Fill Out Your Cbt 2553 Form

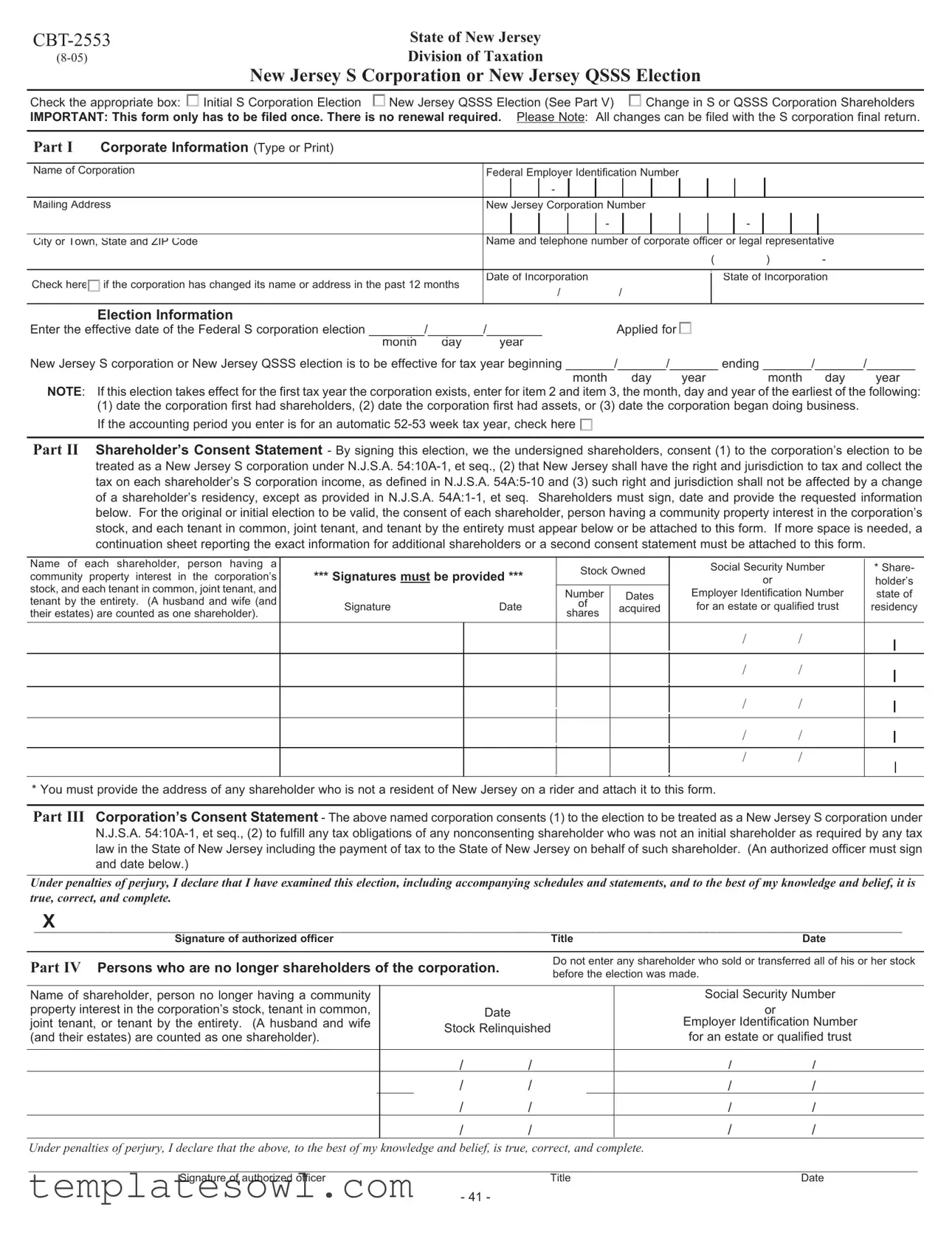

The CBT-2553 form is an essential document for corporations in New Jersey desiring to elect or change their status as S Corporations or Qualified Subchapter S Subsidiaries (QSSS). This form serves multiple purposes, as it must first be completed to establish an initial election or to report any changes in shareholders. The form requires the corporation's basic information, such as its name, federal employer identification number, and state incorporation details, ensuring clarity in its operations. Moreover, it mandates shareholder consent, which is a crucial aspect, as all shareholders must agree to the election for it to be valid. The form is also structured to accommodate any changes in shareholder composition over time without the need for annual renewals—just a single submission is required. As part of the process, the corporation must specify its federal S corporation election date and the duration for which the New Jersey S corporation election will be effective. Additionally, there are specific guidelines for completing each part, including consent statements from both shareholders and corporate officers. Understanding the implications and requirements of the CBT-2553 form is vital for businesses looking to optimize their tax status while complying with New Jersey tax regulations.

Cbt 2553 Example

|

|

|

State of New Jersey |

|

|

|

|

|

|

Division of Taxation |

|

|

|

|

|

New Jersey S Corporation or New Jersey QSSS Election |

||||

|

|

|

|

|

|

|

Check the appropriate box: |

|

Initial S Corporation Election |

|

New Jersey QSSS Election (See Part V) |

|

Change in S or QSSS Corporation Shareholders |

|

|

|

||||

IMPORTANT: This form only has to be filed once. There is no renewal required. Please Note: All changes can be filed with the S corporation final return.

Part I |

Corporate Information (Type or Print) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Name of Corporation |

|

Federal Employer Identification Number |

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address |

|

New Jersey Corporation Number |

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

City or Town, State and ZIP Code |

|

Name and telephone number of corporate officer or legal representative |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

( |

) |

- |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Check here |

|

|

if the corporation has changed its name or address in the past 12 months |

Date of Incorporation |

|

|

|

|

|

|

State of Incorporation |

|||||||||

|

|

|

|

|

|

|

|

|||||||||||||

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Election Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter the effective date of the Federal S corporation election ________/________/________ |

Applied for |

|

|

|

|

|

|

|

||||||||||||

|

|

|

month |

day |

year |

|

|

|

|

|

|

|

|

|

|

|

||||

New Jersey S corporation or New Jersey QSSS election is to be effective for tax year beginning _______/_______/_______ ending _______/_______/_______

month day year month day year

NOTE: If this election takes effect for the first tax year the corporation exists, enter for item 2 and item 3, the month, day and year of the earliest of the following:

(1)date the corporation first had shareholders, (2) date the corporation first had assets, or (3) date the corporation began doing business. If the accounting period you enter is for an automatic

Part II Shareholder’s Consent Statement - By signing this election, we the undersigned shareholders, consent (1) to the corporation’s election to be treated as a New Jersey S corporation under N.J.S.A.

Name of each shareholder, person having a |

|

|

Stock Owned |

Social Security Number |

* Share- |

||||

community property interest in the corporation’s |

*** Signatures must be provided *** |

||||||||

or |

|

holder’s |

|||||||

|

|

|

|||||||

stock, and each tenant in common, joint tenant, and |

|

|

Number |

Dates |

Employer Identification Number |

state of |

|||

tenant by the entirety. (A husband and wife (and |

|

|

|||||||

Signature |

Date |

of |

acquired |

for an estate or qualified trust |

residency |

||||

their estates) are counted as one shareholder). |

|||||||||

|

|

shares |

|

|

|

|

|

||

|

|

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* You must provide the address of any shareholder who is not a resident of New Jersey on a rider and attach it to this form.

Part III Corporation’s Consent Statement - The above named corporation consents (1) to the election to be treated as a New Jersey S corporation under N.J.S.A.

Under penalties of perjury, I declare that I have examined this election, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

____________________________________________________________________________________________________________________________X

Signature of authorized officer |

Title |

Date |

Part IV Persons who are no longer shareholders of the corporation.

Do not enter any shareholder who sold or transferred all of his or her stock before the election was made.

Name of shareholder, person no longer having a community |

|

|

Social Security Number |

||

property interest in the corporation’s stock, tenant in common, |

|

Date |

|

or |

|

joint tenant, or tenant by the entirety. (A husband and wife |

Stock Relinquished |

Employer Identification Number |

|||

(and their estates) are counted as one shareholder). |

for an estate or qualified trust |

||||

|

|

||||

|

|

|

|

|

|

|

/ |

/ |

/ |

/ |

|

|

/ |

/ |

/ |

/ |

|

|

/ |

/ |

/ |

/ |

|

|

/ |

/ |

/ |

/ |

|

Under penalties of perjury, I declare that the above, to the best of my knowledge and belief, is true, correct, and complete.

_______________________________________________________________________________________________________________________________

Signature of authorized officer |

Title |

Date |

- 41 -

PART V Qualified Subchapter S Subsidiary Election

Corporation’s Consent Statement - The above named corporation consents (1) to the election to be treated as a “New Jersey Qualified Subchapter S Subsidiary”, and (2) to file a

Under penalties of perjury, I declare that I have examined this election, and to the best of my knowledge and belief, it is true, correct, and complete.

__________________________________________________________________________________________________________________

Signature of authorized officer |

Title |

Date |

Corporate Parent Company’s Consent Statement - By signing this election, the undersigned corporation consents (1) to the subsidiary’s elec- tion to be treated as a “New Jersey Qualified Subchapter S Subsidiary” and (2) to taxation by New Jersey by filing a

Corporate Parent Name

Address

FID Number

Under penalties of perjury, I declare that I have examined this election, and to the best of my knowledge and belief, it is true, correct, and complete.

_______________________________________________________________________________________________________________________________________________

Signature of authorized officer |

Title |

Date |

INSTRUCTIONS FOR FORM

1.Purpose - A corporation must file form

2.Who may elect - A corporation may make the election to be treat- ed as a New Jersey S corporation only if it meets all of the follow- ing criteria:

a)The corporation is or will be an S corporation pursuant to section 1361 of the Federal Internal Revenue Code;

b)Each shareholder of the corporation consents to the election and the jurisdictional requirements as detailed in Part II of this form;

c)The corporation consents to the election and the assumption of any tax liabilities of any nonconsenting shareholder who was not an initial shareholder as indicated in Part III of this form.

3.Where to file - Mail form

4.When to make the election - The completed form

5.Acceptance or

ed within 30 days after the filing of the

6.End of election - Generally, once an election is made, a corpora- tion remains a New Jersey S corporation as long as it is a Federal S corporation. There is a limited opportunity to revoke an election only during the first tax year to which an election would otherwise apply. To revoke an election, a letter of revocation signed by

shareholders holding more than 50% of the outstanding shares of stock on the day of revocation should be mailed to the address in instruction 3 on or before the last day of the first tax year to which the election would otherwise apply. A copy of the original election should accompany the letter of revocation. Such a revocation will render the original election null and void from inception.

7.Initial election - Complete Parts I, II and III in their entirety for an initial New Jersey S Corporation election. Each shareholder who owns (or is deemed to own) stock at the time the election is made, must consent to the election. A list providing the social security number and the address of any shareholder who is not a New Jersey resident must be attached when filing this form.

8.Reporting shareholders who were not initial shareholders - Complete Parts I, II and III when filing this form to report any new shareholder. A new shareholder is a shareholder who, prior to the acquisition of stock, did not own any shares of stock in the S cor- poration, but who acquired stock (either existing shares or shares issued at a later date) subsequent to the initial New Jersey S cor- poration election. If a new shareholder fails to sign a consent statement, the corporation is obligated to fulfill the tax require- ments as stated in Part III on behalf of the nonconsenting share- holder. An existing shareholder whose percentage of stock own- ership changes is not considered a new shareholder. If the tax- payer previously had elected to be treated as a New Jersey QSSS, the new shareholder must also complete Part V.

9.Part IV should only be completed for any person who is no longer a shareholder of the corporation. You do not have to enter any shareholder who sold or transferred all of his or her stock before the election was made. All changes can be filed with the S corpo- ration final return.

10.Part V must be completed in order to permit a New Jersey S Corporation to be treated as a New Jersey Qualified Subchapter S Subsidiary and remit only a minimum tax. In addition, the parent company also must consent to filing and remitting New Jersey Corporation Business Tax which would include the assets, liabili- ties, income and expenses of its QSSS along with its own. Failure of the parent either to consent or file a

- 42 -

Mail to: |

|

PO Box 252 |

|

|

Trenton, NJ |

|

(609) |

State of New Jersey

Division of Taxation

New Jersey S Corporation Certification

This certification is for use by unauthorized foreign

Part I. Corporate Information (Type or Print)

Name of Corporation: ____________________________________________________

Federal Employer Identification Number: ______ - _____________________________

Part II. Corporate Attestation

By signing this statement, the corporation affirms that the corporation has not conducted any activi- ties within this state that would require the Corporation to file a Certificate of Authority in accordance with N.J.S.A.

Print the name and title of the person executing this document on behalf of the Corporation. This person must be a corporate officer.

Name: ________________________________ |

Title: ___________________________ |

Signature: _____________________________ |

Date: ___________________________ |

- 43 -

Instructions for Form

1.This form is to be used by

2.Name of Corporation: Type or print name exactly as it appears on form

3.Federal Employer Identification Number (FEIN): Please enter the Federal Identification Number assigned by the Internal Revenue Service.

4.Please read the Corporate Attestation and the cited statutes for compliance.

5.Print the name and title of the corporate officer signing this document and the

6.Mail the completed forms to: New Jersey Division of Revenue, PO Box 252 Trenton, NJ

(1)No foreign corporation shall have the right to transact business in this State until it shall have procured a certificate of authority so to do from the Secretary of State. A foreign corporation may be authorized to do in this State any business which may be done lawfully in this State

by a domestic corporation, to the extent that it is authorized to do such business in the jurisdiction of its incorporation, but no other business.

(2)Without excluding other activities which may not constitute transacting business in this State, a foreign corporation shall not be considered to be transacting business in this State, for the purposes of this act, by reason of carrying on in this State any one or more of the following activities

(a)maintaining, defending or otherwise participating in any action or proceeding, whether judicial, administrative, arbitrative or otherwise, or effecting the settlement thereof or the settlement of claims or disputes;

(b)holding meetings of its directors or shareholders;

(c)maintaining bank accounts or borrowing money, with or without security, even if such borrow- ings are repeated and continuous transactions and even if such security has a situs in this State;

(d)maintaining offices or agencies for the transfer, exchange and registration of its securities, or appointing and maintaining trustees or depositaries with relation to its securities.

(3)The specification in subsection

- 44 -

Form Characteristics

| Fact Name | Description |

|---|---|

| Initial Filing Requirement | The CBT-2553 form must be filed only once to elect S corporation status in New Jersey; there is no requirement for renewal. |

| Governing Law | The form operates under New Jersey Statutes Annotated (N.J.S.A.) 54:10A-1, et seq. for S corporations and N.J.S.A. 54A-1-1 for tax jurisdiction. |

| Filing Deadline | The completed form must be submitted within one calendar month of when a Federal S corporation election is due; typically, this is before the 16th day of the fourth month of the tax year. |

| Shareholder Consent | For the election to be valid, all shareholders must consent by signing the form, indicating their acceptance of New Jersey's jurisdiction to tax S corporation income. |

| Notification of Acceptance | The Division of Revenue will notify corporations within 30 days of the filing if their election is accepted or not. Failure to receive notification requires follow-up with the division. |

Guidelines on Utilizing Cbt 2553

Completing the CBT-2553 form involves providing essential corporate and shareholder information to the New Jersey Division of Taxation. After the form is filled out, it must be mailed to the specified address, where it will be processed. Once submitted, the corporation will receive notification regarding the acceptance of their election.

- Check the appropriate box at the top of the form to indicate whether you are making an initial S Corporation election, a New Jersey QSSS election, or reporting a change in shareholders.

- In Part I, fill out the corporate information. Include the name of the corporation, Federal Employer Identification Number (EIN), New Jersey Corporation Number, mailing address, city or town, state, ZIP Code, and the date of incorporation.

- Provide the name and telephone number of a corporate officer or legal representative. If the corporation has changed its name or address in the past 12 months, check the corresponding box.

- Enter the effective date of the Federal S Corporation election. Also indicate the tax year for which the New Jersey S Corporation election is to be effective.

- In Part II, obtain consent from all shareholders. Each shareholder must sign and date the form in the designated section, providing their name, stock owned, Social Security number, and signature.

- If any shareholder is not a resident of New Jersey, an address for them must be provided on a separate rider and attached to the form.

- In Part III, the authorized officer of the corporation must sign and date the consent statement, which confirms the corporation's consent to be treated as a New Jersey S Corporation and agrees to fulfill tax obligations for any non-consenting shareholder.

- Complete Part IV only for persons who are no longer shareholders. Include their name, Social Security number, and the stock relinquished.

- In Part V, if applicable, ensure the corporate parent company consents to the election and signs the document, providing the corporate parent’s name, address, and Federal Identification Number.

- Double-check all entries for accuracy. Make sure to include any required continuation sheets if there are more shareholders than can fit on the form.

- Mail the completed CBT-2553 form to the New Jersey Division of Revenue at: PO Box 252, Trenton, NJ 08646-0252. Consider sending it via registered mail to verify receipt.

What You Should Know About This Form

What is the purpose of Form CBT-2553?

This form allows a corporation to elect to be classified as a New Jersey S Corporation or a New Jersey Qualified Subchapter S Subsidiary (QSSS). It can also be used to report changes in shareholders. By filling it out correctly, you ensure that the corporation benefits from the specific tax treatment associated with these designations.

Who can file Form CBT-2553?

Any corporation that meets the qualifications to be an S Corporation under federal law can file this form. Specifically, it must be an S corporation as per federal regulations, have the consent of all its shareholders, and accept any tax obligations for nonconsenting shareholders. It's essential that every condition is met to validate the election.

When should Form CBT-2553 be filed?

The form should typically be filed within one month of the date when a Federal S Corporation election would be necessary. If you miss the deadline, the election may not take effect until the following tax year. To avoid complications, aim to submit it by the 16th day of the fourth month of the first tax year it applies to.

How does a corporation remain an S Corporation in New Jersey?

As long as the corporation maintains its status as a Federal S Corporation, it will continue to have the S Corporation designation in New Jersey. This election doesn’t need to be renewed annually. However, if the corporation wants to revoke its S Corporation status, specific procedures must be followed.

What should I include in Part I of the form?

Part I requires basic corporate information: the name of the corporation, its Federal Employer Identification Number, the mailing address, and the state of incorporation. It’s also necessary to indicate if the corporation's name or address has changed in the last year and to provide its date of incorporation.

What happens if a shareholder does not consent?

If a new shareholder does not sign the consent statement, the corporation still has obligations. The law requires the corporation to fulfill all tax requirements on behalf of any nonconsenting shareholder. This makes it imperative that all shareholders understand the tax implications before they sign.

Is there a deadline for receiving an acceptance of the election?

Yes, the New Jersey Division of Revenue will notify the corporation within 30 days of the filing of Form CBT-2553. If no notification is received by then, an inquiry can be made by calling the provided number.

Can the election be revoked once made?

Yes, the election can be revoked during the first tax year that it applies. To do this, shareholders holding more than 50% of the shares need to send a letter of revocation, including a copy of the original election. This revocation will nullify the election from its inception.

What is required in Part V of the form?

Part V is specifically for electing to treat a New Jersey S Corporation as a Qualified Subchapter S Subsidiary. It requires the corporation and its parent company to agree to certain tax filing responsibilities and to report the minimum tax liabilities appropriately.

Common mistakes

Filling out the CBT-2553 form can be complicated, and many individuals often make mistakes that can delay the process or impact the election status. One common mistake is failing to check the correct box to indicate the type of election being made. The form has specific options, such as an Initial S Corporation Election or a change in S or Qualified Subchapter S (QSSS) Corporation shareholders. Choosing the wrong option can lead to incorrect processing of the form or even denial of the election altogether.

Another frequent error involves providing incorrect or incomplete information in Part I, which contains the basic corporate information. This part requires details such as the name of the corporation, the Federal Employer Identification Number, and the state of incorporation. Omitting any of these key details or entering inaccurate information can result in the form being rejected and requires resubmission.

Part II requires shareholders to sign a consent statement. Some individuals overlook the importance of collecting signatures from all shareholders, which is essential for validating the election. If any shareholders are missed, the corporation may not be recognized as a New Jersey S Corporation, and tax obligations may fall back on the business, further complicating tax liabilities.

Lastly, neglecting to attach any necessary riders or documentation can lead to additional problems. Shareholders who are not residents of New Jersey must provide their addresses on a separate rider attached to the CBT-2553 form. Failing to include this information when required can lead to delays in processing or rejection of the election.

Documents used along the form

The CBT-2553 form is crucial for businesses looking to elect S Corporation status in New Jersey, but it often requires accompanying documents to properly establish and maintain this designation. Below, some of these essential forms are outlined for better understanding. Each plays a unique role in ensuring compliance with state tax laws and regulations.

- Form CBT-100S: This is the annual corporate business tax return specifically for New Jersey S Corporations. By filing this form, the corporation reports its income and calculates the tax due. It is crucial for ensuring that the company's tax obligations are met under the new status.

- Form CBT-100: Unlike the CBT-100S, this form is used by regular New Jersey corporations, including subsidiaries of S Corporations that do not qualify for the reduced tax rate. It details the income, deductions, and credits of the corporation, ensuring proper taxation is applied.

- Form CBT-2554: This document is for corporations that are looking to withdraw their S Corporation election. Completing and submitting this form indicates the corporation's desire to change its tax status, impacting its filing requirements thereafter.

- Form NJ-REG: This form registers a business entity with the state of New Jersey. If the corporation is new or making a significant change, such as a name change or ownership restructuring, this form must be filled out to update the state’s records accordingly.

- New Jersey S Corporation Certification: Required for unauthorized foreign entities wanting to obtain S Corporation status in New Jersey, this certification must be attached to the CBT-2553. It attests that the foreign corporation has not conducted any business that would necessitate filing a Certificate of Authority in New Jersey.

- Shareholder Consent Statement: This document shows that existing shareholders agree to the S Corporation election. Without these signatures, the CBT-2553 may not be valid, making it essential for new corporations or those bringing on new investors.

Understanding these forms and documents is vital for any business owner seeking S Corporation status in New Jersey. Each form is designed to ensure compliance with state laws and to provide the necessary information for tax and regulatory purposes. By preparing the necessary documentation, businesses can streamline their transition to S Corporation status and enjoy its associated benefits.

Similar forms

Form 2553 - Election by a Small Business Corporation: This federal form allows a corporation to elect to be treated as an S corporation under the Internal Revenue Code. Similar to CBT-2553, it requires shareholder consent and provides guidelines for filing the election. Both forms enable corporations to benefit from pass-through taxation.

Form 1120-S - U.S. Income Tax Return for an S Corporation: Once a corporation elects S corporation status through either form CBT-2553 or Form 2553, it must file Form 1120-S annually. This form reports the income, deductions, and other tax-related information, reflecting the pass-through taxation system.

Form K-1 - Partner's Share of Income, Deductions, Credits, etc.: This form is issued to shareholders of S corporations. It outlines each shareholder's share of the corporation's income or loss, similar to how CBT-2553 details shareholder consents and obligations in New Jersey.

Form CBT-100 - New Jersey Corporation Business Tax Return: Corporations typically file this return to report their business income in New Jersey. Similar to CBT-2553, it complies with state taxation laws and outlines tax obligations for businesses operating as corporations within New Jersey.

Form CBT-100S - New Jersey S Corporation Business Tax Return: This form is specifically for S corporations in New Jersey, paralleling the purposes of CBT-2553. It is used to report income and calculate taxes owed, maintaining the pass-through taxation principle.

Form 1065 - U.S. Return of Partnership Income: Though primarily for partnerships, it shares similarities with S corporation taxation. Both forms require an election and report income on behalf of multiple owners, emphasizing the need for shareholder or partner consent.

Form 8832 - Entity Classification Election: This form allows certain business entities to choose their tax classification. Both forms involve decisions about tax treatment and require compliance with federal and state laws, establishing ownership interests and tax liabilities.

Dos and Don'ts

Things You Should Do:

- Fill out all sections of the CBT-2553 form completely and accurately.

- Check the appropriate box to indicate whether this is an initial election or a change in shareholders.

- Ensure all shareholders sign the consent statement. Every shareholder must consent to the election.

- Attach a list of non-resident shareholders with their addresses if applicable.

- File the form within the specified timeframe to avoid delays in processing.

- Retain a copy of the filled form for your records after submission.

- Notify the New Jersey Division of Revenue if you do not receive confirmation within 30 days.

Things You Shouldn't Do:

- Do not submit incomplete forms; all parts must be filled out.

- Do not skip the consent section for shareholders, as all signatures are necessary for validity.

- Do not forget to include social security numbers for all shareholders.

- Do not file the form after the deadline for your election to take effect.

- Do not ignore the instructions regarding changes in the shareholder list.

- Do not assume that last-minute changes can be accounted for on the form without proper documentation.

- Do not fail to consult a tax professional if unclear about the filing process.

Misconceptions

Understanding the CBT-2553 form can be critical for your business in New Jersey. However, misconceptions often lead to confusion. Here are some common myths about this form along with explanations to clarify them:

- One-time filing only means no further action ever: While it’s true that the form only needs to be filed once for your initial election, any changes in shareholders require additional filings, so keep that in mind.

- All corporations can file for S status: Not all corporations are eligible. A corporation must meet specific criteria, including being an S corporation under federal law, to successfully file Form CBT-2553.

- Filing deadlines are flexible: There’s a strict deadline. The form must be submitted within one calendar month of when the federal S corporation election would be required. Missing this deadline could delay your election.

- Shareholder consent is optional: This is a critical misunderstanding. Every shareholder must consent to the S corporation election for it to be valid. No exceptions exist for this rule.

- Changes in shareholders do not affect the election: If there are any changes in shareholders, the election could be affected. This situation may require you to refile or update your records.

- You cannot revoke the election: Actually, revoking the election is possible but only within specific timeframes. If you change your mind, a formal revocation letter from shareholders needs to be sent.

- Once made, the S corporation status lasts forever: This is misleading. While the status remains as long as you meet specific requirements, failure to comply with tax obligations can lead to loss of that status.

- Only New Jersey residents need to sign: This isn’t accurate. If you have shareholders who are not New Jersey residents, you may need to provide additional information when filing the form.

- Form CBT-2553 has a lot of hidden complexities: While there are rules to follow, the form itself is straightforward. Clear instructions guide you through the process, making it manageable.

By debunking these misconceptions, businesses can better navigate through the crucial process of filing Form CBT-2553 and ensure compliance with New Jersey's tax regulations.

Key takeaways

Filling out and utilizing the CBT-2553 form is crucial for corporations in New Jersey looking to elect S Corporation status. Here are six key takeaways regarding this process:

- One-Time Submission: The CBT-2553 form is only required to be filed once. After the initial election, there is no need for renewal.

- Shareholder Consent: All shareholders must provide consent for the election. This consent is required to validate the election and must be properly documented at the time of submission.

- Specific Filing Timeframe: It’s essential to submit the form within one month of when a Federal S Corporation election would need to be filed. Missing this deadline can result in the election being considered for the following year.

- Changes in Shareholders: If there are changes in the shareholders, the CBT-2553 must be updated to reflect these changes. This includes newly acquired shares by individuals who were not original shareholders.

- Non-Resident Shareholders: If any shareholders live outside of New Jersey, their addresses must be included on an attached rider. This is crucial for tax obligations.

- Revocation of Election: Once the election is made, it generally remains in effect as long as the corporation is still a Federal S Corporation. A revocation is possible but requires a formal letter from shareholders holding over 50% of the outstanding shares.

Understanding these elements will help ensure compliance and protect the corporation’s tax status in New Jersey.

Browse Other Templates

What Is One Benefit of Purchasing Saving Bonds - Consult the Savings Bond Calculator to determine the current bond value before filing.

G-7 Quarterly Return - The taxes reported on the G-7 have implications for your business’s financial standing.

Goodwill Vouchers Near Me - It requires personal information, such as the candidate's name, date of birth, and address.