Fill Out Your Chase Ucard Form

The Chase UCard form is an essential resource for those utilizing the Utah UCardSM benefits, providing step-by-step guidance on activating your card and leveraging its features effectively. First things first, to use your card, you must activate it online or via phone, select a secure 4-digit PIN, and ensure you sign the back of your card to validate it. This form serves as a comprehensive tool to manage your various benefits, such as food stamps, child care, and employment training funds. Users can check their balance easily through the Chase UCard website, ensuring they are well-informed before making any purchases. The instructions also outline the correct procedures for transactions, whether using the card for groceries or paying approved service providers. Notably, users are reminded of the importance of safeguarding their card and PIN to prevent unauthorized access, as these details are critical for accessing funds. Furthermore, the document details protocols for common scenarios, such as incorrect transactions or cash withdrawals at ATMs, allowing cardholders to navigate the UCard system with confidence. Overall, the Chase UCard form is designed to enhance user experience and provide clarity on managing essential benefits effectively.

Chase Ucard Example

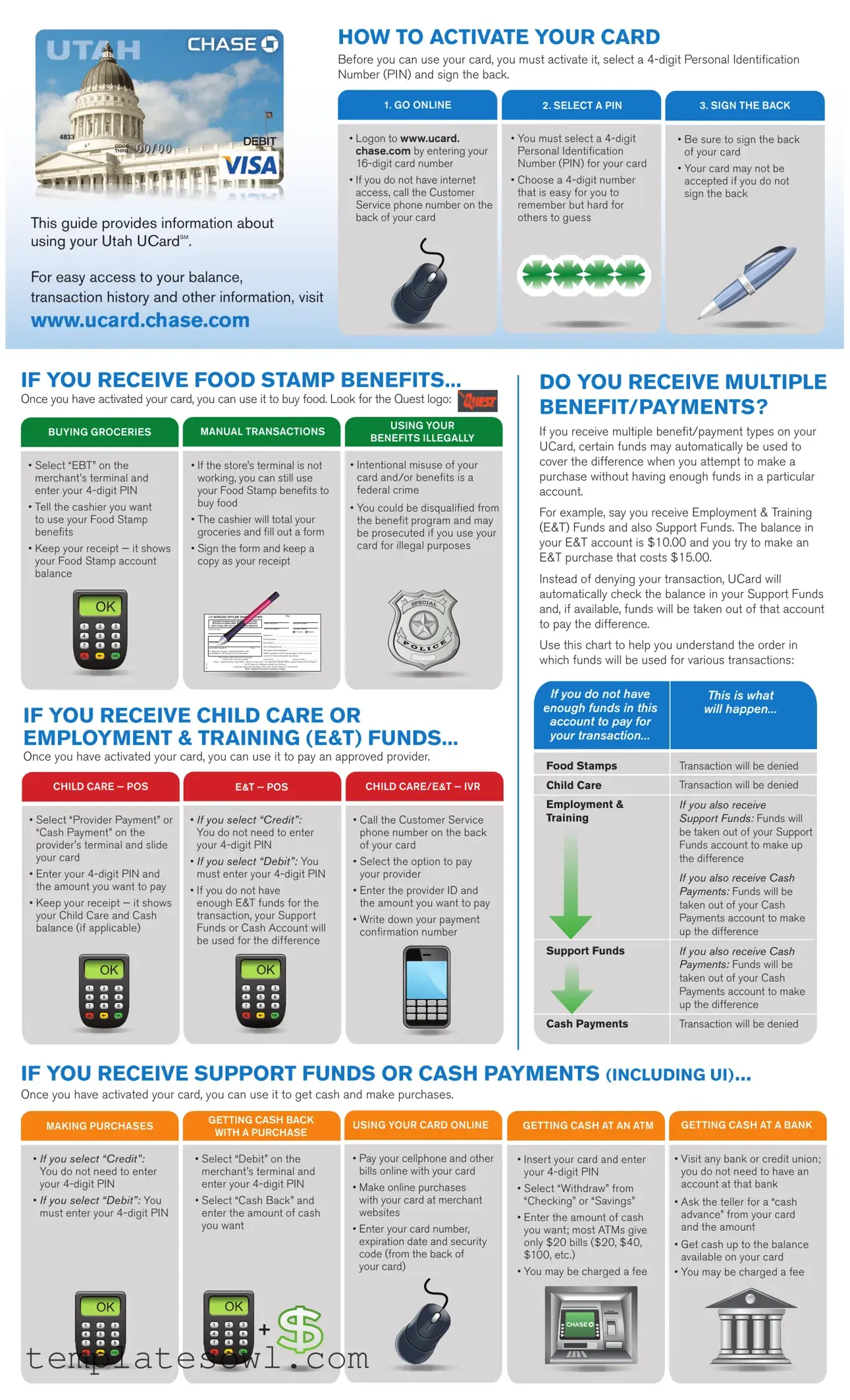

HOW TO ACTIVATE YOUR CARD

Before you can use your card, you must activate it, select a

1. GO ONLINE |

2. SELECT A PIN |

3. SIGN THE BACK |

This guide provides information about using your Utah UCardSM.

For easy access to your balance,

transaction history and other information, visit

www.ucard.chase.com

•Logon to www.ucard. chase.com by entering your

•If you do not have internet access, call the Customer Service phone number on the back of your card

• You must select a |

• Be sure to sign the back |

Personal Identiication |

of your card |

Number (PIN) for your card |

• Your card may not be |

|

|

• Choose a |

accepted if you do not |

that is easy for you to |

sign the back |

remember but hard for |

|

others to guess |

|

IF YOU RECEIVE FOOD STAMP BENEFITS...

Once you have activated your card, you can use it to buy food. Look for the Quest logo:

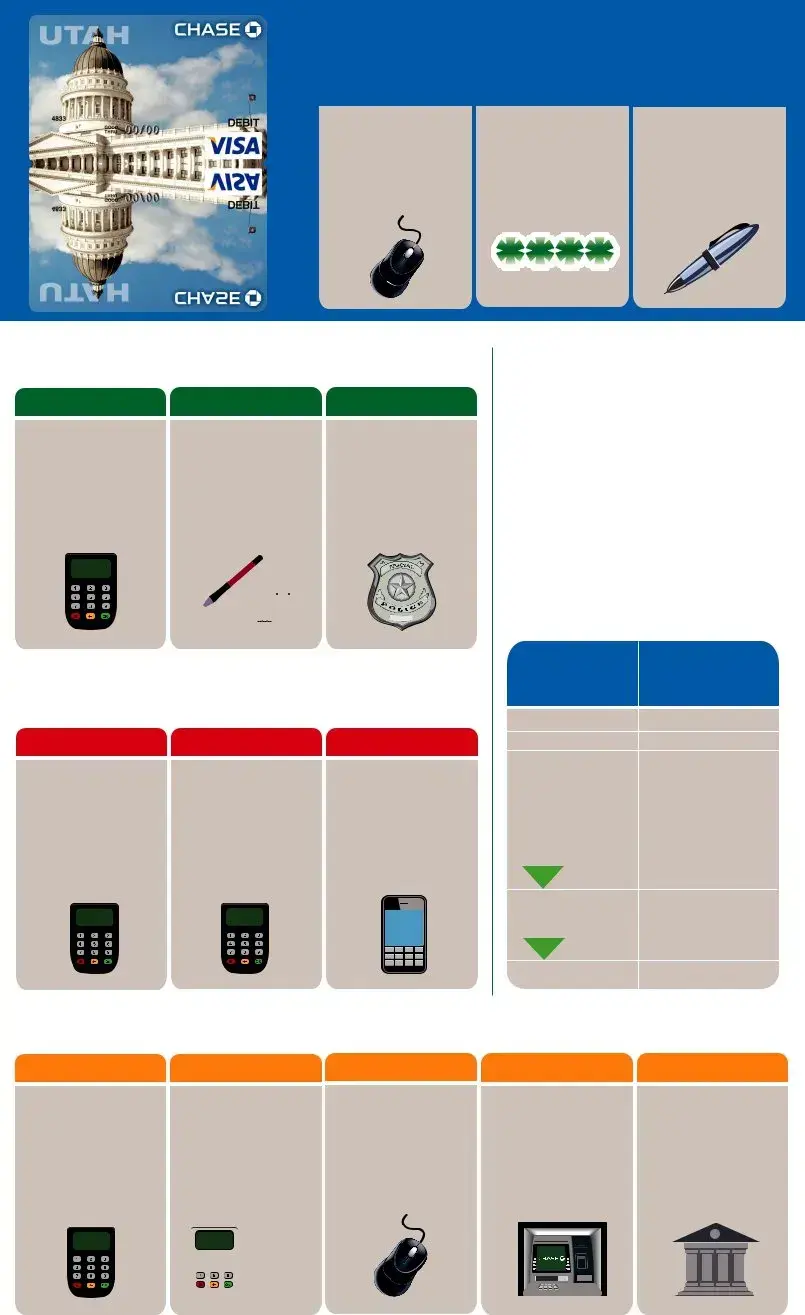

DO YOU RECEIVE MULTIPLE BENEFIT/PAYMENTS?

BUYING GROCERIESMANUAL TRANSACTIONS

USING YOUR

If you receive multiple beneit/payment types on your

BENEFITS ILLEGALLY

• Select “EBT” on the |

• If the store’s terminal is not |

• Intentional misuse of your |

||||||||||

merchant’s terminal and |

working, you can still use |

card and/or beneits is a |

||||||||||

enter your |

your Food Stamp beneits to |

federal crime |

||||||||||

• Tell the cashier you want |

buy food |

|

|

|

|

|

• You could be disqualiied from |

|||||

• The cashier will total your |

||||||||||||

to use your Food Stamp |

the beneit program and may |

|||||||||||

beneits |

groceries and ill out a form |

be prosecuted if you use your |

||||||||||

• Keep your receipt — it shows |

• Sign the form and keep a |

card for illegal purposes |

||||||||||

|

||||||||||||

your Food Stamp account |

copy as your receipt |

|

|

|

|

|||||||

balance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

J.P. MORGAN OFFLINE SNAP VOUCHER |

No. |

|

|

|

|

||||

|

|

|

Important! Vouchers must be entered or cleared on the |

|

|

|

|

|

|

|

||

|

|

|

POS device (or mailed within 10 days if |

|

Trans. Date/Time |

|

Approval Number |

|

|

|

||

|

|

|

within 15 days of the sale or funds will not be reimbursed. |

|

|

|

|

|

|

|

||

|

|

Card Number: |

|

|

Store FNS Number |

Purchase Amount |

|

|

||||

|

|

|

|

|

|

|

|

Purchase Refund |

|

|

||

|

|

|

|

|

|

Merchant ID _________________________________________________ |

|

|

||||

|

|

|

|

|

|

Print Store Name _____________________________________________ |

|

|

||||

|

|

|

Print Cardholder Name |

|

|

Store Address ________________________________________________ |

|

|

||||

|

|

|

|

|

|

Store City/State/Zip Code _______________________________________ |

|

|

||||

|

|

|

Cardholder Signature |

Date |

|

|

|

|||||

|

|

|

In signing this voucher, I believe that SNAP funds |

|

Store Supervisor/Clerk Signature __________________________________ |

|

|

|||||

|

|

|

are available for the full amount of this transaction. |

|

SNAP regulations prohibit representation of this voucher by |

|

|

|||||

|

|

|

This voucher will be rejected if information |

merchant if voice authorization was denied. |

|

|

||||||

|

|

|

in this section has been altered. |

Date Entered |

Operator’s Initials _____________ |

|

|

|||||

|

|

|

White – Client/Customer Copy; Yellow – Merchant Copy; Pink – |

|

|

|||||||

|

|

INC11667 |

SNAP - Supplemental Nutrition Assistance Program |

|

|

|

|

|||||

|

|

|

|

NOTE: Electronic Retailers to Retain the Pink copy |

|

|

|

|

||||

|

|

|

|

J.P. Morgan Retail and Field Support • P.O. Box 30078 • Tampa, FL |

|

|

||||||

IF YOU RECEIVE CHILD CARE OR

EMPLOYMENT & TRAINING (E&T) FUNDS...

Once you have activated your card, you can use it to pay an approved provider.

CHILD CARE — POS |

E&T — POS |

CHILD CARE/E&T — IVR |

|

• Select “Provider Payment” or |

• If you select “Credit”: |

• Call the Customer Service |

|

“Cash Payment” on the |

You do not need to enter |

phone number on the back |

|

provider’s terminal and slide |

your |

of your card |

|

your card |

• If you select “Debit”: You |

• Select the option to pay |

|

|

|||

• Enter your |

must enter your |

your provider |

|

the amount you want to pay |

• If you do not have |

• Enter the provider ID and |

|

|

|||

• Keep your receipt — it shows |

enough E&T funds for the |

the amount you want to pay |

|

your Child Care and Cash |

transaction, your Support |

• Write down your payment |

|

balance (if applicable) |

Funds or Cash Account will |

||

conirmation number |

|||

|

be used for the difference |

||

|

|

UCard, certain funds may automatically be used to cover the difference when you attempt to make a purchase without having enough funds in a particular account.

For example, say you receive Employment & Training (E&T) Funds and also Support Funds. The balance in your E&T account is $10.00 and you try to make an E&T purchase that costs $15.00.

Instead of denying your transaction, UCard will automatically check the balance in your Support Funds and, if available, funds will be taken out of that account to pay the difference.

Use this chart to help you understand the order in which funds will be used for various transactions:

If you do not have |

This is what |

||

enough funds in this |

will happen... |

||

account to pay for |

|

||

your transaction... |

|

||

Food Stamps |

Transaction will be denied |

||

Child Care |

Transaction will be denied |

||

Employment & |

If you also receive |

||

Training |

Support Funds: Funds will |

||

|

|

|

be taken out of your Support |

|

|

|

|

|

|

|

Funds account to make up |

|

|

|

the difference |

|

|

|

If you also receive Cash |

|

|

|

Payments: Funds will be |

|

|

|

taken out of your Cash |

|

|

|

Payments account to make |

|

|

|

up the difference |

Support Funds |

If you also receive Cash |

||

|

|

|

Payments: Funds will be |

|

|

|

|

|

|

|

taken out of your Cash |

|

|

|

Payments account to make |

|

|

|

up the difference |

Cash Payments |

Transaction will be denied |

||

IF YOU RECEIVE SUPPORT FUNDS OR CASH PAYMENTS (INCLUDING UI)...

Once you have activated your card, you can use it to get cash and make purchases.

GETTING CASH BACK

MAKING PURCHASESUSING YOUR CARD ONLINE GETTING CASH AT AN ATM GETTING CASH AT A BANK WITH A PURCHASE

•If you select “Credit”: You do not need to enter your

•If you select “Debit”: You must enter your

•Select “Debit” on the merchant’s terminal and enter your

•Select “Cash Back” and enter the amount of cash you want

•Pay your cellphone and other bills online with your card

•Make online purchases with your card at merchant websites

•Enter your card number, expiration date and security code (from the back of your card)

•Insert your card and enter your

•Select “Withdraw” from “Checking” or “Savings”

•Enter the amount of cash you want; most ATMs give only $20 bills ($20, $40, $100, etc.)

•You may be charged a fee

•Visit any bank or credit union; you do not need to have an account at that bank

•Ask the teller for a “cash advance” from your card and the amount

•Get cash up to the balance available on your card

•You may be charged a fee

+

+

HOW TO CHECK YOUR BALANCE

Before using your card, it’s important to know how much money is on your card. You must have enough money to pay for your transaction plus any fees.

FREQUENTLY ASKED QUESTIONS

What are Deposit Notiication Alerts?

ONLINE

•Check your balance(s) and get your monthly account statements for FREE at www.ucard.chase.com

•If you have a cash account, you can choose to receive a paper statement (fee may apply); see the

ACCOUNT ALERTS |

BY PHONE |

• Automatic alerts will let you |

• Call the Customer Service |

know when a deposit has |

phone number on the |

been made and your new |

back of your card |

available balance |

• You will hear your |

|

|

• Visit www.ucard.chase.com |

balance(s) after you have |

or call Customer Service to |

entered your security |

information |

|

Account Alerts via text, email |

|

or voice message |

|

With Deposit Notiication Alerts, you can get an automatic text, email or phone message whenever funds are added to your UCard account. In addition to providing the speciic deposit amount and date, this alert will also include your available account balance. To sign up for Deposit Notiication Alerts, logon to www.ucard.chase. com or call Customer Service.

What if there is an incorrect food stamp transaction on my account?

When a retailer is paid either too much or too little from your UCard food stamp account due to a computer system problem, a correction may be made to your balance. This correction could impact your current or next month’s balance. You will be mailed an adjustment notice of the correction if it reduces your balance. If you notice an incorrect transaction on your account, call Customer Service.

HOW TO MANAGE YOUR DEPOSITS

It’s important to know when you receive your deposits and how much you have on your card.

What happens if I don’t use all my funds?

Your balance at the end of the month is carried over to the next month. You should access your account on a regular basis. Do not go for long periods of time without

DEPOSITS

•Deposit dates vary depending on the type of payment(s) you receive

•See the Deposit Issuance Schedule that came with your card

•Unused funds are carried over to the next month

KNOW YOUR BALANCE

•Logon to www.ucard. chase.com, or

•Sign up for Deposit Notiication Alerts (see Frequently Asked Questions), or

•For Food Stamps, check your last receipt, or

•Call Customer Service

AVOID FEES

•There may be fees for using your card in certain situations

•See the Card Fees that came with your card

•There is never a fee for using Food Stamp or Child Care beneits

•There is also never a fee for making purchases at a store or a provider

using your account.

•Food Stamp and/or Cash payments that have not been accessed for 365 days will be removed from your account.

•Child Care beneits that have not been accessed for 90 days will be removed from your account.

•Employment and Training funds that have not been accessed for 120 days will be removed from your account.

FEES

HOW TO KEEP YOUR CARD AND PIN SAFE

Your card and PIN are the keys to getting your deposits. If someone gets your card and knows your PIN, they could use all your funds — and those funds will not be replaced.

CARD CARE |

PIN SAFETY |

CARD/PIN REPLACEMENT |

|

• Keep your card in a safe |

• Do not write your PIN on your |

• If your card is lost, stolen |

|

place, like your wallet or purse |

card or on anything you keep |

or damaged logon to www. |

|

• Do not get your card dirty |

with your card |

ucard.chase.com (or call |

|

|

Customer Service) to order |

||

• Keep your card away from |

• NEVER tell your PIN to anyone |

||

a new one |

|||

|

|||

magnets and electronics |

• Do not try to guess your PIN; |

||

• If you forget your PIN or |

|||

• Do not leave your card in |

if you enter it wrong four times, |

||

want to change it, logon to |

|||

direct sunlight |

your card will be locked until |

||

www.ucard.chase.com |

|||

|

midnight Mountain Time |

||

|

(or call Chase Customer |

||

|

|

||

|

|

Service) to select a new one |

HOW TO PAY BILLS WITH YOUR CARD

If you get cash payments, you can pay your cellphone, utilities and other bills with your card.

BY PHONE |

ONLINE — COMPANY WEBSITE |

ONLINE — UCARD |

|||||

• Call the company you are |

• Visit the website of the |

• Online bill pay is only available |

|||||

paying and ask to pay your |

company you are paying |

for Support Funds and Cash |

|||||

bill with your card |

and pay your bill with |

accounts |

|||||

• You will be asked to provide |

your card |

• Visit www.ucard.chase.com to |

|||||

|

|||||||

your card number, expiration |

• Enter your card number, |

enroll in Online Bill Pay and set- |

|||||

date and the |

expiration date and the |

up your list of companies to pay |

|||||

code (from the back of |

• Schedule payments with just |

||||||

your card) |

the back of your card) |

||||||

a few clicks |

|||||||

|

|

||||||

|

|

• You will be charged a small fee |

|||||

|

|

for each bill payment |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

What is the difference between a transaction fee and an ATM surcharge?

An ATM surcharge is a fee charged by the ATM owner and the amount varies by owner. There is no surcharge at any Chase ATM in the U.S. Chase may charge a transaction fee for ATM withdrawals. Please see the Fees for Using Your Card on the letter your card was attached to in this package.

What if I enter the wrong PIN or forget my PIN?

Do not try to guess your PIN. For your security, your card will be locked after four incorrect PIN entries and you will not be able to use it until after midnight Mountain Time.

If you forget your PIN, call Chase Customer Service to select a new one.

What should I do if I lose or damage my card?

If your card is lost, stolen or damaged, go online or call Chase Customer Service right away to protect your money and request a new card.

SAFETY TIPS

•At ATMs, be alert for lights not working, anyone loitering nearby or shadowed areas where someone might hide; consider coming back later if you notice anything or anybody suspicious.

•Avoid scams — Chase will never contact you via

www.ucard.chase.com

USDA is an equal opportunity provider and employer.

© 2012 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, N.A. Member FDIC.

Form Characteristics

| Fact Name | Description |

|---|---|

| Activation Steps | To activate your Chase UCard, go online, select a 4-digit PIN, and sign the back of the card. |

| PIN Selection | Your card may not be accepted if you do not sign the back. Choose a 4-digit PIN that is easy to remember but hard for others to guess. |

| Food Stamp Benefits | You can use your activated card to buy food with Food Stamp benefits. Always look for the Quest logo. |

| Transaction Denials | If you do not have sufficient funds in your account for transactions, they will be denied. UCard automatically checks other accounts to cover the difference when possible. |

| Legal Compliance | Under federal law, misuse of benefits is a crime. Violations can result in disqualification from benefit programs and prosecution. |

Guidelines on Utilizing Chase Ucard

Activating your Chase UCard is a crucial first step before using it for transactions. This involves setting a Personal Identification Number (PIN) and signing your card. By following these simple steps, you can ensure that your UCard is ready for use.

- Go online to www.ucard.chase.com.

- Enter your 16-digit card number to log on.

- Select a **4-digit Personal Identification Number (PIN)** that is easy for you to remember but hard for others to guess.

- Sign the back of your card to complete the activation.

- If you do not have internet access, call the Customer Service number found on the back of your card for assistance.

What You Should Know About This Form

What steps do I need to take to activate my Chase Ucard?

To get started with your Chase Ucard, first ensure you activate it. You can do this by going online to the specified website. Once there, enter your 16-digit card number and follow the prompts. You'll need to select a 4-digit Personal Identification Number (PIN) that is easy for you to remember but hard for others to guess. After that, remember to sign the back of your card before you use it.

How can I check my balance on my Chase Ucard?

You can check your balance by visiting www.ucard.chase.com and logging in with your card number. If you prefer not to use the internet, you can also call the Customer Service number located on the back of your card. It's a good practice to stay updated on your balance to avoid any transaction issues.

What should I do if I notice an incorrect food stamp transaction on my account?

If you find an error, such as an incorrect food stamp transaction, it’s important to take action quickly. Call Customer Service right away to report the issue. Depending on the situation, a correction may automatically be made if there was a payment discrepancy; however, you may receive an adjustment notice if your balance is affected.

Can I receive multiple types of benefits on my Chase Ucard?

Yes, you can receive multiple benefit types simultaneously. When using your card for purchases, make sure to select the appropriate type of benefit on the merchant's terminal. For example, select "EBT" for food stamp benefits or "Provider Payment" for child care costs. Remember, if a transaction is denied due to insufficient funds in one category, the system may automatically check other benefit categories to cover the difference.

What fees should I be aware of when using my Chase Ucard?

There are potential fees to consider. While there are no fees for purchasing food or child care benefits, you may incur fees for other transactions, such as ATM withdrawals or certain online payments. Review the specific fee schedule that came with your card to stay informed about possible charges. It's also worth noting that any funds not accessed for certain periods—such as 365 days for food stamps—may be removed from your account.

What steps should I take if I lose my Chase Ucard?

If your card is lost, stolen, or damaged, act quickly to protect your funds. Go online to www.ucard.chase.com or call Customer Service immediately. Request a new card and take precautions to ensure your existing account information remains secure.

Common mistakes

Filling out the Chase UCard form can be straightforward, but errors are common. One mistake that many individuals make is neglecting to sign the back of the card after activation. Signing the card is essential for security and is a requirement to utilize the card effectively. Without a signature, merchants might hesitate to accept the card, leading to inconvenience when trying to make purchases.

Another frequent error is selecting an insecure 4-digit Personal Identification Number (PIN). People often choose easily remembered numbers, such as birthdays or simple sequences. This practice makes it easier for someone else to guess the PIN and access the card. It is important to select a PIN that is memorable yet challenging for others to figure out in order to protect funds.

Some people also overlook the importance of checking their balance before making transactions. Particularly when funds are received through multiple benefit/payment types, unaware users might attempt to make a purchase or payment that exceeds their available balance. This can lead to transaction denial and frustration.

Lastly, many individuals fail to properly use the correct transaction format when utilizing their benefits. For instance, users receiving food stamp benefits might forget to inform the cashier that they wish to use those benefits. When proper procedures aren't followed, it can lead to misunderstandings and issues at the point of sale. Being clear and informed about the process is key to a smoother experience.

Documents used along the form

When managing your finances, several key documents often accompany the Chase UCard form. These documents ensure that users have the necessary information and processes outlined for proper use. Below is a list of these related forms and documents.

- Activation Guide: This document provides step-by-step instructions on how to activate your card, select a PIN, and sign the back of the card.

- Transaction Receipt: After making a purchase, retain this proof of transaction as it details what was bought and the remaining balance on your card.

- ATM Withdrawal Slip: This slip is received when you take cash from an ATM, which summarizes the withdrawal and remaining balance.

- Deposit Notification Alerts: A service that notifies you when funds are added to your account, keeping you informed of your balance.

- SNAP Voucher: Used primarily for food stamp benefits, this voucher is completed at the point of sale to confirm purchases made with SNAP funds.

- Child Care/E&T Payment Instructions: Guidelines on how to use your card for making payments to approved providers for child care or employment training funds.

- Fees Disclosure Document: This outlines any potential fees associated with your card, such as for ATM withdrawals or transaction fees.

These documents play a vital role in ensuring users optimize their Chase UCard experience. Always refer to them for clarity on processes, rights, and responsibilities regarding your card and funds.

Similar forms

- Credit Card Activation Guide: Similar to the Chase UCard form, a typical credit card activation guide instructs cardholders on how to activate their cards, select a PIN, and sign the card. Both documents emphasize the importance of security measures, such as choosing a memorable but unique PIN.

- EBT Card Holder's Manual: This manual provides specific instructions on using EBT cards, which, like the Chase UCard, guide users through activation, transaction processes, and how to report issues. Both documents help individuals navigate their benefits efficiently.

- ATM Usage Instructions: Documents detailing ATM usage often outline how to withdraw cash and check balances. Similar to the Chase UCard form, they include information about fees, security measures, and the importance of keeping personal identification secret.

- Debit Card User Agreement: The user agreement for debit cards generally covers activation, spending limits, security protocols, and consequences for misuse. This parallels the Chase UCard form in its focus on responsible use and the necessity of safeguarding personal information.

- Payment Card Industry Security Standards: This document sets expectations for protecting cardholder data and ensuring secure transactions. It is akin to parts of the Chase UCard form that emphasize PIN safety and protecting one's card details from unauthorized use.

- Bank Account Statements: Monthly bank statements provide details on transaction history and account balances, similar to the balance checking features promoted in the UCard form. Both keep account holders informed about their financial status and usage.

- Treasury Direct Payment Documentation: When individuals receive payments from government sources, they receive instructional documentation similar to the UCard form. This includes steps for activating accounts and guidelines for secure transactions.

- Insurance Claims Forms: Though primarily for filing claims, these forms share commonalities with the UCard by guiding users through the required steps to access benefits. Both emphasize the importance of providing accurate information for successful transactions.

- Mobile Payment App Guides: Guides for apps like Venmo or PayPal highlight how to link a debit or credit card, make payments, and manage balances securely, similar to the guidance offered by the Chase UCard on managing funds and completing transactions safely.

Dos and Don'ts

When filling out the Chase UCard form, keeping a few key practices in mind can ensure a smooth experience.

- Activate your card online or by calling Customer Service.

- Select a memorable yet secure 4-digit PIN.

- Sign the back of the card immediately upon activation.

- Keep track of your card balance using the provided online tools.

- Store receipts for any purchases made with your benefits.

Conversely, certain actions should be avoided to prevent issues.

- Do not share your PIN with anyone, even close friends or family.

- Do not try to guess your PIN; it could lock your card temporarily.

- Avoid leaving your card in direct sunlight or near magnets.

- Do not misuse your benefits for anything other than what they are intended for.

- Do not ignore your account balance; regularly check it to avoid unexpected penalties.

Misconceptions

1. Activation is Optional - Some people believe they can use the Chase UCard without activating it. However, activation is required before any usage, along with setting up a Personal Identification Number (PIN) and signing the back of the card.

2. Online Access is Mandatory - There is a misconception that you must have internet access to activate or manage your card. In fact, cardholders can also call the Customer Service number provided on the back of the card for assistance.

3. Limited to Food Purchases - Many assume that the Chase UCard can only be used for food purchases. In reality, it can also be used for cash withdrawals and payments for approved services, such as childcare or utilities.

4. PIN Choice is Irrelevant - Some users think that any PIN can be chosen. However, it's crucial to select a 4-digit number that is easy to remember but hard for others to guess to maintain security.

5. Funds are Automatically Returned - A common belief is that unused funds are automatically refunded or returned. Unused funds at the end of the month actually carry over to the next month; they are not refunded.

6. Transaction Fees Apply to All Uses - Some cardholders think that fees apply universally when using the card. It's important to note that there are no fees for using Food Stamp or Child Care benefits, nor for making purchases at providers.

7. Cash Withdrawals are Unlimited - There is a misunderstanding regarding cash withdrawals. While users can withdraw cash, there is typically a limit on ATM withdrawals, and some fees may apply depending on the ATM owner.

8. All Benefits Can be Used Simultaneously - Many individuals believe they can use all accounts simultaneously for a single transaction. However, the system checks available funds in a specific order, and transactions may be denied if funds are insufficient.

9. It’s Safe to Share Your PIN - Some users underestimate the importance of keeping their PIN confidential. Sharing the PIN can lead to unauthorized access to funds, and such losses generally cannot be replaced.

Key takeaways

- Activating your card is the first step to using it. You need to go online, select a PIN, and sign the back of the card.

- You can access your balance and transaction history easily by visiting www.ucard.chase.com.

- If you don't have internet access, you can call the Customer Service number on the back of your card for assistance.

- Choosing a 4-digit Personal Identification Number (PIN) is essential. Make sure it's memorable yet hard for others to guess.

- After activation, you can use the card to buy food where the Quest logo is displayed.

- Be cautious with your benefits. Illegal use of your card is a federal crime that may result in disqualification from benefits.

- For Child Care and Employment & Training funds, select the appropriate payment option on the provider’s terminal to make payments.

- You have the option to get cash back at the store when making a purchase, as well as withdraw cash through ATMs and banks.

- It's important to regularly check your balance to avoid transaction denials. You can do this online or by signing up for alerts.

- To eliminate unexpected fees, be aware of the card fees and limits associated with benefits like Food Stamps and Cash Payments.

Browse Other Templates

Form P17 Notice of Renunciation - If you have questions about this form, seeking clarity before submission is wise.

Ethiopian Embassy - Understanding the implications of giving Power of Attorney can help in filling out this form.