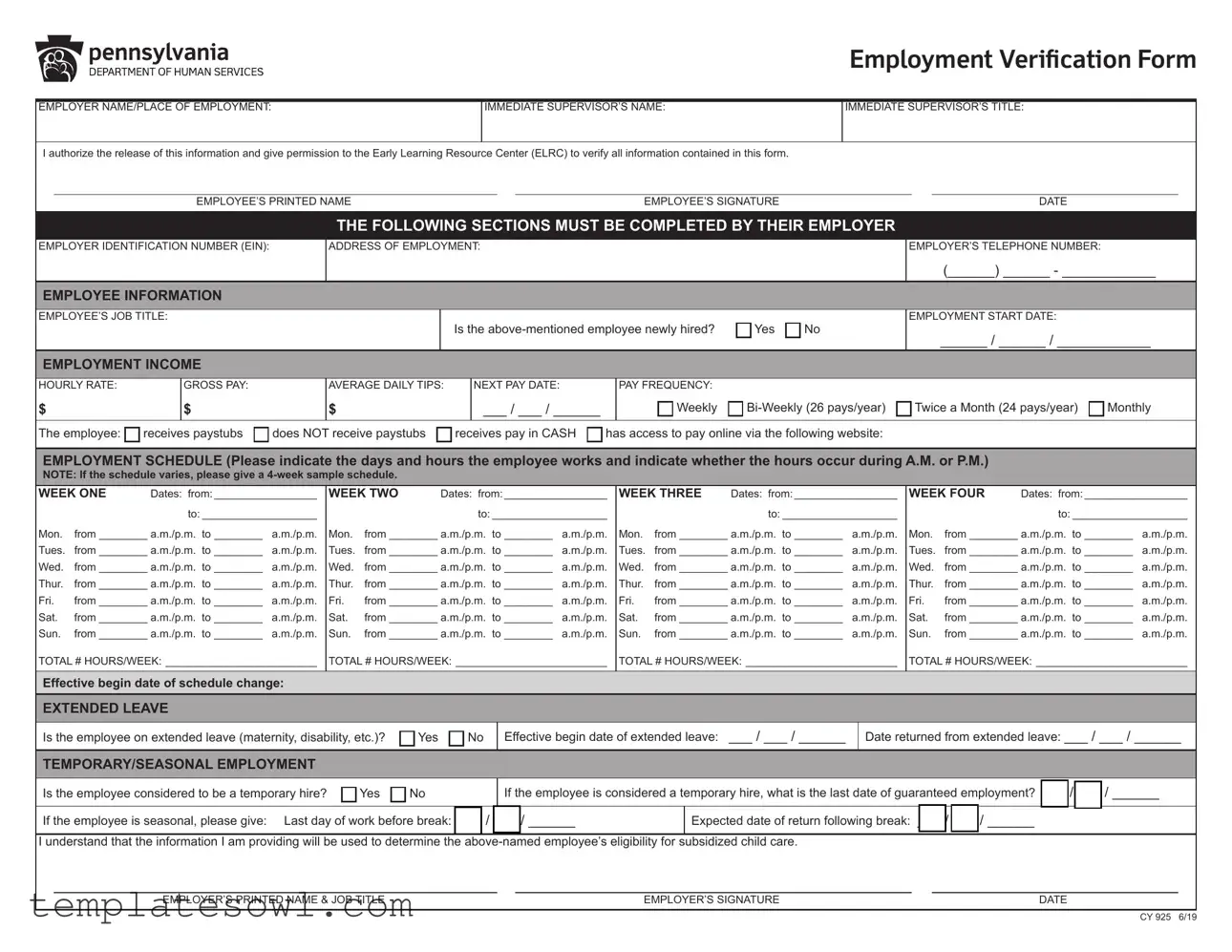

Fill Out Your Ccis Employment Verification Form

The CCIS Employment Verification Form serves a crucial role in helping employees access financial assistance for child care costs. This form is essential for verifying employment details and ensuring that workers qualify for subsidized child care programs. Employers fill out critical information, including the company name, the employee’s job title, and their immediate supervisor's contact details. Additionally, the form requests employment specifics such as the employee’s start date, income, and work schedule. It is important that employers accurately report how much and how often the employee gets paid, whether it be hourly or through a different pay structure. The form also includes sections on extended leave and whether the employment is temporary or seasonal. Overall, the form must be completed and submitted directly to the Early Learning Resource Center (ELRC) by an authorized representative of the company, ensuring that all information submitted is both accurate and complete. This verification process ultimately helps to link families with the financial support they need for child care, contributing positively to their overall well-being.

Ccis Employment Verification Example

|

|

|

|

|

Employment Verification Form |

|||

|

|

|

||||||

EMPLOYER NAME/PLACE OF EMPLOYMENT: |

IMMEDIATE SUPERVISOR’S NAME: |

IMMEDIATE SUPERVISOR’S TITLE: |

||||||

|

|

|

|

|

|

|

|

|

I authorize the release of this information and give permission to the Early Learning Resource Center (ELRC) to verify all information contained in this form. |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

EMPLOYEE’S PRINTED NAME |

|

|

EMPLOYEE’S SIGNATURE |

|

|

DATE |

|

THE FOLLOWING SECTIONS MUST BE COMPLETED BY THEIR EMPLOYER

EMPLOYER IDENTIFICATION NUMBER (EIN):

ADDRESS OF EMPLOYMENT:

EMPLOYER’S TELEPHONE NUMBER:

(______) ______ - ____________

EMPLOYEE INFORMATION

EMPLOYEE’S JOB TITLE:

Is the |

Yes |

No |

EMPLOYMENT START DATE:

______ / ______ / ____________

EMPLOYMENT INCOME

HOURLY RATE: |

GROSS PAY: |

AVERAGE DAILY TIPS: |

NEXT PAY DATE: |

PAY FREQUENCY: |

|

|

|

$ |

$ |

$ |

___ / ___ / ______ |

Weekly |

Twice a Month (24 pays/year) |

Monthly |

The employee:

receives paystubs

receives paystubs  does NOT receive paystubs

does NOT receive paystubs

receives pay in CASH

receives pay in CASH  has access to pay online via the following website:

has access to pay online via the following website:

EMPLOYMENT SCHEDULE (Please indicate the days and hours the employee works and indicate whether the hours occur during A.M. or P.M.)

NOTE: If the schedule varies, please give a

WEEK ONE |

Dates: from:__________________ |

||

|

|

to:____________________ |

|

Mon. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Tues. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Wed. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Thur. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Fri. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Sat. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Sun. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

TOTAL # HOURS/WEEK: _________________________

WEEK TWO |

Dates: from:__________________ |

||

|

|

to:____________________ |

|

Mon. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Tues. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Wed. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Thur. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Fri. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Sat. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Sun. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

TOTAL # HOURS/WEEK: _________________________

WEEK THREE |

Dates: from:__________________ |

||

|

|

to:____________________ |

|

Mon. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Tues. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Wed. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Thur. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Fri. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Sat. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Sun. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

TOTAL # HOURS/WEEK: _________________________

WEEK FOUR |

Dates: from:__________________ |

||

|

|

to:____________________ |

|

Mon. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Tues. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Wed. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Thur. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Fri. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Sat. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Sun. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

TOTAL # HOURS/WEEK: _________________________

Effective begin date of schedule change:

EXTENDED LEAVE

Is the employee on extended leave (maternity, disability, etc.)? |

Yes |

No |

Effective begin date of extended leave: ___ / ___ / ______

Date returned from extended leave: ___ / ___ / ______

TEMPORARY/SEASONAL EMPLOYMENT

Is the employee considered to be a temporary hire? |

Yes |

No |

If the employee is considered a temporary hire, what is the last date of guaranteed employment? ___ / ___ / ______

If the employee is seasonal, please give: Last day of work before break: ___ / ___ / ______ |

|

Expected date of return following break: ___ / ___ / ______ |

|

|

|||||

|

|

|

|

||||||

I understand that the information I am providing will be used to determine the |

subsidized child care. |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

EMPLOYER’S PRINTED NAME & JOB TITLE |

|

|

EMPLOYER’S SIGNATURE |

|

|

DATE |

|

|

CY 925 6/19

Employment Verification Form

Dear Employer:

One of your employees has requested assistance paying his/her child care costs. We must verify his/her employment with you. This information will help us determine if this employee is eligible for the subsidized child care program. The form must be mailed directly to the Early Learning Resource Center (ELRC).

An authorized COMPANY REPRESENTATIVE (not the employee) must complete this form.

We must have an accurate record of your employee’s work schedule and employment income. Please complete the information on the back of this page. It is very important that the hours shown are specific and defined as either A.M. or P.M. (For example, 7:30 a.m. - 3:30 p.m.). If the employee’s schedule varies, please give a

Thank you for your time and assistance. If you have any questions about how to complete this form, please contact the ELRC listed below.

ELRC:

Early Learning Resource Center Region 17

PO Box 311

1430 DeKalb Street

Norristown, PA

(610)

CY 925 6/19

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Ccis Employment Verification form is designed to confirm an employee's details for subsidized childcare eligibility. |

| Authorized Personnel | An authorized company representative, not the employee, must complete the form to ensure accuracy and compliance. |

| Employee Information | Key details about the employee, such as job title, start date, and employment income, must be filled out by the employer. |

| Income Reporting | Employers must provide specific figures regarding the employee's hourly rate, gross pay, and average daily tips. |

| Schedule Documentation | A detailed work schedule is required, showing hours worked across a four-week period for clarity. |

| Extended Leave | Employers should indicate if the employee is on extended leave and provide relevant dates. |

| Temporary or Seasonal Employment | Indications regarding temporary hires or seasonal workers are necessary, including the last date of guaranteed employment. |

| Submission Instructions | The completed form must be sent directly to the Early Learning Resource Center (ELRC) for processing. |

| Governing Laws | The requirements surrounding the employment verification form often fall under local child care subsidy program regulations. |

| Contact Information | For questions or clarifications, employers can reach out to the ELRC using the contact information provided on the form. |

Guidelines on Utilizing Ccis Employment Verification

Once you receive the CCIS Employment Verification form, it's essential to complete it accurately. This ensures that the employee seeking assistance can receive the appropriate support for child care costs. Here are the steps to fill out the form:

- Employer Information: Fill in the employer's name and place of employment.

- Supervisor Details: Enter the immediate supervisor’s name and title.

- Authorization: The employee must print their name, sign the form, and date it to authorize the release of information.

- Employer Identification Number: Input the Employer Identification Number (EIN).

- Address: Provide the complete address of the place of employment.

- Employer Contact: Fill in the employer’s telephone number.

- Employee Job Title: Enter the employee’s job title.

- Employment Status: Indicate if the employee is newly hired by choosing 'Yes' or 'No.'

- Employment Start Date: Write the date the employee started working (MM/DD/YYYY).

- Employment Income:

- Enter the employee's hourly rate.

- Provide the gross pay amount.

- Enter the average daily tips, if any.

- Fill in the next pay date (MM/DD/YYYY).

- Select the pay frequency: Weekly, Bi-Weekly, Twice a Month, or Monthly.

- Circle whether the employee receives paystubs or cash, or has access to pay online.

- Employment Schedule: List the days and hours worked for the next four weeks, specifying AM or PM. If the schedule varies, provide a sample for each week.

- Extended Leave: Indicate if the employee is on an extended leave and fill in the relevant dates.

- Temporary/Seasonal Employment: Note if the employee is temporary or seasonal and enter the important dates as needed.

- Final Employer Details: The employer must print their name and job title, sign, and date the form.

Ensure that all information is clear and specific. After completing the form, it should be mailed directly to the Early Learning Resource Center as directed. This step is crucial for the processing of the employee's child care assistance request.

What You Should Know About This Form

What is the purpose of the CCIS Employment Verification form?

The CCIS Employment Verification form is used to confirm an employee's work status and income for the purpose of determining eligibility for subsidized child care. It helps the Early Learning Resource Center (ELRC) assess whether an employee qualifies for financial assistance with their child care costs.

Who is responsible for completing the CCIS Employment Verification form?

The form must be completed by an authorized representative of the employee's employer, not by the employee themselves. This ensures that the information provided is accurate and verified by someone in a position of authority within the organization.

What specific information is required on the form?

The form requires the employer to provide details such as the employer's name, the employee's job title, employment start date, hourly rate, gross pay, and work schedule. It also asks for information about whether the employee is new, on extended leave, or considered temporary or seasonal. Each section must be filled out completely to ensure proper review.

How is an employee’s work schedule documented on the form?

Employers need to indicate the specific days and hours the employee works. This includes noting whether hours are in the A.M. or P.M. If a schedule varies, a four-week sample must be provided. Clear documentation helps ELRC understand the employee's availability and work commitments.

What should employers do if an employee's schedule varies?

If an employee’s work schedule changes from week to week, employers must provide a sample schedule for four weeks. This documentation should outline the exact times worked each day, clearly indicating A.M. or P.M. This information is critical in evaluating the employee's eligibility for subsidized child care.

What happens if the form is not completed correctly?

If the CCIS Employment Verification form is incomplete or contains inaccurate information, the review process may be delayed. The ELRC relies on accurate data to assess eligibility, so it is crucial that all sections are thoroughly and accurately filled out by the employer.

Are there any privacy concerns related to the information provided?

The information collected on the CCIS Employment Verification form is confidential. Employers must ensure that the employee has authorized the release of this information to the ELRC. The form includes a signature line for the employee's consent, safeguarding their privacy while allowing necessary verification.

How does the completed form get submitted?

The completed CCIS Employment Verification form should be mailed directly to the Early Learning Resource Center (ELRC). Employers should not send this form to the employee or provide copies. Instead, it should go directly to the ELRC to maintain the confidentiality and integrity of the information provided.

Common mistakes

Completing the CCIS Employment Verification form accurately is crucial for determining an employee's eligibility for subsidized child care. Many errors can occur during this process. Understanding these common mistakes can help ensure that the form is filled out properly and avoid delays.

One common mistake is omitting the employee's printed name or signature. Both pieces of information are essential, as they confirm that the employee authorizes the verification of their details. Without this, the form may be considered incomplete and sent back for corrections.

Many people fail to provide the correct employer identification number (EIN). The EIN is needed to identify the company officially. Not including this number can lead to confusion and delay the verification process.

Accurate job title information is another critical component. If the employee’s job title is listed incorrectly, it may raise questions about their employment status. In some cases, it can also affect their eligibility for benefits.

Dates and times of employment are often misreported. Employers should provide specific employment start dates and regular work hours, indicating whether they fall in the A.M. or P.M. Using vague descriptions can result in unnecessary complications during verification.

Another common issue arises when detailing the employee’s work schedule. Employers sometimes forget to add a four-week sample schedule when the hours vary. If the schedule does fluctuate, providing a detailed breakdown ensures an accurate representation of the employee’s working hours.

Errors in the financial records reported can also be problematic. If gross pay or hourly rates are filled out incorrectly, it might lead to eligibility issues. Ensure this information matches the employee's pay stubs for accuracy.

Employers occasionally check both boxes regarding whether or not the employee receives paystubs. Clarity is crucial here; being inconsistent can cause confusion for those processing the application.

Some employers overlook the section regarding extended leave. If the employee is on a leave of absence, this must be noted clearly. Not providing this information can suggest the employee is still actively working, leading to potential misunderstandings.

Finally, the form requires an authorized company representative's signature, which is occasionally neglected. The form should be signed by someone other than the employee to maintain the integrity of the process.

By avoiding these common mistakes, employers can help facilitate a smoother process, ensuring that employees receive the assistance they need promptly.

Documents used along the form

The Ccis Employment Verification form serves as a crucial tool for verifying an employee's work status and income, particularly when accessing subsidized childcare programs. However, several other documents often accompany this form to provide a comprehensive view of the employee’s circumstances. Below is a list of commonly used documents that may be submitted alongside the Employment Verification form.

- Pay Stubs: These are regular statements provided by an employer detailing an employee's earnings. Pay stubs typically show gross pay, deductions, and net pay, helping to verify the employee's income claims outlined in the Employment Verification form.

- W-2 Forms: Issued by employers, W-2 forms summarize an employee's income and tax withheld for the year. These forms help confirm annual earnings and can support the information provided in the Employment Verification form.

- Job Offer Letter: A document given to a new employee upon hiring, this letter outlines essential details like title, salary, and start date. It serves as proof of employment and can corroborate information listed in the Employment Verification form.

- Tax Returns: Personal tax returns provide a detailed annual account of an individual's income from various sources. They serve as another layer of verification for assessing an employee's overall financial situation and confirming their financial claims.

Using these documents alongside the Ccis Employment Verification form enriches the verification process, ensuring the information is accurate and comprehensive. Each document plays a vital role in determining an employee's eligibility for subsidized childcare and supporting their financial stability.

Similar forms

The CCIS Employment Verification Form is designed to gather essential information about an employee's work status and income. Several other documents serve similar functions in various contexts. Below is a list of documents that share similarities with the CCIS Employment Verification Form:

- Employment Reference Letter: This document provides a written confirmation of an employee's job title, responsibilities, and duration of employment, typically for job applications or professional references.

- Pay Stub: A pay stub outlines an employee's earnings, tax deductions, and net pay for a specific pay period, helping to verify income and employment status for loans or benefits.

- Letter of Employment: Employers issue this letter to confirm employment for various purposes, such as securing financing or applying for housing, similar to how the CCIS form verifies employment for child care assistance.

- Tax Form W-2: This document shows annual earnings and taxes withheld for an employee. It serves as proof of income, aligning with the CCIS form's purpose of verifying financial details.

- Employer Income Verification Form: Often required by lenders, this form requires employers to confirm an employee’s income and employment status, much like the CCIS form for child care assistance inquiries.

- Job Application Form: This form collects detailed information about an applicant's previous employment, income, and job title, paralleling the information needed on the CCIS form.

- Unemployment Verification Form: Used to verify past employment status and income when applying for unemployment benefits, this form performs a similar role to the CCIS form in confirming employment details.

Dos and Don'ts

When filling out the Ccis Employment Verification form, it is crucial to follow certain guidelines to ensure accuracy and completeness. Below is a list of essential do’s and don’ts that will aid in the process.

- Do provide complete information for all required fields, such as employer name and identification number.

- Do specify whether the employee is newly hired; this helps establish context for the verification.

- Do accurately report the employee's job title and employment start date; incorrect details can lead to delays.

- Do clearly indicate the employment schedule, including the specific days and hours worked, specifying A.M. or P.M. times.

- Do ensure that the form is signed by an authorized company representative instead of the employee.

- Don’t leave any sections blank; incomplete forms can result in processing delays.

- Don’t make assumptions about employment status; check whether the employee is temporary or on extended leave.

- Don’t provide estimates; always give precise figures for hours worked and income reported.

- Don’t forget to mail the form directly to the Early Learning Resource Center (ELRC); ensure it reaches the correct office.

Adhering to these guidelines will minimize the chance of errors and ensure that your employee’s information is processed smoothly. Take these steps seriously to assist in verifying employment effectively.

Misconceptions

Misconception 1: Employers can rely solely on verbal confirmation of employment.

While a verbal confirmation might seem sufficient, the Ccis Employment Verification form requires written documentation. This ensures that all necessary details, such as job title, income, and work schedule, are accurately recorded and verified by an authorized employer representative.

Misconception 2: Any employee can fill out the form.

Only an authorized company representative is permitted to complete the form. This requirement helps maintain the integrity of the data provided and ensures that the information is both accurate and reliable.

Misconception 3: The employee's pay frequency can be left blank if it varies.

It is essential to specify the pay frequency on the form. If the pay schedule changes, it is still important to indicate the average frequency, whether weekly, bi-weekly, or monthly. This information is crucial for determining eligibility for the subsidized child care program.

Misconception 4: The ELRC does not need detailed information about the employee's work hours.

Providing precise details about the employee's work schedule is vital. The employer must outline specific hours worked, including AM or PM designations. If the work schedule varies, a four-week sample is required to give an accurate picture of the employee’s typical hours.

Key takeaways

Filling out the CCIS Employment Verification form is a critical task to ensure that employees can access subsidized child care programs. Here are some key takeaways to keep in mind:

- The form must be completed by an authorized company representative, not the employee. This ensures that the information is verified and accurate.

- Specific details about the employee's work schedule are essential. Clearly indicate whether hours are in A.M. or P.M., and provide a four-week schedule if the hours vary from week to week.

- Accurate employment income information is vital. Include hourly rates, gross pay, average daily tips, and payfrequency details to allow for a complete understanding of the employee's financial situation.

- Submit the completed form directly to the Early Learning Resource Center (ELRC). Mail it promptly to avoid delays in the employee's eligibility review.

Browse Other Templates

Free Salon Chemical Release Form - Clients must provide a clear history of past chemical applications.

Newbury College Transcripts - Organize your information around the structure provided to expedite the request.