Fill Out Your Chase D19693 Rma 0913 Form

The Chase D19693 RMA 0913 form serves as a vital tool for homeowners facing financial hardship, aiming to streamline the mortgage assistance process. This form collects essential information, beginning with personal details such as the customer’s name and loan number, to establish the basis for their request. It guides applicants through a series of steps, helping them share their unique situations, including specific hardships they may be facing—whether it be unemployment, excessive obligations, or unforeseen medical expenses. The form also outlines what documentation is necessary to support their claims, allowing for a more tailored assessment of assistance options. Furthermore, it emphasizes the importance of open communication, permitting customers to indicate how they prefer to be contacted, and includes a section for optional third-party authorizations. Completing the Chase RMA form empowers individuals to take proactive steps toward finding a viable solution to their mortgage challenges, ultimately encouraging a collaborative approach to financial recovery.

Chase D19693 Rma 0913 Example

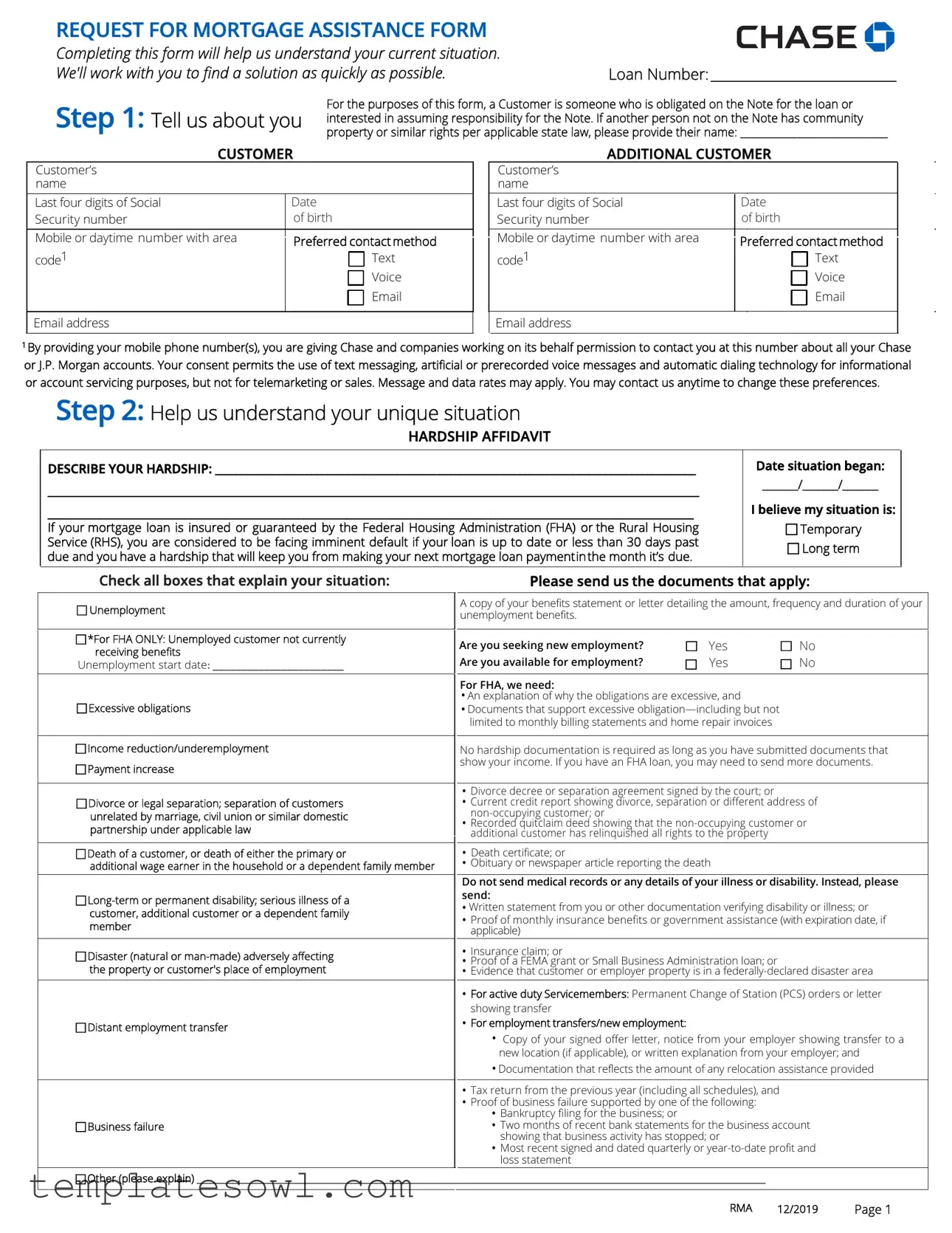

REQUEST FOR MORTGAGE ASSISTANCE FORM

Completing this form will help us understand your current situation. |

|

We'll work with you to find a solution as quickly as possible. |

Loan Number: _____________________________ |

Step 1: Tell us about you |

For the purposes of this form, a Customer is someone who is obligated on the Note for the loan or |

interested in assuming responsibility for the Note. If another person not on the Note has community |

|

|

property or similar rights per applicable state law, please provide their name: ______________________________ |

CUSTOMER

Customer’s name

Last four digits of Social |

Date |

||

Security number |

of birth |

||

|

|

|

|

Mobile or daytime number with area |

Preferred contact method |

|

|

|

|||

code1 |

Text |

|

|

|

Voice |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email address |

|

|

|

|

|

|

|

ADDITIONAL CUSTOMER

Customer’s name

|

|

Last four digits of Social |

Date |

|

|

|

|

Security number |

of birth |

|

|

|

|

|

|

|

|

|

|

Mobile or daytime number with area |

Preferred contact method |

|

|

|

|

||||

|

|

code1 |

Text |

|

|

|

|

|

Voice |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1By providing your mobile phone number(s), you are giving Chase and companies working on its behalf permission to contact you at this number about all your Chase or J.P. Morgan accounts. Your consent permits the use of text messaging, artificial or prerecorded voice messages and automatic dialing technology for informational or account servicing purposes, but not for telemarketing or sales. Message and data rates may apply. You may contact us anytime to change these preferences.

Step 2: Help us understand your unique situation

HARDSHIP AFFIDAVIT

DESCRIBE YOUR HARDSHIP: __________________________________________________________________________________________

__________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________

If your mortgage loan is insured or guaranteed by the Federal Housing Administration (FHA) or the Rural Housing Service (RHS), you are considered to be facing imminent default if your loan is up to date or less than 30 days past due and you have a hardship that will keep you from making your next mortgage loan paymentin the month it’s due.

Date situation began:

_______/_______/_______

I believe my situation is:

nTemporary n Long term

Check all boxes that explain your situation:

nUnemployment

n*For FHA ONLY: Unemployed customer not currently receiving benefits

Unemployment start date: _______________________

nExcessive obligations

nIncome reduction/underemployment

nPayment increase

nDivorce or legal separation; separation of customers unrelated by marriage, civil union or similar domestic partnership under applicable law

nDeath of a customer, or death of either the primary or

additional wage earner in the household or a dependent family member

n

nDisaster (natural or

nDistant employment transfer

nBusiness failure

Please send us the documents that apply:

A copy of your benefits statement or letter detailing the amount, frequency and duration of your unemployment benefits.

Are you seeking new employment? |

n |

Yes |

n No |

Are you available for employment? |

n |

Yes |

n No |

For FHA, we need:

• An explanation of why the obligations are excessive, and

• Documents that support excessive

No hardship documentation is required as long as you have submitted documents that show your income. If you have an FHA loan, you may need to send more documents.

•Divorce decree or separation agreement signed by the court; or

•Current credit report showing divorce, separation or different address of

•Recorded quitclaim deed showing that the

•Death certificate; or

•Obituary or newspaper article reporting the death

Do not send medical records or any details of your illness or disability. Instead, please

send:

•Written statement from you or other documentation verifying disability or illness; or

•Proof of monthly insurance benefits or government assistance (with expiration date, if applicable)

•Insurance claim; or

•Proof of a FEMA grant or Small Business Administration loan; or

•Evidence that customer or employer property is in a

•For active duty Servicemembers: Permanent Change of Station (PCS) orders or letter showing transfer

•For employment transfers/new employment:

•Copy of your signed offer letter, notice from your employer showing transfer to a new location (if applicable), or written explanation from your employer; and

•Documentation that reflects the amount of any relocation assistance provided

•Tax return from the previous year (including all schedules), and

•Proof of business failure supported by one of the following:

•Bankruptcy filing for the business; or

•Two months of recent bank statements for the business account showing that business activity has stopped; or

•Most recent signed and dated quarterly or

nOther (please explain) _______________________________________________________________________________________________________________________________

RMA |

12/2019 |

Page 1 |

REQUEST FOR MORTGAGE ASSISTANCE FORM

Step 3: Help us determine your optionsLoan Number: _____________________________

I'm interested in: |

n |

All assistance options |

|

|

n Only options that involve moving out of the property ADDITIONAL CONTRIBUTOR INFORMATION (Optional)

Does anyone not listed on the loan live in and contribute financially to the household? n Yes n No

Monthly amount they contribute to the household (including amount contributed to the mortgage): $ ___________________________

First and Last Name(s): __________________________________________________ |

Please indicate any living expenses for this person(s) in |

|

the Contributor column of the Monthly Living Expenses |

Last four digits of SSN: __________________________________________________ |

section of this form (see next page). |

For each additional contributor on the property, please complete an Authorization to Obtain Consumer Credit Report form, which you’ll

find in the Forms Center at chase.com/MortgageAssistance. Please also provide proof of the contributor's income.

MONTHLY HOUSEHOLD INCOME

Customer

Contributor

WAGE: |

|

|

|

|

|

Employer 1 name: _________________________________________ Start date: _____/_____/_______ |

|

|

|

||

If you work seasonally or in the education field, how many months per year are you |

|

|

|

||

paid:________ |

|

$ |

$ |

$ |

|

|

|

|

|

|

|

WAGE: |

|

|

|

|

|

Employer 2 name: _________________________________________ Start date: _____/_____/_______ |

|

|

|

||

If you work seasonally or in the education field, how many months per year are you |

|

|

|

||

paid:________ |

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

||

(Includes 1099 income) |

|

$ |

$ |

$ |

|

Percentage of business ownership: _______% |

|||||

|

|

|

|||

|

|

|

|

|

|

Benefits Income: |

|

|

|

|

|

Social Security benefits, investments, pensions or other retirement benefits |

$ |

$ |

$ |

||

Please specify: ________________________________________ |

|||||

|

|

|

|||

|

|

|

|

|

|

Voluntary Income: |

|

|

|

|

|

Child support/alimony/separation maintenance |

$ |

$ |

$ |

||

You aren’t required to disclose child support, alimony or separation |

|||||

|

|

|

|||

maintenance income unless you want us to consider it as qualifying income. |

|

|

|

||

|

|

|

|

||

Gross rents/boarder rents received (Primary recipient) |

$ |

$ |

$ |

||

|

|

|

|

|

|

Unemployment Income |

Start Date _______ End Date _________ |

$ |

$ |

$ |

|

|

|

|

|

||

Food stamps/welfare (Primary recipient) |

$ |

$ |

$ |

||

|

|

|

|

|

|

Tips, commissions, bonuses |

|

$ |

$ |

$ |

|

|

|

|

|

||

Other (please specify) ____________________________________ |

$ |

$ |

$ |

||

|

|

|

|

|

|

TOTAL MONTHLY INCOME

$

$

$

RMA 12/2019 |

Page 2 |

REQUEST FOR MORTGAGE ASSISTANCE FORM

Loan Number: _____________________________

ADDITIONAL REQUIRED INFORMATION

MONTHLY LIVING EXPENSES

Expense |

|

Customer(s) |

Contributor(s) |

|

|

|

|

Food (required field) |

$ |

|

$ |

|

|

|

|

Utilities (required field) |

$ |

|

$ |

|

|

|

|

Automobile (required field) |

|

|

|

(insurance, maintenance, gas) |

$ |

|

$ |

n No automobile |

|

||

|

|

|

|

|

|

|

|

Life insurance premium |

$ |

|

$ |

|

|

|

|

Clothing |

$ |

|

$ |

|

|

|

|

|

|

|

|

Cable, internet, phone |

$ |

|

$ |

|

|

|

|

Medical |

$ |

|

$ |

|

|

|

|

Tuition/school |

$ |

|

$ |

|

|

|

|

Child care (daycare, babysitting) |

$ |

|

$ |

|

|

|

|

Child support/alimony |

$ |

|

$ |

|

|

|

|

Total monthly living expenses |

$ |

|

$ |

HOUSEHOLD ASSETS

Please provide the most recent statement for each account listed

Do you have any existing asset accounts as listed below?

Yes

No

If Yes, please complete this section excluding Retirement

Funds.

|

Checking account #1 |

$ |

|

|

|||

|

Bank name: ________________________________________________________ |

|

|

|

|

|

|

|

Checking account #2 |

$ |

|

|

Bank name: ________________________________________________________ |

|

|

|

|

|

|

|

Savings/money market #1 |

$ |

|

|

Bank name: ________________________________________________________ |

|

|

|

|

|

|

|

Savings/money market #2 |

$ |

|

|

|

||

|

Bank name: ________________________________________________________ |

|

|

|

|

|

|

|

CDs |

$ |

|

|

|

||

|

|

|

|

|

Stocks/bonds |

$ |

|

|

|

|

|

|

Other cash on hand |

$ |

|

|

|

|

|

|

Other (please specify) _____________________________________________________________________ |

$ |

|

|

|

||

|

|

|

|

TOTAL ASSETS

$

RMA 12/2019 |

Page 3 |

REQUEST FOR MORTGAGE ASSISTANCE FORM

Step 4: Property Information

Loan Number: _____________________________

Property address: ____________________________________________________________________________

Number of people in household: ________________

The property is my: |

|

Primary Residence |

The property is: |

|

Owner Occupied |

|

||

|

||

|

|

|

|

Number of vehicles: _______________ |

||

Second Home |

|

|

Investment |

|

|

||

Renter Occupied |

|

|

Vacant |

|

|

||

|

|

||

|

|

|

|

If any customer or occupant of the property is a military Servicemember who is currently on Active Duty or has been on Active Duty within the last 12 months, or is a dependent of a Servicemember, please call Chase Military Services at

LIENS, MORTGAGES OR JUDGMENTS (if applicable)

Please list any other mortgages or liens associated with this property. If you have more than one loan with us, we'll need you to complete a Request for Mortgage Assistance form for each account you’d like us to review for assistance.

Servicer: ___________________________________________________________________________________ |

Account #: __________________________________________________ |

|||

Servicer: ___________________________________________________________________________________ |

Account #: __________________________________________________ |

|||

Servicer: ____________________________________________________________________________________ |

Account #: __________________________________________________ |

|||

|

|

|

|

|

Condominium or HOA fees? n Yes n No |

If yes, how much each month? $_____________ |

Are payments up to date? n Yes n No |

|

|

If you own other properties, please fill out the following section.

OTHER PROPERTIES OWNED

Customers with more than two additional properties, please download the Schedule of Real Estate Owned form from the Forms

Center at chase.com/MortgageAssistance. Please include the completed form with this application.

Property address: ______________________________________________________________________________________ Monthly rents received: $ ______________________

1st mortgage servicer name: ______________________________________________________________________________________________________________________________

Loan #: ________________________________________________________________________ Monthly principal and interest payment: $ ______________________________

2nd mortgage servicername: ____________________________________________________________________________________________________________________________

Loan #: _______________________________________________________________________ Monthly principal and interest payment: $ ________________________________

Escrow payment (taxes, insurance, PMI): $_______________ Property is: n Vacant n Second/seasonal home n

Monthly condominium or HOA fees: $_____________________ Comments: __________________________________________________________________________________

________________________________________________________________________________________________________________________________________________________________

Property address: ___________________________________________________________________________________ Monthly rents received: $ ______________________

1st mortgage servicer name: ___________________________________________________________________________________________________________________________

Loan #: ________________________________________________________________________ Monthly principal and interest payment: $ _______________________________

2nd mortgage servicer name: ___________________________________________________________________________________________________________________________

Loan #: |

_____________________________________________________________________ Monthly principal and interest payment: $ ______________________________ |

||

Escrow payment (taxes, insurance, PMI): $______________ Property is: n Vacant |

n Second/seasonal home n |

n Rented |

|

Monthly |

condominium or HOA fees: $_____________________ Comments: ___________________________________________________________________________ |

||

________________________________________________________________________________________________________________________________________________________________

If you want, you can authorize someone to work with us on your behalf. This is optional.

I/We hereby authorize JPMorgan Chase Bank, N.A., to release, furnish and provide information related to my/our account to:

Name of third party _______________________________________________________________________ Phone number (________)_____________________________________

Address of third party_______________________________________________________________________________________________________________________________________

RMA 12/2019 |

Page 4 |

REQUEST FOR MORTGAGE ASSISTANCE FORM

Step 5: Please read carefully and sign

Loan Number: _____________________________

ACKNOWLEDGMENT AND AGREEMENT

In making this request for consideration, I certify under penalty of

perjury that I understand and agree that:

1.The servicer of my mortgage loan may pull a current credit report for all customers obligated on the Note for the loan.

2.If my liability for the mortgage debt was discharged in a Chapter 7 bankruptcy proceeding after I signed the mortgage documents, or if I am entitled to the protections of any automatic stay in bankruptcy, the servicer is providing information about the mortgage assistance program at my request and for informational purposes, and not as an attempt to impose personal liability for the mortgage debt.

3.If I am eligible for a Trial Period Plan, Repayment Plan or Forbearance Plan, and I accept and agree to all the terms of such a plan, I also agree that the terms of this Acknowledgment and Agreement are incorporated into that plan.

4.If I'm eligible for an assistance option that requires an escrow account to pay taxes and/or insurance and my mortgage loan doesn’t have one, the servicer may establish one. If my loan previously had an escrow account and the servicer agreed to remove this requirement, this agreement has been revoked.

5.All the information in this document is true, and the hardships listed in Step 2 explain why I’m requesting mortgage assistance.

6.The servicer, owner, or guarantor of my mortgage or their agents may investigate the accuracy of my statements and I may need to provide additional documentation.

7.The servicer may directly obtain copies of account statements, including, but not limited to, checking and savings accounts, certificates of deposit (even if held for an extended period of time), mutual funds, money market funds, stocks or bonds, on accounts that are held by the servicer, its subsidiaries and affiliates for the review of my request for mortgage assistance.

8.If I have intentionally defaulted on my existing mortgage or engaged in fraud, or if any of the information I’ve provided is false, I may be ineligible for assistance under applicable investor/insurer programs or guidelines. This includes ineligibility now and for any future benefits and incentives that would otherwise have been available. I also understand that the servicer may recover any benefits or incentives I’ve previously received.

9.The property securing the mortgage I’m requesting assistance for can be lived in and hasn’t been or isn’t at risk of being condemned.

10.The servicer will use the information I provide to determine my eligibility for mortgage assistance, but isn’t obligated to offer me assistance based solely on the statements in this or any other document I send as part of this request.

11.The servicer will collect and record personal information, including my name, address, phone number, Social Security number, credit score, income, payment history and information about account balances and activity. I understand and consent to the disclosure of my personal information and the terms of any mortgage assistance option I receive by the servicer to (a) any investor, insurer, guarantor or servicer of my mortgage loan(s);(b) companies that perform support services in conjunction with any other mortgage relief program; and (c) any

12. The Servicer, Lender, and Other Loan Participants can obtain, use and share tax return information for purposes of (i) providing an offer; (ii) originating, maintaining, managing, monitoring, servicing, selling, insuring, and securitizing a loan; (iii) marketing; or (iv) as otherwise permitted by applicable laws, including state and federal privacy and data security laws. References to “Servicer” and “Lender” in the first sentence shall be deemed to include both parties’ vendors, affiliates, agents, service providers, and any of the aforementioned parties’ successors and assigns. The reference to “Other Loan Participants” in the first sentence shall also include any actual or potential owners of the loan, or acquirers of any beneficial or other interest in the loan, any mortgage insurer, guarantor, any servicers or service providers for these parties and any of the aforementioned parties’ successors and assigns.

13. If I, or someone on my behalf, have submitted a Fair Debt Collection Practices Act cease and desist notice to my Servicer, I withdraw that notice and understand that the servicer must contact me throughout the mortgage assistance process.

14. I consent to being contacted about this request for mortgage assistance at any email address I have provided.

By signing this document, I/we certify that all the information is truthful.

I/We understand that knowingly submitting false information may constitute fraud.

Customer Signature _______________________________________________________________________ Date _______/_______/__________

mm dd yyyy

Additional Customer Signature ____________________________________________________________ Date _______/_______/_________

mm dd yyyy

Step 6: Here’s how to send your documents

When we receive this form and all required documents, we’ll assign a team of dedicated specialists

to your loan who will call you within five business days to talk about your next steps.

Here’s how you can send your information. |

Overnight Mail: |

Regular Mail: |

Fax: |

After you have submitted your documentation, |

Chase |

Chase |

|

please call us at |

720 S. Colorado Blvd., STE 210 |

PO Box 469030 |

|

|

Glendale, CO |

Glendale, CO |

Online: chase.com |

|

|

|

|

If you have questions about this document or the assistance process, please call Chase. If you have questions about government programs that we cannot answer or you need further counseling, call the Homeowner’s HOPE™ Hotline at

For a list of

|

|

|

|

|

|

|

PE |

||

|

|

|

|

|

|

TM |

|||

|

|

|

TM |

|

e |

||||

888 |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

tlin |

|

|

|

|

|

|

|

PE Ho |

|

||

|

|

|

|

r’s |

HO |

|

|

|

|

|

|

|

ne |

|

|

|

|

|

|

|

ow |

|

|

|

|

|

|

||

me |

|

|

|

|

|

|

|

|

|

Ho |

|

|

|

|

|

|

|

|

|

For additional forms, please visit chase.com/MortgageAssistance

Si tiene alguna pregunta sobre asistencia hipotecaria, por favor llame al

RMA |

12/2019 |

Page 5 |

Form Characteristics

| Fact | Description |

|---|---|

| Form Purpose | This form is specifically designed to assist individuals facing financial hardships with their mortgage payments by gathering relevant information. |

| Customer Definition | A customer is defined as anyone who is obligated on the mortgage note or someone interested in assuming responsibility for the loan. |

| Documentation Required | Applicants may need to provide various documents, such as proof of income, hardship explanation, and potentially a divorce decree if applicable. |

| Contact Preferences | Customers can select their preferred contact method for communication regarding their assistance request, including options like text, voice, or email. |

| Assistance Options | The form allows customers to express interest in various assistance options, including those involving relocation. |

| Applicable Governing Law | This form operates under various state laws related to mortgage assistance; specific laws may vary by state. |

Guidelines on Utilizing Chase D19693 Rma 0913

After completing the Chase D19693 RMA 0913 form, you'll send it along with any required documents to your mortgage servicer. A team will review your submission and contact you within five business days to discuss next steps regarding your mortgage assistance.

- Enter your Loan Number at the top of the form.

- Provide your personal information:

- Your name.

- The last four digits of your Social Security number.

- Your date of birth.

- Your mobile or daytime contact number.

- Your preferred contact method: text, voice, or email.

- Your email address.

- If applicable, add information for an additional customer:

- Their name.

- The last four digits of their Social Security number.

- Their date of birth.

- Their mobile or daytime contact number.

- Their preferred contact method.

- Their email address.

- Describe your hardship: Fill in the details of the hardship preventing you from making your mortgage payment. Include the date the situation began and specify if it is temporary or long-term.

- Indicate the hardship type by checking the appropriate boxes from the provided list.

- Provide monthly household income: List all forms of income from each source and calculate your total monthly income.

- Fill out your living expenses: Record all necessary monthly living expense information as requested in the form.

- Provide information about your household assets: List your asset accounts and their balances, excluding retirement funds, in the provided section.

- Detail the property information: Include property address, occupancy status, and any existing liens or mortgages.

- Complete the Third-Party Authorization section (if applicable) by providing the name and contact information for the third party authorized to communicate on your behalf.

- Read and sign the acknowledgment and agreement section: Both customer and additional customer should sign and date the form, certifying the truthfulness of the information provided.

- Submit your documents: Choose your preferred submission method and confirm all required documents are included.

What You Should Know About This Form

What is the purpose of the Chase D19693 RMA 0913 form?

The Chase D19693 RMA 0913 form is designed to assist customers who are facing financial hardship and need help managing their mortgage payments. By completing this form, individuals provide essential information about their current financial situation, which allows Chase to evaluate potential solutions for mortgage assistance. This can include various options like repayment plans, forbearance, or other forms of relief tailored to the customer's unique circumstances.

Who should complete this form?

The form should be completed by individuals who have an obligation on the mortgage note or those interested in assuming responsibility for the loan. This includes primary borrowers and any additional signers. Additionally, if there are individuals with community property rights under state law, their information should also be included. This ensures that all relevant parties are considered in the mortgage assistance process.

What information do I need to provide?

When filling out the form, borrowers must provide personal details, including names, Social Security numbers (last four digits), and contact information. Furthermore, it is essential to describe the hardship that is impacting your ability to make mortgage payments. Additional financial details such as income, monthly living expenses, and any existing assets should also be included. This comprehensive information helps facilitate a thorough review of the assistance options available.

What kind of hardships can I report?

There are various hardships that borrowers can report. Common examples include unemployment, excessive debt obligations, income reduction, divorce, or long-term disability. It is important to describe your situation thoroughly and check all relevant boxes on the form. Chase will take this information into account when determining eligibility for assistance options.

Do I need to provide documentation?

Yes, supporting documentation is typically required to help substantiate the claimed hardship. For instance, if the hardship involves unemployment, providing a benefits statement would be necessary. Depending on the situation, additional documents, such as divorce decrees or medical statements, might also be required. Make sure to include any evidence that supports your financial claims, as this documentation is crucial for the review process.

How will I be contacted after submitting the form?

Once Chase receives the completed form and any associated documents, a team of dedicated specialists will be assigned to your case. You can expect a call within five business days to discuss your situation and any next steps. This streamlined communication process is designed to ensure that you receive timely assistance while navigating your financial difficulties.

What options might I have for assistance?

The specific assistance options available depend on your individual circumstances, but can include repayment plans, forbearance, or modifications to the loan terms. During the consultation call with Chase, representatives will discuss potential strategies tailored to your financial situation. The goal is to find a feasible resolution that allows you to address your mortgage obligations without undue stress.

What should I do if I have questions about the process?

If you have questions regarding the form or the assistance process, it is advisable to reach out to Chase directly at their dedicated customer service number. Additionally, the Homeowner’s HOPE™ Hotline can provide guidance on government programs and free HUD-certified counseling services. Utilizing these resources can help clarify any uncertainties and provide further support in navigating your options.

Common mistakes

When filling out the Chase D19693 Rma 0913 form, it's easy to make mistakes that could delay your request for mortgage assistance. Understanding these common pitfalls can help you avoid unnecessary setbacks and ensure your application is processed smoothly.

First, many applicants overlook the importance of providing complete contact information. Incomplete or incorrect phone numbers and email addresses can result in delayed communications, leaving you uninformed about the status of your application. Make sure to double-check the information before submitting.

Another frequent error is skipping the hardship affidavit. Applicants sometimes forget to describe their current financial situation in detail. This section is crucial, as it helps Chase understand your specific circumstances. Providing clear information about your hardship is key to receiving the appropriate assistance.

Additionally, some people fail to specify how long their hardship has been ongoing. While filling out the form, it's important to include the date your financial challenges started. This information assists the lender in evaluating your situation and determining the best options for you.

When it comes to supporting documentation, mistakes often occur. Many applicants neglect to include required documents or fail to submit the correct evidence supporting their claims. For instance, if you indicated unemployment as your hardship, remember to attach any relevant benefits statements or letters detailing your unemployment status.

Another common oversight involves the monthly household income section. Some individuals either report inaccurate income figures or forget to include all income sources. Ensure that you capture every source of income—such as wages, unemployment benefits, and child support—to present a comprehensive financial picture.

Do not forget about your monthly living expenses. Applicants sometimes leave this section incomplete, which is vital in assessing your financial need. Record all necessary categories, such as food, utilities, and insurance premiums. Omitting any significant expense may lead to an unrepresentative assessment.

Confusion about the property information can also lead to errors. For example, indicating the wrong type of residence—primary, secondary, or rental—can mislead the review process. It's crucial to accurately describe your living situation to avoid complications.

Moreover, many people fail to disclose any additional contributors living in the household. If someone not listed on the mortgage contributes financially, include their details to present an accurate picture of your household financing. This could significantly impact your application.

Lastly, some individuals mistakenly skip the signature section, thinking the form is complete without it. Neglecting to sign or date the form renders your application invalid. Ensure that all signatures are included and correctly dated before you send your request.

By being aware of these mistakes and taking the time to double-check your application, you can significantly enhance your chances of a timely and positive response from Chase. Submit your form correctly, and you’ll be on your path to finding mortgage assistance more effectively.

Documents used along the form

When completing the Chase D19693 RMA 0913 form, several other forms and documents may also be necessary to ensure a comprehensive request for mortgage assistance. Each of these documents plays a crucial role in explaining your situation or supporting your application.

- Hardship Affidavit: This document outlines any financial or personal difficulties you're experiencing that impact your ability to pay the mortgage. It is vital to detail specific hardships, such as job loss or medical emergencies.

- Authorization to Obtain Consumer Credit Report: This form allows the mortgage servicer to access your credit history. It can help them assess your financial situation accurately and determine viable assistance options.

- Proof of Income Documents: These should include pay stubs, tax returns, or any other relevant income documentation. Providing these helps demonstrate your current financial status and supports your request for assistance.

- Benefit Statements: If you are receiving unemployment or disability benefits, a statement detailing the amount and duration of these benefits may be required to consider your economic situation.

- Divorce Decree or Separation Agreement: Required if your hardship involves divorce. This document provides details about any legal financial obligations you might have.

- Death Certificate or Legal Documents: If hardship is due to the death of a key wage earner, a death certificate or relevant legal documents may be needed to validate this claim.

- Request for Mortgage Assistance (for additional properties): If you own more than one property, this form ensures that all mortgage assistance requests related to those properties are reviewed properly.

These documents, along with the Chase D19693 RMA 0913 form, will help clarify your situation and facilitate the assistance process. Ensure that all paperwork is accurate and submitted promptly for the best chance of receiving the help you need.

Similar forms

Loan Modification Application: Like the Chase D19693 RMA 0913, this form seeks personal information and financial details to assess eligibility for adjusting loan terms. Both require hardship statements to establish a need for assistance.

Hardship Affidavit: This document focuses on detailing specific financial challenges. Similar to the RMA form, it verifies the applicant's situation and emphasizes the need for mortgage assistance.

Short Sale Request Form: This form allows homeowners to sell their property for less than the mortgage owed. Both documents outline situations where financial strain prevents regular payments and necessitate alternative solutions.

Forbearance Agreement: Like the RMA, this document allows borrowers facing hardship to temporarily halt payments. Both require detailed hardship descriptions and evidence of financial difficulties.

Deed in Lieu of Foreclosure Agreement: This document transfers property back to the lender when borrowers can’t make payments. Both the D19693 and this agreement aim to assist those in serious financial trouble.

Authorization to Release Information: Similar in function, this document grants permission for lenders to discuss a borrower’s account with third parties, a concept also touched upon in the RMA form.

Bankruptcy Petition: This is a legal filing for individuals who can no longer meet debts. Like the RMA form, it documents financial hardship and may influence mortgage assistance options.

FHA Assistance Request Form: This document is specific to FHA loans and requires similar information about income and hardship. It is comparable to the requirements outlined in the RMA form for FHA borrowers.

Mortgage Assistance Program Application: This document shares the same purpose with the RMA, aiming to secure assistance for borrowers in distress, including financial and property information.

Property Transfer Agreement: This outlines arrangements for transferring ownership, akin to the options presented in the RMA form for those seeking alternate resolutions to mortgage difficulties.

Dos and Don'ts

When filling out the Chase D19693 RMA 0913 form, here are five important do's and don'ts to consider:

- Do: Provide accurate information. Ensure all details, like names and Social Security numbers, are correct and current.

- Do: Use clear handwriting or type your responses to avoid any misunderstandings or errors.

- Do: Include relevant documents that support your situation, such as benefit statements or proof of income.

- Do: Check your contact preferences to ensure Chase can reach you easily for follow-up.

- Do: Read each section carefully before submitting to confirm that you have not missed any parts of the application.

- Don't: Leave any required fields blank. Incomplete forms can lead to delays in processing your request.

- Don't: Send sensitive documents like medical records if not specifically requested.

- Don't: Provide misleading information or omit details about financial hardships; this could impact your eligibility for assistance.

- Don't: Forget to sign and date the form, as unsigned applications will not be processed.

- Don't: Submit multiple forms for the same account, as this can create confusion with your application.

Misconceptions

Misconception 1: The Chase D19693 RMA 0913 form only applies to homeowners who are in serious delinquency.

This form is for individuals who may be facing financial hardship, even if their payments are up to date. It recognizes temporary difficulties that could affect future mortgage payments.

Misconception 2: I need to provide extensive financial documentation to submit this form.

While some documentation is required, such as income statements and hardship explanations, the form does not require overwhelming amounts of paperwork. Only specific documents related to your current situation are needed.

Misconception 3: The form guarantees assistance for all applicants.

Completing the form does not automatically mean you will receive help. The servicer will review your information and determine eligibility based on the criteria established for mortgage assistance programs.

Misconception 4: You cannot get assistance if you have multiple properties.

Assistance is possible even if you own more than one property. However, additional documentation and separate requests may be necessary for each mortgage loan.

Misconception 5: The information shared on this form will not be kept confidential.

The servicer is committed to privacy and will handle your information according to federal and state privacy laws. They will not disclose your personal information without your consent, except as required for processing your request.

Misconception 6: Submitting the form ends any communication with the servicer.

Submitting the form starts a process of communication. You can expect follow-up from a dedicated team, who will assist you in understanding your options and next steps.

Key takeaways

Here are key takeaways for filling out and utilizing the Chase D19693 RMA 0913 form:

- Identify Yourself: Clearly provide information about yourself and any additional customers or contributors. Accurate identification speeds up the process.

- Describe Your Hardship: Be detailed when outlining your financial struggles. This helps Chase understand your situation and find the best assistance option for you.

- Gather Necessary Documentation: Collect all required documents that support your hardship claim. Missing documents can delay your assistance, so ensure you check the list carefully.

- Contact Preferences: Indicate how you prefer to be contacted. Providing a mobile number allows Chase to reach out quickly about your application.

- Honesty is Key: Ensure all information is truthful. Providing false information may affect your eligibility for assistance and could have legal consequences.

- Follow Up: After submitting the form, follow up with Chase. They will assign a team to assist you, and a quick follow-up can keep the process on track.

Browse Other Templates

How to Fill Out a Customs Form for International Shipping - The declaration form demonstrates compliance with federal laws and regulations.

Perc Mediation - This form is used to request representation for public employees in New Jersey.