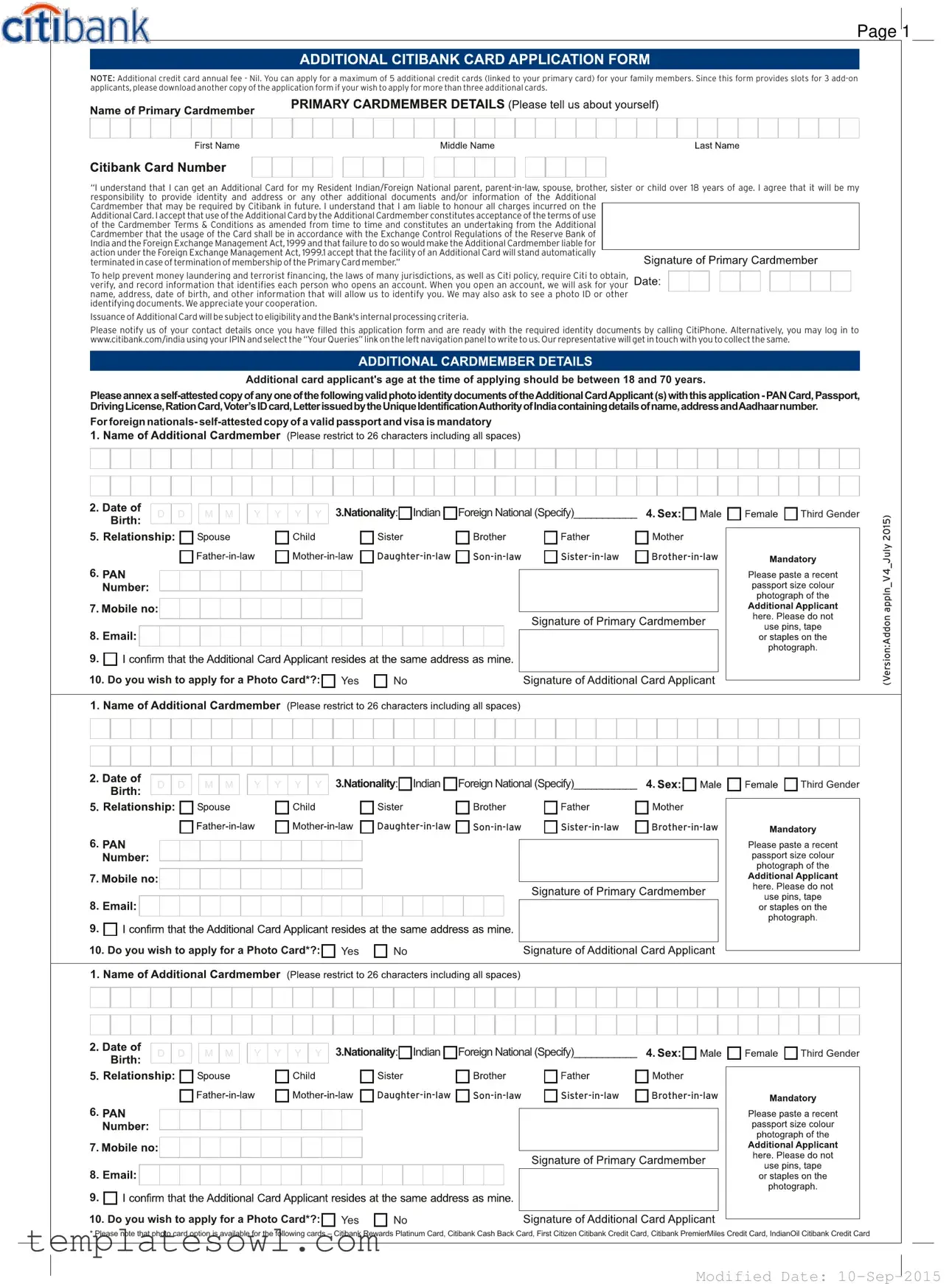

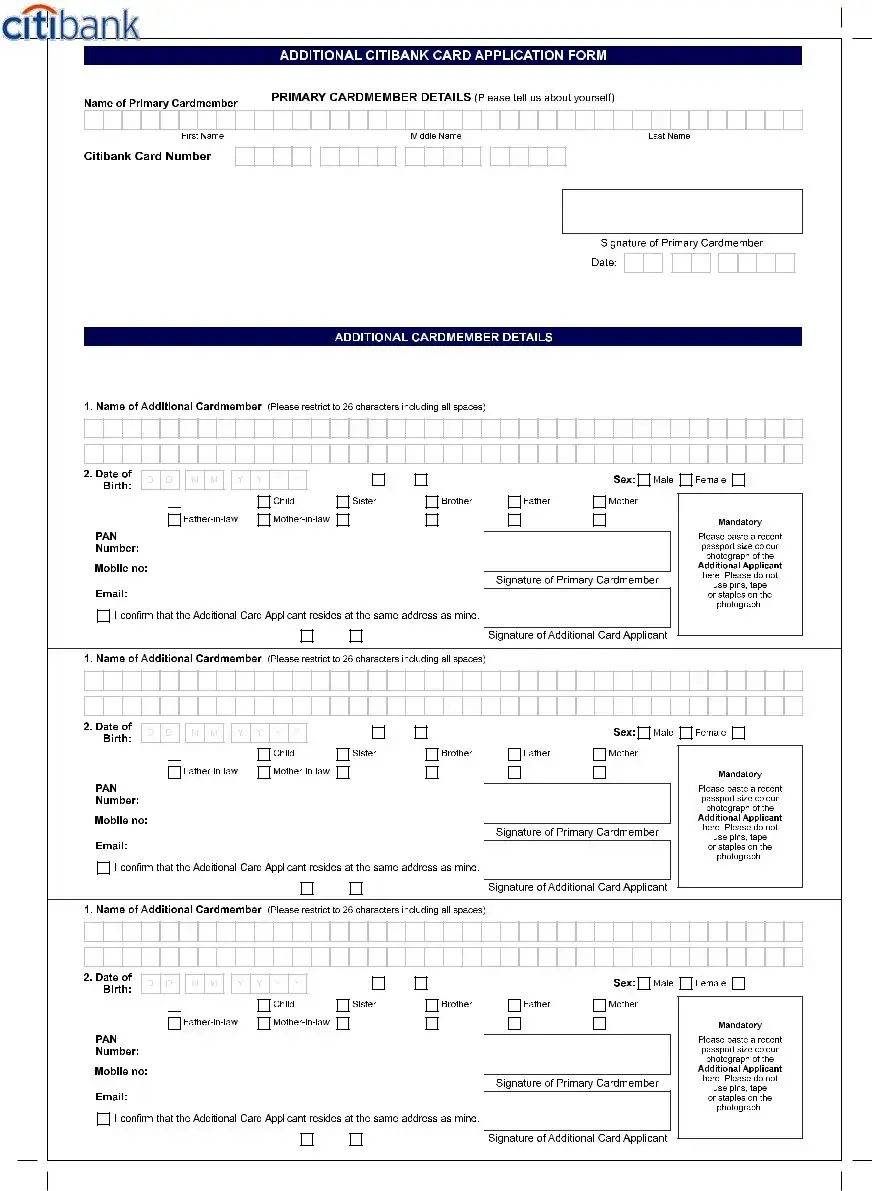

Fill Out Your Citi Bank Aplication Card Form

The Citi Bank Application Card form serves as a comprehensive tool for individuals seeking to apply for a credit card and potentially for additional cards for family members. The form is structured to accommodate requests for up to three add-on cards, with the option to download additional copies for those wishing to apply for more. Key features include no annual fee for the additional cards and specific eligibility criteria for applicants, which include being between the ages of 18 and 70. The primary cardholder assumes full responsibility for any charges incurred by the additional cardmembers. Important instructions regarding the provision of personal identification and documentation emphasize compliance with relevant regulations to combat money laundering and terrorist financing. Applicants must furnish various forms of identification, with a mandatory photo ID for foreign nationals. Furthermore, the form provides information about optional features, such as applying for a photo card, available for a range of specific Citi Bank credit card types. Proper submission processes are outlined, ensuring applicants know how to proceed with their requests efficiently and effectively.

Citi Bank Aplication Card Example

PAGE

1

NOTE: Additional credit card annual fee - Nil. You can apply for a maximum of 5 additional credit cards (linked to your primary card) for your family members. Since this form provides slots for 3

“I understand that I can get an Additional Card for my Resident Indian/Foreign National parent,

Cardmember that may be required by Citibank in future. I understand that I am liable to honour all charges incurred on the Additional Card. I accept that use of the Additional Card by the Additional Cardmember constitutes acceptance of the terms of use of the Cardmember Terms & Conditions as amended from time to time and constitutes an undertaking from the Additional Cardmember that the usage of the Card shall be in accordance with the Exchange Control Regulations of the Reserve Bank of India and the Foreign Exchange Management Act, 1999 and that failure to do so would make the Additional Cardmember liable for action under the Foreign Exchange Management Act, 1999.1 accept that the facility of an Additional Card will stand automatically terminated in case of termination of membership of the Primary Card member.”

To help prevent money laundering and terrorist financing, the laws of many jurisdictions, as well as Citi policy, require Citi to obtain, verify, and record information that identifies each person who opens an account. When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see a photo ID or other identifying documents. We appreciate your cooperation.

Issuance of Additional Card will be subject to eligibility and the Bank's internal processing criteria.

Please notify us of your contact details once you have filled this application form and are ready with the required identity documents by calling CitiPhone. Alternatively, you may log in to www.citibank.com/india using your IPIN and select the “Your Queries” link on the left navigation panel to write to us. Our representative will get in touch with you to collect the same.

Additional card applicant's age at the time of applying should be between 18 and 70 years.

Please annex a

For foreign nationals-

3.Nationality: Indian Foreign National (Specify)___________ 4. |

Third Gender |

5.

2015)

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. Do you wish to apply for a Photo Card*?: |

Yes |

|

No |

|

|

|

|||||||||||||

|

|

|

|

||||||||||||||||

(Version:Addon appln_V4_July

3.Nationality: Indian Foreign National (Specify)___________ 4. |

Third Gender |

5.

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. Do you wish to apply for a Photo Card*?: |

Yes |

|

No |

|

|

|

|||||||||||||

|

|

|

|

||||||||||||||||

3.Nationality: Indian Foreign National (Specify)___________ 4. |

Third Gender |

5.

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. Do you wish to apply for a Photo Card*?: |

Yes |

|

No |

|

|

|

|||||||||||||

|

|

|

|

||||||||||||||||

* Please note that photo card option is available for the following cards – Citibank Rewards Platinum Card, Citibank Cash Back Card, First Citizen Citibank Credit Card, Citibank PremierMiles Credit Card, IndianOil Citibank Credit Card

Modified Date:

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Annual Fee | There is no additional annual fee for the Citi Bank application card. |

| Maximum Cards | Applicants can request up to 5 additional credit cards linked to the primary card. |

| Add-on Applicants | The form includes slots for 3 additional card applicants. More slots require a second application form. |

| Eligibility Criteria | To apply for an additional card, the applicant must be between 18 and 70 years old. |

| Required Documents | A self-attested copy of a valid photo ID, like a Passport or Voter ID, must accompany the application. |

| Foreign Nationals | For foreign nationals, a valid passport and visa are mandatory documents. |

| Personal Information | Citibank must collect identifying information, such as name and address, to prevent money laundering. |

| Contact Notification | Applicants should notify Citibank once they have completed the form and gathered identity documents. |

| Photo Card Option | Applicants can choose to apply for a photo card, available for specific card types listed in the application. |

Guidelines on Utilizing Citi Bank Aplication Card

Once the Citi Bank Application Card form is completed, the next steps involve submitting it along with the required identity documents. This information will enable the bank to process the application and verify your identity. Ensure that you have all necessary materials ready before reaching out to Citibank for further assistance.

- Obtain the Citi Bank Application Card form, either online or at a branch.

- Carefully read the instructions on the form, especially regarding eligibility and documentation.

- Fill in your personal details, including your name, address, and date of birth.

- Specify your nationality as either Indian or Foreign National. If you select Foreign National, you must provide additional information.

- Indicate your desire for an additional card for a family member by filling in their details in the provided slots.

- Check the box if you wish to apply for a Photo Card.

- Attach a self-attested copy of an acceptable photo identity document for each additional card applicant.

- Verify that all information is correct and complete to avoid processing delays.

- Contact Citibank or visit the specified website to submit your application and identity documents.

What You Should Know About This Form

What information is required to apply for an additional Citi Bank credit card?

To apply for an additional Citi Bank credit card, you will need to provide personal information such as the names, addresses, and ages of the additional card applicants. You should also submit a self-attested copy of a valid photo ID, which could be a PAN Card, Passport, Driving License, or Voter's ID. Foreign nationals are required to include a self-attested copy of their valid passport and visa.

Who is eligible for an additional Citi Bank credit card?

Eligibility for an additional card includes family members like parents, parents-in-law, spouses, siblings, or children over 18 years of age. The minimum age for an additional card applicant is 18, and the maximum age is 70. The acceptance of your application will also depend on Citi Bank's internal processing criteria.

Can I apply for more than three additional cards?

This application form has space for three additional card applicants. If you wish to apply for more than three, you will need to download another copy of the application form and fill it out completely for each additional applicant.

What should I do after filling out the application form?

Once the application form is completed, you should contact CitiBank by calling CitiPhone. You can also log into the CitiBank website using your IPIN, select the "Your Queries" link, and send a message to request assistance. A representative will reach out to you for the next steps.

Are there any fees associated with additional credit cards?

No, there is no additional annual fee for the Citi Bank credit cards. You can enjoy the benefit of getting additional cards linked to your primary card without incurring any extra costs.

What happens if the primary card member’s membership is terminated?

If the primary card member's membership is terminated, the additional card will also be automatically terminated. The responsibility for all charges incurred on the additional card lies with the primary card member.

What identification documents might Citibank request?

To comply with legal requirements, Citibank may ask for various identification documents when you open an account. Generally, you may need to provide your name, address, date of birth, and a photo ID. This process helps in preventing money laundering and other fraudulent activities.

Common mistakes

Filling out the Citi Bank Application Card form can seem straightforward, but mistakes can delay your application. One common issue is leaving out necessary personal information. Applicants sometimes forget to include their full name, address, or date of birth. Each section of the form is important, and missing out on these details can result in rejection.

Another mistake is not providing correct identification documents. The form explicitly asks for a self-attested copy of valid photo ID. Many people overlook this step or attach the wrong documents. Make sure to double-check the required IDs like a PAN Card or Passport before submission.

Some applicants also misread the eligibility requirements for additional cardholders. The age limit for these applicants is between 18 and 70. Individuals often apply for family members outside this age range, which can lead to further complications. Always verify that your additional card applicants meet this criteria.

Incomplete contact details can be an overlooked mistake as well. It’s essential to provide a reliable phone number or email address. If Citi Bank needs to follow up about your application, missing contact information can cause delays or even a denial.

People also tend to misunderstand the application process for additional cards. If you wish to apply for more than three cards, you must download another form. Some applicants incorrectly assume that filling out the same form multiple times is acceptable.

Another common oversight is not understanding the implications of accepting the terms and conditions. Applicants may rush through this section without realizing it constitutes an agreement. Take the time to read and comprehend these terms to avoid unforeseen liabilities.

Lastly, some people forget to check their application for errors before submission. Simple typographical errors can lead to setbacks. It’s advisable to review everything thoroughly. Taking the extra time could save you from potential headaches later on.

Being mindful of these common mistakes can help streamline your application process. Take your time to ensure everything is correct and complete. Doing so will increase your chances of a smooth approval.

Documents used along the form

When applying for a Citi Bank Application Card, there are several additional documents and forms you may encounter. These documents are essential for ensuring your application is processed smoothly and can assist in various aspects of your banking relationship. Below is a brief overview of these common documents.

- Identity Verification Document: A key requirement for your application, this document can include a PAN card, passport, or any government-issued photo ID. It helps Citi Bank verify your identity and establish your credibility.

- Address Proof Document: Alongside identity verification, you will need to provide proof of your address. This could be a recent utility bill, rental agreement, or bank statement. It confirms your residency for account management purposes.

- Income Proof Document: Citibank may ask for a document to verify your income, such as a recent pay stub, tax return, or bank statements. This helps assess your eligibility for credit limits.

- Additional Credit Card Application Form: If you're seeking more than three additional cards, a separate application form is required. This allows you to apply for additional cards for your family members comfortably.

- Correspondence Form: Should you have questions after submitting your application, this form is useful for reaching out to Citibank’s customer service. It can often be found on their website or by contacting them directly.

Gathering these documents in advance can streamline your application process, ensuring that you have everything ready when you decide to submit your Citi Bank Application Card form. By being well-prepared, you can focus more on what matters most: your new banking relationship.

Similar forms

The Citi Bank Application Card form shares similarities with several other types of documents used in financial institutions for various purposes. Here is a list detailing these similarities:

- Loan Application Form: Like the Citi Bank form, a loan application form requires personal information, including identification and financial details. Both documents aim to assess the applicant's eligibility for services provided by the bank.

- Mortgage Application Form: Similar to the Citi Bank form, a mortgage application collects information about the applicant's income, debts, and assets. Both forms are intended to evaluate financial responsibility and eligibility.

- Credit Card Authorization Form: This form is akin to the Citi Bank Application Card as it requires consent for charges and provides terms for card use. Both documents establish responsibilities for financial transactions made with the card.

- Bank Account Opening Form: Both the Citi Bank form and an account opening form request personal details to verify identity and eligibility. They serve as the initial step in establishing a banking relationship.

- Identity Verification Form: Similar to what is required in the Citi Bank form, an identity verification form prompts the submission of identification documents. Both forms are essential for compliance with regulations aimed at preventing fraud.

- Membership Application Form: Just like the Citi Bank form, this application collects personal and financial information to determine eligibility and establish a relationship. Both forms include responsibilities outlined for members.

- Additional Card Application Form: This document closely mirrors the Citi Bank form as it focuses on applying for extra cards linked to a primary account. Both require information on the additional cardholder and highlight the primary cardholder's responsibilities.

Dos and Don'ts

When filling out the Citi Bank Application Card form, there are several important do's and don'ts to keep in mind.

- Do fill in all required fields accurately.

- Do provide valid identification documents for yourself and any additional card applicants.

- Do check your eligibility before applying for an additional card.

- Do ensure that the age of additional card applicants is between 18 and 70 years.

- Don't leave any sections of the form blank, as this can delay your application.

- Don't submit documents that are not self-attested or do not meet the required criteria.

- Don't forget to provide your contact details for follow-up communication.

- Don't apply for more than five additional cards in total; only three can be filled out on one form.

- Don't attempt to provide incorrect information, as this may lead to rejection of your application.

Misconceptions

Many people have misconceptions about the Citi Bank Application Card form. Here are ten common misunderstandings, along with explanations to help clarify them:

- There is an annual fee for additional cards. Contrary to popular belief, there is no annual fee for additional credit cards linked to your primary one.

- You can only apply for three additional cards. While the form has space for three applicants, you can request up to five additional cards by downloading more copies of the form.

- The additional cards can only be issued to family members. Yes, the additional card can be requested for family members such as parents, siblings, or children over 18, but they must also meet certain criteria.

- Only Indian citizens can apply for an additional card. Foreign nationals can apply, but they must provide specific documentation such as a valid passport and visa.

- All applicants must be under 18 years old. In fact, applicants must be between 18 and 70 years old to qualify.

- The application process is quick and doesn't require documentation. The bank needs to verify identity, thus you will have to provide certain documents like a photo ID.

- Using an additional card is not your responsibility. As the primary cardholder, you are liable for all charges incurred on any additional cards.

- You cannot terminate an additional card. If the primary card membership is terminated, the additional card will also be automatically canceled.

- There is no option for a Photo Card for all credit cards. The photo card option is available only for specific types of cards, like the Citibank Rewards Platinum Card.

- You cannot change your application after submission. You can notify Citi of any changes in your contact details before your application is processed.

Understanding these points can help streamline your application process and reduce confusion. If you have more questions, don’t hesitate to reach out to Citi for assistance.

Key takeaways

Here are six key takeaways regarding the Citi Bank Application Card form:

- Annual Fees: There is no additional annual fee for obtaining an additional credit card.

- Add-On Cards: Up to five additional credit cards may be applied for family members; additional forms are needed for more than three applicants.

- Eligibility Requirements: Additional card applicants must be between 18 and 70 years old and provide valid identification documents.

- Liability Understanding: The primary card member is responsible for all charges made by the additional cardholder.

- Identification Compliance: Citi Bank requires identification verification, including a photo ID, to comply with legal requirements.

- Support Channels: For application queries or document submission, contact CitiPhone or use the online portal.

Browse Other Templates

Alabama Farmers Bulletin - The development of farmer cooperatives is discussed as a means of support.

Nyc Corp Tax Rate - Corporations must calculate and enter their total franchise tax along with estimated tax installments on the form.

Transportation Authorization Request,Patient Transport Certification Form,Mental Health Transport Approval,Inpatient Transport Authorization,CT Transportation Approval Form,Emergency Transport Certification,Substance Abuse Transport Authorization,Men - Documentation should remain consistent with any prior medical records.