Fill Out Your Cert 119 Form

The Cert 119 form, officially recognized as the Purchases of Tangible Personal Property and Services by Qualifying Exempt Organizations certificate, plays a vital role for qualifying organizations in Connecticut seeking to manage their tax responsibilities effectively. This form is designed primarily for use when an exempt organization makes purchases intended solely for its established purposes. To properly utilize this certificate, organizations must first ensure they meet specific criteria, such as possessing an exemption permit from the Department of Revenue Services or holding a determination letter from the IRS that confirms their tax-exempt status under relevant sections of the Internal Revenue Code. It's essential to understand that while the Cert 119 allows for purchases of tangible personal property for fundraisers and social events, it does not generally cover meals and lodging unless specific approvals are obtained. The completed certificate essentially communicates to sellers that these transactions are exempt from sales and use taxes, providing a streamlined process when properly executed. Furthermore, organizations must retain appropriate documentation to substantiate their claims, fostering both compliance and transparency. By following the outlined instructions, both purchasers and sellers can confidently navigate this valuable tax exemption tool, ensuring that financial contributions to worthy causes continue to be maximized in Connecticut.

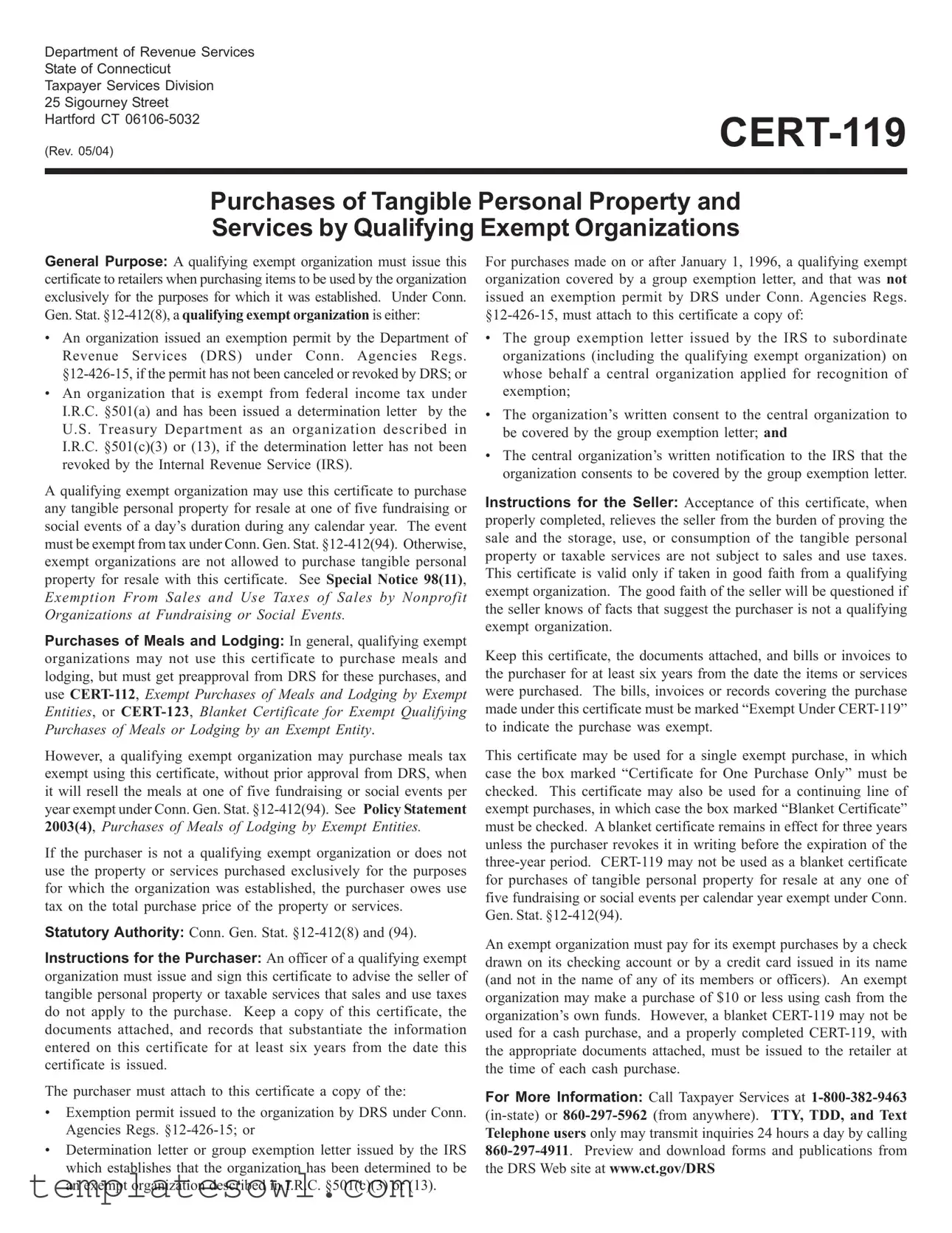

Cert 119 Example

Department of Revenue Services

State of Connecticut

Taxpayer Services Division

25 Sigourney Street

Hartford CT

(Rev. 05/04)

Purchases of Tangible Personal Property and Services by Qualifying Exempt Organizations

General Purpose: A qualifying exempt organization must issue this certificate to retailers when purchasing items to be used by the organization exclusively for the purposes for which it was established. Under Conn. Gen. Stat.

•An organization issued an exemption permit by the Department of Revenue Services (DRS) under Conn. Agencies Regs.

•An organization that is exempt from federal income tax under I.R.C. §501(a) and has been issued a determination letter by the U.S. Treasury Department as an organization described in I.R.C. §501(c)(3) or (13), if the determination letter has not been revoked by the Internal Revenue Service (IRS).

A qualifying exempt organization may use this certificate to purchase any tangible personal property for resale at one of five fundraising or social events of a day’s duration during any calendar year. The event must be exempt from tax under Conn. Gen. Stat.

Purchases of Meals and Lodging: In general, qualifying exempt organizations may not use this certificate to purchase meals and lodging, but must get preapproval from DRS for these purchases, and use

However, a qualifying exempt organization may purchase meals tax exempt using this certificate, without prior approval from DRS, when it will resell the meals at one of five fundraising or social events per year exempt under Conn. Gen. Stat.

If the purchaser is not a qualifying exempt organization or does not use the property or services purchased exclusively for the purposes for which the organization was established, the purchaser owes use tax on the total purchase price of the property or services.

Statutory Authority: Conn. Gen. Stat.

Instructions for the Purchaser: An officer of a qualifying exempt organization must issue and sign this certificate to advise the seller of tangible personal property or taxable services that sales and use taxes do not apply to the purchase. Keep a copy of this certificate, the documents attached, and records that substantiate the information entered on this certificate for at least six years from the date this certificate is issued.

The purchaser must attach to this certificate a copy of the:

•Exemption permit issued to the organization by DRS under Conn. Agencies Regs.

•Determination letter or group exemption letter issued by the IRS which establishes that the organization has been determined to be an exempt organization described in I.R.C. §501(c)(3) or (13).

For purchases made on or after January 1, 1996, a qualifying exempt organization covered by a group exemption letter, and that was not issued an exemption permit by DRS under Conn. Agencies Regs.

•The group exemption letter issued by the IRS to subordinate organizations (including the qualifying exempt organization) on whose behalf a central organization applied for recognition of exemption;

•The organization’s written consent to the central organization to be covered by the group exemption letter; and

•The central organization’s written notification to the IRS that the organization consents to be covered by the group exemption letter.

Instructions for the Seller: Acceptance of this certificate, when properly completed, relieves the seller from the burden of proving the sale and the storage, use, or consumption of the tangible personal property or taxable services are not subject to sales and use taxes. This certificate is valid only if taken in good faith from a qualifying exempt organization. The good faith of the seller will be questioned if the seller knows of facts that suggest the purchaser is not a qualifying exempt organization.

Keep this certificate, the documents attached, and bills or invoices to the purchaser for at least six years from the date the items or services were purchased. The bills, invoices or records covering the purchase made under this certificate must be marked “Exempt Under

This certificate may be used for a single exempt purchase, in which case the box marked “Certificate for One Purchase Only” must be checked. This certificate may also be used for a continuing line of exempt purchases, in which case the box marked “Blanket Certificate” must be checked. A blanket certificate remains in effect for three years unless the purchaser revokes it in writing before the expiration of the

An exempt organization must pay for its exempt purchases by a check drawn on its checking account or by a credit card issued in its name (and not in the name of any of its members or officers). An exempt organization may make a purchase of $10 or less using cash from the organization’s own funds. However, a blanket

For More Information: Call Taxpayer Services at

Name of Purchaser |

Address |

CT Tax Registration Number |

Exemption Permit # (If any) |

|

|

(If none, explain) |

|

|

|

|

|

|

|

|

Federal Employer ID # |

|

|

|

|

Name of Seller |

Address |

CT Tax Registration Number |

Federal Employer ID # |

|

|

(If none, explain) |

|

|

|

|

|

Check one box:

Blanket certificate

Certificate for one purchase only

Purchases that qualify for exemption under Conn. Gen. Stat.

Check the appropriate box and provide a written description of each item purchased:

Tangible Personal Property |

Taxable Services |

|

|

Description: |

|

Declaration by Purchaser

The qualifying exempt organization declares that the tangible personal property or taxable services described above will be used exclusively for the purposes for which the organization was established, including the purchase of tangible personal property or meals for resale at one of five fundraising or social events per year exempt from tax. The organization further declares the exemption permit, determination letter, or group exemption letter (as the case may be) attached to this certificate has not been canceled or revoked.

According to Conn. Gen. Stat.

I declare under penalty of law that I have examined this certificate (including any accompanying schedules and statements) and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return to DRS is a fine of not more than $5,000, or imprisonment for not more than five years, or both.

Name of Purchaser

By:

Signature of Authorized Person |

Title |

Date |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The CERT-119 form allows qualifying exempt organizations to purchase tangible personal property and services without incurring sales and use taxes. |

| Eligibility | Organizations must have an exemption permit from the Department of Revenue Services or be recognized under I.R.C. §501(c)(3) or (13) to qualify. |

| Fundraising Events | Exempt organizations can use CERT-119 for items purchased for resale at up to five fundraising or social events per calendar year. |

| Meals and Lodging | Generally, meals and lodging are not exempt unless purchased for resale at qualifying events, and preapproval from DRS is often required. |

| Record Keeping | Organizations must retain copies of CERT-119, attached documents, and related records for at least six years after issuance. |

| Statutory Authority | The form is governed by Connecticut General Statutes §12-412(8) and §12-412(94), which detail exemptions for qualifying organizations. |

| Purchase Payment | Payments for exempt purchases must be made via a check or credit card issued in the organization's name; cash purchases are limited to $10. |

| Certificate Validity | CERT-119 is valid only if issued in good faith. Sellers must verify that the purchaser is eligible to use the form. |

| Further Information | For any inquiries, organizations can contact Taxpayer Services at 1-800-382-9463 or visit the DRS website for more resources. |

Guidelines on Utilizing Cert 119

Filling out the CERT-119 form is essential for qualifying exempt organizations that wish to make tax-exempt purchases. This form should be filled out carefully and accurately, as it is the official way to inform sellers of your organization's tax-exempt status. By following these steps, you can ensure your purchases are completed smoothly and in compliance with state regulations.

- Identify the Purchaser: Enter the name of the qualifying exempt organization making the purchase.

- Provide the Address: Fill in the complete address of the organization.

- Input the CT Tax Registration Number: Include the organization's Connecticut tax registration number if available.

- Exemption Permit Number: If the organization has an exemption permit, input the number. If none exists, provide an explanation.

- Federal Employer ID Number: Fill in the federal employer ID number of the organization.

- Identify the Seller: Enter the name of the seller who will be providing the tangible personal property or taxable services.

- Provide Seller's Address: Fill in the complete address of the seller.

- Input the Seller's CT Tax Registration Number: Include the seller's Connecticut tax registration number if applicable.

- Vendor's Federal Employer ID Number: Fill in the seller's federal employer ID number, if available.

- Select the Certification Type: Choose between "Blanket Certificate" or "Certificate for One Purchase Only".

- Indicate Prior Fundraising Events: Enter the number of prior fundraising or social events for which exemption was claimed during the calendar year.

- Check the Appropriate Box: Indicate whether the purchase is for tangible personal property or taxable services and provide a written description of each item purchased.

- Declare the Use: Confirm that the tangible personal property or taxable services will be used exclusively for the organization's established purposes.

- Attach Required Documents: Include a copy of the exemption permit or IRS determination letter, as applicable, and any other supporting documents as required.

- Signature and Title: An authorized person must sign the form, providing their title and the date of signing.

Once the form is completed, keep a copy for your records, along with any attached documents. This helps ensure that your organization is prepared for any potential audits or inquiries about your tax-exempt status. Proper documentation and accurate completion of the CERT-119 form can save your organization both time and resources.

What You Should Know About This Form

What is the purpose of the Cert 119 form?

The Cert 119 form is a certificate that allows qualifying exempt organizations in Connecticut to purchase tangible personal property and taxable services without paying sales and use taxes. It is utilized solely for items meant to be used exclusively for the organization's established purposes, such as fundraising events. Qualifying organizations must issue this certificate to retailers to claim their tax exemptions.

Who qualifies as a 'qualifying exempt organization' under the Cert 119 form?

A qualifying exempt organization is defined as one of two types: first, an organization that has been issued an exemption permit by the Connecticut Department of Revenue Services (DRS), and that permit has not been canceled or revoked. Second, it may be an organization that is recognized as tax-exempt under the federal Internal Revenue Code (I.R.C.) §501(a) and has received a determination letter from the U.S. Treasury Department confirming its exempt status under §501(c)(3) or §501(c)(13), provided that this letter has not been revoked by the IRS.

Can qualifying organizations use the Cert 119 for purchasing meals and lodging?

Generally, qualifying exempt organizations may not use the Cert 119 to purchase meals and lodging unless they receive prior approval from the DRS. Instead, they must utilize forms CERT-112 or CERT-123 for exempt purchases of meals or lodging. However, if the organization intends to resell meals at one of five fundraising events during the year, it can use the Cert 119 without prior approval.

What documentation must accompany the Cert 119 when submitting it?

When issuing the Cert 119, the procuring organization must attach a copy of their exemption permit from the DRS or the IRS determination letter that confirms their tax-exempt status. For organizations covered under a group exemption letter and without an individual exemption permit, additional documentation is required, including the group exemption letter, the organization’s consent to the central organization, and a notification from the central organization to the IRS regarding this consent.

What are the obligations of sellers when accepting the Cert 119?

When sellers receive a properly completed Cert 119, they are relieved of the duty to prove that sales and consumption of the property or services are exempt from tax. However, sellers must ensure that the certificate is taken in good faith. If a seller is aware of any factors that suggest that a purchaser is not a qualifying exempt organization, their good faith may be called into question.

How long must organizations and sellers keep copies of the Cert 119?

Both the purchasers and sellers are required to retain copies of the Cert 119 and any attached documents for a minimum of six years from the date the certificate was issued. This retention is critical for compliance and for potential audits by tax authorities.

Are there limitations on using the Cert 119 for fundraising or social events?

Yes, the Cert 119 must not be used as a blanket certificate for purchases of tangible personal property meant for resale at any of the five fundraising or social events within a calendar year. Instead, a qualifying exempt organization can only utilize the certificate for individual purchases or a continuing line of purchases that does not include items intended for resale at these specific events.

Common mistakes

When filling out the Cert 119 form, people often make common mistakes that can lead to complications. One frequent error is not including the correct taxpayer identification information. This includes the CT Tax Registration Number and the Federal Employer ID Number. Double-checking these numbers is crucial to ensure that the form is valid.

Another common mistake is failing to check the appropriate box for the type of certificate being issued. It's important to specify whether it’s a blanket certificate or a certificate for one purchase only. This selection impacts how the exemption is applied, so take a moment to consider which option fits the circumstances.

Additionally, some individuals overlook the requirement to attach necessary documents. For instance, organizations need to provide a copy of their exemption permit or IRS determination letter. Forgetting these documents can result in the seller questioning the exemption status, which could lead to unexpected tax liabilities.

In some cases, people do not accurately list the number of prior fundraising or social events for the year. This information is critical, as it determines how many times the organization can use the exemption. Ensure that accurate records are maintained so that this section is filled out correctly.

Another mistake is not using the certificate correctly for meals and lodging purchases. Many believe that all expenses can go under Cert 119. However, specific approvals or other forms must be used for these purchases. Proper guidance from DRS can clarify this.

Moreover, an oversight occurs when individuals fail to sign the form. An authorized person from the qualifying organization must sign the certificate. A lack of signature can render the entire form invalid.

Sometimes, people forget essential details in the description of the items purchased. It’s important to provide a clear and accurate description of tangible personal property or taxable services. Vague entries can create confusion and invalidate the exemption.

Finally, many organizations mistakenly think they can use cash purchases under a blanket CERT-119. This is incorrect. Each cash purchase requires a properly completed form at the time of the transaction. Adhering to this rule helps maintain compliance with tax regulations.

Documents used along the form

The CERT-119 form is an important document used by qualifying exempt organizations in Connecticut to make tax-exempt purchases. However, this form often goes hand-in-hand with several other documents that help verify the organization's exempt status. The following is a list of eight related forms and documents commonly used in conjunction with the CERT-119.

- Exemption Permit: Issued by the Department of Revenue Services, this permit confirms the organization’s exempt status under specific state regulations. It must be attached to the CERT-119 form for purchases to be considered exempt.

- IRS Determination Letter: This letter is issued by the U.S. Treasury Department to confirm that an organization is exempt from federal income tax under specific sections of the Internal Revenue Code (I.R.C. §501(c)(3) or (13)). It is crucial for qualifying for tax exemptions.

- Group Exemption Letter: For organizations covered under a central organization's group exemption, this letter from the IRS confirms their membership in that group. It is essential for proving their exempt status.

- Written Consent to Central Organization: This document is needed when an organization requests to be included under a group exemption letter. It demonstrates that the organization has consented to be covered by that exemption.

- Written Notification from Central Organization: This letter must notify the IRS that the organization has consented to be part of the group exemption. It is important for compliance particularly for subordinate organizations.

- CERT-112: This form is specifically used for preapproval requests from qualifying exempt organizations wishing to purchase meals or lodging. It is essential for ensuring tax exemption for these types of purchases.

- CERT-123: A blanket certificate issued for exempt qualifying purchases of meals and lodging. This form allows exempt organizations broader leeway for tax-exempt transactions in these categories when properly authorized.

- Policy Statement 2003(4): While not a form per se, this policy statement outlines the tax exemptions for meals and lodging by exempt entities. It provides important guidance on the limitations and requirements for purchasing meals tax-exempt.

Understanding these additional forms and documents can help ensure that qualifying organizations make compliant and efficient use of the CERT-119 form. These documents together create a framework that supports the tax-exempt status and facilitates necessary purchases related to the organization’s mission. If you have any further questions, reaching out to the Taxpayer Services Division can provide clarity and guidance tailored to your specific needs.

Similar forms

The CERT-119 form is an important document for qualifying exempt organizations in Connecticut, allowing them to make tax-exempt purchases. Below are five documents that share similarities with CERT-119, each serving a particular purpose related to tax exemptions for exempt organizations.

- CERT-112: This form is used for exempt purchases of meals and lodging by exempt entities. Like CERT-119, it helps qualifying organizations avoid sales tax, but it specifically addresses situations involving food and accommodations, requiring prior approval from the Department of Revenue Services.

- CERT-123: The Blanket Certificate for Exempt Qualifying Purchases of Meals or Lodging functions similarly to CERT-119, allowing qualifying organizations to purchase meals and lodging without sales tax. However, it is specifically geared toward blanket exemptions and requires adherence to certain conditions set forth by the DRS.

- CERT-125: This document is a multi-use exemption certificate, used for various types of purchases, including supplies and equipment. It, too, enables qualifying exempt organizations to avoid tax on purchases, provided they adhere strictly to the guidelines that govern exempt organizations.

- CERT-126: The CERT-126 is utilized for sales and use tax exemptions specifically for educational institutions. Similar to CERT-119, it allows certain types of tax-free purchases, but its usage is limited to educational purposes, emphasizing the role of the institution’s primary activities.

- CERT-127: This form is designed for retail purchases made by certain exempt organizations for resale. It has similar purposes to CERT-119, allowing the organization to forgo sales tax but is mainly focused on retail operations as opposed to fundraising or social events.

Each of these documents plays a vital role in the operations of exempt organizations, ensuring they can effectively manage their resources while staying compliant with tax regulations. Understanding their specific usages can help organizations optimize their purchasing strategies.

Dos and Don'ts

- Verify Eligibility: Ensure that your organization qualifies as exempt under the applicable statutes before using the CERT-119 form.

- Gather Documentation: Have your exemption permit or IRS determination letter ready to attach to the certificate.

- Provide Accurate Information: Fill in all required fields with correct and current data to avoid delays.

- Sign the Certificate: An authorized person from your organization must sign the form to validate the exemption claim.

- Use Appropriate Payment Methods: Ensure purchases are made using a check or credit card issued in the organization’s name.

- Do Not Use for Ineligible Purchases: Avoid using CERT-119 for meals and lodging unless preapproved by DRS.

- Don’t Forget to Keep Copies: Retain a copy of the certificate and any accompanying documents for at least six years.

- Avoid Cash Payments: Refrain from using CERT-119 for cash purchases, except for purchases of $10 or less from your own funds.

- Do Not Check Both Boxes: If using it for one purchase or as a blanket certificate, only select one option on the form.

- Do Not Misrepresent Usage: Only declare that purchased items will be used for the organization’s exempt purposes when they truly will be.

Misconceptions

Misconceptions about the CERT-119 form can lead to confusion among exempt organizations and retailers. Here are seven common misunderstandings, along with clarifications:

- Misconception 1: Any organization can use the CERT-119 form.

- Misconception 2: The CERT-119 form allows for unlimited purchases.

- Misconception 3: Purchases of meals and lodging are always exempt if using CERT-119.

- Misconception 4: CERT-119 can be used as a blanket certificate for all types of purchases.

- Misconception 5: The seller is not responsible for verifying the validity of the CERT-119 form.

- Misconception 6: Cash payments are not allowed under CERT-119.

- Misconception 7: Exempt organizations can ignore recordkeeping requirements.

In reality, only qualifying exempt organizations can use this form. These organizations must either have an exemption permit from the Department of Revenue Services or be recognized as tax-exempt under specific federal regulations.

This is incorrect. The form can only be used for specific purchases that are for the organization’s exempt purposes. Additionally, it cannot be used for more than five fundraising or social events per year under the applicable statute.

While qualified organizations can sometimes purchase meals for fundraising events without prior approval, general purchases of meals and lodging require separate documentation and may need preapproval from the Department of Revenue Services.

Not true. CERT-119 allows for blanket use, but it cannot be used to purchase items for resale at fundraising events. Each type of purchase must adhere to specific guidelines outlined in the regulations.

This is misleading. While sellers are relieved from tax obligations when accepting a valid CERT-119, they must still take it in good faith and ensure that the form is properly completed. Sellers should maintain records for at least six years.

Contrarily, cash payments can be made for purchases of $10 or less. However, a properly completed CERT-119 form must still be presented to the retailer, ensuring compliance with the required documentation.

This is a misconception. Organizations must keep a copy of the CERT-119 and any supporting documents for a minimum of six years. Failing to do so could lead to issues with tax compliance and accountability.

Key takeaways

The CERT-119 form is used by qualifying exempt organizations in Connecticut to purchase tangible personal property or services without sales and use taxes.

- Eligibility: Only organizations with valid exemption permits from the Department of Revenue Services (DRS) or IRS determination letters can use CERT-119.

- Purpose of Use: This certificate is applicable for purchases made exclusively for the organization's purposes and allows for resale at certain fundraising or social events.

- Limitations on Purchases: Exempt organizations generally cannot use CERT-119 for meals and lodging without prior authorization from DRS.

- Documentation Required: A copy of the exemption permit or IRS letter must be attached when submitting the certificate.

- Retention of Records: Both the purchaser and seller must keep a copy of the completed CERT-119 and associated documents for six years.

- Payment Methods: Purchases must be paid using a check or credit card in the organization's name, except for cash purchases of $10 or less.

- Single vs. Blanket Certificate: The form can be issued for a single purchase or as a blanket certificate, which lasts for three years unless revoked.

- Good Faith Requirement: Sellers must accept the certificate in good faith and ensure it is properly completed to avoid tax liabilities.

- Violation Penalties: Providing false information on the certificate may result in significant fines or imprisonment.

For further assistance, organizations may contact the Taxpayer Services division at the provided phone numbers or visit the DRS website to access additional resources.

Browse Other Templates

Dsp 83 - The DSP-83 form is required for exporting significant military equipment and classified data.

Monthly Expenditure Tracker,Living Expense Outline,Household Financial Planner,Cost Management Worksheet,Financial Planning Spreadsheet,Monthly Spending Assessment,Home Budget Overview,Expense Reduction Checklist,Comprehensive Monthly Finance Form,Fa - Credit card payments as well as any student loans should be documented.