Fill Out Your Cf 1040Pv Form

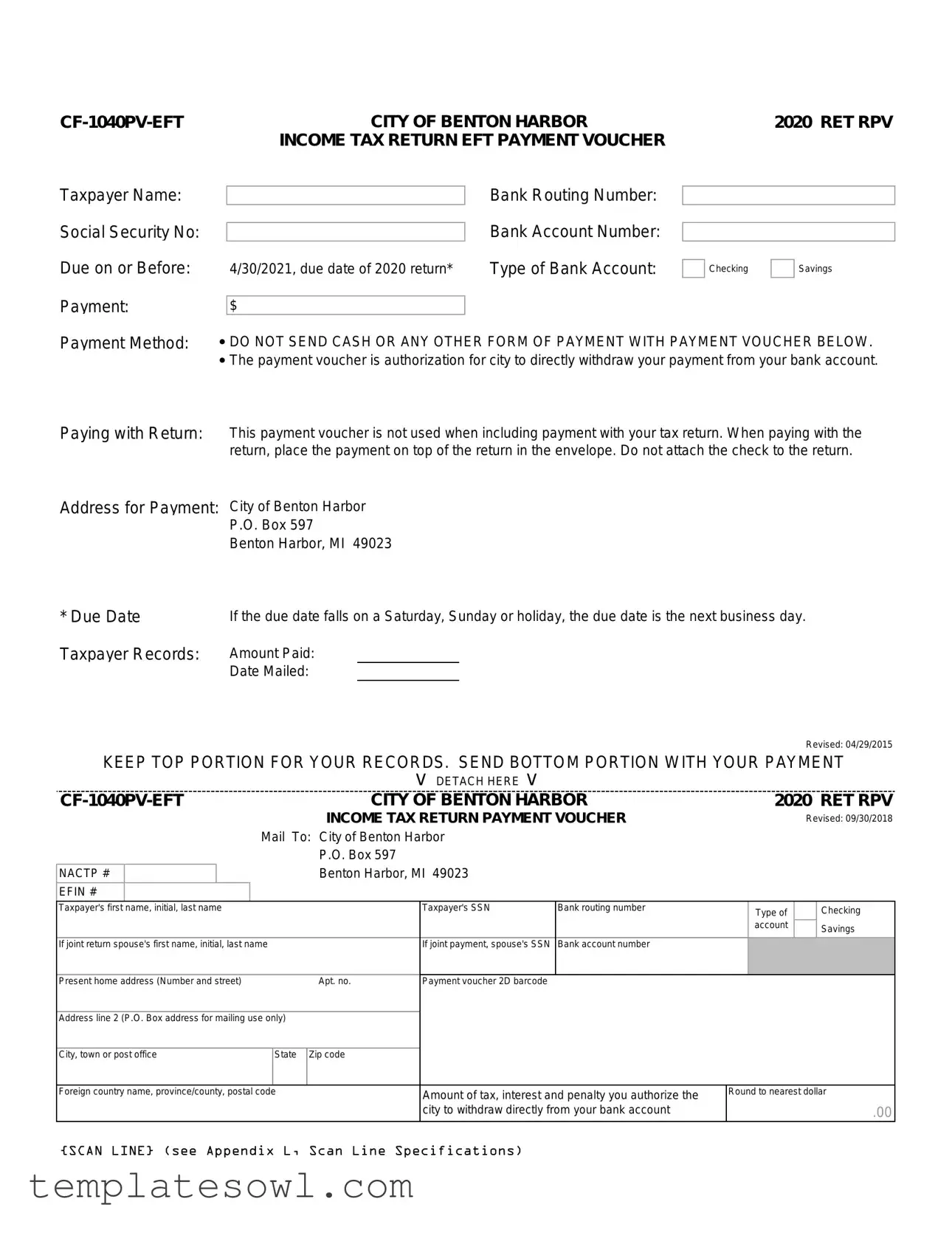

The Cf 1040Pv form, specifically designed for use by residents of Benton Harbor, Michigan, serves an essential purpose in the tax-filing process. This payment voucher allows individuals to authorize the city to directly withdraw their income tax payments from their bank accounts. It is important to note that this form must be submitted by April 30 of the year following the tax year in question—in this case, 2020. Taxpayers will be required to provide personal information such as their name, Social Security number, and bank account details, ensuring that the city can process the payment correctly. Additionally, the form includes spaces for designating the type of bank account, which can be either checking or savings. To facilitate secure transactions, it is explicitly stated that no cash or any other form of payment should accompany the voucher when submitted. For residents who choose to pay alongside their tax return instead, a different procedure is outlined that involves simply placing the payment on top of the return within the envelope. Finally, the form must be mailed to the City of Benton Harbor at the designated address, ensuring clarity and efficiency in the payment process.

Cf 1040Pv Example

|

CITY OF BENTON HARBOR |

|

2020 RET RPV |

||

|

|

INCOME TAX RETURN EFT PAYMENT VOUCHER |

|

|

|

Taxpayer Name: |

|

|

Bank Routing Number: |

|

|

|

|

|

|

||

Social Security No: |

|

|

Bank Account Number: |

|

|

|

|

|

|

||

Due on or Before: |

|

4/30/2021, due date of 2020 return* |

Type of Bank Account: |

Checking |

Savings |

Payment: |

|

|

|

|

|

|

$ |

|

|

|

|

Payment Method: |

• DO NOT SEND CASH OR ANY OTHER FORM OF PAYMENT WITH PAYMENT VOUCHER BELOW. |

||||

•The payment voucher is authorization for city to directly withdraw your payment from your bank account.

Paying with Return: |

This payment voucher is not used when including payment with your tax return. When paying with the |

||

|

return, place the payment on top of the return in the envelope. Do not attach the check to the return. |

||

Address for Payment: City of Benton Harbor |

|||

|

P.O. Box 597 |

||

|

Benton Harbor, MI 49023 |

||

* Due Date |

If the due date falls on a Saturday, Sunday or holiday, the due date is the next business day. |

||

Taxpayer Records: |

Amount Paid: |

|

|

|

Date Mailed: |

|

|

Revised: 04/29/2015

KEEP TOP PORTION FOR YOUR RECORDS. SEND BOTTOM PORTION WITH YOUR PAYMENT

v DETACH HERE v

NACTP #

EFIN #

CITY OF BENTON HARBOR |

2020 RET RPV |

INCOME TAX RETURN PAYMENT VOUCHER |

Revised: 09/30/2018 |

Mail To: City of Benton Harbor |

|

P.O. Box 597 |

|

Benton Harbor, MI 49023 |

|

Taxpayer's first name, initial, last name |

|

|

Taxpayer's SSN |

Bank routing number |

|

Type of |

|

Checking |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

account |

|

Savings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If joint return spouse's first name, initial, last name |

|

|

If joint payment, spouse's SSN |

Bank account number |

|

|

|

|

|

|

|

|

|

|

|

|

|

Present home address (Number and street) |

|

Apt. no. |

Payment voucher 2D barcode |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address line 2 (P.O. Box address for mailing use only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, town or post office |

State |

Zip code |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Foreign country name, province/county, postal code |

|

Amount of tax, interest and penalty you authorize the |

Round to nearest dollar |

|||||

|

|

|

|

|

|

|

||

|

|

|

city to withdraw directly from your bank account |

|

|

.00 |

||

{SCAN LINE} (see Appendix L, Scan Line Specifications)

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | The CF-1040PV form is officially titled "City of Benton Harbor 2020 Ret RPV Income Tax Return EFT Payment Voucher." |

| Taxpayer Information | Taxpayer's name, Social Security number, and bank details are required to process the payment. |

| Due Date | The payment must be made on or before April 30, 2021, which is the due date for the 2020 income tax return. |

| Payment Method | Payments should be made via electronic funds transfer (EFT) only. Cash or other payment forms are not accepted. |

| Authorization | This voucher serves as authorization for the City of Benton Harbor to withdraw the specified amount directly from the taxpayer’s bank account. |

| Mailing Instructions | Only the bottom portion of the voucher should be sent along with the payment. The top part is for taxpayer records. |

| Bank Account Options | Taxpayers can select between checking and savings accounts for the EFT payment. |

| Joint Payments | If filing a joint return, additional information is required for the spouse, including their name and Social Security number. |

| Address for Payment | Payments should be mailed to the following address: City of Benton Harbor, P.O. Box 597, Benton Harbor, MI 49023. |

Guidelines on Utilizing Cf 1040Pv

Completing the CF 1040PV form is a straightforward process that allows you to authorize the City of Benton Harbor to withdraw your tax payment directly from your bank account. Before beginning, ensure you have all necessary information handy, including your bank details and personal information. Once the form is complete, you will submit it to the appropriate address.

- Obtain the CF 1040PV form, either online or through your local tax office.

- Fill in your full name, including first name, middle initial, and last name in the designated fields.

- Enter your Social Security Number (SSN) to identify your tax record.

- Provide your bank’s routing number, which can usually be found on your checks or through your bank.

- Select the type of bank account you are using for the payment: Checking or Savings.

- If you are filing a joint return, provide your spouse's name and SSN.

- Fill in your bank account number accurately to avoid processing errors.

- List your current home address, including apartment number if applicable, and make sure to include city, state, and zip code.

- In the payment section, write down the total amount you are authorizing for withdrawal, rounded to the nearest dollar.

- Review the entire form for accuracy to ensure all information is correct and complete.

- Detach the bottom portion of the form carefully along the perforated line.

- Mail the payment voucher to the following address: City of Benton Harbor, P.O. Box 597, Benton Harbor, MI 49023.

What You Should Know About This Form

What is the CF 1040PV form used for?

The CF 1040PV form is a payment voucher used for the City of Benton Harbor's 2020 Ret RPV Income Tax Return. It authorizes the city to withdraw your income tax payment directly from your bank account. This form is essential if you are making a payment electronically, ensuring that the payment reaches the city in a timely manner.

How should I complete the CF 1040PV form?

To complete the CF 1040PV form, you need to provide your name, Social Security Number, bank account details, and the amount you wish to pay. If your payment is joint, you'll include your spouse’s information as well. It is important to select the type of bank account—either checking or savings. Make sure to double-check all the information for accuracy to prevent any issues with your payment.

When is the payment due if I use the CF 1040PV form?

The payment is due on or before April 30, 2021, which is the due date for the 2020 tax return. If this date falls on a Saturday, Sunday, or holiday, the due date automatically shifts to the next business day. Timely submission of this voucher is crucial to avoid penalties or interest on any outstanding tax obligations.

Where should I send the CF 1040PV form after completing it?

After you have filled out the CF 1040PV form, submit it to the City of Benton Harbor at the following address: P.O. Box 597, Benton Harbor, MI 49023. Ensure that you retain the top portion of the form for your records while sending the bottom portion with your payment. This will help you keep track of your tax obligations and maintain proper documentation of your payment.

Common mistakes

Completing the CF 1040PV form requires attention to detail. One common mistake is leaving out the taxpayer's name. It may seem simple, but without it, payment can be delayed or misapplied. Always check that the name is clearly printed at the top of the form.

Next, many people forget to include their Social Security Number (SSN). This number is essential for establishing your identity and ensuring that the payment matches your tax records. Take a moment to double-check that this number is both accurate and complete.

Another frequent error occurs with the bank routing number. Individuals sometimes misread this number or write it incorrectly. Since this number directs where your payment should go, one small mistake can derail the entire process. Always verify the number with your bank.

When it comes to bank account information, mistakes abound. Applicants occasionally mix up their checking and savings account options. Make sure to select the correct type of account to avoid any unnecessary complications with your withdrawal.

Additionally, individuals often ignore the payment amount field or miscalculate the amount owed. Ensure that you enter the total you authorize the city to withdraw, rounding it to the nearest dollar as instructed. This helps prevent headaches later on.

Some people mistakenly believe they can send cash. This is a big no-go. The form specifically states, “DO NOT SEND CASH OR ANY OTHER FORM OF PAYMENT WITH PAYMENT VOUCHER BELOW.” Adhering to this rule is crucial for keeping your payment secure.

Another area of confusion is when making a payment along with your tax return. Many fail to realize that this payment voucher is not to be used when including payment with the tax return. Instead, when paying alongside a return, place the payment on top and do not attach the check.

The due date can also lead to missteps. If it falls on a weekend or holiday, the payment is due the next business day. Not accounting for this possibility can result in late fees.

People also overlook the present home address section. Failure to update your mailing address can result in important tax documents not reaching you. Thus, ensure that your current residence information is accurate and complete.

Finally, neglecting to keep the top portion of the form for your records is another mistake. This section contains vital information like the amount paid and the date mailed, which could be necessary for future reference. Always retain this information to stay organized.

Documents used along the form

The CF-1040PV form serves as a payment voucher for individual income taxes in the City of Benton Harbor, but users often need to submit additional documents along with it. The following list highlights other forms and documents commonly associated with the CF-1040PV.

- CF-1040: This is the main income tax return form filed by individuals. It reports income, deductions, and tax calculations for a given year.

- W-2 Form: Employers provide this form to report wages paid and taxes withheld for employees. It is crucial for accurately completing the income tax return.

- 1099 Forms: These forms report various types of income other than wages, such as freelance work or interest. Each type of 1099 reports different income sources.

- Schedule A: Used to itemize deductions, this form helps taxpayers detail expenses that can be deducted from their taxable income.

- Schedule C: For self-employed individuals, this form reports income or loss from a business. It details expenses and net profit calculations.

- Form 8889: This form is for taxpayers who have Health Savings Accounts (HSAs). It reports contributions, distributions, and tax-related information regarding the HSA.

- Form 8862: If a taxpayer is reapplying for the Earned Income Credit after it has been disallowed, this form must be completed to claim eligibility again.

- Form 1040-X: This is used to amend a tax return. If errors are found after filing, this form allows for corrections and the submission of new information.

- Form 4684: Used for reporting casualties and thefts, this form helps taxpayers claim losses and calculate deductions related to such events.

Each of these documents plays a significant role in the filing process and ensures that the taxpayer complies with all requirements. Properly completing and submitting these forms along with the CF-1040PV can help facilitate accurate tax assessments and payments.

Similar forms

The CF-1040PV form serves as a payment voucher for submitting local income taxes in Benton Harbor, Michigan. It's designed to streamline payments while ensuring accurate processing. Here are six other documents that bear similarities to the CF-1040PV and highlight their roles in tax-related procedures.

- Form W-4: This document is used by employees to inform their employer about the amount of federal income tax to withhold from their paycheck. Like the CF-1040PV, it requires personal identification information and helps streamline the management of tax obligations.

- Form 1040: The standard IRS form for individual income tax returns. Like CF-1040PV, it includes detailed taxpayer information and outlines tax liability, ensuring accurate processing of payments and potential refunds.

- Form 1040-ES: This is used to calculate and pay estimated taxes for the year. Similar to the CF-1040PV, it facilitates timely payments and includes information about the taxpayer’s financial status.

- Form 4868: This form allows taxpayers to request an extension for filing their federal income tax return. Like the CF-1040PV, it must be submitted to avoid late penalties and includes taxpayer identification details.

- Form 941: This is the Employer's Quarterly Federal Tax Return, used to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. It serves a similar purpose in tracking and reporting taxes owed.

- Payment Authorization Form: Often used for various tax payments, this form allows taxpayers to authorize direct bank withdrawals. Like the CF-1040PV, it includes banking information, ensuring secure and accurate payment processing.

Understanding these documents increases compliance and makes tax management easier. Accurate and timely submission of these forms is critical to avoiding penalties and ensuring a smooth tax filing process.

Dos and Don'ts

When filling out the CF-1040PV form, it's important to follow certain guidelines to ensure that your payment is processed smoothly. Here are six things you should and shouldn't do:

- Do double-check all your information. Ensure that your name, Social Security number, and bank details are accurate. Mistakes can delay your payment.

- Do use a checking account. When choosing the type of bank account for the payment, opt for checking instead of savings for easier processing.

- Do mail your payment promptly. Make sure that you send it early enough to meet the due date of April 30, 2021 to avoid penalties.

- Do keep a copy of the form. Retain the top portion of the voucher for your records as proof of payment.

- Don't send cash. Cash payments could lead to loss and are not accepted. Always utilize the payment voucher for bank withdrawals.

- Don't attach your check to the return. If you pay with your return, place the check on top of the return form in the envelope instead of attaching it.

By following these tips, you improve the chances of a smooth transaction and avoid potential issues with your tax payment. Happy filing!

Misconceptions

-

Misconception 1: The CF-1040PV form is just another tax form.

Many people think of the CF-1040PV as a standard tax document. In reality, it serves a specific purpose as a payment voucher for income tax owed to the City of Benton Harbor. Understanding its unique function is key to proper tax filing.

-

Misconception 2: Cash payments are accepted with the CF-1040PV.

Some taxpayers believe they can send cash along with their payment voucher. However, this is not permitted. The form is designed for direct bank withdrawals only.

-

Misconception 3: The due date for the CF-1040PV is always April 30.

While the general due date is April 30, if that day falls on a weekend or holiday, the deadline shifts to the next business day. Ignoring this detail can lead to late payments.

-

Misconception 4: You can attach a check to your CF-1040PV.

Some taxpayers think they can simply attach a check to this form. Instead, it’s crucial to remember that this particular form does not accompany checks; the amount is withdrawn electronically from your account.

-

Misconception 5: It’s fine to use any payment method with the CF-1040PV.

This form specifically requires electronic payment. Sending checks or any other forms of payment isn’t allowed, so sticking to the established method is necessary for success.

-

Misconception 6: The CF-1040PV can be used for other municipalities.

Many mistakenly believe they can use the CF-1040PV for other locations or tax obligations. This form is exclusively for the City of Benton Harbor, and should not be used elsewhere.

-

Misconception 7: You do not need to keep a copy of the CF-1040PV.

It’s essential to retain the top portion of the CF-1040PV for your records. This serves as proof of your payment and can be important for future reference.

-

Misconception 8: Filing the CF-1040PV automatically files your tax return.

People often confuse submitting the CF-1040PV with filing their tax return. These are separate actions. The voucher is solely for payments, not for the actual return itself.

Key takeaways

Filling out and using the CF 1040PV form is an important step for residents of Benton Harbor who are managing their city income tax payments. Understanding how to properly complete and submit this document can help ensure timely processing and avoid potential penalties. Here are some key takeaways:

- Understand the Purpose: The CF 1040PV form serves as a payment voucher for your income tax return. It allows the city to withdraw your tax payment directly from your bank account.

- Payment Deadline: Payments using this voucher must be made on or before April 30, 2021, for the 2020 tax year. If this date falls on a weekend or holiday, you have until the next business day to submit.

- Bank Account Information: You will need to provide your bank routing number, account number, and specify whether your account is a checking or savings account.

- No Cash Payments: Never send cash with your payment voucher. Only use this voucher to authorize a bank withdrawal.

- Joint Returns: If you are filing a joint return, both taxpayers must provide their names and Social Security numbers on the form.

- Record-Keeping: Keep the top portion of the form for your records. It contains important information regarding your payment.

- No Attachment with Return: If you are including payment with your tax return, do not attach this voucher to the return. Instead, place it on top of the return in the envelope.

- Mailing Address: Send the bottom portion of the voucher along with your payment to the City of Benton Harbor at P.O. Box 597, Benton Harbor, MI 49023.

- Amount to be Withdrawn: Clearly indicate the total amount you authorize the city to withdraw from your account, rounding to the nearest dollar.

- Payment Confirmation: It is recommended to note the amount paid and the date mailed for your personal records, ensuring you have a reference for your financial documentation.

Following these key guidelines will help you navigate the payment process smoothly and avoid any issues with your tax obligations in Benton Harbor.

Browse Other Templates

Final Expense Claim Form,Life Insurance Benefit Claim Form,Insurance Benefits Request Form,Claim Application for Deceased Insured,Insurance Death Benefit Submission Form,Posthumous Benefit Claim Form,Decedent's Claims Application,Bereavement Insuranc - This authorization remains valid for 120 days unless revoked in writing.

Autocad Exam Questions - A minimum of 120 hours of AutoCAD instruction is required before attempting the exam.

Irs Notice of Levy - Form 668-D communicates the cessation of a levy on specific assets.