Fill Out Your Cg 20 10 07 04 Liability Endorsement Form

The CG 20 10 07 04 Liability Endorsement form plays a crucial role in the realm of commercial general liability insurance, particularly for businesses that engage in subcontracting or other types of partnerships. This endorsement allows for the inclusion of additional insured parties—specifically owners, lessees, or contractors—identified in a specified schedule. By modifying Section II of the insurance policy, it ensures coverage for claims related to bodily injury, property damage, or personal injury that may arise from the actions or omissions of the primary insured or their representatives during ongoing operations for the additional insured. However, this coverage is not limitless; it is contingent upon the exact terms of any underlying contract or agreement and is restricted by various exclusions. For instance, the coverage does not extend to incidents occurring after the completion of work, emphasizing the importance of understanding project timelines. Furthermore, the endorsement clarifies the limits of insurance available to the additional insured, ensuring they do not exceed contractually mandated amounts. Collectively, these features ensure that all parties engaged in a construction or service project can navigate liability risks more effectively while respecting both contractual obligations and legal parameters.

Cg 20 10 07 04 Liability Endorsement Example

POLICY NUMBER: |

COMMERCIAL GENERAL LIABILITY |

|

CG 20 10 12 19 |

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

ADDITIONAL INSURED – OWNERS, LESSEES OR

CONTRACTORS – SCHEDULED PERSON OR

ORGANIZATION

This endorsement modifies insurance provided under the following:

COMMERCIAL GENERAL LIABILITY COVERAGE PART

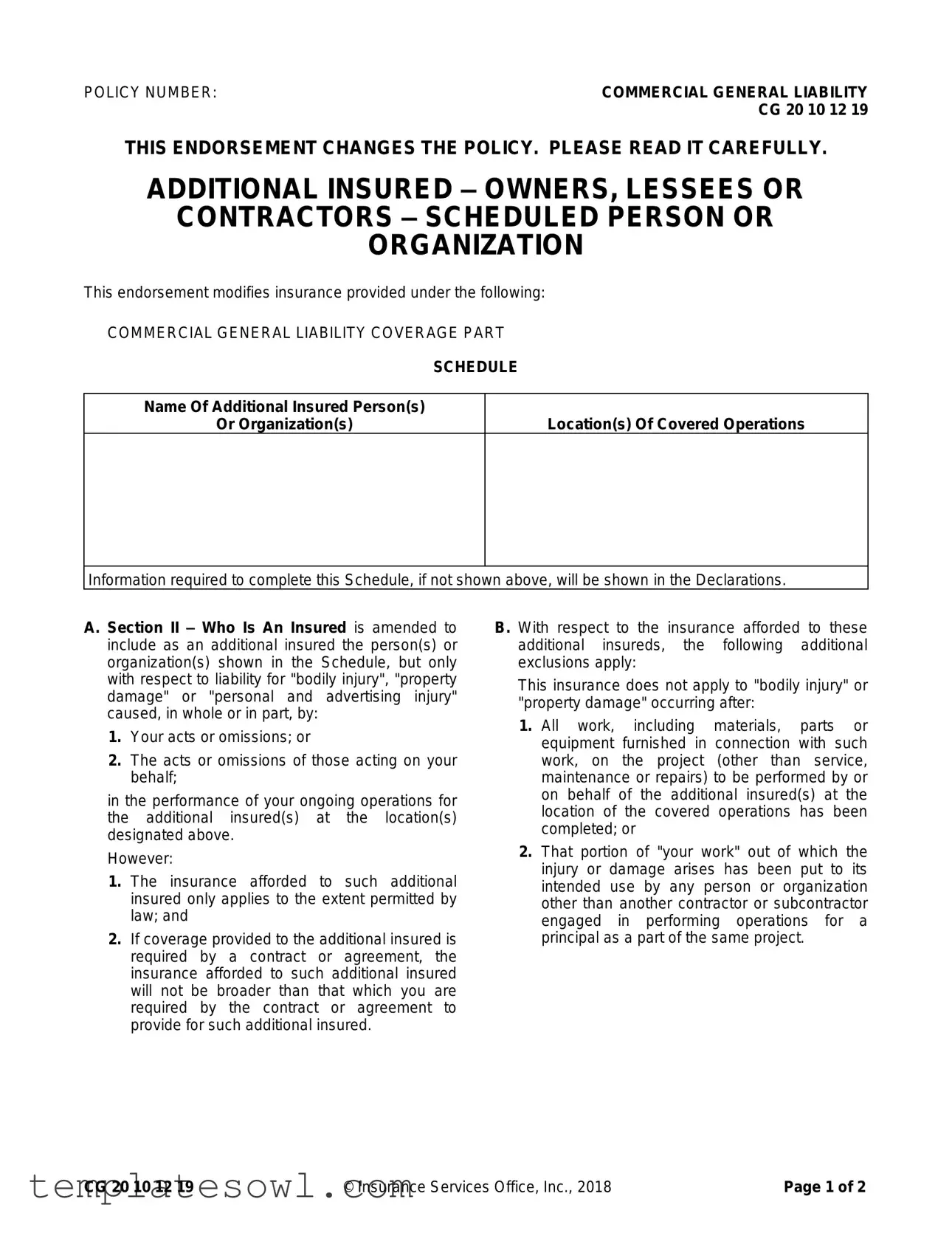

SCHEDULE

Name Of Additional Insured Person(s)

Or Organization(s)

Location(s) Of Covered Operations

Information required to complete this Schedule, if not shown above, will be shown in the Declarations.

A. Section II – Who Is An Insured is amended to include as an additional insured the person(s) or organization(s) shown in the Schedule, but only with respect to liability for "bodily injury", "property damage" or "personal and advertising injury" caused, in whole or in part, by:

1.Your acts or omissions; or

2.The acts or omissions of those acting on your behalf;

in the performance of your ongoing operations for the additional insured(s) at the location(s) designated above.

However:

1.The insurance afforded to such additional insured only applies to the extent permitted by law; and

2.If coverage provided to the additional insured is required by a contract or agreement, the insurance afforded to such additional insured will not be broader than that which you are required by the contract or agreement to provide for such additional insured.

B. With respect to the insurance afforded to these additional insureds, the following additional exclusions apply:

This insurance does not apply to "bodily injury" or "property damage" occurring after:

1.All work, including materials, parts or equipment furnished in connection with such work, on the project (other than service, maintenance or repairs) to be performed by or on behalf of the additional insured(s) at the location of the covered operations has been completed; or

2.That portion of "your work" out of which the injury or damage arises has been put to its intended use by any person or organization other than another contractor or subcontractor engaged in performing operations for a principal as a part of the same project.

CG 20 10 12 19 |

© Insurance Services Office, Inc., 2018 |

Page 1 of 2 |

C. With respect to the insurance afforded to these additional insureds, the following is added to

Section III – Limits Of Insurance:

If coverage provided to the additional insured is required by a contract or agreement, the most we will pay on behalf of the additional insured is the amount of insurance:

1.Required by the contract or agreement; or

2.Available under the applicable limits of insurance;

whichever is less.

This endorsement shall not increase the applicable limits of insurance.

Page 2 of 2 |

© Insurance Services Office, Inc., 2018 |

CG 20 10 12 19 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Policy Number | The endorsement form is identified by the policy number CG 20 10 12 19. |

| Purpose | This endorsement adds specific persons or organizations as additional insured under a Commercial General Liability Policy. |

| Coverage Limitations | Insurance for additional insureds is limited to liability arising from the acts or omissions of the named insured or those acting on their behalf. |

| Completion of Work | Coverage is excluded for bodily injury or property damage occurring after all work on the project has been completed. |

| Contractual Agreements | If coverage is required by contract, it cannot exceed the limits outlined in that contract. |

| Applicable Exclusions | The endorsement specifically outlines situations where coverage will not apply, impacting liability claims. |

| Governing Law | The liability endorsement is governed by laws specific to the state where the policy is written, which can vary. |

Guidelines on Utilizing Cg 20 10 07 04 Liability Endorsement

Completing the CG 20 10 07 04 Liability Endorsement form requires careful attention to detail, as each section must be filled accurately to ensure compliance with the associated insurance policy. This endorsement identifies the additional insured parties and the extent of coverage they will receive. Following the steps below will guide you through the process of filling it out correctly.

- Start by entering the Policy Number in the designated space at the top of the form.

- Locate the section named Additional Insured – Owners, Lessees or Contractors.

- In the Name Of Additional Insured Person(s) Or Organization(s) section, provide the full name of each additional insured individual or organization you are including.

- Next, fill out the Location(s) Of Covered Operations field with the specific address(es) where the operations are taking place.

- If there is any necessary information that is not clearly indicated or requires clarification, include it in the Information required to complete this Schedule section.

- Review your entries to ensure all information is accurate and complete.

- Finally, sign and date the form in the appropriate space to validate it.

What You Should Know About This Form

What is the purpose of the CG 20 10 07 04 Liability Endorsement form?

The CG 20 10 07 04 Liability Endorsement form primarily serves to extend coverage under the Commercial General Liability (CGL) policy. It allows for certain individuals or organizations, specified in a schedule, to be added as additional insureds. This means they can receive coverage for liability stemming from bodily injury, property damage, or personal and advertising injury resulting from the actions or omissions of the insured or those acting on their behalf during ongoing operations at designated locations.

Who qualifies as an additional insured under this endorsement?

Additional insured parties are typically individuals or organizations that are explicitly listed in the endorsement's schedule. This endorsement offers coverage to these additional insureds, but it only applies regarding liabilities that arise from specific acts or omissions in the context of ongoing operations associated with the policyholder. The amount of coverage will also depend on what is permitted under the law and may be influenced by any pre-existing agreements or contracts.

Are there limits to the coverage provided to additional insureds?

Yes, there are notable limits. The coverage for additional insureds is subject to both the limits established in the primary policy and any limits outlined in relevant contracts or agreements. The endorsement clarifies that if coverage is contractually required, the maximum amount payable will be the lesser of what is detailed in the contract or the actual limits available under the insurance policy. This ensures that the coverage does not exceed agreed-upon terms.

What exclusions apply to this endorsement?

The endorsement contains specific exclusions. Coverage does not apply to bodily injury or property damage that occurs after the insured has completed all work associated with the project, except for ongoing service, maintenance, or repair activities. Additionally, if the construction or work has been put to its intended use by someone other than contractors directly involved in the project, coverage may not be applicable if any resulting injury or damage arises from that work.

How does this endorsement impact the overall insurance limits?

This endorsement does not augment the overall limits of insurance coverage. Instead, it operates within the existing limits defined in the general liability policy. Therefore, if additional insured coverage is claimed, the payout will remain bound by the standard limits already established, regardless of any endorsements that may be added.

What should policyholders do if they need to add additional insureds?

Policyholders should closely review the terms of their existing policies and any relevant contracts. When needing to add additional insureds, they must fill out the necessary information in the endorsement's schedule. It may also be prudent to consult with an insurance professional or legal advisor to ensure compliance and understanding of coverage implications and exclusions.

Common mistakes

Filling out the CG 20 10 07 04 Liability Endorsement form requires attention to detail. Many individuals make mistakes that can lead to confusion or gaps in coverage. Understanding these mistakes can help ensure that the form is completed correctly.

One common error is failing to include all necessary information. The Name of Additional Insured Person(s) or Organization(s) must be accurately filled out. Leaving this section blank or writing unclear names can cause issues later on when trying to establish coverage. Make sure the names are precise and reflect the organization exactly as they are registered.

Another mistake involves specifying the Location(s) of Covered Operations. It’s crucial to provide accurate locations where the insured operations take place. Omitting this information or providing vague details can limit the effectiveness of the coverage. Always double-check the addresses to ensure they match the project locations.

Some folks overlook the importance of verifying the policy number. Neglecting to cross-check this number can lead to claims being processed incorrectly. The policy number must be accurately recorded, as this is essential for linking the endorsement to the correct insurance coverage.

Additionally, people often fail to understand the implications of the contract language. The endorsement specifies that coverage will not be broader than what is required by any existing contracts. Neglecting to review the relevant contracts before filling out the form can result in unexpected limitations on coverage. Make sure to align the endorsement with contractual obligations.

Misunderstanding the exclusions can also be an issue. Coverage does not apply after the project work is completed. Some individuals may believe that they are covered indefinitely, which is incorrect. Familiarize yourself with these exclusions to avoid any surprises when a claim needs to be made.

Lastly, a common oversight is not providing adequate details about the limits of insurance required. If the coverage is contractually required, it is crucial to mention the specific amount, as this will dictate the limits available to the additional insured. This ensures everyone understands the extent of the protection being afforded.

By being mindful of these common pitfalls, you can fill out the CG 20 10 07 04 Liability Endorsement form with confidence. Attention to detail will help secure proper coverage and protect all parties involved.

Documents used along the form

The CG 20 10 07 04 Liability Endorsement form is an important document in the realm of commercial general liability insurance. It designates additional insured parties and outlines the scope and limitations of coverage. To comprehensively manage insurance policies, several other documents are commonly used in conjunction with this form. Here is a list of those documents, along with brief descriptions.

- Commercial General Liability Policy (CGL): This policy provides coverage for claims of bodily injury, property damage, and personal injury arising from business operations.

- Certificate of Insurance: This document serves as proof of insurance coverage and typically includes information about the policyholder, the type of coverage, and the coverage limits.

- Contractor Agreement: A detailed document outlining the terms and conditions under which services are provided. It often includes clauses pertaining to liability and insurance requirements.

- Additional Insured Endorsement: Similar to the CG 20 10 07 04 form, this document specifically lists additional insured parties and defines the scope of their coverage under the policy.

- Waiver of Subrogation: This provision prevents an insurer from claiming compensation from a third party after paying out claims to the insured. It is often included in contracts to protect against future disputes.

- Indemnity Agreement: An agreement in which one party agrees to compensate another for certain losses or damages, emphasizing risk transfer between parties.

- Exclusion Endorsements: These documents outline specific situations or entities that are not covered under the insurance policy, helping to clarify coverage limits and responsibilities.

- Policy Declarations Page: This initial page of an insurance policy summarizes the essential details, including the named insured, coverage limits, and effective dates.

- Claims Notice Form: A form used to report an incident that may give rise to an insurance claim, ensuring timely and accurate notification to the insurer.

Understanding these documents can help manage risks effectively and ensure compliance with insurance requirements. Having a comprehensive approach to insurance documentation aids in smooth operations and better protection for all parties involved.

Similar forms

When examining the CG 20 10 07 04 Liability Endorsement form, it shares similarities with several other insurance documents that address liability coverage in different contexts. Here’s a look at those documents:

- CG 20 10 11 85 Additional Insured - Owners, Lessees or Contractors: This form also extends liability coverage to additional insured parties, typically for organizations involved in projects where there might be liability issues arising from the primary insured's operations.

- CG 20 37 07 04 Additional Insured – Owners, Lessees or Contractors – Automatic: Like the CG 20 10 07 04, this endorsement offers automatic coverage for additional insureds without needing to specify each entity, streamlining the coverage process for contractors.

- CG 20 10 04 13 Additional Insured – Employee Benefits Liability: This endorsement extends coverage to additional insureds pertaining to claims related to employee benefits, similar in intent to protect certain parties from liability associated with the primary insured’s actions.

- CG 20 15 07 04 Additional Insured – Joint Venture: This document covers additional insureds in the context of joint ventures, emphasizing liability that may arise from collaborative activities, much like the original endorsement does for ongoing operations.

- CG 20 10 12 19 Additional Insured – Designated Person or Organization: This endorsement allows for more specific identification of additional insured parties and mirrors the CG 20 10 07 04 format in ensuring particular coverage for defined projects.

- CG 20 18 07 04 Additional Insured – Volunteers: This form specifically provides liability coverage for volunteers, similarly ensuring protection for those acting on behalf of the insured, reflecting the same protective intent found in the CG 20 10 07 04.

- CG 21 50 07 04 Additional Insured – Owners, Lessees or Contractors – Aggregate Limit: Similar to the CG 20 10 07 04, this endorsement includes coverage for additional insureds but focuses on aggregate limits, establishing clear financial boundaries for liability claims.

These documents each play a critical role in defining the landscape of liability coverage, ensuring all parties involved are adequately protected based on their relationship to the primary insured.

Dos and Don'ts

When filling out the CG 20 10 07 04 Liability Endorsement form, consider the following tips:

- Do read the endorsement carefully before completing the form to understand its implications.

- Do provide accurate names of the additional insured persons or organizations.

- Do ensure that all covered operations are clearly defined in the provided sections.

- Do review any contract requirements linked to the additional insured provision before submitting.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank unless instructed; incomplete forms can cause delays.

- Don't assume prior information is still relevant; confirm all details each time.

- Don't overlook the legal limitations and exclusions stated in the form.

- Don't submit without double-checking for grammatical errors or typos.

- Don't forget to file the endorsement promptly to ensure coverage is activated.

Misconceptions

Understanding the CG 20 10 07 04 Liability Endorsement form can seem daunting. Here are nine common misconceptions that can create confusion:

- It automatically grants full coverage to additional insureds. This endorsement provides limited coverage. It only covers "bodily injury," "property damage," or "personal and advertising injury" caused by the named insured’s actions or those acting on their behalf.

- All operations are covered. Coverage applies only to ongoing operations for the additional insured at specified locations. Once the work is completed, coverage may cease.

- It replaces existing insurance. This endorsement modifies the existing Commercial General Liability policy. It supplements, rather than replaces, existing coverage.

- The endorsement is unlimited. There are caps on coverage. The most the insurance company will pay for an additional insured is limited to either the amount required by a contract or the available limits of the general policy—whichever is less.

- Any contract can dictate coverage. If coverage is required by a contract, the insurance provided cannot be broader than what the insured is obligated to provide under that contract.

- Coverage includes completed work. The endorsement specifically excludes coverage for damages arising after the work has been completed. Once the project is done and put to use, liability coverage generally ends.

- All injuries or damages are covered. The policy includes specific exclusions. Any damages or injuries not related to ongoing operations may not be covered.

- It applies to all additional insureds. Only those individuals or organizations specifically listed in the schedule are covered. Others will not receive any protection under this endorsement.

- There are no restrictions based on location. Coverage is location-specific. The endorsement only applies to the designated locations listed in the schedule.

Being aware of these misconceptions can help ensure that you fully understand the limitations and protections provided by the CG 20 10 07 04 Liability Endorsement form.

Key takeaways

When filling out and using the CG 20 10 07 04 Liability Endorsement form, there are several important points to consider. Understanding these takeaways can help ensure compliance and avoid common pitfalls.

- Policy Number: Clearly include the policy number on the form. This helps identify the specific coverage being modified.

- Additional Insureds: Specify the names of additional insured persons or organizations. This inclusion broadens the coverage for those listed.

- Location Details: Include the locations of the covered operations for which the additional insured status applies. This information is crucial for determining where coverage is active.

- Coverage Limitations: Understand that the coverage for additional insureds is limited to liability for bodily injury, property damage, or personal and advertising injury related to your operations.

- Contractual Obligations: Recognize that if the coverage for additional insureds is required by a contract, it cannot exceed the obligations specified in that contract.

- Exclusions Overview: Be aware of the exclusions which state that coverage does not apply after the work has been completed or if the damaged work has been put to use.

- Limits of Insurance: Know that the limits for additional insured coverage will not exceed what your contract requires. The maximum payout is limited to either the contractual amount or the policy limits, whichever is lower.

- Review and Accuracy: Carefully review all entries on the form for accuracy. Mistakes can lead to misunderstandings or gaps in coverage.

- Legal Compliance: Ensure all actions taken regarding this form comply with applicable laws and regulations governing insurance and liability in your jurisdiction.

By keeping these key points in mind, you can effectively manage the use of the CG 20 10 07 04 Liability Endorsement and safeguard your interests.

Browse Other Templates

Employee Profiling Template - Your completion of this form reflects your engagement with our organization.

Can an Llc Be Taxed as an S Corp - Correct documentation and payment are essential for smooth processing of the application.

Usmc Page 11 Template - Filling out this form correctly is a responsibility for both service members and their superiors.