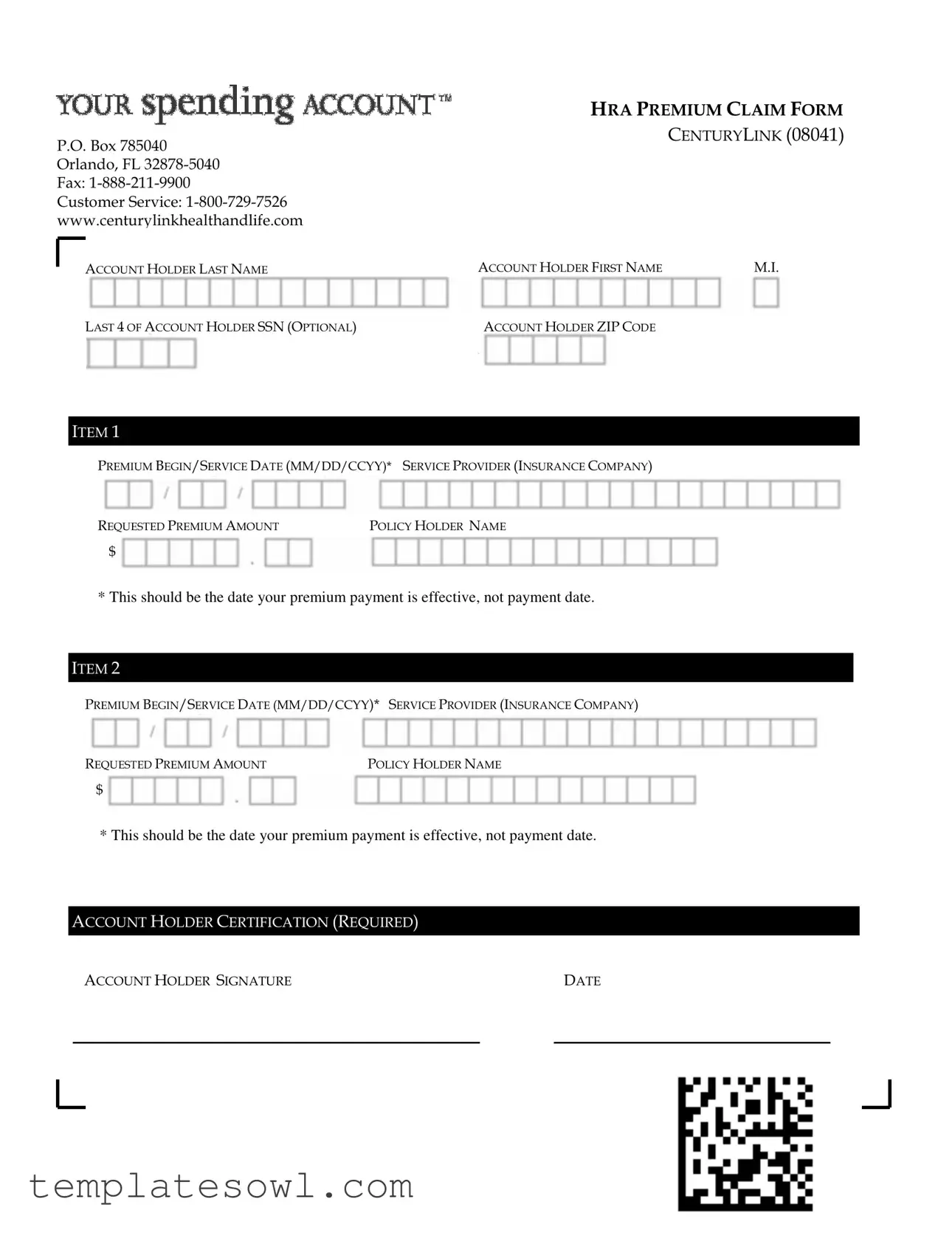

Fill Out Your Century Link Health And Lifecom Form

The Century Link Health and Lifecom form serves as a crucial tool for individuals navigating their health insurance options. It provides essential information required to determine health coverage and manage premium payments effectively. A key aspect of the form involves specifying the effective date of premium payments, which is distinct from the actual payment date; this ensures that all parties are clear on when coverage officially begins. Users must also understand various components outlined within the form, such as guidelines for health spending accounts and specific instructions that impact the administration of benefits. Moreover, it contains critical disclaimers, ensuring users are aware of the terms surrounding their coverage. By accurately completing and submitting this form, individuals can facilitate their enrollment and maximize their access to necessary health services. Ultimately, the form embodies not just bureaucratic necessity but also represents an individual’s proactive approach to securing their health and financial well-being.

Century Link Health And Lifecom Example

! "#$ %

&&&$ '#() )#* $

:1 |

||

|

?

* This should be the date your premium payment is effective, not payment date.

?

* This should be the date your premium payment is effective, not payment date.

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

'#A'#A ) *#@A 1$ #*')) #*#1E@"##A#$ $) @ *&)#$)1E B #A #C *&)#$)1E"##A

F #$ * "#$ $ #" C'' #A#C @ ) @G

F * "#$ *#) * ) '6 )/ #C 5$$36/54( ** $G

6" EC #C #') &'*') $ &EC C# ** #C G

7E#$ ') ) @'C C'@*&)#$)' @ 1 #A#C

1 )) )$ #C E #A#C $#'##"# # $##C

#$$$ )) @"##*) @

$ **##0!@ #A5$$)

) B# $ #$ $ #" '$# '@#$'C @$ )# ' &##

# *##A@@ $) $(@$ #A# $ @#

0@"# @@ @@#A$ #)'

*#$#$C @@"

#( @ ##"#$ )##$ @ #C A# @#$' )

5)A)'# #D $ #@#A)(#** ))

@ C &#&'$#) *A#*#

, * "#$ @"#

7 * "#$ @ #C A# * $)@'

7 $#@#* "#$

5*@ #*)@ #

1

!)#*@@#A$ #

0!@ #A5$$C'*#

34 |

|

|

|

:# |

0!@ #A5$$ |

F) @'#A** $#A

@ #'' @"#

$ #)'$#*#* '@#$#*) $ @ #*) @ )C

@@" @ "#'0#

C#$#** $)@'

@ #

*@' @ #*'E

B #A #C *H'

@ # H') @ # C A# *))'@'

5#$/ #C

#$ @@$) )A)

$)A @356 ,"#A + 6 )40 *#5"#$

$*##*'@@@#$ #C

! #A@# $ @#=##) 0 !@ #A5$$& C# $ I0*# J$$0!@ #A 5$$ @ #" 0

'$) $(#A"#A$$C

C(#AC

Your Spending Account is a trademark of Aon Hewitt

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Usage | The Century Link Health and Lifecom form is utilized for processing health and life insurance premium payments. |

| Effective Dates | Users must enter the effective date of the premium payment, which differs from the payment date. |

| Governing Laws | The rules governing this form vary by state, including regulations related to insurance and financial services. |

| Provider Information | The form includes details pertaining to Aon Hewitt, the trademark holder of Your Spending Account. |

| Payment Method | The form outlines options for electing payment methods, including credit card or direct bank withdrawal. |

| Contact Information | Section of the form necessitates providing contact information for customer service inquiries related to policy management. |

| Compliance | Completion of this form ensures compliance with both state-specific regulations and company policies. |

Guidelines on Utilizing Century Link Health And Lifecom

Filling out the Century Link Health and Lifecom form requires careful attention to detail. Ensure that all fields are completed accurately to avoid delays in processing. The following steps will guide you through the completion of the form.

- Gather necessary personal information such as your full name, address, and contact details.

- Locate the section designated for your premium payment date. Remember to enter the effective date of your premium, not the payment date.

- Next, fill in any relevant health information as requested. This may include medical history or current health status.

- Review any terms or conditions noted in the form and ensure you understand them before proceeding.

- Provide any additional details or documentation that the form may require.

- Finally, double-check all entered information for accuracy to ensure proper processing, then sign and date the form as required.

What You Should Know About This Form

What is the Century Link Health And Lifecom form?

The Century Link Health And Lifecom form is a document used for managing health and life insurance policies associated with Century Link. This form assists in authorizing premium payments, updating beneficiary information, and making changes to coverage selections. It serves as an official record to ensure all parties involved are aware of the specifics regarding your insurance policy.

How do I determine the effective date for my premium payment?

Your effective date for a premium payment is crucial. It should reflect the date you want your insurance coverage to begin or change, not merely when you remit the payment. To avoid misunderstandings, ensure you select a date that clearly indicates when your coverage will take effect. This detail helps in aligning your coverage with any necessary healthcare needs.

Can I make changes to my policy using this form?

Yes, you can make certain modifications to your policy using the Century Link Health And Lifecom form. This includes adjusting coverage amounts, updating beneficiaries, or even canceling your policy if necessary. However, be mindful that some changes may require additional documentation or further verification, depending on the specifics of your current policy.

What should I do if I encounter issues while filling out the form?

If you run into problems while completing the form, first review the instructions provided with it. These guidelines often clarify common points of confusion. If difficulties persist, consider contacting Century Link’s customer service or your insurance agent for assistance. They can provide personalized support to help you navigate the process and resolve any issues you may face.

Is there a deadline for submitting the form?

Yes, timely submission of the Century Link Health And Lifecom form is important. While specific deadlines may depend on the type of change you are requesting, it is generally advisable to submit forms as soon as possible to ensure your changes are processed without delay. Check your policy details or consult customer service to confirm any deadlines that may apply to your situation.

What information is required on the form?

Typically, you will need to provide personal details such as your name, address, and policy number. Additionally, information regarding the changes you wish to make will also be required. This could range from the effective date of premium payments to new beneficiary details. Ensure all required fields are accurately filled out to prevent any setbacks in processing your request.

What happens after I submit the form?

After submitting your Century Link Health And Lifecom form, you should receive confirmation from the insurance provider. This could come in the form of a letter or an email acknowledging receipt of your request. Depending on the nature of your submission, it may take some time to process the changes. Keep an eye on your account statements and communications from Century Link for updates on your policy.

Common mistakes

Filling out the Century Link Health And Lifecom form is a critical step in ensuring that you receive the appropriate health and life insurance coverage. However, there are common mistakes that individuals make during this process. Understanding these pitfalls may save time, reduce complications, and ensure accuracy.

One significant mistake is using the incorrect date format. Many people mistakenly enter the date that their premium payment is made instead of the effective date of the coverage. This could delay processing or even lead to unintended lapses in coverage. Always verify that you are entering the effective date, not the payment date.

Another frequent error involves providing incomplete or incorrect personal information. This can include your name, address, or social security number. Even a small typo can lead to significant issues in your application. Take the time to double-check all personal details for accuracy.

Individuals often overlook the importance of signatures on the form. Failing to sign can result in the form being considered incomplete. Ensure that you not only sign but also date the form appropriately. Missing signatures can lead to disappointment and delays.

Using abbreviations or shorthand is another mistake that many make. Forms are generally designed to be clear and unambiguous. Therefore, using full words is essential to prevent misunderstandings. Avoid any abbreviations that could cause confusion.

Some applicants forget to review the coverage options thoroughly before submission. Each plan may offer varying levels of coverage and benefits. It’s essential to fully understand what each option entails to select what is best suited for your needs. Skipping this part may lead to selecting inadequate coverage.

In addition, people often neglect to check for updates or changes to the form requirements. Form requirements can change periodically, and using an outdated version could mean missing necessary information or documentation. Always ensure you are using the most current form.

Individuals may also misinterpret the instructions provided with the form. Rather than proceeding with assumptions, take the time to read all the instructions carefully. Understanding how to fill out each section correctly will streamline the process.

Another common issue arises when applicants fail to keep a copy of the completed form. Not retaining a copy can create problems if questions or disputes arise later. Always make sure to keep a copy for your records before submitting.

Lastly, submitting the form to the wrong address or department can result in unnecessary delays. Ensure that you are sending your completed form to the designated address outlined in the instructions. A small error in the destination can cause major headaches.

By being aware of these potential mistakes, you can take responsible steps towards completing the Century Link Health And Lifecom form accurately. Every detail matters, and attention to these common pitfalls will ensure that your insurance application is processed efficiently.

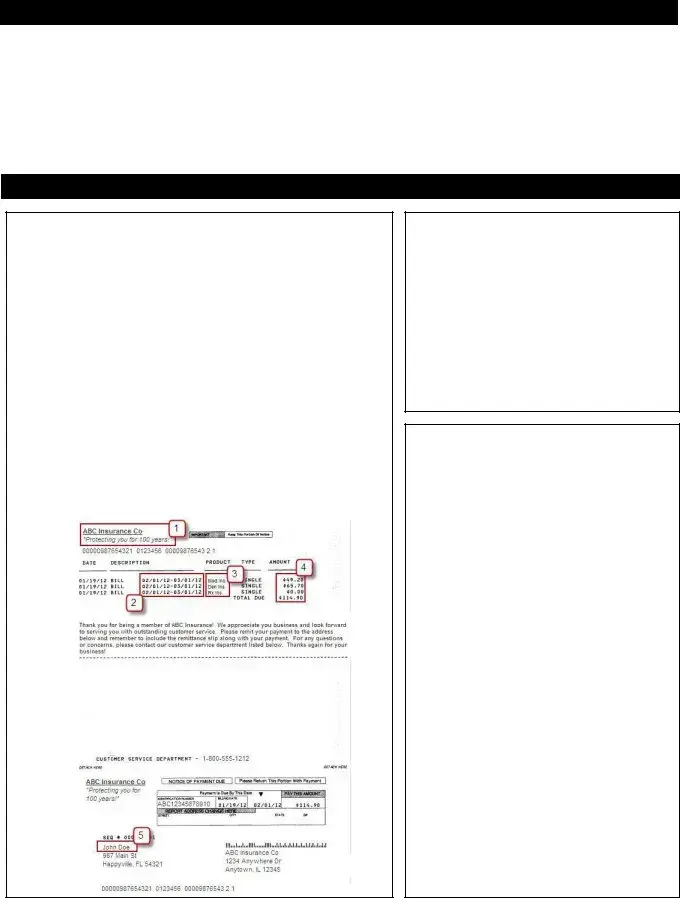

Documents used along the form

The Century Link Health And Lifecom form is often accompanied by other important documents. Each serves a specific purpose in managing your health and life insurance needs. Below is a list of documents commonly used alongside this form.

- Insurance Policy Agreement: This document outlines the specific terms, coverages, and conditions of your insurance policy. It serves as the official contract between the insurance provider and the policyholder, detailing what is covered and any exclusions.

- Beneficiary Designation Form: This form allows policyholders to specify who will receive benefits in the event of their death. It is crucial to keep this updated to ensure that the intended beneficiaries are recognized by the insurance company.

- Medical History Questionnaire: Often required by insurers, this questionnaire collects detailed information about an individual’s health history. This assists in determining eligibility for coverage and the premium rates an individual may qualify for.

- Premium Payment Receipt: This document serves as proof of payment for your insurance premiums. Keeping track of these receipts ensures that you remain informed about your payment status and helps in resolving any potential disputes regarding coverage.

Understanding these documents can help you navigate your health and life insurance more efficiently. Staying organized plays a crucial role in ensuring that your documents are in order, which ultimately contributes to your peace of mind.

Similar forms

- Health Insurance Claim Form: This document is used to submit claims for health care expenses. Like the Century Link Health and Lifecom form, it often requires detailed information about the patient, services rendered, and provider details.

- Enrollment Form: This is essential for enrolling in health insurance plans. Similar to the Century Link form, it collects personal information and requires proper effective date specifications for coverage.

- Request for Benefits: Used to request specific benefits under a health policy. It usually involves providing similar information about covered services and the insured individual's details, mirroring the structure of the Century Link form.

- Change of Beneficiary Form: This document allows policyholders to change beneficiaries on life insurance policies. Like the Century Link form, it requires identification details and often requires the effective date for changes to take place.

- Policy Cancellation Form: This form is submitted to cancel an insurance policy. Much like the Century Link form, it involves the submission of personal and policy information and indicates the desired cancellation date.

- Premium Payment Authorization Form: This document allows policyholders to authorize regular automatic payments. Comparatively, it gathers similar information regarding payment terms and effective dates as seen in the Century Link form.

Dos and Don'ts

When filling out the Century Link Health And Lifecom form, keep these key points in mind:

- Do: Use the date your premium payment becomes effective. This is not the date you make the payment.

- Do: Ensure all personal information is accurate and up-to-date.

- Do: Review the form for any missing sections before submission.

- Don't: Leave any fields blank unless specified. Every section must be completed.

- Don't: Submit the form without verifying the provided information.

Misconceptions

When dealing with the Century Link Health And Lifecom form, several misconceptions can lead to confusion. Here are nine common misunderstandings.

- It is a billing notification. Many people mistakenly think this form only serves as a billing reminder. In reality, it’s a more comprehensive document related to health insurance plans.

- All information provided will be shared publicly. There is a belief that personal information on this form can be accessed by anyone. However, strict privacy laws protect this information.

- Submitting the form is optional. Some individuals believe they can skip submitting the form without consequences. In fact, failing to submit may affect enrollment or benefits.

- The effective date and payment date are the same. A common misconception is that the effective date of payment matches the date when the payment is made. These dates can differ significantly, impacting coverage.

- Health and life insurance are the same. People sometimes assume this form pertains solely to life insurance, but it covers both health and life insurance aspects.

- Assistance is not available for completing the form. Many believe they must handle the form completely on their own. Support is available through customer service or online resources.

- All fields need to be filled for submission. Some think every section of the form must be completed. However, certain fields are optional, and it's crucial to follow the instructions provided.

- It is the only form required for insurance. While this form is essential, it is not the sole document needed. Additional forms may be required for comprehensive coverage.

- Incorrect information can be easily corrected later. Many individuals believe they can fix inaccuracies post-submission without issues. In reality, errors may lead to complications in claims or coverage, so it's vital to double-check before submission.

Understanding these misconceptions can help individuals navigate the complexities of the Century Link Health And Lifecom form more effectively. Always refer to official guidelines or customer support for clarity.

Key takeaways

Here are nine key takeaways regarding the Century Link Health and Lifecom form that will help you fill it out accurately and understand its purpose:

- Effective Date Importance: Ensure that you enter the effective date of your premium payment, not the payment’s transaction date. This distinction is crucial for accurate processing.

- Clear Documentation: Fill out the form in a clear and legible manner. Use capital letters when possible to prevent confusion and ensure readability.

- Completeness Matters: Provide all requested information accurately. Omissions can delay the processing of your application or benefits.

- Keeping Copies: Make copies of the completed form for your records before submission. This practice provides a reference for future inquiries.

- Review Before Submitting: Double-check all entries to avoid mistakes. Errors can impact your coverage and benefits.

- Timely Submission: Submit the form promptly to avoid any gaps in coverage. Timeliness is key in ensuring uninterrupted service.

- Contact Information: Include up-to-date contact information. This allows for quick communication should questions arise about your submission.

- Understand Benefits: Familiarize yourself with the benefits associated with your plan. Knowing what is covered is vital for making informed decisions.

- Seek Assistance: If any section of the form is unclear, do not hesitate to reach out to customer support. They can provide guidance and clarify doubts.

Browse Other Templates

What Is a Ddq - The form must be completed fully to avoid delays in proceedings.

Lic Online - Lic 700 was last revised in August 2008, highlighting its ongoing relevance in child care settings.