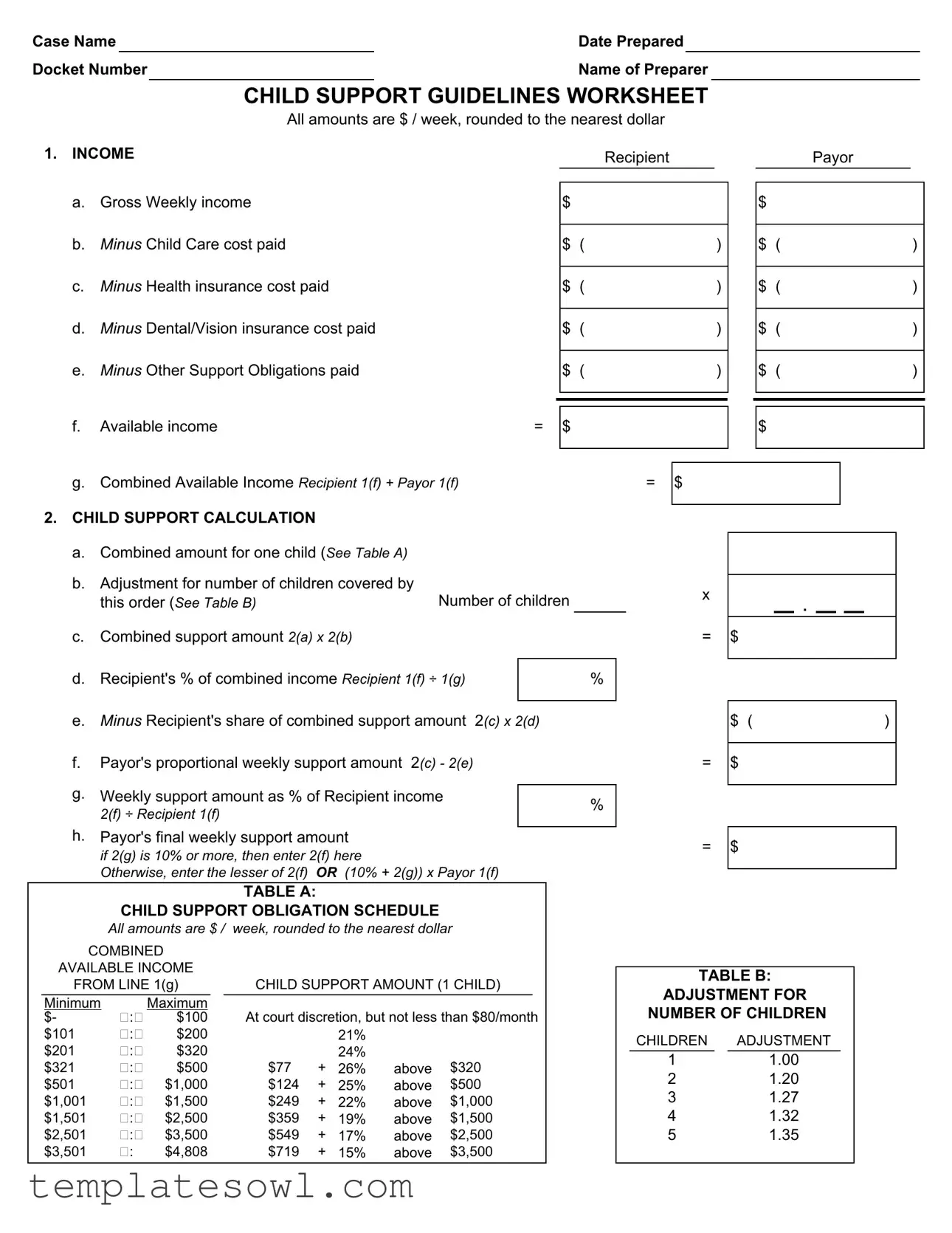

Fill Out Your Child Support Worksheet Form

The Child Support Worksheet form is an essential tool used in the calculation of child support obligations. This form facilitates the determination of appropriate financial support for children by systematically assessing the income of both parents. It outlines various financial components, including gross weekly income, child care costs, health insurance expenses, and other support obligations. Through a series of calculations, the form determines available income for both the recipient and the payor. Once the combined available income is established, child support guidelines and tables provide specific dollar amounts based on this total income. Adjustments can also be made depending on the number of children covered by the support order, ensuring that the obligations accurately reflect the needs of the children involved. By considering factors such as percentage of combined income and specific expenses, the worksheet supports a fair determination of the support amount owed, which is rounded to the nearest dollar for clarity and convenience.

Child Support Worksheet Example

Case Name |

|

|

|

|

|

Date Prepared |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Docket Number |

|

|

|

|

|

Name of Preparer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

CHILD SUPPORT GUIDELINES WORKSHEET |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

All amounts are $ / week, rounded to the nearest dollar |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

1. |

INCOME |

|

|

|

Recipient |

|

|

|

|

Payor |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. |

Gross Weekly income |

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

b. |

Minus Child Care cost paid |

|

|

$ |

( |

|

|

|

|

) |

|

$ |

( |

) |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

c. |

Minus Health insurance cost paid |

|

|

$ |

( |

|

|

|

|

) |

|

$ |

( |

) |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

d. |

Minus Dental/Vision insurance cost paid |

|

|

$ |

( |

|

|

|

|

) |

|

$ |

( |

) |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

e. |

Minus Other Support Obligations paid |

|

|

$ |

( |

|

|

|

|

) |

|

$ |

( |

) |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

f. |

Available income |

= |

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

g. |

Combined Available Income Recipient 1(f) + Payor 1(f) |

= |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

2. |

CHILD SUPPORT CALCULATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

a. |

Combined amount for one child (See Table A) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

b. |

Adjustment for number of children covered by |

|

|

|

|

|

|

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

this order (See Table B) |

Number of children |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c. |

Combined support amount 2(a) x 2(b) |

|

|

|

= |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d.Recipient's % of combined income Recipient 1(f) ÷ 1(g)

e.Minus Recipient's share of combined support amount 2(c) x 2(d)

f.Payor's proportional weekly support amount 2(c) - 2(e)

g.Weekly support amount as % of Recipient income

2(f) ÷ Recipient 1(f)

h.Payor's final weekly support amount if 2(g) is 10% or more, then enter 2(f) here

Otherwise, enter the lesser of 2(f) OR (10% + 2(g)) x Payor 1(f)

%

$ ( |

) |

=$

%

=$

TABLE A:

CHILD SUPPORT OBLIGATION SCHEDULE

|

All amounts are $ / |

week, rounded to the nearest dollar |

||||||||

COMBINED |

|

|

|

|

|

|

||||

AVAILABLE INCOME |

|

|

|

|

|

|

||||

FROM LINE 1(g) |

CHILD SUPPORT AMOUNT (1 CHILD) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

Minimum |

|

Maximum |

|

|

|

|

|

|

||

$- |

: |

$100 |

|

|

At court discretion, but not less than $80/month |

|||||

$101 |

: |

$200 |

|

|

|

|

21% |

|

|

|

$201 |

: |

$320 |

|

|

|

|

24% |

|

|

|

$321 |

: |

$500 |

|

|

$77 |

+ |

26% |

above |

$320 |

|

$501 |

: |

$1,000 |

|

|

$124 |

+ |

25% |

above |

$500 |

|

$1,001 |

: |

$1,500 |

|

|

$249 |

+ |

22% |

above |

$1,000 |

|

$1,501 |

: |

$2,500 |

|

|

$359 |

+ |

19% |

above |

$1,500 |

|

$2,501 |

: |

$3,500 |

|

|

$549 |

+ |

17% |

above |

$2,500 |

|

$3,501 |

: |

$4,808 |

|

|

$719 |

+ |

15% |

above |

$3,500 |

|

TABLE B:

ADJUSTMENT FOR NUMBER OF CHILDREN

CHILDREN ADJUSTMENT

11.00

21.20

31.27

41.32

5 1.35

Form Characteristics

| Fact Name | Details |

|---|---|

| Case Information | The Child Support Worksheet captures essential case details, including the case name, date prepared, docket number, and name of the preparer. |

| Income Calculation | This form requires both the recipient's and payor's gross weekly incomes. It includes deductions for child care and various insurance costs to determine available income. |

| Combined Available Income | The combined available income is calculated by adding the available income of both the recipient and payor, which is crucial for calculating support obligations. |

| Support Amount Determination | The worksheet provides a schedule that outlines minimum and maximum support amounts for one child based on the combined available income, guided by Tables A and B. |

| Adjustment for Multiple Children | Table B shows how the support obligation adjusts based on the number of children covered by the order, with specific percentages noted for each child. |

| Legal Framework | The governing laws for child support calculations may vary by state, typically outlined in local family law statutes. In many states, adherence to these guidelines is essential for courts in awarding support. |

Guidelines on Utilizing Child Support Worksheet

Filling out the Child Support Worksheet is an important step in determining the appropriate support obligation between parents. This form requires accurate financial information to ensure a fair calculation. Below are the steps to successfully complete the worksheet.

- Fill Out Case Information:

- Enter the Case Name.

- Provide the Date Prepared.

- Input the Docket Number.

- Record the Name of Preparer.

- Input Income Details:

- For the Recipient, enter the Gross Weekly Income.

- Subtract the Child Care Cost paid by Recipient.

- Deduct the Health Insurance Cost paid by Recipient.

- Deduct the Dental/Vision Insurance Cost paid by Recipient.

- Subtract any Other Support Obligations paid by Recipient.

- Calculate the Available Income for the Recipient.

- Repeat the previous steps for the Payor.

- Calculate the Combined Available Income by adding the Available Income of both Recipient and Payor.

- Calculate Child Support:

- Refer to Table A to find the combined amount for one child based on Combined Available Income.

- Consult Table B to determine the adjustment for the number of children covered by the order, and input that number.

- Calculate the Combined Support Amount.

- Determine the Recipient's percentage of combined income.

- Subtract the Recipient's Share of the combined support amount from the Combined Support Amount.

- Compute the Payor’s Proportional Weekly Support Amount.

- Calculate the Weekly Support Amount as a percentage of the Recipient's income.

- If this percentage is 10% or greater, record it; otherwise, enter the lesser of the calculated support or a modified amount based on the Payor's income.

What You Should Know About This Form

What is the purpose of the Child Support Worksheet?

The Child Support Worksheet is designed to help determine the amount of child support that should be paid. It collects information about both parents' incomes and expenses related to the children. By following the guidelines in the worksheet, parents can establish a fair support amount based on their financial situations.

How is gross weekly income calculated on the worksheet?

Gross weekly income refers to the total amount each parent earns before any deductions. To complete this section, list all sources of income, including wages, bonuses, and other earnings. This amount is used to determine how much financial support each parent can contribute.

What expenses can be deducted from gross income?

The worksheet allows for certain deductions from gross income. Parents can subtract child care costs, health insurance fees, dental and vision insurance costs, and any other support obligations. This helps to arrive at an available income figure that reflects the actual financial resources each parent has for child support.

How do you calculate combined available income?

To calculate combined available income, add the available income of both the recipient and the payor. This involves summing the available income amounts from both parents, as indicated in the worksheet. The resulting total provides a comprehensive view of the family’s financial capabilities.

What is Table A, and how does it affect the child support calculation?

Table A outlines the child support obligation amounts based on combined available income. The table specifies a minimum and maximum amount of support for one child. It helps parents see the expected child support obligation based on their combined income, making the calculation more straightforward.

How does the number of children affect support calculations?

The worksheet includes Table B, which provides an adjustment for the number of children covered by the support order. This adjustment is crucial, as it changes the total amount of support owed. The more children involved, the different the calculation will become according to the table's guidelines.

What happens if the calculated support amount is too low?

If the final weekly support amount is deemed too low, or if it does not meet the minimum requirement of 10% of the payor's income, the worksheet has guidelines for the payor's contribution. The worksheet ensures the child support amount reflects both parental responsibilities and the needs of the child.

Common mistakes

Filling out the Child Support Worksheet form can be complex, and mistakes can lead to significant complications in the support process. One common error is failing to accurately report gross weekly income. It's essential to list all sources of income, including bonuses and overtime. Omitting part of the income can undermine the accuracy of the calculations and result in an unfair support amount.

Another frequent mistake occurs in the deduction of child care costs. Both the recipient and the payor must detail any child care costs they incur. If these amounts are inaccurately recorded or overlooked, it can impact the available income calculation. Make sure to double-check these figures to ensure that child-related expenses are appropriately reflected.

Health insurance costs often lead to confusion. Participants may forget to report either their individual contributions or can miscalculate the amounts being paid. Properly deducting health, dental, and vision insurance costs when calculating available income is crucial. Any errors could severely alter the final determination of support obligations.

Many submitters neglect to include other support obligations already in place. This oversight can create discrepancies in the available income field. It's imperative to list all other support payments to ensure that the Child Support Worksheet reflects an accurate financial picture.

Also, combining the available income of both the recipient and payor can pose challenges. Errors in this section might arise from improper math or misunderstanding how combined income should be calculated. Each individual’s income must be clearly documented and added together carefully to avoid future complications.

Finally, utilizing the child support tables can be a challenging step. Mistakes often arise when calculating the appropriate support amount based on combined available income and adjustments for the number of children involved. It’s important to reference these tables accurately, ensuring you adjust the calculations based on the number of children covered by the support order.

Documents used along the form

In matters of child support, various forms and documents play vital roles alongside the Child Support Worksheet. These documents help clarify details, support calculations, and ensure compliance with legal requirements. Below is a list of common forms associated with the Child Support Worksheet.

- Child Support Agreement: This is a legally binding document outlining the terms of child support, including payment amounts and schedules agreed upon by both parents.

- Financial Affidavit: This form provides a detailed account of an individual’s income, expenses, assets, and debts, offering the court insight into the financial situation of each parent.

- Parenting Plan: This document outlines custody arrangements and visitation schedules, ensuring that both parents understand their rights and responsibilities regarding their children.

- Income Verification Documents: These can include pay stubs, tax returns, and W-2 forms that verify income used in child support calculations.

- Health Insurance Information: This document details health insurance coverage for the child, including costs and the provider's information, which influences child support adjustments.

- Child Care Expense Documentation: Receipts or invoices that show child care costs incurred by the custodial parent, which may reduce the payor’s obligation.

- Modification Request: A form submitted to the court to request changes in the child support order due to significant changes in circumstances for either parent.

- Enforcement Motion: This is filed when one parent seeks the court's help to ensure compliance with an existing child support order.

- Detailed Support Calculation Worksheet: This is a detailed breakdown of how the child support amount was calculated, based on the guidelines in the Child Support Worksheet.

These documents ensure that the child support process is comprehensive and transparent. Understanding them can significantly affect the management and effectiveness of child support arrangements, benefitting all parties involved, especially the children.

Similar forms

- Income Statement: This document details an individual's income, similar to the Child Support Worksheet's income section. Both forms require reporting gross income as well as deductions for various expenses.

- Expense Report: Just as the Child Support Worksheet accounts for child care and insurance costs, an expense report itemizes regular expenditures. Each document aims to present a clear picture of an individual's financial obligations.

- Financial Affidavit: A financial affidavit outlines an individual's financial situation, including income and expenses. Like the Child Support Worksheet, it is used in legal proceedings to establish financial capabilities and obligations.

- Child Support Guidelines: These guidelines resemble the overview offered in the Child Support Worksheet. They provide a framework for determining support amounts based on income and number of children, ensuring fairness and consistency.

- Tax Return: A tax return includes detailed financial information, including income and deductions, much like the Child Support Worksheet. Both serve to verify reported income and assess overall financial responsibility.

- Budget Worksheet: A budget worksheet is used to plan and manage income and expenditures. It shares similarities with the Child Support Worksheet by categorizing income and expenses to arrive at a net financial position.

- Alimony Worksheet: The alimony worksheet calculates spousal support in a divorce or separation context, akin to the child support determination process. Both worksheets assess financial circumstances to determine appropriate support levels.

- Custody Agreement: While primarily focused on custody arrangements, a custody agreement often includes financial obligations. This ties in with the Child Support Worksheet by defining and quantifying the support expected from each parent.

Dos and Don'ts

When filling out the Child Support Worksheet form, careful attention to detail is crucial. Here are some guidelines to help you navigate the process effectively.

- Do ensure that all income figures are accurate. Errors can lead to significant issues down the line.

- Don't forget to include all relevant expenses, such as child care and health insurance costs. Missing these can result in miscalculations.

- Do round all dollar amounts to the nearest whole number as required. This makes the calculations easier and ensures compliance with the form's instructions.

- Don't assume that the support amount is fixed. Review the guidelines thoroughly and adjust based on the specific circumstances of your case.

- Do consult the Child Support Obligation Schedule for accurate calculations based on your combined available income.

- Don't hesitate to seek help if needed. Consider consulting with a professional familiar with child support laws to clarify any uncertainties.

Misconceptions

Misconceptions about the Child Support Worksheet can lead to unnecessary confusion. Below is a list of common misunderstandings regarding this vital document:

- The worksheet is optional. Many believe the Child Support Worksheet is optional, but it is a required document in most child support cases.

- Child support calculations are straightforward. Calculations can be complex. They depend on various factors like income, expenses, and number of children.

- Only the payor's income matters. This is not true. The income of both the recipient and payor is essential for accurate calculations.

- Child care costs are not considered. Child care costs paid are deducted from gross income when calculating available income for both parties.

- Insurance costs do not impact calculations. Health and dental/vision insurance costs are also deducted from income, affecting the final support amount.

- All families pay the same amount. The child support amount varies greatly based on income and the number of children involved.

- Once established, the amount cannot change. Child support amounts can be modified if there are significant changes in circumstance.

- Only the court can adjust amounts. While a court does have the final say, parties can agree to modifications outside of court.

- The worksheet does not consider additional support obligations. These obligations, if any, are deducted from income and affect the available income calculation.

- Child support is just a one-time payment. Child support is typically a recurring payment, reviewed regularly to ensure it meets the needs of the child.

Understanding these misconceptions can lead to better communication and cooperation between parents, ensuring that the best interests of the child are prioritized.

Key takeaways

When filling out and using the Child Support Worksheet form, keep these key points in mind:

- Accurate Income Reporting: Ensure you provide accurate weekly income figures for both the recipient and the payor.

- Document Adjustments: Adjustments for child care, health insurance, and other obligations must be clearly indicated to determine available income.

- Combined Available Income: The combined available income calculation is crucial, as it affects the overall support amount.

- Reference Tables: Utilize Table A and Table B to find the applicable child support amounts based on your calculated income.

- Percentage Calculations: Be prepared to calculate each party's percentage of the combined income, as it plays a significant role in determining support obligations.

- Follow Court Guidelines: Understand that the court has discretion over final amounts, ensuring that your calculations align with established guidelines.

- Consider Multiple Children: If there are multiple children involved, remember to adjust support amounts according to the number of children covered by the order.

- Final Weekly Support Amount: Assess if the calculated support amount meets the threshold of 10% of the payor's income to finalize the weekly support obligation.

- Review Before Submission: Carefully review all figures and adjustments before submitting the worksheet, as accuracy is paramount.

Browse Other Templates

Global Cash Card Wisely - Participate in payroll innovation with the Global Cash Card.

General Excise Tax Reconciliation Form,Hawaii Business Tax Summary,Annual Tax Return for Hawaii Businesses,Hawaii General Excise Reporting,Tax Year Reconciliation Form,Excise and Use Tax Annual Submission,Hawaii Tax Reconciliation Statement,Business - The information is segmented into parts to simplify the reporting process.