Fill Out Your Cg 2037 Form

The CG 2037 form plays a crucial role in the realm of commercial general liability insurance, particularly with regard to completed operations. It serves as an endorsement that modifies the existing insurance policy to extend coverage to additional insured parties, specifically owners, lessees, or contractors involved in a project. This addition is significant, as it ensures that these additional insured entities are protected against claims related to bodily injury or property damage that arise from the work performed at a designated location. However, this endorsement is not without its limitations. It stipulates that the coverage offered is only as extensive as required by law or existing contractual obligations. In essence, any additional insured cannot receive coverage that is wider than what is specified in the contract with the primary insured. Furthermore, the form clarifies that the insurer's liability is capped, either by the contractual requirements or by the limits stated in the policy declarations, thereby providing a clear framework for understanding the scope of coverage and liability. This balance between protection and contractual limitation is key for parties navigating the complexities of liability in commercial operations.

Cg 2037 Example

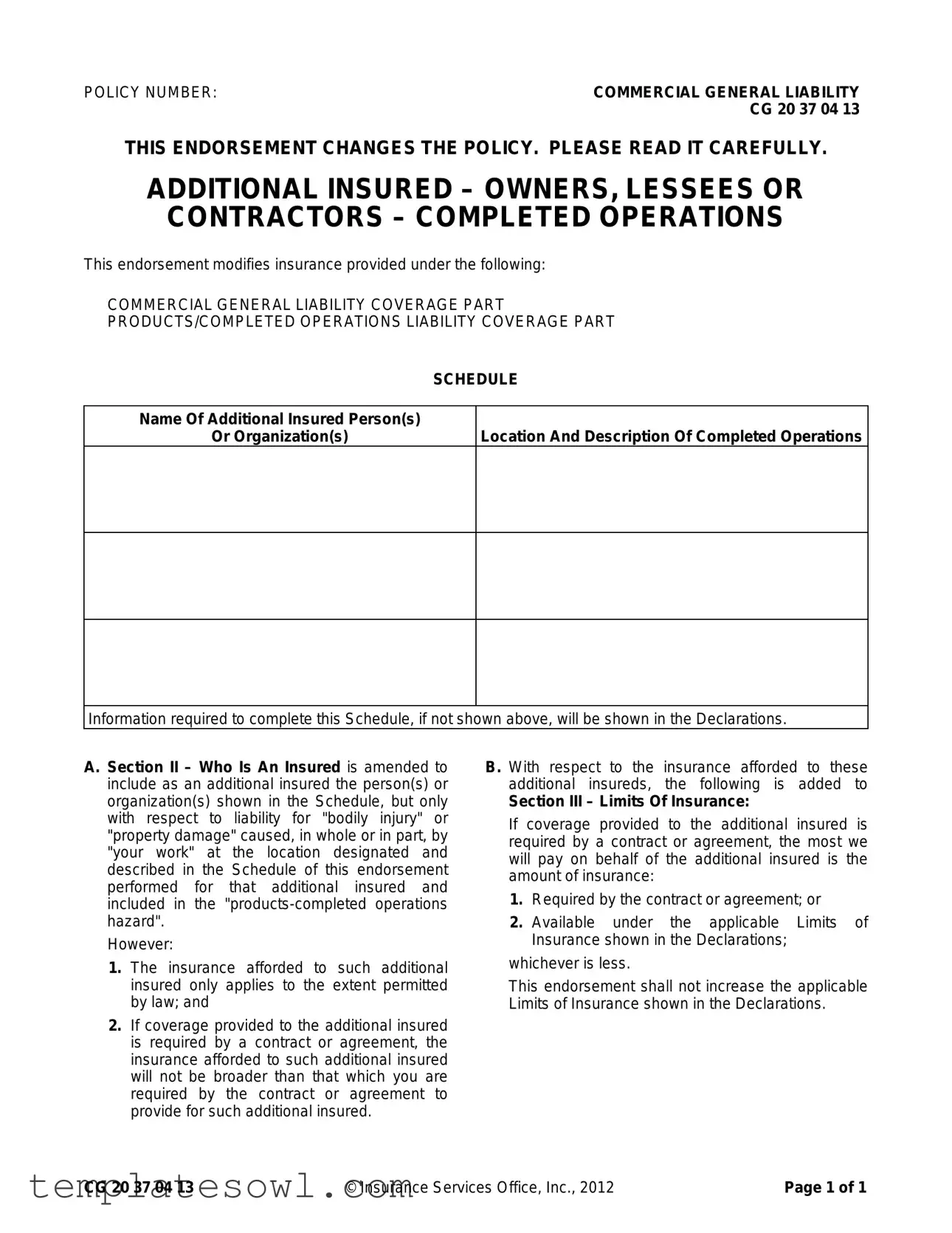

POLICY NUMBER: |

COMMERCIAL GENERAL LIABILITY |

|

CG 20 37 04 13 |

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

ADDITIONAL INSURED – OWNERS, LESSEES OR CONTRACTORS – COMPLETED OPERATIONS

This endorsement modifies insurance provided under the following:

COMMERCIAL GENERAL LIABILITY COVERAGE PART

PRODUCTS/COMPLETED OPERATIONS LIABILITY COVERAGE PART

SCHEDULE

Name Of Additional Insured Person(s)

Or Organization(s)

Location And Description Of Completed Operations

Information required to complete this Schedule, if not shown above, will be shown in the Declarations.

A.Section II – Who Is An Insured is amended to include as an additional insured the person(s) or organization(s) shown in the Schedule, but only with respect to liability for "bodily injury" or "property damage" caused, in whole or in part, by "your work" at the location designated and described in the Schedule of this endorsement performed for that additional insured and included in the

However:

1.The insurance afforded to such additional insured only applies to the extent permitted by law; and

2.If coverage provided to the additional insured is required by a contract or agreement, the insurance afforded to such additional insured will not be broader than that which you are required by the contract or agreement to provide for such additional insured.

B. With respect to the insurance afforded to these additional insureds, the following is added to

Section III – Limits Of Insurance:

If coverage provided to the additional insured is required by a contract or agreement, the most we will pay on behalf of the additional insured is the amount of insurance:

1.Required by the contract or agreement; or

2.Available under the applicable Limits of Insurance shown in the Declarations;

whichever is less.

This endorsement shall not increase the applicable Limits of Insurance shown in the Declarations.

CG 20 37 04 13 |

© Insurance Services Office, Inc., 2012 |

Page 1 of 1 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Policy Number | This endorsement is identified as CG 20 37 04 13. |

| Purpose | The form adds additional insured coverage for owners, lessees, or contractors concerning completed operations. |

| Applicable Coverage | The endorsement modifies the Commercial General Liability (CGL) coverage and Products/Completed Operations Liability coverage. |

| Scope of Coverage | Coverage applies for "bodily injury" or "property damage" caused by "your work" at specified locations. |

| Limits of Insurance | The endorsement ensures coverage limits are either the amount required by a contract or the available limit in the Declarations, whichever is lesser. |

| Legal Requirement | The coverage for additional insureds is contingent upon the legal limits as permitted by law. |

| Contractual Obligations | If required by a contract, the coverage will not exceed what is specified in that contract. |

| Amendment to Insured Definition | Section II of the CGL policy is modified to include those named in the endorsement as additional insureds. |

| Document Authority | This form is authorized by the Insurance Services Office, Inc. and was published in 2012. |

Guidelines on Utilizing Cg 2037

Filling out the CG 2037 form requires attention to detail and clarity. This form is designed to ensure that specific additional insured parties are accurately documented, providing them with the necessary coverage details. After you complete the form, it is important to review all entries for accuracy before submitting it to the relevant stakeholders.

- Gather Necessary Information: Before starting, collect all required information including the policy number, names of additional insured persons or organizations, and details about the completed operations.

- Complete the Policy Number: Begin by entering your COMMERCIAL GENERAL LIABILITY POLICY NUMBER at the top of the form.

- List Additional Insureds: In the appropriate field, write down the names of additional insured person(s) or organization(s) as mentioned in your contract.

- Describe Completed Operations: Provide a clear description and location of the completed operations related to the additional insureds.

- Review Section II: Make sure to review the amended Section II to understand how it applies to the additional insureds.

- Check Limits of Insurance: Confirm the limits of insurance as stated in Section III. This includes understanding what amounts are required by the contract or available under your policy.

- Double-check Entries: Go through all the information entered, ensuring accuracy and completeness.

- Submit the Form: Finally, submit the completed form to the appropriate department or stakeholder, keeping a copy for your records.

What You Should Know About This Form

What is the purpose of the CG 2037 form?

The CG 2037 form, also known as the Additional Insured – Owners, Lessees or Contractors – Completed Operations endorsement, modifies the terms of a Commercial General Liability (CGL) policy. Its primary purpose is to extend coverage to additional insured parties, such as owners or contractors, for liabilities arising from completed operations related to work done by the policyholder. This ensures that those additional insured parties are protected against claims for bodily injury or property damage that might occur as a result of the policyholder’s work.

Who qualifies as an additional insured under this form?

Any person or organization listed in the endorsement’s schedule qualifies as an additional insured. However, this coverage is limited to liabilities related specifically to "bodily injury" or "property damage" caused by the policyholder's work at the designated location mentioned within the schedule. It is important to ensure that the additional insured is named explicitly to benefit from the coverage.

How does the CG 2037 form affect insurance limits?

The insurance coverage provided to additional insureds under the CG 2037 form does not increase the overall policy limits. Rather, the coverage available is equal to the lower of the amount specified in any governing contract or agreement or the limits of insurance detailed in the declarations of the main policy. This means that additional insured parties must be informed of the limits applicable to their protection.

What conditions apply for coverage under the additional insured endorsement?

Coverage for additional insureds is contingent on two key conditions: first, the liability must arise from the policyholder’s work, and secondly, the endorsement will only apply to the extent permitted by law. If the contract or agreement necessitates broader coverage than what is provided by the policy, the coverage will revert to the limits established in the contract, preventing any expansion beyond agreed terms.

Are there any limitations to the coverage offered by the CG 2037 form?

Yes, the coverage provided can be limited in several ways. It only applies to claims related to completed operations at the specified location and described work. Additionally, if a contract requires less coverage than the policy affords, the insurance will conform to that lesser amount. Therefore, both the nature of the work and the contractual obligations significantly impact the extent of coverage.

What is meant by 'completed operations hazard' in this context?

Completed operations hazard refers to the potential risk of liability that arises after work has been completed. Under the CG 2037 form, this coverage protects additional insured parties from claims that occur after the work has concluded, which may involve issues such as defective workmanship or accidents related to the completed project. Understanding this term is essential for assessing risks associated with completed work.

How can companies ensure compliance with the CG 2037 form?

To ensure compliance, companies should carefully review their contractual obligations regarding insurance coverage requirements. Verifying that all necessary parties are named as additional insureds and that the terms of coverage align with what is stipulated in contracts is crucial. It is advisable to maintain open communication with insurance providers to clarify any uncertainties and ensure all endorsements are appropriately executed.

Common mistakes

Completing the CG 2037 form accurately is essential for ensuring proper coverage under a commercial general liability policy. One common mistake is failing to list the correct additional insured person or organization. This oversight can lead to gaps in coverage, resulting in the possibility of financial exposure in the event of a claim. It is crucial to review the legal names of the individuals or entities to be included as additional insureds to ensure compliance with contractual obligations.

Another frequent error occurs in the section that requests the location and description of completed operations. Incomplete or vague descriptions can create confusion when determining liability. Providing specific details, such as job site addresses and the nature of completed work, helps to clarify coverage parameters and minimizes the risk of disputes in the future.

Additionally, individuals may overlook the limits of insurance specified in their contract or agreement. It is essential to understand that the insurance coverage afforded to the additional insured will not exceed the amount required by that contract. Ignoring this can lead to misunderstandings about coverage limits. Reviewing the agreement beforehand ensures the amounts are clearly understood and accurately reflected on the form.

Failing to read the form's instructions carefully is another significant mistake. Each section contains critical information that impacts coverage. Skipping details or neglecting to confirm the accuracy of all entered data can result in incomplete submissions. Taking the time to review the form thoroughly before submission is a vital step that should not be bypassed.

Lastly, many people do not consider the implications of state laws or regulations regarding insurance coverage. This oversight can lead to compliance issues that may affect the validity of the additional insured endorsements. Familiarity with the relevant legal requirements is necessary for fully understanding the scope of coverage being requested. Proper attention to these details can prevent potential denial of claims and ensure that all parties are adequately protected.

Documents used along the form

The CG 2037 form, which deals with additional insured status under a Commercial General Liability (CGL) policy, often appears alongside various other important forms and documents. Each of these documents serves a unique role in the overall insurance process, making it crucial for all parties involved to understand their purposes.

- Certificate of Insurance: This document provides proof of insurance coverage. It outlines the types of coverage in place, the limits, and the effective dates. It assures third parties that insurance is active and compliant with any contractual requirements.

- Additional Insured Endorsement: Similar to the CG 2037, this endorsement adds more parties under the umbrella of coverage. It specifies the entities that are covered in relation to certain risks, often in connection with specific contracts or projects.

- Contractual Agreement: This is a binding document outlining the responsibilities and liabilities of each party. Contracts commonly stipulate the insurance requirements, including the addition of insured parties, and help in determining the coverage scope.

- Notice of Cancellation: This notice informs the insured party that their policy is about to be canceled. It's crucial for maintaining transparency between the insurer and the insured about the status of the coverage.

- Exclusion Endorsement: This form lists specific exclusions or limitations to the coverage being provided. Understanding these exclusions is essential for recognizing what is not covered by the policy.

- Declarations Page: Often found at the beginning of an insurance policy, this page summarizes the insurance coverage details, including premium amounts and limits. It's a key reference point for all policy details.

- Incident Report Form: This document assists in documenting any incidents that may lead to a claim. It helps in providing all necessary information for the claim process, ensuring that all facts are recorded accurately.

- Claim Form: This form is completed when a party needs to file a claim. It outlines the details of the loss, what caused it, and the extent of damages. This form initiates the claims handling process.

- Indemnity Agreement: This agreement states that one party agrees to compensate another for certain losses or damages. It clarifies financial responsibilities and is often relevant in construction or service contracts.

Understanding the various documents accompanying the CG 2037 form is essential for managing risks effectively in any commercial endeavor. Each plays a role in the broader context of insurance, helping to ensure that parties are protected and informed throughout the process.

Similar forms

- CG 20 10: This endorsement adds additional insured status for ongoing operations instead of completed operations. Both forms serve to protect a party's interests in projects but focus on different project phases.

- CG 20 11: Similar to CG 20 37, this form provides additional insured coverage but is tailored for temporary or finished operations. The key difference is that it filters claims to those arising from ongoing work rather than completed tasks.

- CG 20 26: This endorsement offers additional protected coverage for premises and arises when a third-party contractor performs work on a location owned by the additional insured. Like CG 20 37, it covers bodily injury or property damage, but the scope of coverage is broader.

- CG 20 33: It provides additional insured status for specifically identified individuals or organizations within the scope of particular projects. This form is comparable to CG 20 37 in that both forms require a specific description of the operations conducted.

- CG 20 29: This endorsement addresses automatic additional insured coverage for specific types of contracts, such as construction agreements. The fundamental similarity lies in the enhancement of liability coverage, but CG 20 29 may apply more broadly to varied contracts than CG 20 37.

Dos and Don'ts

When filling out the Cg 2037 form, there are important actions to take and mistakes to avoid. Here are four guidelines:

- Do: Carefully read the instructions provided with the form.

- Do: Clearly identify the additional insured individuals or organizations.

- Don't: Overlook the limits of insurance that apply to the additional insured.

- Don't: Provide incomplete information about the location and description of completed operations.

Misconceptions

Many people misunderstand the CG 2037 form. This document is key for understanding coverage in insurance policies, especially for businesses. Here are four common misconceptions:

- It provides unlimited coverage for additional insureds. Many believe that once an additional insured is added, they receive comprehensive protection. However, the form specifically states that coverage is limited to what is outlined in the contract or agreement.

- The additional insured is covered for all liabilities. Some think that an additional insured is protected against every potential claim. In reality, coverage through the CG 2037 form only applies to specific liabilities directly tied to "your work" at the designated location.

- The insurance limits increase with additional insureds. A common misconception is that adding more insureds raises the total coverage limits. However, this form explicitly states that limits will not increase and will be determined by the contract or the existing policy limits.

- The form applies automatically to all operations. Lastly, people often assume that the coverage applies to all operations regardless of specifics. In truth, the form's applicability is confined to the completed operations explicitly mentioned in the schedule.

Understanding these points is crucial for navigating business insurance effectively. Awareness can help avoid costly misunderstandings down the line.

Key takeaways

Understanding and properly utilizing the CG 2037 form is essential for both individuals and organizations involved in commercial general liability insurance. Here are four key takeaways to consider:

- Identify Additional Insureds Clearly: When filling out the form, clearly list the name(s) of additional insured person(s) or organization(s) in the designated schedule. This specificity helps avoid ambiguity in the coverage provided.

- Link to Completed Operations: The insurance coverage afforded to additional insureds is specifically related to liability arising from "completed operations." Ensure that the location and description of the completed operations accurately reflect the work performed.

- Adhere to Contractual Obligations: Be mindful that the coverage for additional insureds cannot exceed that outlined in any contracts or agreements. If a contract stipulates lower coverage, that limit applies here as well.

- Limits of Insurance: Understand that the coverage offered to additional insureds will not increase the overall limits of insurance detailed in the policy’s declarations. Always compare the required contract limits with the limits available under the policy.

Browse Other Templates

Tractor Inspection Checklist - Tractors are significant investments, and proper care can help maintain their value.

Carl Miller Know Your Constitution - Learn how to assert your rights during traffic stops confidently.