Fill Out Your Ce200 Form

The CE200 form is a vital document for businesses and individuals in New York State seeking an exemption from workers’ compensation and disability benefits insurance coverage. This application must be utilized by entities without employees or, in some cases, out-of-state organizations working on contracts where all work is performed outside New York. For workers’ compensation, the exemption applies only to those with no employees or entities whose New York-based employees work less than thirty days within a year. Meanwhile, those seeking a disability benefits exemption must also fit specific criteria, which can include having no employees in certain cases. This form serves a singular purpose: it allows applicants to assert to government agencies that they are not obligated to carry these insurance coverages. Completing the CE200 application accurately is essential. It must be submitted in totality to the Workers' Compensation Board through mail or fax, and processing can take up to four weeks. However, for those in a hurry, an online version is available for immediate processing, allowing for the instant printing of the certificate. Clear instructions are provided alongside the application to guide applicants through this process, ensuring that they supply all necessary information before submission.

Ce200 Example

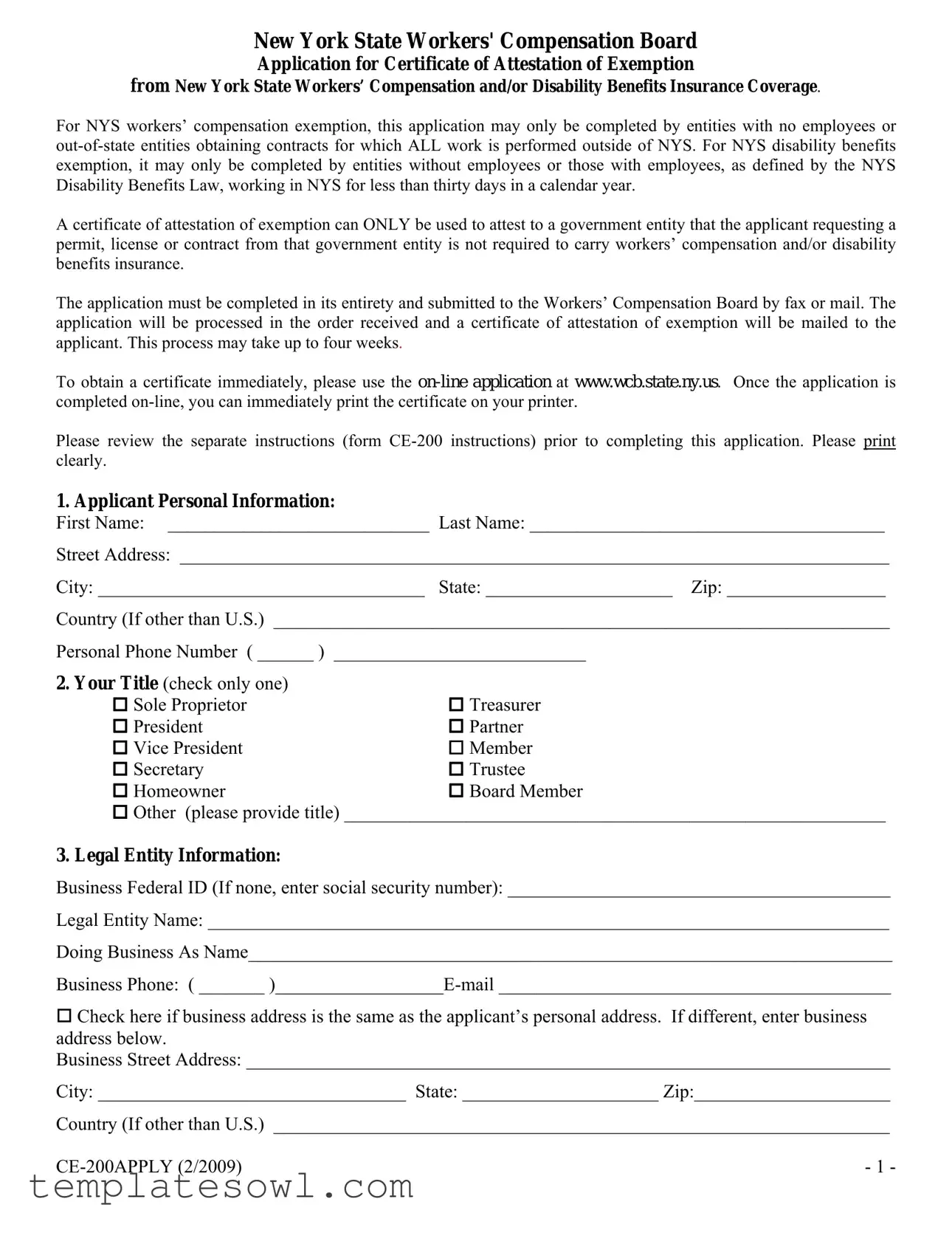

New York State Workers' Compensation Board

Application for Certificate of Attestation of Exemption

from New York State Workers’ Compensation and/or Disability Benefits Insurance Coverage.

For NYS workers’ compensation exemption, this application may only be completed by entities with no employees or

A certificate of attestation of exemption can ONLY be used to attest to a government entity that the applicant requesting a permit, license or contract from that government entity is not required to carry workers’ compensation and/or disability benefits insurance.

The application must be completed in its entirety and submitted to the Workers’ Compensation Board by fax or mail. The application will be processed in the order received and a certificate of attestation of exemption will be mailed to the applicant. This process may take up to four weeks.

To obtain a certificate immediately, please use the

Please review the separate instructions (form

1. Applicant Personal Information:

First Name: ____________________________ Last Name: ______________________________________

Street Address: ____________________________________________________________________________

City: ___________________________________ State: ____________________ Zip: _________________

Country (If other than U.S.) __________________________________________________________________

Personal Phone Number ( ______ ) ___________________________

2.Your Title (check only one)

Sole Proprietor |

Treasurer |

President |

Partner |

Vice President |

Member |

Secretary |

Trustee |

Homeowner |

Board Member |

Other (please provide title) __________________________________________________________

3.Legal Entity Information:

Business Federal ID (If none, enter social security number): _________________________________________

Legal Entity Name: _________________________________________________________________________

Doing Business As Name_____________________________________________________________________

Business Phone: ( _______

Check here if business address is the same as the applicant’s personal address. If different, enter business address below.

Business Street Address: _____________________________________________________________________

City: _________________________________ State: _____________________ Zip:_____________________

Country (If other than U.S.) __________________________________________________________________

- 1 - |

4.Permit/License/Contract Information:

A. Nature of Business:(please check only one)

Construction/Carpentry |

Electrical |

Demolition |

Landscaping |

Plumbing |

Farm |

Restaurant / Food Service |

Trucking / Hauling |

Food CartVendor |

Horse Trainer/Owner |

Homeowner |

Hotel / Motel |

Bar / Tavern |

Mobile - Home Park |

Other (please explain) ______________________________________________________________

B. Applying for:

License (list type) __________________________________________________________________

Permit (list type) ___________________________________________________________________

Contract with Government Agency

Issuing Government Agency: _____________________________________________________________

(e.g. New York City Building Department, Ulster County Health Department, New York State Department of Labor, etc.)

5.Job Site Location Information: (Required if applying for a building, plumbing, or electrical permit) A. Job Site Address

Street address________________________________________________________________________

City: _________________________ State: ___________ Zip: ________County: ________________

B. Dates of project: (mm/dd/yyyy) ___________________ to:(mm/dd/yyyy) _________________________

Estimated Dollar amount of project: |

|

$0 - $10,000 |

$50,001 - $100,000 |

10,001- $25,000 |

Over $100,000 |

$25,001 - $50,000

6.Partners/Members/Corporate Officers

Name: ________________________________________ |

Title: _____________________________________ |

Name: ________________________________________ |

Title: _____________________________________ |

Name: ________________________________________ |

Title: _____________________________________ |

Name: ________________________________________ |

Title: _____________________________________ |

(Attach additional sheet if necessary) |

|

- 2 - |

Employees of the Workers’ Compensation Board cannot assist applicants in answering questions in the following two sections. Please contact an attorney if you have any questions regarding these sections.

7.Please select the reason that the legal entity is NOT required to obtain New York State Specific Workers’ Compensation Insurance Coverage:

□A. The applicant is NOT applying for a workers' compensation certificate of attestation of exemption and will show a separate certificate of NYS workers' compensation insurance coverage.

□B. The business is owned by one individual and is not a corporation. Other than the owner, there are no employees, day labor, leased employees, borrowed employees,

□C. The business is a LLC, LLP, PLLP or a RLLP; OR is a partnership under the laws of New York State and is not a corporation. Other than the partners or members, there are no employees, day labor, leased employees, borrowed employees,

□D. The business is a one person owned corporation, with that individual owning all of the stock and holding all

□

□

offices of the corporation. Other than the corporate owner, there are no employees, day labor, leased employees, borrowed employees,

E.The business is a two person owned corporation, with those individuals owning all of the stock and holding all offices of the corporation (each individual must hold an office and own at least one share of stock). Other than the two corporate officers/owners, there are no employees, day labor, leased employees, borrowed employees,

F.The applicant is a nonprofit (under IRS rules) with NO compensated individuals providing services except for

clergy; or is a religious, charitable or educational nonprofit (Section 501(c)(3) under the IRS tax code) with no compensated individuals providing services except for clergy providing ministerial services; and persons performing teaching or nonmanual labor. [Manual labor includes but is not limited to such tasks as filing; carrying materials such as pamphlets, binders, or books; cleaning such as dusting or vacuuming; playing musical instruments; moving furniture; shoveling snow; mowing lawns; and construction of any sort.]

□G. The business is a farm with less than $1,200 in payroll the preceding calendar year.

□H. The applicant is a homeowner serving as the general contractor for his/her primary/secondary personal residence. The homeowner has no employees, day labor, leased employees, borrowed employees,

□

□

I.Other than the business owner(s) and individuals obtained from a temporary service agency, there are no employees, day labor, leased employees, borrowed employees,

Temporary Service Agency

Name _________________________________________________ Phone #_______________________________

J.The

Carrier______________________________________Policy #__________________________________________

Policy start date _____________________________Policy expiration date ________________________________

- 3 - |

8.Please select the reason that the legal entity is NOT required to obtain New York State Statutory Disability Benefits Insurance Coverage:

□

□

A.The applicant is NOT applying for a disability benefits exemption and will show a separate certificate of NYS statutory disability benefits insurance coverage.

B.The business MUST be either: 1) owned by one individual; OR 2) is a partnership (including LLC, LLP, PLLP, RLLP, or LP) under the laws of New York State and is not a corporation; OR 3) is a one or two person owned corporation, with those individuals owning all of the stock and holding all offices of the corporation (in a two person owned corporation each individual must be an officer and own at least one share of stock); OR 4) is a business with no NYS location. In addition, the business does not require disability benefits coverage at this time since it has not employed one or more individuals on at least 30 days in any calendar year in New York State. (Independent contractors are not considered to be employees under the Disability Benefits Law.)

□

□

C.The applicant is a political subdivision that is legally exempt from providing statutory disability benefits coverage.

D.The applicant is a nonprofit (under IRS rules) with NO compensated individuals providing services except for

□

□

clergy; or is a religious, charitable or educational nonprofit (Section 501(c)(3) under the IRS tax code) with no compensated individuals providing services except for executive officers, clergy, sextons, teachers or professionals.

E.The business is a farm and all employees are farm laborers.

F.The applicant is a homeowner serving as the general contractor for his/her primary/secondary personal residence. The homeowner has not employed one or more individuals on at least 30 days in any calendar year in New York State. (Independent contractors are not considered to be employees under the Disability Benefits Law.)

□G. Other than the business owner(s) and individuals obtained from the temporary service agency, there are no other employees. Other than the business owner(s), all individuals providing services to the business are obtained from a temporary service agency and that agency has covered these individuals for New York State disability benefits insurance. In addition, the business is owned by one individual or is a partnership under the laws of New York State and is not a corporation; or is a one or two person owned corporation, with those individuals owning all of the stock and holding all offices of the corporation (in a two person owned corporation, each individual must be an officer and own at least one share of stock). A Temporary Service Agency is a business that is classified as a temporary service agency under the business’s North American Industrial Classification System (NAICS) code.

9.I affirm that due to my position with the

Signature |

Title |

Date |

- 4 - |

STATE OF NEW YORK

WORKERS' COMPENSATION BOARD

BUREAU OF COMPLIANCE

100BROADWAY ALBANY. NY

THIS AGENCY EMPLOYS AND SERVES PEOPLE WITH DISABILITIES WITHOUT DISCRIMINATION.

Attached is an application for a certificate of attestation of exemption from New York State Workers' Compensation and/or Disability Benefits insurance coverage.

A certificate of attestation of exemption can ONLY be used to attest to a government entity that the applicant requesting a permit, license or contract from that government entity is not required to carry workers' compensation and/or disability benefits insurance.

Please carefully review the instructions before completing the application.

Exemption Application Instructions:

This application must be completed in its entirety and submitted to the Workers' Compensation Board by mailor fax. The application will be processed in the order received and a certificate of attestation of exemption will be mailed to the applicant. This process may take up to four weeks to complete.

For those who require an exemption immediately, please access the

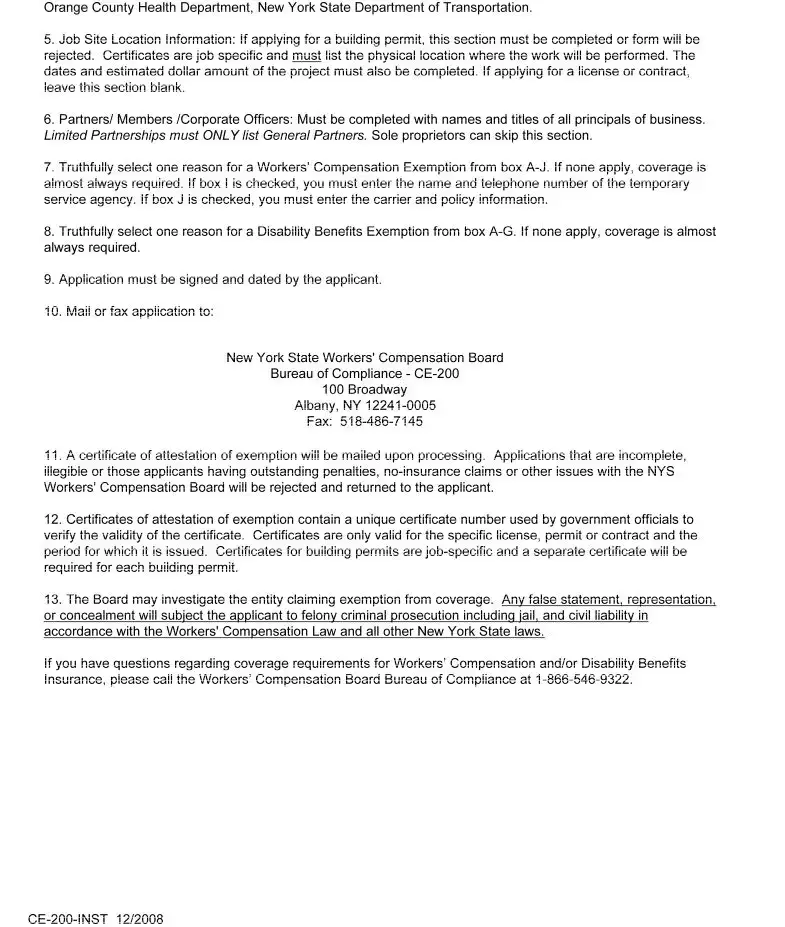

Instructions:

1.Applicant Personal Information: Enter the name (first and last), address and phone number. The applicant must have the knowledge, information and legal authority to file the application. An accountant or lawyer may not file the application on behalf of a client. The applicant will also be required to sign the certificate of attestation of exemption prior to filing it with the government entity.

2.Your title: Title refers to the position held by the applicant. Example: Sole Proprietor, Partner, Member, President, Secretary, Treasurer.

3.Legal Entity Information: Enter Federal ID number used for tax purposes. If the entity does not have a Federal

ID number, enter your social security number. Legal Entity is the business's legally filed name with the Department of State or County Clerk. Example: Corporation (ABC, Inc.) or LLC name ( XYZ, LLC). If this does not apply, enter the applicant's name. Doing business as refersto trade name or the name the business is known by.

4.Permit/License/Contract Information: Nature of business refers to what type of work is being performed. Enter the type of permit, license or contract for which you are applying. Examples: Building permit, health permit, liquor license. Issuing Government Agency is the agency to which you will give the certificate. Examples: City of Albany,

(Continued on reverse)

Form Characteristics

| Fact | Description |

|---|---|

| Purpose | The CE-200 form serves as an application for a Certificate of Attestation of Exemption from New York State Workers' Compensation and/or Disability Benefits Insurance coverage. |

| Eligibility | Only entities with no employees or out-of-state entities performing all work outside of New York State can complete this form for workers' compensation exemption. |

| Processing Time | The processing time for the application can take up to four weeks. Applicants requiring immediate certification can complete the online application at the New York State Workers’ Compensation Board website. |

| Governing Law | This application is governed by the Workers' Compensation Law and the New York State Disability Benefits Law. |

Guidelines on Utilizing Ce200

The CE-200 form is a formal application submitted to the New York State Workers' Compensation Board to obtain a certificate that exempts certain businesses from needing workers’ compensation or disability benefits insurance. Completing this form accurately is crucial, as it verifies to government entities that specific insurance coverage is not required for the applicant.

- Gather Personal Information: Collect your first and last name, street address, city, state, zip code, and country if it is outside the U.S. Also, have your personal phone number ready.

- Enter Your Title: Check the box that corresponds to your position, such as Sole Proprietor, President, Treasurer, etc.

- Fill in Legal Entity Information: Input your business’s Federal ID or, if none, provide your Social Security number. Include the legal entity name and any "Doing Business As" name. Also, provide your business phone number and email address. If your business address is the same as your personal address, check the appropriate box; otherwise, list the business address separately.

- Complete Permit/License/Contract Information: Specify the nature of your business by selecting one option and filling in the type of permit, license, or contract you are applying for, along with the relevant government agency.

- Provide Job Site Location Information: If necessary, enter the job site address, including the county, and add the project dates and estimated dollar amount of the project.

- List Partners/Members: If applicable, list the names and titles of all partners, members, or corporate officers related to the business, if you aren't a sole proprietor. Use an additional sheet if needed.

- Select Reasons for Exemption: Choose the appropriate reasons for not needing New York State Workers' Compensation Insurance and/or Disability Benefits Insurance, making sure to mark the correct boxes carefully.

- Affirm the Application: Finally, sign and date the application, affirming that all information provided is accurate and true to your knowledge.

Once the form is filled out completely, you can submit it to the Workers' Compensation Board by mail or fax. Expect the processing of your application to take up to four weeks. If immediate exemption is needed, an online application option is available on their website, allowing you to print your certificate right away.

What You Should Know About This Form

What is the CE-200 form?

The CE-200 form is an application for a Certificate of Attestation of Exemption from New York State Workers' Compensation and/or Disability Benefits Insurance Coverage. It is intended for entities without employees or those who meet specific criteria relating to employment and contracts within New York State.

Who can complete the CE-200 form?

This form may be completed by entities with no employees or out-of-state entities that will perform all work outside New York State. It can also be used by businesses without employees or those employing individuals for less than thirty days in a calendar year in New York State.

How is the information submitted on the CE-200 form?

To submit the CE-200 form, it must be completed in full and sent to the Workers' Compensation Board by fax or mail. The application must be clear and legible. Ensure all sections are filled out accurately to avoid delays in processing.

What can the Certificate of Attestation of Exemption be used for?

The certificate can only be used to attest to a government entity that the applicant is not required to carry workers' compensation and/or disability benefits insurance for the purpose of obtaining a permit, license, or contract.

How long does it take to receive the certificate?

The processing of the CE-200 application can take up to four weeks. If immediate proof is required, applicants can submit the form online via the Workers' Compensation Board website and print the certificate immediately upon completion.

What if I need assistance while filling out the form?

Employees of the Workers' Compensation Board cannot assist you with any questions regarding the application. It is advisable to consult with an attorney for any legal questions or clarifications while completing the form.

What happens if the information I provide is incorrect?

Submitting false information on the CE-200 form can lead to severe penalties, including felony prosecution and civil liability. It is essential to provide accurate and truthful information throughout the application process.

Is there a specific format for submitting my application?

Your application should be clear and must follow the instructions outlined on the form. It is important to double-check all details and signatures before submission to prevent any mistakes that might cause delays.

Can I use the CE-200 certificate for commercial functions?

The CE-200 certificate is designed strictly for regulatory purposes related to government entities. It is not applicable for use beyond these contexts, such as commercial business transactions or activities.

Common mistakes

When filling out the CE200 form, applicants often encounter various challenges that can lead to mistakes. One common error is illegible handwriting. Since the form must be submitted clearly, applicants should print their entries. Illegible handwriting can delay processing, and it’s important to remember that clarity is key.

Another frequent mistake involves providing inaccurate personal information. This includes entering incorrect phone numbers or failing to update the address. Any discrepancy can complicate communication between the Workers’ Compensation Board and the applicant and may lead to application denial.

Many people also overlook the requirement to list all partners or corporate officers. Skipping this section can lead to significant issues, especially for businesses structured as partnerships or corporations. Each individual holding a title must be disclosed properly, as failure to do so can render the application ineffective.

In addition, applicants often misinterpret the legal entity selection section. It's essential to choose the right category that describes the business structure. Misclassification can not only result in denial but may also create compliance headaches in the future.

Another common error involves the exemption category selection. Applicants sometimes do not fully understand the qualifiers for exemption from New York State Workers’ Compensation and Disability Benefits. Selecting an option that doesn't accurately describe the business situation can lead to frustrations in the application process.

Failing to provide a current email address and business phone number is yet another oversight. These details are necessary for correspondence regarding the application status and any additional information that might be required.

Moreover, some applicants mistakenly forget to sign the application. The signature confirms the accuracy of the information provided, and without it, the application cannot be processed. This error can significantly delay the certification process.

Another notable mistake lies in the timing of submitting the form. Applicants should ideally plan ahead, understanding that processing may take up to four weeks. Last-minute submissions can lead to insufficient time for receiving necessary certificates.

Lastly, not reviewing the separate instructions before completing the application is a critical mistake. Each section contains specific guidelines that, if overlooked, can result in an incomplete form. Applicants should always read the instructions thoroughly to ensure all requirements are met.

Documents used along the form

The CE-200 form serves as an important document for entities seeking exemption from New York State Workers' Compensation and/or Disability Benefits insurance requirements. When applying for this exemption, several other documents often accompany the CE-200 to complete the requirements or provide additional information. Below are four such documents.

- CE-200 Instructions: This document provides step-by-step guidance on how to fill out the CE-200 form correctly. It details the information required, explains the eligibility criteria, and outlines the submission process, ensuring applicants understand their responsibilities.

- Business Registration Document: This document serves as proof of the legal entity's formation and registration with the state. It includes essential information such as the business's name, formation date, and the nature of business activities, helping verify the applicant's official status.

- Tax Identification Number (TIN) Application (Form SS-4): If applicable, this form is used to obtain a Federal Employer Identification Number (EIN) from the IRS. This number is sometimes necessary for the CE-200 application, especially for businesses that may employ workers or are structured as corporations.

- Proof of Insurance Coverage: A certificate of insurance may be required to confirm that the business meets specific insurance standards, even if it claims an exemption. This documentation can clarify the type and extent of insurance currently held by the business.

These supplementary forms and documents are crucial in supporting the CE-200 application. They ensure that the application process proceeds smoothly while providing necessary verification of the applicant's claims. Proper preparation can lead to timely processing and eventual exemption approval.

Similar forms

The CE-200 form serves an essential purpose in the realm of New York State workers' compensation and disability benefits insurance. Several other documents are similar in nature. Here is a list highlighting those documents:

- Certificate of Insurance: Like the CE-200, this document proves insurance coverage. It confirms that a business holds the requisite insurance policies, essential when applying for licenses or contracts.

- Application for Permit: Similar to the CE-200 form, this application is necessary for obtaining permits related to specific business activities. It also requires detailed information about the applicant and their business structure.

- Exemption Certificate: Just as the CE-200 indicates an exemption from workers' compensation, this certificate serves to confirm that certain businesses or individuals qualify for specific exemptions from regulations or requirements.

- Disability Insurance Waiver Form: Akin to the CE-200, this form is used when a business declares that it does not need to carry disability benefits insurance, based on certain eligibility criteria.

- Worker’s Compensation Exemption Application (CE-201): This document is closely related, as it is an application for exemption from New York State workers' compensation insurance, specifically designed for different scenarios than those covered by the CE-200.

- Business Registration Form: Much like the CE-200, this form collects essential information about a business, including its structure and operations while serving as a prerequisite for many permits.

- Independent Contractor Agreement: This document outlines the nature of work performed by independent contractors, similar to how the CE-200 clarifies participation in work without traditional employment structures.

- Nonprofit Status Confirmation: Similar to the CE-200's focus on specific types of entities, this form verifies that a nonprofit organization meets the criteria for exemptions under specific regulations.

Timely submission of these forms is crucial for compliance with regulations and to ensure that businesses can operate without delays. Understanding these documents will help streamline application processes for anyone engaged with New York State regulations.

Dos and Don'ts

When filling out the CE200 form for a Certificate of Attestation of Exemption from New York State Workers’ Compensation and/or Disability Benefits Insurance Coverage, it is important to follow specific guidelines to ensure a smooth application process. Here’s a list of things to do and avoid:

- Do: Review the separate instructions (form CE-200 instructions) before starting the application to understand requirements.

- Print clearly to avoid any misinterpretation of your information.

- Fill out the application completely. Incomplete applications may delay processing.

- Ensure all personal and business information is accurate, including names, addresses, and phone numbers.

- Submit the application by fax or mail to the Workers’ Compensation Board.

- Don't: Do not allow someone else, like an accountant, to submit the application on your behalf; only the applicant can file it.

- Avoid leaving any sections blank; each part of the form needs a response.

- Don't exceed the allowed time by assuming the process will be quick; it can take up to four weeks.

- Do not provide false information, as this may lead to penalties or delays.

- Avoid submitting the paper application if immediate processing is needed; consider using the online service instead.

Following these steps can help ensure that your application is processed efficiently, allowing you to obtain the exemption you need.

Misconceptions

- Misconception 1: The CE200 form can be used by any business.

In reality, only specific entities are eligible to complete the CE200 form. This application is primarily for businesses with no employees or out-of-state entities performing work outside of New York State. Understanding these limitations is crucial to avoid unnecessary delays.

- Misconception 2: All businesses can apply for instant exemption coverage online.

This is misleading. While online applications allow for immediate printing of the certificate, not all businesses meet the criteria for an exemption. It's essential to review the eligibility requirements closely before applying.

- Misconception 3: Completing the CE200 form is a straightforward process.

While the form may appear simple, accurate completion is vital. Each section requires specific information, and failure to fill it out in its entirety may result in rejection. It's advisable to follow the instructions carefully.

- Misconception 4: Certification from the CE200 form provides coverage for all types of insurance.

That is not correct. The CE200 form specifically attests to exemptions from New York State Workers' Compensation and Disability Benefits insurance. It does not cover other types of insurance that a business may require.

- Misconception 5: An attorney can assist in filling out the CE200 form.

Actually, employees of the Workers’ Compensation Board cannot provide assistance in answering questions regarding the CE200 form. If specific legal questions arise, contacting a licensed attorney is recommended for guidance.

Key takeaways

1. Application Purpose: The CE-200 form is used to request a Certificate of Attestation of Exemption from New York State Workers’ Compensation and/or Disability Benefits Insurance. This certificate is essential for businesses that are not required to carry insurance coverage.

2. Eligibility Criteria: Entities can only fill out the CE-200 form if they have no employees or are out-of-state firms working entirely outside of New York. For disability benefits, eligibility is extended to businesses in New York for employees working less than thirty days a year.

3. Completion and Submission: Completing the form requires entering personal and business information accurately. The application must be submitted completely through mail or fax to the Workers’ Compensation Board, and clear printing is required.

4. Processing Time: After submission, the application will be processed in the order it is received. It may take up to four weeks to receive the certificate by mail. For immediate needs, applicants can use the online application on the Board's website.

5. Review Instructions: Prior to filling out the CE-200, applicants should review the provided instructions carefully. This ensures all required sections are filled out correctly, minimizing the risk of delays.

6. Signature Requirement: The applicant must sign the form affirming the truthfulness and accuracy of the information provided. Misrepresentation or false information may lead to serious legal consequences, including prosecution.

Browse Other Templates

Homestead in Texas - Income-producing properties may not qualify for a residence homestead exemption if the income-generating use is too significant.

Accident Report Form,Incident Notification Form,Accident Investigation Report,Safety Incident Form,Emergency Report Sheet,Serious Incident Report,Workplace Accident Notification,Accidental Injury Report,Incident Recording Form,Safety Event Documentat - Completed by individuals involved or witnesses of an accident.

Checklist of Labor Law Requirements - Unfair competition practices among contractors are prohibited.