Fill Out Your Certificate Of Cremation Form

The Certificate of Cremation form is an important document used in the cremation process. It serves as an official record that confirms cremation has occurred. This form includes key details such as the name of the deceased, the date of cremation, and the location of the cremation facility. Additionally, it requires the signature of the crematory operator, which verifies that the cremation was performed in accordance with the law. In some jurisdictions, the form may also include information about any permits or authorizations required for cremation. Having this certificate is crucial for legal and administrative purposes, especially when settling the deceased’s estate or when dealing with burial plots. Understanding the components of the Certificate of Cremation form helps ensure that all necessary information is accurately documented and can provide peace of mind during a difficult time.

Certificate Of Cremation Example

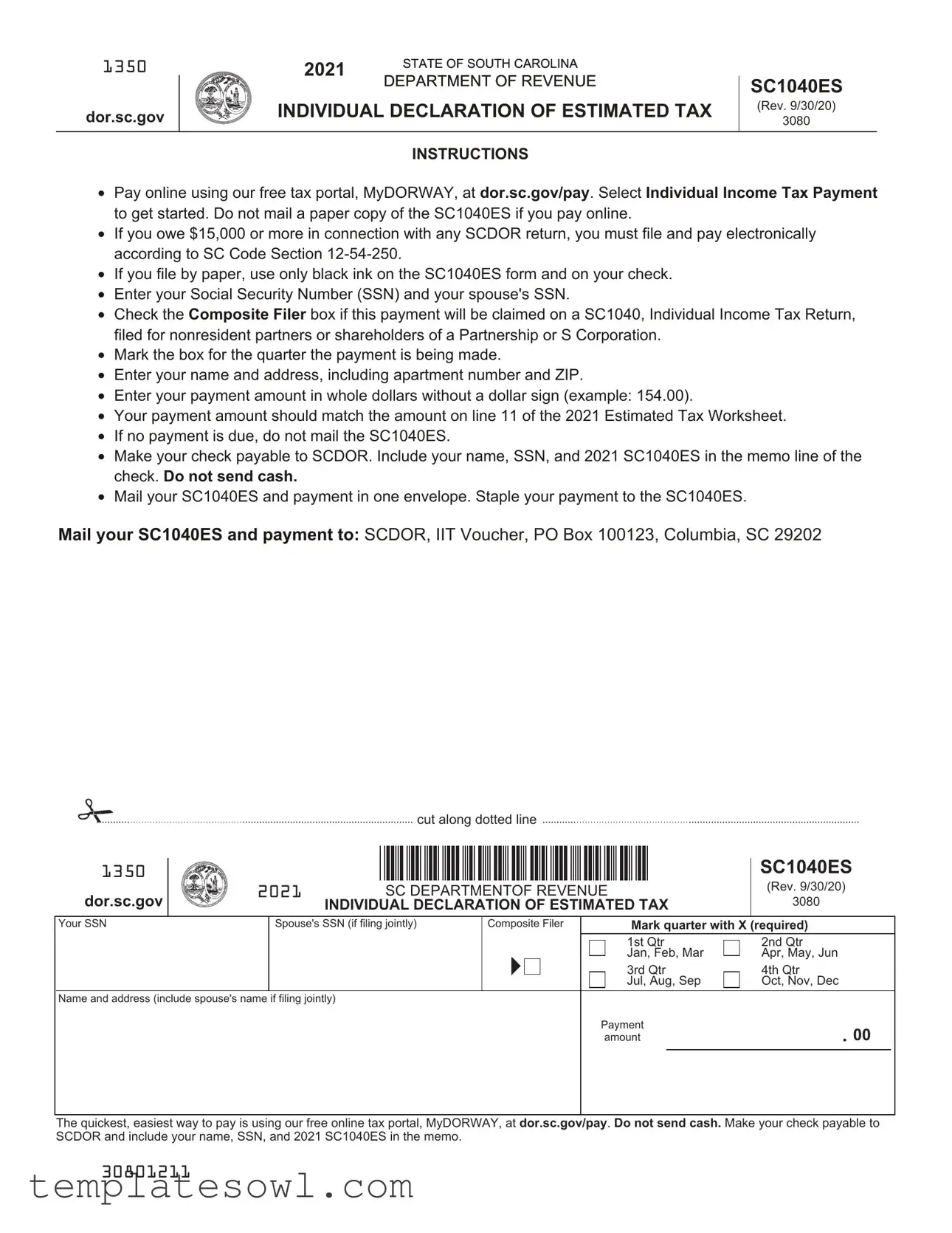

1350

dor.sc.gov

2021 |

STATE OF SOUTH CAROLINA |

|

DEPARTMENT OF REVENUE |

||

|

INDIVIDUAL DECLARATION OF ESTIMATED TAX

SC1040ES

(Rev. 9/30/20)

3080

INSTRUCTIONS

•Pay online using our free tax portal, MyDORWAY, at dor.sc.gov/pay. Select Individual Income Tax Payment to get started. Do not mail a paper copy of the SC1040ES if you pay online.

•If you owe $15,000 or more in connection with any SCDOR return, you must file and pay electronically according to SC Code Section

•If you file by paper, use only black ink on the SC1040ES form and on your check.

•Enter your Social Security Number (SSN) and your spouse's SSN.

•Check the Composite Filer box if this payment will be claimed on a SC1040, Individual Income Tax Return, filed for nonresident partners or shareholders of a Partnership or S Corporation.

•Mark the box for the quarter the payment is being made.

•Enter your name and address, including apartment number and ZIP.

•Enter your payment amount in whole dollars without a dollar sign (example: 154.00).

•Your payment amount should match the amount on line 11 of the 2021 Estimated Tax Worksheet.

•If no payment is due, do not mail the SC1040ES.

•Make your check payable to SCDOR. Include your name, SSN, and 2021 SC1040ES in the memo line of the check. Do not send cash.

•Mail your SC1040ES and payment in one envelope. Staple your payment to the SC1040ES.

Mail your SC1040ES and payment to: SCDOR, IIT Voucher, PO Box 100123, Columbia, SC 29202

cut along dotted line

1350 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SC1040ES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

dor.sc.gov |

2021 |

|

|

SC DEPARTMENTOF REVENUE |

(Rev. 9/30/20) |

|||||||||||||||||||||||||||||||||||

|

|

INDIVIDUAL DECLARATION OF ESTIMATED TAX |

3080 |

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your SSN |

|

Spouse's SSN (if filing jointly) |

Composite Filer |

|

|

|

|

|

|

|

Mark quarter with X (required) |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1st Qtr |

|

|

2nd Qtr |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jan, Feb, Mar |

|

|

Apr, May, Jun |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3rd Qtr |

|

|

4th Qtr |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jul, Aug, Sep |

|

|

Oct, Nov, Dec |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and address (include spouse's name if filing jointly) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment |

. 00 |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

amount |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The quickest, easiest way to pay is using our free online tax portal, MyDORWAY, at dor.sc.gov/pay. Do not send cash. Make your check payable to SCDOR and include your name, SSN, and 2021 SC1040ES in the memo.

30801211

1350 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SC1040ES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

dor.sc.gov |

2021 |

|

|

SC DEPARTMENTOF REVENUE |

(Rev. 9/30/20) |

|||||||||||||||||||||||||||||||||||

|

|

INDIVIDUAL DECLARATION OF ESTIMATED TAX |

3080 |

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your SSN |

|

Spouse's SSN (if filing jointly) |

Composite Filer |

|

|

|

|

|

|

|

Mark quarter with X (required) |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1st Qtr |

|

|

2nd Qtr |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jan, Feb, Mar |

|

|

Apr, May, Jun |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3rd Qtr |

|

|

4th Qtr |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jul, Aug, Sep |

|

|

Oct, Nov, Dec |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and address (include spouse's name if filing jointly) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment |

. 00 |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

amount |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The quickest, easiest way to pay is using our free online tax portal, MyDORWAY, at dor.sc.gov/pay. Do not send cash. Make your check payable to SCDOR and include your name, SSN, and 2021 SC1040ES in the memo.

30801211

cut along dotted line

1350

dor.sc.gov

2021 SC DEPARTMENTOF REVENUE

INDIVIDUAL DECLARATION OF ESTIMATED TAX

SC1040ES

(Rev. 9/30/20)

3080

Your SSN |

Spouse's SSN (if filing jointly) |

Composite Filer |

|

|

Mark quarter with X (required) |

||||||

|

|

|

|

|

|

|

1st Qtr |

|

2nd Qtr |

||

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

Jan, Feb, Mar |

|

Apr, May, Jun |

||

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

3rd Qtr |

|

4th Qtr |

||

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

Jul, Aug, Sep |

|

Oct, Nov, Dec |

||

|

|

|

|

|

|

|

|

|

|

|

|

Name and address (include spouse's name if filing jointly) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment |

. 00 |

|

|||

|

|

|

|

|

|

amount |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The quickest, easiest way to pay is using our free online tax portal, MyDORWAY, at dor.sc.gov/pay. Do not send cash. Make your check payable to SCDOR and include your name, SSN, and 2021 SC1040ES in the memo.

30801211

cut along dotted line

1350 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SC1040ES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

dor.sc.gov |

2021 |

|

|

SC DEPARTMENTOF REVENUE |

(Rev. 9/30/20) |

|||||||||||||||||||||||||||||||||||

|

|

INDIVIDUAL DECLARATION OF ESTIMATED TAX |

3080 |

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your SSN |

|

Spouse's SSN (if filing jointly) |

Composite Filer |

|

|

|

|

|

|

|

Mark quarter with X (required) |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1st Qtr |

|

|

2nd Qtr |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jan, Feb, Mar |

|

|

Apr, May, Jun |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3rd Qtr |

|

|

4th Qtr |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jul, Aug, Sep |

|

|

Oct, Nov, Dec |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and address (include spouse's name if filing jointly) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment |

. 00 |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

amount |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The quickest, easiest way to pay is using our free online tax portal, MyDORWAY, at dor.sc.gov/pay. Do not send cash. Make your check payable to SCDOR and include your name, SSN, and 2021 SC1040ES in the memo.

30801211

Filing requirements

You must file a declaration of Estimated Tax if you expect to owe an Income Tax liability of $100 or more with the filing of your SC1040, Individual Income Tax Return.

Use the Estimated Tax Worksheet to compute your Estimated Tax:

•If you are a resident of South Carolina, use your 2020 SC1040 as a basis for figuring your Estimated Tax.

•If you are a nonresident of South Carolina, use your 2020 SC1040 and Schedule NR as a basis to calculate the modified South Carolina taxable income to enter on line 3 of the Worksheet.

Exceptions to filing a declaration of Estimated Tax:

•Farmers and commercial fishermen whose gross income from farming or fishing for 2020 or 2021 is at least

•Individuals whose prior year tax liability was $0 for a full 12 months

•Nonresidents of South Carolina doing business in this state on a contract basis where the contract is more than $10,000 and tax is withheld at 2% from each contract payment

Declaration adjustment

If your Estimated Tax is substantially increased due to a change in income, dependents, or Income Tax withholding, file the adjusted declaration by the next payment due date. Use the SC1040ES to make the adjusted payment.

Complete the Adjusted Declaration Schedule, found in these instructions, to determine the amount to be paid. Use the corrected amounts of income and deductions from your federal information.

Payment due dates

1.If you file using a calendar year end of December 31, your Estimated Tax payments are due in four equal installments:

•1st quarter due April 15, 2021

•2nd quarter due June 15, 2021

•3rd quarter due September 15, 2021

•4th quarter due January 18, 2022

You can choose to pay all of your Estimated Tax on April 15, the due date of the first installment. Instead of making your last payment on January 18, you can choose to file your SC1040 by February 1 and pay the full balance of Income Tax due.

2.If you are not required to file on April 15 and:

•you meet your Estimated Tax filing requirement after April 1 and before June 1, your first Estimated Tax payment is due on June 15, 2021.

•you meet your Estimated Tax filing requirement after June 1 and before September 1, your first Estimated Tax payment is due on September 15, 2021.

•you meet your Estimated Tax filing requirement after September 1, your first Estimated Tax payment is due on January 18, 2022.

3.If you file on a fiscal tax year, your Estimated Tax payments are due on the 15th day of the fourth, sixth, and ninth months of the fiscal year and the first month of the following fiscal year.

Penalty for failure to file and pay Estimated Tax

You may be charged a penalty if:

•you do not pay enough Estimated Tax.

•you do not make your payments by the due date and for the required amount.

•you do not pay at least 90% of the total tax due.

A penalty will not be charged if your underpayment results from personal service income earned in another state and tax was withheld to the other state.

Generally you can avoid a penalty if you make timely Estimated Tax payments equal to 100% of the tax shown due on your SC1040 for the prior tax year. You must have filed a SC1040 for the prior tax year and it must have covered a

If the adjusted gross income on your prior year SC1040 was more than $150,000, the 100% rule is adjusted to 110% of last year's tax liability. Calculate adjusted gross income by using federal guidelines and making South Carolina adjustments.

Refer to the SC2210 at dor.sc.gov/forms for more information on computing the underpayment penalty.

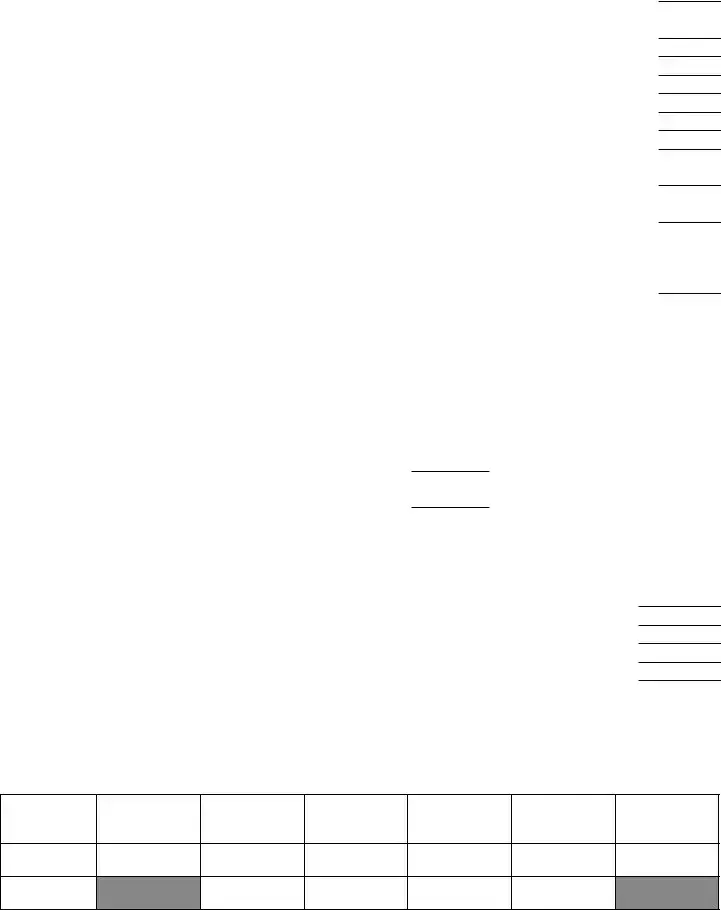

2021 Estimated Tax Worksheet

1. |

Enter the federal taxable income from your 2021 federal 1040ES, line 3 |

1. |

$ |

|

2. |

South Carolina state adjustments (positive or negative). |

|

|

|

|

For purposes of the 110% rule, include Active Trade or Business Income |

2. |

$ |

|

3. |

South Carolina taxable income (add line 1 and line 2) |

3. |

$ |

|

4. |

Tax (Calculate the tax on line 3 using the Tax Computation Schedule in these instructions) |

4. |

$ |

|

5. |

Enter any additional tax (SC4972 or |

5. |

$ |

|

6. |

Add line 4 and line 5 |

6. |

$ |

|

7. |

Nonrefundable credits (child and dependent care credit, two wage earner credit, and credits from SC1040TC) . . . |

7. $ |

||

8. |

Subtract line 7 from line 6 |

8. |

$ |

|

9. |

State Income Tax withheld and estimated to be withheld during year 2021 |

|

|

|

|

Include withholding from wages, pension, and annuities |

9. |

$ |

|

10. |

Balance of Estimated Tax (subtract line 9 from line 8) If $100 or more, you must make Estimated Tax payments. |

|

|

|

|

If less than $100, no payment is required. Round to the nearest dollar |

10. |

$ |

|

11. |

If the first payment you are required to file is: |

|

|

|

|

due April 15, 2021, enter 1/4 |

|

|

|

|

due June 15, 2021, enter 1/2 |

of line 10, less any 2020 overpayment applied to 2021 Estimated Tax. |

|

|

|

due September 15, 2021, enter 3/4 |

}Enter here and as the payment amount on your voucher |

11. |

$ |

|

due January 18, 2022, enter amount |

|||

2021 Tax Computation Schedule for South Carolina Residents and Nonresidents

Tax Computation Schedule |

Example of computation |

If the amount on line 3 of worksheet is: |

|

At |

But less |

|

least |

than |

Compute the tax as follows: |

|

|

|

$0 |

$3,110 |

0% times the amount |

|

|

|

3,110 |

6,220 |

3% times the amount less $ 93 |

|

|

|

6,220 |

9,330 |

4% times the amount less $ 156 |

|

|

|

9,330 |

12,440 |

5% times the amount less $ 249 |

|

|

|

12,440 |

15,560 |

6% times the amount less $ 373 |

|

|

|

15,560 |

or more |

7% times the amount less $ 529 |

|

|

|

South Carolina income subject to tax on line 3 of worksheet is $16,940. The tax is calculated as follows:

$16,940 income from line 3 of worksheet

X.07 percent from tax computation schedule

1,186 (1,185.80 rounded to the nearest dollar)

-529 amount from tax computation schedule

$ 657 tax to be entered on line 4 of worksheet

2021 Adjusted Declaration Schedule

1. Adjusted Estimated Tax (line 11 of Estimated Tax Worksheet) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

2. Subtract: a. Amount of 2020 overpayment applied to Estimated Tax for 2021 . . . . . . . . . . . . . . . . . . . . . . . . . . 2a. b. Total Estimated Tax payments made. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b. c. Total (add line 2a and line 2b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2c.

3. Unpaid balance (subtract line 2c from line 1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

4. Amount to be paid (line 3 divided by number of remaining payments)

Enter here and as the payment amount on the SC1040ES voucher . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

Record of Estimated Tax Payment

The SCDOR does not mail a statement of the amount of Estimated Tax paid during the year. Complete this section for your records.

Overpayment |

|

|

|

|

|

credit on |

Voucher 1 |

Voucher 2 |

Voucher 3 |

Voucher 4 |

Total |

2020 return |

|

|

|

|

|

Amount

Date

Social Security Privacy Act Disclosure

It is mandatory that you provide your Social Security Number on this tax form if you are an individual taxpayer. 42 U.S.C. 405(c)(2)(C)(i) permits a state to use an individual's Social Security Number as means of identification in administration of any tax. SC Regulation

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the SCDOR is limited to the information necessary for the SCDOR to fulfill its statutory duties. In most instances, once this information is collected by the SCDOR, it is protected by law from public disclosure. In those situations where public disclosure is not prohibited, the Family Privacy Protection Act prevents such information from being used by third parties for commercial solicitation purposes.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Form | The Certificate of Cremation is an official document that certifies the cremation of a deceased person. It serves as proof of cremation and is often required for legal purposes, such as settling an estate. |

| State-Specific Requirements | In South Carolina, the Certificate of Cremation is governed by the S.C. Code Ann. § 44-63-40. This law outlines the responsibilities of crematories and ensures that the proper paperwork is completed. |

| Who Issues the Certificate | The Certificate of Cremation is typically issued by the funeral home or crematory that handles the cremation process. They are responsible for ensuring that all information is accurate and submitted to the state. |

| Important Elements | The form usually includes vital details such as the deceased's name, date of birth, date of death, and the name of the crematory. It is essential for maintaining accurate records and complying with legal standards. |

Guidelines on Utilizing Certificate Of Cremation

Completing the Certificate Of Cremation form requires careful attention to detail to ensure all required information is accurately provided. Once the form is filled out, it will usually need to be submitted to the appropriate authorities along with any necessary documentation.

- Obtain the Certificate Of Cremation form from the local authorities or online resources.

- Begin by filling out the deceased's full name in the first section.

- Provide the date of birth of the deceased.

- Next, enter the date of death.

- Specify the location of death, including city and state.

- Complete the section regarding the cremation facility, including the name and address.

- Enter the date and time of the cremation.

- Provide any required identification numbers or case numbers associated with the deceased.

- Include the signature of the authorized person overseeing the cremation.

- Finally, review the completed form for any errors or missing information before submitting it.

What You Should Know About This Form

What is a Certificate of Cremation?

A Certificate of Cremation is an official document that confirms that a person has been cremated. It is issued by the crematory and includes details such as the deceased's name, date of birth, date of death, and the date of cremation. This certificate serves as important legal proof of cremation, which may be needed for various purposes, including settling estates or completing death-related paperwork.

Who needs a Certificate of Cremation?

Typically, family members or authorized representatives of the deceased will need a Certificate of Cremation. It may be required for funeral arrangements, insurance claims, or legal matters related to the deceased's estate. In some cases, individuals or organizations that need to verify the death and cremation may also request a copy of this certificate.

How can I obtain a Certificate of Cremation?

You can obtain a Certificate of Cremation through the crematory that handled the cremation process. Reach out to them directly, as they will have the necessary records. You may need to provide specific information about the deceased and possibly fill out a request form. There may be a fee for obtaining this document.

Is a Certificate of Cremation the same as a death certificate?

No, a Certificate of Cremation is not the same as a death certificate. While both serve as legal documents related to the deceased, a death certificate is issued by the state or local government and provides evidence of death. A Certificate of Cremation, on the other hand, specifically confirms that cremation has occurred. Both documents may be required for various legal and administrative purposes.

What should I do if I lost the Certificate of Cremation?

If you have lost the Certificate of Cremation, contact the crematory to request a replacement. They typically keep records of issued certificates and may require you to provide identification and details about the deceased. There may be a fee associated with issuing a replacement certificate.

Common mistakes

Completing the Certificate of Cremation form can be an emotional and sensitive task, and it is essential to fill out the details accurately to avoid any potential delays. One common mistake people make is failing to provide all required personal information. This includes not only the decedent's details but also the necessary identification numbers, such as Social Security Numbers (SSNs), where applicable. Missing this information can lead to further complications during the cremation process.

Another frequent error occurs with payment clarity. Individuals often forget or miscalculate the payment amount by including a dollar sign or decimal points. It is imperative to enter the amount in whole dollars, aligning with the guidelines provided on the form. Inaccurate amounts, including incorrectly labeled payments, can delay processing and create confusion regarding the fees involved.

Many people overlook the importance of marking the appropriate box for the quarter in which the payment is due. This oversight can have consequences, as the state may not process the payment correctly. Ensuring that this step is completed with an “X” next to the correct quarter helps to avoid any administrative errors. It highlights the necessary deadline clearly and assists in proper tracking of payments.

Incomplete or incorrect addresses are another misstep that can hinder the cremation process. When providing the name and address, it is crucial to include any apartment numbers and the correct ZIP code. Accuracy in this section not only ensures prompt cremation services but also helps facilitate communication regarding any potential follow-up actions or requirements.

Lastly, forgetting to sign and date the form is a mistake that occurs frequently. A signature is required to validate the document, and without it, the form may be considered incomplete. This simple oversight can result in significant delays and complications. Consequently, reviewing the form carefully before submission can help ensure all critical elements are complete and accurate.

Documents used along the form

When dealing with the loss of a loved one, it’s essential to navigate various legal documents along with the Certificate of Cremation. Each document serves a specific purpose, contributing to the transparency and legality of the cremation process and the management of the deceased's affairs. Below is a list of some commonly used forms and documents that may accompany the Certificate of Cremation.

- Death Certificate: This is an official record of a person's death, issued by a legal authority. It provides vital information, including the date, location, and cause of death, and is often required for settling estates and claiming life insurance.

- Cremation Authorization Form: This document must be signed by the deceased’s next of kin or legal representative, granting permission for the cremation to take place. It confirms that the necessary legal requirements have been met before proceeding.

- Disposition Permit: Issued by a local health department or vital statistics office, this permit authorizes the disposition of the body through cremation. It is typically required by crematories to comply with local regulations.

- Funeral Home Contract: When a funeral home is involved, this contract outlines the services provided, associated costs, and responsibilities of both parties. It's important for understanding what to expect and ensuring that your choices are honored.

- Payment Receipt: A document confirming payment for cremation services, which may be needed for personal records or to settle estate matters.

- Memorial Service Program: While not strictly a legal document, this program outlines the details for a memorial service, including who will speak, music selections, and other important information pertinent to honoring the deceased.

- Will or Trust Documentation: If the deceased had a will or trust, these documents will outline how their estate should be distributed after death. They are critical for estate planning and settling affairs.

- Insurance Policy Documentation: These documents detail any life insurance policies the deceased may have had. They are essential for ensuring beneficiaries can claim any funds due.

- Power of Attorney or Advance Directive: If applicable, these documents can provide insight into the deceased’s wishes regarding medical care and financial decisions leading up to their passing.

Understanding these documents and their roles can alleviate some stress during a challenging time. Each serves a purpose in honoring the deceased while addressing legal and financial matters. Consider consulting with a professional if you have questions about any of these forms and their significance.

Similar forms

- Death Certificate - A legal document issued when a person passes away, confirming the time and cause of death. Both forms serve as official records related to a person's death, although the Certificate of Cremation specifically focuses on the cremation process.

- Burial Permit - This document allows for a burial or interment to take place. Like the Certificate of Cremation, it is a necessary document in the process following a death and provides permission for final disposition.

- Authorization for Cremation - A signed document from the next of kin or legal representative authorizing the cremation of the deceased. This form, similar to the Certificate of Cremation, is essential in the cremation process.

- Funeral Home Arrangements - This documentation includes details about the final arrangements made for a deceased person. It often reiterates information found in the Certificate of Cremation, such as the funeral services chosen.

- Obituary - A published notice of a person's death, providing information about their life and funeral arrangements. Both documents honor the deceased, although the obituary serves a more public purpose.

- Affidavit of Deceased Person's Estate - A sworn statement regarding the assets and liabilities of a deceased person. Both forms relate to matters following a death, but the affidavit is focused on probate matters.

- Will - A legal document that outlines the testator's wishes for their estate upon their passing. While not directly related to the cremation process, it can influence how remains are handled after death, similar to the Certificate of Cremation.

- Trust Document - This document outlines the management of assets left for a beneficiary after the original owner’s death. It may dictate how remains are handled, paralleling the intentions noted in the Certificate of Cremation.

- Life Insurance Policy - This document provides financial benefit upon the death of the policyholder. Similar to the Certificate of Cremation, it acts as a means of covering the expenses related to final arrangements.

Dos and Don'ts

When it comes to filling out the Certificate Of Cremation form, careful attention to detail is essential. Here are five things to consider doing and avoiding to ensure a smooth process:

- Do: Carefully enter your name and address, including any apartment number and ZIP code.

- Do: Use black ink if you are filling out the form by hand.

- Do: Check the appropriate box for the quarter your payment applies to.

- Do: Pay online using the MyDORWAY tax portal for convenience.

- Do: Ensure your payment amount matches the previous year’s estimated tax worksheet.

- Don't: Mail a paper copy of the form if you choose to pay online; this could lead to duplication.

- Don't: Send cash; it’s important to keep your records clear.

- Don't: Skip entering your Social Security Number; it's a required field.

- Don't: Forget to staple your payment to the form.

- Don't: Leave any fields blank; incomplete forms can cause delays.

Misconceptions

Misconceptions about the Certificate of Cremation form can lead to confusion during an already challenging time. Here are ten common misunderstandings:

- The Certificate of Cremation is the same as a Death Certificate. While both documents are needed, they serve different purposes. A Death Certificate is primarily used for legal identification and estate matters, whereas the Certificate of Cremation confirms that cremation has taken place.

- Only a funeral home can provide a Certificate of Cremation. This is incorrect. While funeral homes typically handle cremations and issue the certificate, other licensed entities can perform cremations and provide the documentation as well.

- You do not need consent for cremation. This is a myth. Consent is usually required from the next of kin or authorized representative before cremation can proceed, ensuring that all legal and ethical obligations are met.

- The Certificate of Cremation is only necessary for direct cremations. In reality, any type of cremation performed requires a Certificate of Cremation, regardless of the method.

- All states have the same requirements for a Certificate of Cremation. Requirements can vary significantly by state. It is crucial to check local laws and guidelines to ensure compliance.

- The Certificate of Cremation is not an important document. On the contrary, it is vital for settling estate affairs, insurance claims, and other legal matters that require proof of cremation.

- You can get a Certificate of Cremation after the cremation has occurred. While it is typically issued post-cremation, many jurisdictions require it to be filed promptly, so delays could affect the handling of the deceased's affairs.

- There is no fee for obtaining a Certificate of Cremation. Fees may apply for processing the certificate, depending on the policies of the crematorium or funeral home.

- The Certificate of Cremation includes burial details. This is a misconception, as the certificate primarily focuses on the cremation itself and does not include specific burial information.

- Once you have the Certificate of Cremation, no additional paperwork is needed. It is crucial to complete any additional requirements for legal matters, such as obtaining a Death Certificate and settling estate-related documents.

Key takeaways

Understanding the Certificate of Cremation form is essential for anyone involved in the cremation process. Here are seven key takeaways to keep in mind:

- Accurate Information: Ensure that all information provided on the form is accurate. Mistakes can lead to delays or complications in the cremation process.

- Signature Requirement: The form must be signed by the authorizing agent. This signature confirms consent for cremation and is a crucial part of the process.

- Document Retention: Keep a copy of the Certificate of Cremation for your records. This document serves as an important legal record of the cremation.

- Filing Procedures: Familiarize yourself with the filing procedures for the Certificate of Cremation. Different jurisdictions may have different requirements.

- Timeliness: Submit the Certificate of Cremation promptly after the cremation has taken place. Delays can complicate the final arrangements.

- Cremation Alternatives: Consider discussing cremation alternatives with the funeral home or crematory. This can help ensure the process aligns with your wishes.

- Understand Your Rights: Know your rights regarding cremation. Understanding local laws can help protect your interests during the process.

By following these key takeaways, you can navigate the Certificate of Cremation form with greater confidence and clarity.

Browse Other Templates

American Funds Ira Distribution Form - If you have questions, call 1-800-447-4930 for assistance.

How Much Can I Claim for Child Care Expenses - Provide the child's full name for registration.

Set Up Direct Deposit - Fill out the entire form completely to ensure it's processed correctly.