Fill Out Your Change Of Beneficiary Request Form

The Change of Beneficiary Request form is an important document for anyone looking to update their beneficiaries on an insurance policy. This form can only be submitted while the insured person is alive. Once the insurer receives the completed form, the changes will take effect from the date of signing, regardless of the insured’s situation at that time. However, it's essential to note that these changes are subject to any actions taken by the insurer before the form's receipt. The form requires critical information such as policy details, including policy number and names of the insured and policyowner. It allows for designations of primary and contingent beneficiaries, including necessary information like Social Security numbers, dates of birth, and relationships to the insured. If beneficiaries are trusts, a trust document must accompany the request. For multiple beneficiaries, percentages must be specified for distribution. Completing the form includes gathering necessary signatures, and a witness who is not a beneficiary must sign off on it. Failing to provide complete information could delay or complicate the processing of beneficiary changes.

Change Of Beneficiary Request Example

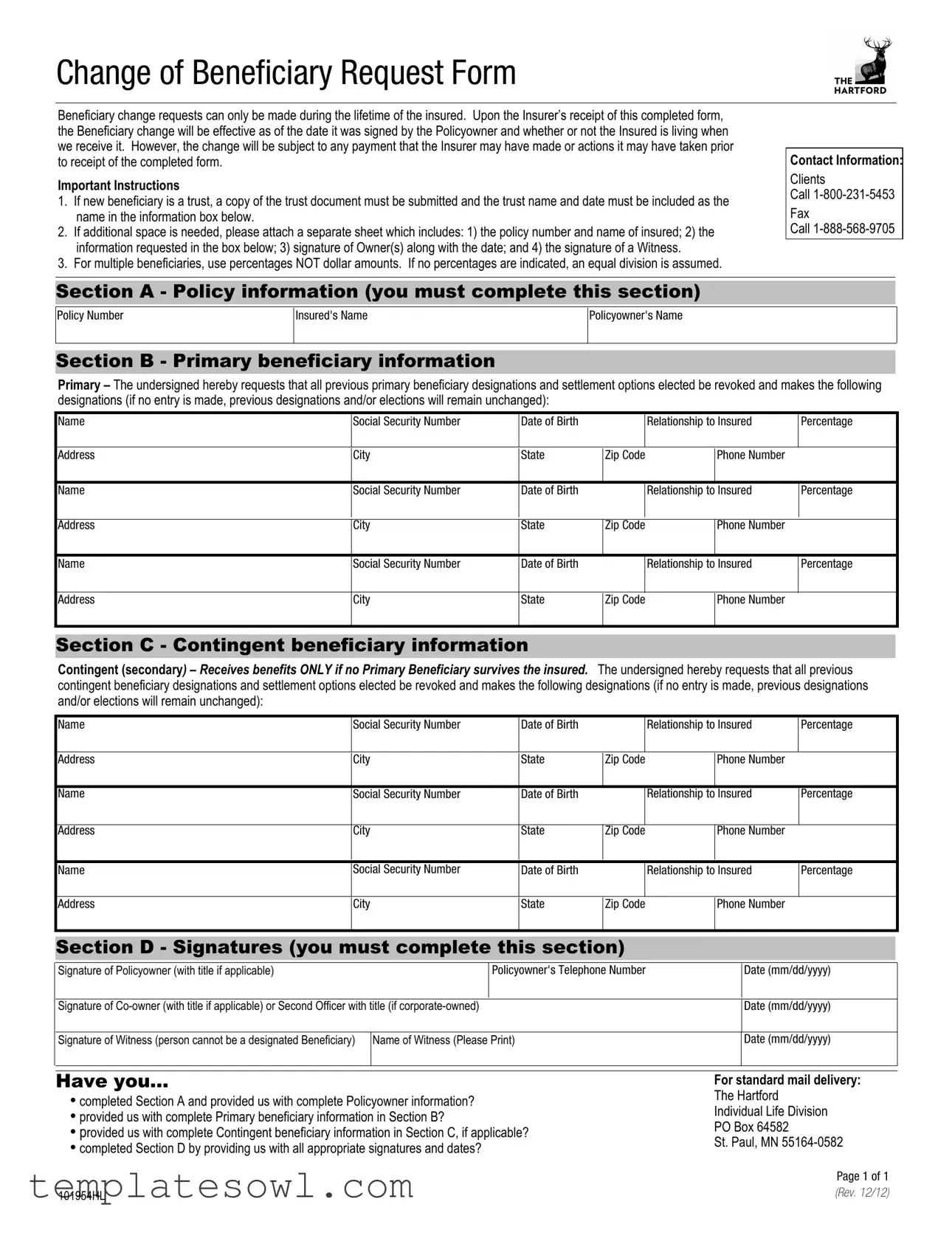

Change of Beneficiary Request Form

Beneficiary change requests can only be made during the lifetime of the insured. Upon the Insurer’s receipt of this completed form, the Beneficiary change will be effective as of the date it was signed by the Policyowner and whether or not the Insured is living when we receive it. However, the change will be subject to any payment that the Insurer may have made or actions it may have taken prior to receipt of the completed form.

Important Instructions

1.If new beneficiary is a trust, a copy of the trust document must be submitted and the trust name and date must be included as the name in the information box below.

2.If additional space is needed, please attach a separate sheet which includes: 1) the policy number and name of insured; 2) the information requested in the box below; 3) signature of Owner(s) along with the date; and 4) the signature of a Witness.

3.For multiple beneficiaries, use percentages NOT dollar amounts. If no percentages are indicated, an equal division is assumed.

Contact Information:

Clients

Call

Fax

Call

Section A - Policy information (you must complete this section)

Policy Number

Insured's Name

Policyowner's Name

Section B - Primary beneficiary information

Primary – The undersigned hereby requests that all previous primary beneficiary designations and settlement options elected be revoked and makes the following designations (if no entry is made, previous designations and/or elections will remain unchanged):

Name |

Social Security Number |

Date of Birth |

|

Relationship to Insured |

Percentage |

|

|

|

|

|

|

|

|

Address |

City |

State |

Zip Code |

|

Phone Number |

|

|

|

|

|

|

|

|

Name |

Social Security Number |

Date of Birth |

|

Relationship to Insured |

Percentage |

|

|

|

|

|

|

|

|

Address |

City |

State |

Zip Code |

|

Phone Number |

|

|

|

|

|

|

|

|

Name |

Social Security Number |

Date of Birth |

|

Relationship to Insured |

Percentage |

|

|

|

|

|

|

|

|

Address |

City |

State |

Zip Code |

|

Phone Number |

|

|

|

|

|

|

|

|

Section C - Contingent beneficiary information

Contingent (secondary) – Receives benefits ONLY if no Primary Beneficiary survives the insured. The undersigned hereby requests that all previous contingent beneficiary designations and settlement options elected be revoked and makes the following designations (if no entry is made, previous designations and/or elections will remain unchanged):

Name |

Social Security Number |

Date of Birth |

|

Relationship to Insured |

Percentage |

|

|

|

|

|

|

|

|

Address |

City |

State |

Zip Code |

|

Phone Number |

|

|

|

|

|

|

|

|

Name |

Social Security Number |

Date of Birth |

|

Relationship to Insured |

Percentage |

|

|

|

|

|

|

|

|

Address |

City |

State |

Zip Code |

|

Phone Number |

|

|

|

|

|

|

|

|

Name |

Social Security Number |

Date of Birth |

|

Relationship to Insured |

Percentage |

|

|

|

|

|

|

|

|

Address |

City |

State |

Zip Code |

|

Phone Number |

|

|

|

|

|

|

|

|

Section D - Signatures (you must complete this section)

Signature of Policyowner (with title if applicable) |

|

Policyowner's Telephone Number |

Date (mm/dd/yyyy) |

|

|

|

|

Signature of |

Date (mm/dd/yyyy) |

||

|

|

|

|

Signature of Witness (person cannot be a designated Beneficiary) |

Name of Witness (Please Print) |

Date (mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

Have you...

•completed Section A and provided us with complete Policyowner information?

•provided us with complete Primary beneficiary information in Section B?

•provided us with complete Contingent beneficiary information in Section C, if applicable?

•completed Section D by providing us with all appropriate signatures and dates?

101954HL

For standard mail delivery:

The Hartford

Individual Life Division

PO Box 64582

St. Paul, MN

Page 1 of 1

(REV. 12/12)

Form Characteristics

| Fact Name | Description |

|---|---|

| Timeliness of Change | Beneficiary change requests can only be made while the insured is alive, and the change takes effect from the date the Policyowner signs the form, regardless of the insured's status upon receipt. |

| Trust Designation | If the new beneficiary is a trust, a copy of the trust document must accompany the request, and the trust's name and date must be clearly indicated. |

| Multiple Beneficiaries | When designating multiple beneficiaries, percentages must be specified instead of dollar amounts. If not provided, an equal distribution is presumed among the beneficiaries. |

| State-Specific Law | While the Change of Beneficiary Request is generally governed by the insurance policy's terms, state-specific laws may apply depending on jurisdiction, which informs how beneficiary changes are processed. |

Guidelines on Utilizing Change Of Beneficiary Request

Once you've completed the Change of Beneficiary Request form, submit it to the insurance company for processing. Make sure all the information is accurate and thorough, as this will help prevent any delays or issues. Now, let's go through the steps to fill out the form correctly.

- Fill out Section A: Provide your Policy Number, the Insured's Name, and the Policyowner's Name.

- Complete Section B: Enter the details for each Primary Beneficiary, including their Name, Social Security Number, Date of Birth, Relationship to the Insured, Percentage of the benefit, and their Address, City, State, Zip Code, and Phone Number. If you have more beneficiaries, add their information in the same format.

- Complete Section C: If applicable, list the Contingent Beneficiaries in the same manner. Include their Name, Social Security Number, Date of Birth, Relationship to the Insured, Percentage, and their Address, City, State, Zip Code, and Phone Number.

- Fill out Section D: Sign and date the form as the Policyowner. Include any necessary titles if applicable. If there is a Co-owner or Second Officer, their signature and date are also needed. Don’t forget to have a Witness sign as well, ensuring the Witness is not a designated Beneficiary. The Witness must also print their name and date.

Before submitting, double-check that you’ve filled in all required sections. Mail the completed form to the address provided for standard delivery.

What You Should Know About This Form

What is the purpose of the Change of Beneficiary Request form?

The Change of Beneficiary Request form allows policyowners to update who will receive the benefits of their policy in the event of the insured's passing. This change can only be made while the insured is alive and is effective immediately upon receipt of the completed form by the insurer. However, the change will be subject to any actions or payments made by the insurer prior to receiving the form.

What information is needed to complete the form?

The form requires specific information about the policy and its owner, including the policy number, the names of the insured and policyowner, and complete details about the new beneficiaries. This information includes their names, social security numbers, dates of birth, relationships to the insured, and contact information. If there are multiple beneficiaries, the policyowner must indicate the percentage of benefits each will receive, rather than specific dollar amounts.

What if the new beneficiary is a trust?

If the new beneficiary is a trust, it is necessary to attach a copy of the trust document. Additionally, the trust's name and date must be included in the information section of the form. This ensures that the insurer can accurately identify the trust and process the beneficiary designation correctly.

What should I do if I need more space to list beneficiaries?

If there is insufficient space on the form to list all beneficiaries, a separate sheet can be attached. This sheet should include the policy number, the name of the insured, the information for each beneficiary, and the signatures of the policyowner(s) along with the date. It is crucial to also include a witness's signature, who cannot be a designated beneficiary.

How do I ensure my beneficiary change is effective?

Common mistakes

When filling out the Change Of Beneficiary Request form, mistakes can lead to significant issues down the line. One common error occurs when individuals neglect to include required information in Section A. This section mandates specific details about the policy, including the policy number, insured's name, and policyowner's name. Omitting any one of these elements can invalidate the request, causing delays that may affect the intended beneficiaries' rights.

Another frequent misstep involves failing to designate percentages for multiple beneficiaries in Section B and Section C. The instructions state clearly that using percentages is necessary, yet many people mistakenly try to assign dollar amounts. Without the correct percentage allocations, the insurance company will assume an equal division among beneficiaries, which may not reflect the policyowner's actual wishes.

Additionally, a lack of attention to signatures can create problems. In Section D, it is crucial to gather all required signatures. Some policyowners forget to include the witness’s signature, which should come from an individual who is not designated as a beneficiary. Insufficient signatures can lead to the rejection of the form, complicating an already time-sensitive situation.

Lastly, people often overlook the significance of attaching supporting documentation when needed. If a new beneficiary is a trust, a copy of the trust document must be included along with the name and date of the trust. Failing to provide such documentation can slow down the processing of the request and create unnecessary confusion for the insurance company.

Documents used along the form

When submitting a Change of Beneficiary Request form, several other documents may be required to support the process and ensure that it is handled correctly. Below are some commonly associated forms and documents.

- Trust Document: If the new beneficiary is a trust, a copy of the trust document must be included. This document outlines the specific terms and conditions governing the trust and identifies the individuals or entities responsible for managing it.

- Witness Statement: A separate statement may be needed that confirms the signing of the Change of Beneficiary Request form. This document must be signed by a witness who is not listed as a beneficiary to ensure impartiality and validate the request.

- Affidavit of Identity: In some cases, an affidavit may be required to affirm the identity of the Policyowner. This document serves as a sworn statement asserting the identity of the individual making the changes, which helps prevent fraud.

- Additional Information Sheet: If more space is needed for listing beneficiaries or relevant details, a separate information sheet can be attached. This should include the policy number, names of the insured and owner, and any additional required information.

Providing the necessary forms and documents along with the Change of Beneficiary Request form will facilitate a smoother processing experience. It is essential to ensure all requirements are met before submission.

Similar forms

- Beneficiary Designation Form: Like the Change of Beneficiary Request form, this document allows policyholders to specify who will receive benefits. It also revokes any prior designations and ensures clarity regarding beneficiaries' identities.

- Life Insurance Application: This form is typically completed at the start of a policy and includes beneficiary information. Changes can later be made through the Change of Beneficiary Request to update who is entitled to benefits.

- Will: A will outlines the distribution of an individual's assets upon death. Similar to the Change of Beneficiary Request, it designates how assets, including life insurance benefits, should be allocated after the policyholder's passing.

- Trust Document: When a trust is named as the beneficiary, the trust document provides essential details about the trust's terms and conditions. It’s important to submit this alongside the Change of Beneficiary Request when applicable.

- Power of Attorney: This document allows an appointed individual to make decisions on behalf of the policyholder, including managing beneficiary designations in life insurance. Both forms require careful selection of individuals who have authority in financial matters.

- Notification of Change Form: Similar in purpose, this document officially communicates changes to benefits or important details about a policy with the insurance company, ensuring records are updated to reflect the policyholder's wishes.

- Release of Beneficiary form: This form is used when a beneficiary is formally relinquishing their rights to claims on a policy. It functions alongside the Change of Beneficiary Request to clarify who will receive proceeds posthumously or during a policy's lifecycle.

Dos and Don'ts

When filling out the Change Of Beneficiary Request form, follow these guidelines to ensure the process goes smoothly.

- Do provide complete information for the Policyowner in Section A.

- Do ensure you use percentages for multiple beneficiaries in Section B and C.

- Do sign and date Section D correctly, including all required signatures.

- Do attach any necessary documents, such as a trust document if applicable.

- Don't leave any sections blank; incomplete forms may be rejected.

- Don't use dollar amounts when specifying percentages for beneficiaries.

- Don't list a witness who is also a designated beneficiary in Section D.

- Don't forget to check for any additional requirements specific to your form.

Misconceptions

Here are four common misconceptions about the Change of Beneficiary Request form. Understanding these can help ensure your requests are handled correctly.

- Beneficiary changes can only be made when the insured is alive. This is not true. Beneficiary changes can be submitted regardless of the insured's status. The change is effective as of the date the policyowner signs the form, even if the insured has passed away when the form is received by the insurer.

- You cannot change beneficiaries without a witness. While it is essential to have a witness's signature, this rule applies only if you are changing the beneficiary designation. If the primary beneficiary is being changed, the signature of a witness is necessary, but changes can still be made without additional complications.

- All beneficiaries must be assigned fixed dollar amounts. This misconception can lead to issues. Instead of assigning specific dollar amounts to beneficiaries, percentages should be used. The insurer defaults to an equal division if no percentages are provided.

- No extra information is needed if changes involve a trust. This is incorrect. If the new beneficiary is a trust, a copy of the trust document must accompany the request form. Additionally, the trust's name and date should be included in the designated area.

Key takeaways

Filling out and using the Change of Beneficiary Request form is crucial for those looking to specify who will benefit from their life insurance policy. Here are seven key takeaways to keep in mind:

- Only during your lifetime: You can only request to change the beneficiary while you are alive. This ensures that the request reflects your current wishes.

- Effective date: The change will take effect on the date you sign the form, regardless of whether the insured is alive when the insurer receives it.

- Trusts require documentation: If you name a trust as a beneficiary, always attach a copy of the trust document. Be sure to include the trust's name and date on the form.

- Add additional information if needed: If you require more space for beneficiaries, attach a separate sheet. Include the policy number, names of the insured and owner, and signatures.

- Specify percentages: When naming multiple beneficiaries, always use percentages to indicate how benefits should be divided. Without percentages, an equal split is assumed.

- Complete all sections: Ensure that you fill out Sections A, B, C, and D completely. Missing information will delay the processing of your request.

- Get the right signatures: Don’t forget to sign the form. A witness is also required, but this person cannot be a designated beneficiary. Their signature is essential to verify the request.

Following these guidelines will help make the process smooth and ensure that your wishes are honored in a timely manner.

Browse Other Templates

Processor Certification - Signatures are required for official validation of documents.

Types of Liens in Georgia - The undersigned waives all claims against the property mentioned in the form upon receipt of payment.

Rental Charge Documentation Form - This form helps in tracking rent levels for HUD-managed housing projects.