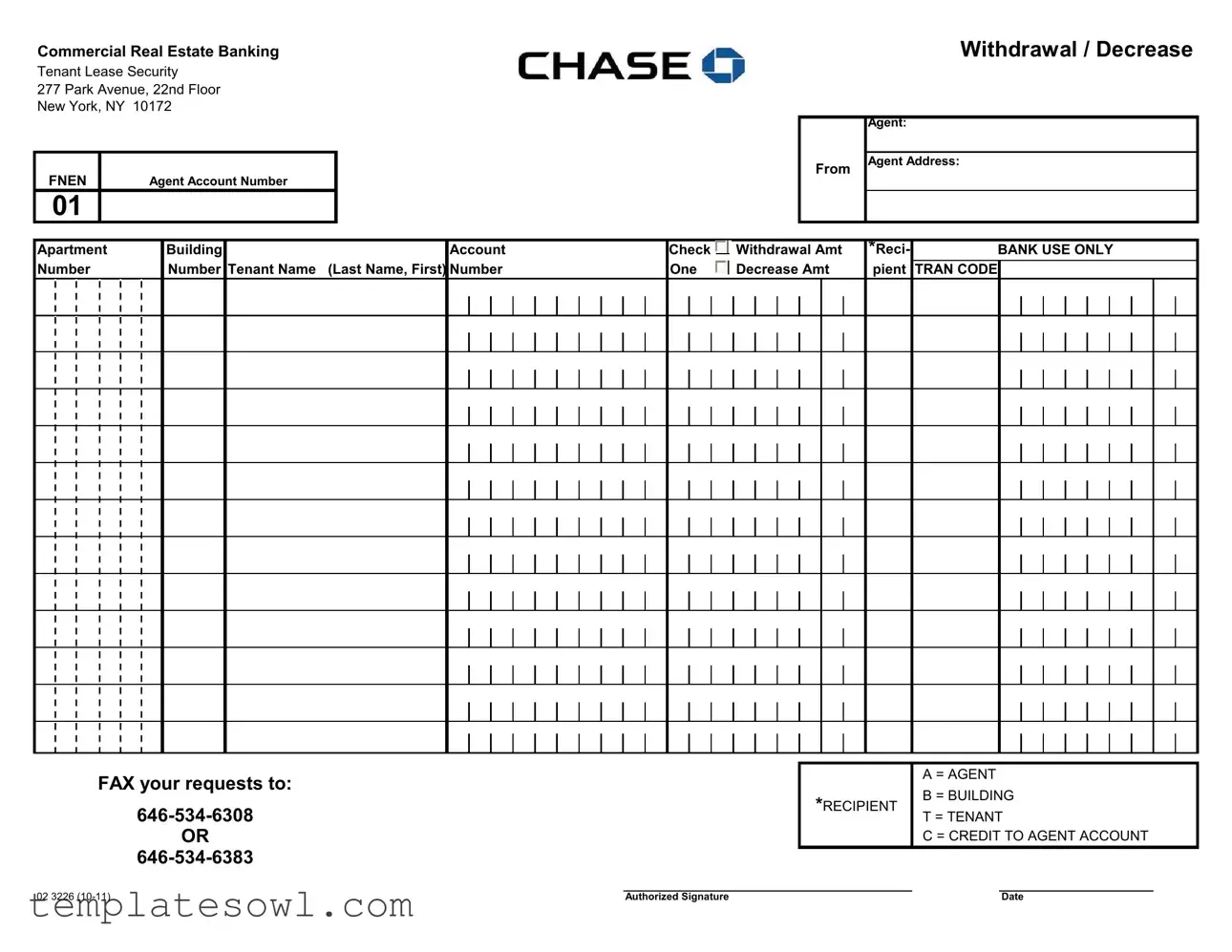

Fill Out Your Chase Withdrawal Slips Form

The Chase Withdrawal Slips form facilitates important transactions within the commercial real estate banking sector, streamlining the process of making withdrawals or decreases in account balances. This form is designed to be filled out by agents, with sections dedicated to important details such as agent information, account numbers, and tenant names, which help ensure accurate record-keeping. Located at 277 Park Avenue, the form serves clients in New York, providing a direct contact point for maintaining transaction integrity. Users must indicate the type of request — whether it is a withdrawal of funds or a decrease in an existing amount. Notably, the form includes a section to specify the recipient of the transaction, detailing the options for crediting to either the agent’s account, the building account, or the tenant's account. The submission process is direct, allowing for requests to be faxed to designated numbers for expedient processing. Additionally, an authorized signature field and date capture are crucial elements, ensuring that the transaction is authorized and documented properly for legal compliance and future reference. This form thus plays a vital role, not just in facilitating immediate financial activities, but also in reinforcing the broader framework of accountability and transparency in commercial real estate transactions.

Chase Withdrawal Slips Example

Commercial Real Estate Banking

Tenant Lease Security

277 Park Avenue, 22nd Floor

New York, NY 10172

FNEN |

Agent Account Number |

01

Withdrawal / Decrease

Agent:

From Agent Address:

Apartment Number

Building |

|

|

Account |

Number |

Tenant Name |

(Last Name, First) |

Number |

|

|

|

|

Check Withdrawal Amt One Decrease Amt

*Reci- |

BANK USE ONLY |

pient TRAN CODE

3

FAX your requests to:

OR

*RECIPIENT

A = AGENT

B = BUILDING

T = TENANT

C = CREDIT TO AGENT ACCOUNT

02 3226 |

Authorized Signature |

|

Date |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of the Form | The Chase Withdrawal Slip is utilized for processing withdrawals or decreases from a commercial banking account, particularly in the context of tenant leases. |

| Location | This specific form is associated with Chase Bank's Commercial Real Estate Banking division, located at 277 Park Avenue, 22nd Floor, New York, NY 10172. |

| Identification Requirements | To complete the form, individuals must provide essential information including the account number, agent information, and tenant details. |

| Authorized Signatures | The form requires an authorized signature to validate the request. This signature represents approval for the withdrawal or decrease. |

| Communication Methods | Requests can be sent via fax to either of the provided numbers: 646-534-6308 or 646-534-6383. |

| Recipient Options | The withdrawal slip allows for various recipient designations, including the agent, building, tenant, or crediting to the agent's account. |

Guidelines on Utilizing Chase Withdrawal Slips

Once you have the Chase Withdrawal Slip in hand, it's time to accurately fill it out. This form is essential for processing your request, so make sure to complete each section carefully to avoid any delays.

- Start by entering the Agent Account Number in the designated box.

- Choose whether you’re making a Withdrawal or Decrease by checking the appropriate box.

- Fill in the From Agent section with the agent's name.

- Next, provide the Agent Address, including street, city, and Zip code.

- If applicable, include the Apartment Number and Building Account Number.

- In the Tenant Name section, write the tenant's last name followed by their first name.

- Check the box next to Number Check if you require a check.

- Indicate the Withdrawal Amount or Decrease Amount as needed in the appropriate fields.

- For the Recipient section, mark 'A' for Agent, 'B' for Building, 'T' for Tenant, or 'C' for Credit to Agent Account, as applicable.

- Leave the BANK USE ONLY section blank; it will be filled in by the bank.

- Sign the form in the Authorized Signature box.

- Finally, write the current Date in the space provided.

After completing the form, you can send it to the bank for processing. Be sure to keep a copy for your records, and consider following up to ensure everything is in order.

What You Should Know About This Form

What is the purpose of the Chase Withdrawal Slips form?

The Chase Withdrawal Slips form is used in the context of commercial real estate banking. Primarily, it serves to request the withdrawal or decrease of funds from an agent's account. This can relate to security deposits, tenant leases, or other financial transactions involving real estate agents, tenants, and building management.

How do I fill out the Chase Withdrawal Slips form?

To complete the form, start by entering the account number associated with the agent. Provide the name of the tenant, including their last name and first name. Then, select whether you wish to withdraw an amount or simply decrease a pre-existing amount. Clearly indicate the desired amount in the designated field. Be sure to sign and date the form before submission.

Where do I send the completed Chase Withdrawal Slips form?

You can submit the completed form electronically by faxing it to one of the provided numbers: 646-534-6308 or 646-534-6383. It is wise to keep a copy for your records, in case you need to reference it later or follow up on your request.

What should I do if there is a mistake on the form?

If you notice a mistake after you've completed the form, do not submit it. Instead, simply start a new form. Ensure that all information is accurate before faxing it to avoid any delays in processing your request. Double-checking details can save you time and ensure that your transaction proceeds smoothly.

Common mistakes

Filling out the Chase Withdrawal Slips form can be straightforward, but mistakes can occur that complicate the process. One common error involves incorrect account or tenant information. Individuals often overlook the necessity of verifying the Account Number or Tenant Name. Providing inaccurate details may delay the withdrawal or lead to funds being sent to the wrong account.

Another frequent mistake is failing to select the appropriate option for the type of transaction. Users may forget to check the box for either Withdrawal Amt or Decrease Amt. Neglecting to make this selection can lead to misunderstandings regarding the intended action, which can result in processing errors.

Completing the Authorized Signature section without confirming the signature is valid is also problematic. Some may sign without ensuring their signature matches the one on file with the bank. This discrepancy can cause the withdrawal request to be rejected or flagged for additional review, potentially delaying access to funds.

Finally, individuals might neglect to include the date in the Date field. Omitting this information can lead to confusion about the timing of the transaction and may hinder the bank's ability to process the request efficiently. It's crucial to provide a complete and accurate date when submitting the form.

Documents used along the form

When managing banking transactions, several forms and documents may accompany the Chase Withdrawal Slips form. Each of these documents serves a unique purpose in facilitating financial processes. Here is a list of commonly used forms related to this transaction:

- Deposit Slip: This form is used to deposit funds into an account. It includes information such as the account number and the amount being deposited.

- Account Change Request Form: If there are changes to an account, such as updating contact information or changing signatories, this form is required.

- Transfer Request Form: This document is necessary for transferring funds between accounts. It includes details about the accounts involved and the transfer amount.

- Authorization Letter: Often needed for third parties to conduct transactions on behalf of an account holder. It must be signed by the account holder.

- Check Request Form: This form is used to request a check to be issued from an account. It specifies the payee and the amount.

- Wire Transfer Request Form: Required for initiating a wire transfer. This document includes account details and transfer instructions.

- Statement Request Form: Use this form to obtain a bank statement for a specific period. It's essential for record-keeping and financial review.

Understanding these documents can help streamline banking transactions and ensure that all required paperwork is in order. Keeping them readily available can simplify the process and reduce delays.

Similar forms

Withdrawal Slip: Similar to the Chase Withdrawal Slip, a bank withdrawal slip is used to request cash or transfer funds from a bank account. It includes account details and the amount to be withdrawn, ensuring a clear record of transactions.

Deposit Slip: A deposit slip serves a similar purpose but for adding funds to an account. Like the withdrawal slip, it requires specific account information and documentation of the amount being deposited.

Transfer Request Form: This form is used to facilitate the movement of funds between different accounts at the same bank or across different banks. It also features account numbers and transaction details, similar to withdrawal slips.

Direct Debit Authorization Form: This document allows a bank to withdraw funds automatically from an account to pay recurring bills. It contains account information, authorization, and often includes amounts, much like how a withdrawal slip operates.

Check: A check is a written, dated, and signed document that directs a bank to pay a specific amount of money from a person’s account to the person named on the check. Like a withdrawal slip, it requires accurate account information and an authorized signature.

Payment Authorization Form: Used for authorizing payment transactions, this document details the specifics of a payment, such as amounts and recipient's information, paralleling the key functions of the withdrawal slip.

Loan Payment Slip: This slip is utilized to submit payments on a loan. It features similar fields, including account numbers and transaction amounts, just like the withdrawal slip.

Refund Request Form: When asking for a refund, this form collects necessary banking information to process the return, closely echoing the format and requirements of a withdrawal slip.

Service Charge Authorization Form: This document allows a bank to impose service charges on an account. It requires account information and is comparable in structure to the withdrawal slip, emphasizing transparency in account transactions.

Dos and Don'ts

When completing the Chase Withdrawal Slips form, there are specific practices to follow to ensure accuracy and compliance. Below is a list of six things to keep in mind:

- Do double-check the account number before submission to avoid processing delays.

- Do clearly print the information required for the tenant's name and address to ensure legibility.

- Do include your authorized signature to validate the request.

- Do specify the correct withdrawal or decrease amount in the designated space.

- Don’t leave any blank fields that may be necessary for processing your request.

- Don’t forget to fax the form to the correct number to ensure prompt attention.

Misconceptions

Many people misunderstand the Chase Withdrawal Slips form. Below are six common misconceptions, along with clarifications that may help ensure proper usage.

- Misconception 1: The form is only for agents.

- Misconception 2: You can submit the form without a signature.

- Misconception 3: Withdrawal and decrease amounts are the same.

- Misconception 4: All requests go directly to the bank.

- Misconception 5: The account numbers are interchangeable.

- Misconception 6: You can use the form for any type of transaction.

In reality, tenants can also submit this form for specific transactions. Understanding who can use the form is essential.

Every submission requires an authorized signature. A missing signature may result in processing delays or rejection.

These are distinct transactions. Ensure you understand the differences to avoid complications.

Requests must be faxed to the specified numbers. Skipping this step can lead to missed transactions.

This is not the case. Using the correct account number is crucial for ensuring funds are processed properly.

The form is strictly for withdrawal or decrease requests related to tenant leases. Using it for other purposes may cause confusion.

Understanding these key points can streamline your transaction process. Be proactive in clarifying any uncertainties to avoid potential issues.

Key takeaways

When using the Chase Withdrawal Slips form, keep these key points in mind:

- Ensure Accuracy: Fill out the form completely and correctly. Double-check the agent account number and tenant information to avoid delays.

- Select the Correct Option: Indicate whether you are requesting a withdrawal or a decrease in amount clearly. This helps prevent confusion later on.

- Provide Necessary Details: Include the recipient's designation (A, B, T, or C) as specified on the form to ensure the funds are directed correctly.

- Signature Requirement: Don’t forget to sign and date the form. An authorized signature is necessary for processing your request.

- Use Proper Submission Channels: Fax your completed form to the provided numbers. This ensures your request is processed efficiently.

By keeping these takeaways in mind, you can navigate the withdrawal process smoothly and with confidence.

Browse Other Templates

Lab Refrigerator Temperature Log Sheet - Legal and regulatory compliance is reinforced through diligent use of the Refrigerator Temperature Log form.

New York W2 Reporting Requirements - Understand the importance of accurate wage reporting to avoid penalties.