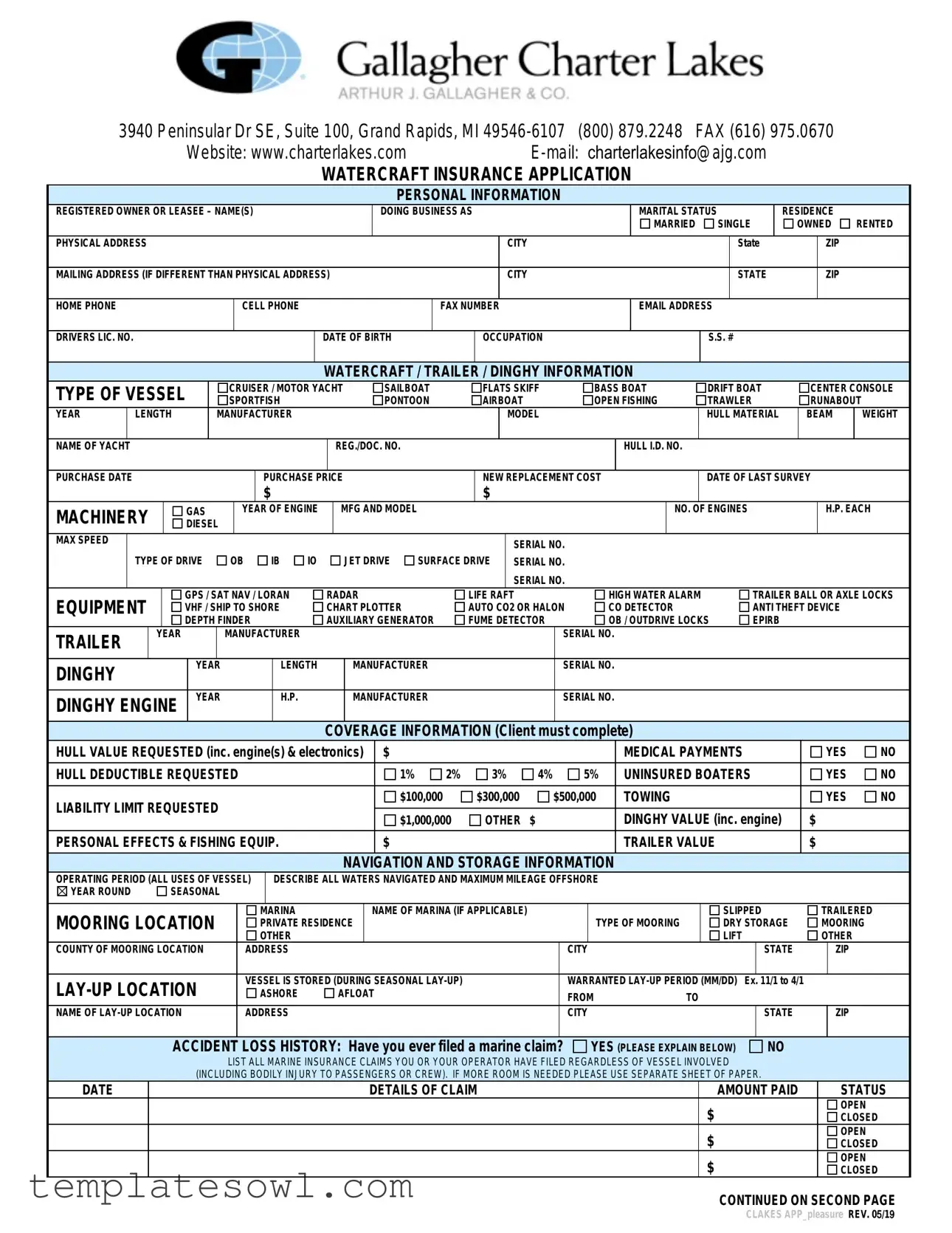

Fill Out Your Charter Lakes Insurance Application Form

The Charter Lakes Insurance Application form is a comprehensive document designed to gather essential information from applicants seeking watercraft insurance. It includes various sections aiming to cover personal information, such as the applicant's name, marital status, and contact details, which facilitate easy communication. The section detailing the watercraft itself asks for specifics like type, year, manufacturer, size, and identification numbers, ensuring clarity and precision in the insurable asset. Additionally, applicants are required to provide information on machinery, equipment, and the value of the watercraft, further strengthening the application process. Coverage preferences are clearly outlined, allowing individuals to specify hull value, liability limits, and whether they require medical payments or towing options. The form also requests details about navigation and storage, including lay-up periods and marina information, to assess risk accurately. Importantly, it prompts for a history of accidents or claims, allowing insurers to gauge the risk presented by the applicant and their vessel. Lastly, the General Information section inquires about intended usage of the watercraft, which can notably affect underwriting decisions. This methodical layout helps streamline the process for both the applicant and the insurance provider, ensuring all critical factors are accounted for in the insurance underwriting process.

Charter Lakes Insurance Application Example

|

|

3940 Peninsular Dr SE, Suite 100, Grand Rapids, MI |

(800) 879.2248 FAX (616) 975.0670 |

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

Website: www.charterlakes.com |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WATERCRAFT INSURANCE APPLICATION |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PERSONAL INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

REGISTERED OWNER OR LEASEE – NAME(S) |

|

|

|

|

|

|

|

|

|

|

DOING BUSINESS AS |

|

|

|

|

|

|

|

MARITAL STATUS |

|

|

RESIDENCE |

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MARRIED |

SINGLE |

|

OWNED |

RENTED |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PHYSICAL ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

ZIP |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

MAILING ADDRESS (IF DIFFERENT THAN PHYSICAL ADDRESS) |

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

ZIP |

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

HOME PHONE |

|

|

|

|

|

|

|

|

|

CELL PHONE |

|

|

|

|

|

|

|

|

|

FAX NUMBER |

|

|

|

|

|

|

|

|

|

EMAIL ADDRESS |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

DRIVERS LIC. NO. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE OF BIRTH |

|

|

|

OCCUPATION |

|

|

|

|

|

|

|

S.S. # |

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WATERCRAFT / TRAILER |

/ DINGHY INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

TYPE OF VESSEL |

|

|

CRUISER / MOTOR YACHT |

SAILBOAT |

|

FLATS SKIFF |

|

BASS BOAT |

DRIFT BOAT |

CENTER CONSOLE |

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

SPORTFISH |

|

|

|

|

|

|

|

PONTOON |

|

AIRBOAT |

|

|

|

|

OPEN FISHING |

TRAWLER |

RUNABOUT |

|

||||||||||||||||||||||||||||

|

|

YEAR |

|

LENGTH |

|

|

|

MANUFACTURER |

|

|

|

|

|

|

|

|

|

|

|

|

|

MODEL |

|

|

|

|

|

|

|

HULL MATERIAL |

BEAM |

WEIGHT |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME OF YACHT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REG./DOC. NO. |

|

|

|

|

|

|

|

|

|

|

|

|

HULL I.D. NO. |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

PURCHASE DATE |

|

|

|

|

|

|

|

|

|

|

PURCHASE PRICE |

|

|

|

|

NEW REPLACEMENT COST |

|

|

|

|

|

DATE OF LAST SURVEY |

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MACHINERY |

|

GAS |

|

YEAR OF ENGINE |

|

|

MFG AND MODEL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NO. OF ENGINES |

|

H.P. EACH |

|

|||||||||||||||||||||||

|

|

|

DIESEL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

MAX SPEED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SERIAL NO. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

TYPE OF DRIVE |

OB |

|

IB |

IO |

|

|

|

JET DRIVE |

SURFACE DRIVE |

SERIAL NO. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SERIAL NO. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

EQUIPMENT |

|

|

GPS / SAT NAV / LORAN |

|

|

RADAR |

|

|

|

LIFE RAFT |

|

|

|

|

|

HIGH WATER ALARM |

|

|

TRAILER BALL OR AXLE LOCKS |

|

||||||||||||||||||||||||||||

|

|

|

VHF / SHIP TO SHORE |

|

|

CHART PLOTTER |

|

|

AUTO CO2 OR HALON |

|

|

CO DETECTOR |

|

|

ANTI THEFT DEVICE |

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

DEPTH FINDER |

|

|

|

|

|

AUXILIARY GENERATOR |

FUME DETECTOR |

|

|

OB / OUTDRIVE LOCKS |

EPIRB |

|

|

|

|

|

||||||||||||||||||||||||||

|

|

TRAILER |

|

|

YEAR |

|

|

|

|

MANUFACTURER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SERIAL NO. |

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

DINGHY |

|

|

|

|

|

YEAR |

|

|

|

|

|

LENGTH |

|

|

|

MANUFACTURER |

|

|

|

|

|

|

SERIAL NO. |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

DINGHY ENGINE |

|

YEAR |

|

|

|

|

H.P. |

|

|

|

|

|

MANUFACTURER |

|

|

|

|

|

|

SERIAL NO. |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COVERAGE INFORMATION (Client must complete) |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

HULL VALUE REQUESTED (inc. engine(s) & electronics) |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

MEDICAL PAYMENTS |

|

YES |

NO |

|

||||||||||||||||||||||||||||||

|

|

HULL DEDUCTIBLE REQUESTED |

|

|

|

|

|

|

|

|

|

|

1% |

2% |

3% |

4% |

|

|

5% |

|

UNINSURED BOATERS |

|

YES |

NO |

|

|||||||||||||||||||||||||

|

|

LIABILITY LIMIT REQUESTED |

|

|

|

|

|

|

|

|

|

|

|

|

$100,000 |

$300,000 |

$500,000 |

|

TOWING |

|

|

|

|

|

|

YES |

NO |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$1,000,000 |

|

OTHER |

$ |

|

|

|

|

|

DINGHY VALUE (inc. engine) |

$ |

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

PERSONAL EFFECTS & FISHING EQUIP. |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

TRAILER VALUE |

|

|

|

$ |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAVIGATION AND STORAGE INFORMATION |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

OPERATING PERIOD (ALL USES OF VESSEL) |

|

|

DESCRIBE ALL WATERS NAVIGATED AND MAXIMUM MILEAGE OFFSHORE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

YEAR ROUND |

|

|

|

SEASONAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

MOORING LOCATION |

|

|

|

MARINA |

|

|

|

|

|

|

|

NAME OF MARINA (IF APPLICABLE) |

|

|

|

|

|

|

|

|

|

|

SLIPPED |

|

TRAILERED |

|

||||||||||||||||||||||

|

|

|

|

PRIVATE RESIDENCE |

|

|

|

|

|

|

|

|

|

|

|

|

TYPE OF MOORING |

|

DRY STORAGE |

|

MOORING |

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIFT |

|

OTHER |

|

|

|||||||

|

|

COUNTY OF MOORING LOCATION |

|

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

STATE |

|

|

ZIP |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

VESSEL IS STORED (DURING SEASONAL |

|

|

|

|

|

|

|

WARRANTED |

Ex. |

11/1 to 4/1 |

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

ASHORE |

|

|

|

|

AFLOAT |

|

|

|

|

|

|

|

|

|

FROM |

|

|

|

TO |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

NAME OF |

|

|

|

|

|

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

STATE |

|

|

ZIP |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

ACCIDENT |

LOSS HISTORY: Have you ever filed a marine claim? |

|

|

YES (PLEASE EXPLAIN BELOW) |

|

NO |

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

LIST ALL MARINE INSURANCE CLAIMS YOU OR YOUR OPERATOR HAVE FILED REGARDLESS OF VESSEL INVOLVED |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

(INCLUDING BODILY INJURY TO PASSENGERS OR CREW). IF MORE ROOM IS NEEDED PLEASE USE SEPARATE SHEET OF PAPER. |

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

DATE

DETAILS OF CLAIM |

|

AMOUNT PAID |

STATUS |

|

$ |

|

OPEN |

|

|

CLOSED |

|

|

$ |

|

OPEN |

|

|

CLOSED |

|

|

$ |

|

OPEN |

|

|

CLOSED |

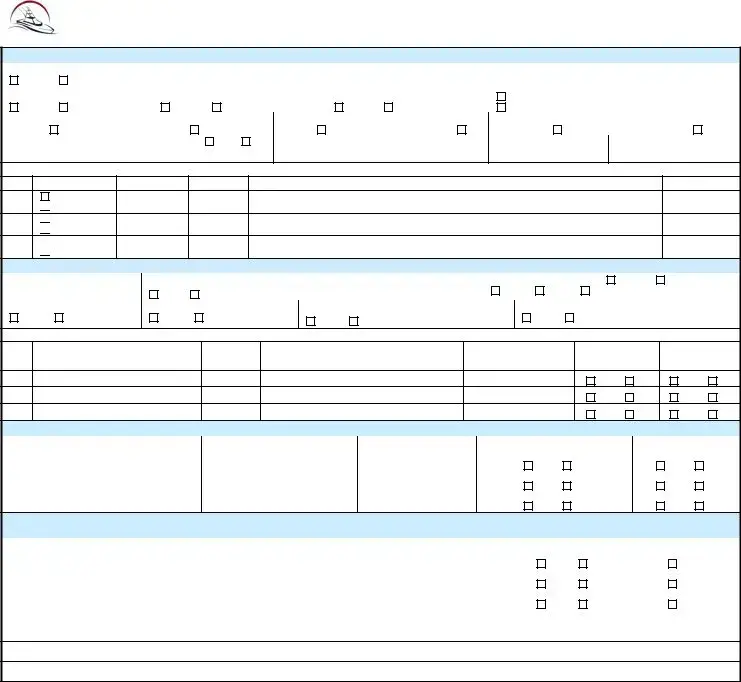

CONTINUED ON SECOND PAGE

CLAKES APP_pleasure REV. 05/19

CONTINUED

GENERAL INFORMATION

IS THIS VESSEL USED FOR CHARTER OR ANY OTHER COMMERCIAL PURPOSES? |

IF YES, PLEASE EXPLAIN |

|

|

|

|

|

||||||

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

DO YOU TOW SKIERS? |

IS VESSEL USED FOR RACING? |

|

IS VESSEL USED AS A LIVEABOARD? |

PRIMARY RESIDENCE |

|

|

||||||

YES |

NO |

YES |

NO |

|

|

YES |

NO |

|

SECONDARY RESIDENCE |

|

|

|

HAS ANY NAMED INSURED EVER BEEN |

CONVICTED OF A |

|

ANY DRIVING |

VIOLATIONS IN THE LAST THREE |

|

HAVE YOU EVER BEEN REFUSED INSURANCE OR |

|

|||||

FELONY? |

YES (PLEASE EXPLAIN BELOW) |

NO |

|

YEARS? |

YES (PLEASE EXPLAIN BELOW) |

NO |

CANCELLED? |

YES (PLEASE EXPLAIN BELOW) |

NO |

|||

ANY EXISTING OR PRIOR DAMAGE TO THE YACHT? |

YES |

NO |

CURRENT INSURANCE CARRIER |

|

EXPIRATION DATE |

CURRENT PREMIUM |

|

|||||

IF YES, EXPLAIN ON FIRST PAGE UNDER CLAIM INFORMATION |

|

|

|

|

|

|

|

$ |

|

|||

LIST PREVIOUS VESSELS OWNED OR OPERATED:

# |

YEAR |

LENGTH |

MANUFACTURER |

OWNED

1. OPERATED

OPERATED

OWNED

OWNED

2. OPERATED

OPERATED

OWNED

OWNED

3. OPERATED

OPERATED

OPERATOR / CREW INFORMATION

# YEARS

# YEARS BOATING EXPERIENCE |

ARE YOU A LICENSED CAPTAIN? |

# YRS LICENSED |

|

HAVE YOU COMPLETED A BOATING SAFETY COURSE? |

YES |

NO |

||||||

|

|

YES |

NO |

|

|

IF YES, PLEASE INDICATE: |

USPS |

USCG |

|

USCG AUX |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

IS VESSEL OWNER OPERATED? |

DO YOU EMPLOY A CAPTAIN? |

DO YOU EMPLOY |

CREW? |

HOW MANY? |

CAPTAIN & CREW COVERAGE REQUESTED? |

|||||||

YES |

NO |

YES |

NO |

YES |

NO |

|

|

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

LIST ADDITIONAL OPERATORS BELOW

#

1.

2.

3.

NAME |

DATE OF |

DRIVERS LICENSE NUMBER & STATE |

YRS. OPERATING |

USCG |

|

BOATING |

|

BIRTH |

EXPERIENCE |

LICENSE |

CLAIMS |

|

|||

|

|

|

|||||

|

|

|

|

YES |

NO |

YES |

NO |

|

|

|

|

YES |

NO |

YES |

NO |

|

|

|

|

YES |

NO |

YES |

NO |

CORPORATE OWNERSHIP AND CORPORATE OFFICERS

NAME |

PERCENTAGE OWNERSHIP |

TITLE |

DO YOU OPERATE VESSEL |

USCG LICENSED |

||

|

|

|

YES |

NO |

YES |

NO |

|

|

|

YES |

NO |

YES |

NO |

|

|

|

YES |

NO |

YES |

NO |

ADDITIONAL INSURED / CERTIFICATE HOLDER / LOSS PAYEE INFORMATION

(PLEASE ATTACH ADDITIONAL SHEET IF MORE SPACE IS NEEDED)

|

NAME |

|

ADDRESS: STREET, CITY, STATE, ZIP |

|

INTEREST |

|

|

|

|

|

|

AI |

CERT HOLDER |

LOSS PAYEE |

|

|

|

|

|

|

|

|

|

|

|

|

|

AI |

CERT HOLDER |

LOSS PAYEE |

|

|

|

|

|

|

|

|

|

|

|

|

|

AI |

CERT HOLDER |

LOSS PAYEE |

|

|

|

|

|

|

|

|

|

|

|

|

SPECIAL CONDITIONS / COMMENTS |

|

|

|

|

|

|

(PLEASE USE TO EXPLAIN ANY “YES” RESPONSES WHERE AN EXPLANATION IS REQUESTED) |

|

|

|

||

1.Any person who knowingly and with intent to defraud any insurance company or another person files an application for insurance containing any materially false information, or conceals for the purposes of misleading, information concerning a fact material thereto, commits a fraudulent insurance act, which is a crime and subjects the person to criminal and civil penalties.

2.As part of underwriting procedures, an investigative consumer report may be made which could include information regarding your character, general reputation, personal characteristics and mode of living. This information will be used solely by the underwriting insurance company(s). Future reports may be used for an update, renewal or extension of your insurance. At your request, we will provide you with the sources of these reports, their addresses and customer service phone numbers for verification and correction of your information.

3.By signing this document I declare that the statements within this Watercraft Application are true to the best of my knowledge and belief. The selections indicated within this Watercraft Application accurately reflect the limits, coverages and deductibles I desire. I understand and agree that the company may obtain from third parties information regarding me, my watercraft, and listed operators, including driving records, financial credit information and prior claims information. I understand that I have the right of access and correction with respect to all such information collected and that the company will provide further information regarding my statutory rights upon request.

|

HOW DID YOU HEAR ABOUT US? |

EFFECTIVE DATE OF COVERAGE |

APPLICANT SIGNATURE |

DATED |

|

|

|

|

|

|

My (the producer) signature verifies that all of the information on the application has been obtained by me |

PRODUCER (AGENT) SIGNATURE |

DATED |

|

from the applicant and that I have no reason or basis to believe that the information is anything but truthful. |

|

|

||

|

|

|

|

|

PAGE 2

CLAKES APP_pleasure REV. 05/19

Form Characteristics

| Fact Name | Details |

|---|---|

| Contact Information | The application includes essential contact details such as the address, phone number, fax, email, and website for Charter Lakes Insurance, located at 3940 Peninsular Dr SE, Suite 100, Grand Rapids, MI 49546-6107. |

| Personal Information Required | Applicants must provide personal information, including their name, marital status, physical and mailing addresses, phone numbers, driver's license number, date of birth, occupation, and Social Security number. |

| Watercraft Information | Details about the watercraft must be submitted, including the type of vessel, year, length, manufacturer, model, and Hull ID number, along with information about engines and equipment. |

| Governing Law | This form adheres to Michigan state laws regarding marine insurance, ensuring compliance with local regulations. |

Guidelines on Utilizing Charter Lakes Insurance Application

Completing the Charter Lakes Insurance Application form is an essential step toward securing insurance coverage for your watercraft. Be sure to have all relevant information on hand, including personal details, watercraft specifications, and any claim history. Following these instructions will help facilitate the process and ensure that you fill out the form accurately.

- Begin by filling in your personal information in the designated section. Include your full name, marital status, and your physical and mailing addresses. Provide your contact details, including phone numbers and email address.

- Next, input your driver's license number and date of birth. Indicate your occupation and Social Security number.

- Proceed to the watercraft information section. Specify the type of vessel you own, the year, length, manufacturer, model, hull material, and weight.

- Fill in the details for the registration, including the registration or documentation number, hull identification number, purchase date, and purchase price.

- In the machinery section, specify the type of engine, horsepower, maximum speed, and any serial numbers associated with the engines.

- List the equipment on board such as GPS, radar, life rafts, and any alarms.

- Provide the necessary information about the dinkhy if applicable, including its year, length, manufacturer, and serial number.

- Next, specify the coverage information you desire, including hull value, deductibles, and limits for medical payments and liability.

- Detail your navigation and storage information. Outline the operating period and describe the waters navigated, mooring location, and lay-up information.

- Complete the accident loss history section by indicating if you’ve filed any marine claims and provide details if applicable.

- Fill out the general information section, answering questions about vessel use and previous violations or claims.

- In the operator/crew information section, list your boating experience and whether you or your crew members have completed a boating safety course.

- If your watercraft has corporate ownership, fill in the relevant details about the owners and their percentages.

- Provide details for any additional insured parties or certificate holders that may apply.

- Finally, review the special conditions/comments section for any necessary explanations related to your answers.

- Sign the application to affirm the truthfulness of your information. Include your effective date of coverage and notes about how you learned about Charter Lakes Insurance.

- Have your producer or agent sign to verify the information was obtained correctly.

What You Should Know About This Form

What personal information is required on the Charter Lakes Insurance Application form?

The application requests several details about the registered owner or leasee. This includes their name, marital status, residence type, physical and mailing addresses, and contact information such as home and cell phone numbers, email address, and driver’s license number. Additionally, applicants must provide their date of birth and occupation.

What information about the watercraft must be provided?

Applicants need to specify details about the watercraft, trailer, or dinghy. This includes the type of vessel (e.g., cruiser, sailboat, pontoon), its year, length, manufacturer, and model. Other important information includes the hull material, beam width, weight, registration number, and hull identification number. Details about the engine, machinery, and any additional equipment should also be included.

How is coverage information determined in the application?

In order to request insurance coverage, clients must complete the coverage section of the application. This part includes specifying the hull value requested, indicating any medical payments desired, and selecting hull deductible amounts. Additionally, clients can choose liability limits they wish to have, along with options for towing and coverage for personal effects, trailers, and dinghies.

What should I do if I have a history of marine claims?

If you have previously filed marine insurance claims, it is important to disclose this information accurately in the application. The form contains a section dedicated to listing all insurance claims, where you provide details such as the date of the claim, the amount paid, and whether the claim is open or closed. Providing this information is essential for the underwriting process.

What happens if I fail to provide accurate information in the application?

It's crucial to provide truthful information on the Charter Lakes Insurance Application. Any individual who knowingly submits false information may be committing a fraudulent insurance act, which is a serious offense. This can lead to criminal and civil penalties. Furthermore, it could potentially void the insurance coverage being applied for.

Common mistakes

Completing the Charter Lakes Insurance Application form requires careful attention to detail. One common mistake people make is failing to provide accurate personal information. The personal information section includes critical details such as your full name, date of birth, and driver's license number. Even a slight error can lead to delays in processing your application or complications down the road when filing a claim.

Another frequent oversight occurs during the section dedicated to watercraft and equipment details. Applicants sometimes skip the "Year," "Length," or "Manufacturer" fields, leaving them blank. Incomplete information may result in incorrect coverage or an inability to have a claim deemed valid when the time comes. It is essential to be thorough and precise as you fill out this part of the application.

Additionally, many people underestimate the significance of the accident and loss history section. Failing to disclose prior claims or neglecting to answer questions about prior damage can lead to complications later. Even if you think a past incident is irrelevant, it is better to provide full transparency. Insurance providers may flag omissions as attempts to mislead, resulting in potential denial of claims or coverage altogether.

Lastly, individuals often neglect to review their entire application before submission. Rushing through this process increases the chances of making mistakes. After filling everything out, take a moment to read through each section carefully. Checking for inaccuracies or missing information could save significant time and headaches in the future. Submitting a well-prepared application helps ensure that you move forward without unnecessary delays.

Documents used along the form

When completing the Charter Lakes Insurance Application form, you may also encounter several other important documents. These forms provide additional information necessary for obtaining coverage and ensure a comprehensive understanding of your insurance needs.

- Declaration Page: This document summarizes your insurance policy details, including coverage amounts, deductibles, and important contact information. It serves as proof of your coverage and outlines the key terms and conditions of your insurance.

- Proof of Ownership: This may include documents like a bill of sale or registration certificate that verify you own the watercraft. Proof of ownership is critical for identifying your liability and coverage needs.

- Loss History Report: This report lists any past claims you've made on your watercraft. Insurers use this information to assess risk and determine your premium, making it essential for an accurate evaluation of your application.

- Captain's License Verification: If the boat is operated by a licensed captain, providing a copy of the license may be required. This helps confirm the experience and qualifications of the operator, which can influence coverage options.

- Safety Course Completion Certificate: If you have completed a boating safety course, submitting this certificate can demonstrate responsible boating practices. Insurers may offer discounts for individuals with this qualification.

- Corporate Documentation: For corporate-owned vessels, documentation such as bylaws and officer lists needs to be submitted. This verifies ownership structure and ensures correct underwriting processes.

Gathering these forms along with the Charter Lakes Insurance Application will help streamline your application process and ensure you get the coverage that best fits your needs.

Similar forms

- Personal Insurance Application: Similar to the Charter Lakes Insurance Application, a personal insurance application collects essential details about the applicant, including personal information, coverage preferences, and any prior claims history. Both forms aim to assess risk and determine appropriate coverage.

- Auto Insurance Application: Just like the watercraft insurance, an auto insurance application requires details about the vehicle, the owner's driving history, and any previous claims. Information such as the vehicle's make, model, and VIN parallels the data required for watercraft.

- Homeowners Insurance Application: This application gathers personal information and specifics about the home, akin to how the Charter Lakes form collects information about the watercraft. Both forms address the value of the property being insured and any vulnerabilities that may exist.

- Renters Insurance Application: Much like the Charter Lakes application, renters insurance applications require personal details, property information, and coverage preferences. The emphasis here is on securing personal belongings, similar to protecting the assets on a watercraft.

- Boat Registration Application: A boat registration application, like the Charter Lakes form, gathers information about the owner, vessel specifications, and usage intentions. Both documents help establish legal ownership and authority over the watercraft.

- Health Insurance Application: The similarities lie in the personal identification details and health history, both of which inform coverage decisions. Accurate information is crucial for the insurer to assess risk effectively, just as in the watercraft application.

- Travel Insurance Application: Information about the insured's personal background, travel plans, and any previous claims are vital to both travel and watercraft insurance applications. Each form assesses potential risks encountered during travel or navigation.

- Liability Insurance Application: Like the Charter Lakes form, a liability insurance application requires comprehensive personal details and information about what is being insured (property, activities). Both application types share the goal of protecting against unforeseen liabilities.

Dos and Don'ts

Dos and Don'ts for Filling Out the Charter Lakes Insurance Application Form

- Do read all instructions carefully before starting the application.

- Do provide accurate information to avoid issues later.

- Do double-check all entries for spelling and numerical errors.

- Do keep a copy of your completed application for reference.

- Do ensure all required documents are included with the application.

- Don't leave any sections blank; provide "N/A" if not applicable.

- Don't rush through the application; take your time to be thorough.

- Don't provide misleading or incorrect information.

- Don't forget to sign and date the application before submission.

- Don't ignore the deadline for submission to ensure timely processing.

Misconceptions

Here are some common misconceptions regarding the Charter Lakes Insurance Application form:

- It’s only for new boat owners. Many believe that the application is exclusively for individuals purchasing a new watercraft. In reality, it is suitable for anyone who wants to insure their vessel, whether new or used.

- All questions must be answered. Some users feel overwhelmed by the number of questions. However, certain sections only require completion if they pertain to the applicant's specific situation, meaning not everything must be filled out.

- You don’t need prior boating experience. A misconception exists that prior boating experience is irrelevant. Conversely, details about boating experience can influence the application process and coverage options.

- This form is the final step. There's an assumption that submitting the application is the last action needed. In fact, after submission, the insurance provider may request additional information or clarifications.

- Insurance is guaranteed after submitting the application. Many think that filing the application guarantees coverage. However, approval depends on the underwriting review of the submitted information.

- Only one type of coverage is available. Some believe that the application allows for only a single type of insurance. The truth is that applicants have options and can choose various coverage levels based on their needs.

- All claims will be approved. There’s a misconception that all claims disclosed in the application will automatically be accepted. Each claim undergoes a review process, and approval is not guaranteed.

- It’s unnecessary to report minor claims. Some applicants think that small claims can be overlooked. However, all claims, regardless of size, should be listed for a complete and honest application.

- Personal information is not protected. Many worry about the safety of their personal data. In fact, insurance companies have privacy policies in place to protect the information provided in the application.

Understanding these common misunderstandings can help applicants complete the Charter Lakes Insurance Application form with confidence and clarity.

Key takeaways

Filling out the Charter Lakes Insurance Application form is a critical step for securing the appropriate marine insurance coverage. Here are key takeaways to consider:

- Accuracy is Crucial: Providing precise information about your vessel, including its type, model, and any equipment on board, helps ensure you receive the correct coverage. Incorrect details may lead to coverage disputes later on.

- Be Thorough with Your History: Disclose any previous marine insurance claims or driving violations. This information impacts underwriting decisions and premium calculations.

- Understand Coverage Options: Familiarize yourself with the different types of coverage available, such as hull value, medical payments, and towing. Knowing what you need can facilitate a smoother application process.

- Provide Complete Contact Information: Make sure to give accurate contact details for quick communication. This includes phone numbers, email addresses, and any additional insured parties if applicable.

Browse Other Templates

Promotion Qualification Report,Officer Advancement Documentation,Military Promotion Assessment Form,Service Member Qualification Review,Officer Promotion Evaluation Sheet,Rank Advancement Agreement Form,Military Officer Review Record,Promotion Eligib - The form also includes details about the officer’s previous position, if applicable.

Policy Brief - Developing a personal method for case briefing can make legal study more efficient.

Bill of Sale Template Uk - Inaccuracies in personal information can lead to complications post-sale.