Fill Out Your Charitable Worksheet Form

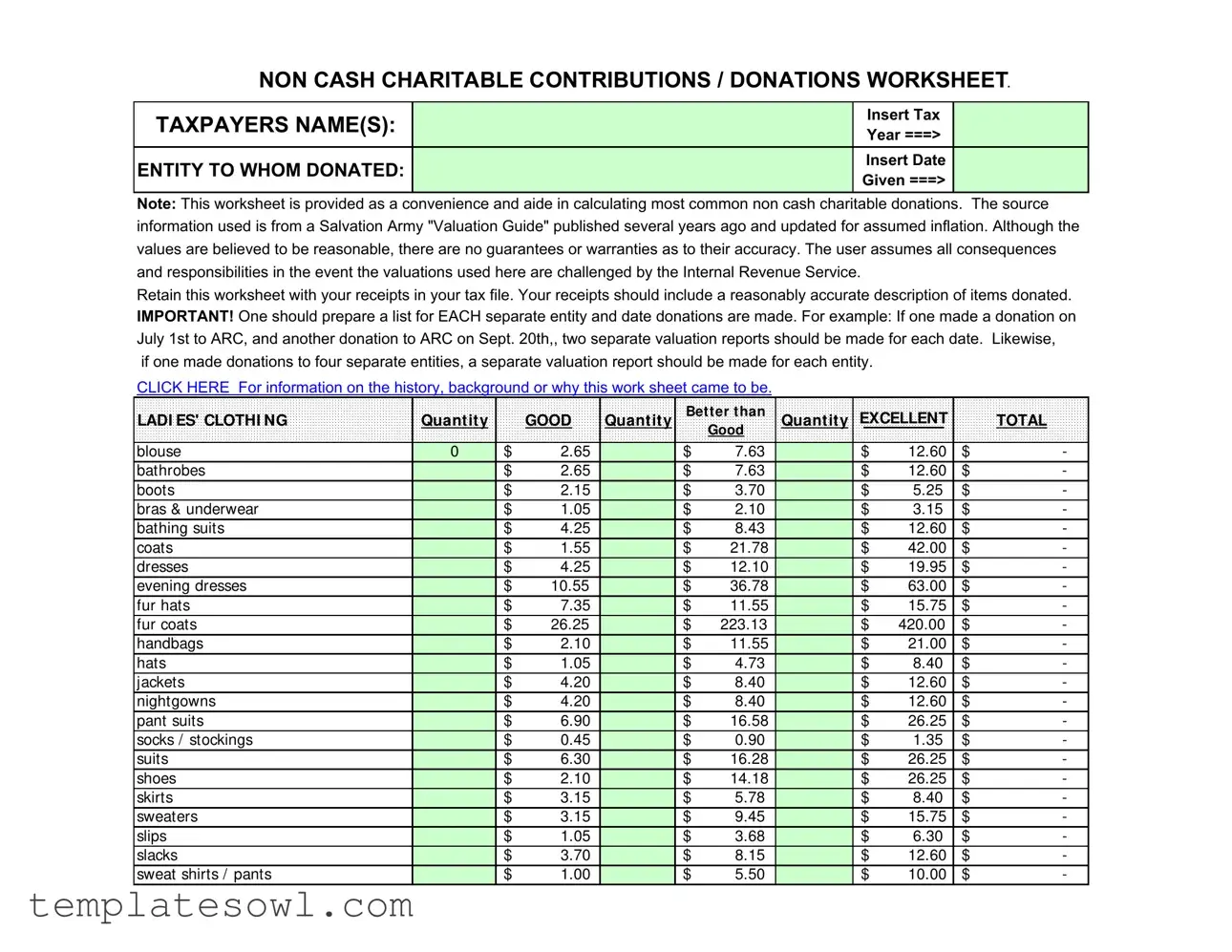

The Charitable Worksheet form serves as an invaluable tool for taxpayers who wish to track non-cash charitable contributions effectively. This user-friendly worksheet simplifies the intricate process of calculating the fair market value of donated items, helping individuals prepare for tax season. At the core of the form, taxpayers are guided to enter their names, the entities to which donations were made, and specific details for the tax year in question. Notably, the worksheet refers to a valuation guide from the Salvation Army that facilitates estimating the values of various household items—covering categories from clothing and dry goods to appliances and furniture. While the provided values are based on reasonable assumptions, users should maintain caution: the IRS may challenge these valuations, so individuals are encouraged to keep their receipts and this worksheet together in their tax files. It's essential to prepare separate reports not only for different entities but also for varying donation dates, ensuring that each contribution is distinctly recorded. As taxpayers engage with this form, they can better understand the importance of accurate reporting in receiving potential tax benefits for their generous contributions.

Charitable Worksheet Example

NON CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET.

TAXPAYERS NAME(S):

ENTITY TO WHOM DONATED:

INSERT TAX YEAR ===>

INSERT DATE GIVEN ===>

NOTE: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the values are believed to be reasonable, there are no guarantees or warranties as to their accuracy. The user assumes all consequences and responsibilities in the event the valuations used here are challenged by the Internal Revenue Service.

Retain this worksheet with your receipts in your tax file. Your receipts should include a reasonably accurate description of items donated. IMPORTANT! One should prepare a list for EACH separate entity and date donations are made. For example: If one made a donation on July 1st to ARC, and another donation to ARC on Sept. 20th,, two separate valuation reports should be made for each date. Likewise, if one made donations to four separate entities, a separate valuation report should be made for each entity.

CLICK HERE For information on the history, background or why this work sheet came to be.

LADI ES' CLOTHI NG |

Quantity |

|

GOOD |

Quantity |

Better than |

Quantity |

EXCELLENT |

|

TOTAL |

||

|

|

Good |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

blouse |

0 |

$ |

2.65 |

|

$ |

7.63 |

|

$ |

12.60 |

$ |

- |

bathrobes |

|

$ |

2.65 |

|

$ |

7.63 |

|

$ |

12.60 |

$ |

- |

boots |

|

$ |

2.15 |

|

$ |

3.70 |

|

$ |

5.25 |

$ |

- |

bras & underwear |

|

$ |

1.05 |

|

$ |

2.10 |

|

$ |

3.15 |

$ |

- |

bathing suits |

|

$ |

4.25 |

|

$ |

8.43 |

|

$ |

12.60 |

$ |

- |

coats |

|

$ |

1.55 |

|

$ |

21.78 |

|

$ |

42.00 |

$ |

- |

dresses |

|

$ |

4.25 |

|

$ |

12.10 |

|

$ |

19.95 |

$ |

- |

evening dresses |

|

$ |

10.55 |

|

$ |

36.78 |

|

$ |

63.00 |

$ |

- |

fur hats |

|

$ |

7.35 |

|

$ |

11.55 |

|

$ |

15.75 |

$ |

- |

fur coats |

|

$ |

26.25 |

|

$ |

223.13 |

|

$ |

420.00 |

$ |

- |

handbags |

|

$ |

2.10 |

|

$ |

11.55 |

|

$ |

21.00 |

$ |

- |

hats |

|

$ |

1.05 |

|

$ |

4.73 |

|

$ |

8.40 |

$ |

- |

jackets |

|

$ |

4.20 |

|

$ |

8.40 |

|

$ |

12.60 |

$ |

- |

nightgowns |

|

$ |

4.20 |

|

$ |

8.40 |

|

$ |

12.60 |

$ |

- |

pant suits |

|

$ |

6.90 |

|

$ |

16.58 |

|

$ |

26.25 |

$ |

- |

socks / stockings |

|

$ |

0.45 |

|

$ |

0.90 |

|

$ |

1.35 |

$ |

- |

suits |

|

$ |

6.30 |

|

$ |

16.28 |

|

$ |

26.25 |

$ |

- |

shoes |

|

$ |

2.10 |

|

$ |

14.18 |

|

$ |

26.25 |

$ |

- |

skirts |

|

$ |

3.15 |

|

$ |

5.78 |

|

$ |

8.40 |

$ |

- |

sweaters |

|

$ |

3.15 |

|

$ |

9.45 |

|

$ |

15.75 |

$ |

- |

slips |

|

$ |

1.05 |

|

$ |

3.68 |

|

$ |

6.30 |

$ |

- |

slacks |

|

$ |

3.70 |

|

$ |

8.15 |

|

$ |

12.60 |

$ |

- |

sweat shirts / pants |

|

$ |

1.00 |

|

$ |

5.50 |

|

$ |

10.00 |

$ |

- |

MEN'S CLOTHI NG |

Quantity |

|

GOOD |

Quantity |

Better than |

Quantity |

EXCELLENT |

|

TOTAL |

||

|

|

Good |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

casual wear jackets: fabric |

|

$ |

7.90 |

|

$ |

17.08 |

|

$ |

26.25 |

$ |

- |

casual wear jackets: leather |

|

$ |

15.75 |

|

$ |

47.25 |

|

$ |

78.75 |

$ |

- |

over coats |

|

$ |

15.75 |

|

$ |

39.38 |

|

$ |

63.00 |

$ |

- |

pajamas |

|

$ |

2.10 |

|

$ |

5.25 |

|

$ |

8.40 |

$ |

- |

pants - shorts |

|

$ |

3.70 |

|

$ |

7.10 |

|

$ |

10.50 |

$ |

- |

raincoats |

|

$ |

5.25 |

|

$ |

13.13 |

|

$ |

21.00 |

$ |

- |

suits |

|

$ |

15.75 |

|

$ |

39.38 |

|

$ |

63.00 |

$ |

- |

dress slacks |

|

$ |

5.25 |

|

$ |

8.93 |

|

$ |

12.60 |

$ |

- |

shirts |

|

$ |

2.65 |

|

$ |

7.63 |

|

$ |

12.60 |

$ |

- |

sweaters |

|

$ |

2.65 |

|

$ |

7.63 |

|

$ |

12.60 |

$ |

- |

shoes |

|

$ |

3.70 |

|

$ |

14.98 |

|

$ |

26.25 |

$ |

- |

swim trunks |

|

$ |

2.65 |

|

$ |

5.53 |

|

$ |

8.40 |

$ |

- |

sport coats |

|

$ |

8.40 |

|

$ |

30.45 |

|

$ |

52.50 |

$ |

- |

tuxedo |

|

$ |

10.50 |

|

$ |

36.75 |

|

$ |

63.00 |

$ |

- |

under shirts / under shorts |

|

$ |

1.05 |

|

$ |

2.10 |

|

$ |

3.15 |

$ |

- |

sweat shirts / pants |

|

$ |

1.00 |

|

$ |

5.50 |

|

$ |

10.00 |

$ |

- |

belts - ties |

|

$ |

3.15 |

|

$ |

5.78 |

|

$ |

8.40 |

$ |

- |

CHI LDREN'S CLOTHI NG |

Quantity |

|

GOOD |

Quantity |

Better than |

Quantity |

EXCELLENT |

|

TOTAL |

||

|

|

Good |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

blouses |

|

$ |

2.10 |

|

$ |

5.25 |

|

$ |

8.40 |

$ |

- |

boots |

|

$ |

3.15 |

|

$ |

12.08 |

|

$ |

21.00 |

$ |

- |

coats |

|

$ |

4.75 |

|

$ |

12.88 |

|

$ |

21.00 |

$ |

- |

dresses |

|

$ |

3.70 |

|

$ |

8.15 |

|

$ |

12.60 |

$ |

- |

jackets |

|

$ |

3.15 |

|

$ |

14.70 |

|

$ |

26.25 |

$ |

- |

jeans |

|

$ |

3.70 |

|

$ |

8.15 |

|

$ |

12.60 |

$ |

- |

pants |

|

$ |

2.65 |

|

$ |

7.63 |

|

$ |

12.60 |

$ |

- |

snowsuits |

|

$ |

4.20 |

|

$ |

12.08 |

|

$ |

19.95 |

$ |

- |

shoes |

|

$ |

2.65 |

|

$ |

5.93 |

|

$ |

9.20 |

$ |

- |

skirts |

|

$ |

1.60 |

|

$ |

3.95 |

|

$ |

6.30 |

$ |

- |

sweaters |

|

$ |

2.65 |

|

$ |

5.53 |

|

$ |

8.40 |

$ |

- |

slacks |

|

$ |

2.10 |

|

$ |

5.25 |

|

$ |

8.40 |

$ |

- |

shirts |

|

$ |

2.10 |

|

$ |

4.20 |

|

$ |

6.30 |

$ |

- |

socks |

|

$ |

0.55 |

|

$ |

1.08 |

|

$ |

1.60 |

$ |

- |

underwear |

|

$ |

1.05 |

|

$ |

2.38 |

|

$ |

3.70 |

$ |

- |

DRY GOODS |

Quantity |

|

GOOD |

Quantity |

Better than |

Quantity |

EXCELLENT |

|

TOTAL |

||

|

|

Good |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

blankets |

|

$ |

2.65 |

|

$ |

5.53 |

|

$ |

8.40 |

$ |

- |

bedspreads |

|

$ |

3.15 |

|

$ |

14.18 |

|

$ |

25.20 |

$ |

- |

chair covers |

|

$ |

15.75 |

|

$ |

26.25 |

|

$ |

36.75 |

$ |

- |

curtains |

|

$ |

1.60 |

|

$ |

7.10 |

|

$ |

12.60 |

$ |

- |

drapes |

|

$ |

6.90 |

|

$ |

24.45 |

|

$ |

42.00 |

$ |

- |

pillows |

|

$ |

2.10 |

|

$ |

5.25 |

|

$ |

8.40 |

$ |

- |

sheets |

|

$ |

2.10 |

|

$ |

5.25 |

|

$ |

8.40 |

$ |

- |

throw rugs |

|

$ |

1.60 |

|

$ |

7.10 |

|

$ |

12.60 |

$ |

- |

towels |

|

$ |

0.55 |

|

$ |

2.38 |

|

$ |

4.20 |

$ |

- |

HOUSEWARES & SMALL |

Quantity |

|

GOOD |

Quantity |

Better than |

Quantity |

EXCELLENT |

|

TOTAL |

||

APPLI ANCES |

|

|

Good |

|

|||||||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

broiler ovens |

|

$ |

15.75 |

|

$ |

21.00 |

|

$ |

26.25 |

$ |

- |

mixer / blender |

|

$ |

5.25 |

|

$ |

13.13 |

|

$ |

21.00 |

$ |

- |

toaster |

|

$ |

6.30 |

|

$ |

11.03 |

|

$ |

15.75 |

$ |

- |

coffee maker |

|

$ |

7.90 |

|

$ |

17.08 |

|

$ |

26.25 |

$ |

- |

microwave |

|

$ |

31.50 |

|

$ |

55.13 |

|

$ |

78.75 |

$ |

- |

dinner plates - each |

|

$ |

0.55 |

|

$ |

0.80 |

|

$ |

1.05 |

$ |

- |

saucers - each |

|

$ |

0.35 |

|

$ |

0.58 |

|

$ |

0.80 |

$ |

- |

cups - each |

|

$ |

0.40 |

|

$ |

0.63 |

|

$ |

0.85 |

$ |

- |

glasses - each |

|

$ |

0.20 |

|

$ |

0.25 |

|

$ |

0.30 |

$ |

- |

flatware - place setting of 4 pieces |

|

$ |

5.25 |

|

$ |

13.13 |

|

$ |

21.00 |

$ |

- |

soup bowls |

|

$ |

0.35 |

|

$ |

0.58 |

|

$ |

0.80 |

$ |

- |

serving dishes |

|

$ |

1.05 |

|

$ |

2.10 |

|

$ |

3.15 |

$ |

- |

misc. cooking utensils |

|

$ |

1.05 |

|

$ |

2.10 |

|

$ |

3.15 |

$ |

- |

misc. serving utensils |

|

$ |

1.05 |

|

$ |

2.10 |

|

$ |

3.15 |

$ |

- |

misc. cutting utensils |

|

$ |

1.05 |

|

$ |

2.10 |

|

$ |

3.15 |

$ |

- |

SPORTI NG GOODS |

Quantity |

|

GOOD |

Quantity |

Better than |

Quantity |

EXCELLENT |

|

TOTAL |

||

|

|

Good |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

bicycles |

|

$ |

15.75 |

|

$ |

42.00 |

|

$ |

68.25 |

$ |

- |

fishing rods with reels |

|

$ |

5.25 |

|

$ |

15.75 |

|

$ |

26.25 |

$ |

- |

ice / roller / inline skates |

|

$ |

10.50 |

|

$ |

26.25 |

|

$ |

42.00 |

$ |

- |

skis |

|

$ |

15.75 |

|

$ |

60.38 |

|

$ |

105.00 |

$ |

- |

ski boots/ bindings |

|

$ |

21.00 |

|

$ |

89.25 |

|

$ |

157.50 |

$ |

- |

sleds |

|

$ |

5.25 |

|

$ |

13.13 |

|

$ |

21.00 |

$ |

- |

tennis/ racquetball rackets |

|

$ |

5.25 |

|

$ |

23.63 |

|

$ |

42.00 |

$ |

- |

toboggans |

|

$ |

15.75 |

|

$ |

55.13 |

|

$ |

94.50 |

$ |

- |

MI SCELLANEOUS |

Quant it y |

|

GOOD |

Quant it y |

Better than |

Quant it y |

EXCELLENT |

|

TOTAL |

||

|

|

Good |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

adding machines |

|

$ |

21.00 |

|

$ |

49.88 |

|

$ |

78.75 |

$ |

- |

Christmas trees |

|

$ |

15.75 |

|

$ |

34.13 |

|

$ |

52.50 |

$ |

- |

copier |

|

$ |

105.00 |

|

$ |

157.50 |

|

$ |

210.00 |

$ |

- |

home computer |

|

$ |

157.55 |

|

$ |

341.28 |

|

$ |

525.00 |

$ |

- |

ink jet printer |

|

$ |

26.25 |

|

$ |

65.63 |

|

$ |

105.00 |

$ |

- |

laser printer |

|

$ |

52.50 |

|

$ |

131.25 |

|

$ |

210.00 |

$ |

- |

fax machine |

|

$ |

26.25 |

|

$ |

52.50 |

|

$ |

78.75 |

$ |

- |

mower (riding) |

|

$ |

105.00 |

|

$ |

183.75 |

|

$ |

262.50 |

$ |

- |

mower (auto) |

|

$ |

10.50 |

|

$ |

57.75 |

|

$ |

105.00 |

$ |

- |

power edger |

|

$ |

5.25 |

|

$ |

15.75 |

|

$ |

26.25 |

$ |

- |

rototiller |

|

$ |

26.25 |

|

$ |

60.38 |

|

$ |

94.50 |

$ |

- |

sewing machine |

|

$ |

15.75 |

|

$ |

47.25 |

|

$ |

78.75 |

$ |

- |

snow blower |

|

$ |

52.50 |

|

$ |

105.00 |

|

$ |

157.50 |

$ |

- |

telephone answering machine |

|

$ |

26.25 |

|

$ |

52.50 |

|

$ |

78.75 |

$ |

- |

typewriter |

|

$ |

7.90 |

|

$ |

22.33 |

|

$ |

36.75 |

$ |

- |

vacuum cleaner (working) |

|

$ |

21.00 |

|

$ |

42.00 |

|

$ |

63.00 |

$ |

- |

carpet cleaner (working) |

|

$ |

26.25 |

|

$ |

52.50 |

|

$ |

78.75 |

$ |

- |

FURNI TURE |

Quant it y |

|

GOOD |

Quant it y |

Better than |

Quant it y |

EXCELLENT |

|

TOTAL |

||

|

|

Good |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

air conditioner |

|

$ |

21.00 |

|

$ |

57.75 |

|

$ |

94.50 |

$ |

- |

bar |

|

$ |

31.50 |

|

$ |

55.13 |

|

$ |

78.75 |

$ |

- |

bar stools |

|

$ |

10.50 |

|

$ |

15.75 |

|

$ |

21.00 |

$ |

- |

bed (double) complete |

|

$ |

52.50 |

|

$ |

115.50 |

|

$ |

178.50 |

$ |

- |

bed (single) complete |

|

$ |

36.75 |

|

$ |

70.88 |

|

$ |

105.00 |

$ |

- |

chest |

|

$ |

26.25 |

|

$ |

62.50 |

|

$ |

98.75 |

$ |

- |

clothes closet |

|

$ |

15.75 |

|

$ |

34.13 |

|

$ |

52.50 |

$ |

- |

china cabinet |

|

$ |

89.25 |

|

$ |

202.13 |

|

$ |

315.00 |

$ |

- |

convertible sofa (w/ mattress) |

|

$ |

89.25 |

|

$ |

202.13 |

|

$ |

315.00 |

$ |

- |

crib (w/ mattress) |

|

$ |

26.25 |

|

$ |

65.63 |

|

$ |

105.00 |

$ |

- |

baby carriage / stroller |

|

$ |

5.25 |

|

$ |

55.13 |

|

$ |

105.00 |

$ |

- |

chair (upholstered) |

|

$ |

26.25 |

|

$ |

52.50 |

|

$ |

78.75 |

$ |

- |

coffee table |

|

$ |

15.75 |

|

$ |

42.00 |

|

$ |

68.25 |

$ |

- |

dresser w/ mirror |

|

$ |

21.00 |

|

$ |

63.00 |

|

$ |

105.00 |

$ |

- |

desk |

|

$ |

26.25 |

|

$ |

86.63 |

|

$ |

147.00 |

$ |

- |

dryer |

|

$ |

47.25 |

|

$ |

70.88 |

|

$ |

94.50 |

$ |

- |

kitchen stove / range (working) |

|

$ |

78.75 |

|

$ |

118.13 |

|

$ |

157.50 |

$ |

- |

end tables (2) |

|

$ |

10.50 |

|

$ |

31.50 |

|

$ |

52.50 |

$ |

- |

figurines (lg.) |

|

$ |

52.50 |

|

$ |

78.75 |

|

$ |

105.00 |

$ |

- |

fireplace set |

|

$ |

31.50 |

|

$ |

63.00 |

|

$ |

94.50 |

$ |

- |

floor lamps |

|

$ |

7.90 |

|

$ |

24.95 |

|

$ |

42.00 |

$ |

- |

folding beds |

|

$ |

21.00 |

|

$ |

42.00 |

|

$ |

63.00 |

$ |

- |

gas stoves |

|

$ |

52.50 |

|

$ |

91.88 |

|

$ |

131.25 |

$ |

- |

heaters |

|

$ |

7.90 |

|

$ |

15.50 |

|

$ |

23.10 |

$ |

- |

high chair |

|

$ |

10.50 |

|

$ |

31.50 |

|

$ |

52.50 |

$ |

- |

hi riser |

|

$ |

36.75 |

|

$ |

57.75 |

|

$ |

78.75 |

$ |

- |

kitchen table |

|

$ |

26.25 |

|

$ |

44.63 |

|

$ |

63.00 |

$ |

- |

kitchen cabinets |

|

$ |

26.25 |

|

$ |

52.50 |

|

$ |

78.75 |

$ |

- |

kitchen chair |

|

$ |

2.65 |

|

$ |

6.58 |

|

$ |

10.50 |

$ |

- |

mattress (double) |

|

$ |

36.75 |

|

$ |

57.75 |

|

$ |

78.75 |

$ |

- |

mattress (single) |

|

$ |

15.75 |

|

$ |

26.25 |

|

$ |

36.75 |

$ |

- |

organ console |

|

$ |

78.75 |

|

$ |

144.38 |

|

$ |

210.00 |

$ |

- |

piano |

|

$ |

78.75 |

|

$ |

144.38 |

|

$ |

210.00 |

$ |

- |

pictures and paintings |

|

$ |

5.25 |

|

$ |

107.63 |

|

$ |

210.00 |

$ |

- |

ping pong tables |

|

$ |

15.75 |

|

$ |

28.88 |

|

$ |

42.00 |

$ |

- |

|

$ |

15.75 |

|

$ |

23.63 |

|

$ |

31.50 |

$ |

- |

|

pool tables |

|

$ |

21.00 |

|

$ |

49.88 |

|

$ |

78.75 |

$ |

- |

CD / DVD / record player (stereo) |

|

$ |

31.50 |

|

$ |

120.75 |

|

$ |

210.00 |

$ |

- |

record player (components) |

|

$ |

10.50 |

|

$ |

44.63 |

|

$ |

78.75 |

$ |

- |

rugs |

|

$ |

21.00 |

|

$ |

57.75 |

|

$ |

94.50 |

$ |

- |

refrigerator (working) |

|

$ |

78.75 |

|

$ |

170.63 |

|

$ |

262.50 |

$ |

- |

radio / stereo / tuner |

|

$ |

7.90 |

|

$ |

30.20 |

|

$ |

52.50 |

$ |

- |

secretary |

|

$ |

52.50 |

|

$ |

99.75 |

|

$ |

147.00 |

$ |

- |

sofa |

|

$ |

36.75 |

|

$ |

123.38 |

|

$ |

210.00 |

$ |

- |

TV b/ w (working) |

|

$ |

26.25 |

|

$ |

44.63 |

|

$ |

63.00 |

$ |

- |

TV color (working) |

|

$ |

78.75 |

|

$ |

157.50 |

|

$ |

236.25 |

$ |

- |

trunk / suitcase |

|

$ |

5.25 |

|

$ |

39.38 |

|

$ |

73.50 |

$ |

- |

wardrobe |

|

$ |

21.00 |

|

$ |

63.00 |

|

$ |

105.00 |

$ |

- |

washer (working) |

|

$ |

52.50 |

|

$ |

105.00 |

|

$ |

157.50 |

$ |

- |

waterbed (frame) |

|

$ |

15.75 |

|

$ |

28.88 |

|

$ |

42.00 |

$ |

- |

waterbed headboard |

|

$ |

31.50 |

|

$ |

63.00 |

|

$ |

94.50 |

$ |

- |

waterbed (complete) |

|

$ |

157.50 |

|

$ |

249.38 |

|

$ |

341.25 |

$ |

- |

MY / OUR |

|

|

|

ENTER I TEMS NOT PROVI DED FOR I N THE ABOVE CATEGORI ES. SET YOUR OWN VALUE. Quant it y |

BEST |

|

TOTAL |

GUESS OF |

|

|

|

$ |

- |

$ |

- |

|

|

|

|

$ |

- |

$ |

- |

|

|

|

|

$ |

- |

$ |

- |

|

|

|

|

$ |

- |

$ |

- |

|

|

|

|

$ |

- |

$ |

- |

|

|

|

|

$ |

- |

$ |

- |

|

|

|

|

|

|

|

|

|

|

|

$ |

- |

|

$ |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

- |

|

$ |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

- |

|

$ |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

- |

|

$ |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

- |

|

$ |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

- |

|

$ |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

- |

|

$ |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

- |

|

$ |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

- |

|

$ |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

- |

|

$ |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

- |

|

$ |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

- |

|

$ |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

- |

|

$ |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

- |

|

$ |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

- |

|

$ |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

- |

|

$ |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

- |

|

$ |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

- |

|

$ |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

- |

|

$ |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

- |

|

$ |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

- |

|

$ |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL OF ALL DONATED I TEMS |

> |

> |

> |

> |

> |

> |

- > |

> |

|

$ |

- |

|

- - - - - - |

|

|

|

|||||||||

WHAT I S YOUR ORI GI NAL COST BASED ON RECI EPTS, OR YOUR BEST ESTI MATE, OF THE I TEMS DONATE |

$ |

|

- |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR MORE INFORMATION ABOUT NON CASH DONATIONS SEE:

http://www.salvationarmyusa.org  Revised March 22, 2007

Revised March 22, 2007

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | This worksheet aids in calculating values for non-cash charitable donations. |

| Tax Year | Users must enter the specific tax year for which they are reporting donations. |

| Documentation | Retain the worksheet along with receipts that detail donated items. |

| Separate Reports | Lists are required for each entity and donation date to ensure accurate reporting. |

| Valuation Guide | The worksheet utilizes values based on a Salvation Army Valuation Guide. |

| IRS Considerations | The user is responsible for any challenges by the IRS regarding valuation accuracy. |

Guidelines on Utilizing Charitable Worksheet

After gathering all necessary receipts and information regarding non-cash charitable contributions, the next step involves accurately completing the Charitable Worksheet form. This will help document each item donated, along with its assessed value, making the process smoother when filing taxes. Follow the steps outlined below to ensure everything is filled out correctly and efficiently.

- Enter Your Name(s): Fill in the names of the taxpayers on the designated line at the top of the form.

- Identify the Entity: Specify the name of the organization to which the donation was made.

- Insert Tax Year: Clearly indicate the year for which these contributions apply.

- Document Donation Dates: Write down the date when each donation was made. Keep in mind that a new report is needed for each date.

- List Each Item Donated: Refer to the valuation guide and list each item. Include the quantity and choose from 'Good', 'Better than', or 'Excellent' to describe the condition of each item.

- Record Values: Use the valuation guide to assign a total value to each item based on its condition. Be sure to total these values for accurate reporting.

- Keep for Your Records: Retain this worksheet along with your receipts in your tax file for any future reference or audits.

What You Should Know About This Form

What is the purpose of the Charitable Worksheet form?

The Charitable Worksheet form is designed to help individuals track their non-cash charitable contributions. It provides a convenient way to calculate the value of items donated, using standard valuation guidelines that have been adapted for inflation over time. This form is particularly useful during tax season, ensuring you accurately report your contributions to the IRS.

How should I use the Charitable Worksheet form?

To effectively use the form, begin by filling in your name and the entity to which you donated items. Specify the tax year and date of each contribution. It’s essential to prepare a separate worksheet for each entity and date. For example, a donation made on July 1st should be documented independently from a donation made on September 20th. This helps maintain clarity and ensures accurate reporting.

What do I need to retain along with this worksheet?

Along with the worksheet, you should keep receipts for all donated items. These receipts should offer a reasonably accurate description of the items and their condition. This documentation is vital if you ever need to provide proof of your donations to the IRS or other entities.

Why is it important to list donations separately by entity and date?

Listing donations separately is crucial for several reasons. It helps in providing a clear and organized record of your contributions. The IRS requires precise documentation for donated items, and having distinct forms for each donation can simplify the verification process. Additionally, it allows you to accurately report the value of each donation when filing your taxes, reducing the risk of discrepancies.

What happens if the IRS challenges the values I've reported?

The worksheet contains a disclaimer stating that while the values are believed to be reasonable, no guarantees are made regarding their accuracy. If the IRS challenges your reported values, you will assume responsibility for justifying them. Therefore, it's prudent to use the worksheet as a guide and support it with solid documentation and valuations whenever possible.

Can I set my own values for items not listed in the worksheet?

Yes, the worksheet provides a section for you to set your own values for any items that are not included. When doing so, it’s important to provide a realistic and justifiable estimate based on the item's condition and market value. This can help demonstrate good faith in reporting your charitable contributions.

Common mistakes

When completing the Charitable Worksheet form, individuals often encounter several common mistakes that can complicate their tax reporting and charitable donation valuations. Addressing these errors can lead to more accurate submissions and potential tax benefits.

One frequent error is failing to list separate donations for different entities. Each donation made to a distinct organization requires its own valuation report. For instance, if a person donates to the American Red Cross on one date and the Salvation Army on another, they should maintain separate records for each transaction. This method helps ensure clarity and compliance with IRS requirements.

Additionally, many people overlook the importance of accurately noting the date of each donation. The date is crucial not only for record-keeping but also for aligning with the correct tax year. Errors in dating can lead to complications during an audit, so it's essential to keep a precise account of when donations were made.

Misclassifying items is another common mistake. Each item donated should be categorized correctly according to its condition, whether it's 'Good', 'Better than Good', or 'Excellent'. This classification impacts the estimated value assigned, which might later be disputed if not clearly articulated and justified.

Many individuals also forget to attach or retain receipts with their worksheets. A thorough description of each item, as well as the receipt from the charitable organization, should be kept together with the worksheet. This documentation is vital for proving the legitimacy of the donations should they be questioned by the IRS.

Another issue arises from ignored analytical tools, like the Salvation Army "Valuation Guide." Not consulting this guide can lead to undervaluation or overvaluation of donated items, which can trigger further scrutiny from tax authorities.

Moreover, some may inaccurately estimate the value of miscellaneous items not assigned specific categories in the worksheet. Although individuals can assign their values, they must ensure these are reasonable and consistent with market trends to withstand potential audits.

Failure to provide adequate details about the items donated can also be a significant oversight. Merely stating 'clothing' without specifics creates ambiguity and may make it difficult to justify the assigned value later on.

People sometimes confuse the categorization of items like home goods and appliances, further complicating the valuation process. Each item should fit neatly into the specific categories provided in the worksheet to streamline evaluation.

Lastly, one mistake that is often made involves ignoring the need for a comprehensive review before submission. Rushing through the completion of the worksheet can lead to clerical errors, omissions, or miscalculations that may affect the final valuation and tax reporting.

Awareness of these common mistakes can empower individuals to complete their Charitable Worksheet more effectively. By maintaining meticulous records and seeking clarity on valuations, taxpayers can enhance both their compliance and accuracy regarding charitable contributions.

Documents used along the form

When dealing with non-cash charitable contributions, several important documents accompany the Charitable Worksheet form to ensure proper reporting and valuation of donations. Each of these documents serves a crucial role in documenting the entirety of your charitable giving process. Below is a list of common forms used alongside the Charitable Worksheet.

- Receipt from Charitable Organization: This document confirms the donation made to a charity. It typically includes the date, description of the items donated, and their estimated value. Keep this for your records.

- Form 8283: Required for non-cash contributions over $500, this IRS form provides details about the donated items and their fair market value, helping to substantiate your deduction on your tax return.

- Donation Valuation Guide: Many organizations provide a guide to help donors estimate the value of their contributions. This guide can be crucial for determining accurate fair market values for various items.

- List of Donated Items: A simple list detailing each item donated can be helpful. It should include quantities, brief descriptions, and estimated values to enhance your documentation.

- Appraisal Report: For more valuable items, an appraisal may be necessary to support the claimed deduction on your taxes. This report provides a professional valuation of the donated items.

- Form 1040: This is the standard individual income tax return form used to report your income, deductions, and credits, including any deductions for charitable contributions.

- State Tax Forms: Depending on your state, additional forms may be required to report charitable contributions on your state tax return. Check with your state’s tax authority for specifics.

Organizing these documents effectively allows for a smoother process when filing taxes and ensures that all contributions are accurately reported. You should always keep thorough records, as they may be necessary in case of an audit or inquiry from the IRS.

Similar forms

- Non-Cash Charitable Contributions Statement - Like the Charitable Worksheet form, this statement serves as documentation for non-cash donations. It details items donated and provides estimated values, helping taxpayers comply with IRS requirements for deducting charitable contributions.

- Donation Receipt Form - A donation receipt form provides proof of contributions made to charitable organizations. Similar to the Charitable Worksheet, it requires itemization of donated goods along with their estimated values for tax reporting.

- Appraisal Report for Charitable Contributions - This report offers a professional assessment of non-cash items donated. While the Worksheet provides estimated values, an appraisal report requires a certified appraisal to substantiate the reported values on tax forms, ensuring compliance with IRS guidelines.

- Schedule A (Form 1040) - This form is where non-cash charitable contributions are reported on the taxpayer's income tax return. It ultimately depends on accurate reporting in the Charitable Worksheet to inform the values inputted into Schedule A, reinforcing the necessity for meticulous record-keeping.

Dos and Don'ts

When filling out the Charitable Worksheet form, there are several important things to keep in mind. Below is a list of ten suggestions regarding what you should do and what you should avoid doing during this process.

- Do prepare a separate worksheet for each donation made.

- Do ensure that receipts are attached for the donations listed.

- Do describe items donated in a clear and accurate manner.

- Do use the provided valuation guide to estimate the worth of items.

- Do retain the worksheet with receipts for tax purposes.

- Don't combine multiple donations into one worksheet.

- Don't overlook the importance of accurate item descriptions.

- Don't use outdated values or estimates for items donated.

- Don't forget to include the date and entity name for each donation.

- Don't discard or misplace any relevant documents associated with your donations.

Misconceptions

Here are some common misconceptions about the Charitable Worksheet form:

- The worksheet is official IRS documentation. The Charitable Worksheet is a tool for estimating values but is not official IRS documentation.

- You can use one worksheet for multiple donations. Each donation to different entities or on different dates requires a separate worksheet to ensure accuracy.

- The values provided are guaranteed to be accurate. The values are based on historical estimates and are not guaranteed; the user assumes responsibility for their accuracy.

- You do not need receipts if you use the worksheet. It is essential to keep receipts that describe donated items, even when using the worksheet.

- The worksheet is only for clothing donations. The worksheet covers a variety of non-cash contributions, including household goods and appliances.

- You should not keep the worksheet after filing your taxes. Retaining the worksheet with your tax files is important in case the IRS questions your valuations.

- The worksheet reflects current valuation trends. The worksheet is based on a valuation guide from years ago and does not reflect real-time conditions or market values.

- You don’t need to list the condition of the items donated. The worksheet asks for the condition of items (Good, Better, Excellent) to help determine accurate valuations.

Key takeaways

Filling out and using the Charitable Worksheet form requires attention to detail and adherence to specific guidelines. Here are key takeaways to consider:

- Document Each Donation: Prepare a separate valuation report for each donation made to distinct entities or on different dates.

- Include Accurate Descriptions: Ensure receipts provide a reasonably accurate description of each item donated. This helps validate your contributions if questioned.

- Understand Valuation Source: The values for items are derived from the Salvation Army's valuation guide, which may vary. Use these as estimates, and remain cautious about potential IRS challenges.

- Retain Record Keeping: Keep the completed worksheet with donation receipts in your tax file as evidence of your contributions.

- Know Your Tax Year: Clearly indicate the tax year and the date each item was given on the worksheet to ensure proper record keeping.

- Use Reliable Estimates: If items do not fall within listed categories, assign your best estimate of value to those items. Document these with care.

Browse Other Templates

Working Papers Nj - Parent/guardian authorization is crucial and must be clearly documented on the form.

Remodeling Contract Example - States the legal status of the contract and the necessity for both parties' initial agreement.