 1: This criterion does not apply to goods that wholly originate in Canada or the United States and are imported into either country. NOTE 2: A tariff rate quota is not a quantitative restriction.

FIELD 8: For each good described in Field #5, state "YES" if you are the producer of the good. If you are not the producer of the good, state "NO" followed by (1), (2), or (3), depending on whether this certificate was based upon: (1) your knowledge of whether the good qualifies as an originating good; (2) your reliance on the producer's written representation (other than a Certificate of Origin) that the good qualifies as an originating good; or (3) a completed and signed Certificate for the good, voluntarily provided to the exporter by the producer.

FIELD 9: For each good described in field #5, where the good is subject to a regional value content (RVC) requirement, indicate "NC" if the RVC is calculated according to the net cost method; otherwise, indicate "NO". If the RVC is calculated over a period of time, further identify the beginning and ending dates (MM/DD/YYYY) of that period. (Reference: Article 402.1, 402.5).

FIELD 10: Identify the name of the country ("MX" or "US" for agricultural and textile goods exported to Canada; "US" or "CA" for all goods exported to Mexico; or "CA" or "MX" for all goods exported to the United States) to which the preferential rate of CBP duty applies, as set out in Annex 302.2, in accordance with the Marking Rules or in each party's schedule of tariff elimination.

For all other originating goods exported to Canada, indicate appropriately "MX" or "US" if the goods originate in that NAFTA country, within the meaning of the NAFTA Rules of Origin Regulations, and any subsequent processing in the other NAFTA country does not increase the transaction value of the goods by more than seven percent; otherwise indicate "JNT" for joint production. (Reference: Annex 302.2)

FIELD 11: This field must be completed, signed, and dated by the exporter. When the Certificate is completed by the producer for use by the exporter, it must be completed, signed, and dated by the producer. The date must be the date the Certificate was completed and signed.

CBP Form 434 (8/20) |

Page 3 of 3 |

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose | The CBP 434 form is used as a North American Free Trade Agreement (NAFTA) Certificate of Origin. |

| Governing Laws | This form operates under the regulations specified in 19 CFR 181.11 and 181.22. |

| Expiration Date | The OMB approval for the form expires on August 31, 2023. |

| Fields Required | The form requires information such as exporter, producer, and importer details, along with product description and tariff classification. |

| Tax Identification Number | It is necessary to provide tax identification numbers for exporters, producers, and importers to ensure proper identification. |

| Blanket Period | The form can cover multiple shipments over a specified time frame, known as a blanket period, which can extend up to one year. |

| Certification | Individuals signing the form must certify that the provided information is true, and they are responsible for its accuracy. |

| Confidentiality Option | If confidentiality is desired, exporters can indicate that certain producer information is available "upon request". |

| Regional Value Content | The form includes provisions for indicating whether goods meet specific regional value content requirements, with necessary dates for calculations. |

Guidelines on Utilizing Cbp 434

Filling out the CBP 434 form is a crucial step for exporters and importers seeking preferential tariff treatment under the North American Free Trade Agreement (NAFTA). It requires accurate information about the exporters, producers, and goods being exported. After completing the form, it is important to ensure that all parties involved are aware of the details provided so that any necessary adjustments can be made promptly.

- Enter the exporter’s name, address, email, and tax identification number in Field 1. Ensure all details are accurate and legible.

- If applicable, fill out Field 2 with the blanket period. Provide the start and end dates for the certificate's validity.

- In Field 3, input the producer’s name, address, email, and tax identification number. If there are multiple producers, attach a list.

- Complete Field 4 with the importer’s name, address, email, and tax identification number. Use "UNKNOWN" or "VARIOUS" if the importer is not known or if there are multiple importers.

- Provide a full description of each good in Field 5. Ensure it relates to the invoice description and Harmonized System (HS) description.

- Identify the HS tariff classification for each good in Field 6, providing six or eight digits as necessary.

- In Field 7, state which origin criterion applies (A through F) for each good described.

- Field 8 requires you to indicate if you are the producer of the good. Answer "YES" or "NO" and specify the basis for your claim.

- For Field 9, if the good requires a regional value content (RVC), indicate if it's calculated using the net cost method or not, including relevant dates if applicable.

- Field 10 asks you to identify the country to which the preferential rate of CBP duty applies.

- Finally, ensure Field 11 is completed with the authorized signature, name, date, and telephone numbers of the exporter or producer.

What You Should Know About This Form

What is the CBP Form 434?

The CBP Form 434 is also known as the North American Free Trade Agreement (NAFTA) Certificate of Origin. This document is essential for exporters seeking preferential tariff treatment when shipping goods between the U.S., Canada, and Mexico. It certifies that the goods in question originate from one of these NAFTA countries and meet the required criteria for preferential tariffs.

Who needs to complete the CBP Form 434?

The exporter is primarily responsible for completing the CBP Form 434. However, the producer may also complete the form for use by the exporter. This is beneficial if the producer has a better understanding of the origin and classification of the goods being exported.

What information is required on the CBP Form 434?

The form requires information such as the full legal names, addresses, emails, and Tax Identification Numbers of the exporter, producer, and importer. Additionally, it asks for details about the goods themselves, including descriptions, Harmonized System (H.S.) tariff classifications, and the criteria for claiming originating status.

What is a “blanket period” on the form?

A blanket period refers to a specified timeframe during which the certificate covers multiple shipments of identical goods. This period can extend up to one year, making it easier for exporters to manage documentation for repeated shipments. The start and end dates must be clearly indicated on the form.

Why is the Certificate of Origin needed?

This certificate is crucial for claiming preferential tariff treatment under NAFTA. Without it, goods may be subject to regular tariffs rather than the reduced or eliminated rates available to qualifying products. Accurate documentation ensures that exporters avoid unnecessary costs.

How do I certify the information on the CBP Form 434?

The exporter must sign the form, certifying that all information provided is true and accurate. An acknowledgment of responsibility for proving the statements made in the form is also essential. This includes retaining documentation that supports the origin claims of the goods.

What happens if the information on Form 434 is incorrect?

Providing incorrect information can lead to penalties. If a false statement or material omission occurs, the exporter may be held liable, resulting in fines or other legal repercussions. Therefore, it’s essential to double-check all entries before submission.

Can additional producers be listed on the CBP Form 434?

Yes, if multiple producers are involved, an attachment listing each additional producer is required. The additional list must include their names, addresses, and Tax Identification Numbers while being referenced to the related goods on the form.

What is the expiration date of the CBP Form 434?

The current edition of the CBP Form 434 has an expiration date listed as 08-31-2023. It’s advisable to always check for an updated version to ensure compliance with the latest regulations.

Common mistakes

Filling out the CBP 434 form can be a straightforward task, but many people overlook a few critical details that can lead to significant complications. One common mistake is failing to use legible writing. The form must be completed legibly and in full, whether printed or typed. If the information is unreadable, it can result in delays or outright rejection of the application. Ensuring clarity is paramount; using all capital letters or typing can minimize the risk of misinterpretation.

Another frequent error involves neglecting to provide complete and accurate addresses. Each section of the form that requires the legal name and address of the exporter, producer, and importer needs to be filled out with the utmost precision. Missing details, such as the country or full street address, can lead to processing issues. Moreover, don’t forget to include the tax identification number for each party involved. The absence of this crucial information will likely complicate the approval process.

Many individuals also misinterpret the requirements for field descriptions of goods. Field #5 should include a detailed description sufficient to relate it to the invoice description and the Harmonized System (H.S.) description. Insufficient or vague descriptions can bring the whole process to a halt, as Customs and Border Protection (CBP) may lack the necessary information to classify the goods correctly. The importance of specificity cannot be overstated in this context.

Finally, a lack of diligence in certifying the accuracy of the information can be detrimental. The form includes a certification statement that outlines the exporter’s responsibility for the truthfulness of the document. Individuals sometimes overlook the implications of this certification, which can lead to legal repercussions if false information is provided. Being aware of the gravity of one’s assertions guarantees that the certificate stands up to scrutiny.

Documents used along the form

The CBP Form 434 is essential for businesses looking to navigate cross-border trade under the North American Free Trade Agreement (NAFTA). However, using this form often requires the completion of several other documents that support the claims made within it. Below are some commonly associated forms that can assist in this process.

- CBP Form 7501: This is the entry summary form used by importers to declare imported goods. It provides key details about the shipment, including value, classification, and the duty owed.

- Commercial Invoice: This document outlines the sale transaction between the buyer and seller. It includes information such as the description of goods, quantities, and prices, serving as a vital reference for customs authorities.

- Bill of Lading: This transport document serves as a receipt for goods and outlines the terms of delivery. It is crucial for both the shipping and receiving parties, as it defines who is responsible during transit.

- Certificate of Origin: Similar to the CBP 434, this document certifies the country where the goods were produced. Importers may need it to claim preferential duty rates under trade agreements.

- NAFTA Certificate of Origin: This specific certificate verifies that the goods qualify for NAFTA preferential treatment. Importers use it to substantiate their claims regarding the origins of goods.

- Packing List: This document provides a detailed list of the contents in a shipment. It assists customs officials in verifying that the goods received match those declared.

- Importer Security Filing (ISF): Required by U.S. Customs, this filing must be submitted before shipments arrive in the United States. It provides advance information about cargo loaded on vessels headed to the U.S.

- Power of Attorney: This document allows a customs broker to act on behalf of an importer, enabling them to facilitate the entry process and other customs-related functions.

- Freight Invoice: This bill details the transportation charges incurred for the shipment. It’s necessary for accounting purposes and provides proof of transportation costs.

Understanding these documents and their purposes can significantly ease the process of importing goods under NAFTA. It helps businesses ensure compliance while maximizing the benefits of trade agreements.

Similar forms

The CBP Form 434 is recognized for its role in certifying the origin of goods imported under the North American Free Trade Agreement (NAFTA). Several other documents share similar functions and purposes, enhancing the customs clearance process. Below are six documents that are comparable to the CBP Form 434, along with a brief explanation of how they align.

- CBP Form 7501: This form, known as the Entry Summary, is used by importers to declare imported goods. Like the CBP Form 434, it requires detailed information about the goods being imported, including their origin, value, and classification. Both forms are essential for claiming duty exemptions based on trade agreements.

- NAFTA Certificate of Origin: While the CBP Form 434 is specific to the U.S., the NAFTA Certificate of Origin is an overarching document that confirms goods qualify for NAFTA preferences. It serves a similar purpose, detailing the origin of goods and facilitating preferential tariff treatment.

- Commercial Invoice: This document provides important information about the sale of goods, including the parties involved, price, and description. It works alongside the CBP Form 434 by verifying the details required for customs clearance and compliance with trade regulations.

- Form 3461: This form is used as a Declaration for Free Entry of Returned American Products. Similar to the CBP Form 434, it allows for the declaration of goods' origins, ensuring they comply with applicable trade laws when entering the U.S.

- Form I-94: Although primarily used for immigration purposes, the I-94 form can sometimes accompany goods being imported by non-residents. It documents a visitor’s status in the U.S. and can cross-reference with the CBP Form 434 to validate the entry of goods associated with non-resident transactions.

- Bill of Lading: This document serves as a contractual agreement between a shipper and carrier. It provides details about the goods being transported and their origin, ensuring a clear link with the information provided in the CBP Form 434 regarding the shipment's legitimacy.

Each of these documents plays a vital role in facilitating international trade while ensuring compliance with U.S. customs regulations. Accurate and thorough completion of these forms aids in the efficient processing of goods and minimizes potential delays at the border.

Dos and Don'ts

When it comes to completing the CBP Form 434, the North American Free Trade Agreement Certificate of Origin, careful attention to detail is crucial. Here are some important dos and don'ts to follow:

- Do: Ensure all sections are filled out completely and legibly.

- Do: Provide the full legal name, address, and email of the exporter, producer, and importer.

- Do: Include valid tax identification numbers for all parties involved.

- Do: Describe each good clearly, referring to the Harmonized System classification.

- Do: Specify the blanket period accurately, if applicable, with precise start and end dates.

- Don't: Leave any fields blank; missing information can delay the process.

- Don't: Misrepresent the origin of the goods; this can result in penalties.

- Don't: Use abbreviations or incomplete names; clarity is vital.

- Don't: Forget to sign and date the certificate; an unsigned form is invalid.

- Don't: Ignore the requirement for documentation to support your claims; be prepared to provide proof if needed.

Misconceptions

- Form 434 is only for exporters. This is a common misconception. While the primary responsibility for completing the form lies with the exporter, it can also be completed voluntarily by the producer for use by the exporter.

- Only large businesses need to use the form. In reality, any business, regardless of size, that plans to import goods into NAFTA countries and wants to claim preferential tariff treatment must complete the CBP Form 434.

- All goods automatically qualify for preferential treatment. This is incorrect. Each good must meet specific criteria set forth in the North American Free Trade Agreement (NAFTA) rules of origin to qualify for reduced tariffs.

- The form does not need to be accurate. This is a misconception that can lead to serious consequences. It is mandatory to provide truthful and accurate information on the form. False statements can result in penalties.

- Filling out the form is quick and easy. While it might seem straightforward, completing the form accurately can be quite complex, especially for goods that have specific rules of origin.

- Once filed, the form can be ignored. This is misleading. It's essential to maintain documentation to support the claims made on the form. Failure to do so can jeopardize the benefits claimed under NAFTA.

Key takeaways

When dealing with the CBP Form 434, it’s essential to ensure accuracy and compliance. Here are seven key takeaways to keep in mind:

- Complete Accuracy is Crucial: Ensure that all information you provide on the form is true and accurate. Incorrect or misleading information can lead to serious repercussions.

- Know the Blanket Period: If your certificate covers multiple shipments, define the blanket period clearly by filling out the "FROM" and "TO" dates accurately.

- Identify All Parties: Provide complete names, addresses, and tax identification numbers for exporters, producers, and importers. Incomplete details can delay processing.

- Properly Describe Goods: Clearly describe the goods in question. Your description should relate to both the invoice and the Harmonized System description.

- Understand the Tariff Classification: Use the correct HS tariff classification for each good. A classification error may lead to improper duty assessment.

- Document Retention is Key: Maintain documentation that supports the claims made in the certificate. Be prepared to present it when requested.

- Compliance with Origin Criteria: It’s important that the goods meet the origin requirements specified in the North American Free Trade Agreement (NAFTA). Review the rules of origin to ensure compliance.

Browse Other Templates

Va Residual Income Chart 2023 Pdf - Legal obligations for loan qualification are highlighted throughout the form.

Forbarance - Homeowners may face foreclosure if mortgage payments are missed, highlighting the urgency of completing the hardship form.

Types of Va Claims - Veterans must acknowledge receipt of the conveyance in Section IV of the form upon acquisition.