Fill Out Your Citibank Payroll Account Form

The Citibank Payroll Account form is a crucial tool for anyone looking to streamline their finances. This form allows you to set up Direct Deposit for regular payments, ensuring that your money goes directly into your new Citibank account instead of being sent as a paper check. Imagine having your payroll, pension, retirement payments, or even Social Security benefits deposited right into your account without worry. With this setup, lost or stolen checks will be a thing of the past. You'll gain access to your funds faster, often right after they’re deposited. The form is simple: you’ll attach a voided personal check, sign it, and submit it to your employer or the relevant fund originator. Clear fields for your personal information, such as your name, employee ID, and the specific account you want your funds deposited into, make it straightforward. Whether you prefer the entire net pay, a percentage, or a specific amount, the form caters to your choice. Plus, Citibank provides helpful tips, including how to track your request and what to do if your deposits don’t appear as expected. Understanding the routing number is also important, as it's necessary for ensuring the correct deposits. With easy instructions and a reliable process, this form is a gateway to managing your funds more effectively.

Citibank Payroll Account Example

Save

Clear

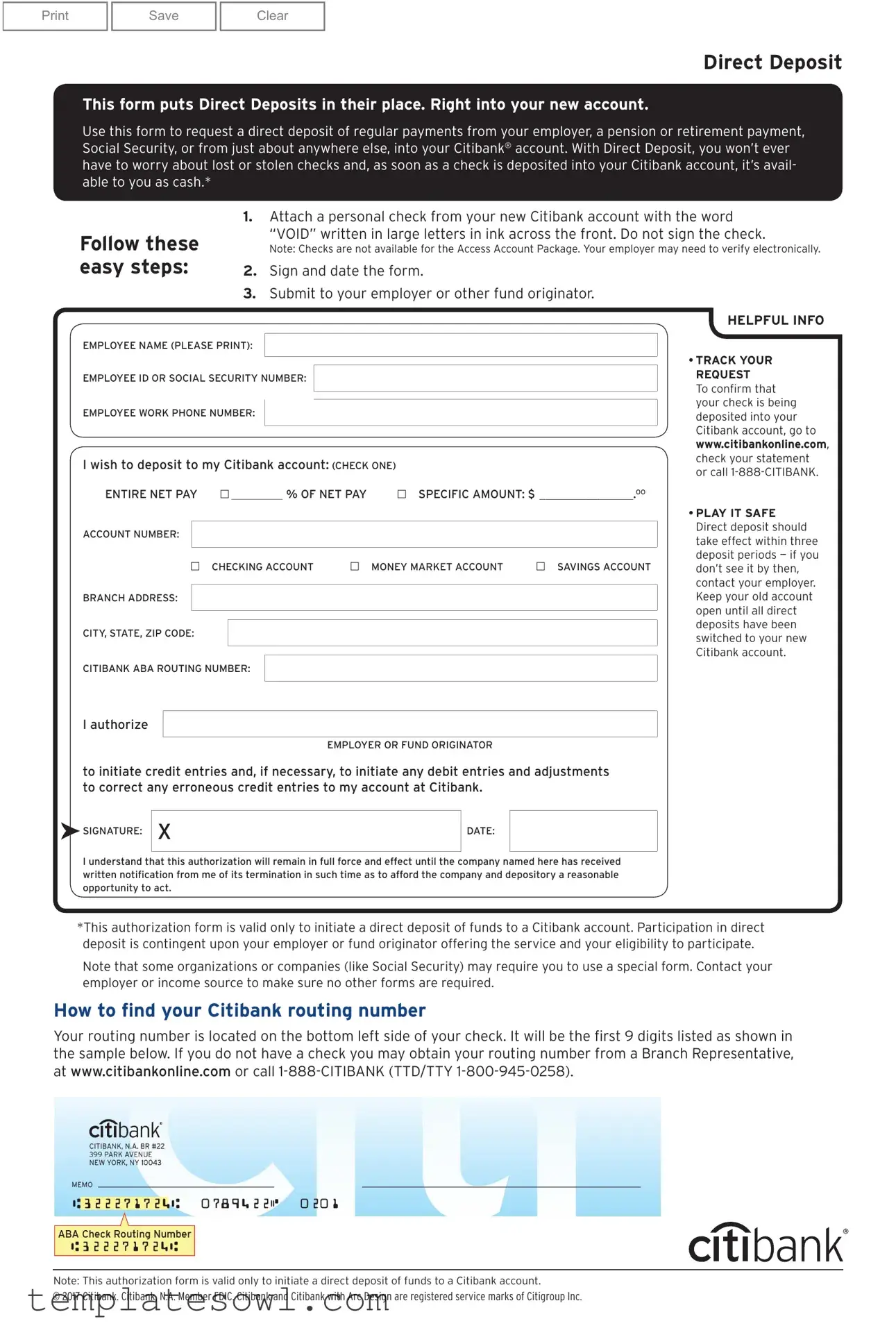

Direct Deposit

This form puts Direct Deposits in their place. Right into your new account.

Use this form to request a direct deposit of regular payments from your employer, a pension or retirement payment, Social Security, or from just about anywhere else, into your Citibank® account. With Direct Deposit, you won’t ever have to worry about lost or stolen checks and, as soon as a check is deposited into your Citibank account, it’s avail- able to you as cash.*

Follow these easy steps:

1.Attach a personal check from your new Citibank account with the word

“VOID” written in large letters in ink across the front. Do not sign the check.

Note: Checks are not available for the Access Account Package. Your employer may need to verify electronically.

2.Sign and date the form.

3.Submit to your employer or other fund originator.

HELPFUL INFO

EMPLOYEE NAME (PLEASE PRINT):

EMPLOYEE ID OR SOCIAL SECURITY NUMBER:

EMPLOYEE WORK PHONE NUMBER:

I wish to deposit to my Citibank account: (CHECK ONE)

ENTIRE NET PAY ☐__________ % OF NET PAY |

☐ SPECIFIC AMOUNT: $ ________________.OO |

ACCOUNT NUMBER:

☐ CHECKING ACCOUNT |

☐ MONEY MARKET ACCOUNT |

☐ SAVINGS ACCOUNT |

BRANCH ADDRESS:

CITY, STATE, ZIP CODE:

CITIBANK ABA ROUTING NUMBER:

•TRACK YOUR REQUEST

To confirm that your check is being deposited into your Citibank account, go to www.citibankonline.com, check your statement or call

•PLAY IT SAFE Direct deposit should take effect within three deposit periods — if you don’t see it by then, contact your employer. Keep your old account open until all direct deposits have been switched to your new Citibank account.

I authorize

EMPLOYER OR FUND ORIGINATOR

to initiate credit entries and, if necessary, to initiate any debit entries and adjustments to correct any erroneous credit entries to my account at Citibank.

SIGNATURE:

SIGNATURE:

X

DATE:

I understand that this authorization will remain in full force and effect until the company named here has received written notification from me of its termination in such time as to afford the company and depository a reasonable opportunity to act.

*This authorization form is valid only to initiate a direct deposit of funds to a Citibank account. Participation in direct deposit is contingent upon your employer or fund originator offering the service and your eligibility to participate.

Note that some organizations or companies (like Social Security) may require you to use a special form. Contact your employer or income source to make sure no other forms are required.

How to find your Citibank routing number

Your routing number is located on the bottom left side of your check. It will be the first 9 digits listed as shown in the sample below. If you do not have a check you may obtain your routing number from a Branch Representative, at www.citibankonline.com or call

Note: This authorization form is valid only to initiate a direct deposit of funds to a Citibank account.

© 2017 Citibank. Citibank, N.A. Member FDIC. Citibank and Citibank with Arc Design are registered service marks of Citigroup Inc.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | This form is used to request the direct deposit of regular payments into a Citibank account. |

| Required Information | The form requires employee details, including identification and account preferences, to process the request. |

| Authorization | By signing the form, the employee authorizes their employer or fund originator to initiate credit and debit entries to the specified Citibank account. |

| Effectiveness | Direct deposit should take effect within three deposit periods, after which employees should verify their deposits. |

Guidelines on Utilizing Citibank Payroll Account

Filling out the Citibank Payroll Account form is straightforward and will help set up your direct deposit. After completing the form, you will need to submit it to your employer or the organization that will be making payments to you. This will enable them to deposit your funds directly into your Citibank account.

- Attach a personal check from your new Citibank account with the word “VOID” written in large letters in ink across the front. Do not sign the check.

- Print your name in the EMPLOYEE NAME section.

- Fill in your EMPLOYEE ID OR SOCIAL SECURITY NUMBER.

- Provide your EMPLOYEE WORK PHONE NUMBER.

- Specify how you wish to deposit to your Citibank account by checking one option: ENTIRE NET PAY, % OF NET PAY, or SPECIFIC AMOUNT and write the amount if applicable.

- Indicate your ACCOUNT NUMBER and select if it is a CHECKING ACCOUNT, MONEY MARKET ACCOUNT, or SAVINGS ACCOUNT.

- Fill in the BRANCH ADDRESS, CITY, STATE, and ZIP CODE.

- Find and enter the CITIBANK ABA ROUTING NUMBER; it's the first 9 digits on the bottom left side of your check.

- Sign and date the form in the designated area.

- Finally, submit the completed form to your employer or other fund originator.

What You Should Know About This Form

What is the purpose of the Citibank Payroll Account form?

This form is designed to facilitate the direct deposit of regular payments into your Citibank account. Whether it’s your salary from an employer, a pension payment, or social security benefit, this form ensures that your funds are deposited directly into your account safely and conveniently. This means no more worries about lost checks; your money is available as soon as it hits your account.

How do I fill out the Citibank Payroll Account form?

Filling out the form is straightforward. Start by attaching a voided personal check from your new Citibank account. Ensure that you write “VOID” in large letters across the front of the check. Next, complete your personal and employment details, including your name, social security number or employee ID, and contact information. Decide how much you want to deposit—either your entire net pay, a percentage, or a specific amount. Finally, sign and date the form before submitting it to your employer or the fund originator.

What if I don’t have a personal check to attach?

If you do not have a personal check to attach, you can obtain your Citibank routing number by visiting your local branch or checking online at www.citibankonline.com. Additionally, you can call 1-888-CITIBANK for assistance. However, without a check, you may face challenges in completing the direct deposit setup, so it's best to acquire one if possible.

How will I know when my direct deposit has started?

You can track your request by logging into your Citibank online account, checking your bank statement, or calling customer service at 1-888-CITIBANK. Generally, direct deposits are expected to take effect within three deposit periods. If you haven't seen your funds by that time, reach out to your employer to ensure they have processed your request efficiently.

Is it necessary to keep my old bank account open?

Yes, it’s a good idea to keep your old bank account open until you confirm that all direct deposits have been switched to your new Citibank account. This backup will help you receive any payments that may still be directed to your previous account during the transition period.

What should I do if I change my mind about the direct deposit?

If you wish to terminate the authorization for direct deposit, you must provide written notification to your employer or fund originator. This notification should give them reasonable time to process your request. Keep in mind that your authorization will remain valid until they receive and act upon your termination request.

Are there any eligibility requirements for using direct deposit?

Direct deposit is only available if your employer or fund originator offers the service and you meet any specific eligibility criteria they might have. Some organizations may require additional or special forms for setting up direct deposits, such as Social Security. Always check with your employer or the source of your income to ensure you have everything you need.

Common mistakes

Filling out the Citibank Payroll Account form can seem straightforward, but many people make common mistakes that can lead to complications. One major error is failing to provide the correct routing number. This number is essential for directing funds into your account properly. It is typically found at the bottom left of your checks. Without it, your employer might not be able to deposit your paycheck accurately.

Another frequent mistake is not marking the desired deposit option clearly. The form allows for different choices, such as whole paychecks, a percentage, or a specific amount. Leaving this section blank or providing unclear information can delay payments. Make sure to clearly check one box and write in exact amounts if necessary.

Many individuals also forget to attach a voided check. This document helps to confirm your account details. Ensure that your check is correctly voided, displaying the word “VOID” clearly written across the front in ink. Not doing this can lead to further verification steps that may take extra time.

Signatures and dates are crucial, yet some individuals overlook these requirements. Failing to sign or date the form can render it invalid. This simple oversight can mean a delay in getting your direct deposits set up.

Additionally, people sometimes submit the form without confirming their personal information. Double-check that your name, Employee ID, and phone number are correct. Inaccuracies here could cause issues with your employer or financial institution contacting you if needed.

A prevalent issue is not checking with the employer about any additional forms required. In some cases, companies have specific processes or need extra documentation. Always confirm with your HR department if there are additional requirements before submitting the form.

Another mistake involves not keeping their old account open during the transition. It is wise to keep access to your previous account until you're certain that all deposits have switched over smoothly. This proactive step avoids complications if the new account does not receive expected funds right away.

Some people neglect to verify their direct deposit after submission. It is important to monitor your bank statements or online account to ensure that the deposits are being processed correctly. If payments have not started within a few deposit cycles, reach out to your employer.

Errors can also occur with the account type selection. It is vital to correctly indicate whether your funds should go to a checking, savings, or money market account. An oversight here can lead to funds being deposited into the wrong type of account, which could complicate access to your money.

Lastly, individuals may ignore the importance of clear communication with their employer about any changes. After the form has been submitted, maintaining open lines with HR will help ensure any issues are quickly addressed. Each step in the process plays a vital role in making sure your direct deposits function seamlessly.

Documents used along the form

When setting up a Citibank Payroll Account, there are several other forms and documents that may be useful. Each of these plays an important role in the account management and payroll process. Here is a brief overview of these documents:

- Direct Deposit Authorization Form: This form allows employees to authorize their employers to deposit wages directly into their bank accounts. It contains similar information as the Citibank Payroll Account form.

- W-4 Form: Employees fill out this tax withholding form to indicate their tax situation to their employers. This helps determine the amount of federal income tax withheld from paychecks.

- Employee Information Form: Employers may require this form to gather key details about their new hires, such as contact information and emergency contacts.

- State Tax Withholding Forms: Depending on the state, employees might need to complete additional forms to specify their state tax withholding preferences.

- Bank Account Authorization Form: This document is sometimes required for employers to initiate direct deposits to employees, ensuring that they have the correct banking details.

- Beneficiary Designation Form: If employees want to assign beneficiaries for retirement accounts or pension plans, this form serves that purpose and ensures that funds are distributed according to their wishes.

- Payroll Change Form: When employees need to update their payment details, such as changing bank accounts or adjusting withholdings, they will use this form.

- Employment Contract or Offer Letter: This document outlines the terms of employment, including salary, benefits, and other important conditions that may affect payroll processing.

Collecting and completing these documents ensures a smooth transition to your new Citibank Payroll Account. It also minimizes confusion regarding payment processing and tax obligations. Always check with your employer to ensure you have all necessary forms ready for a hassle-free experience.

Similar forms

The Citibank Payroll Account form shares similarities with several other financial documents commonly used for direct deposit and account management. The following list outlines four such documents:

- Direct Deposit Authorization Form: This document is used by employees to authorize their employer to deposit their paycheck directly into their bank account. Like the Citibank Payroll Account form, it typically requires a voided check and personal information, such as account number and routing number.

- ACH Credit Authorization Form: This form enables individuals to authorize an organization to make automated clearing house (ACH) payments directly into their bank account. Similar to the Citibank form, it includes fields for account information and requires the account holder's signature to validate the authorization.

- Social Security Direct Deposit Form: This specific form is designed for individuals receiving Social Security benefits and allows them to set up direct deposit. Much like the Citibank Payroll Account form, it necessitates the provision of banking details and a voided check to ensure the funds are directed to the correct account.

- Pension Direct Deposit Request Form: Employed by pension plan participants, this form facilitates the direct deposit of pension payments into a designated bank account. It mirrors the Citibank Payroll Account form in its requirements for account verification and authorization signatures from the account holder.

Dos and Don'ts

When filling out the Citibank Payroll Account form, it's important to ensure accuracy and clarity. Here are some key dos and don'ts:

- Do attach a personal check from your new Citibank account with "VOID" written across the front.

- Do sign and date the form to confirm your authorization.

- Do ensure your employee name and identification details are printed clearly.

- Do specify the type of deposit you wish to make (net pay, percentage, or specific amount).

- Do keep your old account open until all direct deposits have transitioned to your new account.

- Don't sign the voided check; it should remain unsigned.

- Don't forget to check your statements for confirmation of the direct deposit.

- Don't submit the form without verifying your Citibank ABA routing number.

- Don't neglect to contact your employer if the deposit does not appear after three deposit periods.

Misconceptions

There are many assumptions about the Citibank Payroll Account form. Below are misconceptions that often arise.

- Direct Deposit is available for every type of account. Some account types, such as the Access Account Package, do not allow for checks, which may affect direct deposit.

- Once submitted, the direct deposit will start immediately. It can take up to three deposit periods for the direct deposit to begin after the form is submitted.

- Only employers can set up direct deposit. Direct deposits can originate from pensions, retirement payments, Social Security, and other sources.

- A signature on the VOID check is necessary. The check should not be signed; writing “VOID” in large letters suffices for submission.

- You don’t need to keep your old account open. It is advisable to keep the existing account open until you see complete transition of direct deposits to the new Citibank account.

- Only one form is needed for multiple sources of income. Each employer or fund originator may require their own authorization form for direct deposits.

- Tracking deposits is complicated. Customers can easily track their deposits online at Citibank's website or by calling customer service.

- The form is the same for all banks. Each bank has different forms and procedures, so using Citibank's specific form is essential.

- All funds deposited are available immediately. Although checks deposited into the Citibank account are usually available as cash right away, some delays can occur.

- You can change the amount anytime without re-submitting the form. Any adjustments to the amount or account require a new authorization form to be submitted.

Key takeaways

Direct deposit is a straightforward way to manage your finances, and using the Citibank Payroll Account form is essential for setting it up properly. Here are some key takeaways to keep in mind:

- Complete the Form Accurately: Ensure all personal details, including your name, employee ID or Social Security number, and work phone number, are filled out correctly.

- Attach a Void Check: Include a personal check marked “VOID.” This acts as a reference for your account number and routing information. Remember, do not sign the check.

- Select Your Deposit Preferences: Choose whether you want your entire net pay, a percentage of it, or a specific amount to be deposited into your Citibank account.

- Account Type Matters: Clearly indicate whether the funds should go into a checking, money market, or savings account.

- Stay Informed: After submission, track your request online at Citibank’s website or call customer service to ensure your direct deposit is active.

- Be Patient: It may take up to three deposit periods for direct deposit to begin. If there's a delay, reach out to your employer.

- Keep Prior Accounts Open: Maintain your old bank account until you are sure that all direct deposits have shifted to your new Citibank account.

Using the Citibank Payroll Account form correctly is crucial for a smooth transition to direct deposit. Taking these steps can help you avoid disruptions in your financial management.

Browse Other Templates

Marker Casino Meaning - Complete the form and fax it to the provided number for processing.

Da200 Army - The DA 200 form embodies best practices in shipment documentation for military records.

What Are Insurable Earnings - Submission of this form is vital for receiving benefits related to illness.