Fill Out Your Ccc 902I Form

The CCC-902I form is an essential document for individuals seeking benefits from the Farm Service Agency (FSA) under various agricultural programs governed by the regulations of 7 CFR Part 1400. This form is tailored specifically for individual producers, allowing them to apply for financial assistance and support for their farming operations. It gathers detailed information about the individual’s contributions to farming, encompassing aspects such as land, equipment, capital, labor, and management involvement. The form also establishes the eligibility criteria for program payments by determining how actively engaged the producer is in their farming activities. Additionally, the CCC-902I collects personal identification details, including the social security number of the individual applying. Entities with which the individual has interests may also be involved, but they need to submit a separate CCC-902E form. A crucial aspect of the CCC-902I is its focus on transparency and accuracy; any incorrect information provided can lead to serious repercussions, including the forfeiture of payments. Thus, understanding how to properly complete the form is vital for smooth processing and compliance with federal regulations.

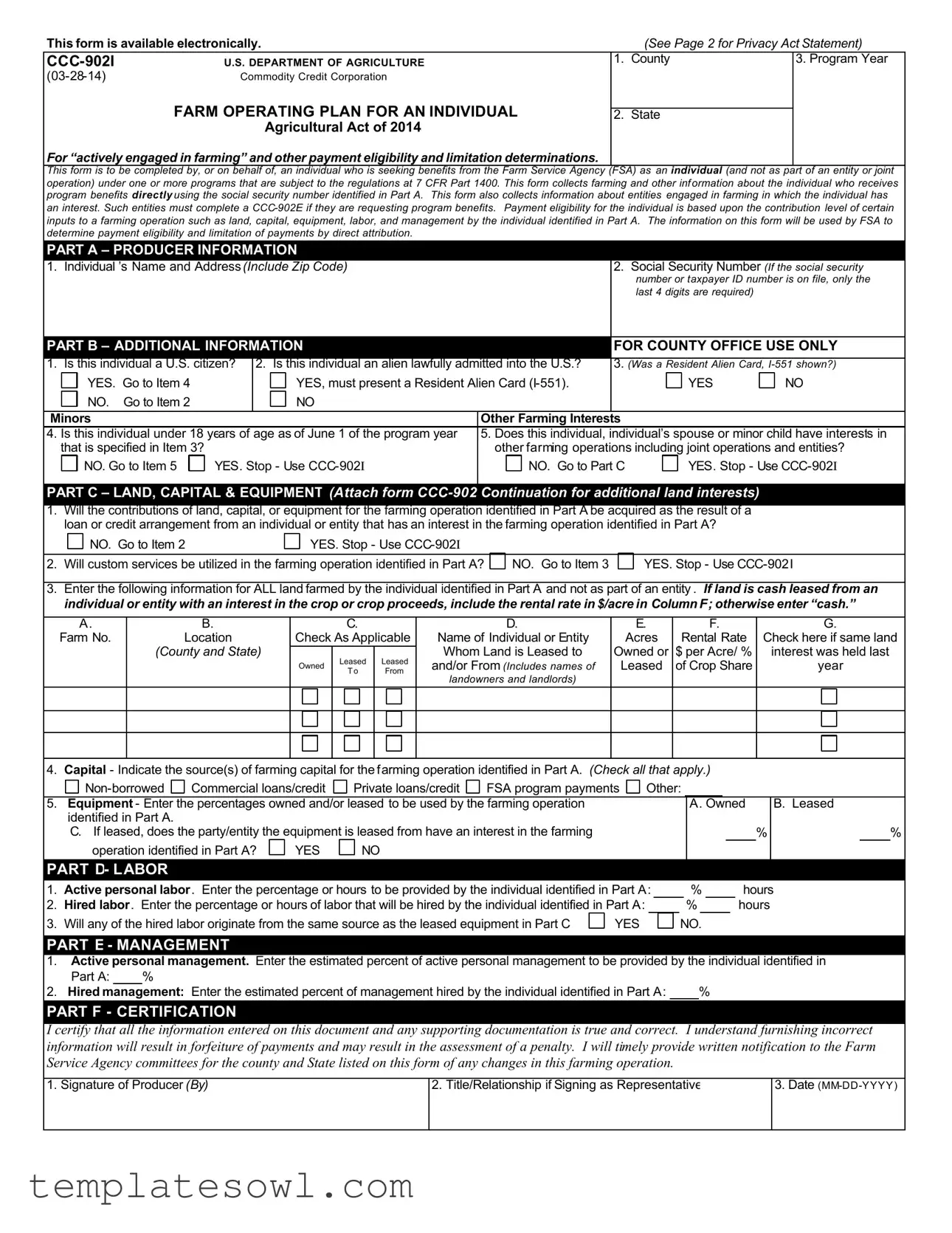

Ccc 902I Example

This form is available electronically. |

|

(See Page 2 for Privacy Act Statement) |

||

U.S. DEPARTMENT OF AGRICULTURE |

1. |

County |

3. Program Year |

|

Commodity Credit Corporation |

|

|

|

|

|

FARM OPERATING PLAN FOR AN INDIVIDUAL |

|

|

|

|

2. |

State |

|

|

|

Agricultural Act of 2014 |

|

|

|

For “actively engaged in farming” and other payment eligibility and limitation determinations. |

|

|

|

|

This form is to be completed by, or on behalf of, an individual who is seeking benefits from the Farm Service Agency (FSA) as an individual (and not as part of an entity or joint operation) under one or more programs that are subject to the regulations at 7 CFR Part 1400. This form collects farming and other information about the individual who receives program benefits directly using the social security number identified in Part A. This form also collects information about entities engaged in farming in which the individual has an interest. Such entities must complete a

PART A – PRODUCER INFORMATION

1. Individual ’s Name and Address(Include Zip Code) |

2. Social Security Number (If the social security |

|

number or taxpayer ID number is on file, only the |

|

last 4 digits are required) |

|

PART B – ADDITIONAL INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

FOR COUNTY OFFICE USE ONLY |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Is this individual a U.S. citizen? |

2. |

Is this individual an alien lawfully admitted into the U.S.? |

3. (Was a Resident Alien Card, |

||||||||||||||||||||||||||||||||||||||||||

|

|

YES. Go to Item 4 |

|

|

YES, must present a Resident Alien Card |

|

|

|

|

|

|

|

|

|

|

YES |

|

|

|

|

|

NO |

||||||||||||||||||||||||

|

|

NO. |

Go to Item 2 |

|

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Minors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Farming Interests |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

4. |

Is this individual under 18 years of age as of June 1 of the program year |

5. Does this individual, individual’s spouse or minor child have interests in |

||||||||||||||||||||||||||||||||||||||||||||

|

|

that is specified in Item 3? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

other farming operations including joint operations and entities? |

|||||||||||||||||||||||||||||

|

|

NO. Go to Item 5 |

YES. Stop - Use |

|

|

|

|

|

|

|

NO. Go to Part C |

|

|

|

|

|

|

|

|

YES. Stop - Use |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

PART C – LAND, CAPITAL & EQUIPMENT (Attach form |

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Will the contributions of land, capital, or equipment for the farming operation identified in Part A be acquired as the result of a |

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

loan or credit arrangement from an individual or entity that has an interest in the farming operation identified in Part A? |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

NO. Go to Item 2 |

|

|

YES. Stop - Use |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

2. |

Will custom services be utilized in the farming operation identified in Part A? |

|

|

NO. Go to Item 3 |

|

|

|

YES. Stop - Use |

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

3. |

Enter the following information for ALL land farmed by the individual identified in Part A and not as part of an entity . If land is cash leased from an |

|||||||||||||||||||||||||||||||||||||||||||||

|

|

individual or entity with an interest in the crop or crop proceeds, include the rental rate in $/acre in Column F; otherwise enter “cash.” |

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. |

|

|

|

B. |

|

|

|

|

|

C. |

|

|

|

|

|

|

|

D. |

|

|

|

E. |

|

|

|

|

|

F. |

|

|

|

|

|

|

G. |

|||||||||

|

|

Farm No. |

|

|

|

Location |

|

Check As Applicable |

Name of Individual or Entity |

|

|

Acres |

|

Rental Rate |

Check here if same land |

|||||||||||||||||||||||||||||||

|

|

|

|

|

(County and State) |

|

|

|

|

Leased |

|

Leased |

Whom Land is Leased to |

Owned or |

$ per Acre/ % |

|

interest was held last |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

Owned |

|

and/or From (Includes names of |

|

Leased |

of Crop Share |

|

year |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

To |

|

From |

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

landowners and landlords) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

4. |

Capital - Indicate the source(s) of farming capital for the farming operation identified in Part A. (Check all that apply.) |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

Commercial loans/credit |

|

Private loans/credit |

|

FSA program payments |

|

Other: |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

5. |

Equipment - Enter the percentages owned and/or leased to be used by the farming operation |

|

|

|

|

|

|

|

|

|

|

A. Owned |

B. Leased |

|||||||||||||||||||||||||||||||||

|

|

identified in Part A. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

C. If leased, does the party/entity the equipment is leased from have an interest in the farming |

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

% |

|||||||||||||||||||||||||||||

|

|

operation identified in Part A? |

|

YES |

|

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

PART D- LABOR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

1. |

Active personal labor. Enter the percentage or hours to be provided by the individual identified in Part A: |

|

|

% |

|

|

|

|

hours |

|||||||||||||||||||||||||||||||||||||

2. |

Hired labor. Enter the percentage or hours of labor that will be hired by the individual identified in Part A: |

|

|

% |

|

|

|

|

|

hours |

|

|

|

|

|

|||||||||||||||||||||||||||||||

3. |

Will any of the hired labor originate from the same source as the leased equipment in Part C |

YES |

|

NO. |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

PART E - MANAGEMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

1. |

Active personal management. Enter the estimated percent of active personal management to be provided by the individual identified in |

|||||||||||||||||||||||||||||||||||||||||||||

|

|

Part A: |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Hired management: Enter the estimated percent of management hired by the individual identified in Part A: |

|

|

% |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

PART F - CERTIFICATION

I certify that all the information entered on this document and any supporting documentation is true and correct. I understand furnishing incorrect information will result in forfeiture of payments and may result in the assessment of a penalty. I will timely provide written notification to the Farm Service Agency committees for the county and State listed on this form of any changes in this farming operation.

1. Signature of Producer (By) |

2. Title/Relationship if Signing as Representative |

3. Date |

|

|

|

Page 2 of 2 |

DEFINITIONS

The following definitions apply to Form

1.ACTIVELY ENGAGED IN FARMING – means providing both: 1) significant contributions of capital, equipment, or land, or combination thereof to the farming operation; and 2) significant contributions of active personal labor or active personal management, or a combination thereof, to the farming operation as described. Further, for a person or legal entity to be considered actively engaged in farming for program payment purposes, the contributions of the person or legal entity must be

2.INTEREST IN A FARMING OPERATION– a person or legal entity is considered to have an interest in a particular farming operation if the person or legal entity owns or rents land to or from that farming operation; has an interest in the agricultural commodities produced on the operation; or is a member of a joint operation that either owns or rents land to or from the farming operation, or has an interest in the agricultural commodities produced on that operation.

3.JOINT OPERATION- is a general partnership, joint venture, or similar organization.

4.PERSON – is a natural person (an individual) and does not include a legal entity.

5.ACTIVE PERSONAL LABOR – a person is considered to be providing active personal labor with respect to a farming operation if that person is directly and personally providing physical activities necessary to conduct the farming operation, including land preparation, planting, cultivating, harvesting, and marketing of agricultural commodities. Other qualifying physical activities include establishing and maintaining conserving covers and those physical activities necessary for livestock production for the farming operation.

6.ACTIVE PERSONAL MANAGEMENT– a person is considered to be providing active personal management with respect to a farming operation if that person is directly and personally providing the general supervision and direction of activities and labor involved in the farming operation; or providing services (whether performed

7.CAPITAL – with respect to afarming operation is the funding provided by a person or legal entity to the farming operation in order for such operation to conduct farming activities. To be considered a countable contribution for a person or legal entity, the capital must have been derived from a fund or account separate and distinct from that of any other person or entity involved in such operation. Countable capital does not include the value of any labor or management which is contributed to the farming operation. A capital contribution may be a direct

8.CONTRIBUTION – with respect to a farming operation isthe provision of land, capital or equipment assets, and providing active personal labor, or active personal management to the farming operation in exchange for, or the expectation of, deriving benefits based solely on the success of the farming operation.

9.CUSTOM SERVICES – with respect to a farming operation is the hiring of a contractor or vendor that is in the business of providing such specialized services to perform services for the farming operation in exchange for the payment of a fee for such services performed.

10.ENTITY - is a corporation, joint stock company, limited liability company, association, limited partnership, limited liability partnership, irrevocable trust, revocable trust, estate, charitable organization, or other similar organization including any such organization participating in the farming operation as a partner in a general partnership, participant in a joint venture, a grantor of a revocable trust, or as a participant in a similar organization.

11.EQUIPMENT – with respect to a farming operation is the machinery and implements needed to conduct activities of the farming operation including machinery and implements used for land preparation, planting, cultivating, harvesting or marketing crops. Equipment also includes machinery and implements needed to establish and maintain conserving covers.

12.FAMILY MEMBER – a person is considered to be a family member of another person in the farming operation of that person is related to the other as a lineal ancestor, lineal descendant, sibling, spouse, or otherwise by marriage.

13.FARMING OPERATION - is a business enterprise engaged in the production of agricultural products which is operated by a person or a formal or informal entity which is eligible to receive payments, directly or indirectly.

14.LAND – with a respect to a contribution to a farming operation is farmland consisting of cropland, pastureland, wetland, or rangeland which meets the specific requirements of the applicable program for which payments or benefits are sought.

15.SUPPORTING DOCUMENTATION– is any information that supports the relevant representations made such as, but not limited to: articles of incorporation; corporate meeting minutes; stock certificates; organizational papers; trust agreement; last will or testament or a deceased individual; affidavit of heirship approved by Office of General Counsel; partnership agreement; property lease agreement; purchase agreement; land deed; lending security agreement; and financial statement.

16.All other terms utilized in this form shall be defined pursuant to 7 CFR Part 1400.

NOTE: The following statement is made in accordance with the Privacy Act of 1974 (5 USC 552a – as amended). The authority for requesting the information identified on this form is 7 CFR Part 1400, the Commodity Credit Corporation Charter Act (15 U.S.C. 714 et seq.), and the Agricultural Act of 2014 (Pub. L.

information will be used to identify the farm operating plan data needed to determine an individual’s eligibility for program benefits. The information collected on this form may be disclosed to other Federal, State, Local government agencies, Tribal agencies, and nongovernmental entities that have been authorized access to the information by statute or regulation and/or as described in applicable Routine Uses identified in the System of Records Notice for

This information collection is exempted from the Paperwork Reduction Act as specified in the Agricultural Act of 2014 (Pub. L.

FORM TO YOUR COUNTY FSA OFFICE.

The U.S. Department of Agriculture (USDA) prohibits discrimination against its customers, employees, and applicants for employment on the basis of race, color, national origin, age, disability, sex, gender identity, religion, reprisal, and where applicable, political beliefs, marital status, familial or parental status, sexual orientation, or all or part of an individual’s income is derived from any public assistance program, or protected genetic information in employment or in any program or activity conducted or funded by the Department. (Not all prohibited bases will apply to all programs and/or employment activities.) Persons with disabilities, who wish to file a program complaint, write to the addres s below or if you require alternative means of communication for program information (e.g., Braille, large print, audiotape, etc.) please contact USDA’s TARGET Center at (202)

If you wish to file a Civil Rights program complaint of discrimination, complete the USDA Program Discrimination Complaint Form, found online at http://www.ascr.usda.gov/complaint_filing_cust.html, or at any USDA office, or call (866)

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Electronic Availability | The CCC-902I form is available electronically, simplifying access and submission. |

| Governing Law | This form is governed by the Agricultural Act of 2014, which outlines eligibility for farming benefits. |

| Purpose of Form | The form is used to determine payment eligibility and limitations for individuals seeking benefits from the Farm Service Agency (FSA). |

| Data Collection | It collects farming-related information tied to the individual's Social Security number and any farming interests they may have. |

| Eligibility Requirements | To qualify as "actively engaged in farming," an individual must provide significant contributions of capital, labor, or management. |

| Required Supporting Document | Supporting documentation, such as leases or financial statements, may be required alongside the form during submission. |

Guidelines on Utilizing Ccc 902I

Filling out the CCC-902I form can seem daunting at first, but it is essential for those seeking benefits from the Farm Service Agency (FSA). Follow these steps carefully to ensure your form is completed accurately and fully, minimizing the risk of delays in processing your application.

- Start with **Part A – Producer Information**. Enter your full name and address in the designated fields, ensuring you include your zip code. Then, provide your Social Security Number; if it’s already on file, just enter the last four digits.

- Proceed to **Part B – Additional Information for County Office Use Only**. Answer questions regarding your citizenship status. Indicate if you are under 18 by checking the appropriate box. If you or your family members have interests in other farming operations, check 'yes' and use CCC-902I, as further documentation may be required.

- Move to **Part C – Land, Capital & Equipment**. If acquiring land, capital, or equipment through loans from an interested party, check the appropriate box. List all lands farmed under your name, detailing location, ownership status, and rental rates as applicable. If land is leased, identify the entity and the rental rates.

- For capital contributions, select all applicable sources of funding in this section. Specify the percentages of your equipment that is owned versus leased, including whether the equipment lessor has interest in your farming operation.

- In **Part D – Labor**, indicate the percentage of personal labor you will contribute, as well as any hired help. If hired labor shares a source with your leased equipment, mark accordingly.

- Complete **Part E – Management**. Enter the estimated percentage of personal management you will contribute and any hiring plans for management positions.

- Finally, certify your information in **Part F**. Sign in the designated space, provide the title or relationship if you are signing as a representative, and include the date of signing.

When you have filled out the CCC-902I form, make sure to review all of your responses for accuracy. Submit the completed form to your county FSA office for processing. Understanding the details and gathering necessary information before you start can help ensure a smooth filing process.

What You Should Know About This Form

What is the purpose of the CCC-902I form?

The CCC-902I form is used to collect information from individuals seeking benefits from the Farm Service Agency (FSA). This form helps determine whether a person is eligible for payments under various agricultural programs. It focuses on assessing the contributions an individual makes to their farming operation, such as land, labor, and management. Furthermore, it collects essential data regarding the individual's farming activities and any interests they may have in other farming operations.

Who should complete the CCC-902I form?

The CCC-902I form must be completed by individuals who are looking to receive program benefits directly from the FSA. This form is specifically intended for individuals, not entities or joint operations. If someone has an interest in farming operations through other legal entities, those entities must complete separate forms, like the CCC-902E, when applying for benefits.

What information is collected on the CCC-902I form?

The form collects personal information, including the individual’s name, address, and Social Security number. It also asks about citizenship status, age, and interests in other farming operations. The form further gathers details about land, capital, equipment, and labor contributions to the individual's farming operation. This comprehensive data helps the FSA evaluate payment eligibility and any limits on payments based on contributions to farming activities.

Where should the completed CCC-902I form be sent?

After completing the CCC-902I form, the individual must return it to their county FSA office. Ensuring the form is submitted to the right location is important for timely processing and determination of eligibility for any program benefits. This helps avoid delays in receiving assistance based on agricultural activities.

Common mistakes

Completing the CCC-902I form can be a straightforward task, but several common mistakes may hinder the process. One of the primary errors made is failing to provide complete and accurate personal information. This includes ensuring that the full name and complete address, inclusive of the zip code, are written correctly. Omitting even a single digit of the social security number can lead to delays in processing claims or even rejection of the application altogether.

Another frequent mistake is not properly indicating the individual's citizenship status. The form contains specific sections that require the applicant to clarify whether they are a U.S. citizen or a lawful alien. Failing to answer these questions correctly or skipping them entirely can result in compliance issues and questions about eligibility for benefits.

Misunderstanding the definitions of terms such as "actively engaged in farming" can also lead to significant mistakes. It is essential that the individual understands that being actively engaged means making substantial contributions in terms of capital, labor, and management. Providing incorrect information regarding these contributions may trigger eligibility complications, causing unnecessary complications for an otherwise qualified applicant.

Moreover, individuals often overlook the need for accurate reporting of land, capital, and equipment involvement. When listing land interests, it is vital to include information about rental rates and whether the land is leased from someone who has an interest in the crops. A lack of detail or incorrect figures can lead to misunderstandings with the Farm Service Agency (FSA), which may result in delays or a denial of benefits.

Finally, one of the more critical errors involves the certification section at the end of the form. A signature must be provided, and it should be ensured that the document is signed by the appropriate individual, whether it be the producer or a designated representative. Failing to sign or improperly completing this section could invalidate the entire application, leading to forfeiture of potential benefits and requiring re-submission of the form.

Documents used along the form

The CCC-902I form is critical for individuals seeking benefits from the Farm Service Agency. It collects essential information about farming operations. Alongside it, various other forms and documents support the application process. Below is a list of commonly used forms and their brief descriptions.

- CCC-902E: This form is required for entities engaged in farming. It provides details about the entity's contributions and operations, similar to the CCC-902I but tailored for joint ventures or partnerships.

- CCC-901: The CCC-901 form collects basic information about farm operations. It serves as a precursor to the CCC-902I and helps in assessing initial eligibility.

- FSA-578: This document is the Report of Acreage. Producers use it to declare the crops planted and the acreage for each, which is crucial for calculating program benefits.

- FSA-505: Known as the Farm and Ranch Land Protection Program application. This form is used by individuals seeking to protect their agricultural land from being developed.

- AD-1026: The Highly Erodible Land and Wetland Conservation Certification form. It ensures compliance with conservation provisions necessary for receiving certain benefits under agricultural programs.

- CCC-1: This is an application for Agricultural Commodity Certification. It gathers necessary information about the commodities involved in the farming operation.

- FSA-850: The Request for Direct Payment form. Producers file this to receive direct payments through various agricultural programs.

- FSA-1: This is the Farm Service Agency's Program Application form. It allows individuals to apply for various programs administered by the FSA, streamlining the application process.

Gathering all relevant forms is essential for a successful application. Complete documentation ensures that the Farm Service Agency can efficiently assess eligibility and assist farmers in accessing the benefits they need.

Similar forms

- CCC-902E Form: Similar to the CCC-902I form, the CCC-902E is used for entities seeking benefits. It also gathers detailed information about the farming operations, including contributions and ownership interests. This form directly complements the CCC-902I by addressing cases involving multiple participants rather than individuals.

- FSA-1005: This form applies to requests for farm service loans. Like the CCC-902I, it collects individual-level data to establish eligibility for program benefits. Both forms share a focus on the applicant's involvement in farming and the resources they use, ensuring proper assessments for financial assistance.

- CCC-901: The CCC-901 form is a certification of eligibility for various agricultural programs. It, too, collects personal and operational information about the individual involved in farming. Requirements overlap, as both forms aim to confirm qualifications for receiving USDA program benefits.

- FSA-1930: This document is utilized for reporting production and financial information related to a specific farming operation. It shares a goal with the CCC-902I form, gathering data essential for the Farm Service Agency to make informed decisions regarding benefits and eligibility.

Dos and Don'ts

When filling out the CCC-902I form, it is important to pay close attention to detail. Below is a list of things you should and shouldn't do to ensure your application is completed correctly.

- Do: Provide your complete name and address, including zip code.

- Do: Include your full Social Security Number, or just the last four digits if it's already on file.

- Do: Check all applicable boxes regarding citizenship and age.

- Do: Ensure that all contributions are accurately reported, including land and capital.

- Do: Use clear and legible handwriting if filling out the form by hand.

- Don't: Skip any required sections or leave them blank.

- Don't: Provide incorrect or misleading information, as this may lead to penalties.

- Don't: Forget to sign and date the form before submitting.

- Don't: Include personal information on the form that is not requested.

- Don't: Submit the form without verifying that all information is complete and correct.

Misconceptions

Misconceptions about the CCC-902I form can lead to confusion for individuals seeking benefits. Here are nine common misconceptions, along with clarifications:

- Misconception 1: The CCC-902I form is only for large farming operations.

- Misconception 2: Only farms with financial backing need to complete the CCC-902I form.

- Misconception 3: The CCC-902I form cannot be completed electronically.

- Misconception 4: Only U.S. citizens can apply using the CCC-902I form.

- Misconception 5: If an individual is under 18, they cannot apply for benefits.

- Misconception 6: Individuals do not need to report other farming interests when completing the form.

- Misconception 7: Completing the form guarantees eligibility for payments.

- Misconception 8: The information provided will not be shared with other agencies.

- Misconception 9: The CCC-902I form cannot be updated once it has been submitted.

This form is designed for individual farmers, regardless of the size of their operation. Individuals engaged in farming can use it to apply for benefits.

Every individual seeking benefits must submit the CCC-902I form, regardless of their financing status. The form collects essential information to determine payment eligibility.

Contrary to this belief, the CCC-902I form is available electronically, making it convenient to fill out and submit.

The form allows for eligibility by both U.S. citizens and aliens lawfully admitted into the country, as long as proper documentation is presented.

Minors can still utilize the CCC-902I form through a representative, ensuring that young farmers are not excluded from program benefits.

The form explicitly asks about other farming interests the individual may have. Failing to provide this information can jeopardize eligibility.

Submitting the CCC-902I form does not guarantee benefits. Eligibility is determined after review of the submitted information.

The data collected may be disclosed to various federal, state, and local agencies as necessary for program management.

Individuals are required to provide timely updates regarding any changes in their farming operation after submitting the form.

Key takeaways

The CCC-902I form is essential for individuals seeking benefits from the Farm Service Agency (FSA) under various agriculture programs.

Be sure to complete the form accurately. Incorrect information can result in forfeiture of payments and possible penalties.

The form collects vital personal information, such as the individual’s name, address, and Social Security number. This information helps determine eligibility for direct payment programs.

Individuals must also disclose their contributions to the farming operation, including land, capital, and labor, which are crucial for establishing their level of engagement in farming.

If you have interests in other farming operations, ensure to assess whether you need to complete any additional forms, such as the CCC-902E.

After completing the form, return it to your local county FSA office for processing. It is important to keep a copy for your records and future reference.

Browse Other Templates

R229 - The DMV uses this form to track all issued permits and licenses, ensuring organized record-keeping.

Atm Fill Form - Confirm your understanding of the terms and conditions before submission.

Ammunition Usage Report,Training Ammunition Statement,Munitions Expenditure Record,Live Fire Consumption Log,Consumption Verification Form,Ammunition Accountability Certificate,Range Activity Reporting Form,Munitions Consumption Declaration,Training - Name and signature of the certifying official are mandatory.