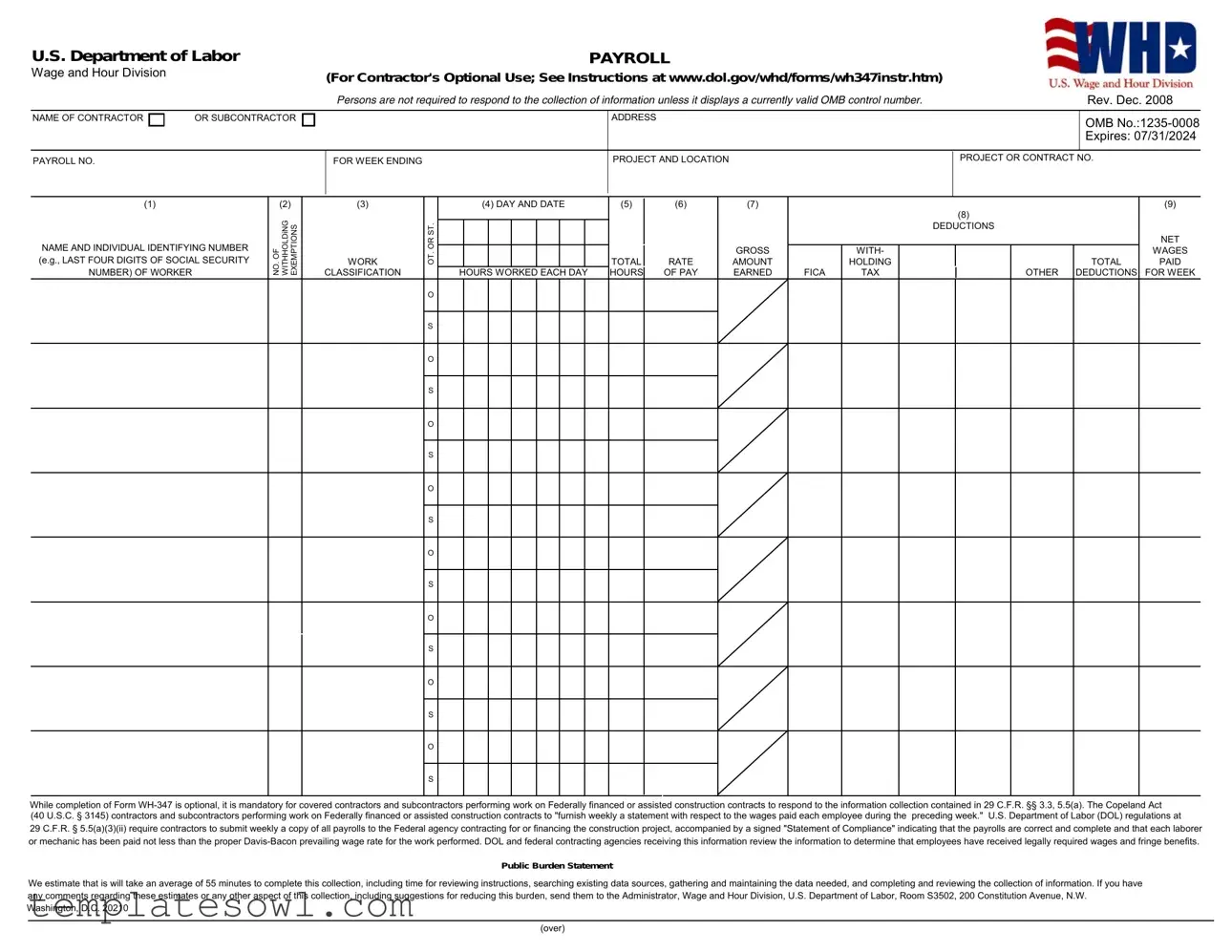

Fill Out Your Certified Payroll Form

The Certified Payroll form, officially known as Form WH-347, plays a crucial role in ensuring compliance with federal labor laws within the construction industry, particularly for projects using federal funds. This form must be completed by contractors and subcontractors working on federally financed or assisted construction contracts. It requires detailed information about each worker's wages, work classification, and deductions for a specified week. Essential data includes the contractor's name and address, the project location, and individual details for each worker, such as identifying numbers and hours worked. Submissions include a signed Statement of Compliance, certifying that employees have been paid at least the prevailing wage rates mandated by the Davis-Bacon Act. Regulatory standards mandate that contractors submit this information weekly to the appropriate federal agency. The U.S. Department of Labor uses these submissions to review compliance with wage and benefit requirements, ensuring that workers receive their legally mandated earnings. Moreover, substantial penalties, including civil and criminal prosecution, may arise from any falsified statements, emphasizing the importance of accuracy in reporting. While completion of the Certified Payroll form is technically optional, it remains a critical tool for maintaining transparency and adherence to labor laws in federally funded projects.

Certified Payroll Example

U.S. Department of Labor |

|

PAYROLL |

|

|

Wage and Hour Division |

|

(For Contractor's Optional Use; See Instructions at www.dol.gov/whd/forms/wh347instr.htm) |

|

|

|

|

Persons are not required to respond to the collection of information unless it displays a currently valid OMB control number. |

Rev. Dec. 2008 |

|

NAME OF CONTRACTOR |

OR SUBCONTRACTOR |

|

ADDRESS |

OMB |

|

|

|

|

|

|

|

|

|

Expires: 07/31/2024 |

|

|

|

|

|

PAYROLL NO. |

|

FOR WEEK ENDING |

PROJECT AND LOCATION |

PROJECT OR CONTRACT NO. |

(1)

NAME AND INDIVIDUAL IDENTIFYING NUMBER (e.g., LAST FOUR DIGITS OF SOCIAL SECURITY NUMBER) OF WORKER

(2)

NO. OF WITHHOLDi NG TXE EMP IONS

(3)

WORK

CLASSIFICATION

(4) DAY AND DATE |

(5) |

(6) |

(7) |

|

|

(8) |

|

(9) |

|

|

|

|

|

|

|

|

|

T. |

|

|

|

|

|

DEDUCTIONS |

|

|

ORS |

|

|

|

|

|

|

|

NET |

|

|

GROSS |

|

WITH- |

|

|

WAGES |

|

OT. |

|

|

|

|

|

|||

TOTAL |

RATE |

AMOUNT |

|

HOLDING |

|

TOTAL |

PAID |

|

HOURS WORKED EACH DAY |

HOURS |

OF PAY |

EARNED |

FICA |

TAX |

OTHER |

DEDUCTIONS |

FOR WEEK |

O |

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

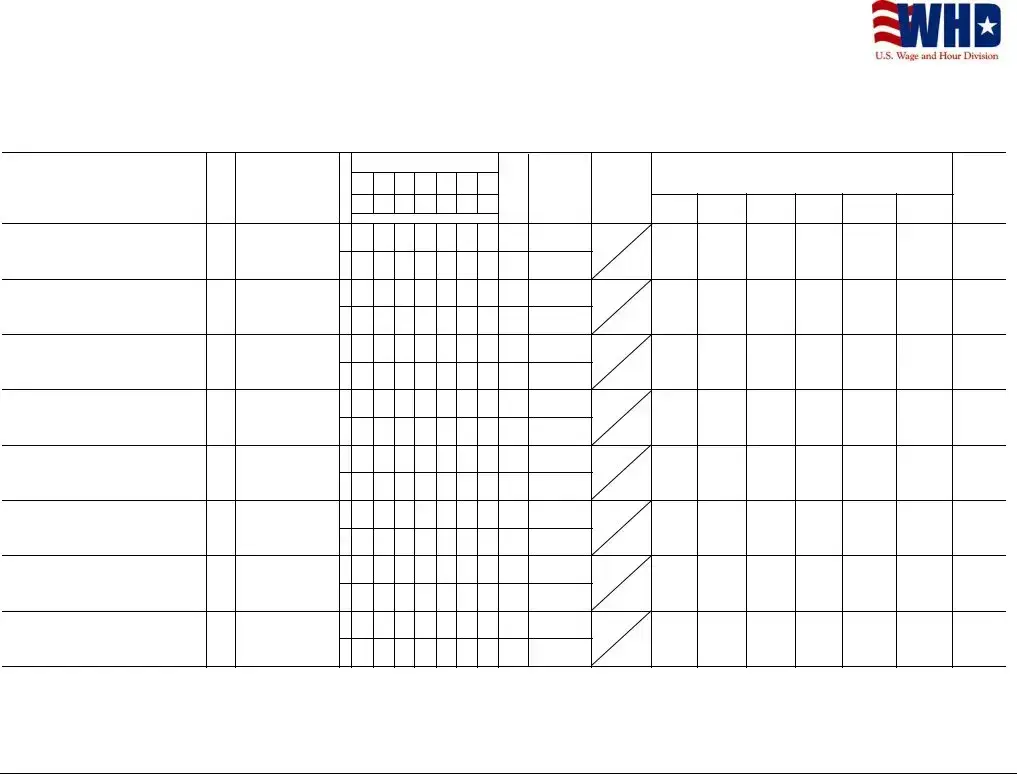

While completion of Form

(40 U.S.C. § 3145) contractors and subcontractors performing work on Federally financed or assisted construction contracts to "furnish weekly a statement with respect to the wages paid each employee during the preceding week." U.S. Department of Labor (DOL) regulations at

29 C.F.R. § 5.5(a)(3)(ii) require contractors to submit weekly a copy of all payrolls to the Federal agency contracting for or financing the construction project, accompanied by a signed "Statement of Compliance" indicating that the payrolls are correct and complete and that each laborer or mechanic has been paid not less than the proper

Public Burden Statement

We estimate that is will take an average of 55 minutes to complete this collection, including time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. If you have any comments regarding these estimates or any other aspect of this collection, including suggestions for reducing this burden, send them to the Administrator, Wage and Hour Division, U.S. Department of Labor, Room S3502, 200 Constitution Avenue, N.W. Washington, D.C. 20210

(over)

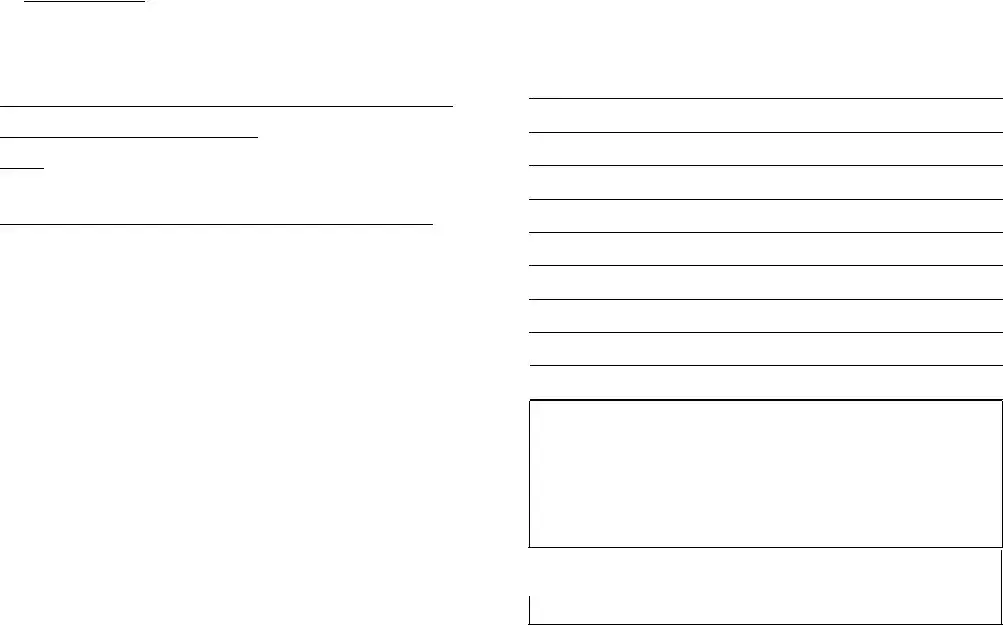

Date

I,

(Name of Signatory Party) |

|

(Title) |

do hereby state:

(1) That I pay or supervise the payment of the persons employed by

(b)WHERE FRINGE BENEFITS ARE PAID IN CASH

−Each laborer or mechanic listed in the above referenced payroll has been paid, as indicated on the payroll, an amount not less than the sum of the applicable basic hourly wage rate plus the amount of the required fringe benefits as listed in the contract, except as noted in section 4(c) below.

(c)EXCEPTIONS

(Contractor or Subcontractor)

on the

EXCEPTION (CRAFT) |

EXPLANATION |

; that during the payroll period commencing on the

(Building or Work)

day of |

|

, |

|

, and ending the |

|

day of |

|

, |

|

, |

all persons employed on said project have been paid the full weekly wages earned, that no rebates have been or will be made either directly or indirectly to or on behalf of said

from the full

(Contractor or Subcontractor)

weekly wages earned by any person and that no deductions have been made either directly or indirectly from the full wages earned by any person, other than permissible deductions as defined in Regulations, Part

3 (29 C.F.R. Subtitle A), issued by the Secretary of Labor under the Copeland Act, as amended (48 Stat. 948,

63 Stat. 108, 72 Stat. 967; 76 Stat. 357; 40 U.S.C. § 3145), and described below:

(2)That any payrolls otherwise under this contract required to be submitted for the above period are correct and complete; that the wage rates for laborers or mechanics contained therein are not less than the applicable wage rates contained in any wage determination incorporated into the contract; that the classifications set forth therein for each laborer or mechanic conform with the work he performed.

(3)That any apprentices employed in the above period are duly registered in a bona fide apprenticeship program registered with a State apprenticeship agency recognized by the Bureau of Apprenticeship and Training, United States Department of Labor, or if no such recognized agency exists in a State, are registered with the Bureau of Apprenticeship and Training, United States Department of Labor.

(4)That:

(a)WHERE FRINGE BENEFITS ARE PAID TO APPROVED PLANS, FUNDS, OR PROGRAMS

−in addition to the basic hourly wage rates paid to each laborer or mechanic listed in the above referenced payroll, payments of fringe benefits as listed in the contract have been or will be made to appropriate programs for the benefit of such employees, except as noted in section 4(c) below.

REMARKS:

NAME AND TITLE |

SIGNATURE |

|

|

THE WILLFUL FALSIFICATION OF ANY OF THE ABOVE STATEMENTS MAY SUBJECT THE CONTRACTOR OR SUBCONTRACTOR TO CIVIL OR CRIMINAL PROSECUTION. SEE SECTION 1001 OF TITLE 18 AND SECTION 3729 OF TITLE 31 OF THE UNITED STATES CODE.

Form Characteristics

| Fact Name | Fact Detail |

|---|---|

| Form Purpose | The Certified Payroll form (WH-347) is used by contractors and subcontractors on federally financed or assisted construction projects to report wages paid to workers. |

| Voluntary vs. Mandatory Use | While completion of the WH-347 is optional, certain contractors are required by law to complete it for compliance with federal regulations. |

| Governing Laws | The form complies with the Copeland Act (40 U.S.C. § 3145) and 29 C.F.R. §§ 3.3 and 5.5(a), which necessitate detailed payroll reporting for applicable projects. |

| Weekly Submission | Contractors must submit payroll information weekly to the federal agency overseeing the project, ensuring compliance with labor laws. |

| Payroll Components | The form requires details such as worker names, wages, hours worked, deductions, and classifications, ensuring transparency in the payments made to employees. |

| Compliance Statement | Along with the payroll, contractors must sign a "Statement of Compliance" asserting that workers have been paid at least the prevailing wage rates. |

| Estimated Completion Time | Completing the form is estimated to take approximately 55 minutes, which includes reviewing instructions and gathering necessary information. |

| Fringe Benefits | Payments for fringe benefits must either be made in cash or into approved plans, ensuring workers receive full compensation as required by law. |

| Consequences of Falsification | Falsifying information on the form can lead to severe consequences, including civil or criminal prosecution under federal law. |

Guidelines on Utilizing Certified Payroll

Before proceeding with the completion of the Certified Payroll form, it is essential to gather all relevant information regarding employees, hours worked, and wages paid. Accurate and complete records will facilitate compliance with federal regulations governing wage payments on federally financed or assisted construction projects.

- Obtain a copy of the Certified Payroll form (WH-347) from the U.S. Department of Labor website.

- Fill in the name of the contractor or subcontractor in the designated field.

- Provide the address of the contractor or subcontractor.

- Record the payroll number for the week ending on the date indicated.

- Specify the project and location of the work being reported.

- Enter the project or contract number as required.

- For each employee, list the following information in the appropriate columns:

- Name and identifying number: Include the last four digits of the employee’s Social Security number.

- Number of withholding tax exemptions: Indicate the number of exemptions claimed by the employee.

- Work classification: Describe the job title or classification of the employee.

- Days worked: Record each day and date the employee worked during the pay period.

- Hours worked each day: Document the total hours worked by the employee each day.

- Gross wages earned: Calculate and input the total gross wages earned during the week.

- Total deductions: List any deductions made from the employee's wages for the week.

- Net amount paid: Calculate and enter the net amount paid to the employee.

- In the section regarding fringe benefits, check the appropriate box to indicate how these benefits are paid.

- Complete the section for exceptions, if applicable, by providing necessary details.

- Sign the form, including the name and title of the signing party, correctly attesting to the accuracy of the payroll information.

- Ensure all required documents accompany the payroll submission.

What You Should Know About This Form

What is the Certified Payroll form and who needs to use it?

The Certified Payroll form, also known as Form WH-347, is a document used by contractors and subcontractors on federally financed or assisted construction projects. It serves to report the wages paid to workers and ensure compliance with federal labor laws. Although using the form is optional, it is mandatory for covered contractors to submit accurate payroll information weekly to the federal agency overseeing the project. This form helps ensure all workers receive the proper wages as required by the Davis-Bacon Act.

What information is required on the Certified Payroll form?

The Certified Payroll form requires detailed information about each worker's wages for the reporting week. This includes the worker's name, identifying number, work classification, gross wages, deductions, and net pay. The form also needs to specify the number of hours worked each day, overtime hours, and any fringe benefits paid. It is crucial that the information is accurate, as it is used to determine compliance with wage laws.

What is the significance of the "Statement of Compliance" included with the Certified Payroll form?

The "Statement of Compliance" is a certification that accompanies the payroll submission. By signing it, the contractor confirms that the payroll is complete and accurate and that all workers have been paid at least the prevailing wage for their classification. This ensures accountability and compliance with labor laws. Falsifying this statement can result in serious legal consequences for the contractor or subcontractor.

How often must the Certified Payroll form be submitted?

Contractors must submit the Certified Payroll form weekly. Each submission should cover the previous week’s payroll data. This regular reporting is required to maintain transparency and ensure that workers are paid fairly and in accordance with federal regulations. The federal agency overseeing the project reviews these submissions for compliance purposes.

What happens if a contractor does not submit the Certified Payroll form correctly or on time?

If a contractor fails to submit the Certified Payroll form accurately or on time, they may face various penalties. Potential consequences include withholding of payment, requirement to pay back wages to workers, or even disqualification from future federal contracts. It is crucial for contractors to adhere to the reporting requirements to avoid these issues.

Common mistakes

Filling out the Certified Payroll form correctly is crucial for compliance with federal regulations. Many individuals make common mistakes that can lead to significant delays or legal issues. One prevalent error is improper identification of workers. Each worker’s name must be spelled correctly, and the last four digits of their Social Security number must be accurate. Mistakes in this area can cause issues with wage disbursement and lead to compliance infractions.

Another frequent mistake is failing to update the payroll week ending date. Some contractors neglect to change this date each week, resulting in payroll records that do not accurately reflect the current pay period. This can raise red flags during audits and lead to complications with the reviewing agency.

A third common error is inaccurately reporting work classifications. Every worker should be classified according to the job they performed. Misclassifications may not only confuse audits but can also result in penalties if workers are not paid the correct wage for their classifications.

Additionally, many people overlook the obligations surrounding fringe benefits. Contractors often forget to list the proper amounts for fringe benefits, whether they are paid in cash or through plans, funds, or programs. This oversight can lead to allegations of underpayment and ultimately harm the contractor’s reputation.

Inaccurate reporting of hours worked is another significant mistake. Contractors must ensure that the total hours each worker has worked are correctly documented, including regular and overtime hours. Any discrepancies can result in investigations and potential fines.

Errors in the deductions section can also be problematic. This involves ensuring the correct totals of deductions for federal taxes, FICA, and other deductions are accurately reflected. Missing this information or declaring incorrect amounts could initiate questions from federal reviewers.

Moreover, submitting the form without a signed "Statement of Compliance" is a critical mistake. This statement ensures that the payrolls are deemed correct and confirms that every laborer was paid appropriately according to regulations. Failure to include this can lead to automatic rejection of the payroll submission.

Lastly, many contractors forget to retain copies of their submitted payrolls. Keeping accurate records not only provides a safety net during audits but also demonstrates compliance efforts. Failing to maintain these documents can hinder defense against any future disputes regarding wages or compliance.

Documents used along the form

The Certified Payroll form is an essential document for contractors and subcontractors engaged in federally funded or assisted construction projects. In conjunction with this form, several other documents help ensure compliance with labor laws and regulations. Here is a list of related forms and documents commonly used.

- Statement of Compliance: This document accompanies the Certified Payroll form. It certifies that the submitted payrolls are accurate and that all workers have been paid at least the prevailing wage.

- Wage Determination: Issued by the Department of Labor, this document outlines the minimum wage rates for various classifications of workers on federally funded projects.

- Apprenticeship Certification: This verifies that apprentices are enrolled in registered programs, ensuring compliance with labor standards concerning training and pay.

- Payroll Records: Detailed records maintained by the contractor that document hours worked, wages paid, and deductions for all employees on the project.

- Fringe Benefit Plan Documentation: This includes details about additional benefits provided to employees, such as health insurance or retirement contributions, as required by contract.

- Employee List: A complete roster of all employees working on a project, often required for audit and compliance purposes.

- Notice of Requirement for Wage Rates: Typically posted on the construction site, this notice informs workers of their rights regarding wages and benefits under the Davis-Bacon Act.

- Weekly Time Sheets: These documents log the hours worked by each employee on a weekly basis, serving as a basis for payroll calculations.

- Subcontractor Payrolls: If subcontractors are hired, they must submit their payroll forms to ensure compliance with federal wage standards just like the prime contractor.

- Compliance Reviews and Audits: These reports are created by federal agencies to assess compliance with labor laws and regulations associated with the project.

Understanding these forms and their purpose is vital for contractors to adhere to federal regulations. Proper documentation protects the rights of workers and ensures transparent payment practices while avoiding penalties for non-compliance.

Similar forms

- Payroll Journal: Similar to the Certified Payroll form, payroll journals detail the hours worked, wages paid, and tax withholdings for employees. Both documents serve the purpose of tracking employee compensation, ensuring compliance with labor laws, and providing a record for financial audits.

- W-2 Form: The W-2 form reports annual wages and the taxes withheld from an employee's paycheck. While the Certified Payroll focuses on weekly payments, both documents are critical for accurately reflecting employee compensation and tax obligations.

- 1099 Form: This form is used for independent contractors to report income paid to them over the year. Like the Certified Payroll form, it ensures that the revenue information provided to the IRS reflects funds earned. Both documents highlight the importance of transparency in financial transactions.

- Time Card: Employees use time cards to record hours worked. Similar to the Certified Payroll, time cards capture daily work hours and can serve as a basis for weekly pay calculations. Accuracy in both documents ensures correct compensation.

- Statement of Compliance: This accompanying document is part of the Certified Payroll submission. It certifies wage compliance with contracting rules, just as other statements confirm adherence to labor regulations. Both documents reassure stakeholders regarding lawful employment practices.

- Employee Pay Stub: A pay stub provides detailed information about an employee's pay for a specific period, including hours worked, gross pay, deductions, and net pay. This element is closely linked to the Certified Payroll, as it breaks down the information presented weekly in a more digestible format.

- Labor Condition Application (LCA): The LCA requires employers to attest to specific wage conditions and labor practices before hiring foreign workers. While more focused on visa applications, both documents reflect an employer's commitment to paying lawful wages and maintaining fair labor practices.

Dos and Don'ts

When filling out the Certified Payroll form, attention to detail is crucial. Here are some guidelines to follow:

- Do ensure accuracy. Double-check that all names, social security numbers, and wage rates are correct.

- Do report all hours worked. Make sure to include all hours each worker put in during the pay period.

- Do keep records. Maintain copies of the payrolls and any related documents for your records.

- Do submit on time. Ensure the completed forms are sent out weekly as required.

There are also pitfalls to avoid when completing the form:

- Don't falsify information. Providing incorrect information can lead to serious legal consequences.

- Don't forget compliance. Remember to sign the "Statement of Compliance" and ensure it is included with the payrolls.

- Don't skip details. Omitting necessary information about withholding taxes or deductions can cause issues down the line.

- Don't ignore updates. Stay informed about changes to labor laws and wage rates that may affect your reporting.

Misconceptions

Misconceptions about the Certified Payroll form can lead to confusion and unintentional errors. The following points aim to clarify some common misunderstandings surrounding this important document.

- Completion of the Form is Optional: While it may seem that the completion of Form WH-347 is optional, it is actually mandatory for contractors and subcontractors working on Federally financed or assisted projects. They must submit it weekly to comply with federal regulations.

- One Standard Rate for All Workers: There is a misconception that one wage rate applies to all workers on a project. In reality, each role may have a distinct prevailing wage rate based on the work classification and region, making proper documentation essential.

- Fringe Benefits are Automatically Included: Some might assume that fringe benefits are automatically accounted for in wages. However, contractors must explicitly report both the basic hourly wage and any necessary fringe benefits on the Certified Payroll form.

- Errors Will Go Unnoticed: It is a common belief that errors in reporting will not be scrutinized. In truth, federal agencies will review submitted payrolls thoroughly to ensure compliance with wage laws, potentially leading to serious consequences for misreporting.

- Apprenticeships Do Not Need Documentation: There is a misconception that apprentices can simply be listed without further documentation. In fact, each apprentice must be registered in a bona fide apprenticeship program recognized by the appropriate state or federal agency.

- Only Monetary Deductions Need to Be Reported: Many people think it is enough to report only the monetary deductions. However, it is important to note that any deductions, whether monetary or otherwise, must be reported if they deviate from permissible deductions as defined by the relevant regulations.

By addressing these misconceptions, contractors and subcontractors can better navigate the requirements of the Certified Payroll form and promote compliance with federal wage laws.

Key takeaways

Understanding the Certified Payroll form is crucial for compliance with federal regulations. Here are key takeaways:

- All contractors and subcontractors on federally funded projects must use the Certified Payroll form (WH-347).

- The form serves as a weekly wage statement that ensures transparency and compliance with the Davis-Bacon Act.

- Submission of the payrolls to the contracting federal agency is mandatory and must be done weekly.

- Each payroll must include detailed information about the payment for every worker, including wages, hours worked, and deductions.

- A signed "Statement of Compliance" must accompany the payroll, confirming that wages paid meet legal standards.

- Failure to provide accurate payroll information may lead to legal consequences, including civil and criminal prosecution.

- Fringe benefits, whether paid in cash or through plans, must be documented correctly in the payroll.

- The completion of the form typically takes about 55 minutes, which includes various preparatory tasks.

- Make sure to keep the form and all related documentation organized and readily available for audits or inspections.

Following these guidelines will help maintain compliance and protect both contractor and worker interests in federally funded projects.

Browse Other Templates

What Is a Certificate of Compliance Maryland - Misrepresentation on the form could lead to penalties or legal repercussions.

What Is the Purpose of an Elevation Certificate - The Elevation Certificate includes sections for building use and geographic data.

Therapy Progress Notes Examples - This section may summarize the patient's progress towards health goals.