Fill Out Your Change Pay Rate Form

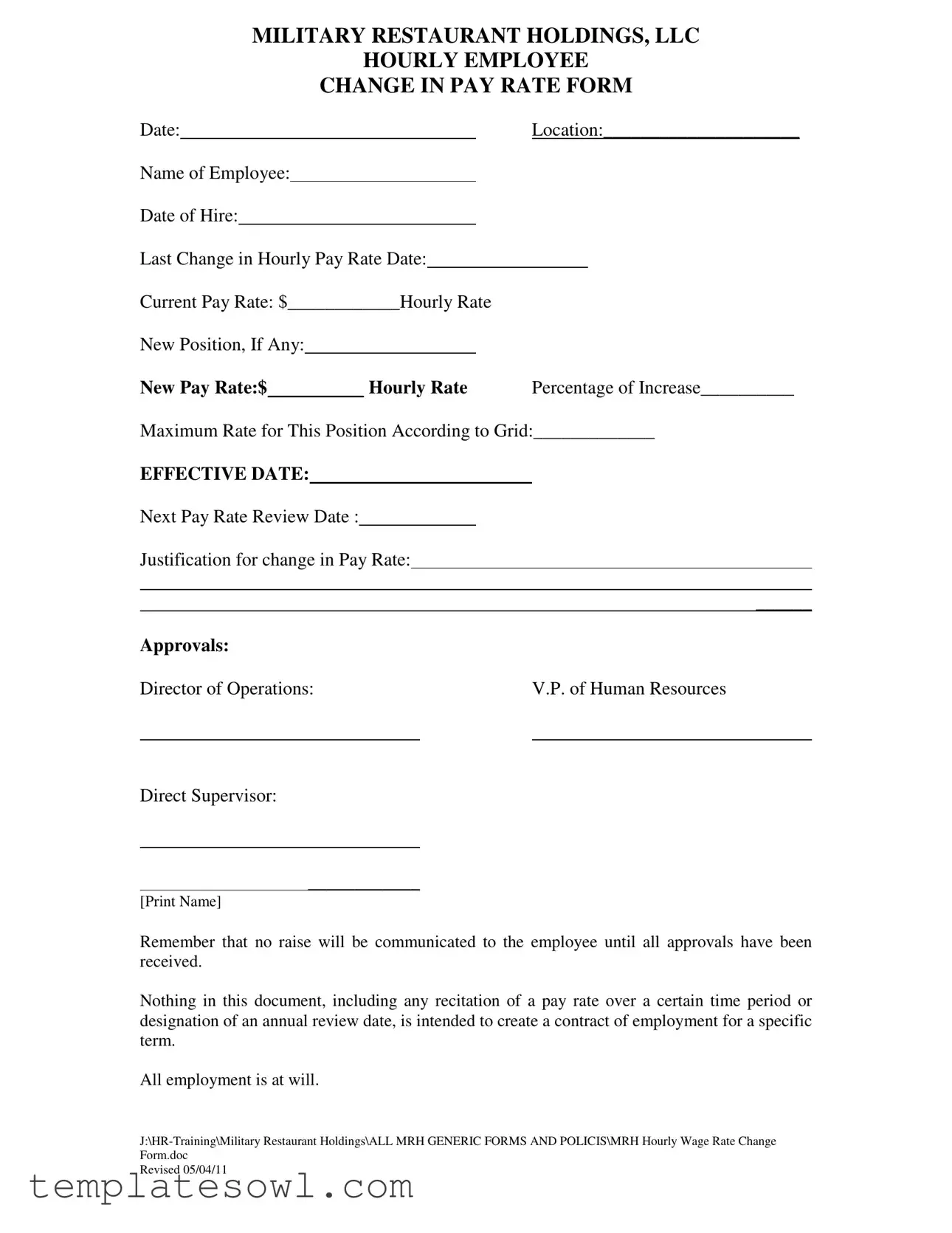

The Change Pay Rate form from Military Restaurant Holdings, LLC is a vital document used to officially update an hourly employee's compensation details. This form captures essential information, including the employee’s name, date of hire, and current pay rate. It allows management to document any changes to the employee's pay rate, whether due to a new position or a scheduled pay increase. Key fields on the form include the effective date of the new rate, reasons for the pay change, and the approval signatures from relevant supervisors. The form also outlines a maximum pay rate based on internal grids, ensuring transparency in salary adjustments. It is important to note that until all required approvals are obtained, no salary adjustments will be communicated to the employee. This form is not intended to create a contract of employment but rather serves to manage pay changes effectively within the organization, maintaining the principle of at-will employment.

Change Pay Rate Example

|

|

MILITARY RESTAURANT HOLDINGS, LLC |

|||||||||

|

|

|

|

|

HOURLY EMPLOYEE |

||||||

|

|

|

|

|

CHANGE IN PAY RATE FORM |

||||||

Date: |

|

|

|

|

|

|

Location:_____________________ |

||||

Name of Employee: |

|

|

|

|

|

|

|

|

|||

Date of Hire: |

|

|

|

|

|

|

|

|

|||

Last Change in Hourly Pay Rate Date: |

|

|

|

||||||||

Current Pay Rate: $____________Hourly Rate |

|

|

|||||||||

New Position, If Any: |

|

|

|

|

|

|

|

||||

New Pay Rate:$ |

|

|

Hourly Rate |

Percentage of Increase__________ |

|||||||

Maximum Rate for This Position According to Grid:_____________

EFFECTIVE DATE:

Next Pay Rate Review Date :

Justification for change in Pay Rate:

______

Approvals:

Director of Operations: |

|

V.P. of Human Resources |

|

|

|

Direct Supervisor:

____________

[Print Name]

Remember that no raise will be communicated to the employee until all approvals have been received.

Nothing in this document, including any recitation of a pay rate over a certain time period or designation of an annual review date, is intended to create a contract of employment for a specific term.

All employment is at will.

Form.doc

Revised 05/04/11

Form Characteristics

| Fact Title | Description |

|---|---|

| Form Purpose | This form is used to officially document changes in the pay rate for hourly employees at Military Restaurant Holdings, LLC. |

| Employee Identification | The form requires specific identification details such as the employee's name, date of hire, and last change in hourly pay rate date. |

| Current Pay Rate | Employees must indicate their current hourly pay rate before applying for any changes. |

| New Pay Rate | A section is provided to enter the new pay rate, which will replace the current rate upon approval. |

| Percentage of Increase | The form includes a calculation field for the percentage increase from the current rate to the new rate. |

| Maximum Rate Compliance | Employees must reference the maximum pay rate for their position according to the established grid. |

| Effective Date | The form mandates an effective date for the new pay rate, indicating when the change will take effect. |

| Next Review Date | A next pay rate review date must be specified, ensuring periodic evaluations of compensation. |

| Approval Process | Three approvals are necessary: from the Director of Operations, V.P. of Human Resources, and the employee's direct supervisor. |

| Employment Status | It is clearly stated that this document does not constitute a contract of employment and that all employment remains at-will. |

Guidelines on Utilizing Change Pay Rate

Understanding how to properly complete the Change Pay Rate form is essential to ensure a smooth approval process. After filling out this form, it will need to be signed by relevant authorities to finalize the change. The following steps outline the process for accurately completing the form.

- Begin by entering the Date in the designated space at the top of the form.

- In the Location field, specify the workplace location associated with the employee.

- For the Name of Employee, write the full name of the person whose pay rate is being changed.

- Indicate the Date of Hire for the employee.

- Provide the Last Change in Hourly Pay Rate Date to track previous adjustments.

- Fill in the Current Pay Rate with the employee's hourly rate, including the dollar amount.

- If applicable, enter the New Position that the employee will be transitioning to.

- State the New Pay Rate in the specified section, noting the hourly rate in dollars.

- Calculate and write the Percentage of Increase in pay, providing a clear percentage value.

- Include the Maximum Rate for This Position According to Grid as required.

- Set the EFFECTIVE DATE for the new pay rate to take effect.

- Specify the Next Pay Rate Review Date for future evaluations.

- Complete the Justification for change in Pay Rate section by providing a brief explanation for the adjustment.

- Ensure that the necessary approvals are obtained by entering the signatures or names in the Approvals section, including the Director of Operations, V.P. of Human Resources, and the Direct Supervisor's printed name.

After you have completed the form, it is crucial to ensure that all required signatures are obtained. Only when all approvals are secured will the increase be communicated to the employee.

What You Should Know About This Form

What is the Change Pay Rate form used for?

The Change Pay Rate form is specifically designed to document any changes to an hourly employee's pay rate. Whether the employee has received a raise, changed positions, or has a new agreed-upon pay structure, this form serves as the official record. It ensures that all necessary details, such as the current pay rate, new pay rate, and justifications for the change, are properly captured and reviewed by key personnel before any communication is made to the employee.

What information is required to complete the form?

Completing the Change Pay Rate form requires several pieces of information. You will need to fill in the employee's name, date of hire, current pay rate, the new pay rate, and the percentage of increase. Additionally, you must indicate if there is a new position associated with the pay change. There’s also a section for justifications for the change and required approvals from the Director of Operations, V.P. of Human Resources, and the employee’s direct supervisor. This information is crucial for ensuring that the pay change is well-documented and justified.

When will the employee be informed about their new pay rate?

An employee will only be informed of the new pay rate after all necessary approvals have been obtained. The process involves several layers of oversight, and it is vital that these approvals are in place before any communication can take place. This ensures consistency and fairness in the pay change process, safeguarding the interests of both the organization and the employee.

Does the Change Pay Rate form create an employment contract?

No, the Change Pay Rate form does not create a contract of employment. It is simply a tool to document changes in pay and does not guarantee employment for a specific term. Employment with the company remains at-will, meaning either the employer or the employee can terminate the employment relationship at any time, for any lawful reason. The form serves purely administrative purposes in tracking pay adjustments.

Common mistakes

Filling out the Change Pay Rate form may seem straightforward, but there are several common mistakes that can complicate the process. Understanding these errors can help ensure accuracy and clarity. This is particularly important because any inaccuracies may delay or complicate the intended changes.

One frequent mistake is failing to provide a specific location on the form. By omitting the location, it becomes challenging to ascertain where the employee works, which can lead to confusion during the approval process. Each workplace may have different pay structures and policies, so this detail is crucial.

Another common oversight is not including the full name of the employee. Simply writing 'John' instead of 'John Smith' may cause delays in documentation and communication. The complete name helps avoid any potential mix-ups with employees who may have similar names.

Many individuals also forget to specify the effective date of the pay change. Without this key detail, it can be unclear when the new rate is intended to take effect, leading to potential payroll issues. Moreover, clarity on the effective date allows employees to anticipate changes in their paychecks more accurately.

Not providing a clear justification for the change in pay rate is another common issue. This section is essential for maintaining transparency and justifying the increase or change. Failing to include an explanation not only affects approval but can also lead to questions about the rationale behind the pay adjustment.

Additionally, many people overlook the importance of including the maximum rate for the position according to the pay grid. This oversight can lead to discrepancies later on, especially if the new pay rate exceeds the established limits without appropriate justification.

In some cases, individuals neglect to gather necessary approvals before finalizing the form. Without the signatures from the Director of Operations, Human Resources, and Direct Supervisor, the raise will not be communicated to the employee. This delay can be frustrating for employees awaiting notification.

Another mistake often observed is not indicating the previous pay rate clearly. This information allows for easy comparison and review of the proposed change. If the prior rate is left out, it becomes harder for approvers to evaluate the fairness and appropriateness of the change.

Errors in calculating the percentage of increase also occur frequently. A simple miscalculation can lead to significant financial discrepancies. It's essential to double-check calculations before finalizing the form to prevent confusion and dissatisfaction later.

Lastly, not adhering to submission protocols can hinder the approval process. Familiarizing oneself with how and where to submit the form ensures that it reaches the right individuals promptly, preventing unnecessary delays.

By being mindful of these common mistakes when filling out the Change Pay Rate form, individuals can ensure a smoother process. Clarity, accuracy, and attention to detail are paramount for efficient pay adjustments.

Documents used along the form

When handling changes to employee compensation, several other documents may be necessary alongside the Change Pay Rate form. These additional forms help ensure a thorough and organized process, making it clear for all parties involved. Here’s a brief overview of related documents often used in conjunction with the Change Pay Rate form.

- Employee Acknowledgment Form: This document confirms the employee's receipt and understanding of the pay rate change. It serves as a record that the employee has been informed about the new terms.

- Supervisory Approval Form: Required for obtaining necessary endorsements from supervisors or managers, this form outlines the reasons for the change and must be signed before the Change Pay Rate form can proceed.

- Performance Review Form: Often linked to pay adjustments, this document provides an evaluation of the employee's work performance. It may serve as a basis for justifying the new pay rate.

- Payroll Change Notification Form: This form alerts the payroll department of any changes in an employee's pay details. It ensures that the updated information is accurately reflected in payroll systems.

- New Position/Promotion Form: If the pay change is due to a promotion, this document outlines the details of the new position, including responsibilities and any changes in duties.

- Job Description Update Form: Whenever there is a change in pay rate associated with a change in job responsibilities, this form updates the job description, ensuring that it aligns with the new expectations.

Utilizing these forms in tandem with the Change Pay Rate form facilitates clarity and accountability in the payroll adjustment process. Each document plays a vital role in maintaining transparency and ensuring that both employee and employer understand the implications of any changes to compensation.

Similar forms

- Employee Performance Review Form: This document assesses employee performance and can impact pay rates. Both forms require and document justifications for salary changes and often involve multiple levels of approval.

- Hourly Wage Adjustment Request: Similar to the Change Pay Rate form, this document is used to request changes in hourly wages. Both require specific details about current and new rates, as well as effective dates.

- Promotion Notification Form: When an employee is promoted, this form communicates changes in position and pay. Like the Change Pay Rate form, it outlines new responsibilities and corresponding compensation adjustments.

- Compensation Adjustment Memo: This memo notifies stakeholders of pay changes. Both documents necessitate proper approvals and outline justifications for adjustments in pay structures.

- Job Description Update Form: When job duties change, this form is used to update the employee's role. Similar to the Change Pay Rate form, it often includes discussions about rate changes based on the new responsibilities.

- Leave of Absence Request Form: This document details an employee's request for time off. It can affect pay particularly if unpaid leave is requested, akin to how changes in pay rates must be officially noted and approved.

- Time Card Adjustment Form: Used for correcting hours worked, this form can result in pay rate changes for hourly employees. Both forms require a record of changes and justifications, ensuring transparency in compensation practices.

- Separation Notice: This document is filed when an employee leaves. It may include final pay rate calculations and similar approvals, connecting it to the Change Pay Rate form in terms of final pay adjustments.

Dos and Don'ts

When filling out the Change Pay Rate form, there are important actions to take and avoid. Here are four key do’s and don'ts:

- Do provide accurate details for the employee, including their name and date of hire.

- Do clearly specify the new pay rate and ensure it aligns with the company’s pay grid.

- Don’t submit the form without obtaining all necessary approvals from the Director of Operations and V.P. of Human Resources.

- Don’t communicate any pay raise to the employee before all approvals are received.

Following these guidelines will help ensure a smooth process when submitting changes to pay rates. Accuracy and adherence to approval protocols are essential for compliance and clarity.

Misconceptions

Many people have misconceptions regarding the Change Pay Rate form. Here are ten common misunderstandings:

- This form guarantees a pay raise. A signed form does not automatically mean a raise is granted. All approvals must be completed first.

- Once submitted, changes are immediate. The changes take effect only after all necessary approvals, including from the Director of Operations and V.P. of Human Resources.

- Approval from all levels is not necessary. Every approval listed on the form is essential. Without them, the change is not valid.

- This form is legally binding. The language in the document clarifies that it does not create an employment contract.

- All employees are eligible for a pay increase. Eligibility for a pay rate change may depend on performance, position, and company policy.

- Previous pay history remains hidden. The form requires information on current and last pay rates for transparency.

- Changes can be communicated to the employee at any time. Employees will only be informed of changes once all approvals have been finalized.

- The effective date of the change is set in stone. The effective date can differ from the approval date, depending on company policy and procedures.

- This form applies to all types of employees. The Change Pay Rate form is specifically designed for hourly employees in the restaurant setting.

- There is a standard percentage for pay increases. Each increase is unique and depends on the circumstances surrounding the employee's performance and company guidelines.

Key takeaways

Filling out the Change Pay Rate form is an essential part of managing employee compensation. Here are some key takeaways to keep in mind:

- Complete all required fields. Ensure you fill in the date, location, employee name, and all other necessary information.

- Provide accurate pay details. List the current pay rate before indicating the new rate and the percentage of increase. This clarity helps in decision-making.

- Understand the effective date. Clearly state when the new pay rate will start. This is crucial for payroll accuracy.

- Review position changes. If the employee is moving to a new position, make sure to note this on the form.

- Obtain necessary approvals. The form requires signatures from the Director of Operations, V.P. of Human Resources, and the direct supervisor.

- Communicate clearly. Remember that employees will not be informed of any pay changes until all approvals are secured.

- Employment is at-will. The form clarifies that nothing about pay rates or review dates creates a contract for employment for any specific term.

Following these steps can help streamline the process and ensure everything is handled correctly.

Browse Other Templates

Comprehensive Nursing Assessment Pdf - Information about allergies and medications, including over-the-counter drugs, is detailed.

Federal Net Banking Login - Personal information obtained during registration will be securely processed by the bank.