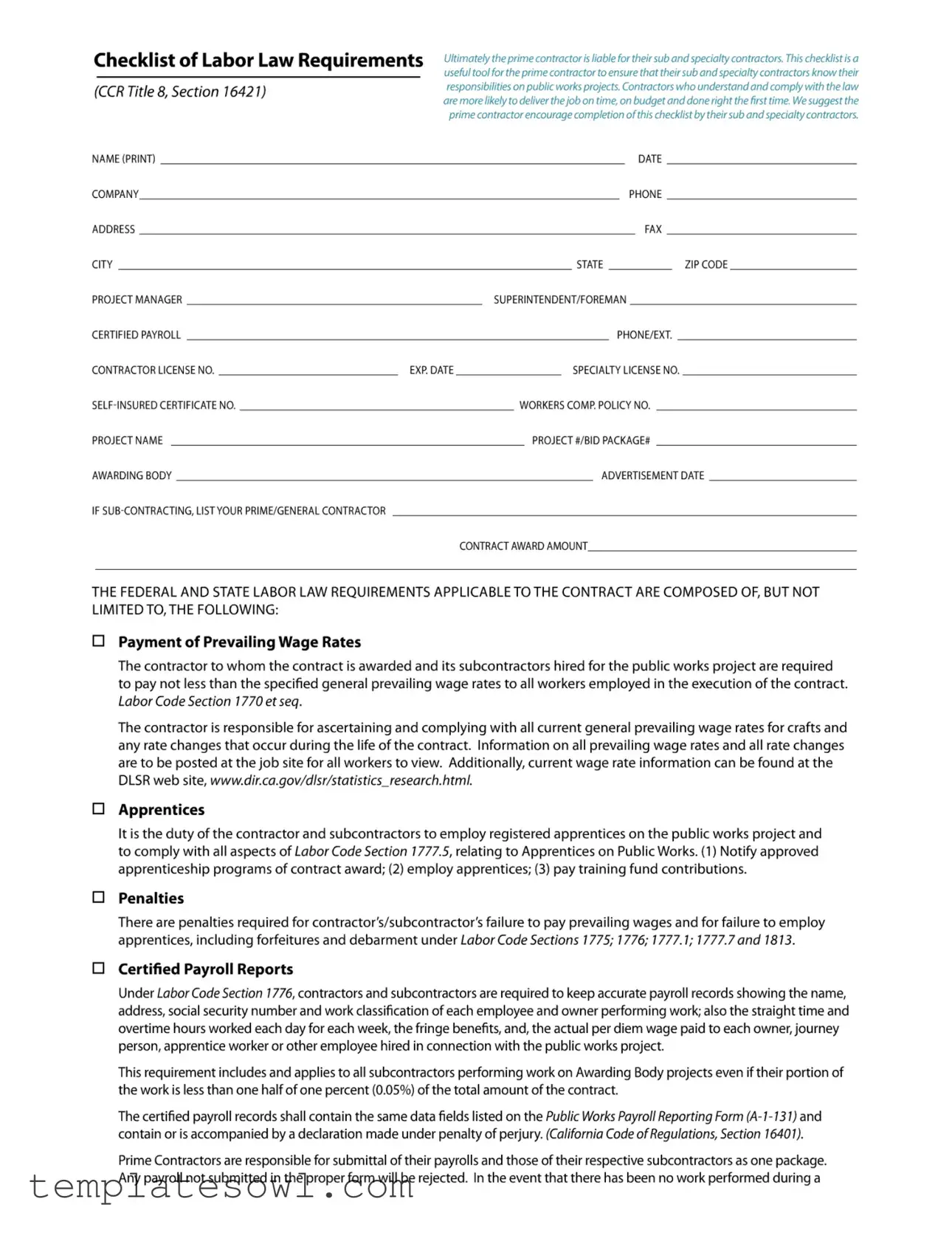

Fill Out Your Checklist Labor Law Form

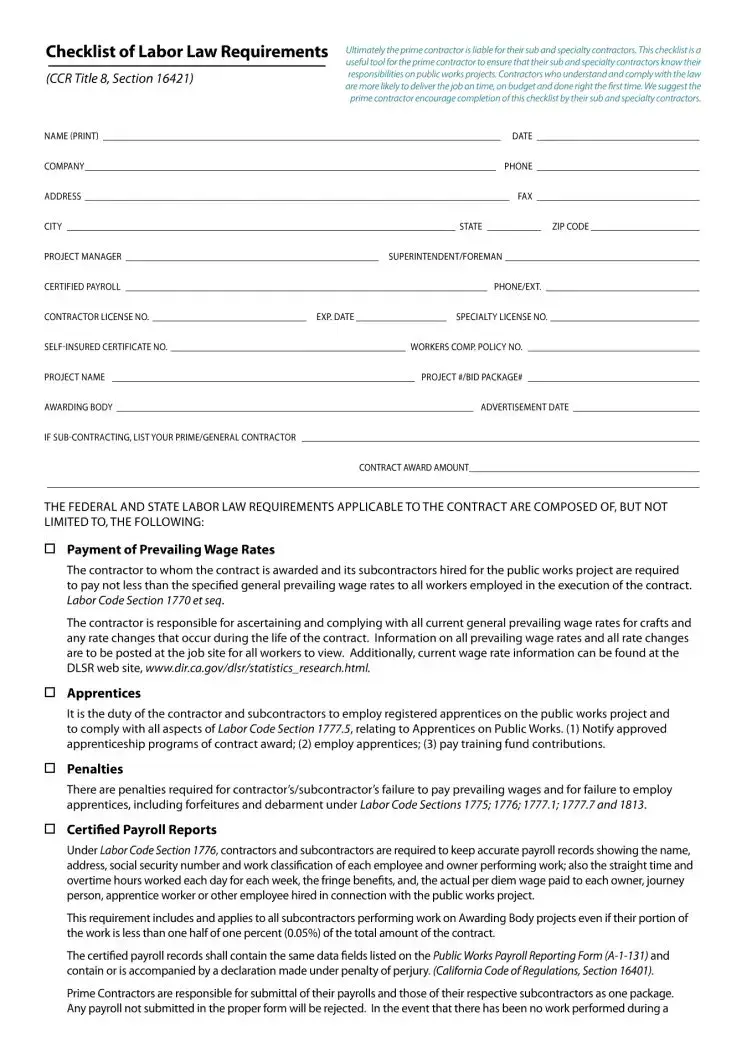

The Checklist Labor Law form serves as a vital resource for ensuring compliance with federal and state labor laws, particularly on public works projects. This form requires essential information such as the contractor's name, company address, project details, and the designated project manager. Key responsibilities outlined include the payment of prevailing wage rates, where contractors must pay their workers according to specified wage standards, and maintain up-to-date records of these rates at the job site. Additionally, the form emphasizes the importance of employing registered apprentices and adhering to apprenticeship program requirements. Accurate payroll records must be maintained, reflecting each worker's details, hours, and wages, while contractors bear the collective responsibility for both their payrolls and those of their subcontractors. Non-discrimination in employment practices, the prohibition of wage kickbacks, and licensing compliance are also highlighted. Moreover, workers must be provided with itemized wage statements, and contractors must secure proof of eligibility and citizenship for all employees. Failure to comply with these regulations can lead to significant penalties, making the checklist not just a bureaucratic formality, but a critical instrument for project success and legal adherence.

Checklist Labor Law Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | This checklist is governed by California Code of Regulations (CCR) Title 8, Section 16421. |

| Payment of Prevailing Wage | Contractors must pay their workers the specified general prevailing wage rates according to Labor Code Section 1770 et seq. |

| Apprenticeship Requirements | Employers must comply with Labor Code Section 1777.5 by employing registered apprentices and promptly notifying approved apprenticeship programs. |

| Certified Payroll Reports | Contractors must maintain accurate payroll records and submit certified payroll reports as required by Labor Code Section 1776. |

| Nondiscrimination | Labor Code Sections 1735 and 1777.6 prohibit employment discrimination in public works contracts. |

| Kickbacks | Labor Code Section 1778 prohibits contractors from illegally recapturing wages through kickbacks from employees. |

| Subcontractor Listing | As per Government Code Section 4104, prime contractors must list subcontractors performing significant work. |

| Workers' Compensation Insurance | Contractors are required by Labor Code Section 1861 to maintain proper Workers’ Compensation insurance. |

| Itemized Wage Statement | Labor Code Section 226 mandates that employees receive itemized wage statements reflecting their pay details. |

Guidelines on Utilizing Checklist Labor Law

Filling out the Checklist Labor Law form is an essential step in ensuring compliance with labor regulations for public works projects. To navigate this process smoothly, follow the outlined steps carefully. Your attention to detail here not only helps avoid potential penalties but also fosters a better working environment for everyone involved.

- Identify the Form: Obtain the Checklist Labor Law form and place it in a convenient location for easy access.

- Provide Your Company Information: Fill in the name of your company, address, city, state, and ZIP code. Ensure that this information is accurate to prevent any delays.

- Project Details: Enter the project name and the name of the awarding body. Make sure this matches official documents related to the project.

- Contact Information: Complete the fields for the project manager, including phone and fax numbers. This ensures proper communication if needed.

- Specialty License and Worker's Compensation: Fill in your contractor license number, specialty license number, and workers' compensation policy number. This information is critical for compliance checks.

- Project Management Team: Include the name and contact number of the superintendent or foreman associated with the project.

- Contract Information: Document the project number or bid package number, advertisement date, and the contract award amount. These details provide transparency.

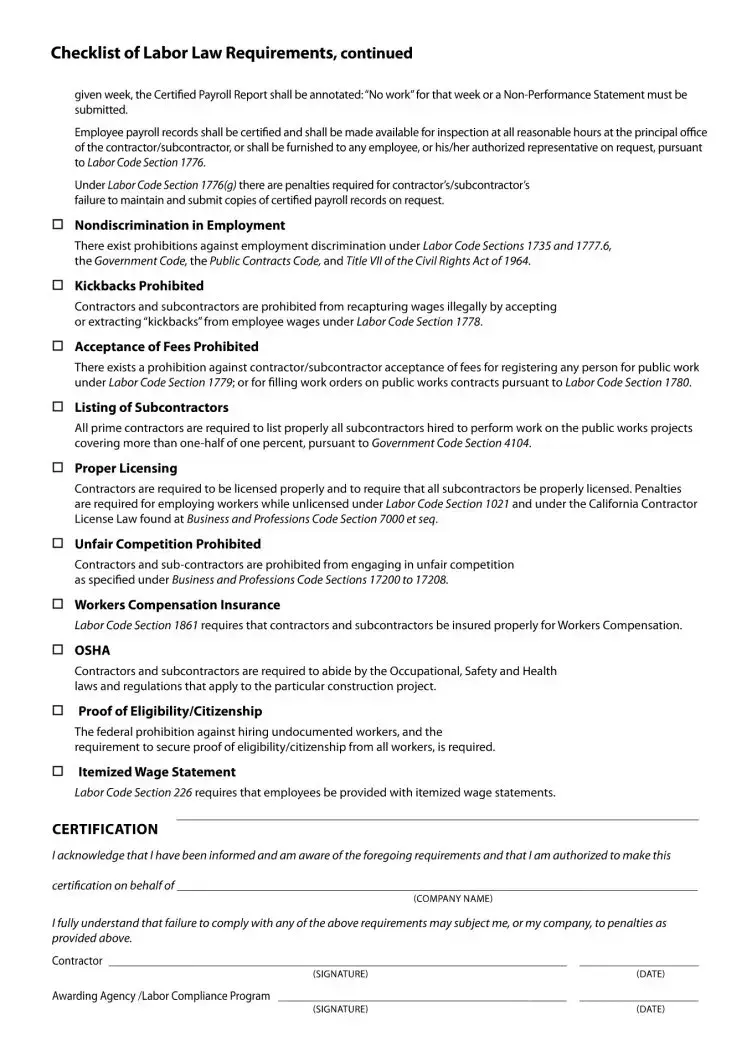

- Certification: Sign and date the certification section, acknowledging your understanding of the labor law requirements. Ensure that the signature reflects the authorized person representing your company.

- Second Signature: If required, get the signature and date from the Awarding Agency or Labor Compliance Program to finalize the process.

Double-check your entries for accuracy to ensure compliance with labor laws. Once completed, keep a copy of the form for your records and provide it to the necessary regulatory bodies as indicated. Each step taken helps build a foundation for a successful project delivery and adherence to legal obligations.

What You Should Know About This Form

What is the purpose of the Checklist Labor Law form?

The Checklist Labor Law form is designed to help prime contractors ensure compliance with applicable labor laws on public works projects. By utilizing this checklist, contractors can familiarize themselves and their subcontractors with the legal responsibilities required under state and federal law. This promotes timely project completion and adherence to budgetary guidelines while ensuring all workers receive appropriate wages and benefits.

What are the key responsibilities outlined in the form?

The form outlines several critical responsibilities for contractors. They must pay prevailing wage rates to all workers and keep accurate payroll records, including employee information like hours worked and wages paid. Additionally, contractors are required to employ registered apprentices and comply with non-discrimination laws. Proper licenses must be maintained, and all subcontractors must be listed accurately. Failure to meet these obligations may result in penalties.

How should certified payroll reports be handled?

Contractors are required to maintain and submit certified payroll records for themselves and their subcontractors as a unified package. These reports must include essential details for each worker, such as name, classification, and hours worked. If no work is performed in a given week, the report should indicate “No work” or a Non-Performance Statement must be provided. These records must be accessible for inspection upon request, reinforcing transparency and accountability.

What penalties may occur for non-compliance?

Non-compliance with the requirements outlined in the Checklist Labor Law form can lead to several consequences. Contractors may face forfeitures, debarment, and fines for failing to pay prevailing wages or submit accurate payroll records. Additionally, penalties can be applied for inadequate record-keeping, hiring unlicensed workers, or failing to provide necessary documentation related to employee eligibility. It is essential for contractors to take these requirements seriously to avoid costly repercussions.

Common mistakes

Filling out the Checklist Labor Law form can seem straightforward, but several common mistakes can lead to complications down the line. Paying attention to detail is crucial, as a tiny oversight can have significant repercussions. Here are some pitfalls to avoid.

One prevalent mistake is failing to accurately list all subcontractors. The Checklist Labor Law form requires prime contractors to disclose all subcontractors involved in a project, especially those whose scope exceeds one-half of one percent of the total contract value. Omitting a subcontractor can lead to potential penalties. It also reflects poorly on the contractor's compliance practices.

Another common error is neglecting to verify that all contractors and subcontractors possess the required licenses. Under California law, only licensed individuals can perform work on public projects. If someone is unlicensed, not only does it violate the law, but it can also threaten project integrity and lead to liability issues.

Errors in reporting wages and hours are also frequently observed. The law mandates accurate payroll records that detail each worker's name, job classification, and hours worked. If discrepancies arise, they can result in financial penalties and damage to reputation. Contractors should ensure that everyone involved understands the importance of accuracy in payroll reporting.

Lastly, many contractors overlook the requirement to provide itemized wage statements to their employees. This regulation, under Labor Code Section 226, ensures transparency in wage distribution. Failing to provide these statements can lead to serious legal ramifications and dissatisfaction among workers. Knowing these requirements can help avoid unnecessary complications.

Documents used along the form

The Checklist of Labor Law Requirements is crucial for ensuring compliance with various labor regulations on public works projects. However, several other forms and documents are typically used alongside this checklist to guarantee adherence to the law. Below is a list of those documents, each described briefly for clarity.

- Certified Payroll Report: This document records the names, work classifications, and pay details of all employees. It is essential for verifying that prevailing wage laws are being followed.

- Subcontractor Listing Form: Required by law, this form lists all subcontractors working on a project. It helps maintain transparency and accountability throughout the project.

- Apprenticeship Agreement: This document outlines the responsibilities of employers and apprentices in adhering to labor law requirements related to registered apprenticeship programs.

- Workers’ Compensation Insurance Certificate: Evidence of workers' compensation insurance is necessary to prove compliance with labor laws and to protect both workers and employers.

- Itemized Wage Statement: Employers are required to provide employees with detailed wage statements to clearly show wages earned, deductions, and hours worked.

- Affidavit of Eligibility: This tool provides proof that all workers are eligible for employment, ensuring compliance with federal immigration laws.

- Non-Performance Statement: Used when no work has been performed during a given week, it helps maintain accurate records for certified payroll reporting.

- Labor Compliance Program Agreement: A signed agreement demonstrating that all parties will adhere to labor laws and requirements specific to the project.

- OSHA Compliance Documentation: This paperwork confirms adherence to safety and health regulations on the job site, which is critical for worker safety.

- Prevailing Wage Determination: A document that details the specific wage rates that must be paid to workers on public works projects, established by law.

Understanding the role of these documents can significantly aid in navigating the complexities of labor law compliance. Proper use and management of these forms will contribute to a smoother project execution and mitigate potential legal issues.

Similar forms

- Certified Payroll Reports: Similar to the Checklist Labor Law form, Certified Payroll Reports require contractors to maintain accurate payroll records detailing employee work classifications, hours worked, and wages paid. Both documents emphasize the importance of transparency and compliance with labor laws.

- Employee Wage Statements: Both the Checklist Labor Law form and itemized wage statements underscore the necessity for documenting employee earnings. The Checklist requires acknowledgment of wage compliance, while wage statements must itemize earnings and deductions, ensuring that employees understand their total compensation.

- Apprenticeship Documentation: The requirement to employ registered apprentices is similar to the checklist’s focus on compliance with labor laws. Both documents emphasize contractors' responsibilities regarding apprenticeship programs and the reporting of relevant information.

- Nondiscrimination Policies: Both the Checklist Labor Law form and nondiscrimination in employment mandates highlight the importance of fair treatment. Each stresses that contractors must operate without discrimination based on protected characteristics in workforce practices.

- Subcontractor Listing Requirements: The checklist and the requirement to list subcontractors reflect a mutual emphasis on clarity in the workforce structure. Both documents aim to ensure that accountability flows down from prime contractors to subcontractors, promoting responsibility in contract execution.

- Labor Code Compliance Notices: The Checklist Labor Law form and labor code compliance notices share a vital function: communicating legal obligations. Both encourage proactive adherence to relevant regulations in construction projects, protecting both workers' rights and contractors' interests.

- Workers Compensation Insurance Documentation: Like the checklist, the requirement for workers' compensation insurance emphasizes risk management and legal protections for workers. Both highlight the necessity for contractors to secure appropriate insurance and mitigate workplace injury risks.

- Proof of Eligibility and Immigration Compliance: Both the Checklist Labor Law form and requirements for employee eligibility focus on verifying that workers are legally permitted to work. This becomes crucial in maintaining compliance with both state and federal employment laws.

Dos and Don'ts

When filling out the Checklist Labor Law form, it is crucial to adhere to best practices to ensure compliance and avoid penalties. Here’s a concise list of what you should and shouldn’t do:

- Do print your name and company information clearly to avoid confusion.

- Do ensure all relevant project details are filled in completely.

- Do keep updated records of prevailing wage rates on site for all workers.

- Do submit certified payroll reports on time, including those from subcontractors.

- Do employ registered apprentices as required by law.

- Don’t overlook the requirement to list all subcontractors, even if their share is minor.

- Don’t forget to verify that all contractors and subcontractors have proper licenses.

- Don’t accept kickbacks that violate labor laws regarding employee wages.

- Don’t fail to provide itemized wage statements to employees as required.

- Don’t ignore the penalties associated with non-compliance; they can be severe.

By following these guidelines, you can help ensure that all required documentation is correct and complete, ultimately facilitating a smoother project experience.

Misconceptions

Misconceptions about the Checklist Labor Law form can lead to significant misunderstandings in compliance. Below is a list of common misconceptions and clarifications concerning this important legal document.

- All Contractors are Automatically Compliant: Many believe that simply filling out the Checklist Labor Law form guarantees compliance with labor laws. Compliance requires ongoing adherence to the requirements outlined in the form, not just its completion.

- Only Prime Contractors are Responsible: Some assume that only prime contractors are liable for compliance. In fact, all parties, including subcontractors, share responsibility for meeting labor law requirements.

- Prevailing Wage Information is Optional: Some contractors think posting prevailing wage information at job sites is merely recommended. However, it is a mandatory requirement under labor codes.

- Apprenticeships are Not Necessary on Small Projects: There is a belief that employing registered apprentices is unnecessary for contracts that seem small. This is false; all public works projects must comply with apprentice employment requirements, regardless of size.

- Record Keeping is Easy and Flexible: Some contractors believe that the requirements for maintaining accurate payroll records are lax. In reality, they must follow strict guidelines, including detailed documentation and timely submissions.

- Companies Can Use Generic Forms: Many think they can use generic payroll forms without repercussions. However, the Checklist Labor Law form outlines specific fields and declarations required by California law.

- Nondiscrimination Policies are Optional: Some individuals view nondiscrimination statutes as optional. They are actually mandatory, and failing to adhere to these can lead to severe penalties.

- Inspections Only Happen Occasionally: There is a belief that employee payroll records don’t need to be readily available for inspection frequently. In fact, they must be accessible at all reasonable hours upon request.

- Kickbacks are Rarely Enforced: Some contractors assume that laws against kickbacks from employee wages are not strictly enforced. This is a misconception; enforcement is rigorous, and violators face significant penalties.

- Hiring Undocumented Workers is Manageable: Many think that hiring undocumented workers can be overlooked or managed quietly. This is illegal and has serious consequences, including penalties for both the workers and the contractors.

Understanding these misconceptions can enhance compliance and foster a better working environment on public works projects. Accurate and thorough knowledge of the Checklist Labor Law form helps contractors navigate the complexities of labor regulations effectively.

Key takeaways

Filling out and utilizing the Checklist Labor Law form is crucial for contractors engaged in public works projects. Here are five key takeaways to consider:

- Understand Prevailing Wage Rates: Contractors must ensure they pay at least the prevailing wage rates to all workers. Knowing the current wage rates and posting them on-site is essential for compliance.

- Compliance with Apprenticeship Requirements: It is vital to employ registered apprentices and adhere to the regulations specified in Labor Code Section 1777.5. Failure to comply can result in penalties.

- Maintain Accurate Payroll Records: Contractors are required to keep detailed payroll records for all employees and subcontractors. This documentation is critical for compliance and must be readily available for inspection.

- Prevent Discrimination: Adherence to employment discrimination laws is mandatory. Contractors must remain vigilant against practices that violate Labor Code Sections 1735 and 1777.6, among others.

- Proper Licensing is Essential: All contractors and their subcontractors must hold the proper licenses. Engaging unlicensed workers can lead to significant penalties.

By following these guidelines, contractors can mitigate risks and foster a compliant work environment on their projects.

Browse Other Templates

State Background Check - Your residence address must be complete and current.

Nj Tax Forms 2023 - Line items on the CBT-200-T must reflect accurate financial data from the corporation.

What Counties in Pa Require Emissions - This form helps ensure that your vehicle complies with safety and emissions regulations.