Fill Out Your Childcare Receipt Form

The Childcare Receipt form plays an essential role in documenting the services provided by childcare providers to families. Each receipt includes crucial information like the date of service, which helps parents keep track of when care was provided. The amount charged for the services is clearly stated, ensuring transparency in financial transactions. Families will find space to indicate the name of the child or children receiving care, reinforcing the personal connection to the service. The period during which the childcare was provided is specified, allowing for precise record-keeping. Finally, the provider's signature authenticates the receipt, assuring parents that the document is valid and legitimate. Together, these elements form a comprehensive record that can be both useful for budgeting purposes and tax deductions.

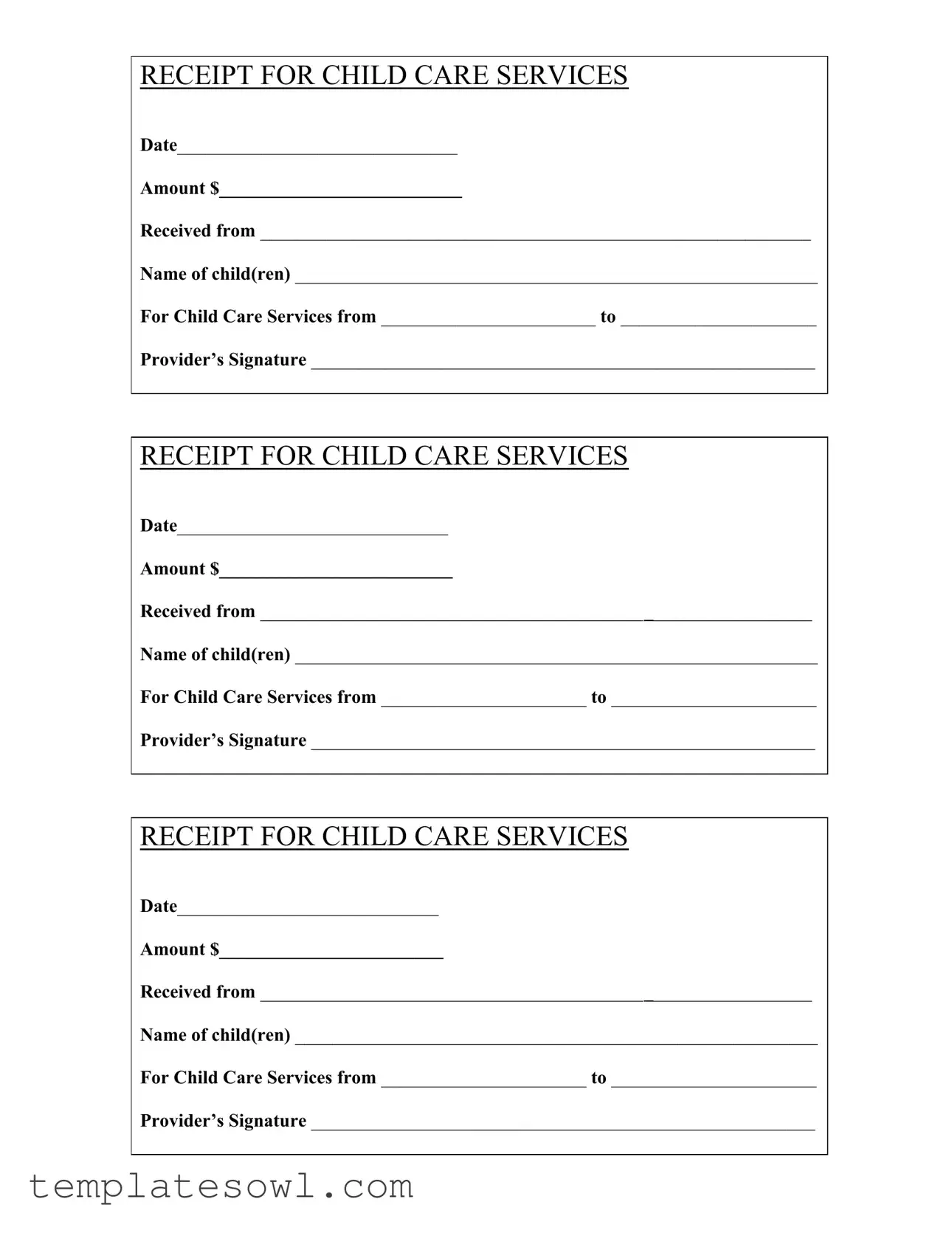

Childcare Receipt Example

RECEIPT FOR CHILD CARE SERVICES

Date______________________________

Amount $__________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from _______________________ to _____________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date_____________________________

Amount $_________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date____________________________

Amount $________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Childcare Receipt form is used to document payments made for child care services. |

| Date Entry | It requires the date of service or payment, ensuring accurate record-keeping for both parents and providers. |

| Payment Amount | The form includes a dedicated space to record the amount paid, promoting transparency. |

| Receiving Party | A section is provided for the name of the person making the payment, allowing for clear identification. |

| Child Identification | Parents must list the name(s) of their child(ren) receiving the care, helping to ensure accurate records. |

| Service Dates | The form specifies the dates for which child care services were provided, offering a clear timeframe for services rendered. |

| Provider's Acknowledgment | Signature from the provider confirms receipt of payment, establishing mutual agreement on the transaction. |

| State Variations | Different states may have unique requirements regarding the form, governed by specific laws related to child care documentation. |

| Use in Tax Deductions | This form can be used by parents as proof of child care expenses when filing taxes, potentially qualifying for deductions. |

Guidelines on Utilizing Childcare Receipt

Completing the Childcare Receipt form requires careful attention to detail. Each section of the form must be filled out accurately to ensure proper documentation of childcare services rendered. Follow these steps to successfully complete the form.

- Begin by entering the Date of the receipt at the top of the form. Make sure this reflects the date when the payment was received.

- In the Amount field, write the total dollar amount received for the childcare services.

- In the section labeled Received from, fill in the name of the individual making the payment.

- List the child's name or names in the Name of child(ren) section. Ensure that the names are spelled correctly.

- Include the timeframe for which services were provided in the For Child Care Services from and to fields. Specify the start and end dates clearly.

- Finally, the provider must sign the form in the Provider’s Signature section. This verifies that services were rendered and payment was received.

What You Should Know About This Form

What is the purpose of the Childcare Receipt form?

The Childcare Receipt form serves as a record of payment for childcare services. It documents important details such as the date of service, amount paid, and the name of the child or children receiving care. This form is essential for both parents and childcare providers for bookkeeping and tax purposes.

What information is required on the form?

The form requires several key pieces of information. You will need to fill out the date of payment, the total amount paid, the name of the person making the payment, the names of the child or children receiving care, the service period (dates of service), and the signature of the childcare provider. All this information ensures accurate record-keeping.

How can this receipt be used for tax purposes?

Is the signature of the childcare provider mandatory?

Yes, the signature of the childcare provider is a mandatory part of the form. This signature serves as verification that the payment was received for the specified childcare services. Without it, the receipt may not be considered valid.

Can this form be modified or customized?

How should the form be stored after it is completed?

After completing the Childcare Receipt form, it should be stored in a safe and organized manner. Whether you choose to keep a physical copy or a digital version, ensure it is easily accessible for future reference, especially during tax filing seasons.

What should I do if I lose a receipt?

If a receipt is lost, it's best to contact the childcare provider for a duplicate. Providers usually keep records of payments and can issue a new receipt with all the necessary information. Maintaining good communication with your provider can help resolve such situations smoothly.

Common mistakes

When filling out the Childcare Receipt form, it’s easy to make mistakes. These errors can cause confusion and delays, which can be frustrating. Here are seven common mistakes that people should watch out for.

One mistake is not including the date on the form. Without a date, the receipt may lack important context. Always fill in the date clearly to ensure it accurately reflects when payment was made.

Another common error is skipping the amount field. Forgetting to write down the amount received can lead to disputes or questions later on. It is crucial to enter the exact amount paid for the services provided.

Sometimes, people neglect to fill in the name of the child or children. This information is essential to link the payment to specific services rendered. If this section is left blank, it can create confusion about whom the receipt pertains to.

Inadequate details about the child care services are also a frequent oversight. Filling in the dates for services is vital. Make sure to include the start and end dates accurately. This clarity will help if any verification is necessary later.

People often forget to secure the provider’s signature. A signature validates the receipt and confirms that the transaction occurred. Without it, the receipt may not carry the same weight if questioned.

Another issue arises when the receipt is not kept organized. Misplacing receipts can lead to problems, especially during tax season. Maintain a tidy record of all receipts to ensure easy access when needed.

Lastly, failure to double-check for accidental errors, such as typos in names or numbers, can create complications. Take a moment to review the form before submitting. This small step can prevent misunderstanding down the line.

Documents used along the form

When utilizing the Childcare Receipt form, several other documents may be necessary to ensure a comprehensive record-keeping process. These forms help clarify the arrangement between caregivers and parents while supporting any potential financial or administrative needs. Here’s a list of common forms often associated with childcare receipts.

- Child Enrollment Form: This document captures essential information regarding the child, including emergency contacts, allergies, and medical history. It ensures that caregivers have the information they need for safety and care.

- Childcare Agreement: This written contract outlines the terms of care services, including hours of operation, payment terms, and responsibilities of both parties. It serves as a formal understanding between parents and providers.

- Payment Agreement Form: This form details the payment schedule and methods accepted by the childcare provider. It helps to clarify obligations and prevent misunderstandings about financial agreements.

- Tax Identification Number (TIN) Form: Often needed for tax purposes, this form allows childcare providers to collect the necessary taxpayer information from parents. This is especially important for those seeking childcare tax credits.

- Immunization Records: This document confirms that a child has received required vaccinations. Many childcare centers require this information to ensure a safe environment for all children.

- Incident Report Form: Used to document any accidents or injuries that occur while a child is in care. This form ensures transparency and helps in tracking any recurrent issues.

- Daily Log: A daily log records information about the child's activities, meals, and behaviors during their time in care. This form helps parents understand their child's day and provide continuity between home and care.

- Authorization to Release Form: This document gives consent for caregivers to release the child to specified individuals. It is essential for safety and ensures that children are only picked up by authorized individuals.

- Withdrawal Notice: When parents decide to withdraw their child from care, this form communicates the decision and provides necessary details about the transition. It helps maintain a professional relationship between both parties.

- Annual Tax Statements: Childcare providers typically offer tax statements at the end of the year. These summarizing documents are essential for parents when filing taxes and claiming childcare expenses.

Understanding these various forms facilitates smoother interactions between parents and childcare providers. Utilizing each document effectively can contribute significantly to a positive childcare experience.

Similar forms

-

Invoice: Like the Childcare Receipt form, an invoice outlines services rendered, including details about the amount owed and the parties involved. It serves as a formal request for payment.

-

Payment Receipt: This document confirms that payment has been received for services or goods. Similar to the Childcare Receipt, it includes the date, amount, and description of services or products provided.

-

Service Agreement: While more detailed, a service agreement defines the relationship between the provider and client, stating terms, services provided, and payment structure. It often summarizes what is included in a childcare receipt.

-

Deposit Receipt: When a deposit is made for future services, such as childcare, this receipt confirms the transaction. It shares similarities in structure, noting the amount and purpose of the payment.

-

Billing Statement: A billing statement summarizes all charges for services provided over a certain period. It is similar in that it often details multiple invoices or receipts, including childcare services.

-

Contract for Childcare Services: This document formally outlines the agreed-upon terms for childcare. While more comprehensive, it includes the same critical information about services as the receipt.

-

Gift Certificate: If a childcare service is gifted, a gift certificate functions similarly to a receipt, stating the service provided and confirming a value that can be redeemed.

-

Tax Document (like a W-2): Although for different purposes, tax documents can summarize payments received over a year, similar to how a childcare receipt summarizes services and payments for a defined period.

-

Client Agreement Confirmation: Like the childcare receipt, this confirmation outlines the initial arrangements between the provider and client. It seals the deal on services to be rendered, mirroring the receipt's acknowledgment of payment for those services.

Dos and Don'ts

When filling out the Childcare Receipt form, it is essential to be thorough and accurate. Here are five important do's and don'ts to keep in mind.

- Do enter the correct date for the service.

- Do provide the exact amount received for clarity.

- Do write the name of the child(ren) in full.

- Do specify the duration of care accurately.

- Do ensure the provider's signature is present.

- Don't skip any fields on the form; all information is vital.

- Don't use abbreviations; write everything out clearly.

- Don't forget to check for spelling errors before submission.

- Don't leave out the provider's signature, as it validates the receipt.

- Don't provide incorrect or misleading information; it may cause issues later.

Misconceptions

- Misconception 1: The form only applies to professional childcare providers.

- Misconception 2: The receipt must be filled out in a specific way.

- Misconception 3: Receipts are not necessary for childcare payments under a certain amount.

- Misconception 4: The receipt is only needed for tax purposes.

This is not true. While the form is commonly used by licensed childcare centers, it can also be utilized by individual caregivers, family members, or friends who provide childcare services. Any service that entails the care of children can warrant the use of this receipt.

There is flexibility in how the receipt can be completed. As long as it captures essential information—such as date, amount paid, provider's signature, and details of child care services—it serves its purpose. Providers can personalize the structure as needed.

This misconception can lead to misunderstandings. Whether the payment amount is large or small, documentation is important for maintaining accurate records. Both parents and providers benefit from written confirmation to avoid potential disputes.

While it is true that receipts can help in tax deductions for childcare expenses, this is not their sole purpose. Receipts also serve to confirm payment and outline the services provided. They promote transparency and accountability between parents and caregivers.

Key takeaways

Each Childcare Receipt form must be fully completed. Ensure the date, amount, names of the child(ren), and service dates are filled in accurately.

Providers should sign each receipt to validate the services rendered. A signature serves as proof of the transaction and is critical for both parties.

Keep copies of all receipts for personal records. This practice aids in tracking childcare expenses throughout the year.

Receipts may be needed for tax purposes. Families can use these documents to claim childcare expenses on their tax returns.

Discrepancies in receipt details can lead to complications. Always verify the information before submitting or keeping the receipt.

Store receipts in a safe and organized manner. This will help in case of inquiries or audits regarding childcare expenses.

Browse Other Templates

Dd Form 2875 Pdf Fillable - Completing the form indicates a commitment to upholding DoD security standards.

Transcript Retrieval Request,Academic Record Request Form,Official Transcript Order,Student Transcript Application,Transcript Delivery Request,Bluefield College Transcript Form,Transcription Request Document,Educational Record Request Form,Transcript - Include your name as it appeared while enrolled at the school.