Fill Out Your Cd 479 Form

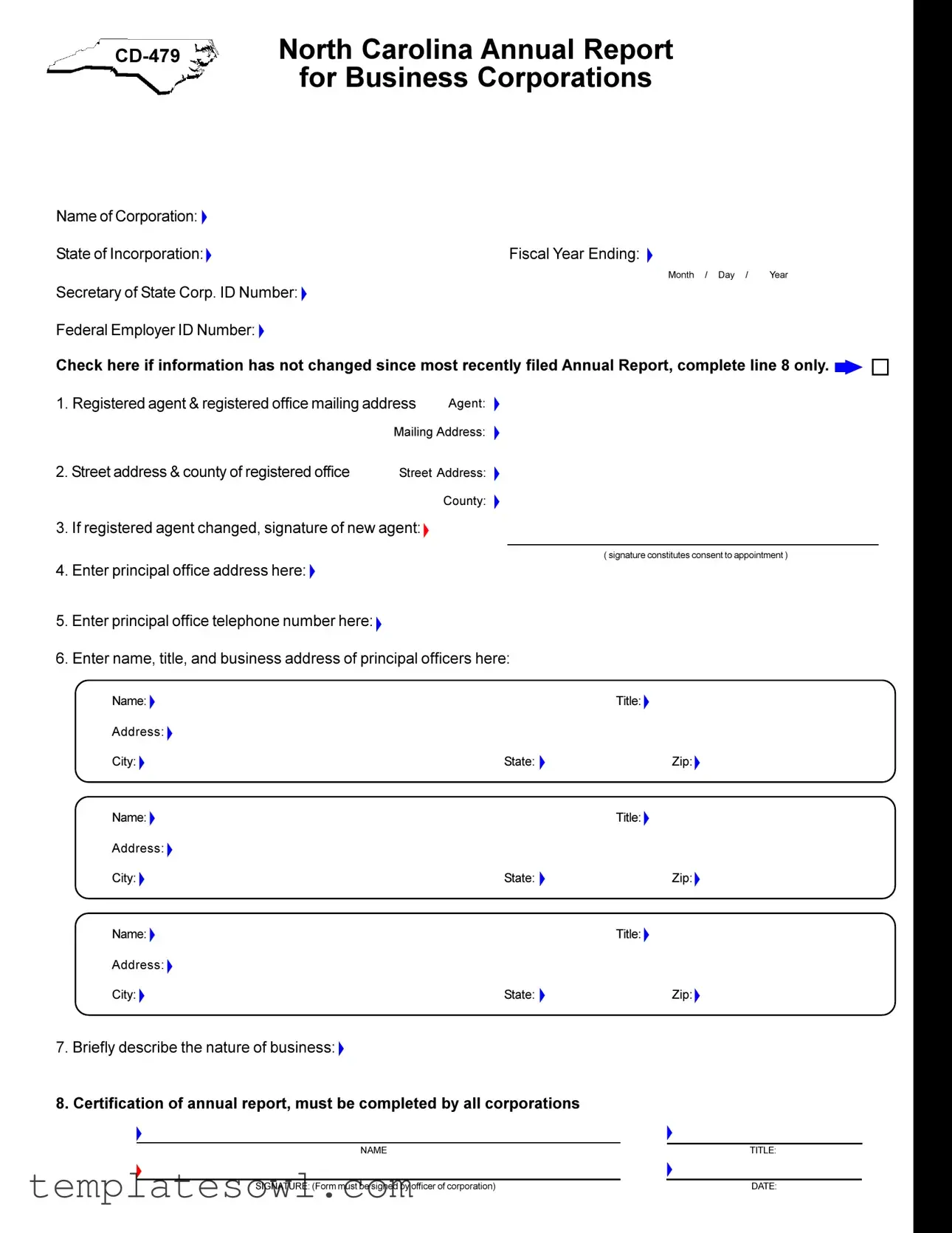

The CD-479 form is an essential document for business corporations operating in North Carolina, serving as the Annual Report that keeps the state informed about the corporation's key details. Each year, corporations must provide crucial information, including their name, state of incorporation, and fiscal year-end date. The form requires the Secretary of State Corporation ID number and Federal Employer ID number, ensuring that the business is properly recognized and compliant with state regulations. Additionally, the CD-479 asks for information about the registered agent and registered office, outlining changes when necessary. This document is not just a checklist of facts; it demands a signature from a principal officer, affirming that the information provided is both accurate and current. Moreover, a brief description of the nature of the business must be submitted, offering insight into what the corporation does. By completing this form, companies fulfill their legal obligation while also maintaining good standing, allowing them to thrive in North Carolina’s dynamic business landscape. Understanding the nuances of the CD-479 is crucial for anyone overseeing corporate compliance in the state, making this article a valuable resource for business owners and officers alike.

Cd 479 Example

North CarolinaAnnual Report

for Business Corporations

NameofCorporation:

StateofIncorporation: |

FiscalYear Ending: |

Month / Day / |

Year |

SecretaryofStateCorp.IDNumber:

FederalEmployerIDNumber:

Check here if information has not changed since most recently filedAnnual Report, complete line 8 only.

1.Registeredagent®isteredofficemailingaddress |

Agent: |

2.Streetaddress&countyofregisteredoffice

Mailing Address:

Street Address:  County:

County:

3.Ifregisteredagentchanged,signatureofnewagent:

(signatureconstitutesconsenttoappointment)

4.Enterprincipalofficeaddresshere:

5.Enterprincipalofficetelephonenumberhere:

6.Entername,title,andbusinessaddressofprincipalofficershere:

Name: |

|

Title: |

Address: |

|

|

City: |

State: |

Zip: |

Name: |

|

Title: |

Address: |

|

|

City: |

State: |

Zip: |

Name: |

|

Title: |

Address: |

|

|

City: |

State: |

Zip: |

7.Brieflydescribethenatureofbusiness:

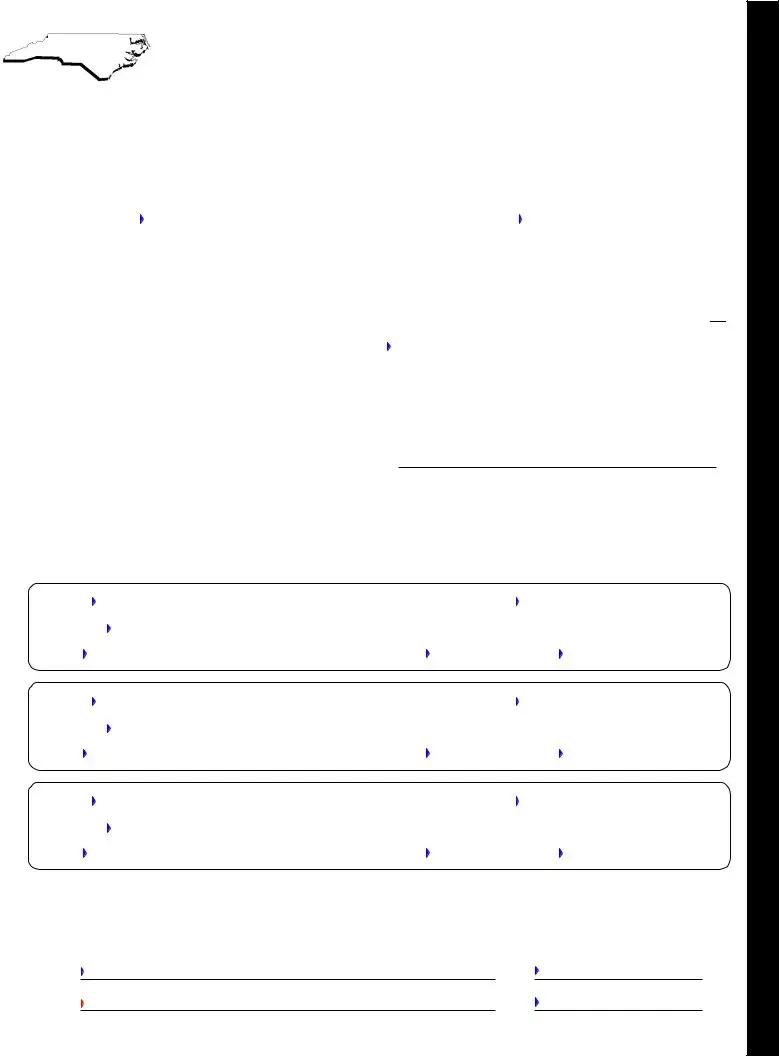

8.Certification of annual report, must be completed by all corporations

NAME |

TITLE: |

SIGNATURE:(Formmustbesignedbyofficerofcorporation) |

DATE: |

CheckListforNCAnnualReportforBusinessCorporations

(Instructions for the preparation of the Business Annual Report Form, CD - 479)

Thischecklistisincludedtoassistyouinpreparingtheannualreportforyourbusinesscorporation.Pleasetakeafew minutesandreadtheinformationprovided.

1.ThefollowinginformationmustbeprovidedbyeachcorporationfilinganAnnualReportwiththeNorthCarolina DepartmentofRevenue:

A.NameofCorporation

B.StateofIncorporation

C.SecretaryofStateCorp.IDNumber

D.FederalEmployerIDNumber

EffectiveJanuary1,1998andapplyingtotaxyearsendingonorafterDecember31,1997,allcorporationsauthorizedto transactbusinessinNorthCarolinaexceptforinsurancecompanies,limitedliabilitycompanies,nonprofitcorporations, andprofessionalassociationsmustfileaCorporateAnnualReportwiththeDepartmentofRevenueandremitatwenty

2.Whenchangingtheregisteredagentortheregisteredofficemailingaddressinformation,indicatethechangein Item1.Theregisteredagentnamemustbetypedorprinted.TheregisteredofficemailingaddresscanbeaPost OfficeBox.

3.Ifthestreetaddressoftheregisteredofficechanged,indicatethechangeinitem2.Thestreetaddressofthe registeredofficemustbea“StreetAddress”andnota“PostOfficeBox”.

4.Iftheregisteredagenthaschanged,thenewregisteredagentmustsignconsenttotheappointmentinthespace provided.Iftheregisteredagent’snamewaschangedduetomarriage,orbyanyotherlegalmeans,the corporationmustindicatesuchchangeinthespaceprovidedandhavetheagentsignconsenttotheappointment undertheirnewname.

5.Theprincipalofficeaddressshouldrevealthecorporation’sphysicallocation.

6.EntertheprincipalofficetelephonenumberinItem5.

7.Everycorporationmusthaveatleastoneofficer.Ifonlyoneofficerislistedonthereport,itmustbethePresident. Enterthecompletename,title,andbusinessaddressoftheprincipalofficersinItem6.

8.ProvideabriefdescriptionofthenatureofyourbusinessinItem7.Eachcorporationmustprovideabrief descriptionofthenatureofbusinessbeforetheannualreportcanbefiled.

9.ChecktheAnnualReportcarefullytoensureallinformationrequiredforfilinghasbeenprovided.Completethe signature,date,andtypeand/orprintthenameandtitleinthespaceprovidedontheformtocertifythatthe informationisaccurateandcurrent.

For more information or assistance, |

|

please contact: |

NCAnnual Report for BC forms are available on the |

|

Internet at both the Secretary of State’s Web Site, and at |

Secretary of State |

the Department of Revenue’s Web Site: |

Corporations Division |

|

Post Office Box 29525 |

Secretary of State’s Office: www.state.nc.us/secstate |

Raleigh, NC |

|

Phone |

Department of Revenue: www.dor.state.nc.us/DOR |

Toll Free |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The CD-479 form is used for the Annual Report of Business Corporations in North Carolina. |

| Filing Requirements | All corporations, except for certain exclusions, must file this report with the North Carolina Department of Revenue. |

| Filing Fee | A $20.00 fee is required when submitting the Annual Report. |

| Governing Law | This form complies with North Carolina General Statutes, specifically G.S. 55-16-22. |

| Information Needed | Corporations must provide information, such as the name, state of incorporation, and various addresses. |

| Certification Requirement | An officer of the corporation must sign to certify the accuracy of the information provided. |

Guidelines on Utilizing Cd 479

Once you have reviewed the requirements, you are ready to start filling out the CD-479 form. It is crucial to provide accurate and up-to-date information to ensure compliance with state regulations. Follow these steps to complete the form effectively.

- Name of Corporation: Enter the full name of your corporation.

- State of Incorporation: Specify the state where your corporation is incorporated.

- Fiscal Year Ending: Indicate the month, day, and year when your fiscal year ends.

- Secretary of State Corp ID Number: Fill in your corporation's ID number issued by the Secretary of State.

- Federal Employer ID Number: Enter your corporation’s federal EIN.

- Information Change Check: If no information has changed since the last filed report, check the provided box and complete only line 8.

- Registered Agent & Registered Office Mailing Address: Provide the name of the registered agent and their mailing address.

- Street Address & County of Registered Office: Fill in the street address and county where the registered office is located.

- Registered Agent Change: If the registered agent has changed, include the signature of the new agent to confirm their appointment.

- Principal Office Address: Enter the physical address of the corporation’s main office.

- Principal Office Telephone Number: Provide the phone number where the principal office can be reached.

- Principal Officers: List the names, titles, addresses, cities, states, and zip codes of all principal officers of the corporation.

- Nature of Business: Provide a brief description of what your corporation does.

- Certification of Annual Report: Complete the final section by entering the name and title of the certifying officer, signing the form, and dating it.

After completing these steps, carefully review the form to confirm all details are accurate. This review ensures that your annual report can be processed without delay.

What You Should Know About This Form

What is the purpose of the CD-479 form?

The CD-479 form serves as the Annual Report for Business Corporations in North Carolina. This report is a requirement for all corporations authorized to conduct business in the state, with certain exceptions. It provides the Secretary of State with updated information about the corporation, including its registered agent, mailing address, and the nature of its business. Filing this report ensures compliance with state regulations and helps maintain the corporation's good standing.

Who needs to file the CD-479 form?

All corporations that are authorized to transact business in North Carolina, except for insurance companies, limited liability companies, nonprofit corporations, and professional associations, must file the CD-479. This includes both domestic and foreign corporations. It is essential to file this form annually to avoid penalties and ensure that the corporation remains in good standing with the state.

What information is required to complete the CD-479 form?

To successfully complete the CD-479 form, the following details must be provided: 1. Name and state of incorporation of the corporation 2. Secretary of State Corp ID Number 3. Federal Employer ID Number 4. Information about the registered agent and the registered office 5. Principal office address and telephone number 6. Names, titles, and addresses of principal officers 7. A brief description of the business’s nature It’s important to ensure all information is accurate before submission.

What happens if the information has not changed since the last filing?

If there have been no changes to the corporation's information since the last filed Annual Report, the filer can indicate this by checking the appropriate box on the form. This allows for a more streamlined filing process. However, all required sections must still be completed to maintain compliance.

How much is the filing fee for the CD-479 form?

The fee for filing the CD-479 Annual Report is twenty dollars ($20.00). This fee must be submitted along with the completed form to the North Carolina Department of Revenue. Timely payment of this fee, along with accurate information, is crucial to prevent any issues with the corporation's standing in the state.

Common mistakes

Filling out the CD-479 form can be straightforward, but several common mistakes can lead to filing issues. One primary mistake is not providing accurate identification numbers. Corporations need to include both the Secretary of State Corporation ID Number and the Federal Employer ID Number. Omitting or misentering these numbers can delay processing and create complications down the line.

Another common error involves the registered agent information. It is crucial to ensure that the registered agent's name is printed correctly. If the name is not legible or is inaccurately stated, it can interfere with communication between the corporation and the state, potentially leading to legal complications. Additionally, if the registered office mailing address has changed, this must also be indicated in Item 1; failing to do so can result in compliance issues.

Moreover, failing to provide a principal office address is a frequent oversight. The form requires the physical location of the principal office, and using a P.O. Box instead of a street address will not meet the requirements. Item 4 must accurately reflect the corporation's actual business location to avoid issues with the filing.

When listing officers in Item 6, many people do not realize that only the President should be listed if there is just one officer. If additional officers are present, their names, titles, and business addresses must be fully detailed. Incomplete information can lead to rejections. Also, ensuring a brief description of the corporation’s business in Item 7 is critical; many corporates skip this step, impacting the approval process.

Finally, many errors occur at the certification stage. Corporations often neglect to sign or date the form. Accurate certification is necessary to validate the report to the state. Without a signature, the submission may be deemed invalid. Corporations should double-check to ensure all required areas are filled before sending the form.

Documents used along the form

The CD-479 form, which is the North Carolina Annual Report for Business Corporations, is often used alongside several other important documents. These forms are essential for ensuring compliance with state laws and maintaining up-to-date information for your business. Below is a list of commonly associated forms and documents, each briefly described for clarity.

- CD-500: This is the form for filing Articles of Incorporation in North Carolina. It provides essential details about the corporation's structure and purpose at the time of establishment.

- CD-401: This document is used for filing Articles of Amendment. If the corporation needs to make changes to its original Articles of Incorporation, such as modifications to its name or purpose, this form is required.

- CD-104: This form is designated for applying for an Employer Identification Number (EIN) through the IRS. An EIN is vital for tax identification and reporting for corporations.

- CD-410: Used for the filing of Articles of Dissolution, this document officially ends the corporation's existence in North Carolina, ensuring that all liabilities and obligations are addressed.

- CD-479A: This is the form utilized for filing an Annual Report for foreign corporations doing business in North Carolina. It ensures compliance for out-of-state entities operating within North Carolina.

- NCDOR-101: The North Carolina Corporate Income and Franchise Tax Form, necessary for corporations to report and pay state taxes. It includes detailed financial information for tax purposes.

- NCP-110: The Business Personal Property Tax form is used to report personal property held by the corporation, ensuring proper taxation on business assets.

- NC-SOS Form for Registered Agent: This document informs the state of any changes to the registered agent for a corporation, critical for communication and legal notification purposes.

Each of these forms plays a significant role in maintaining compliance and ensuring the smooth operation of business entities in North Carolina. Keeping these documents organized and updated will not only facilitate smoother business operations but also uphold the legal integrity of the corporation.

Similar forms

- Form 990: This is used by nonprofits to report their financial information to the IRS. Like the CD-479, it requires details about organization’s activities, governance, and financial performance.

- Form 10-K: Public companies submit this annual report to the SEC. It contains a comprehensive overview of the company’s financial condition and operations, similar to how the CD-479 gives a snapshot of a corporation’s status.

- Form SS-4: This form is used to apply for an Employer Identification Number (EIN). Just as the CD-479 requires a Federal Employer Identification Number, SS-4 collects key identification details for businesses.

- Form B-1: This is an annual report for business entities registered in some states. It shares similarities with the CD-479 in that it gathers essential information about the business and verifies its operational status.

- Articles of Incorporation: This document is filed to legally create a corporation. It shares information about the business, similar to how the CD-479 summarizes the company’s information annually.

- Form 5471: This form is filed by U.S. citizens or residents who are officers or directors of certain foreign corporations. It requires detailed reporting on operations and ownership, much like the annual report outlined in the CD-479.

Dos and Don'ts

When filling out the CD-479 form for North Carolina Annual Report for Business Corporations, it’s important to follow some key dos and don'ts. Here’s a list to guide you:

- Do provide accurate and complete information about your corporation.

- Do check the box if your information hasn’t changed since the last report.

- Do make sure the registered agent’s name is typed or printed clearly.

- Do include the physical address of your principal office.

- Do verify the business description is brief yet informative.

- Don't use a Post Office Box for the registered office street address.

- Don't forget to have the new registered agent sign if a change is made.

- Don't skip the signature, date, and name/title certification at the end of the form.

- Don't rush; review all details thoroughly before submitting to ensure accuracy.

Following these simple guidelines will help you complete the form correctly and efficiently.

Misconceptions

Many business owners have misconceptions about the CD 479 form used in North Carolina for annual reporting. Here are five of the most common misunderstandings, along with clarification:

- The CD 479 form is only for corporations. Some people believe this form is exclusively for corporate entities. However, any business entity authorized to transact business in North Carolina, including limited liability companies and professional associations, may need to file this report.

- If there are no changes, I don’t have to submit the form. It is a common misconception that if no information has changed, a business owner can skip submitting the annual report. In fact, all corporations are required to file the CD 479 form annually, even if they check the box indicating no changes have occurred.

- I can use a P.O. Box for my registered office address. Many individuals assume a P.O. Box is acceptable for the registered office address. This is incorrect; the registered office must include a physical street address and cannot be a P.O. Box.

- The form can be signed by anyone in the company. Some believe that any employee can sign the CD 479 form. In reality, the form must be signed by an officer of the corporation, such as the President or another authorized individual.

- Filing the form is optional for small businesses. It is a misconception that small businesses or those with minimal revenue are exempt from filing the CD 479 form. All corporations, regardless of size, are mandated to file this annual report to maintain their good standing in North Carolina.

By understanding these common misconceptions, business owners can ensure compliance with state regulations and avoid potential penalties.

Key takeaways

Filling out the CD-479 form, also known as the Annual Report for Business Corporations in North Carolina, requires attention to detail and accurate information. Here are some key takeaways:

- Information Accuracy: Ensure that all required information is accurate, including the name of the corporation, state of incorporation, and identification numbers.

- Changes in Registered Agent: If there have been changes to the registered agent or registered office mailing address, this must be indicated clearly on the form.

- Principal Officers Requirement: A corporation must list at least one principal officer. If only one officer is listed, it must be the President.

- Timely Submission: The report must be filed annually. If no information has changed since the last report, simply check the box at the top of the form to expedite the process.

Browse Other Templates

Disability Determination Office - The SSA-3368 form requires details about whether the person can read and write in English.

Landlord Sample Letter Giving Notice to Tenant - Direct communication through this letter aids in establishing professionalism.

Homeless Court - Successful applications lead to ticket resolution and potential new opportunities.