Fill Out Your Chase Print Counter Checks Form

The Chase Print Counter Checks form is an essential tool for clients navigating their Chase Total Checking® accounts. Designed to streamline banking activities, this form allows account holders to request temporary checks for various transactions when standard checks are unavailable. Alongside this convenience, it outlines important features of the Chase Total Checking account, such as monthly service fees, criteria for avoiding these fees, and a comprehensive overview of ATM and overdraft fees. By knowing the types of transactions that can incur costs, account holders can make informed decisions to manage their finances more effectively. Additionally, the form provides clarity on how deposits and withdrawals are processed, detailing important timelines and necessary actions to avoid penalties. Understanding these details can enhance the user's banking experience while informing them of their responsibilities. Those interested in utilizing these counter checks must be aware that each request incurs a nominal fee of $2 per page, which makes it a practical choice for occasional use while remaining cost-effective. Overall, the Chase Print Counter Checks form serves both as a functional resource and a reference guide, ensuring that account holders remain informed about their financial choices and potential fees associated with their banking activities.

Chase Print Counter Checks Example

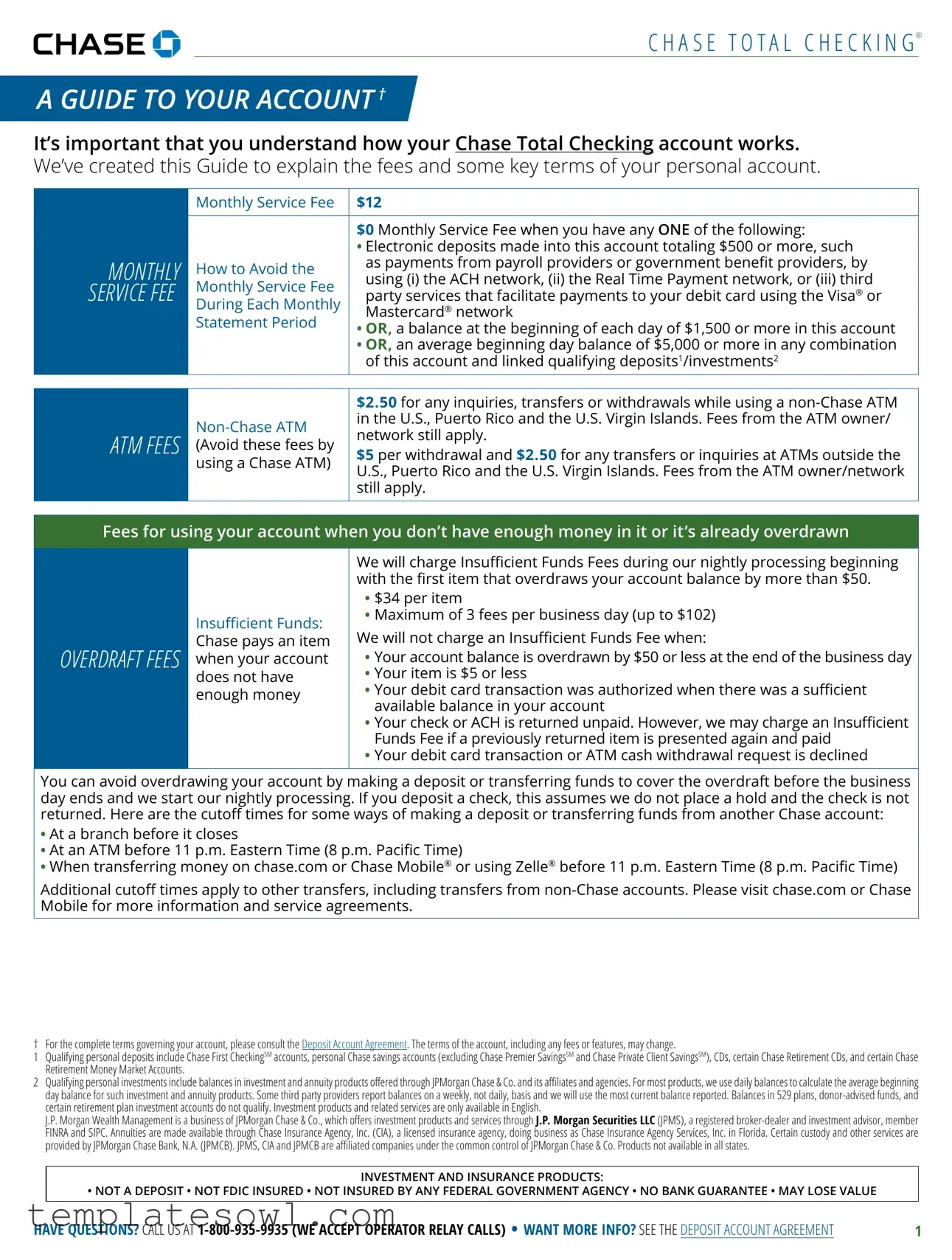

C H A S E T O T A L C H E C K I N G®

A GUIDE TO YOUR ACCOUNT †

It’s important that you understand how your Chase Total Checking account works.

We’ve created this Guide to explain the fees and some key terms of your personal account.

MONTHLY SERVICE FEE

Monthly Service Fee |

$12 |

|

|

|

|

|

$0 Monthly Service Fee when you have any ONE of the following: |

|

|

• Electronic deposits made into this account totaling $500 or more, such |

|

How to Avoid the |

as payments from payroll providers or government benefit providers, by |

|

using (i) the ACH network, (ii) the Real Time Payment network, or (iii) third |

||

Monthly Service Fee |

||

party services that facilitate payments to your debit card using the Visa® or |

||

During Each Monthly |

||

Mastercard® network |

||

Statement Period |

• OR, a balance at the beginning of each day of $1,500 or more in this account |

|

|

• OR, an average beginning day balance of $5,000 or more in any combination |

|

|

of this account and linked qualifying deposits1/investments2 |

|

|

|

ATM FEES

$2.50 for any inquiries, transfers or withdrawals while using a

$5 per withdrawal and $2.50 for any transfers or inquiries at ATMs outside the U.S., Puerto Rico and the U.S. Virgin Islands. Fees from the ATM owner/network still apply.

Fees for using your account when you don’t have enough money in it or it’s already overdrawn

OVERDRAFT FEES

Insufficient Funds:

Chase pays an item when your account does not have enough money

We will charge Insufficient Funds Fees during our nightly processing beginning with the first item that overdraws your account balance by more than $50.

•$34 per item

•Maximum of 3 fees per business day (up to $102)

We will not charge an Insufficient Funds Fee when:

•Your account balance is overdrawn by $50 or less at the end of the business day

•Your item is $5 or less

•Your debit card transaction was authorized when there was a sufficient available balance in your account

•Your check or ACH is returned unpaid. However, we may charge an Insufficient

Funds Fee if a previously returned item is presented again and paid

•Your debit card transaction or ATM cash withdrawal request is declined

You can avoid overdrawing your account by making a deposit or transferring funds to cover the overdraft before the business day ends and we start our nightly processing. If you deposit a check, this assumes we do not place a hold and the check is not returned. Here are the cutoff times for some ways of making a deposit or transferring funds from another Chase account:

•At a branch before it closes

•At an ATM before 11 p.m. Eastern Time (8 p.m. Pacific Time)

•When transferring money on chase.com or Chase Mobile® or using Zelle® before 11 p.m. Eastern Time (8 p.m. Pacific Time)

Additional cutoff times apply to other transfers, including transfers from

† For the complete terms governing your account, please consult the Deposit Account Agreement. The terms of the account, including any fees or features, may change.

1Qualifying personal deposits include Chase First CheckingSM accounts, personal Chase savings accounts (excluding Chase Premier SavingsSM and Chase Private Client SavingsSM), CDs, certain Chase Retirement CDs, and certain Chase Retirement Money Market Accounts.

2Qualifying personal investments include balances in investment and annuity products offered through JPMorgan Chase & Co. and its affiliates and agencies. For most products, we use daily balances to calculate the average beginning day balance for such investment and annuity products. Some third party providers report balances on a weekly, not daily, basis and we will use the most current balance reported. Balances in 529 plans,

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered

FINRA and SIPC. Annuities are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

INVESTMENT AND INSURANCE PRODUCTS:

• NOT A DEPOSIT • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NO BANK GUARANTEE • MAY LOSE VALUE

HAVE QUESTIONS? CALL US AT |

1 |

C H A S E T O T A L C H E C K I N G®

Chase Debit Card Coverage: You can choose how we treat your everyday (not recurring) debit card

transactions when you don’t have enough money available. Please note: Regardless of which option you choose for Chase Debit Card Coverage, you may also want to sign up for Overdraft Protection if you are eligible. Please visit www.chase.com/OverdraftProtection for more details, including terms and conditions.

OPTION #1 (YES): You ask us to add Chase Debit Card Coverage

This means you want Chase to approve and pay your everyday debit card transactions, at our discretion, when you don’t have enough money available (this includes available funds in your linked Overdraft Protection account, if enrolled). Fees may apply. You’ll have until the end of the business day to transfer or deposit enough money to avoid an Insufficient Funds Fee on these transactions.

CHASE DEBIT CARD COVERAGE SM AND FEES 3

(Please visit www.chase.com/checking/

Insufficient Funds

We will charge Insufficient Funds Fees during our nightly processing beginning with the first item that overdraws your account balance by more than $50.

•$34 per item

•Maximum of 3 fees per business day (up to $102)

We will not charge an Insufficient Funds Fee when:

•Your account balance is overdrawn by $50 or less at the end of the business day

•Your item is $5 or less

•Your debit card transaction was authorized when there was a sufficient available balance in your account

•Your check or ACH is returned unpaid. However, we may charge an Insufficient

Funds Fee if a previously returned item is presented again and paid

•Your debit card transaction or ATM cash withdrawal request is declined

OPTION #2 (NO): No Chase Debit Card Coverage (If you don’t choose an option when you open your account, Option #2 (No) is automatically selected for you)

This means you do not want Chase to approve and pay your everyday debit card transactions when you don’t have enough money available (this includes available funds in your linked Overdraft Protection account, if enrolled). Since everyday debit card transactions will be declined when there is not enough money available, you won’t be charged an Insufficient Funds Fee for everyday debit card transactions.

You can avoid overdrawing your account by making a deposit or transferring funds to cover the overdraft before the business day ends and we start our nightly processing. If you deposit a check, this assumes we do not place a hold and the check is not returned. Here are the cutoff times for some ways of making a deposit or transferring funds from another Chase account:

•At a branch before it closes

•At an ATM before 11 p.m. Eastern Time (8 p.m. Pacific Time)

•When transferring money on chase.com or Chase Mobile or using Zelle before 11 p.m. Eastern Time (8 p.m. Pacific Time)

Additional cutoff times apply to other transfers, including transfers from

See the next page for other fees that may apply.

3Important details about your Chase Debit Card Coverage: An everyday debit card transaction is a

HAVE QUESTIONS? CALL US AT |

2 |

C H A S E T O T A L C H E C K I N G®

HOW DEPOSITS AND WITHDRAWALS WORK

Posting order is the order in which we apply deposits and withdrawals to your account. We provide you with visibility into how transactions are posted and in what order to help you better manage your account.

When we transition from one business day to the next business day we post transactions to and from your account during our nightly processing. The order in which we generally post items during nightly processing for each business day is:

•First, we make any previous day adjustments, and add deposits to your account.

•Second, we subtract transactions in chronological order by using the date and time of when the transaction was authorized or shown as pending. This includes ATM and Chase banker withdrawals, transfers and payments; automatic payments; chase.com or Chase Mobile online transactions; checks drawn on your account; debit card transactions; wire transfers; and real time payments. If multiple transactions have the same date and time, then they are posted in high to low dollar order.

The Order in |

°°There are some instances where we do not have the time of the transaction |

|

Which Withdrawals |

therefore we post at the end of the day the transaction occurred: |

|

••We are unable to show the transaction as pending; or |

||

and Deposits |

||

••We don’t receive an authorization request from the merchant but the |

||

Are Processed |

||

transaction is presented for payment. |

||

|

•Third, there are some transactions that we cannot process automatically or until we’ve completed posting of your chronological transactions. This includes Overdraft Protection transfers or transfers to maintain target balances in other accounts. We subtract these remaining items in high to low dollar order.

•Finally, fees are assessed last.

If you review your account during the day, you will see that we show some transactions as “pending.” For details, refer to the section “Pending” transactions in the Deposit Account Agreement. These transactions impact your available balance, but have not yet posted to your account and do not guarantee that we will pay these transactions to your account if you have a negative balance at that time. We may still return a transaction unpaid if your balance has insufficient funds during that business day’s nightly processing, even if it had been displayed as a “pending” transaction on a positive balance during the day. If a transaction that you made or authorized does not display as “pending,” you are still responsible for it and it may still be posted against your account during nightly processing.

|

• Cash deposit – Same business day |

|

|

• Direct deposit/wire transfer – Same business day |

|

When Your Deposits |

• Check deposit – Usually the next business day, but sometimes longer: |

|

Are Available |

||

next business day |

||

(See Funds |

||

Availability Policy in |

||

receipt |

||

the Deposit Account |

||

Agreement for |

||

made that your funds (including the first $225) will not be available for up to |

||

details) |

||

seven business days |

||

|

A “business day” is a |

|

|

above will determine the “business day” for your deposit. |

|

Card Replacement – Rush Request: You request express shipping of a |

$5 per card, upon request |

|

|

replacement debit or ATM card |

||

|

(Avoid this fee by requesting standard shipping) |

|

|

|

|

|

|

OTHER ATM |

3% of the dollar amount of |

||

the transaction OR |

|||

a teller at a bank that is not Chase |

|||

AND DEBIT CARD |

|

$5, whichever is greater |

|

|

|

||

FEES |

|

3% of withdrawal amount |

|

|

Foreign Exchange Rate Adjustment: You make card purchases, |

after conversion to U.S. |

|

|

dollars. For additional |

||

|

|||

|

information on exchange |

||

|

than U.S. dollars |

||

|

rates, refer to the Deposit |

||

|

|

||

|

|

Account Agreement |

|

|

|

|

|

|

See the next page for other fees that may apply. |

|

|

|

|

|

HAVE QUESTIONS? CALL US AT |

3 |

C H A S E T O T A L C H E C K I N G®

WIRE TRANSFER FEES4

|

$15 per transfer OR |

|

Domestic and International Incoming Wire: A wire transfer is |

$0 if the transfer was |

|

originally sent with the help |

||

deposited into your account |

||

of a Chase banker or using |

||

|

||

|

chase.com or Chase Mobile |

|

|

|

|

Domestic Wire: A banker helps you to send a wire to a bank account |

$35 per transfer |

|

within the U.S. |

||

|

||

|

|

|

Online Domestic Wire: You use chase.com or Chase Mobile to send a |

$25 per transfer |

|

wire from your checking account to a bank account within the U.S. |

||

|

||

Consumer USD/FX International Wire: A banker helps you to send a |

$50 per transfer |

|

wire to a bank account outside the U.S. in either U.S. dollars (USD) or |

||

foreign currency (FX) |

|

|

|

|

|

Consumer Online USD International Wire: You use chase.com or |

$40 per transfer |

|

Chase Mobile to send a wire from your checking account to a bank |

||

account outside the U.S. in U.S. dollars (USD) |

|

|

|

|

|

Consumer Online FX International Wire: You use chase.com or Chase |

$5 per transfer OR |

|

$0 per transfer if the |

||

Mobile to send a wire from your checking account to a bank account |

||

amount is equal to $5,000 |

||

outside the U.S. in foreign currency (FX) |

||

USD or more |

||

|

||

|

|

OTHER FEES

Stop Payment: You contact us and a banker places your stop payment |

$30 per request |

|

request on a check or ACH item |

||

|

||

|

|

|

Online or Automated Phone Stop Payment: You use chase.com, Chase |

$25 per request |

|

Mobile or our automated phone system to place a stop payment on a |

||

check. Only some types of stop payments are available |

|

|

|

$12 for each item you |

|

|

deposit or cash that is |

|

|

returned unpaid. Example: |

|

|

You deposit a check from |

|

Deposited Item Returned or Cashed Check Returned: You deposit or |

someone who didn’t have |

|

enough money in his/her |

||

cash an item that is returned unpaid |

||

account. The amount of the |

||

|

||

|

deposit will be subtracted |

|

|

from your balance and |

|

|

you will be charged the |

|

|

Deposited Item Returned Fee |

|

|

|

|

Order for Checks or Supplies: An order of personal checks, deposit |

Varies (based on items |

|

slips or other banking supplies |

ordered) |

|

|

|

|

Counter Check: A blank page of 3 personal checks we print upon your |

$2 per page |

|

request at a branch |

||

|

||

|

|

|

Money Order: A check issued by you, purchased at a branch, for an |

$5 per check |

|

amount up to $1,000 |

||

|

||

|

|

|

Cashier’s Check: A check issued by the bank, purchased at a branch, for |

$8 per check |

|

any amount and to a payee you designate |

||

|

||

|

|

|

Legal Processing: Processing of any garnishment, tax levy, or other |

Up to $100 per order |

|

court administrative order against your accounts, whether or not the |

||

funds are actually paid |

|

|

|

|

SAFE DEPOSIT BOX ANNUAL RENT

Assessed annually at lease renewal. We currently do not rent new Safe Deposit Boxes

Varies by size and location, includes sales tax where applicable

4 Financial institutions may deduct processing fees and/or charges from the amount of the incoming or outgoing wire transfers. Any deductions taken by us, and our affiliates, may include processing fees charged by Chase.

JPMorgan Chase Bank, N.A. Member FDIC

© 2022 JPMorgan Chase & Co.

Effective 1/31/2022

HAVE QUESTIONS? CALL US AT |

4 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Monthly Service Fee | The Chase Total Checking account has a monthly service fee of $12, which can be waived based on certain criteria such as maintaining a daily balance or receiving electronic deposits of $500 or more. |

| ATM Fees | Using non-Chase ATMs incurs a fee of $2.50 for inquiries, transfers, or withdrawals in the U.S. and $5 outside the U.S. Additional fees from the ATM owner may also apply. |

| Overdraft Fees | Chase charges $34 for overdrafts exceeding $50, with a maximum of three fees per business day. Transactions below this threshold are not charged a fee. |

| Debit Card Coverage Options | Account holders can choose to enable or disable Chase Debit Card Coverage, affecting how overdrafts from everyday debit card transactions are handled. |

| Wire Transfer Fees | Various fees apply for wire transfers. For example, sending a domestic wire online costs $25, while sending an international wire can range from $40 to $50, depending on the method used. |

| Fee for Counter Checks | Counter checks, which are personal checks printed at a branch, are available for $2 per page. |

Guidelines on Utilizing Chase Print Counter Checks

When you need to fill out the Chase Print Counter Checks form, it's essential to ensure that all information is accurately provided to avoid any delays. The process for filling out the form is straightforward, and with a little attention to detail, you can complete it without any hassle.

- Obtain the Chase Print Counter Checks form from your local Chase branch or the official Chase website.

- Begin by entering your full name in the designated field. Make sure to spell it correctly.

- Next, provide your account number. This number is typically found on your account statement or checks.

- Indicate the number of checks you wish to order. Usually, you can order a specific amount, such as a single page that contains multiple checks.

- Fill in the address where you would like the checks to be sent. Double-check to ensure accuracy, especially if it's different from your billing address.

- Review the fees associated with the print counter checks, which might be indicated at the bottom or side of the form.

- Once all fields are complete, sign the form at the required section to authorize the order.

- Finally, submit the completed form to a bank representative at your nearest Chase branch or via mail, depending on the instructions provided on the form.

Once submitted, your request will be processed, and the checks will be printed and sent to the address you provided. Keep an eye on your mailbox for your new checks, and make sure to check them for any errors once they arrive.

What You Should Know About This Form

What is the Chase Print Counter Checks form used for?

The Chase Print Counter Checks form is a request for temporary personal checks that customers can use when they need checks but have run out of their personalized checks. These counter checks can provide a convenient solution for individuals who need to make payments or transactions in lieu of waiting for their check order to arrive.

How can I obtain counter checks from Chase?

To obtain counter checks, visit a local Chase branch. You should request the checks directly from a Chase representative. Typically, they will print the checks on-site, which can be done quickly. You may need to provide your identification and account details to facilitate this process.

What fees are associated with using counter checks?

There is a fee of $2 per page for counter checks. Each page typically contains three personal checks. Therefore, using counter checks can be an affordable temporary solution compared to ordering personalized checks, which may take longer to receive and could involve higher fees depending on the design and quantity.

Are counter checks the same as standard checks?

While counter checks function similarly to regular checks as they allow you to withdraw funds from your checking account, they differ in appearance. Counter checks do not have personal information like your name and address printed on them; instead, they are blank checks issued directly by the bank. It is advisable to limit their use to situations where you cannot use your personal checks or where immediate access to funds is essential.

Common mistakes

When completing the Chase Print Counter Checks form, individuals often make several common mistakes. First, many forget to include their full name as it appears on their bank account. Omitting or misspelling this detail can lead to delays or complications. It's essential that the name matches your official identification and account records.

Second, incorrect account numbers are a frequent issue. If the account number is wrong, the checks may not process correctly. Double-checking the account number will help avoid unnecessary problems with deposits or withdrawals.

Another common mistake involves the wrong date. If you forget to write the current date on the checks, it can cause confusion for both you and the recipient. Always ensure that the date is accurate and reflects when you are issuing the check.

Fourth, individuals sometimes do not clearly specify the amount of the check in both numbers and words. This inconsistency can result in discrepancies that might lead to disputes or payment rejections. Be meticulous in ensuring both representations are aligned.

Fifth, many people overlook including a signature. An unsigned check is not valid, and banks will not process it. Make sure to sign every check issued to prevent it from being refused by the bank.

Moreover, some fail to check the formatting of the checks. If the form is not filled out correctly according to the specifications, the entire request may be rejected. Pay attention to any guidelines provided by Chase to ensure compliance.

Lastly, failing to keep a copy of the completed checks can pose problems. A duplicate record is crucial for tracking your expenses and resolving potential disputes. Always maintain documentation of your transactions for future reference.

Documents used along the form

The Chase Print Counter Checks form is just one element in managing your Chase Total Checking account. Alongside it, there are several other important documents and forms you'll likely encounter. Each serves a specific function, ensuring your banking experience is smooth and efficient. Below is a list of related forms and documents that complement your Chase account management.

- Money Order Form: This document allows you to request a money order, which is a secure way to send payments. You can purchase money orders for amounts up to $1,000, and they can be helpful when you don’t want to use a personal check.

- Cashier's Check Request: This form is used to order a cashier's check, which is a check guaranteed by the bank. It’s often required for large transactions such as home purchases, as it provides security for both parties involved.

- Stop Payment Request: If you need to stop a check or ACH transaction from being processed, this form is essential. You can make a stop payment request through a banker, online, or via automated phone services.

- Order for Checks or Supplies: Use this document to order personal checks, deposit slips, or other banking supplies. The cost varies and is based on the items you choose.

- Wire Transfer Form: This is necessary for requesting wire transfers, both domestic and international. It includes details on fees associated with these transfers.

- Deposited Item Returned Fee Notice: This notice alerts you about fees when a deposited check bounces due to insufficient funds from the payer's bank. It's important to be aware of this to manage your finances effectively.

- Safe Deposit Box Lease Agreement: If you choose to rent a safe deposit box for secure storage of valuables, this document outlines the terms and any associated annual fees.

Understanding these forms can empower you to navigate your banking activities with confidence. By being familiar with this documentation, you can better manage your finances and ensure that your banking experience is positive and efficient.

Similar forms

- Personal Checks: Similar to counter checks, personal checks are issued to individuals and allow them to pay funds directly from their bank account. Both can be used as immediate payment instruments, though personal checks typically require a checking account to be opened beforehand and may carry personal information.

- Money Orders: Like counter checks, money orders do not require a bank account and can be purchased in denominations up to a certain limit. Both serve as secure payment methods and can be issued at financial institutions, making them suitable for various transactions.

- Cashier's Checks: Cashier's checks are issued by a bank and provide a guaranteed payment from the bank's funds rather than the buyer's funds. Counter checks are often temporary and don't provide a guarantee, while cashier's checks are considered more secure in larger transactions. Both serve as a reliable form of payment.

- Traveler's Checks: Traveler’s checks are pre-printed and can be used like cash while traveling. Similar to counter checks, they provide a replacement if lost or stolen and are a safe way to carry currency. However, they have become less common with the rise of credit and debit cards.

Dos and Don'ts

When filling out the Chase Print Counter Checks form, it is essential to be mindful of the details you provide and the procedures you follow. Here’s a list of dos and don’ts to ensure a smooth process.

- Do double-check your personal information to avoid errors.

- Do select the correct account type associated with your checks.

- Do ensure your signature matches the one on file with Chase.

- Do specify the number of checks you need clearly on the form.

- Do provide a valid identification if required by the bank representative.

- Don't leave any fields blank to avoid delays in processing.

- Don't forget to read through the instructions thoroughly.

- Don't submit the form without reviewing it for accuracy.

- Don't share sensitive information unnecessarily.

- Don't assume that all checks will be available for immediate use; verify processing times with the bank.

Misconceptions

- Misconception 1: Counter checks are the same as regular checks.

- Misconception 2: You can order an unlimited number of counter checks.

- Misconception 3: Counter checks do not have associated fees.

- Misconception 4: There is no risk of overdrawing when using counter checks.

- Misconception 5: Counter checks can be used anywhere.

Counter checks are blank checks provided by the bank, meant for immediate use, whereas regular checks are personal checks printed in advance, usually with printed account details. Counter checks typically carry fewer security features and are considered less formal.

The bank may limit the number of counter checks issued to a customer at one time. Generally, you receive a specific number per request, and any additional requests might incur charges or require waiting periods.

Although counter checks are convenient, they do come with fees that can vary from $2 per page at some banks. Understanding these costs can help in financial planning.

Using counter checks without sufficient funds can lead to overdraft fees. If funds are insufficient at the time of processing, the transaction may not go through, but this does not prevent fees from accruing if the account is overdrawn subsequently.

Not all merchants accept counter checks. It's advisable to use them where specifically accepted, as some businesses may only accept traditional checks or other forms of payment. Always verify acceptance beforehand to avoid complications.

Key takeaways

Understanding Monthly Fees: To avoid the $12 monthly service fee, ensure you meet one of the specified criteria.

ATM Fee Awareness: Using non-Chase ATMs will incur a $2.50 fee for transactions within the U.S.

Overdraft Fee Structure: Be mindful of the $34 fee charged for overdrafts and the maximum of three fees per business day.

Deposit Availability: Cash deposits are available the same business day, while check deposits may take longer.

Transfer Timing: For online transfers using chase.com or Chase Mobile, use the cutoff time to ensure same-day processing.

Debit Card Coverage Options: Decide whether to opt for Chase Debit Card Coverage to approve transactions with insufficient funds.

Stop Payment Requests: Fees apply for placing stop payments on checks; an online request is generally cheaper.

Counter Checks: Need counter checks? Chase charges $2 for each page of checks printed at a branch.

Transaction Posting Order: Transactions are posted starting with deposits, then withdrawals in chronological order.

Wire Transfer Fees: Be aware of varying costs depending on whether the transfer is domestic or international.

Browse Other Templates

North Carolina Car Registration - Owners can take note of these procedures to make informed decisions regarding their vehicles.

How to Get a Survivorship Deed Ohio - The legal representatives of the owners are protected as well under this deed.