Fill Out Your Charlotte Metro Credit Union Direct Deposit Form

Direct deposit is a convenient option that many members of the Charlotte Metro Credit Union can utilize to streamline their banking experience. This form is essential for setting up direct deposits into your savings account, facilitating faster access to your funds. It contains key information, such as the member’s name, savings account number, and the routing number for Charlotte Metro, which is 253075028. Members are encouraged to provide this form to their payroll department to ensure accurate processing. Notably, deposits do not require separate deposit slips, as this form serves as proper verification of the member's account. For any questions or further verification, members can readily contact Charlotte Metro at 704.375.0183. The form also allows members to specify whether they wish to receive their full pay or a partial amount. Completing this form accurately helps ensure that your direct deposits are processed smoothly and efficiently, enhancing your banking experience with Charlotte Metro Credit Union.

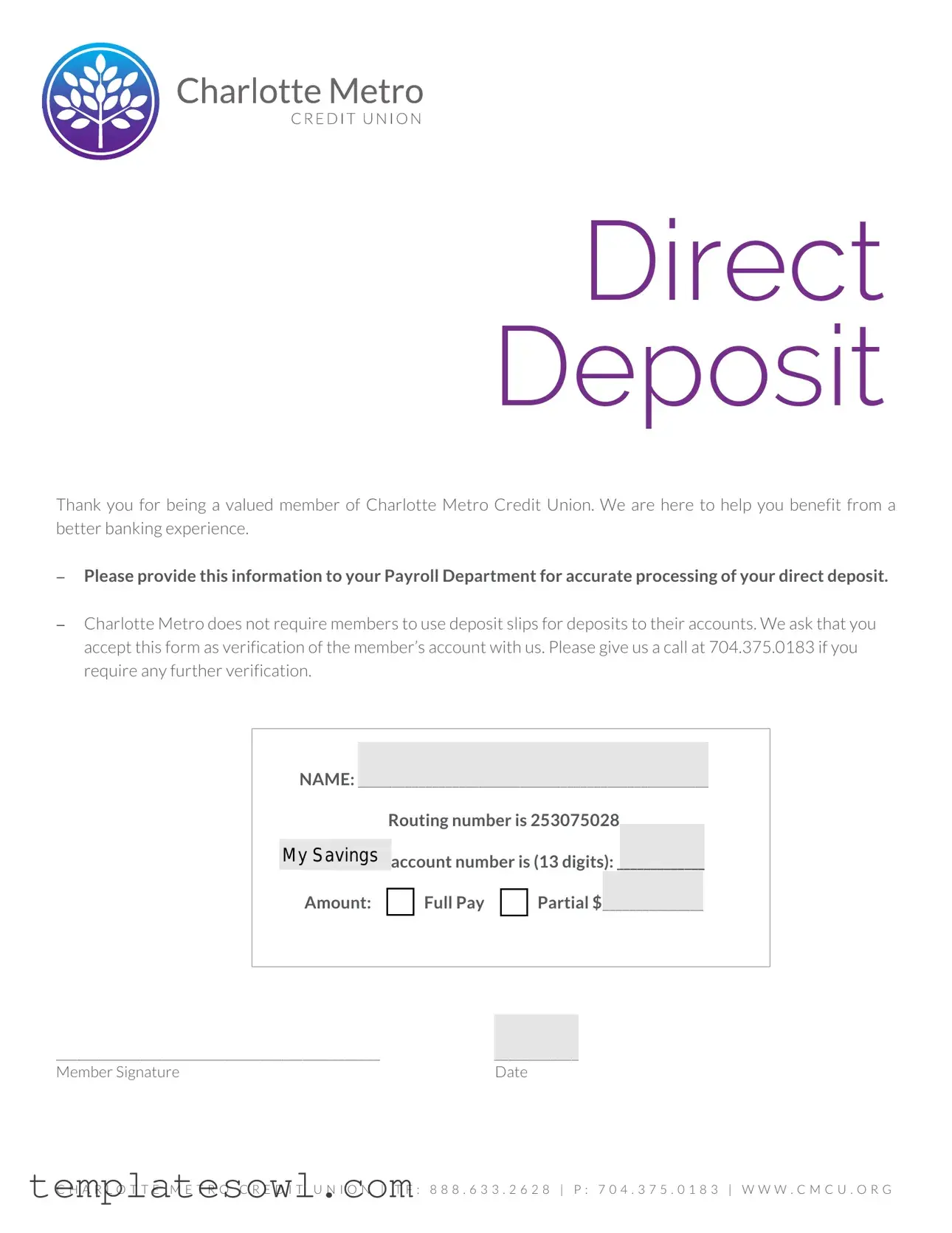

Charlotte Metro Credit Union Direct Deposit Example

Direct

Deposit

Thank you for being a valued member of Charlotte Metro Credit Union. We are here to help you benefit from a better banking experience.

−Please provide this information to your Payroll Department for accurate processing of your direct deposit.

−Charlotte Metro does not require members to use deposit slips for deposits to their accounts. We ask that you accept this form as verification of the member’s account with us. Please give us a call at 704.375.0183 if you require any further verification.

NAME: ____________________________________________________

Routing number is 253075028

My Savings |

account number is (13 digits): _____________ |

||

Amount: |

Full Pay |

Partial $ |

_______________ |

______________________________________________ |

____________ |

Member Signature |

Date |

C H A R L O T T E M E T R O C R E D I T U N I O N | T F : 8 8 8 . 6 3 3 . 2 6 2 8 | P : 7 0 4 . 3 7 5 . 0 1 8 3 | W W W . C M C U . O R G

Form Characteristics

| Fact Name | Description |

|---|---|

| Routing Number | The routing number for Charlotte Metro Credit Union is 253075028. |

| Account Type | Members can directly deposit funds into their savings accounts without needing deposit slips. |

| Member Verification | This form serves as verification of the member's account and should be provided to the Payroll Department. |

| Contact Information | If you need further assistance, you can call 704.375.0183 for support. |

Guidelines on Utilizing Charlotte Metro Credit Union Direct Deposit

Completing the Charlotte Metro Credit Union Direct Deposit form is straightforward. You'll need to provide specific information about your bank account to ensure that your funds are deposited correctly. After you fill out the form, submit it to your payroll department for processing.

- Begin by writing your name in the designated space at the top of the form.

- Locate the routing number field. Here, enter the routing number: 253075028.

- In the account number section, fill in your Savings account number, ensuring it is 13 digits long.

- Specify the amount of your direct deposit. Choose between "Full Pay" or "Partial" and clearly indicate the amount if you select "Partial."

- Sign your name in the Member Signature field to authorize the deposit.

- Add the date in the space provided next to your signature.

Once the form is completed, ensure it is submitted to your payroll department so they can process it accordingly. If you have any questions or need assistance, don't hesitate to reach out to Charlotte Metro Credit Union at 704-375-0183.

What You Should Know About This Form

What is the purpose of the Direct Deposit form for Charlotte Metro Credit Union?

The Direct Deposit form serves to facilitate the electronic transfer of funds directly into your Charlotte Metro Credit Union account. It streamlines the process, reducing the need for physical checks and ensuring that your funds are deposited efficiently. By providing this form to your payroll department, you enable them to process your direct deposits with the correct account details, enhancing your banking experience.

What information do I need to fill out on the Direct Deposit form?

You will need to provide several key pieces of information on the form. First, your full name must be included to identify your account. Next, the routing number for Charlotte Metro Credit Union is essential; this number is 253075028 and should be clearly marked on the form. You must also input your 13-digit savings account number, which directs the deposit to the proper account. Additionally, you can indicate whether you would like your full pay deposited or a partial amount, should you choose a specific figure for a partial deposit.

Do I need to use deposit slips along with my Direct Deposit form?

No, Charlotte Metro Credit Union does not require members to use deposit slips for deposits into their accounts. Instead, the Direct Deposit form itself acts as verification of your account, streamlining the process further. There's no need for additional paperwork, which simplifies your banking experience.

What should I do if I need further verification of my account?

If you require additional verification or have questions regarding the Direct Deposit form, you can contact Charlotte Metro Credit Union directly. The team can be reached at 704.375.0183. They are available to assist you with any inquiries you may have and to ensure that your direct deposit is set up correctly.

How do I submit the completed Direct Deposit form?

Common mistakes

Filling out the Charlotte Metro Credit Union Direct Deposit form can be straightforward, but some common mistakes can lead to issues with processing. One frequent error is incomplete information. Members often forget to fill in crucial details, such as their full name, which can result in delays. Proper identification is key. Ensure your name matches the records at the credit union.

Another common mistake involves miswriting the routing number. The routing number, which is 253075028, must be precisely recorded. Even a single incorrect digit can direct funds to the wrong account. Double-check this number to avoid any complications with your deposits.

Some members mistakenly confuse the account type, leading them to fill out the wrong account number. Only the savings account number should be provided, and it must contain 13 digits. Failure to follow this format could result in a rejected deposit.

Additionally, members sometimes neglect to specify the deposit amount. Choosing either a full or partial deposit is essential. If opting for a partial deposit, clearly state the amount to ensure accurate processing. Leaving this section blank can cause funds to be deposited incorrectly or not at all.

Lastly, forgetting to sign and date the form is a common oversight. This signature serves as verification that you authorize the deposit to your account. A missing signature could lead to the form being considered invalid, which can delay your direct deposit setup. Always remember to check off these details before submitting the form to ensure a seamless banking experience.

Documents used along the form

When setting up a direct deposit with Charlotte Metro Credit Union, there are several forms and documents you may encounter. Each serves a specific purpose to ensure the smooth processing of your banking needs. Here is a brief overview of key documents often used alongside the Direct Deposit form:

- Paystub: A paystub provides details of your earnings, deductions, and other relevant payroll information. Employers may require it to set up direct deposit accurately.

- Bank Account Information: This document includes your account number and routing number, which are necessary for directing funds to your account.

- Employee Information Form: This form collects essential information about you, such as your Social Security number and contact details. It's often needed for payroll processing.

- W-4 Form: The W-4 form helps your employer determine the right amount of federal income tax to withhold from your paycheck.

- Proof of Identity: A government-issued ID, such as a driver's license or passport, may be required to verify your identity when setting up direct deposit.

- Change of Address Form: If you've recently moved, this document updates your employer with your new address, ensuring all correspondence and documents reach you timely.

- Termination/Separation Notice: If you’ve left a job, this notice tells the credit union where to direct your final paycheck or any remaining balances owed.

Understanding these forms can make your direct deposit experience with Charlotte Metro Credit Union much smoother. Always keep an eye out for any specific requests from your employer to ensure all documentation is complete and accurate.

Similar forms

Several documents serve similar purposes to the Charlotte Metro Credit Union Direct Deposit form, often facilitating financial transactions and account management. Here is a list of six such documents, each sharing common characteristics:

- Direct Deposit Authorization Agreement: This document is used to authorize an employer or other entity to deposit funds directly into an account. Like the Charlotte Metro form, it requires account information such as routing and account numbers.

- Wire Transfer Authorization Form: Similar to the direct deposit form, this document allows individuals to authorize a one-time or recurring transfer of funds to another account. Both require details about the sender's and recipient's accounts.

- Social Security Direct Deposit Form: This form allows individuals to set up direct deposits for Social Security benefits. It includes similar account verification details, ensuring funds are deposited into the correct bank account.

- Payroll Deduction Authorization Form: Often used by companies for automatic deductions to savings accounts or retirement plans, this document requires similar account details and authorization just like the direct deposit form.

- Bank Account Application Form: When opening a new account, individuals complete this form, which includes personal information and account details. It serves to verify account ownership, analogous to submitting the direct deposit form.

- Auto-Payment Authorization Form: This form allows payments, such as utility bills or loan payments, to be automatically deducted from a bank account. Like the direct deposit form, it requires verified account information and consent.

These documents play a vital role in streamlining financial processes, ensuring that transactions are accurate and efficient.

Dos and Don'ts

When filling out the Charlotte Metro Credit Union Direct Deposit form, follow these guidelines to ensure a smooth process:

- Do provide your full name as it appears on your account.

- Do double-check the routing number (253075028) for accuracy.

- Do enter your 13-digit savings account number correctly.

- Do indicate whether you want full or partial pay.

- Do sign and date the form before submitting it.

- Don't forget to inform your Payroll Department that you are using this form.

- Don't use deposit slips as Charlotte Metro does not require them.

- Don't leave any sections of the form blank.

- Don't include any additional account numbers outside of the savings account number required.

- Don't hesitate to call Charlotte Metro at 704.375.0183 if you have questions.

Misconceptions

Understanding the Charlotte Metro Credit Union Direct Deposit form can sometimes lead to misunderstandings. Here are eight common misconceptions to clarify:

- Direct deposit forms are only for new members. Many assume that direct deposit forms are only necessary for those opening a new account. In reality, existing members who wish to set up, change, or cancel their direct deposits must also fill out this form.

- Deposit slips are required for direct deposits. It is a misconception that deposit slips are needed to process direct deposits. Charlotte Metro does not require deposit slips, as the Direct Deposit form itself serves as the verification of the member's account.

- You must fill out the entire form each time. Some believe that it's mandatory to complete every section of the form for each deposit. However, only the relevant sections need to be filled based on the specific changes being made—such as a new account number or amount changes.

- Direct deposit guarantees immediate access to funds. While direct deposit is often quicker and more efficient, it does not guarantee immediate access to funds. Processing times can vary based on your payroll department's schedule and timing.

- The routing number is only needed for new accounts. Many think the routing number is irrelevant if their account details haven't changed. However, providing the correct routing number is crucial for ensuring funds are deposited accurately, regardless of account familiarity.

- Everyone can see my direct deposit information. There is concern that personal details on the direct deposit form can be accessed by anyone. However, this form is intended for restricted use by your payroll department to ensure privacy and security.

- Once submitted, you cannot make changes. Some members worry that submitting the form locks them into their decisions. In fact, the form can be resubmitted if changes are necessary, allowing for flexibility in managing account settings.

- All payroll departments handle the form in the same manner. There may be an assumption that every payroll department processes direct deposit forms similarly. Each workplace may have distinct protocols, so it’s important to check with your specific payroll department on their requirements.

Comprehending these misconceptions helps in making informed decisions regarding your direct deposits with Charlotte Metro Credit Union. If any questions remain, reaching out to customer service can provide additional guidance and clarity.

Key takeaways

Charlotte Metro Credit Union Direct Deposit Form simplifies the way you receive funds. Here are some key takeaways to help you complete and use the form effectively:

- Provide the form to your Payroll Department for accurate processing.

- The routing number for Charlotte Metro is 253075028.

- Enter your savings account number, which should be 13 digits long.

- You can choose to receive your paycheck via full pay or a partial deposit.

- Make sure to sign and date the form to validate your request.

- No deposit slips are needed; this form serves as your verification.

- If you have questions, call 704.375.0183 for assistance.

By being thorough with this form, you ensure that your direct deposit is processed without issues, making your banking experience smoother.

Browse Other Templates

Transfer on Death Deed Form Michigan - It is crucial for petitioners to declare the contents of the application under penalty of perjury.

Real Estate Client Information Sheet - Buyers can reflect on their readiness to navigate the real estate market.