Fill Out Your Cg 20 26 04 13 Form

The CG 20 26 04 13 form represents an important endorsement within Commercial General Liability insurance policies. Specifically, it relates to the inclusion of additional insured parties under certain conditions. This endorsement allows individuals or organizations, identified in the form, to be covered for liabilities arising from bodily injury, property damage, or personal and advertising injury to the extent caused by the actions or omissions of the policyholder or their agents. Crucially, the insurance provided to these additional insureds is limited—it functions within the constraints of applicable laws and must align with any contract or agreement specifying coverage requirements. Furthermore, the coverage for additional insureds does not exceed what the policyholder is obligated to provide through contracts. Additionally, if the necessary coverage is stipulated by a contract, the maximum payout for any claims will also be capped at the lesser of the fixed amount dictated by that agreement or the limits outlined in the policy’s declarations. Understanding this form is essential for individuals and organizations seeking liability coverage, as it delineates the scope and extent of protection afforded by the primary policyholder's insurance. The nuances of these clauses can significantly affect both coverage and potential financial exposure in the event of an incident.

Cg 20 26 04 13 Example

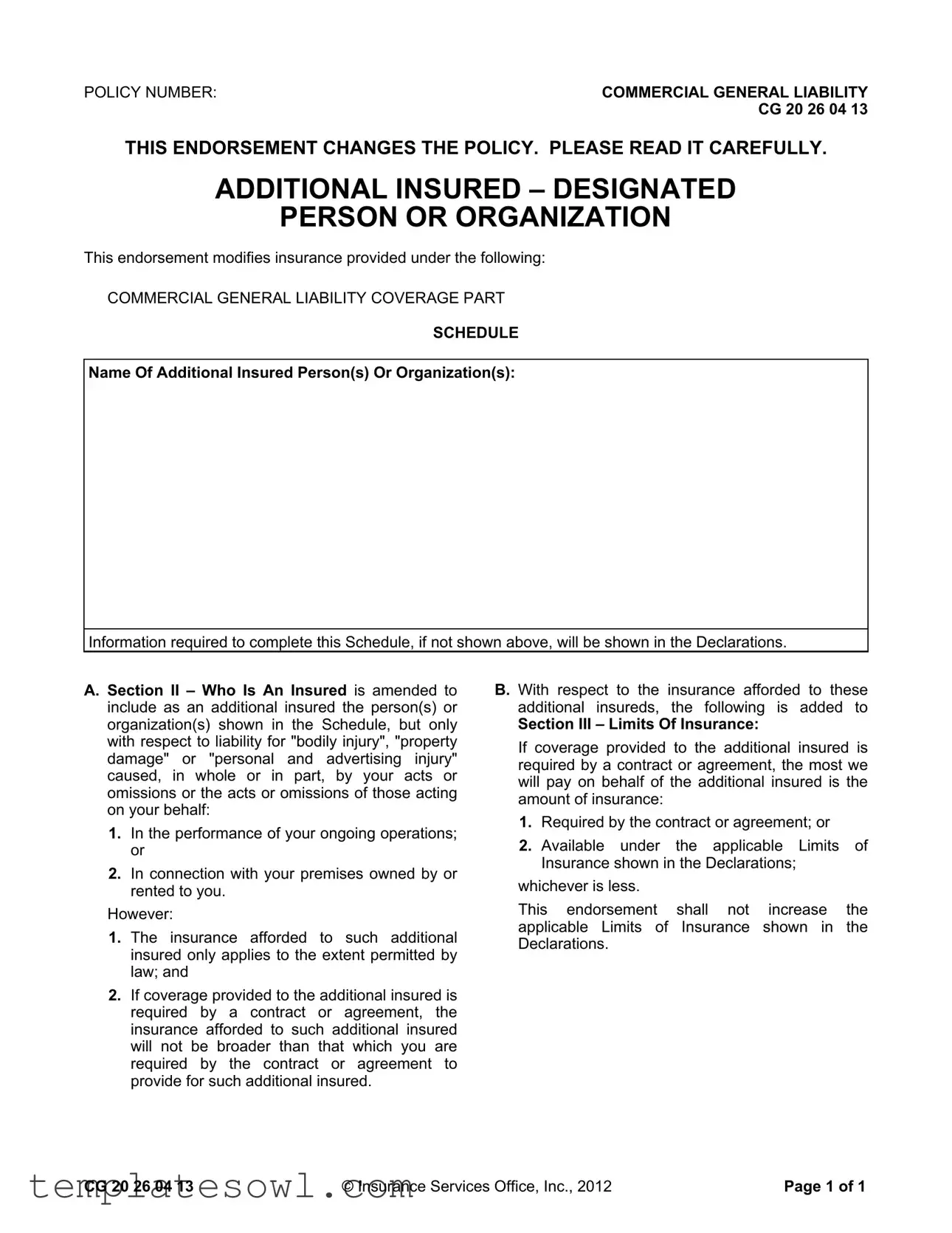

POLICY NUMBER: |

COMMERCIAL GENERAL LIABILITY |

|

CG 20 26 04 13 |

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

ADDITIONAL INSURED – DESIGNATED

PERSON OR ORGANIZATION

This endorsement modifies insurance provided under the following:

COMMERCIAL GENERAL LIABILITY COVERAGE PART

SCHEDULE

Name Of Additional Insured Person(s) Or Organization(s):

Information required to complete this Schedule, if not shown above, will be shown in the Declarations.

A. Section II – Who Is An Insured is amended to include as an additional insured the person(s) or organization(s) shown in the Schedule, but only with respect to liability for "bodily injury", "property damage" or "personal and advertising injury" caused, in whole or in part, by your acts or omissions or the acts or omissions of those acting on your behalf:

1.In the performance of your ongoing operations; or

2.In connection with your premises owned by or rented to you.

However:

1.The insurance afforded to such additional insured only applies to the extent permitted by law; and

2.If coverage provided to the additional insured is required by a contract or agreement, the insurance afforded to such additional insured will not be broader than that which you are required by the contract or agreement to provide for such additional insured.

B. With respect to the insurance afforded to these additional insureds, the following is added to

Section III – Limits Of Insurance:

If coverage provided to the additional insured is required by a contract or agreement, the most we will pay on behalf of the additional insured is the amount of insurance:

1.Required by the contract or agreement; or

2.Available under the applicable Limits of Insurance shown in the Declarations;

whichever is less.

This endorsement shall not increase the applicable Limits of Insurance shown in the Declarations.

CG 20 26 04 13 |

© Insurance Services Office, Inc., 2012 |

Page 1 of 1 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Policy Type | This form is an endorsement for Commercial General Liability insurance. |

| Effective Date | The form is dated April 13, 2012, indicating the version of the endorsement. |

| Purpose of Endorsement | This form provides additional insured coverage for designated persons or organizations. |

| Modified Coverage | It alters Section II of the policy to include additional insureds for specific liabilities only. |

| Scope of Liability | Coverage applies to claims for bodily injury, property damage, or personal and advertising injury. |

| Ongoing Operations | The endorsement covers liabilities associated with ongoing operations and premises owned or rented. |

| Limitations on Coverage | Coverage is limited to the extent required by law and cannot exceed contractual obligations. |

| Maximum Payment | The maximum payment on behalf of the additional insured is capped by either the contract or the policy limits. |

| Governing Laws | State-specific regulations may apply based on the insurance laws in the applicable jurisdiction. |

Guidelines on Utilizing Cg 20 26 04 13

Completing the CG 20 26 04 13 form involves collecting specific information and following a series of straightforward steps. By providing accurate details, you will facilitate the process of adding designated individuals or organizations as additional insureds under your commercial general liability insurance policy.

- Begin by locating the form, CG 20 26 04 13.

- Write down your policy number in the designated area at the top of the form.

- Identify the name of the additional insured person(s) or organization(s) you wish to include.

- If not shown on the form, refer to the Declarations page to find any additional information needed to complete this section.

- Review the section regarding who is insured to ensure that the additional insureds are covered for liability in relation to your operations or premises.

- Ensure that you understand the limits of insurance that apply. Make a note of whether the coverage for the additional insured is required by a contract and what the limits are.

- Attach any necessary documentation that might be required as evidence for the additional insured's status.

- Sign and date the form at the bottom to certify the information provided is accurate.

- Submit the completed form to your insurance provider, ensuring it’s sent to the correct department for processing.

What You Should Know About This Form

What is the purpose of the CG 20 26 04 13 form?

The CG 20 26 04 13 form serves as an endorsement to the Commercial General Liability (CGL) insurance policy. Its primary purpose is to add specific individuals or organizations as additional insured parties. This coverage applies to incidents involving bodily injury, property damage, or personal and advertising injury that occur due to the actions or omissions of the named insured or their representatives. It is crucial to note that the endorsement is limited to certain conditions related to the insured's operations and properties.

Who qualifies as an additional insured under this form?

Additional insured individuals or organizations are those specified in the Schedule of the form. They are typically parties that require insurance coverage for liabilities associated with the named insured’s operations or premises. It is important for policyholders to ensure that anyone they want to include is clearly listed in this Schedule, as coverage can only extend to those explicitly named.

What limitations come with the coverage provided to additional insureds?

The coverage provided to additional insureds is subject to certain limitations. First, it only applies to situations permitted by law. Additionally, if the policy is being amended to fulfill a contractual obligation, the coverage cannot exceed what the primary insured is required to provide under that contract. This means that if a contract specifies lesser coverage, that limitation will apply.

How does the limit of insurance work for additional insureds?

When it comes to limits, the amount available to additional insureds is determined by either the contractual requirement or the limits outlined in the original policy, whichever is lower. This ensures that while additional insureds receive necessary coverage, the insured party doesn’t face unexpected financial exposure. Notably, the endorsement does not change the applicable limits of insurance found in the Declarations of the policy.

Is there any way the endorsement could result in increased coverage limits?

No, the CG 20 26 04 13 endorsement does not provide for increased coverage limits. The maximum amount payable remains the same as described in the original policy. It is vital for policyholders to understand this aspect, as it ensures that while additional insured coverage is granted, it doesn't expand the overall policy limits. Maintaining awareness of these limits is essential to avoid unintended risks.

Common mistakes

Filling out the CG 20 26 04 13 form can seem straightforward, but several common mistakes may lead to issues later. One mistake frequently made is not clearly identifying the additional insured. This section requires precise names and, if applicable, addresses of the individuals or organizations. Omitting important details can result in confusion and may affect the coverage provided.

Another common error is misunderstanding the scope of the insurance coverage afforded to the additional insured. Sometimes, individuals don’t realize that the coverage is only as broad as required by any underlying contracts or agreements. Misinterpreting this aspect can lead to gaps in protection, leaving the additional insured exposed when they expect coverage.

Moreover, people often overlook the limits of insurance listed in the form. Many assume that the coverage would automatically cover any costs. However, the form specifies that the payment on behalf of the additional insured is limited to either the amount specified in a contract or the limits available under the policy. Failing to review these details can result in unexpected financial burdens later.

Lastly, many individuals neglect to read the entire endorsement carefully. Addressing only the main sections like the additional insured’s name and not considering the accompanying stipulations can lead to critical misunderstandings. Taking the time to understand every aspect of the form ensures that all parties involved are adequately protected under the policy.

Documents used along the form

Understanding the various forms and documents associated with the CG 20 26 04 13 form can enhance your comprehension of your insurance policy. Below is a brief overview of several other related documents. Each serves an essential purpose in managing risk and outlining responsibilities.

- ACORD Certificate of Liability Insurance: This certificate provides proof of insurance coverage and summarizes key elements, including policy limits and coverage dates. It is commonly requested by clients or partners to verify that adequate insurance is in place.

- Commercial General Liability Policy: The core policy outlines the coverage terms and conditions for liability, including protection against bodily injury, property damage, and specific exclusions.

- Additional Insured Endorsement Form: Similar to the CG 20 26 04 13, this document specifically identifies additional parties covered under a primary policy, detailing the limitations of their coverage.

- Waiver of Subrogation Clause: This clause in an insurance policy relinquishes the insurer's right to seek compensation from a third party after a covered loss. It fosters collaboration between parties by preventing disputes over liability.

- Indemnity Agreement: An indemnity agreement outlines the responsibilities of parties to compensate for losses incurred due to specific actions, ensuring that one party protects another against certain claims.

- Contractual Risk Transfer Documents: These documents are pivotal in outlining how risk is managed between parties through contracts. They establish which party is responsible for damages or claims that may arise.

- Exclusionary Endorsements: Endorsements that limit or exclude certain coverages within the commercial general liability policy, providing clarity on what is not covered under specific circumstances.

- Claim Notification Form: This form is essential for reporting any incidents that may lead to a claim. Timely notification is integral to ensuring that the insurance policy properly responds to potential claims.

- Policy Endorsement Forms: These are adjustments to the standard policy that modify the coverage terms or conditions. They clarify additional coverage or changes agreed upon after the policy is issued.

Each of these documents plays a vital role in ensuring that all parties understand their rights, responsibilities, and coverage. Knowing how they interrelate can help you make informed decisions and safeguard your interests.

Similar forms

The CG 20 26 04 13 form is an insurance endorsement that provides specific coverage details related to additional insured parties in a Commercial General Liability insurance policy. Here are eight other documents that are similar to this form, explaining their respective functions and how they relate to the CG 20 26 04 13:

- CG 20 10 04 13 - Additional Insured - Owners, Lessees, or Contractors: This form offers coverage to owners, lessees, or contractors for liability arising from the named insured’s operations, similar to the CG 20 26 04 13 but focused specifically on contractual relationships in construction or leased premises.

- CG 20 33 - Additional Insured - Completed Operations: This endorsement extends coverage to additional insured parties for injuries or damages occurring after the insured’s work on a project is completed. Like CG 20 26 04 13, it emphasizes liability arising from the insured’s actions.

- CG 20 37 - Additional Insured - Owners, Lessees, or Contractors (but limited to ongoing operations): This form provides limited additional insured coverage, much like CG 20 26 04 13, but only for ongoing operations rather than all general liability concerns.

- CG 24 04 05 09 - Other Insurance - Company: This endorsement provides details on how coverage interacts with other insurance policies, similar to CG 20 26 04 13's clauses on limitations of coverage based on contracts.

- CG 00 01 - Commercial General Liability Coverage Form: This core form sets forth the overall framework for general liability insurance, with instances of liability-related and coverage details akin to those found in the CG 20 26 04 13 endorsement.

- CG 20 11 04 13 - Additional Insured - Managers or Lessors of Premises: This form grants coverage to property owners or managers for incidents on the premises rented or managed by the named insured, similar in intent to adding additional insured entities.

- CG 21 47 07 98 - Additional Insured - Designated Project: This endorsement specifically covers entities involved in a designated project, paralleling the purpose of the CG 20 26 04 13 by providing additional insured status based on particular engagements.

- CG 24 02 10 93 - Limitation of Coverage to Designated Premises: This form restricts coverage to specified premises, akin to the CG 20 26 04 13 endorsement’s emphasis on coverage related to specific locations associated with the named insured.

Dos and Don'ts

Filling out the CG 20 26 04 13 form correctly is essential for ensuring proper insurance coverage. Here’s a list of things to do and avoid:

- Do read the form in its entirety before starting.

- Do clearly indicate the name of the additional insured.

- Do provide accurate information regarding your ongoing operations.

- Do check the applicable limits of insurance before completing the form.

- Do ensure that all necessary signatures are included.

- Don't leave any sections blank; complete every required field.

- Don't provide misrepresentations or outdated information.

- Don't overlook any contractual obligations related to the coverage.

- Don't rush through the process; take your time to review.

- Don't assume the endowment changes automatically; clarity is key.

Misconceptions

Understanding the CG 20 26 04 13 form can be tricky, as several misconceptions often arise. Below is a list of ten common misunderstandings about this endorsement:

- It automatically grants unlimited coverage. Many believe that the endorsement provides unlimited insurance. In reality, coverage is limited to the terms outlined in the policy and does not exceed the specified limits.

- Any party can be added as an additional insured. It is a common misconception that anyone can be added as an additional insured. This endorsement only applies to the individuals or organizations designated in the schedule of the form.

- It covers all claims without restrictions. Some assume the coverage applies to all types of claims. However, the coverage is specific to liability related to bodily injury, property damage, or personal and advertising injury resulting from the policyholder’s acts or omissions.

- The endorsement guarantees protection in all situations. Many think that this endorsement provides comprehensive protection. Nevertheless, it only covers specific incidents related to ongoing operations or premises owned or rented by the policyholder.

- There’s no need to reference contractual obligations. A misconception exists that the endorsement offers protection regardless of existing contracts. In truth, if coverage is tied to a contract, it cannot exceed the coverage required by that contract.

- Additional insureds have the same coverage as the primary insured. It is incorrect to assume that an additional insured enjoys the same level of protection as the primary policyholder. The coverage is limited and tailored to the terms required by the agreement.

- All additional insureds receive full benefits. Some people believe that all additional insureds receive the same benefits. Availability of coverage can vary based on what is negotiated in the contract.

- This endorsement increases the overall policy limit. A common belief is that adding an additional insured raises the policy limits. However, this endorsement does not increase the policy limits shown in the declarations.

- Claims are processed like a standard claim. Many think claims will be treated the same way as those for the primary insured. This is misleading as claims involving additional insureds often undergo a different process, considering their unique circumstances.

- The endorsement applies retroactively to all incidents. There is a misconception that coverage is retroactive. Instead, the endorsement applies only to claims arising from incidents that occur after the endorsement is added.

Clear understanding of these misconceptions can help parties navigate their insurance coverage effectively.

Key takeaways

Here are key takeaways about filling out and using the CG 20 26 04 13 form:

- The form acts as an endorsement to the Commercial General Liability (CGL) policy.

- It allows for additional insured persons or organizations to be added to the policy.

- Information regarding additional insureds must be entered in the Schedule section.

- The coverage applies to liability for bodily injury, property damage, or personal and advertising injury.

- Liability must result from acts or omissions of the primary insured or their representatives.

- Coverage is limited to ongoing operations or premises owned/rented by the primary insured.

- The coverage for additional insureds must comply with any contractual obligations.

- Limits of insurance for additional insureds are capped at the lower of the contractual requirement or the available policy limits.

- The endorsement does not increase the overall limits of insurance already stated in the policy Declarations.

Browse Other Templates

Va Parent Dependent - The instructions emphasize the importance of compliance with privacy laws in submitting the form.

Seller Disclosure Statement Washington State - Delivery of the completed disclosure must occur within five business days after the acceptance of a purchase agreement.