Fill Out Your Church Financial Expense Form

Managing finances in a church setting requires careful attention to detail, and the Church Financial Expense form plays a vital role in this process. This form, crafted to streamline the purchasing process, captures essential information such as the date of request, the vendor to whom the check will be payable, and the purpose of the purchase. Additionally, it helps organize expenses by allowing users to categorize them under specific ministry departments, contributing to a clearer financial overview. As individuals complete the form, they must provide a breakdown of costs, thus keeping track of total expenditures. The form also offers options for distributing checks, whether through the church office, phone, email, or mail. Important details like the approved by section ensure accountability, while sections for debit and credit purchases keep the church's financial health visible and manageable. Ultimately, the Church Financial Expense form is more than just a tool; it serves as a foundational element in maintaining the integrity and transparency of church finances.

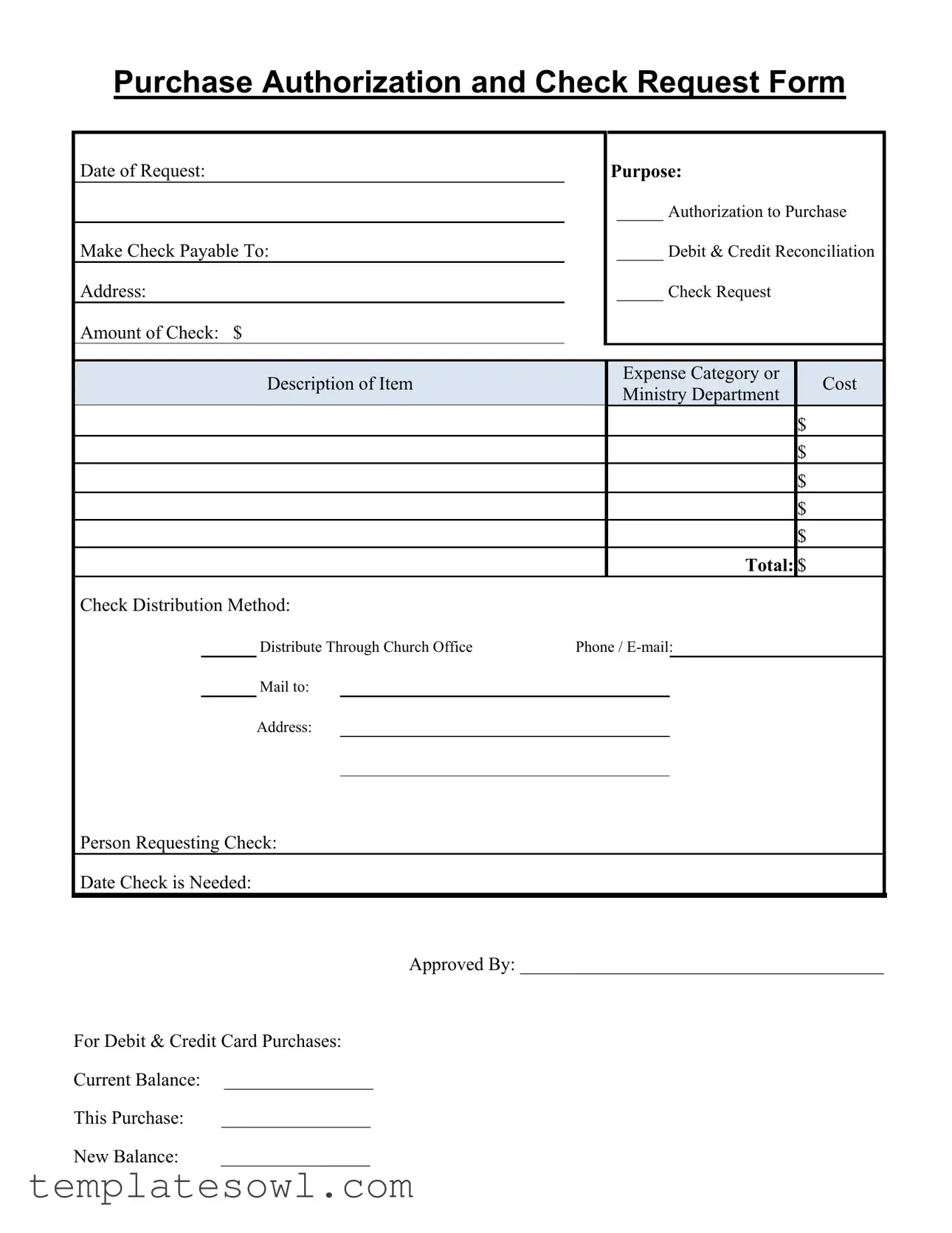

Church Financial Expense Example

Purchase Authorization and Check Request Form

Date of Request:

Make Check Payable To:

Address:

Amount of Check: $

Purpose:

_____ Authorization to Purchase

_____ Debit & Credit Reconciliation

_____ Check Request

|

Description of Item |

Expense Category or |

|

Cost |

|

|

Ministry Department |

|

|

||

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

Total: |

$ |

|

|

Check Distribution Method:

Distribute Through Church Office |

Phone / |

Mail to:

Address:

Person Requesting Check:

Date Check is Needed:

Approved By: _______________________________________

For Debit & Credit Card Purchases:

Current Balance: |

________________ |

This Purchase: |

________________ |

New Balance: |

________________ |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Church Financial Expense form is used for requesting authorization to make purchases and to reconcile debit and credit expenses within the church's financial system. |

| Key Components | This form includes essential information such as the date of request, payee details, amount, and purpose of the expense. |

| Expense Categories | Users must specify the expense category or cost associated with the purchase, ensuring accurate financial categorization. |

| Approval Process | After filling out the form, it requires approval from a designated individual, which adds an important layer of oversight. |

| Check Distribution | The form allows for flexibility in the distribution method of checks, either through the church office or via mail, to suit different needs. |

| State-Specific Laws | For specific states, this form may need to comply with state laws governing church financial transactions. Always check local regulations for guidance. |

Guidelines on Utilizing Church Financial Expense

Filling out the Church Financial Expense form is a straightforward process that ensures proper tracking of expenses. Once completed, it is essential to submit the form to the appropriate church authorities for approval. Below are the steps to accurately fill out the form.

- Record the Date of Request at the top of the form.

- In the Make Check Payable To field, enter the name of the individual or organization that should receive the check.

- Fill in the Address of the payee, ensuring it is accurate for mailing purposes.

- Indicate the Amount of Check in the designated space, writing the total amount in dollars.

- Describe the Purpose of the expense, choosing one of the categories provided:

- Authorization to Purchase

- Debit & Credit Reconciliation

- Check Request

- Provide a Description of Item to clarify the nature of the expense.

- Assign a Cost to the item within the Expense Category, including up to four separate entries if necessary.

- Calculate the Total amount of all expenses and write it in the appropriate space.

- Select a Check Distribution Method:

- Distribute Through Church Office

- Mail to a specified address

- In the Phone / E-mail field, provide your contact information for any necessary follow-up.

- Indicate the Mail to: address if it differs from the payee address.

- Enter your name as the Person Requesting Check.

- Specify the Date Check is Needed for timely processing.

- Leave space for the Approved By signature or written approval.

- If applicable, complete the section for Debit & Credit purchases by entering the Current Balance, This Purchase amount, and then calculate and enter the New Balance.

What You Should Know About This Form

What is the purpose of the Church Financial Expense form?

The Church Financial Expense form is a tool that helps manage and track financial requests within the church. It is used for various purposes, including purchasing items, requesting checks, and reconciling debit and credit card expenses. This form ensures that all financial activities are properly authorized and documented, promoting accountability and transparency in church finances.

What information do I need to fill out the form?

To complete the Church Financial Expense form, you will need to provide specific details. This includes the date of your request, the name of the payee, their address, and the amount of the check needed. You also need to describe the purpose of the expense, whether it's for a purchase, reconciliation, or a check request. Additionally, you should indicate the expense category, the ministry department, and the total amount. Make sure to include your contact information, like your phone number or email, and indicate how the check should be distributed.

How do I indicate if my request is approved?

The form includes a section for approval. A designated authority must sign or provide their name in the “Approved By” field. This signature confirms the request has been reviewed and authorized, ensuring that all expenditures are in line with the church's financial policies. It is crucial to have this step completed before any purchases are made or checks are issued.

What should I do if my request involves a debit or credit card purchase?

If your request involves a debit or credit card, you must fill out the section related to card transactions. Here, you will indicate the current balance on the card, the amount of the proposed purchase, and the new balance after the purchase. This information helps maintain accurate records of the church’s financial activities and ensures that the card is not overused.

When should I submit this form?

You should submit the Church Financial Expense form as soon as you determine a need for a financial transaction. To avoid delays, submit it in advance of when you need the check or purchase completed. Providing as much lead time as possible helps ensure that all financial requests are processed efficiently and that the necessary approvals are obtained.

Common mistakes

When filling out the Church Financial Expense form, individuals often make several common mistakes. One frequent error occurs at the very beginning: failing to provide a specific date of request. This information is crucial not only for record-keeping but also for ensuring timely processing of the request. Without a clear date, it might create confusion during audits or when reviewing past transactions.

Another common mistake is not filling in the amount of the check correctly. If the total amount is missing or inaccurate, it can lead to numerous complications, including delayed payments or insufficient funds. It's essential to double-check this figure before submission to avoid any setbacks.

People also forget to write a detailed description of the item being purchased. Vague descriptions can lead to misunderstandings about the purpose of the expense. This can create issues later on when trying to reconcile accounts or justify the expense to church leadership.

Identifying the right expense category or cost is sometimes overlooked. Each purchase should be categorized accurately to ensure that financial records reflect the church's spending appropriately. Incorrect categorization can complicate budget analysis and financial reporting.

In addition, individuals often neglect to include their contact information. Providing a phone number or email allows for quick communication if there are any questions or issues with the request. Omitting this detail can lead to delays in processing the check.

People fail to indicate the check distribution method accurately. Clarity on whether the check should be distributed through the church office or mailed helps prevent misunderstandings. Without this direction, the church staff may not know how to proceed with the request.

In some cases, individuals also do not sign or obtain the necessary authorization. This oversight can result in unauthorized purchases, which may lead to financial discrepancies or disputes down the line. Approval from the designated authority is key to maintaining accountability.

Finally, those using debit or credit cards sometimes skip filling in the current balance, this purchase amount, and the new balance. Providing this information is vital for tracking church finances accurately. It allows church leadership to monitor expenses more effectively, ensuring that spending stays within budgetary limits.

Documents used along the form

The Church Financial Expense form serves as an important tool for managing and tracking financial transactions within a church. Several other forms complement this document, enhancing financial oversight and ensuring accountability. Below is a list of commonly used forms that work in conjunction with the Church Financial Expense form.

- Purchase Authorization Form: This form is used to get approval for significant purchases before they occur. It outlines the item, cost, and justification, ensuring the church leadership is aware of all expenditures.

- Check Request Form: Similar to the expense form, this document specifically requests a check be issued. It details the recipient, purpose, and amount needed, streamlining the payment process.

- Expense Reimbursement Form: When employees or church members incur expenses on behalf of the church, this form allows them to seek reimbursement. It requires receipts and explanations of the costs incurred.

- Budget Worksheet: This document helps in planning the church's finances by outlining projected income and expenses for a specified period. It provides a framework for financial decision-making.

- Credit Card Reconciliation Form: This form reconciles church credit card expenditures. It ensures all charges match receipts and provides a clear view of spending trends.

- Financial Statement Template: A structured report that summarizes the church’s financial status. It includes income, expenses, and net assets, giving stakeholders a transparent view of financial health.

- Donation Receipt Template: This document acknowledges contributions made to the church. It includes donor names, amounts, and dates, and serves as important documentation for tax purposes.

- Monthly Expense Report: A comprehensive review of all expenses incurred during a month, allowing the church leadership to monitor financial activity and adjust budgets as necessary.

- Audit Checklist: A tool used during financial audits to ensure all necessary documents are in order. This list helps track compliance with financial policies and procedures, facilitating accountability.

Utilizing these forms alongside the Church Financial Expense form helps maintain comprehensive financial oversight and ensures proper management of the church’s resources. Good financial practices foster trust and transparency within the community.

Similar forms

The Church Financial Expense form shares similarities with several other financial documents. Here’s a breakdown of five similar forms and how they connect:

- Expense Reimbursement Form: Like the Church Financial Expense form, this document is used to outline expenses incurred by individuals. It requires details such as the amount spent, purpose, and approval from a designated authority.

- Purchase Request Form: This form also requests authorization prior to making a purchase. It includes the nature of the expense, the amount, and is typically subject to approval, mirroring the structure of the Church Financial Expense form.

- Payment Request Form: Similar in intent, this form seeks payment for services or goods received. It includes pertinent details like the amount to be paid and the reasoning behind the request, ensuring a clear record of the transaction.

- Budget Proposal Form: This document connects in function by outlining anticipated expenses. It requires itemization of costs and is submitted for approval, similar to how expenses are listed in the Church Financial Expense form.

- Financial Report Form: While this document summarizes financial data, it serves a similar purpose by providing an overview of expenses. It captures totals and categories, reinforcing transparency and accountability within the church's finances.

Dos and Don'ts

When completing the Church Financial Expense form, certain practices can help ensure accuracy and compliance. Below is a summary of what you should and shouldn't do.

- Do clearly specify the date of your request.

- Do detail the purpose of the expense in the designated section.

- Do ensure that all amounts are clearly written and correct, including the total.

- Do include the necessary approvals before submission.

- Do provide accurate contact information for follow-up.

- Don't skip the expense category; every item needs to be categorized.

- Don't forget to check your spelling and grammar for clarity.

- Don't leave out the person requesting the check.

- Don't ignore the distribution method; indicate how you want the check delivered.

- Don't fill out the form hastily; take your time to minimize errors.

Misconceptions

Misconceptions about the Church Financial Expense form can lead to confusion and inefficiency. Here are six common misunderstandings, clarified for better understanding:

- It is only for large purchases. Many believe this form is only necessary for big expenses. In reality, it is essential for all expenditures, regardless of the amount.

- You need a separate form for every expense type. Some think different forms exist for various expense categories. The Church Financial Expense form accommodates all types of purchases under a single document.

- Only pastors can authorize purchases. While pastoral authorization is important, any designated church leader can approve requests. Ensure clarity about who has the authority within your ministry.

- Checks are only sent to the requester. Many feel checks can only be mailed to the person requesting. However, checks can be sent to different addresses based on specific needs or preferences.

- Reconciliation details are optional. Some individuals ignore the reconciliation section. Accurate record-keeping is crucial for financial transparency and accountability.

- The form is complicated. Many people perceive this document as complex, but it is straightforward. Just fill in the required information clearly and thoroughly for processing.

Key takeaways

Here are some important points to remember when filling out and using the Church Financial Expense form:

- Always start by entering the Date of Request at the top of the form.

- Clearly indicate the Payable To section to avoid any confusion regarding the recipient.

- Provide a complete Address for the payee to ensure proper delivery.

- Specify the Amount of Check to be issued in dollars and cents.

- Describe the purpose of the expense in the designated area, ensuring clarity.

- List items under the Description of Item section to provide detail on what is being purchased.

- Identify the Expense Category or Cost for each item to assist in tracking financial records.

- Calculate the Total and ensure it reflects the sum of all listed expenses.

- Choose the appropriate Check Distribution Method, whether through the church office or mail.

- Finally, secure Approval by obtaining a signature from an authorized person.

When using the form, ensure that you have a valid reason for each purchase and stick to the guidelines set by the church. Document every expense properly to maintain accurate financial records.

Browse Other Templates

How to Apply for Leave of Absence - Reviewing the company's Leave of Absence Policy can provide clarity.

Boys Night Out Permission Slip - Every detail is crafted to enhance accountability in a comical relationship context.

Conditional Waiver and Release on Progress Payment California - Ensure you follow up with the other party for confirmation once the waiver is signed.