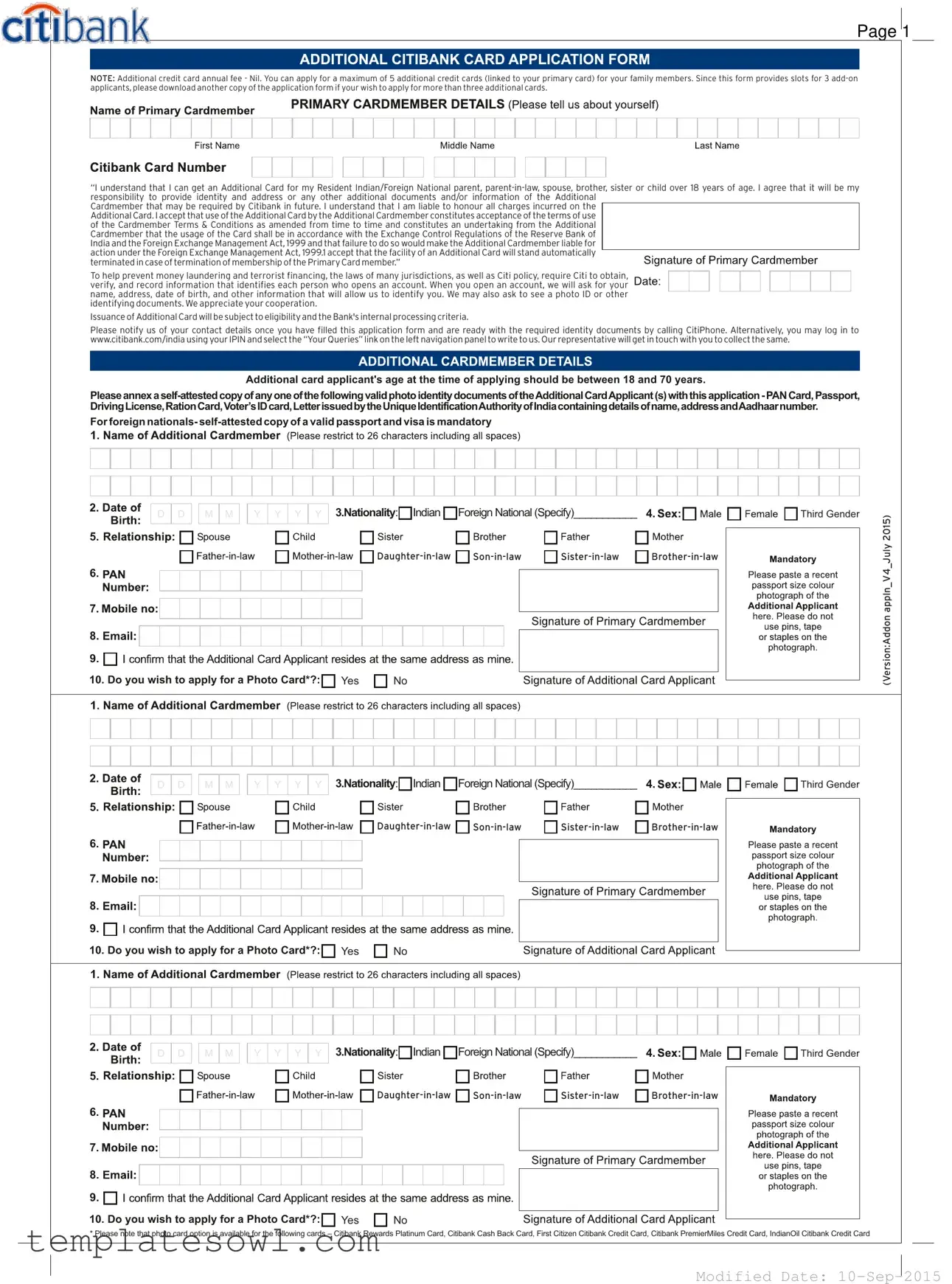

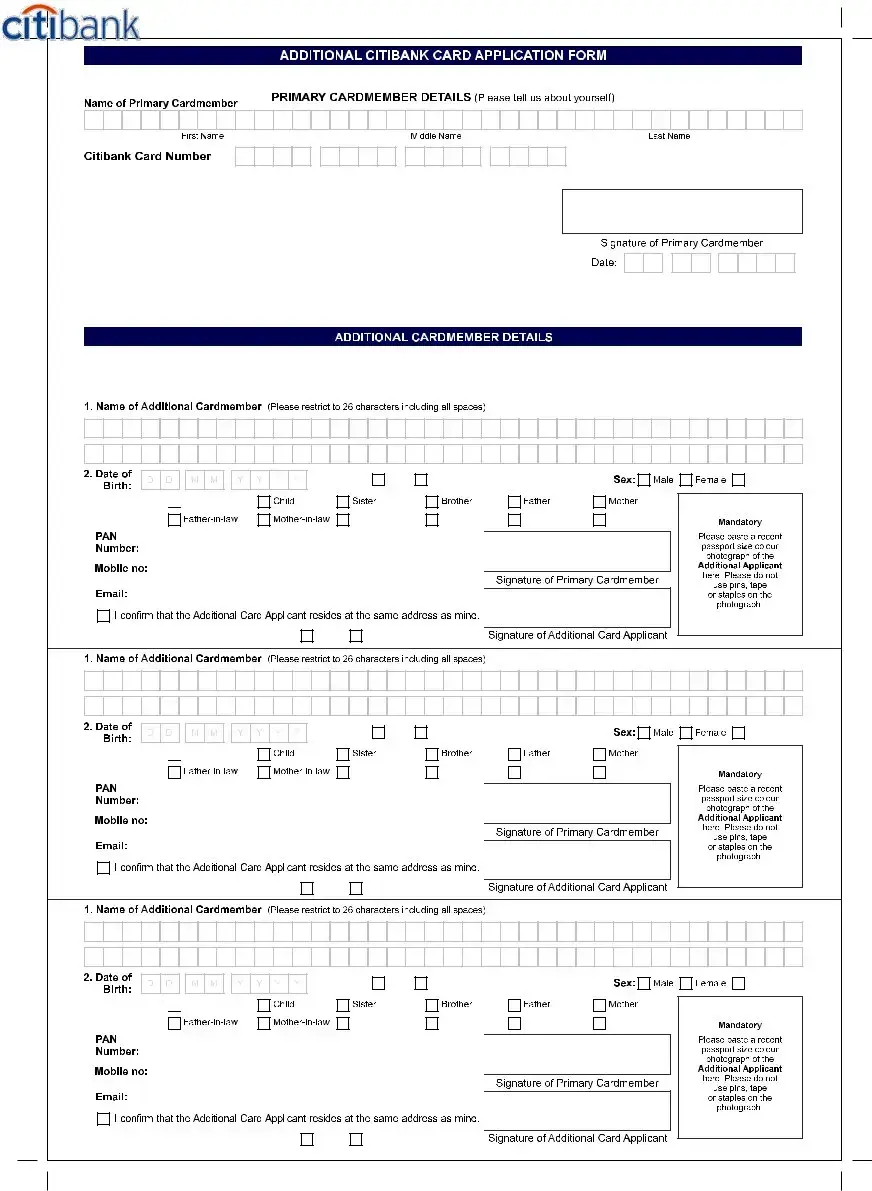

Fill Out Your Citi Beneficiary Form

The Citi Beneficiary form serves a critical role for individuals seeking to manage their credit relationships responsibly. It allows primary cardholders to apply for up to five additional credit cards for family members. The form includes spaces for three add-on applicants; if you wish to include more, you will need to download another copy. This initiative accommodates a variety of relatives, including parents, spouses, and children over the age of 18. However, applying for these additional cards comes with specific responsibilities. The primary cardholder must provide the required documentation for identity verification of the additional cardholders and is ultimately liable for all charges incurred. Importantly, compliance with national regulations is emphasized, particularly the Foreign Exchange Management Act, requiring cardholders to adhere strictly to use guidelines. While there is no annual fee for additional cards, eligibility and issuance still depend on Citibank’s internal criteria. For those interested, the process is straightforward—simply prepare the necessary identity documents and reach out to Citibank for assistance. Additional measures are in place to prevent misuse, including thorough verification procedures to ensure compliance with laws aimed at combating money laundering and terrorism financing. Ultimately, the Citi Beneficiary form is designed to facilitate a smooth application process while ensuring adherence to necessary regulations and responsibilities.

Citi Beneficiary Example

PAGE

1

NOTE: Additional credit card annual fee - Nil. You can apply for a maximum of 5 additional credit cards (linked to your primary card) for your family members. Since this form provides slots for 3

“I understand that I can get an Additional Card for my Resident Indian/Foreign National parent,

Cardmember that may be required by Citibank in future. I understand that I am liable to honour all charges incurred on the Additional Card. I accept that use of the Additional Card by the Additional Cardmember constitutes acceptance of the terms of use of the Cardmember Terms & Conditions as amended from time to time and constitutes an undertaking from the Additional Cardmember that the usage of the Card shall be in accordance with the Exchange Control Regulations of the Reserve Bank of India and the Foreign Exchange Management Act, 1999 and that failure to do so would make the Additional Cardmember liable for action under the Foreign Exchange Management Act, 1999.1 accept that the facility of an Additional Card will stand automatically terminated in case of termination of membership of the Primary Card member.”

To help prevent money laundering and terrorist financing, the laws of many jurisdictions, as well as Citi policy, require Citi to obtain, verify, and record information that identifies each person who opens an account. When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see a photo ID or other identifying documents. We appreciate your cooperation.

Issuance of Additional Card will be subject to eligibility and the Bank's internal processing criteria.

Please notify us of your contact details once you have filled this application form and are ready with the required identity documents by calling CitiPhone. Alternatively, you may log in to www.citibank.com/india using your IPIN and select the “Your Queries” link on the left navigation panel to write to us. Our representative will get in touch with you to collect the same.

Additional card applicant's age at the time of applying should be between 18 and 70 years.

Please annex a

For foreign nationals-

3.Nationality: Indian Foreign National (Specify)___________ 4. |

Third Gender |

5.

2015)

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. Do you wish to apply for a Photo Card*?: |

Yes |

|

No |

|

|

|

|||||||||||||

|

|

|

|

||||||||||||||||

(Version:Addon appln_V4_July

3.Nationality: Indian Foreign National (Specify)___________ 4. |

Third Gender |

5.

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. Do you wish to apply for a Photo Card*?: |

Yes |

|

No |

|

|

|

|||||||||||||

|

|

|

|

||||||||||||||||

3.Nationality: Indian Foreign National (Specify)___________ 4. |

Third Gender |

5.

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. Do you wish to apply for a Photo Card*?: |

Yes |

|

No |

|

|

|

|||||||||||||

|

|

|

|

||||||||||||||||

* Please note that photo card option is available for the following cards – Citibank Rewards Platinum Card, Citibank Cash Back Card, First Citizen Citibank Credit Card, Citibank PremierMiles Credit Card, IndianOil Citibank Credit Card

Modified Date:

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Eligibility | To apply for an additional card, the applicant must be between the ages of 18 and 70 years. |

| Maximum Cards | A primary cardholder can apply for a maximum of five additional credit cards linked to their own account. |

| Documentation | Applicants must provide a self-attested copy of valid identification, such as a PAN Card, Passport, or Driving License. |

| Additional Cardholder Responsibility | The primary cardholder is liable for all charges incurred on the additional card. |

| Foreign National Requirements | For foreign nationals, a self-attested copy of a valid passport and visa is required for the application. |

| Application Process | To begin the application, contact CitiPhone or log in to the Citibank India website using your IPIN. |

| Risk Prevention Compliance | As part of anti-money laundering efforts, Citi must collect specific information to verify the identity of each account applicant. |

| Photo Card Option | Applicants can choose a photo card option, available for select credit cards. |

| Termination Clause | The additional card facility will automatically terminate if the primary cardholder's membership is terminated. |

Guidelines on Utilizing Citi Beneficiary

Once you have obtained the Citi Beneficiary form, it is crucial to fill it out accurately to ensure a smooth processing experience. Below, you will find a step-by-step guide to help you complete the form correctly.

- Read the instructions carefully: Familiarize yourself with the guidelines provided at the top of the form to avoid any mistakes.

- Provide your personal information: Fill in your full name, address, date of birth, and any other required personal details as specified.

- Specify your relationship: Indicate the relationship of the additional card applicant (e.g., spouse, sibling, parent) to the primary cardholder.

- Select the nationality: Choose between 'Indian' or 'Foreign National' and specify if applicable.

- Age verification: Confirm that the additional card applicant falls between the ages of 18 and 70 years.

- Document submission: Attach a self-attested copy of a valid photo ID (e.g., PAN Card, Passport, Driving License) for each additional card applicant.

- Check for the photo card option: Indicate whether you wish to apply for a Photo Card and select 'Yes' or 'No' as applicable.

- Confirm your understanding: Ensure you acknowledge the responsibilities outlined in the form concerning charges and identity verification.

- Contact details: Provide your contact number and any other relevant details for easy follow-up by Citi's representatives.

- Review your application: Thoroughly check all entries for accuracy before submission.

After completing the form, it is imperative to notify the relevant Citi contact to confirm that you've filled out the application and gathered the necessary identification documents. This ensures the process can move forward without unnecessary delays.

What You Should Know About This Form

What is the Citi Beneficiary form used for?

The Citi Beneficiary form is used to apply for additional credit cards linked to a primary card. It allows the primary cardholder to request cards for family members, such as parents, siblings, or children over 18 years of age. The form also ensures that the primary cardholder understands their responsibilities regarding the additional cards.

How many additional cards can I apply for?

A primary cardholder can apply for a maximum of five additional credit cards. The form accommodates up to three additional card applicants, so if you wish to apply for more than three, you will need to download another copy of the application form.

What age restrictions are there for additional card applicants?

Applicants for additional cards must be between 18 and 70 years of age at the time of application. This age range ensures that only individuals of legal age can be added to the primary account.

What documents are required to apply for additional cards?

A self-attested copy of a valid photo identity document must be included with the application. Acceptable forms of ID include a PAN card, passport, driving license, ration card, voter ID, or a letter from the Unique Identification Authority of India. For foreign nationals, a self-attested copy of both a valid passport and visa is mandatory.

How do I submit my application and documents?

Once you have filled out the application form and gathered the required identity documents, you can notify Citi of your contact details by calling CitiPhone. Alternatively, you can log into the Citibank website using your IPIN and select the "Your Queries" link to write to them. A representative will then contact you to collect the documents.

What happens if the primary cardholder's membership is terminated?

If the primary cardholder's membership is terminated, the facility of the additional card will also be automatically terminated. It is essential for the primary cardholder to be aware of this responsibility, as it affects the additional cardholders as well.

Is there a fee for additional cards?

No, there is no additional credit card annual fee for the added cards. This allows the primary cardholder to obtain cards for their family members without incurring extra costs.

Common mistakes

Completing the Citi Beneficiary form can be straightforward, but several common mistakes often lead to complications. First, many applicants fail to check the eligibility criteria. The form specifically states that the additional card applicant must be between 18 and 70 years old. Ignoring this requirement can result in unnecessary delays or outright denial of the application.

Another frequent error is neglecting to provide proper identification documents. The form requests a self-attested copy of valid photo identification for additional card applicants. Acceptable documents include the PAN Card, Passport, or Voter’s ID card. Some people mistakenly assume other forms of ID are acceptable, which can stall the application process.

Additionally, the submission of incomplete forms is a prevalent issue. Applicants sometimes overlook sections or fail to provide all required details. This mistake often leads to processing delays. It's essential to take the time to review the entire form and ensure all fields are filled out correctly before submission.

Some individuals forget to download additional application forms when seeking to apply for more than three add-on cards. The Citi Beneficiary form allows for only three additional card applications at a time. As a result, those who require more must print and submit separate forms, a step that is frequently overlooked.

Moreover, failing to specify the nationality can cause confusion. The form has specific fields indicating whether the applicant is Indian or a foreign national. Miscommunication about nationality may lead to compliance issues later in the application process.

Another mistake relates to understanding the implications of the card usage. Significantly, some applicants do not grasp that accepting the additional card signifies their commitment to the terms and conditions outlined in the application. Ignoring these terms can result in unexpected responsibilities and liabilities.

In some cases, applicants may not update their contact information when they fill out the form. Upon submission, it is crucial to provide current contact details so that Citibank can reach out to collect necessary documents or provide updates. Failing to do so only adds another layer of complication.

Finally, neglecting to review any updates or modifications to the application's terms is a mistake that keeps cropping up. The form may be revised over time, and depending on the version, essential details could change. Regularly checking for updates ensures compliance with the latest requirements.

Documents used along the form

When submitting the Citi Beneficiary form, several other documents may be essential to complete the application process. Each of these documents serves a specific function, ensuring that the applicant’s identity and eligibility for financial services are verified in accordance with regulatory requirements.

- Identity Verification Documents: These are required to confirm the identity of the applicant. Common examples include a government-issued photo ID, such as a passport or driver's license. These documents help ensure compliance with anti-money laundering laws.

- Proof of Address: A recent utility bill, bank statement, or rental agreement can serve as proof of the applicant's current residential address. This documentation is important for maintaining accurate records and ensuring proper communication.

- Income Verification: Pay stubs, tax returns, or bank statements may be requested to verify the applicant’s income. This is vital to assess the financial capacity of the applicant and determine eligibility for specific credit products.

- Citibank Account Statements: Recent statements from any existing Citibank accounts may be necessary for applicants who currently hold accounts with the bank. These statements provide valuable insight into the banking history and account handling of the applicant.

- Loan or Credit Card Applications: If the beneficiary form accompanies a new loan or credit card application, the associated application forms should also be submitted. These documents provide a comprehensive view of the applicant's financial needs and creditworthiness.

Gathering all necessary documents along with the Citi Beneficiary form will help facilitate a smooth processing experience. Ensuring that each document is accurate and up-to-date is essential in demonstrating your reliability as an applicant.

Similar forms

The Citi Beneficiary form shares similarities with several other documents often used in banking and financial services. Below is a list of ten documents that bear resemblance to the Citi Beneficiary form, along with a brief explanation of how they are similar:

- Additional Card Application Form: Like the Citi Beneficiary form, this document is utilized to apply for additional credit cards for family members, requiring personal information and identification verification for each applicant.

- Account Opening Form: This form also collects essential personal details from a new account holder, including identification documents and demographic information, similar to the requirements outlined in the Citi Beneficiary form.

- Power of Attorney Document: A power of attorney grants authority to another person to manage a financial account, requiring similar identification information of the principal and the agent, just as the Citi Beneficiary form does.

- Beneficiary Designation Form: This document specifies beneficiaries for an account or policy, much like the Citi Beneficiary form, which identifies additional cardholders and their corresponding responsibilities.

- Credit Card Agreement: The terms and conditions associated with a credit card often require acknowledgment of similar responsibilities and liabilities, mirroring the agreement terms found in the Citi Beneficiary form.

- Loan Application Form: In securing a loan, applicants provide personal and financial information, reflecting a process akin to applying for an additional card, both requiring identification verification.

- Identity Verification Form: This document is necessary for confirming an individual's identity, sharing processes with the Citi Beneficiary form that mandates verification through photo ID and other documents.

- Insurance Beneficiary Form: Similar to the Citi form, it allows policyholders to designate beneficiaries, necessitating personal information and identification for each individual named.

- Customer Information Update Form: When clients update their details, this form collects information much like the Citi Beneficiary form, ensuring accurate records are maintained for associated accounts.

- Tax Identification Form: This document requires individuals to provide personal information for tax purposes, paralleling the identification and personal data collection seen in the Citi Beneficiary form.

Each of these documents emphasizes the importance of identifying and managing relationships and responsibilities in various financial contexts, reflecting a common theme of accountability and security in financial transactions.

Dos and Don'ts

When filling out the Citi Beneficiary form, there are important considerations to keep in mind. Here’s a list of things you should and shouldn’t do.

- Do ensure that all personal information, such as name, address, and date of birth, is accurate and up to date.

- Do attach a self-attested copy of a valid photo ID for every additional card applicant.

- Do check the eligibility criteria for additional card applicants, including age limits.

- Do contact Citi if you have any questions or need assistance while completing the form.

- Don’t leave any required fields blank; incomplete forms can delay processing.

- Don’t submit fraudulent information; this could result in rejection or legal consequences.

- Don’t apply for more than three additional cards on a single form; use a separate form for more.

- Don’t forget to review the terms and conditions before signing the form.

Misconceptions

Many individuals hold misconceptions about the Citi Beneficiary form. Understanding the truth behind these misconceptions can help smooth the application process and ensure compliance with the bank's guidelines. Here are four common misunderstandings:

- Additional Cards Can Only Be Granted to Immediate Family Members: While the form specifies that you can apply for cards for certain family members, it’s important to note that you can also include Resident Indian or Foreign National relatives. This includes parents, siblings, and even children over the age of 18.

- There's No Limit to the Number of Additional Cards: In reality, you can apply for a maximum of five additional credit cards linked to your primary card. If you wish to request more than three, a new form must be downloaded and completed.

- Providing Identity Documents Is Optional: On the contrary, submitting valid identity documents is mandatory. You must provide a self-attested copy of an acceptable form of identification for the additional card applicants, such as a PAN card or passport, among others.

- Anyone Can Apply for an Additional Card: There are specific eligibility criteria. The applicant's age must fall between 18 and 70 years. If the applicant does not meet this criterion, the form cannot be processed.

Being aware of these facts can facilitate a more efficient and accurate completion of the Citi Beneficiary form. It is always best to refer to the official guidelines for the most up-to-date information.

Key takeaways

Filling out the Citi Beneficiary form correctly is crucial for a smooth application process. Here are some key takeaways:

- The form allows for the application of up to three additional credit cards. If you need more, download an additional copy of the form.

- Additional cardholders must be family members who are over 18 years old. This includes parents, siblings, and children.

- Identity verification is mandatory. You will need to provide a self-attested photo ID along with the application.

- Communicating with Citi is essential for a successful application. Once the form is completed, you should call CitiPhone or log into their website for assistance.

- The age limit for additional card applicants is between 18 and 70 years, making it necessary to verify their age accordingly.

Browse Other Templates

Usps Forms - Shippers must provide the date of the shipment on the form.

Roster Form in Maths - Capture session dates and times for scheduling needs.