Fill Out Your Cert 125 Form

The CERT-125 form is an important document for nonresidents purchasing motor vehicles in Connecticut. It provides a means to apply for a sales and use tax exemption under specific conditions outlined by state law. To qualify, the purchaser must not maintain a permanent residence in Connecticut and must not register the vehicle in the state, except for obtaining an in-transit plate. This form is utilized when a nonresident buys a vehicle from a licensed Connecticut dealership. The certificate has to be completed accurately and acknowledged by both the purchaser and the retailer to be valid; misrepresentation can lead to significant penalties. For business entities, stricter criteria apply, including that no owner or member of the entity can be a resident or maintain a permanent place of abode in Connecticut. Retailers are also required to keep copies of the form along with sales invoices for at least six years to validate the tax-exempt status of the sale. Understanding the guidelines on using the CERT-125 form will help avoid legal repercussions and ensure compliance with Connecticut's tax regulations.

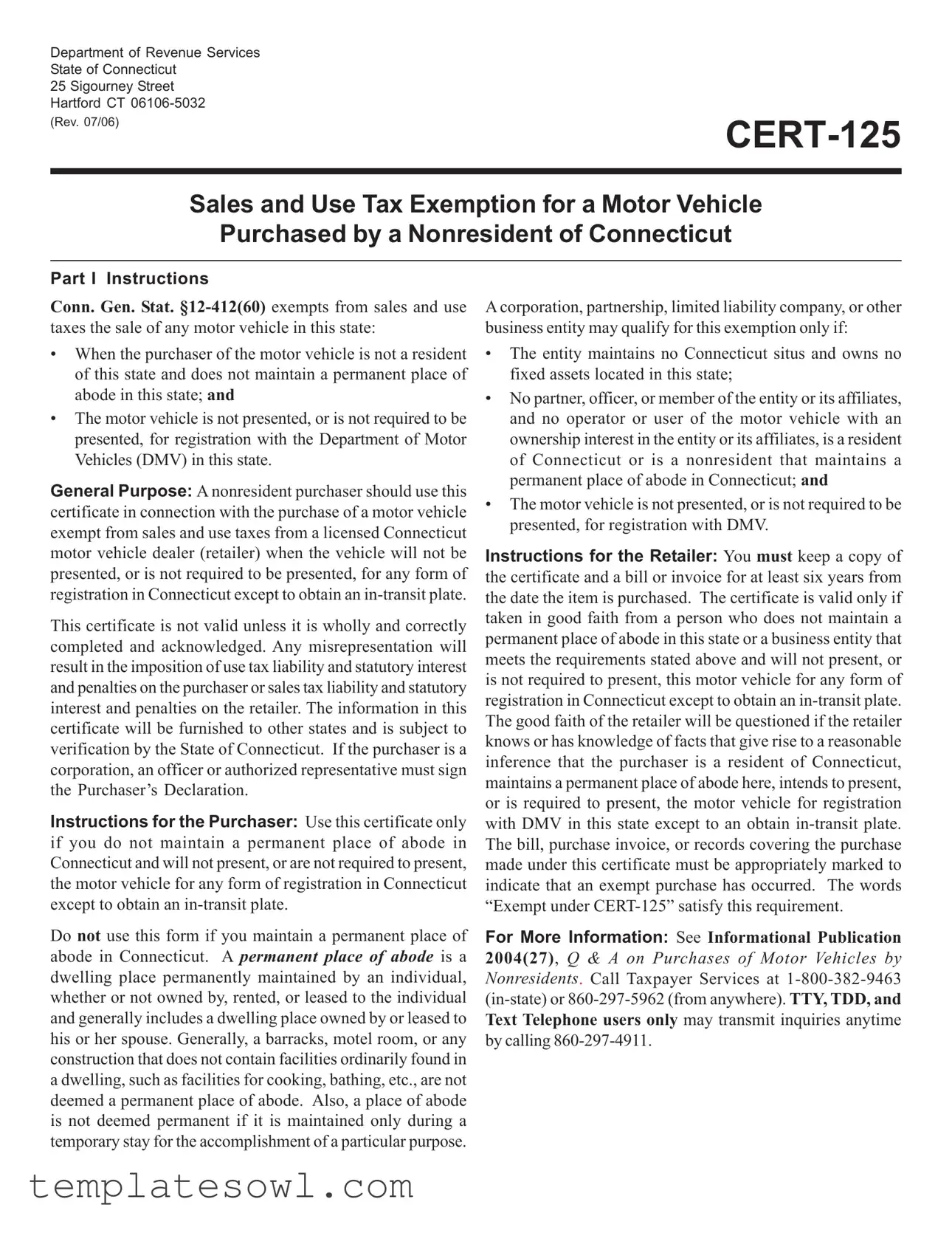

Cert 125 Example

Department of Revenue Services

State of Connecticut

25 Sigourney Street

Hartford CT

(Rev. 07/06)

Sales and Use Tax Exemption for a Motor Vehicle

Purchased by a Nonresident of Connecticut

Part I Instructions

Conn. Gen. Stat.

•When the purchaser of the motor vehicle is not a resident of this state and does not maintain a permanent place of abode in this state; and

•The motor vehicle is not presented, or is not required to be presented, for registration with the Department of Motor Vehicles (DMV) in this state.

General Purpose: A nonresident purchaser should use this certificate in connection with the purchase of a motor vehicle exempt from sales and use taxes from a licensed Connecticut motor vehicle dealer (retailer) when the vehicle will not be presented, or is not required to be presented, for any form of registration in Connecticut except to obtain an

This certificate is not valid unless it is wholly and correctly completed and acknowledged. Any misrepresentation will result in the imposition of use tax liability and statutory interest and penalties on the purchaser or sales tax liability and statutory interest and penalties on the retailer. The information in this certificate will be furnished to other states and is subject to verification by the State of Connecticut. If the purchaser is a corporation, an officer or authorized representative must sign the Purchaser’s Declaration.

Instructions for the Purchaser: Use this certificate only if you do not maintain a permanent place of abode in Connecticut and will not present, or are not required to present, the motor vehicle for any form of registration in Connecticut except to obtain an

Do not use this form if you maintain a permanent place of abode in Connecticut. A permanent place of abode is a dwelling place permanently maintained by an individual, whether or not owned by, rented, or leased to the individual and generally includes a dwelling place owned by or leased to his or her spouse. Generally, a barracks, motel room, or any construction that does not contain facilities ordinarily found in a dwelling, such as facilities for cooking, bathing, etc., are not deemed a permanent place of abode. Also, a place of abode is not deemed permanent if it is maintained only during a temporary stay for the accomplishment of a particular purpose.

Acorporation, partnership, limited liability company, or other business entity may qualify for this exemption only if:

•The entity maintains no Connecticut situs and owns no fixed assets located in this state;

•No partner, officer, or member of the entity or its affiliates, and no operator or user of the motor vehicle with an ownership interest in the entity or its affiliates, is a resident of Connecticut or is a nonresident that maintains a permanent place of abode in Connecticut; and

•The motor vehicle is not presented, or is not required to be presented, for registration with DMV.

Instructions for the Retailer: You must keep a copy of the certificate and a bill or invoice for at least six years from the date the item is purchased. The certificate is valid only if taken in good faith from a person who does not maintain a permanent place of abode in this state or a business entity that meets the requirements stated above and will not present, or is not required to present, this motor vehicle for any form of registration in Connecticut except to obtain an

For More Information: See Informational Publication 2004(27), Q & A on Purchases of Motor Vehicles by Nonresidents. Call Taxpayer Services at

Part II Retailer and Purchaser - Read instructions first, then complete Parts II, III, IV, and V.

Retailer Information

Name of retailer _____________________________________________________________________ |

CT Tax Registration No. _____________________ |

Street address _______________________________________________________________________ |

Date of sale ________________________________ |

City or town, State, ZIP Code __________________________________________________________ |

Telephone No. _____________________________ |

Purchaser Information

Name of Purchaser ________________________________________________ |

Daytime Telephone No. _________________________________________ |

||||||||||||

If an individual: |

|

|

|

|

|

|

If corporation, partnership, limited liability company, or other business entity: |

||||||

Home address |

___________________________________________________ |

Business address |

_______________________________________________ |

||||||||||

|

___________________________________________________ |

|

|

_______________________________________________ |

|||||||||

Name and address ________________________________________________ |

Name and address ______________________________________________ |

||||||||||||

of employer |

________________________________________________ |

of partners, |

______________________________________________ |

||||||||||

|

|

|

|

|

|

|

officers, |

|

|

|

|

|

|

|

________________________________________________ |

members, and |

______________________________________________ |

||||||||||

|

________________________________________________ |

operator(s) of |

______________________________________________ |

||||||||||

|

|

|

|

|

|

|

motor vehicle |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Driver’s License Number |

|

State |

|

Expiration Date |

|

Driver’s License Number |

|

State |

|

Expiration Date |

|||

(Attach copy of each

Part III Motor Vehicle Identification Data

Year _________________ Model __________________ Make of vehicle _____________________________________ Color ______________

Vehicle identification number ___________________________________ State of registration and number __________________________________

Computation of Price |

|

Gross sales price* ____________________________ |

Year ________________ Make ___________________ Model __________________ |

State of registration and plate number _________________________________________ |

|

Net sales price ______________________________ |

Vehicle identification number ________________________________________________ |

* Do not deduct manufacturer’s rebates from the gross sales price.

Part IV Purchaser’s Declaration

Please initial:

_______ I, the purchaser, or person authorized to sign on behalf of the purchaser named in Part II, acknowledge that the retailer has explained to me the

meaning of a permanent place of abode as defined in Part I (or the requirements for business entities as described in Part I) and I declare that I do not maintain such a permanent place of abode in Connecticut.

I, the purchaser, or person authorized to sign on behalf of the purchaser named in Part II, declare that I purchased the motor vehicle described in Part III from the retailer named in Part II. The purchaser is not a Connecticut resident and does not maintain a permanent place of abode in Connecticut, or the business entity meets the requirements described in Part I. The purchaser is a resident of (or the business entity is located in) the State of __________________ . This motor

vehicle will not be presented, or is not required to be presented, for registration with the Connecticut DMV. I declare under the penalty of false statement that I have examined this certificate and to the best of my knowledge and belief it is true, complete, and correct. I understand the penalty for wilfully delivering a false return or document to the Department of Revenue Services (DRS) is a fine of not more than $5,000, or imprisonment for not more than five years, or both.

Signature of purchaser

or authorized person ________________________________________________ Date ________________________________________________________

If corporation, partnership, limited liability company, or other business entity:

Print name of purchaser

or authorized person ________________________________________________ Title _____________________________________ Date ___________

If jointly purchased,

signature of other purchaser __________________________________________ Print name of other purchaser ___________________________________

Part V |

Retailer’s Declaration |

Please initial: |

|

_______ |

I, an authorized agent of the retailer named in Part II, declare that I have explained to the purchaser that owning, leasing or otherwise maintaining |

|

a permanent place of abode in Connecticut, even if it is not permanently occupied by the purchaser, subjects this purchase to Connecticut sales tax |

|

and prohibits the use of this certificate. If the purchaser is a business entity, I have explained the exemption requirements for business entities set forth |

|

in Part I, or if pertinent, I have explained the requirement for business entities to use this certificate as described in Part I. |

I, an authorized agent of the retailer named in Part II, declare under the penalty of false statement that I have examined this certificate and to the best of my knowledge and belief it is true, complete, and correct. I understand the penalty for wilfully delivering a false return or document to DRS is a fine of not more than $5,000, or imprisonment for not more than five years, or both.

Print name of retailer’s authorized agent _________________________________________________________ Date _______________________________

Signature of retailer’s authorized agent ___________________________________________________________ Title _______________________________

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The Cert 125 form is governed by Connecticut General Statutes §12-412(60), which outlines tax exemptions for nonresidents purchasing motor vehicles. |

| Eligibility Requirements | To qualify for exemption, the purchaser must not maintain a permanent place of abode in Connecticut. |

| Registration Exemption | The motor vehicle purchased should not require registration with the Connecticut DMV, except for obtaining an in-transit plate. |

| Completion Requirement | The form must be filled out completely and accurately. Misrepresentation can trigger tax liability and penalties for both purchaser and retailer. |

| Retailer Obligations | Retailers must retain a copy of the Cert 125 form and purchase invoice for at least six years. |

| Good Faith Requirement | The retailer is expected to act in good faith and must not intentionally sell to a non-eligible purchaser, as this could raise questions about the validity of the exemption. |

| Punishment for False Statements | Any person who willfully submits false information on the form may face fines up to $5,000 or imprisonment of up to five years, or both. |

Guidelines on Utilizing Cert 125

Once you have the CERT-125 form ready, it’s important to ensure accurate completion to avoid potential tax liability issues. Follow these steps carefully to fill it out correctly.

- Gather all necessary documents, including proof of your residence outside Connecticut and any identification required.

- Complete the Retailer Information section by filling in the retailer’s name, tax registration number, street address, date of sale, city or town, state, ZIP code, and telephone number.

- In the Purchaser Information section, provide your name, daytime telephone number, home address (if an individual), or business address (if applicable), and details about your employer or business associates.

- Complete the Motor Vehicle Identification Data by filling in the year, model, make, color, vehicle identification number, and state of registration and number.

- In the Computation of Price section, indicate the gross sales price of the vehicle, details about any trade-in vehicle (such as year, make, model), trade-in allowance, and calculate the net sales price. Do not deduct manufacturer’s rebates.

- Sign the Purchaser’s Declaration, initialing where indicated, to affirm that you do not maintain a permanent place of abode in Connecticut and provide the state of residence. Include your signature and the date.

- If applicable, have an authorized person from a corporation, partnership, or other business entity sign and print their name and title in the appropriate spaces.

- Have the Retailer’s Declaration completed by an authorized agent of the retailer, including their name, signature, title, and date.

- Review the entire completed form for accuracy and clarity before submission.

What You Should Know About This Form

What is the Cert 125 form?

The Cert 125 form is used in Connecticut for nonresidents to claim a sales and use tax exemption when purchasing a motor vehicle. This exemption applies to individuals who do not reside in Connecticut and do not maintain a permanent place of abode in the state. It allows for tax-free purchases as long as the vehicle will not be registered in Connecticut, except to obtain an in-transit plate.

Who qualifies to use the Cert 125 form?

To qualify for the Cert 125 form, the purchaser must be a nonresident of Connecticut and not have a permanent place of abode in the state. This also applies to business entities that do not maintain any Connecticut situs or fixed assets. It's essential that neither the purchaser nor any associated individuals, such as partners or officers, reside in Connecticut. If you meet these conditions, you can use this certificate to purchase a vehicle tax-free.

What is considered a permanent place of abode?

A permanent place of abode includes any dwelling that an individual maintains, regardless of ownership. It applies to homes, rented apartments, or any established living space that offers standard living facilities. Temporary accommodations like hotel rooms or barracks do not qualify as permanent since they lack essential facilities for day-to-day living.

What happens if the Cert 125 form is not properly completed?

If the Cert 125 form is not fully and correctly completed, it may be deemed invalid. Any misrepresentation can lead to tax liabilities and penalties for both the purchaser and the retailer. It’s crucial for both parties to provide accurate information to avoid future complications.

What documentation is required to support the Cert 125 form?

Along with the Cert 125 form, purchasers must attach copies of their out-of-state driver’s licenses. If the purchaser is a corporation or other business entity, additional information about its members and partners may be necessary. Retailers should also retain the certificate and associated sale documents for at least six years.

Can businesses use the Cert 125 form for vehicle purchases?

Yes, businesses like corporations or partnerships can use the Cert 125 form if they meet specific criteria. The business must not have a presence in Connecticut, and its partners or members must not be Connecticut residents. Furthermore, the vehicle must not be presented for registration in Connecticut, except for in-transit purposes.

Where can one get more information about the Cert 125 form?

For additional details on the Cert 125 form, consult Informational Publication 2004(27), which covers nonresident vehicle purchases. You can also reach out to Connecticut’s Taxpayer Services at 1-800-382-9463 or 860-297-5962 for inquiries. Additionally, TTY users may call 860-297-4911 for assistance.

Common mistakes

When individuals attempt to fill out the Cert 125 form for sales and use tax exemption on a motor vehicle purchase, they can inadvertently make several common mistakes that may jeopardize the validity of the certificate. Understanding these pitfalls is essential for ensuring a smooth transaction.

One frequent error is failing to confirm residency status accurately. The form is designed specifically for nonresidents who do not possess a permanent place of abode in Connecticut. Some purchasers mistakenly believe they are eligible for exemption without fully considering their living situation. Ignoring details such as temporary housing arrangements, like motel stays, can lead to complications. A temporary dwelling does not qualify as a permanent place of abode, which is defined in the instructions.

Another common mistake involves incomplete sections of the form. Omitting required information, such as the driver's license numbers or complete addresses, can render the form invalid. Each part must be filled out thoroughly, as the State of Connecticut scrutinizes the information provided, and missing data could result in delays or rejections.

Misunderstanding the vehicle registration requirements is also problematic. Some buyers incorrectly assume that any purchase made without immediate registration is eligible for tax exemption. However, the exemptions specifically apply to situations in which the vehicle will not be registered in Connecticut, except for obtaining an in-transit plate. Clarity about the intended use of the vehicle is crucial.

People often neglect to attach necessary documents, such as copies of out-of-state driver's licenses. Failing to include required attachments may lead to inquiries from the Department of Revenue Services, complicating what should be a straightforward process. Always ensure that supplementary documents are included with the form.

Another mistake is not paying close attention to trade-in details. Miscalculating the trade-in allowance or misunderstanding how it impacts the overall sales price can lead to incorrect exemption claims. The form explicitly states not to deduct manufacturer’s rebates from the gross sales price, and missing this point could result in financial liability.

Lastly, purchasers might overlook the importance of signing and dating the declaration accurately. This declaration asserts that all information is true and complete. An unsigned or undated form can be treated as incomplete, potentially nullifying the intended exemption. It is vital to ensure that all signatures are in place before submission.

In conclusion, while the Cert 125 form is a valuable tool for nonresidents in Connecticut seeking tax exemption on vehicle purchases, careful attention to detail is crucial. Understanding residency requirements, completing all sections accurately, and attaching necessary documentation will significantly enhance the likelihood of a successful application.

Documents used along the form

In addition to the Cert 125 form, there are several other documents that are commonly used in similar transactions involving sales tax exemption for motor vehicles purchased by nonresidents. Here’s a brief overview of these related documents.

- Form B-195: This form is the Connecticut Exempt Purchaser Certificate. It certifies that a purchaser is exempt from sales and use tax in Connecticut due to their status, such as being a governmental entity or a nonprofit organization. Retailers must accept this form to confirm the exemption.

- Certificate of Title: This document is crucial for establishing ownership of a vehicle. It shows the previous owner’s information, and it is often required during the registration process in the buyer's home state, especially if they plan to register the vehicle.

- Transaction Invoice: This is the document issued by the seller detailing the sale. It includes vital information such as the purchase price, descriptions of the vehicle, and both the buyer's and seller's information. It serves as proof of the transaction and is essential for maintaining tax records.

- Out-of-State Registration Application: When a nonresident purchases a vehicle, they typically need to submit this application to their home state for registration. This document is necessary to ensure the vehicle is legally registered outside of Connecticut and complies with that state’s laws.

Understanding these documents can streamline the process of purchasing a vehicle in Connecticut while ensuring compliance with tax regulations. Be sure to handle each form correctly to prevent any complications down the road.

Similar forms

- Form ST-5: This document serves as a sales tax exemption certificate for various types of purchases, similar to the Cert 125, in that both allow certain parties to avoid paying sales tax under specific conditions.

- Form ST-3: The ST-3 sales tax exemption certificate is utilized for purchases made by non-profit organizations, mirroring the Cert 125's emphasis on residency status and exemption criteria.

- Form ST-12: This exempt use certificate is for out-of-state buyers claiming tax exemption on purchases, much like the Cert 125, which addresses nonresident buyers specifically.

- Form ST-2: This form is an exemption certificate for purchases made by governmental entities. Both documents require clear acknowledgement and understanding of applicable regulations for tax exemption.

- Form REG-1: This is a general registration form for businesses in Connecticut. It shares the Cert 125's requirement for accurate information and compliance in transaction processes.

- Form DR-1: Used for non-residential purchases, this form parallels the Cert 125 in addressing criteria for exemption based on the residency of the purchaser.

- Form CERT-119: This certificate provides exemption for purchases related to manufacturing. It emphasizes the conditions under which tax exemption is granted, akin to the rules specified in the Cert 125.

- Form TB-120: This is an exemption certificate for promotional items purchased by businesses. While focused on a different category of goods, it similarly outlines parameters for tax exemption eligibility.

Dos and Don'ts

When filling out the Cert 125 form, there are important dos and don'ts to keep in mind. This will help ensure that the process goes smoothly and that you remain compliant with tax regulations.

- Do read all instructions carefully before starting to fill out the form.

- Do make sure you are a nonresident and do not maintain a permanent place of abode in Connecticut.

- Do complete all required sections of the form accurately and honestly.

- Do have all necessary documentation, including driver’s licenses from out-of-state, ready for submission.

- Do sign the declaration section to acknowledge your understanding of the requirements for exemption.

- Don't use this form if you maintain a permanent place of abode in Connecticut.

- Don't leave any sections blank; all required fields must be filled out.

Following these guidelines will help facilitate a correct and legal submission of the Cert 125 form.

Misconceptions

- Misconception 1: Nonresidents can use the CERT-125 form without restrictions.

- Misconception 2: Any individual can claim exemption by simply declaring nonresidency.

- Misconception 3: All vehicles purchased in Connecticut by nonresidents are automatically exempt from sales tax.

- Misconception 4: Retailers do not have any responsibilities when accepting the CERT-125 form.

This is not true. The CERT-125 form is only valid if the purchaser does not maintain a permanent place of abode in Connecticut and will not present the vehicle for any form of registration in Connecticut, except to obtain an in-transit plate. Misuse of the form can result in tax liabilities.

This misconception overlooks the requirement to prove that the individual does not maintain a permanent place of abode in Connecticut. A dwelling that is rented, owned, or used for temporary stays may still disqualify a purchaser from receiving the tax exemption.

This is incorrect. The exemption applies only if the motor vehicle is not required to be registered in Connecticut. If there is a requirement to present the vehicle for registration, the nonresident must pay applicable sales taxes.

Retailers must verify that the form is correctly completed and that the purchaser does indeed qualify for the exemption. They are required to maintain copies of the certificate along with related documents to demonstrate compliance during audits or inquiries.

Key takeaways

- Purpose of CERT-125: This form certifies that a motor vehicle purchase by a nonresident is exempt from Connecticut's sales and use taxes.

- Eligibility Criteria: Nonresidents must not maintain a permanent place of abode in Connecticut to qualify for this exemption.

- Acknowledgment Requirement: Both the purchaser and retailer must fully complete and acknowledge the CERT-125 for it to be valid.

- Exemption Limitations: The vehicle cannot be registered in Connecticut except for obtaining an in-transit plate.

- Documentation Retention: Retailers must keep a copy of the certificate along with the sale invoice for six years.

- Good Faith Requirement: Retailers must take the certificate in good faith, meaning they should not have reason to believe the purchaser is a Connecticut resident.

- Punitive Measures: Misrepresentation on the form can lead to significant fines and penalties for both the purchaser and the retailer.

- Declaration Signatures: The form requires valid signatures from the purchaser and an authorized representative of the retailer to confirm the transaction's legitimacy.

- Offsetting Trade-ins: The gross sales price should not include manufacturer’s rebates, but trade-in allowances can affect the net sales price.

Browse Other Templates

Is Gift of Equity Taxable - No repayment is expected for this gift of equity.

Llc-12 Online - A section is dedicated to listing individuals or corporations for service of process.

Printable Power of Attorney for Child - Involving both parents in this form can mitigate potential travel disputes.