Fill Out Your Cigna Vision Claim Form

When seeking reimbursement for vision care services outside the Cigna Vision network, filling out the Cigna Vision Claim Form becomes an essential step for subscribers and their dependents. This form is designed to simplify the claims process for individuals who have received care from non-participating providers and is crucial for ensuring that you receive the funds to which you're entitled. It’s important to note that no claim form is necessary if you’ve utilized the services of a participating provider. As you work through the form, you will find several sections that require your personal details, along with information about your provider and the services received. Key steps include providing accurate patient and subscriber information, including any other insurance coverage you may have. Remember to attach original itemized receipts that detail the services and materials provided. Accurate completion is vital, as missing or illegible information could lead to delays or denial of payment. Finally, don’t forget to sign and date the form before mailing it to Cigna Vision at the designated address, and keep the contact information handy should you have any questions along the way.

Cigna Vision Claim Example

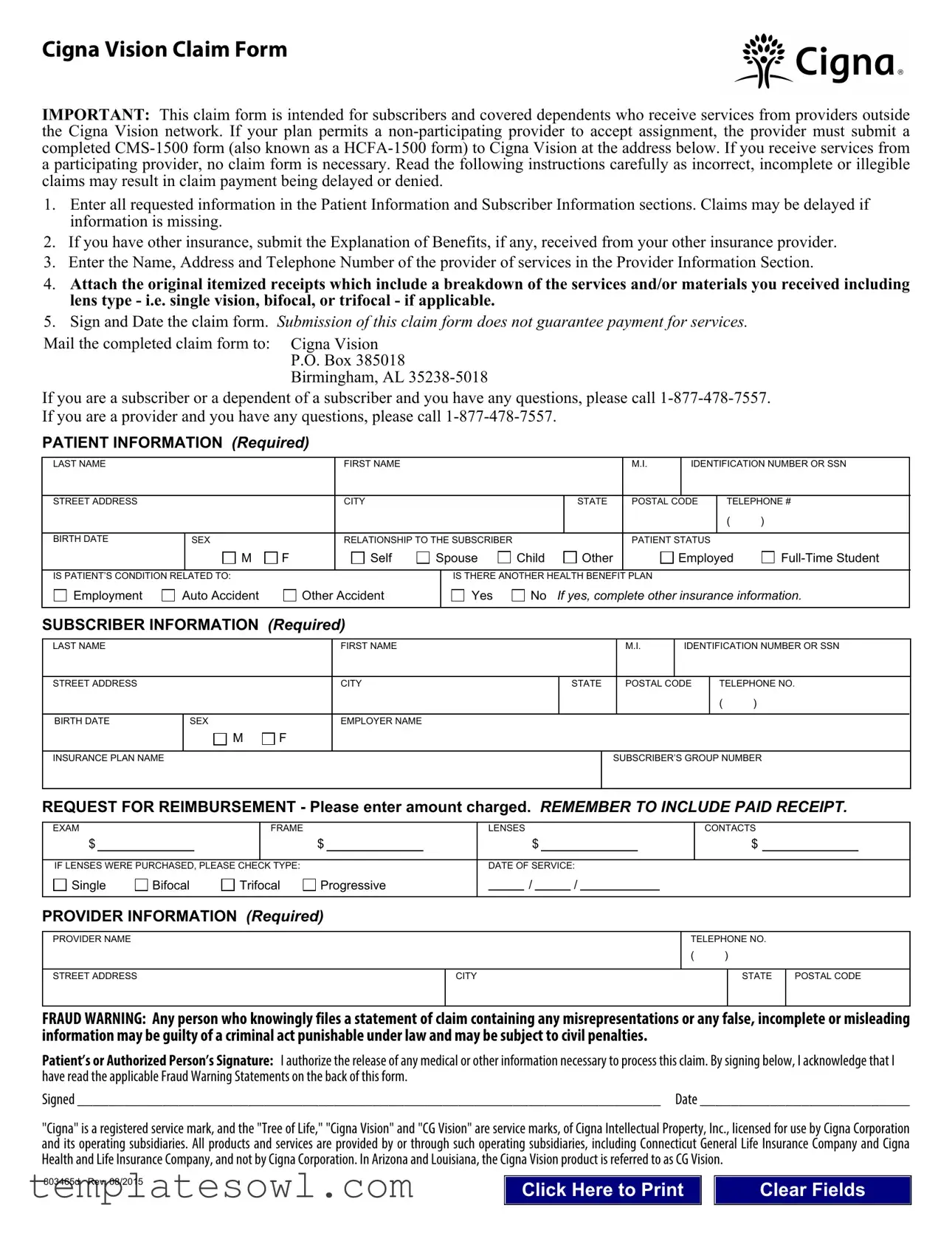

Cigna Vision Claim Form

IMPORTANT: This claim form is intended for subscribers and covered dependents who receive services from providers outside the Cigna Vision network. If your plan permits a

1.Enter all requested information in the Patient Information and Subscriber Information sections. Claims may be delayed if information is missing.

2.If you have other insurance, submit the Explanation of Benefits, if any, received from your other insurance provider.

3.Enter the Name, Address and Telephone Number of the provider of services in the Provider Information Section.

4.Attach the original itemized receipts which include a breakdown of the services and/or materials you received including lens type - i.e. single vision, bifocal, or trifocal - if applicable.

5.Sign and Date the claim form. Submission of this claim form does not guarantee payment for services.

Mail the completed claim form to: |

|

Cigna Vision |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

P.O. Box 385018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Birmingham, AL |

|

|

|

|

|

|

|

|

|

|

|

|

||||

If you are a subscriber or a dependent of a subscriber and you have any questions, please call |

|||||||||||||||||||

If you are a provider and you have any questions, please call |

|

|

|

|

|

|

|

|

|

|

|

||||||||

PATIENT INFORMATION (Required) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LAST NAME |

|

|

|

|

FIRST NAME |

|

|

|

|

|

|

|

|

M.I. |

|

IDENTIFICATION NUMBER OR SSN |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STREET ADDRESS |

|

|

|

|

CITY |

|

|

|

|

STATE |

|

|

POSTAL CODE |

TELEPHONE # |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

BIRTH DATE |

SEX |

|

|

|

RELATIONSHIP TO THE SUBSCRIBER |

|

|

|

|

|

|

PATIENT STATUS |

|

|

|||||

|

M |

F |

|

|

Self |

Spouse |

Child |

|

Other |

|

|

|

Employed |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

IS PATIENT’S CONDITION RELATED TO: |

|

|

|

|

|

IS THERE ANOTHER HEALTH BENEFIT PLAN |

|

|

|

|

|

||||||||

Employment |

Auto Accident |

|

Other Accident |

|

Yes |

No |

If yes, complete other insurance information. |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

SUBSCRIBER INFORMATION (Required) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

LAST NAME |

|

|

|

|

FIRST NAME |

|

|

|

|

|

|

|

|

M.I. |

|

IDENTIFICATION NUMBER OR SSN |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

STREET ADDRESS |

|

|

|

|

CITY |

|

|

|

|

STATE |

|

|

POSTAL CODE |

|

TELEPHONE NO. |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BIRTH DATE |

SEX |

|

|

|

EMPLOYER NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

INSURANCE PLAN NAME |

|

|

|

|

|

|

|

|

|

|

|

SUBSCRIBER’S GROUP NUMBER |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REQUEST FOR REIMBURSEMENT - Please enter amount charged. REMEMBER TO INCLUDE PAID RECEIPT.

EXAM |

|

|

FRAME |

|

|

|

LENSES |

|

|

|

|

|

CONTACTS |

||||||

$ |

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|

$ |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IF LENSES WERE PURCHASED, PLEASE CHECK TYPE: |

|

|

|

DATE OF SERVICE: |

|||||||||||||||

Single |

Bifocal |

Trifocal |

Progressive |

/ |

|

/ |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROVIDER INFORMATION (Required)

PROVIDER NAME

STREET ADDRESS

TELEPHONE NO.

( )

CITY |

STATE |

POSTAL CODE |

|

|

|

FRAUD WARNING: Any person who knowingly files a statement of claim containing any misrepresentations or any false, incomplete or misleading information may be guilty of a criminal act punishable under law and may be subject to civil penalties.

Patient’s or Authorized Person’s Signature: I authorize the release of any medical or other information necessary to process this claim. By signing below, I acknowledge that I have read the applicable Fraud Warning Statements on the back of this form.

Signed ___________________________________________________________________________ Date ___________________________

"Cigna" is a registered service mark, and the "Tree of Life," "Cigna Vision" and "CG Vision" are service marks, of Cigna Intellectual Property, Inc., licensed for use by Cigna Corporation and its operating subsidiaries. All products and services are provided by or through such operating subsidiaries, including Connecticut General Life Insurance Company and Cigna Health and Life Insurance Company, and not by Cigna Corporation. In Arizona and Louisiana, the Cigna Vision product is referred to as CG Vision.

803465d Rev. 08/2015 |

Click Here to Print |

Clear Fields |

|

Caution: Any person who, knowingly and with intent to defraud any insurance company or other person: (1) files an application for insurance or statement of claim containing any materially false information; or (2) conceals for the purpose of misleading, information concerning any material fact thereto, commits a fraudulent insurance act.

IMPORTANT CLAIM NOTICE

Alaska Residents: A person who knowingly and with intent to injure, defraud or deceive an insurance company or files a claim containing false, incomplete or misleading information may be prosecuted under state law.

Arizona Residents: For your protection, Arizona law requires the following statement to appear on/with this form. Any person who knowingly presents a false or fraudulent claim for payment of loss is subject to criminal and civil penalties.

California Residents: For your protection, California law requires the following to appear on/with this form. Any person who knowingly presents a false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

Colorado Residents: It is unlawful to knowingly provide false, incomplete or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance, and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Division of Insurance within the Department of Regulatory Agencies.

District of Columbia Residents: WARNING: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding the insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits if false information materially related to a claim was provided by the applicant.

Florida Residents: Any person who knowingly and with intent to injure, defraud or deceive any insurer files a statement of claim or an application containing any false, incomplete or misleading information is guilty of a felony of the third degree.

Kentucky Residents: Any person who knowingly and with intent to defraud any insurance company or other person files a statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime.

Maryland Residents: Any person who knowingly OR willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly OR willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

Minnesota Residents: A person who files a claim with intent to defraud or helps commit a fraud against an insurer is guilty of a crime.

New Jersey Residents: Any person who knowingly files a statement of claim containing any false or misleading information is subject to criminal and civil penalties.

New Mexico Residents: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to civil fines and criminal penalties.

New York Residents: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime and shall also be subject to a civil penalty not to exceed $5000 and the stated value of the claim for each such violation.

Oregon Residents: Any person who knowingly and with intent to defraud any insurance company or other person: (1) files an application for insurance or statement of claim containing any materially false information; or, (2) conceals for the purpose of misleading, information concerning any material fact, may have committed a fraudulent insurance act.

Pennsylvania Residents: Any person who, knowingly and with intent to defraud any insurance company or other person, files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

Rhode Island Residents: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

Tennessee Residents: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines and denial of insurance benefits.

Texas Residents: Any person who knowingly presents a false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

Virginia Residents: Any person who, with the intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement may have violated state law.

803465d Rev. 08/2015

Form Characteristics

| Fact Name | Details |

|---|---|

| Claim Form Purpose | This form is used by subscribers and dependents who receive services from providers outside the Cigna Vision network. |

| Non-Participating Provider Submission | If using a non-participating provider, the CMS-1500 form must be submitted to Cigna Vision. |

| Claim Submission Guarantee | Submitting the claim form does not guarantee payment for the services received. |

| Required Patient Information | All requested information in the Patient Information and Subscriber Information sections must be completed to avoid delays. |

| Original Receipts Requirement | Claimants must attach the original itemized receipts detailing the services and materials received. |

| Provider Contact Information | Providers' name, address, and telephone number need to be included in the submission. |

| State-Specific Fraud Warnings | Each state has specific laws regarding fraudulent claims, with potential penalties including fines and imprisonment. |

| Submission Address | The completed claim form should be mailed to Cigna Vision at P.O. Box 385018, Birmingham, AL 35238-5018. |

| Contact Information for Queries | Subscribers and dependents can call 1-877-478-7557 for inquiries related to their claims. |

Guidelines on Utilizing Cigna Vision Claim

Filling out the Cigna Vision Claim form is an essential step to receive reimbursement for vision services from non-participating providers. To ensure a smooth process and timely payment, please follow the steps outlined below for completing the form accurately.

- Provide all required information in the Patient Information section. This includes the patient's last name, first name, middle initial, identification number or Social Security Number, address, city, state, postal code, telephone number, birth date, sex, relationship to the subscriber, and patient status.

- If applicable, indicate if the patient has other insurance. Be sure to submit any Explanation of Benefits received from that insurance provider as well.

- Fill out the Subscriber Information section with similar details as required for the patient: last name, first name, middle initial, identification number or Social Security Number, address, city, state, postal code, telephone number, birth date, sex, employer name, insurance plan name, and subscriber's group number.

- In the Request for Reimbursement section, enter the amounts charged for the exam, frame, lenses, and contacts. Make sure to include a paid receipt.

- If lenses were purchased, check the appropriate type: Single, Bifocal, Trifocal, or Progressive.

- Indicate the date of service in the provided format.

- Complete the Provider Information section by entering the provider's name, address, city, state, postal code, and telephone number.

- Sign and date the claim form. Your signature authorizes the release of necessary medical information to process the claim.

- Mail the completed claim form along with all required documents to Cigna Vision at the specified address: Cigna Vision, P.O. Box 385018, Birmingham, AL 35238-5018.

Once submitted, you can expect to receive updates regarding the status of your claim. If questions arise during the process, don't hesitate to contact customer service for assistance.

What You Should Know About This Form

What should I do if I received vision services from a non-participating provider?

If you received vision services from a provider that is not part of the Cigna Vision network, you will need to fill out the Cigna Vision Claim Form. Ensure that you enter all necessary information accurately in both the Patient Information and Subscriber Information sections. Attach the original itemized receipts that detail the services received, including the type of lenses if applicable. Submit the completed form to the address provided for processing.

Do I need to submit a claim form if I used a participating provider?

No, you do not need to submit a claim form if you used a participating provider within the Cigna Vision network. The provider will handle the billing directly with Cigna Vision, and you will not need to take any additional steps to file a claim.

What happens if my claim form is incomplete or incorrect?

Submitting an incomplete or incorrect claim form can lead to delays in processing your claim. It may also result in denial of the claim. To avoid these issues, carefully read and follow all instructions on the claim form. Ensure that all required fields are filled out, and double-check that you've attached the necessary documentation.

What should I include when submitting my claim for reimbursement?

When submitting your claim for reimbursement, include the completed Cigna Vision Claim Form along with the original itemized receipts for services rendered. The itemized receipts must provide a breakdown of the services and materials received, including details about lens types if lenses were purchased. Additionally, ensure that the claim form is signed and dated before mailing it to the address provided.

Common mistakes

Filling out the Cigna Vision Claim form can be straightforward, but mistakes happen often. One common error is the absence of required information in the Patient Information and Subscriber Information sections. Missing information can lead to delays. Always double-check to ensure everything is filled in completely.

Another mistake involves not submitting the required Explanation of Benefits if other insurance is involved. If you have additional insurance coverage, include this documentation to support your claim. Omitting this can also result in delays or denial of the claim.

Providing an incomplete Provider Information section is another frequent issue. It's crucial to include the name, address, and telephone number of the provider. Without this information, Cigna may struggle to verify the services rendered, further complicating your claim.

Failing to attach an original itemized receipt is a third common error. This receipt should detail the services and materials received. Whether you got single vision lenses or multifocal ones, make sure the breakdown is clear. If this attachment is missing, your claim may be rejected.

Another mistake is neglecting to sign and date the claim form. This step confirms that the information you've provided is accurate and that you authorize Cigna to process your claim. Not signing the form will inevitably delay the review process.

Many people overlook the fact that simply submitting the claim form doesn't guarantee payment. Many expect immediate reimbursement without understanding the potential for further review. Claims may be subject to additional verification, so patience is necessary after submission.

Lastly, leaving out the date of service or entering it incorrectly can lead to confusion. It's important to be precise about when you received your vision services. Providing accurate dates ensures that Cigna can process your claim in a timely manner.

Documents used along the form

When submitting a claim to Cigna Vision, several supporting documents may be necessary. These documents help ensure a smooth reimbursement process for subscribers and their dependents. Here’s a brief overview of the forms and documents commonly used alongside the Cigna Vision Claim form.

- CMS-1500 Form: This is a standard form used by healthcare providers to bill Medicare and other insurers. If services were provided by a non-participating provider who accepts assignment, they must submit this form to Cigna Vision.

- Explanation of Benefits (EOB): An EOB is provided by your other health insurance plan if applicable. It details how much the other insurer paid and how much is remaining or owed, helping Cigna Vision process your claim accurately.

- Itemized Receipts: Original itemized receipts should include detailed information about services and materials received. This documentation should specify lens type, providing clarity on the services billed.

- Proof of Payment: It's essential to include proof of payment with your claim. This documentation could be in the form of a paid receipt or other records, ensuring Cigna Vision can verify expenses incurred.

- Authorization Form: In some cases, an authorization form might be required to release patient information. This form allows healthcare providers to share necessary details with Cigna Vision to facilitate the claims process.

Gathering these documents minimizes the risk of delays or denials when filing a claim. Each piece of information plays a crucial role in streamlining the reimbursement process, ensuring you receive the benefits due under your vision plan.

Similar forms

- CMS-1500 Form: Similar to the Cigna Vision Claim Form, the CMS-1500 form is used by non-participating providers to submit medical claims for reimbursement. Both documents require detailed patient and provider information, along with itemized charges.

- Health Insurance Claim Form: This generic claim form is also utilized by providers to request payment for services rendered. It shares the same structure, requiring patient and provider details and a breakdown of services.

- Medicare Claim Form: Used for patients under Medicare, this form requests reimbursement similarly to the Cigna form, demanding itemized receipts and the provider’s information.

- Vision Insurance Claim Form: Insurance companies that offer vision benefits typically have their own claim forms. These documents require similar information about services rendered, provider details, and patient information.

- Accident Claim Form: When injuries occur due to accidents, this form requests coverage for services. Like the Cigna Vision Claim Form, it asks for details about the accident and related services.

- Prescription Drug Claim Form: Individuals can submit this to obtain reimbursement for medication costs. It parallels the Cigna claim form in needing patient and provider details and itemized information about services received.

- Flexible Spending Account (FSA) Claim Form: This form is used to request reimbursement for eligible out-of-pocket health care expenses. It requires similar comprehensive details about expenditures.

- Coordination of Benefits (COB) Form: Used when a patient has multiple insurance plans, this form coordinates payments and requires detailed information about both coverages, akin to those needed in the Cigna claim.

- Medical Reimbursement Claim Form: Often used by employers or insurance plans, this document requests reimbursement for medical expenses. It requires similar detailed patient information and service breakdowns.

- Out-of-Network Claim Form: Patients receiving care from out-of-network providers need to fill this out for reimbursement. It features the same format and requirements for patient and provider information as the Cigna Vision Claim Form.

Dos and Don'ts

When filling out the Cigna Vision Claim form, there are several important steps to follow. Here is a list of things you should do, and things you should avoid.

- DO enter all required patient and subscriber information accurately.

- DO include any Explanation of Benefits from other insurance.

- DO provide the provider’s name, address, and phone number.

- DO attach original itemized receipts detailing your services.

- DO sign and date the claim form before submission.

- DON'T leave any sections blank or incomplete.

- DON'T submit the claim without the necessary supporting documents.

- DON'T forget to double-check if your plan requires a specific form for non-participating providers.

- DON'T assume your claim will be processed without your signature.

- DON'T send the claim form to any address other than the one specified.

By following these guidelines, you can help ensure that your claim is processed smoothly and without unnecessary delays.

Misconceptions

When navigating the Cigna Vision Claim form, it is essential to have a clear understanding of what it entails. There are several misconceptions that often arise. Here’s a breakdown of these misunderstandings to help clarify the process.

- Claim forms are always required for services from participating providers. This is not true. If you receive services from a provider who is part of the Cigna Vision network, you do not need to submit a claim form.

- All claims will be paid as long as the form is submitted. Unfortunately, this is misleading. Submitting the claim form does not guarantee payment. Proper documentation and completeness are crucial for the claim to be processed and approved.

- You don't need to submit itemized receipts. This is incorrect. It’s necessary to attach original itemized receipts that clearly indicate the services and materials provided, such as lens types.

- Only the patient needs to provide information. Both the patient and subscriber information sections need to be completed. Missing information from either section can lead to delays in processing.

- Submitting other insurance documents is optional. If you have coverage from another insurer, including the Explanation of Benefits (EOB) from that insurance is mandatory. This information is vital for the processing of your claim.

- Signing the claim form is just a formality. On the contrary, your signature is a crucial part of the process. It authorizes the release of necessary information and confirms that all provided details are correct.

Understanding these misconceptions can help you navigate the claim process more effectively and avoid unnecessary delays or denials. Always take the time to read the instructions carefully and ensure that all required information is complete before submitting your claim.

Key takeaways

Filling out the Cigna Vision Claim form accurately is crucial for a smooth reimbursement process. Here are some key takeaways to ensure your claim is successful:

- Use the Correct Form: This claim form is specifically for subscribers and dependents who visited non-network providers. If using a participating provider, there's no need to fill it out.

- Complete Patient and Subscriber Information: All requested fields in both the Patient Information and Subscriber Information sections must be filled in. Missing information can delay your claim.

- Additional Insurance: If you have other health insurance, attach the Explanation of Benefits (EOB) from that provider to your claim. This is important for processing payments accurately.

- Provider Details: Make sure to include the name, address, and phone number of the provider who delivered the services. This information is essential for verifying your claim.

- Receipts: Attach the original itemized receipts for the services rendered. Receipts should detail the types of services, such as whether lenses were single vision, bifocal, or trifocal.

- Signature and Date: Don’t forget to sign and date the claim form before submission. An unsigned form may lead to denial of your claim.

- Mailing the Form: Once completed, send the claim form to Cigna Vision at the address provided. Proper mailing ensures your claim is received timely.

By following these steps carefully, you can enhance the chances of a smooth claim processing experience. For any further questions, a dedicated phone line is available for both subscribers and providers.

Browse Other Templates

State of California Workers Compensation - Supporting documentation must be attached to justify the lien claim.

Ach Form for Vendors - Regular reviews of this form can aid in maintaining up-to-date financial details.