Fill Out Your Certficate Of Organization Domestic Llc Sample Pa Form

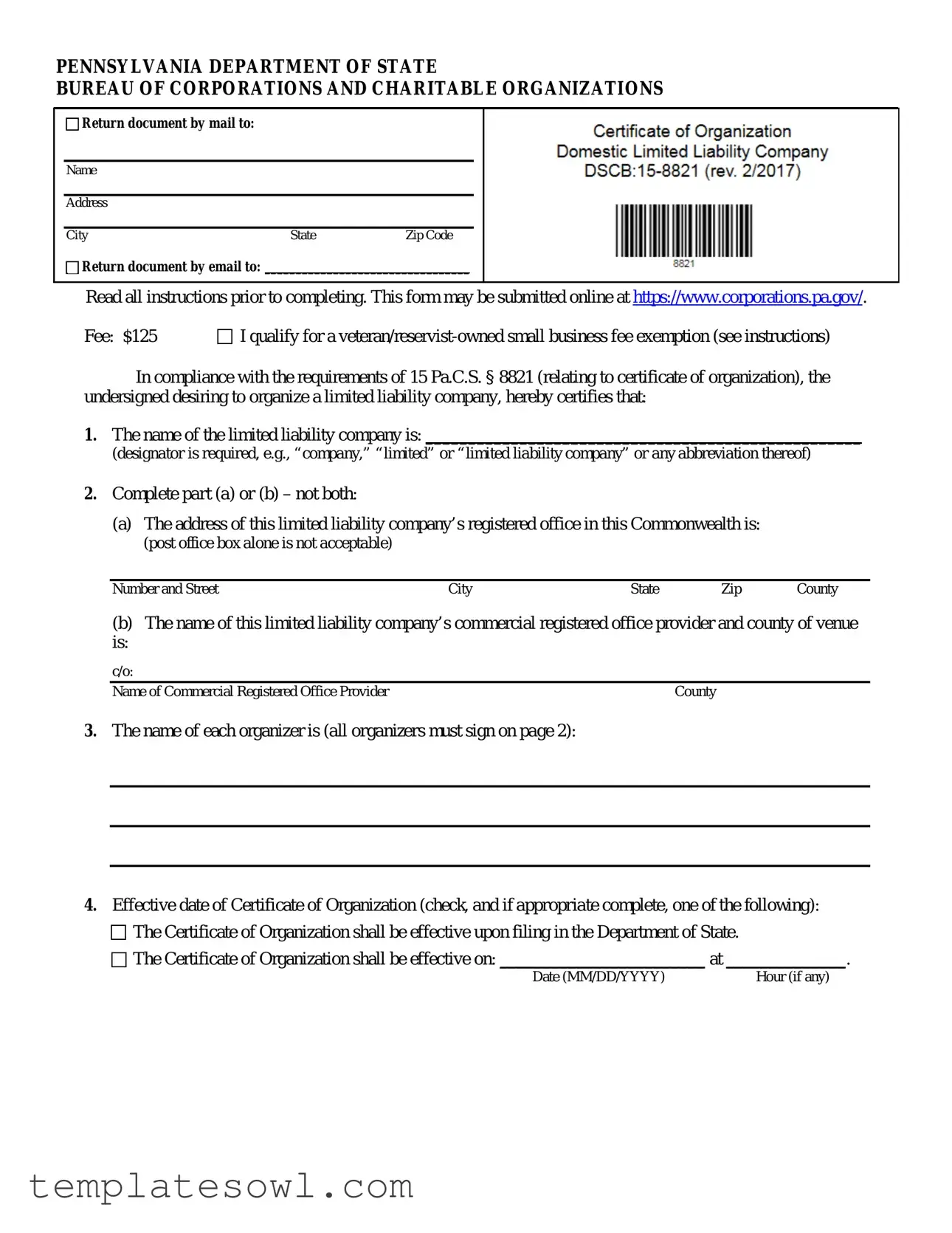

The Certificate of Organization for a Domestic Limited Liability Company (LLC) in Pennsylvania is a crucial form for anyone looking to establish a business entity in the state. This form serves as the official document to create your LLC and outlines essential details that define your company. Key components include the name of the LLC, which must include a designator such as "company" or "limited," ensuring it complies with naming requirements. The form also requires the address of the LLC's registered office within Pennsylvania, or the name and address of a commercial registered office provider if applicable. Additionally, the document specifies the names of all individuals organizing the LLC, along with their signatures. An effective date for the organization can be chosen, whether immediately upon filing or at a later date. If the LLC is intended to provide specific restricted professional services, this must be indicated on the form. Moreover, there’s an option for establishing the LLC as a benefit company, which incorporates societal and environmental objectives into its purpose. For any unique provisions outside standard requirements, there is an option to attach additional pages. This document can be submitted online or by mail, with a fee of $125 required for processing. Special considerations exist for veteran or reservist-owned businesses, allowing potential fee exemptions. Understanding the nuances of the Certificate of Organization is fundamental for meeting state requirements and setting a solid foundation for your new venture.

Certficate Of Organization Domestic Llc Sample Pa Example

PENNSYLVANIA DEPARTMENT OF STATE

BUREAU OF CORPORATIONS AND CHARITABLE ORGANIZATIONS

Return document by mail to:

Name

Address

City |

State |

Zip Code |

Return document by email to: _________________________________

Read all instructions prior to completing. This form may be submitted online at https://www.corporations.pa.gov/.

Fee: $125 |

I qualify for a |

In compliance with the requirements of 15 Pa.C.S. § 8821 (relating to certificate of organization), the undersigned desiring to organize a limited liability company, hereby certifies that:

1.The name of the limited liability company is: ___________________________________________________

(designator is required, e.g., “company,” “limited” or “limited liability company” or any abbreviation thereof)

2.Complete part (a) or (b) – not both:

(a)The address of this limited liability company’s registered office in this Commonwealth is:

(post office box alone is not acceptable)

Number and Street |

City |

State |

Zip |

County |

(b)The name of this limited liability company’s commercial registered office provider and county of venue

is:

c/o: |

|

Name of Commercial Registered Office Provider |

County |

3.The name of each organizer is (all organizers must sign on page 2):

4.Effective date of Certificate of Organization (check, and if appropriate complete, one of the following):  The Certificate of Organization shall be effective upon filing in the Department of State.

The Certificate of Organization shall be effective upon filing in the Department of State.

The Certificate of Organization shall be effective on: ________________________ at ______________.

The Certificate of Organization shall be effective on: ________________________ at ______________.

Date (MM/DD/YYYY) |

Hour (if any) |

5.Restricted professional companies only.

Check the box if the limited liability company is organized to render a restricted professional service and check the type of restricted professional service(s).

The company is a restricted professional company organized to render the following restricted professional service(s):

The company is a restricted professional company organized to render the following restricted professional service(s):

Chiropractic

Dentistry

Law

Medicine and surgery

Optometry

Osteopathic medicine and surgery

Podiatric medicine

Public accounting

Psychology

Veterinary medicine

6.Benefit companies only.

Check the box immediately below if the limited liability company is organized as a benefit company:

This limited liability company shall have the purpose of creating general public benefit.

Optional specific public benefit purpose. Check the box immediately below if the benefit company is organized to have one or more specific public benefits and supply the specific public benefit(s). See instructions for examples of specific public benefit.

This limited liability company shall have the purpose of creating the enumerated specific public benefit(s):

7.For additional provisions of the certificate, if any, attach 8½ x 11 sheet(s).

IN TESTIMONY WHEREOF, the organizer(s) has (have) executed this Certificate of Organization this

__________ day of _____________________________, 20 |

|

. |

______________________________________________________________

Signature

______________________________________________________________

Signature

______________________________________________________________

Signature

Pennsylvania Department of State

Bureau of Corporations and Charitable Organizations

P.O. Box 8722

Harrisburg, PA

(717)

Website: www.dos.pa.gov/corps

General Information

Typewritten is preferred. If handwritten, the form must be legible and completed in black or

The nonrefundable filing fee for this form is $125. Checks should be made payable to the Department of State. Checks must contain a commercially

This form and all accompanying documents shall be mailed to the address stated above.

Who should file this form?

One or more persons acting as organizers to form a limited liability company must file a certificate of organization in the Department of State.

Applicable Law

See 15 Pa.C.S. § 8821 for general information on Formation of Limited Liability Company and Certificate of Organization. Statutes are available on the Pennsylvania General Assembly website, www.legis.state.pa.us, by following the link for Statutes. See also 15 Pa.C.S. § 8898 and § 8998 for provisions on annual reports/registrations that are required of benefit companies and restricted professional companies, respectively.

Limited Liability Company Name Requirements Generally, the name of an association may not be the same as the name of another association which is already on the records of the Department of State. Depending on the type of association, certain designators must be used in the association name. Designators are the words or abbreviations used at the end of the association name which designate the type of association. The minimum requirements for limited liability company names can be found at 15 Pa.C.S. §§ 201, 202 and 204.

The name of a domestic limited liability company must contain:

(1)the term “company,” “limited” or “limited liability comp any” or an abbreviation of one of those terms, or

(2)words or abbreviations of like import used in a jurisdiction other than this Commonwealth.

The name of a limited liability company may not contain any words implying that it is a business corporation, such as “corporation” or “incorporated” or an abbreviation of these terms.

Restricted words and/or approvals:

Association names may not contain words, phrases or abbreviations prohibited or restricted by statute or regulation, unless in compliance with the restriction, generally with the consent or approval of a government agency, board or commission. These may include certain professional and occupational boards or commissions of the Bureau of Professional and Occupational Affairs, the Department of Education, the Department of Banking and Securities, the Insurance Department or the Public Utility Commission. There are also words and abbreviations that may be restricted, prohibited, or may be permitted in certain instances as provided in various federal statutes, Attorney General opinions and Bureau regulations.

Attachments

The following, in addition to the filing fee, shall accompany this form:

(1)One copy of a completed form

(2)Any necessary copies of form

(3)Any necessary governmental approvals.

Form Instructions

Enter the name and mailing address to which any correspondence regarding this filing should be sent. This field must be completed for the Bureau to return the filing. If the filing is to be returned by email, an email address must be provided. An email will be sent to address provided, containing a link and instructions on how a copy of the filed document or correspondence may be downloaded. Any email or mailing addresses provided on this form will become part of the filed document and therefore public record.

1.Give the exact name of the limited liability company. This should include the exact spelling, punctuation and a permissible designator. This field is required.

2.Address. This address must be in Pennsylvania. Give one of the following: the registered office address in the Commonwealth in (a) or the name of a Commercial Registered Office Provider in (b) and the county of venue.

Listing a Commercial Registered Office Provider in lieu of providing a registered office address is an option for any association that does not have a physical location or mailing address in Pennsylvania. Prior to listing a Commercial Registered Office Provider address, the association should enter into a contract for the services of the Commercial Registered Office Provider.

Post office boxes are not acceptable for any address. Under 15 Pa.C.S. § 135(c) (relating to addresses), an actual street or rural route box number must be used as an address, and the Department of State is required to refuse to receive or file any document that sets forth only a post office box address.

This field is required.

3.An organizer is a person that acts to form a limited liability company. “Person” is defined to include a corporation, partnership, limited liability company, business trust, other association, government entity (other than the Commonwealth), estate, trust, foundation or natural person. When the limited liability company has more than three organizers, additional lines should be added as appropriate.

This field is required.

4.Effective date. Any date specified as the effective date of the Certificate of Organization must be a future effective date (after the date and time of its delivery to the Department). A specified effective date may not be retroactive (prior to the date and time of the Certificate’s delivery to the Department). If a delayed effective date is specified, but no time is given, then the time used will be 12:01 a.m. on the date specified. If no effective date is provided, it will be presumed that no specified delayed effective date is intended and the document will be effective upon filing. This field is required.

5.Restricted professional services are identified as the following professional services: chiropractic, dentistry, law, medicine and surgery, optometry, osteopathic medicine and surgery, podiatric medicine, public accounting, psychology or veterinary medicine. If the limited liability company is organized to render any of the identified restricted professional services, the box before the statement “The company is a restricted professional company organized to render the following restricted professional service(s)” must be checked and the appropriate restricted professional service(s) must be checked. If the limited liability company is not organized to render any of the identified restricted professional services, do not check the box or list a profession.

Note that restricted professional companies must file certificates of annual registration and pay annual registration fees in accordance with 15 Pa.C.S. § 8998.

6.A benefit company shall be formed in accordance with 15 Pa.C.S. § 8821, except that its certificate of organization shall also state that it is a benefit company.

A benefit company shall have a purpose of creating general public benefit. A “general public benefit” is defined as a material positive impact on society and the environment, taken as a whole and assessed against a

The certificate of organization of a benefit company may identify one or more specific public benefits that it is the purpose of the benefit company to create in addition to its general public benefit purpose under 15 Pa.C.S. § 8894(a) and

its purpose under 15 Pa.C.S. § 8818(b). “Specific public benefit” includes:

(1)providing

(2)promoting economic opportunity for individuals or communities beyond the creation of jobs in the normal course of business;

(3)preserving the environment;

(4)improving human health;

(5)promoting the arts, sciences or advancement of knowledge;

(6)promoting economic development through support of initiatives that increase access to capital for emerging and growing technology enterprises, facilitate the transfer and commercial adoption of new technologies, provide technical and business support to emerging and growing technology enterprises or form support partnerships that support those objectives;

(7)increasing the flow of capital to entities with a public benefit purpose; and

(8)the accomplishment of any other particular benefit for society or the environment.

Note that benefit companies must file annual benefit reports in accordance with 15 Pa.C.S. § 8898.

If the limited liability company is organized as a benefit company, the box before the statement “This limited liability company shall have the purpose of creating general public benefit” should be checked. If the limited liability company is organized as a benefit company, a specific public benefit purpose is optional. If the box before the statement “This limited liability company shall have the purpose of creating the enumerated specific public benefit(s)” is checked, one or more specific public benefits must be listed. If the limited liability company is not organized as a benefit company, do not check any of the boxes or list any specific public benefits.

7.Additional provisions. A certificate of organization may contain statements as to matters other than those required by

15Pa.C.S. § 8821(b), but may not vary or otherwise affect the provisions specified under § 8815(c) and (d) (relating to contents of operating agreement) in a manner inconsistent with that section.

Signature and Verification

All organizers must sign the Certificate of Organization. If an organizer is not a natural person, an authorized representative of the organizing association must sign the Certificate.

When the limited liability company has more than three executing organizers, additional signature lines should be added as appropriate. Signing a document delivered to the Department for filing is an affirmation under the penalties provided in 18 Pa.C.S. § 4904 (relating to unsworn falsification to authorities) that the facts stated in the document are true in all material respects. This field is

required.

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Title | Certificate of Organization Domestic LLC Sample PA |

| Governing Statute | 15 Pa.C.S. § 8821 |

| Filing Fee | $125, non-refundable |

| Filing Options | Form can be submitted online or by mail to the Pennsylvania Department of State. |

| Effective Date | The certificate can be effective upon filing or on a specified future date. |

| Organizer Requirement | At least one organizer must sign the form; all organizers must be listed. |

| Restricted Profession Check | Checkbox required if the LLC is providing restricted professional services such as law or medicine. |

| Benefit Company Option | Boxes available for indicating if the LLC is a benefit company. Specific public benefits can be listed. |

| Attachments Required | Must include a completed Docketing Statement and possibly other approvals, if applicable. |

Guidelines on Utilizing Certficate Of Organization Domestic Llc Sample Pa

Completing the Certificate of Organization for a Domestic LLC in Pennsylvania is a crucial step in establishing a limited liability company. After filling out this form, it should be submitted to the Pennsylvania Department of State along with the appropriate filing fee. Below are clear, step-by-step instructions to help guide you through the process.

- Return Document Instructions: Indicate how you want the document returned, either by mail or email. Fill in your name, address, city, state, and zip code for mail delivery. If you choose email, provide the email address.

- Organization Name: Enter the exact name of your limited liability company, including proper designator (e.g., “company,” “limited,” or “LLC”).

- Registered Office Address: Complete either part (a) or part (b). If using part (a), provide the address (not a P.O. box) of your registered office in Pennsylvania. If using part (b), give the name of a Commercial Registered Office Provider and the county of venue.

- Name of Organizers: List the name of each organizer responsible for forming the LLC. All organizers must sign on the next page.

- Effective Date: Check the appropriate box for when the Certificate of Organization will take effect. It can be the filing date or a specified future date. If choosing a future date, provide the exact date and time.

- Professional Services: If your LLC will provide restricted professional services (like law or medicine), check the box and specify the type of service.

- Benefit Company Designation: If applicable, indicate whether the LLC is a benefit company by checking the corresponding box. If it is a benefit company, you can also specify if it will aim for particular public benefits.

- Additional Provisions: If you have extra provisions, attach them on a separate 8½ x 11 sheet.

- Signatures: Have all organizers sign and date the form. The date must include the exact day, month, and year of signing.

After completing these steps, review the form to ensure all information is correct. Then, send the form along with the filing fee to the address provided. Ensure to keep a copy for your records.

What You Should Know About This Form

What is the Certificate of Organization for a Domestic LLC in Pennsylvania?

The Certificate of Organization is a document that must be filed with the Pennsylvania Department of State to officially form a Limited Liability Company (LLC) in Pennsylvania. This declaration provides important information about the LLC, including its name, registered office address, and organizers. It establishes the LLC's legal existence under Pennsylvania law.

What information do I need to include when completing the form?

When filling out the Certificate of Organization, you will need to provide several key pieces of information. Start with the exact name of your LLC, ensuring it includes a designator such as "Company," "Limited," or "LLC." Next, either provide a physical Pennsylvania address for the LLC or the name and address of a registered office provider. You will also list the names of the organizers and specify whether the LLC will have an effective date upon filing or at a later date. Lastly, if applicable, indicate if your LLC is a restricted professional company or a benefit company.

Is there a fee to file the Certificate of Organization?

Yes, there is a filing fee of $125 when submitting the Certificate of Organization. This fee is nonrefundable, so it’s essential to ensure that all information is correct and complete before submitting your application. If you qualify for a veteran/reservist-owned small business fee exemption, you can provide proof along with your filing.

How do I submit the Certificate of Organization?

You can file the Certificate of Organization online on the Pennsylvania Department of State's website or mail it to their office. If you choose to file by mail, be sure to include all required information and attachments, as well as the payment. Choose how you want the document returned, whether by mail or email.

Who is considered an organizer for the LLC?

An organizer is any individual or entity that helps establish the LLC. This can include natural persons (individuals) or other business entities such as corporations or partnerships. When listing organizers on the form, ensure that all involved parties sign the certificate, as their signatures validate the filing.

What are restricted professional services?

Restricted professional services are specific types of professional services that have additional legal regulations. If the LLC will provide services such as chiropractic, law, medicine, or veterinary services, it must identify this on the Certificate of Organization. This designation ensures compliance with relevant professional licensing and regulations in Pennsylvania, which may require further documentation or registration.

Can I add additional provisions to the Certificate of Organization?

Yes, if there are specific provisions or additional statements you want to include, you can do so by attaching an 8½ x 11 sheet to the Certificate. However, keep in mind that these additional provisions cannot contradict essential legal requirements set forth in the state's regulations regarding operating agreements and other foundational elements of the LLC.

Common mistakes

Filling out the Certificate of Organization Domestic LLC Sample PA form can be straightforward, but many people stumble on a few common mistakes. Understanding these can save time and help ensure your application is accepted on the first try.

One frequent error is regarding the name of the LLC. Many individuals forget to include the required designator, like "Company," "Limited," or "LLC." It's essential to remember that without the correct designation at the end of the name, the form will be rejected. Additionally, double-check that the name is unique and doesn't duplicate another existing business in Pennsylvania.

Another common mistake is with the address section. The registered office must be a physical location and not just a post office box. Some filers mistakenly provide a P.O. box which leads to rejection. It's crucial to ensure that the address includes a street number and a city, complying with the state requirements without exceptions.

Many also misinterpret the effective date section. Specifying a past date is a common pitfall. If you choose to set a future effective date, ensure it’s clear and not ambiguous. If no effective date is provided, the filing will be assumed to be effective immediately upon submission. Always ensure the date aligns with your intended start time for the LLC.

Lastly, when it comes to the signatures, some individuals overlook the fact that all organizers must sign the form. If the LLC has more than three organizers, additional lines should be added, which many neglect to do. Each signature indicates acceptance of the details provided in the document, so it’s vital that this step isn't missed.

Documents used along the form

When filing the Certificate of Organization for a Domestic LLC in Pennsylvania, several other documents may also be required or beneficial to accompany the primary form. Understanding these additional forms can help streamline the process and ensure that everything is submitted correctly.

- Docketing Statement (Form DSCB:15-134A): This form provides necessary details about the LLC, including its name, registered office address, and other critical information. It should accompany the Certificate of Organization when submitted.

- Consent to Appropriation of Name (Form DSCB:19-17.2): If there is a potential conflict with the proposed name of the LLC, this form may be needed. It serves as consent from an existing entity using a similar name.

- Operating Agreement: While not filed with the state, this internal document outlines how the LLC will be managed, including the rights and responsibilities of members. Having one protects the interests of the owners and clarifies operational procedures.

- Commercial Registered Office Provider Agreement: If the LLC uses a commercial registered office provider for its registered address, a contract with the provider should be maintained for reference and compliance.

- Professional License Documents: For LLCs offering restricted professional services, relevant state licensure or certification documents may need to be included or referenced to comply with professional regulations.

- Benefit Company Registration Documents: If the LLC is being formed as a benefit company, additional documentation stating its social or environmental goals may be required to demonstrate its commitment to public benefit.

- Annual Reports: For specific types of LLCs, such as benefit or restricted professional companies, annual reports must be filed regularly to maintain compliance with state regulations.

Each of these forms and documents plays a vital role in the establishment and operation of a Domestic LLC in Pennsylvania. Properly preparing and submitting the required materials ensures compliance with state regulations and supports the smooth operation of the business entity.

Similar forms

-

Articles of Incorporation: Similar to the Certificate of Organization for an LLC, the Articles of Incorporation serve as the foundational document needed to create a corporation. Both documents require essential information regarding the entity, such as its name, registered agent, and the purpose of formation. However, while the Certificate of Organization applies to LLCs, the Articles of Incorporation address the specific needs of corporations, including share structure.

-

Operating Agreement: This document is not a filing requirement but is crucial for LLCs. Like the Certificate of Organization, it delineates the structure and governance of the LLC. While the Certificate establishes the legal existence of the LLC, the Operating Agreement details how it will operate, including decision-making processes and member responsibilities.

-

Partnership Agreement: This agreement is comparable to both the Certificate of Organization and the Operating Agreement but is utilized for general or limited partnerships. It outlines the partners' roles, responsibilities, and profit-sharing arrangements. While the Certificate of Organization establishes an LLC as a distinct legal entity, the Partnership Agreement details the relational aspects of a partnership.

-

Certificate of Assumed Name (DBA Certificate): Often filed along with or after the Certificate of Organization, the Certificate of Assumed Name allows a business to operate under a name different from its official registered name. This document parallels the Certificate of Organization in that it requires specific information about the business but focuses on the branding aspect rather than the formation of the entity.

Dos and Don'ts

Things to Do:

- Read all instructions carefully before starting to complete the form.

- Provide the exact name of the limited liability company, including correct spelling and punctuation.

- Enter a physical address in Pennsylvania; avoid using a post office box.

- Ensure all organizers sign the form on the designated page.

- Check the appropriate box if your company is a restricted professional company and specify the service.

- Attach any required documents, such as proof for fee exemption if applicable.

- Specify an effective date if you want the Certificate of Organization to be effective at a later time.

- Make the filing fee payment clear and include a pre-printed name and address on the check.

Things Not to Do:

- Do not submit incomplete forms; every section must be filled out as instructed.

- Avoid using an email that cannot be publicly disclosed if opting for email return.

- Do not use restricted words in the name of your LLC without proper approvals.

- Never check multiple options in parts 2(a) and 2(b); choose only one.

- Do not forget to confirm that an organizer is a legal entity or a natural person.

- Do not provide a retroactive effective date; it must be future-dated.

- Do not leave any required signature lines empty.

- Avoid submitting handwritten forms that are not legible; type when possible.

Misconceptions

Many people hold misconceptions about the Certificate of Organization Domestic LLC Sample PA form. Understanding the facts can help to clarify any confusion. Here is a list of common misconceptions:

- Only professionals can form an LLC. Many think that only licensed professionals can use the Certificate of Organization. In reality, anyone can create an LLC for most types of businesses.

- The form must be filled out by a lawyer. Some individuals believe that only an attorney can complete this form. However, many people successfully file the form on their own.

- Filing online is not an option. There is a belief that the form can only be submitted by mail. In fact, it is possible to file the Certificate of Organization online.

- The LLC name can be anything. Some may think they can choose any name for their LLC. However, specific naming requirements must be met to avoid confusion with existing entities.

- Annual fees are not necessary. A misconception exists that once the LLC is formed, no further fees are required. In truth, LLCs may need to file annual reports and pay applicable fees.

- All LLCs are the same. People may believe that all LLCs are structured identically. There can be variations, especially when it comes to professional services or benefit companies.

- A physical address is not needed. Some individuals think they can list only a P.O. box. However, an actual street address or a registered office provider must be provided.

- The form does not require a signature. There is a belief that a signature is not necessary for the Certificate of Organization. In fact, all organizers must sign the document for it to be valid.

- Filing this form is the only step. Some may mistakenly think that submitting the Certificate of Organization is the final step in establishing an LLC. Further steps are often needed to comply with local regulations.

Understanding these misconceptions can empower individuals to navigate the process of forming an LLC more effectively. Being informed is vital for a successful start.

Key takeaways

The Certificate of Organization for a Domestic LLC is an important document when starting a business in Pennsylvania. Here are key takeaways for filling out and using this form:

- Correctly fill in the company's name: Ensure that the name of your LLC includes one of the required designators, like "limited" or "company." This helps identify the type of business entity it is.

- Provide a valid address: A Pennsylvania address must be given, either as a registered office or through a Commercial Registered Office Provider. A post office box is not acceptable.

- Effective date considerations: You can specify when the Certificate of Organization will take effect. If you leave it blank, it will be effective immediately upon filing.

- Include necessary signatures: All organizers must sign the document. If there are more than three organizers, be sure to add extra signature lines for everyone involved.

Browse Other Templates

Online Aa Meetings Zoom Proof of Attendance - Use this sheet to record your progress and the topics that resonate with you.

Farm Financial Assessment,Agricultural Asset Evaluation,Farm Wealth Report,Farm Viability Matrix,Agricultural Business Equity Assessment,Rural Financial Health Chart,Farm Balance Summary,Agricultural Financial Overview,Farm Resource Inventory,Farm We - The entity named on the form is responsible for all entries.