Fill Out Your Chase Short Sale Packet Form

Navigating the complexities of a short sale can be daunting, especially when addressing the specific requirements set forth by lenders like Chase. The Chase Short Sale Packet is a vital tool designed to guide homeowners through the process of requesting a short sale on their property. It encompasses a range of necessary components that must be meticulously completed and submitted for evaluation. Among these is a Required Documentation Checklist, which outlines all essential documents from both the borrower and their real estate agent. This checklist ensures that all needed information is provided, including financial statements, employment verification, and proofs of hardship. The packet also includes an Authorization to Provide and Release Information, allowing Chase to share relevant details about your mortgage with authorized parties, such as real estate agents. Furthermore, the Request for Consideration of Short Sale form plays a crucial role in detailing your property information and the circumstances leading to your financial difficulties. Additional paperwork, such as the 4506T-EZ Request for Transcript of Tax Return form, is included to verify income information by allowing Chase access to tax return transcripts. By understanding and fully completing this packet, borrowers improve their chances of a smooth transaction and an approved short sale, ultimately paving the way for a fresh start.

Chase Short Sale Packet Example

Short Sale Information Packet

In order for us to evaluate your Short Sale request, you must complete this packet, sign in all the required places and fax or mail it to Chase with the required documentation.

Please keep a copy of everything you send to us for your records.

This packet contains the following items:

1.Required Documentation Checklist –

Detailed list of the documents you must send to us in addition to the packet

a.From You, the Borrower and

b.From Your Real Estate Agent

2.Authorization to Provide and Release Information –

Grants Chase permission to provide information pertaining to your mortgage to necessary agents

3.Request for Consideration of Short Sale –

Information about your property, loans, income, etc., as well as details on the circumstances that have made it difficult for you to stay

4.

Allows Chase to receive a transcript of your tax return to verify income information

If you need any assistance completing this packet please contact us:

For Chase mortages:

For WaMu mortgages:

Please send the completed packet as well as all required documentation to Chase:

By Regular Mail: |

By Overnight Mail: |

Chase Fulfillment Center |

Chase Fulfillment Center |

P.O. Box 469030 |

4500 Cherry Creek Drive South |

Glendale, CO 80246 |

Suite #100 |

|

Glendale, CO 80246 |

|

By Fax: |

Important Information

We are attempting to collect a debt, and any information obtained will be used for that purpose.

We may report information about your account to credit bureaus. Late payments, missed payments, or other defaults on your account may be reflected in your credit report.

If you are represented by an attorney, please refer this letter to your attorney and provide us with the attorney’s name, address, and telephone number.

If you are currently a debtor in bankruptcy proceedings and subject to the protections of the automatic stay, or if you have received a final discharge in a bankruptcy, this notice is for compliance and/or informational purposes only and not an attempt to impose personal liability for the debt in violation of the bankruptcy laws. However, Chase Home Finance LLC still has the right under the Mortgage to foreclose on the Property.

SSIP 04/10A (Chase) |

Short Sale Information Packet Page 1 of 9 |

Required Documentation Checklist

1A. FROM YOU, THE BORROWER AND

If you are a Wage Earner (you receive a

Two (2) most recent Pay Stubs (two for each borrower)

Length of service with Current Employer: Borrower Year(s):______ Month(s):______ |

Most recent one (1) month’s complete Bank Statement

If you are Self Employed, please provide:

P & L Statement / Audited or reviewed YTD Income Statement (must provide)

Most recent two (2) years’ Tax Returns Completed (personal and business, signed with all pages) or 1099s or most recent two (2) years filed and proof of extension

Last four (4) months complete Business and Personal Bank Statements (must provide all pages. If a business account is not used, provide a written statement stating a business account is not used)

Everyone must provide the following:

Most recent statement(s) supporting assets listed on page 2 of the Request for Consideration of Short Sale Form (must provide all pages of statements)

Most recent completed Tax Return (signed with all pages) or most recent filed and proof of extension (signed with all pages)

Proof of occupancy (if owner occupied) - a recent utility bill in your name at property address

If loan is

A)Copy of the most recent property tax bill(s) with a copy of the cancelled check for all applicable taxes (County, City, School, etc.)

B)Copy of the current insurance declaration page for all applicable coverage types (must show premium amount for homeowner’s, flood, and wind)

C)Proof of payment of Homeowner’s Association Fees (if applicable)

If

A)Rental Income with copies of Rental Agreement if a tenant resides in the property

B)Amount of Principal, Interest, Taxes, Insurance, and Home Owner Dues for Primary Residence

C)Primary Residence Address

Authorization to Provide and Release Information- Allows Realtor or designee to discuss the account with Chase, if desired.

Be sure to sign this form

Completed Request for Consideration of Short Sale Form (enclosed). Be sure to sign and date this form.

Completed

1B. FROM YOUR REAL ESTATE AGENT

Listing Agreement

Detailed Listing History (MLS Printout)

Sales / Purchase Contract (Signed Offer)

3 Comparable Active Listings/3 Comparable Sales/Pictures of the Property & Neighborhood

HUD (Estimated Closing Statement)

SSIP 04/10A (Chase) |

Short Sale Information Packet Page 2 of 9 |

AUTHORIZATION TO PROVIDE AND RELEASE INFORMATION

TO: |

Chase |

DATE: |

______________________________ |

RE: MORTGAGE LOAN NUMBER: ______________________________ |

|

BORROWER(S): |

_________________________________________________ |

PROPERTY ADDRESS: |

_________________________________________ |

|

_________________________________________ |

I/(We), _________________________________________________________________________(borrower(s) name(s)) , currently residing

at _______________________________________________________________________ in the County of _________________________________,

State of __________, hereby authorize Chase Home Finance LLP/JPMorgan Chase Bank, N.A (collectively “Chase”) to release, furnish, and

provide any information related to my mortgage under loan number ____________________________ to _____________________________

_______________________________________________________________ (name of third party).

I UNDERSTAND THAT THIS AUTHORIZATION IS VALID UNTIL SUCH TIME

THAT CHASE CONFIRMS IT HAS RECEIVED WRITTEN NOTICE FROM ME

REVOKING THIS PRIOR AGREEMENT.

____________________________________________ |

____________________________________________ |

Borrower Signature |

|

____________________________________________ |

____________________________________________ |

Borrower Name (Printed) |

SSIP 04/10A (Chase) |

Short Sale Information Packet Page 3 of 9 |

REQUEST FOR CONSIDERATION OF SHORT SALE FORM page 1 |

COMPLETE ALL FOUR PAGES OF THIS FORM |

Loan I.D. Number____________________________________ |

Servicer ____________________________________ |

|

BORROWER |

Borrower’s |

|

name |

|

|

|

Social Security |

Date |

number |

of birth |

|

|

Home phone number |

|

with area code |

|

|

|

Cell or work number |

|

with area code |

|

|

|

|

|

name |

|

|

|

Social Security |

Date |

number |

of birth |

|

|

Home phone number |

|

with area code |

|

|

|

Cell or work number |

|

with area code |

|

I want to: |

Keep the Property |

Sell the Property |

|

|

|

|

|

The property is my: |

Primary Residence |

Second Home |

Investment |

|

|

|

|

The property is: |

Owner Occupied |

Renter Occupied |

Vacant |

|

|

|

|

Mailing address

Property address (if same as mailing address, just write same) |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|||||

Is the property listed for sale? |

Yes |

No |

|

|

|

Have you contacted a |

Yes |

No |

|||||

|

|

|

|

|

Yes |

No |

|

If yes, please complete the following: |

|

|

|||

|

|

|

|

_____________________ |

Counselor’s Name: _________________________________________ |

||||||||

Agent’s Name: ___________________________________________ |

Agency Name: ____________________________________________ |

||||||||||||

Agent’s Phone Number: ____________________________________ |

Counselor’s Phone Number: __________________________________ |

||||||||||||

For Sale by Owner? |

Yes |

No |

|

|

|

|

Counselor’s |

||||||

|

|

|

|

|

|

||||||||

Who pays the real estate tax bill on your property? |

|

|

Who pays the hazard insurance premium for your property? |

|

|

||||||||

I do |

Lender does |

Paid by condo or HOA |

|

|

I do |

Lender does |

|

Paid by Condo or HOA |

|

|

|||

Are the taxes current? |

Yes |

No |

|

|

|

|

Is the policy current? |

Yes |

No |

|

|

||

Condominium or HOA Fees |

Yes |

No $ __________________ |

Name of Insurance Co.: ______________________________________ |

||||||||||

Paid to: _________________________________________________ |

Insurance Co. Tel #: _________________________________________ |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Yes |

No |

If yes: |

Chapter 7 |

Chapter 13 |

Filing Date:_________________________ |

|

|

|||

Has your bankruptcy been discharged? |

Yes |

|

No |

Bankruptcy case number _________________________________ |

|

|

|||||||

Additional Liens/Mortgages or Judgments on this property:

Lien Holder’s Name/Servicer

Balance

Contact Number

Loan Number

HARDSHIP AFFIDAVIT

My household income has been reduced. For example: unemployment, |

My monthly debt payments are excessive and I am overextended with |

|

underemployment, reduced pay or hours, decline in business earnings, |

my creditors. Debt includes credit cards, home equity or other debt. |

|

death, disability or divorce of a borrower or |

|

|

|

|

|

My expenses have increased. For example: monthly mortgage payment |

My cash reserves, including all liquid assets, are insufficient to maintain |

|

reset, high medical or health care costs, uninsured losses, increased |

my current mortgage payment and cover basic living expenses at the |

|

utilities or property taxes. |

same time. |

|

|

|

|

Other:

Other:

Explanation (continue on back of page 3 if necessary): __________________________________________________________________________

______________________________________________________________________________________________________________________

SSIP 04/10A (Chase) |

Short Sale Information Packet Page 4 of 9 |

REQUEST FOR CONSIDERATION OF SHORT SALE FORM page 2 |

|

COMPLETE ALL FOUR PAGES OF THIS FORM |

|

|

|

|

|

INCOME/EXPENSES FOR HOUSEHOLD |

1 |

|

Number of People in Household: |

|

|

||

|

|

|

|

Monthly Household Income

Monthly Gross Wages |

$ |

|

|

Overtime |

$ |

|

|

Child Support / Alimony / |

$ |

Separation2 |

|

Social Security/SSDI |

$ |

|

|

Other monthly income from |

$ |

pensions, annuities or |

|

retirement plans |

|

|

|

Tips, commissions, bonus |

$ |

and |

|

|

|

Rents Received |

$ |

|

|

|

|

Unemployment Income |

$ |

|

|

|

|

Food Stamps/Welfare |

$ |

|

|

Other (investment income, |

$ |

|

|

royalties, interest, dividends |

|

etc.) |

|

|

|

Total (Gross Income) |

$ |

|

|

Monthly Household Expenses/Debt

First Mortgage Payment |

$ |

|

|

Second Mortgage Payment |

$ |

|

|

Insurance |

$ |

|

|

Property Taxes |

$ |

|

|

Credit Cards / Installment |

$ |

Loan(s) (total minimum |

|

payment per month) |

|

|

|

Alimony, child support |

$ |

payments |

|

|

|

Net Rental Expenses |

$ |

|

|

|

|

HOA/Condo Fees/Property |

$ |

Maintenance |

|

|

|

Car Payments |

$ |

|

|

Other ________________ |

$ |

_____________________ |

|

|

|

Total Debt/Expenses |

$ |

|

|

Household Assets

Checking Account(s) |

$ |

|

|

Checking Account(s) |

$ |

|

|

Savings/ Money Market |

$ |

|

|

CDs |

$ |

|

|

Stocks / Bonds |

$ |

|

|

Other Cash on Hand |

$ |

|

|

Other Real Estate |

$ |

(estimated value) |

|

|

|

Other _____________ |

$ |

|

|

|

|

Other _____________ |

$ |

|

|

Do not include the value of life insurance or retirement plans when calculating assets (401k, pension funds, annuities, IRAs, Keogh plans, etc.)

Total Assets |

$ |

|

|

INCOME MUST BE DOCUMENTED

1Include combined income and expenses from the borrower and

2You are not required to disclose Child Support, Alimony or Separation Maintenance income, unless you choose to have it considered by your servicer.

INFORMATION FOR GOVERNMENT MONITORING PURPOSES

The following information is requested by the federal government in order to monitor compliance with federal statutes that prohibit discrimination in housing. You are not required to furnish this information, but are encouraged to do so. The law provides that a lender or servicer may not discriminate either on the basis of this information, or on whether you choose to furnish it. If you furnish the information, please provide both ethnicity and race. For race, you may check more than one designation. If you do not furnish ethnicity, race, or sex, the lender or servicer is required to note the information on the basis of visual observation or surname if you have made this request for a loan modification in person. If you do not wish to furnish the information, please check the box below.

BORROWER |

I do not wish to furnish this information |

|

I do not wish to furnish this information |

|

|

||||

|

|

|

|

|

Ethnicity: |

Hispanic or Latino |

|

Ethnicity: |

Hispanic or Latino |

|

Not Hispanic or Latino |

|

|

Not Hispanic or Latino |

|

|

|

|

|

Race: |

American Indian or Alaska Native |

|

Race: |

American Indian or Alaska Native |

|

Asian |

|

|

Asian |

|

Black or African American |

|

|

Black or African American |

|

Native Hawaiian or Other Pacific Islander |

|

|

Native Hawaiian or Other Pacific Islander |

|

White |

|

|

White |

|

|

|

|

|

Sex: |

Female |

|

Sex: |

Female |

|

Male |

|

|

Male |

|

|

|

|

|

SSIP 04/10A (Chase) |

Short Sale Information Packet Page 5 of 9 |

REQUEST FOR CONSIDERATION OF SHORT SALE FORM page 3 |

COMPLETE ALL FOUR PAGES OF THIS FORM |

ACKNOWLEDGEMENT AND AGREEMENT

In making this request for consideration under the Making Home Affordable Program I certify under penalty of perjury:

1.That all of the information in this document is truthful and the event(s) identified on page 1 is/are the reason that I need to request a modification of the terms of my mortgage loan, short sale or

2.I understand that the Servicer, the U.S. Department of Treasury, or their agents may investigate the accuracy of my statements and may require me to provide supporting documentation. I also understand that knowingly submitting false information may violate Federal law.

3.I understand the Servicer will pull a current credit report on all borrowers obligated on the Note.

4.I understand that if I have intentionally defaulted on my existing mortgage, engaged in fraud or misrepresented any facts(s) in connection with this document, the Servicer may cancel any Agreement under Making Home Affordable and may pursue foreclosure on my home.

5.I am willing to provide all requested documents and to respond to all Servicer questions in a timely manner and to otherwise comply with all requirements of the Making Home Affordable Program that may be in effect from time to time.

6.I understand that the Servicer will use the information in this document to evaluate my eligibility for a loan modification or short sale or

7.I am willing to commit to credit counseling if it is determined that my financial hardship is related to excessive debt.

8.If I was discharged in a Chapter 7 bankruptcy proceeding subsequent to the execution of the Loan Documents, or am currently entitled to the protections of any automatic stay in bankruptcy, I acknowledge that Servicer is providing the information about the Making Home Affordable program at my request and for informational purposes, and not as an attempt to impose personal liability for the debt evidenced by the Note.

9.I acknowledge that while my request is being evaluated, the Servicer may suspend any scheduled foreclosure sale, but may continue to send legal notices related to foreclosure. Any pending foreclosure action will not be dismissed and may be immediately resumed from the point at which it was suspended if I fail to comply with the terms and conditions of the Making Home Affordable program, including any trial period plan, and no new notice of default, notice of intent to accelerate, notice of acceleration, or similar notice will be necessary to continue the foreclosure action. All rights to such notices are hereby waived by me to the extent permitted by applicable law. I further acknowledge that when the Servicer accepts and posts a payment during the time I am being evaluated, including during any trial period, it will be without prejudice to, and will not be deemed a waiver of, the acceleration of the loan or any foreclosure action and related activities and shall not constitute a cure of any default under the loan documents evidencing and securing the loan unless such payments are sufficient to completely cure my entire default under the loan documents. If I am in foreclosure, I agree that all trial payments will be made in certified funds.

10.I further acknowledge and agree that if I am offered a trial period plan by the Servicer, making the first payment due under such trial period plan shall be deemed an acceptance of the terms and conditions of the plan.

11.I understand that the Servicer will collect and record personal information, including, but not limited to, my name, address, telephone number, social security number, credit score, income, payment history, government monitoring information, and information about account balances and activity. I understand and consent to the disclosure of my personal information and the terms of Making Home Affordable Agreement by Servicer to (a) the U.S. Department of the Treasury;

(b) Fannie Mae and Freddie Mac in connection with their responsibilities under the Homeowner Affordability and Stability Plan; (c) any investor, insurer, guarantor or servicer that owns, insures, guarantees or services my first lien or subordinate lien (if applicable) mortgage loan(s); (d) companies that perform support services in conjunction with Making Home Affordable; and (e) any HUD certified housing counselor.

12.I will execute such other and further documents as may be reasonably necessary to either (i) consummate the terms and

conditions of this Plan or any final modification, short sale or

SSIP 04/10A (Chase) |

Short Sale Information Packet Page 6 of 9 |

REQUEST FOR CONSIDERATION OF SHORT SALE FORM page 4 |

COMPLETE ALL FOUR PAGES OF THIS FORM |

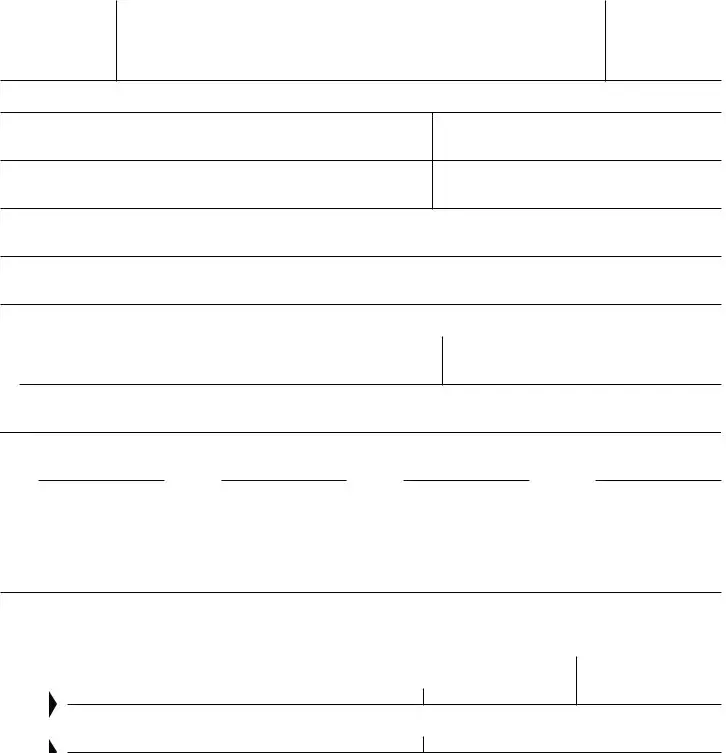

Date:

BORROWER SIGNATURE

Date:

SSIP 04/10A (Chase) |

Short Sale Information Packet Page 7 of 9 |

Form

(Rev. January 2010)

Department of the Treasury Internal Revenue Service

Short Form Request for Individual Tax Return Transcript

Request may not be processed if the form is incomplete or illegible.

Request may not be processed if the form is incomplete or illegible.

OMB No.

Tip. Use Form

1a Name shown on tax return. If a joint return, enter the name shown first.

1b First social security number on tax return

2a If a joint return, enter spouse’s name shown on tax return.

2b Second social security number if joint tax return

3Current name, address (including apt., room, or suite no.), city, state, and ZIP code

4Previous address shown on the last return filed if different from line 3

5If the transcript is to be mailed to a third party (such as a mortgage company), enter the third party’s name, address, and telephone number. The IRS has no control over what the third party does with the tax information.

Third party name

Chase Fulfillment Center

Telephone number

Chase mortages:

Chase mortages:

Address (including apt., room, or suite no.), city, state, and ZIP code

Regular Mail: PO Box 469030, Glendale, CO 80246 |

Overnight Mail: 4500 Cherry Creek Drive South, Suite 100, Glendale, CO 80246 |

6Year(s) requested. Enter the year(s) of the return transcript you are requesting (for example, “2008”). Most requests will be processed within 10 business days.

2008

Caution. If the transcript is being mailed to a third party, ensure that you have filled in line 6 before signing. Sign and date the form once you have filled in line 6. Completing these steps helps to protect your privacy.

Note. If the IRS is unable to locate a return that matches the taxpayer identity information provided above, or if IRS records indicate that the return has not been filed, the IRS may notify you or the third party that it was unable to locate a return, or that a return was not filed, whichever is applicable.

Signature of taxpayer(s). I declare that I am the taxpayer whose name is shown on either line 1a or 2a. If the request applies to a joint return, either husband or wife must sign. Note. For transcripts being sent to a third party, this form must be received within 120 days of signature date.

Sign Here

Telephone number of taxpayer on line 1a or 2a

Signature (see instructions) |

Date |

Spouse’s signature |

Date |

|

For Privacy Act and Paperwork Reduction Act Notice, see page 2. |

Cat. No. 54185S |

Form |

SSIP 04/10A (Chase) |

Short Sale Information Packet Page 8 of 9 |

Form |

Page 2 |

Purpose of form. Individuals can use Form

Use Form

ss! TRANSCRIPT OFSACBUSINESS RETURN (including estate and trust returns).

ss!N ACCOUNT TRANSCRIPTTCONTAINSN information on the financial status of the account, such as payments made on the account, penalty assessments, and adjustments made by you or the IRS after the return was filed).

ss! RECORD OFCACCOUNT WHICH ISCAC combination of line item information and later adjustments to the account.

ss! VERIFICATION OFINONFILING WHICH IS PROOFN from the IRS that you did not file a return for the year.

ss! &ORM 7 R&ORM SERIESO&ORM SERIES ORR&ORM SERIES TRANSCRIPT

Form

Automated transcript request. You can CALL

TO ORDER A TAX RETURNT transcript through the automated

Where to file. Mail or fax Form

If you are requesting more than one transcript or other product and the chart

BELOWLSHOWS TWOHDIFFERENTT2!)63 TEAMS send your request to the team based on the address of your most recent return.

If you filed an |

Mail or fax to the |

|

individual return |

“Internal Revenue |

|

and lived in: |

Service” at: |

|

|

|

|

Florida, Georgia, |

2!)63)4EAM |

|

North Carolina, |

||

P.O. Box |

||

South Carolina |

||

3TOP P |

||

|

$ORAVILLE '!L |

|

|

|

|

|

|

|

!LABAMA +ENTUCKY |

|

|

Louisiana, |

2!)63)4EAM |

|

Mississippi, |

||

3TOP !53# |

||

Tennessee, Texas, a |

||

!USTINT48 |

||

foreign country, or |

||

!0/ OR/&0/ |

||

|

||

address |

|

|

!LASKAS!RIZONA |

|

|

California, Colorado, |

|

|

Hawaii, Idaho, Illinois, |

|

|

Indiana, Iowa, |

|

|

+ANSASS |

2!)63)4EAM |

|

Minnesota, Montana, |

||

3TOP |

||

.EBRASKAA.EVADA |

||

&RESNOS#! # |

||

New Mexico, North |

||

|

||

$AKOTAO/KLAHOMA/ |

||

|

||

Oregon, South |

|

|

$AKOTAO5TAH |

|

|

7ASHINGTONN |

|

|

7ISCONSIN 7YOMING |

|

|

|

|

|

!RKANSASN |

|

|

Connecticut, |

|

|

Delaware, District of |

|

|

Columbia, Maine, |

|

|

Maryland, |

2!)63)4EAM |

|

Massachusetts, |

||

Stop 6705 |

||

Missouri, New |

+ANSAS #ITY |

|

Hampshire, New |

||

*ERSEYS.EWY9ORK. |

|

|

Ohio, Pennsylvania, |

|

|

Rhode Island, |

|

|

6ERMONT 6IRGINIA 6 |

|

|

7EST 6IRGINIAI |

|

|

|

|

Signature and date. Form

Transcripts of jointly filed tax returns may be furnished to either spouse. Only one signature is required. Sign Form

Privacy Act and Paperwork Reduction Act Notice. 7E ASK FOR THE INFORMATION ON this form to establish your right to gain access to the requested tax information under the Internal 2EVENUEE#ODEE7E need this information to properly identify the tax information and respond to your REQUEST 3ECTIONS AND NREQUIRE you to provide this information, including your SSN. If you do not provide this information, we may not be able to process your request. Providing false or fraudulent information may subject you to penalties.

Routine uses of this information include giving it to the Department of Justice for civil and criminal litigation, and cities, states, and the District of Columbia for use

IN ADMINISTERING THEIR TAX LAWS 7ETMAYE also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

You are not required to provide the information requested on a form that is

SUBJECTJTO THE 0APERWORK 2EDUCTION !CT R unless the form displays a valid OMB CONTROLTNUMBER "OOKSMOR RECORDS RELATINGS to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are

CONFIDENTIALEAS REQUIREDBY SECTION

The time needed to complete and file Form

If you have comments concerning the accuracy of these time estimates or SUGGESTIONSSFORIMAKING &ORMO4

%: simpler, we would be happy to hear from you. You can write to the Internal Revenue Service, Tax Products Coordinating #OMMITTEE

7ASHINGTONN$# $O NOT SENDTHE form to this address. Instead, see Where to file on this page.

SSIP 04/10A (Chase) |

Short Sale Information Packet Page 9 of 9 |

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose of the Packet | The Chase Short Sale Packet is essential for evaluating short sale requests, requiring completion and submission to Chase with necessary documents. |

| Required Documentation | A detailed checklist of documents from the borrower, co-borrower, and real estate agent is included in the packet for submission. |

| Authorization to Share Information | The packet contains an authorization form allowing Chase to provide mortgage information to designated agents, ensuring communication is permitted. |

| Request for Consideration | Borrowers must complete a detailed form that includes property information and the financial hardships they are facing to justify the short sale. |

| Tax Return Verification | Included is the 4506T-EZ form, which allows Chase to obtain a tax return transcript, aiding in income verification for the short sale process. |

| Governance | Depending on the state, the laws governing mortgages and foreclosure will apply, such as the Uniform Commercial Code (UCC) and state-specific foreclosure laws. |

Guidelines on Utilizing Chase Short Sale Packet

Completing the Chase Short Sale Packet is a crucial step in the short sale process. This packet must be filled out accurately and submitted along with the required documentation. Below are the steps you need to take to complete the form correctly.

- Read through the entire Short Sale Information Packet to understand what is required.

- Gather the necessary documents as listed in the Required Documentation Checklist. This includes pay stubs, bank statements, tax returns, and proof of occupancy.

- Complete the Authorization to Provide and Release Information form. Be sure to sign and date it.

- Fill out the Request for Consideration of Short Sale form. Provide all requested personal information, including your loan ID number, property address, and household details.

- Detail your financial situation in the attached hardship affidavit. Clearly explain the reasons for your financial distress.

- Complete the income and expenses section accurately. Include all sources of income and total expenses.

- If applicable, obtain information from your real estate agent, including the listing agreement and sales contract.

- Review the entire packet for completeness and accuracy. Ensure that all signatures are present where required.

- Make copies of all documents for your records.

- Submit the completed packet and all attached documents to Chase via your chosen method: regular mail, overnight mail, or fax.

Following these steps will help ensure that you complete the Chase Short Sale Packet effectively. After submission, keep a close eye on your communication with Chase for updates regarding your request.

What You Should Know About This Form

What is the purpose of the Chase Short Sale Packet?

The Chase Short Sale Packet is designed to gather all necessary information and documentation to evaluate your request for a short sale. Completing this packet is essential for Chase to review your current financial situation and the circumstances leading to your decision to sell the property for less than what you owe on your mortgage.

What items are included in the Short Sale Information Packet?

The packet includes a Required Documentation Checklist, Authorization to Provide and Release Information, Request for Consideration of Short Sale, and the 4506T-EZ Request for Transcript of Tax Return Form. Each section plays a crucial role in the assessment of your request.

What documentation do I need to provide as a borrower?

As a borrower, you need to provide various documents depending on your employment status. Wage earners must submit recent pay stubs, a complete bank statement, and tax returns. If self-employed, you’ll need profit and loss statements, tax returns, and bank statements. Everyone must also submit documentation supporting any listed assets and proof of occupancy or rental income, if applicable.

How do I authorize my real estate agent to discuss my case with Chase?

You must fill out and sign the Authorization to Provide and Release Information form included in the packet. This grants your agent the permission to discuss your mortgage information with Chase, ensuring they can act on your behalf effectively.

What is the process for submitting the completed packet?

You can submit the completed packet via mail or fax. For regular mail, send it to the Chase Fulfillment Center at P.O. Box 469030, Glendale, CO 80246. For overnight mail, use 4500 Cherry Creek Drive South, Suite #100, Glendale, CO 80246. You may also fax the documents to 866-220-4130. Remember to keep copies of everything you send.

What happens if I am currently in bankruptcy?

If you are in bankruptcy proceedings, the notice about the short sale request is for informational purposes only. It does not impose any personal liability for the debt. However, Chase may still proceed with foreclosure as allowed under the mortgage agreement.

Why is it important to include a hardship affidavit?

The hardship affidavit outlines the circumstances that have made it difficult for you to keep up with your mortgage payments. This information is vital as it helps Chase understand your situation better and may influence the outcome of your short sale request.

Can I get help with completing the Short Sale Packet?

Yes, assistance is available if you need help completing the packet. You can contact Chase Mortgage Customer Service at 800-446-8939 for Chase mortgages or 800-848-9380 for WaMu mortgages. They can guide you through the process and answer any questions you may have.

Will this process affect my credit score?

Potentially, yes. If you are in default or have late payments, this may be reflected in your credit report. Chase may report your account information to credit bureaus, which can impact your credit score. It’s important to consider this before proceeding with a short sale.

What should I do if I have more questions?

If you find yourself with additional questions or need clarification on any aspect of the short sale packet or process, reaching out to Chase directly is highly recommended. Their customer service representatives can provide assistance and ensure you have the information needed to move forward.

Common mistakes

When filling out the Chase Short Sale Packet, there are several common mistakes individuals often encounter. These errors can lead to processing delays or even denials, so being aware of them is crucial. One common mistake is not providing complete information. Each section of the packet must be filled out thoroughly. Omitting details can give the impression that the submission is incomplete, prompting unnecessary follow-ups.

Another frequent error concerns signatures. It is essential to ensure that all required signatures are present. Missing a signature can result in the packet being returned. Additionally, the date is just as important. Not dating the documents may signal that they are outdated, creating confusion for the processing team.

Your documentation must also be thorough. Provide all required supporting documents listed in the checklist. Failing to include a recent utility bill or the last four months of bank statements could stall your request. A common pitfall is forgetting to submit proof of ownership or occupancy. Ensure to attach a recent utility bill in your name at the property address.

Inaccuracies in financial information can have significant consequences. Be sure to double-check income figures, debt payments, and other financial data. Discrepancies can raise red flags and lead to delays, as Chase will seek clarification on any inconsistencies. Furthermore, forgetting to properly document your income can make it difficult for Chase to assess your financial situation accurately.

Another area where mistakes appear is in the Authorization to Provide and Release Information form. Ensure you have signed it properly and included the necessary details. Incomplete authorization may prevent your real estate agent from communicating effectively with Chase on your behalf.

Thoroughly read and follow the instructions provided. Not adhering to specific guidelines can lead to the packet being deemed non-compliant or incomplete. Additionally, be mindful of submission methods and ensure your packet is sent to the correct address or fax number.

In closing, avoid common mistakes by reviewing your completed packet carefully. Checking each requirement against the checklist can save time and reduce stress. Being diligent during the submission process can lead to a smoother experience and a better outcome for your short sale request.

Documents used along the form

When submitting the Chase Short Sale Packet, several additional forms and documents are commonly required to facilitate the process. These documents play crucial roles in ensuring that the sale is processed efficiently and that all necessary information is provided to Chase. Here’s a brief overview of the essential documents you may need to include:

- Required Documentation Checklist – This document provides a comprehensive list of all paperwork that must be submitted alongside the short sale packet. It separates the requirements based on the borrower and co-borrower, as well as the real estate agent’s documentation.

- Authorization to Provide and Release Information – This form permits Chase to discuss your mortgage details with your real estate agent or any other designated individual. Signing this document ensures that your representatives can effectively communicate with Chase on your behalf.

- Request for Consideration of Short Sale – This key document captures vital information about your property, income, and financial circumstances. It outlines the reasons for your short sale request and helps Chase assess your situation.

- 4506T-EZ Request for Transcript of Tax Return Form – Completing this form allows Chase to obtain a transcript of your tax returns directly from the IRS. This verification process is critical for income assessment and confirms your financial status.

It is important to gather all required documents thoroughly and promptly. Incomplete submissions can delay the process, so ensure that everything is accurate and submitted on time. If you have any questions while preparing your paperwork, consider reaching out for professional assistance.

Similar forms

- Loan Modification Packet - Similar to the Short Sale Packet, the Loan Modification Packet requires documentation about your financial situation. It includes a request for a loan modification, allowing you to restructure your mortgage to better suit your current needs.

- Hardship Affidavit - This form may be included in both the Short Sale and Loan Modification processes. The Hardship Affidavit details the reasons behind your financial difficulties and provides essential context for your request.

- Listing Agreement - This document, often required in short sales, establishes an agreement between the seller and the real estate agent. It outlines the terms under which the agent will help sell the property, similar to other sale-related documents.

- Request for Transcript of Tax Return (4506-T) - Just like the Chase Short Sale Packet, this form allows lenders to access your tax information. It's a necessary part of verifying your income to proceed with both short sales and loan modifications.

- Credit Counseling Agreement - If you pursue credit counseling, this agreement allows the counselor to communicate with your lender. It shares similarities with the Authorization to Provide and Release Information in the Short Sale Packet.

- Conventional Sale Contract - This document formalizes the sale of a property typically used in traditional home sales. It contains details about the buyer, seller, and sale conditions, paralleling elements found in the Short Sale Packet.

- Short Sale Addendum - This document works alongside the purchase contract when selling a property in short sale. It specifically addresses the conditions and contingencies unique to short sales, making it similar to the various forms included in the Short Sale Packet.

Dos and Don'ts

When filling out the Chase Short Sale Packet form, consider the following dos and don'ts to ensure a smooth process.

- Do keep a copy of everything you send for your records.

- Do read all instructions carefully before starting on the packet.

- Do complete all forms in full; incomplete forms may delay your request.

- Do double-check that you have signed and dated all required documents.

- Don't submit the forms without including all required documentation.

- Don't forget to provide proof of occupancy, like a recent utility bill.

- Don't leave any blank fields on the forms; even "N/A" can clarify your answers.

- Don't wait until the last minute to send your completed packet; allow processing time.

Misconceptions

- Misconception 1: The Chase Short Sale Packet is optional.

- Misconception 2: Submission doesn’t require any additional documents.

- Misconception 3: Anything can be sent to Chase via fax or mail.

- Misconception 4: Completing the packet is straightforward and takes no time.

- Misconception 5: I don’t need to inform Chase if I have a lawyer.

- Misconception 6: I can skip the Authorization to Provide and Release Information form.

- Misconception 7: Chase will handle my short sale without any input from me after submission.

Many people think filling out the Chase Short Sale Packet is not mandatory. However, it is essential for your short sale request. You must complete it to have your situation evaluated.

Some believe that simply sending the packet is enough. In reality, you'll need to include a checklist of required documentation alongside the form to support your request.

It's vital to follow the specific guidelines for submission. The packet outlines where to send documents and to which address, whether by regular mail, overnight mail, or fax.

While it may seem simple, the process requires careful attention. Gathering documentation and answering questions can take some time, so give yourself plenty of time to prepare.

If you are represented by an attorney, it's crucial to inform Chase. Provide your lawyer's contact information on the packet to ensure all communications are appropriate.

This form allows your realtor or another designated person to communicate with Chase regarding your mortgage. Skipping it can complicate the process, so make sure to include it.

Once you've submitted the packet, Chase will review your situation. However, you may still need to provide additional information or respond to requests. Stay engaged in the process to ensure the best outcome.

Key takeaways

When filling out the Chase Short Sale Packet, there are important steps to follow to ensure success.

- Complete All Forms: Make sure to fill out every required form in the packet fully. Any missing information can delay your short sale request.

- Gather Required Documents: Collect all necessary documents as listed in the checklist. This includes pay stubs, tax returns, and bank statements from both the borrower and co-borrower.

- Be Mindful of Signatures: Sign in all required places. Incomplete signatures can lead to processing issues.

- Provide Authorization: If you have a real estate agent, complete the “Authorization to Provide and Release Information” form. This allows your agent to discuss your accounts with Chase.

- Mailing Options: Choose the right mailing method for your completed packet—either regular mail, overnight mail, or fax. Ensure it goes to the Chase Fulfillment Center.

- Keep Copies: Always keep a copy of everything you send to Chase for your personal records. This can be helpful if any issues arise.

- Understanding Communication: If you're represented by an attorney, inform Chase of your attorney’s contact details. This ensures proper communication.

- Check Updates: After submitting, follow up if you do not receive a confirmation of receipt within a few days. Stay engaged in the process.

By following these key takeaways, you can navigate the Chase Short Sale Packet process more efficiently and effectively.

Browse Other Templates

Form 2055 - The report is designed to serve lenders and clients engaged in mortgage finance transactions.

Unemployment Direct Deposit - In Section B, a financial institution representative must confirm account details if not using a voided check.

Acs Voucher Application - The CS-1069 form collects gross income data for the last three months to conclude financial eligibility.