Fill Out Your Citibank Wire Form

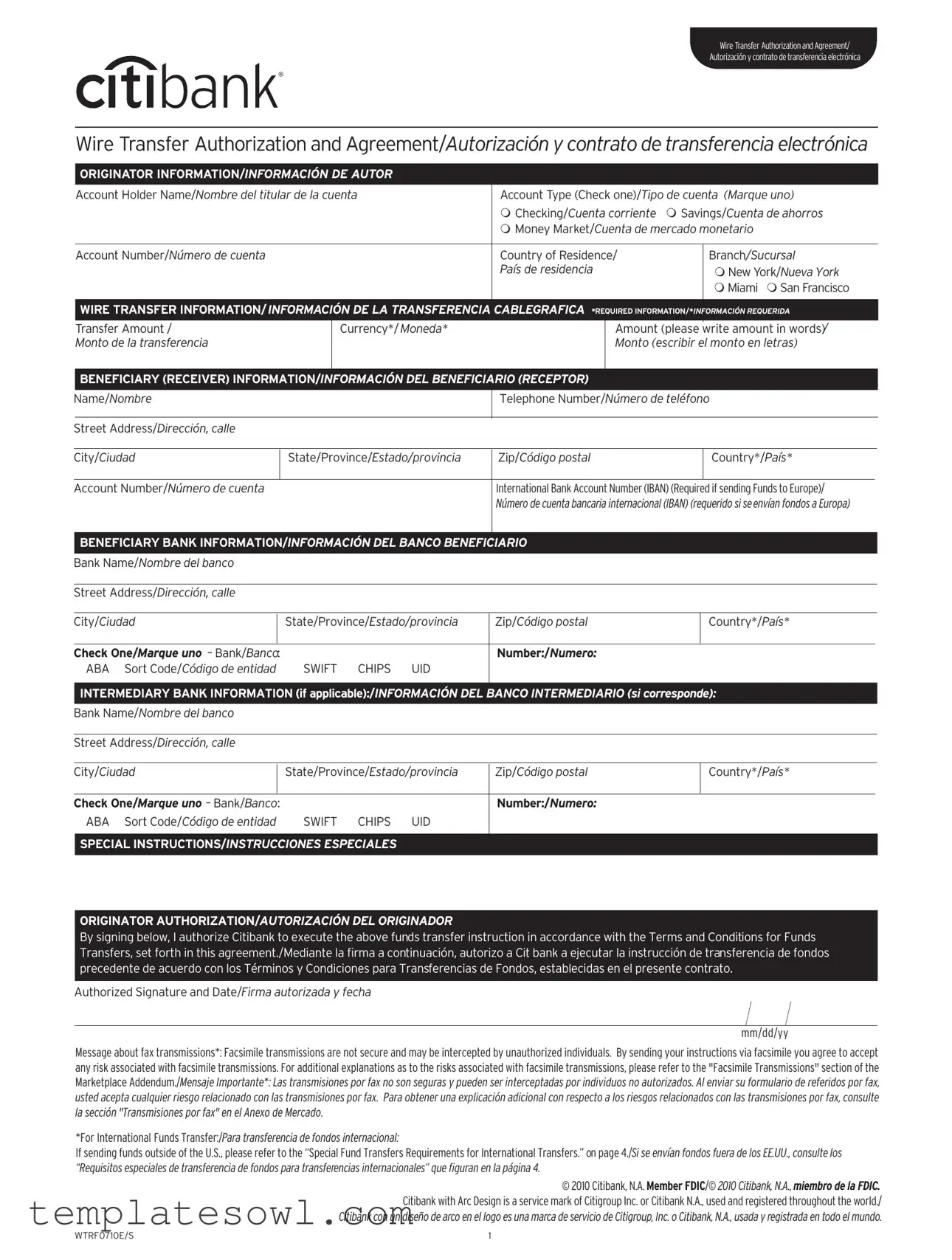

For individuals and businesses alike, the Citibank Wire Transfer Form serves as an essential document for executing electronic funds transfers securely and efficiently. Users must provide a variety of details to ensure the accurate processing of their requests. Firstly, account holder information is required, including the account holder's name, account type—be it checking, savings, or money market—and the associated account number. Additionally, the form emphasizes specific wire transfer information such as the transfer amount and currency, which must be clearly stated in both numerical and written forms. To facilitate the transaction, the beneficiary's information is critical, encompassing their name, address, and account details, including the International Bank Account Number (IBAN) when applicable. Moreover, the beneficiary bank section demands thorough specifics, ensuring that the funds reach the right institution. It’s important to remember that any special instructions for the transfer can also be designated in this form. Completing the Citibank Wire Transfer Form not only authorizes the bank to proceed with the transaction but also outlines the terms and conditions governing it, including potential fees and liabilities. Given the complexities surrounding international transfers, extra attention is necessary to comply with respective jurisdictional requirements. Understanding this form is imperative for anyone looking to facilitate a fast, secure, and accurate wire transfer through Citibank.

Citibank Wire Example

Wire Transfer Authorization and Agreement/

Autorización y contrato de transferencia electrónica

®

Wire Transfer Authorization and Agreement/Autorización y contrato de transferencia electrónica

|

ORIGINATOR INFORMATION/INFORMACIÓN DE AUTOR |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

Account Holder Name/Nombre del titular de la cuenta |

|

|

|

Account Type (Check one)/Tipo de cuenta (Marque uno) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

Checking/Cuenta corriente |

Savings/Cuenta de ahorros |

||||

|

|

|

|

|

|

|

|

|

|

|

Money Market/Cuenta de mercado monetario |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account Number/Número de cuenta |

|

|

|

|

|

|

Country of Residence/ |

|

|

Branch/Sucursal |

|||||

|

|

|

|

|

|

|

|

|

|

|

País de residencia |

|

|

New York/Nueva York |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Miami San Francisco |

|

|

WIRE TRANSFER INFORMATION/INFORMACIÓN DE LA TRANSFERENCIA |

|

CABLEGRAFICA *REQUIRED INFORMATION/ |

|

*INFORMACIÓN REQUERIDA |

|||||||||||

|

|

|||||||||||||||

Transfer Amount / |

|

|

Currency*/ Moneda* |

|

|

Amount (please |

|

write amount in words)/ |

||||||||

|

|

|

|

|

||||||||||||

|

Monto de la transferencia |

|

|

|

|

|

|

|

Monto (escribir el monto en letras) |

|||||||

|

BENEFICIARY (RECEIVER) INFORMATION/ |

INFORMACIÓN DEL BENEFICIARIO (RECEPTOR) |

|

|

|

|

|

|||||||||

Name/Nombre |

|

|

|

|

|

|

Telephone Number/Número de teléfono |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Street Address/Dirección, calle |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

City/Ciudad |

|

State/Province/Estado/provincia |

|

Zip/Código postal |

|

|

Country*/País* |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Account Number/Número de cuenta |

|

|

|

|

|

|

International Bank Account Number (IBAN) (Required if sending Funds to Europe)/ |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

Número de cuenta bancaria internacional (IBAN) (requerido si se envían fondos a Europa) |

|||||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

BENEFICIARY BANK INFORMATION/INFORMACIÓN DEL BANCO BENEFICIARIO |

|

|

|

|

|||||||||||

Bank Name/Nombre del banco |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Street Address/Dirección, calle |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||||

City/Ciudad |

|

State/Province/Estado/provincia |

|

|

Zip/Código postal |

|

|

Country*/País* |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Check One/Marque uno – Bank/Banco: |

|

|

|

|

|

|

Number:/Numero: |

|

|

|

|

|||||

|

ABA |

Sort Code/Código de entidad |

SWIFT |

CHIPS |

UID |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|||||||||||

|

INTERMEDIARY BANK INFORMATION (if applicable):/INFORMACIÓN DEL BANCO INTERMEDIARIO (si corresponde): |

|||||||||||||||

Bank Name/Nombre del banco |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Street Address/Dirección, calle |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

||||||||||

City/Ciudad |

|

State/Province/Estado/provincia |

|

Zip/Código postal |

|

|

Country*/País* |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Check One/Marque uno – Bank/Banco: |

|

|

|

|

|

|

Number:/Numero: |

|

|

|

|

|||||

|

ABA |

Sort Code/Código de entidad |

SWIFT |

CHIPS |

UID |

|

|

|

|

|

|

|

||||

SPECIAL INSTRUCTIONS/INSTRUCCIONES ESPECIALES

ORIGINATOR AUTHORIZATION/AUTORIZACIÓN DEL ORIGINADOR

By signing below, I authorize Citibank to execute the above funds transfer instruction in accordance with the Terms and Conditions for Funds Transfers, set forth in this agreement./Mediante la firma a continuación, autorizo a Cit bank a ejecutar la instrucción de transferencia de fondos precedente de acuerdo con los Términos y Condiciones para Transferencias de Fondos, establecidas en el presente contrato.

Authorized Signature and Date/Firma autorizada y fecha

mm/dd/yy

Message about fax transmissions*: Facsimile transmissions are not secure and may be intercepted by unauthorized individuals. By sending your instructions via facsimile you agree to accept any risk associated with facsimile transmissions. For additional explanations as to the risks associated with facsimile transmissions, please refer to the "Facsimile Transmissions" section of the Marketplace Addendum./Mensaje Importante*: Las transmisiones por fax no son seguras y pueden ser interceptadas por individuos no autorizados. Al enviar su formulario de referidos por fax, usted acepta cualquier riesgo relacionado con las transmisiones por fax. Para obtener una explicación adicional con respecto a los riesgos relacionados con las transmisiones por fax, consulte la sección "Transmisiones por fax" en el Anexo de Mercado.

*For International Funds Transfer:/Para transferencia de fondos internacional:

If sending funds outside of the U.S., please refer to the “Special Fund Transfers Requirements for International Transfers.” on page 4./Si se envían fondos fuera de los EE.UU., consulte los “Requisitos especiales de transferencia de fondos para transferencias internacionales” que figuran en la página 4.

© 2010 Citibank, N.A. Member FDIC/© 2010 Citibank, N.A., miembro de la FDIC. Citibank with Arc Design is a service mark of Citigroup Inc. or Citibank N.A., used and registered throughout the world./ Citibank con un diseño de arco en el logo es una marca de servicio de Citigroup, Inc. o Citibank, N.A., usada y registrada en todo el mundo.

WTRF0710E/S |

1 |

Please do not fax the Terms & Conditions. Please keep this for your files./No envíe por fax los Términos y condiciones, guárdelos para sus archivos.

TERMS AND CONDITIONS/TÉRMINOS Y CONDICIONES

By placing a funds transfer order with Citibank, you agree to the following/Con un pedido de transferencia de fondos a Citibank, usted acuerda lo siguiente:

Reliance by Citibank. Citibank may rely on the information on this form in making your funds transfer. Any errors in the information, including misidentification of beneficiary(ies) {recipient(s)}, incorrect or inconsistent account names and numbers, identifying numbers of the intermediary bank or beneficiary bank, and misspellings, are your responsibility. If you identify a beneficiary or other entity by name and account or any other number, payment may be made on the basis of the number and your payment will be final even if the number you provided does not correspond to your beneficiary or other entity that you have identified./Confianza por parte de Citibank. Citibank puede confiar en la información del presente formulario al realizar su transferencia de fondos. Cualesquiera errores en la información, incluyendo la identificación errónea de beneficiario(s) {receptor(es)}, nombres y números de cuenta, números identificatorios del banco intermediario o beneficiario incorrectos o incompatibles y errores de ortografía, son su responsabilidad. Si usted identifica un beneficiario o entidad por nombre y cuenta o cualquier otro número, el pago puede realizarse sobre la base del número y su pago será definitivo incluso si el número que usted indicó no le corresponde a su beneficiario u otra entidad que usted haya identificado.

Debit Authorization. Citibank is authorized to debit your account for the amount of your funds transfer order. You further authorize Citibank to charge your account a service fee for each funds transfer order you place in accordance with our fee schedule in effect from time to time./Autorización de débito. Citibank esta autorizado a debitar su cuenta por el monto de su pedido de transferencia de fondos. Asimismo usted autoriza a Citibank a cobrar una comisión de servicio en su cuenta por cada pedido de transferencia de fondos de acuerdo con nuestro listado de comisiones vigente periódicamente.

Transfer of Beneficiary Bank. When you place an order with Citibank for a funds transfer, you must select a financial institution as the beneficiary bank (recipient bank) for the transfer. For transfers within the United States, the beneficiary bank must be a member of the Federal Reserve System or a correspondent bank of such a member, or a Clearing House Interbank Payment System (CHIPS) member./Transferencia del banco beneficiario. Cuando usted coloca un pedido en Citibank para una transferencia de fondos, debe seleccionar una institución financiera como el banco beneficiario (banco receptor) para la transferencia. Para transferencias dentro de los Estados Unidos, el banco beneficiario debe ser un miembro del Sistema de la Reserva Federal o un banco corresponsal de dicho miembro o un miembro del Sistema Interbancario de Compensación de Pagos (CHIPS).

You may request that the funds either be deposited to a particular account at the beneficiary bank or that they be held at the beneficiary bank for your beneficiary. The beneficiary bank will be responsible for following your instructions and for notifying the beneficiary that the funds are available./Puede solicitar que los fondos sean depositados en una cuenta determinada del banco beneficiario o que sean retenidos en el banco beneficiario para su beneficiario. El banco beneficiario será responsable de seguir sus instrucciones y de notificar al beneficiario que los fondos están disponibles.

After the funds are transferred to the beneficiary bank, they become the property of the beneficiary bank. The beneficiary bank is responsible to locate, identify, and make payment to your beneficiary. If your beneficiary cannot be properly identified, the funds may be returned./Una vez que los fondos son transferidos al banco beneficiario, se convierten en propiedad del banco beneficiario. El banco beneficiario es responsable de localizar, identificar y realizar el pago a su beneficiario. Si su beneficiario no puede identificarse debidamente, los fondos pueden ser devueltos.

Currency of Transfer. Funds transfers to beneficiaries within the United States are made only in U.S. dollars./Moneda de la transferencia. Las transferencias de fondos a beneficiarios dentro de los Estados Unidos son realizadas únicamente en dólares estadounidenses.

For funds transfers to beneficiaries and beneficiary banks in other countries, unless you choose to send U.S. dollars, the transfer will be made in the currency of that country. For such funds transfers, we will convert your U.S. dollar payment to the local currency at Citibank’s exchange rate in effect at that time. The exchange rate includes a commission to Citibank for exchanging the currency./Para transferencias de fondos a beneficiarios y bancos beneficiarios en otros países, a menos que usted decida enviar dólares estadounidenses, la transferencia se realizará en la moneda de este país. Para dichas transferencias de fondos, convertiremos su pago en dólares estadounidenses a la moneda local al tipo de cambio de Citibank vigente en ese momento. El tipo de cambio incluye una comisión a Citibank por la conversión de moneda.

Because of the laws of some countries in which beneficiary banks are located, if you request a transfer in U.S. dollars we cannot guarantee that your beneficiary will be able to receive U.S. dollars. If your transfer must be converted to the local currency, the beneficiary bank may charge a fee for this exchange. Regardless of the currency transferred, the actual amount that your beneficiary receives may be reduced by charges imposed by the beneficiary bank, including those for exchanging currency./Debido a las leyes de algunos países en los cuales están ubicados los bancos beneficiarios, si usted solicita una transferencia en dólares estadounidenses, no podemos garantizar que el beneficiario podrá recibir dólares estadounidenses. Si su transferencia debe convertirse a la moneda local, el banco beneficiario puede cobrar una comisión por esta conversión. Independientemente de la moneda transferida, el monto real que su beneficiario recibe puede verse reducido por los cargos impuestos por el banco beneficiario, incluyendo los cargos por la conversión de moneda.

Means of Transfer. Citibank uses a variety of banking channels and facilities to make funds transfers, but will ordinarily use electronic means. We may choose any conventional means that we consider suitable to transfer your funds to your beneficiary./Medios de transferencia. Citibank usa una variedad de canales bancarios e instalaciones para realizar las transferencias de fondos, pero en general usará medios electrónicos. Podemos elegir cualquier medio convencional que consideremos adecuado para transferir sus fondos a su beneficiario.

Because we do not maintain banking relations with every bank, we sometimes use one or more intermediary banks to transfer your funds to the beneficiary bank. After we transmit your order to an intermediary bank, that bank is responsible to complete your order./Debido a que no mantenemos relaciones bancarias con todos los bancos, en ocasiones usamos uno o más bancos intermediarios para transferir sus fondos al banco beneficiario. Después de transmitir su pedido a un banco intermediario, ese banco es responsable de completar su pedido.

Recalls/Amendments. You may recall or amend your funds transfer order only if we receive your request prior to our execution of the funds transfer order and at a time that provides us a reasonable opportunity to act upon that request. If your funds transfer order has been executed by Citibank, the order can be recalled and amended only if the beneficiary bank consents to such a request. Citibank will not be liable to you for any loss resulting from the failure of the beneficiary bank to recall or amend your funds transfer order./Anulaciones/modificaciones. Usted puede anular o modificar su pedido de transferencia de fondos únicamente si recibimos su solicitud antes de que ejecutemos su pedido de transferencia de fondos y a un horario que nos brinde una oportunidad razonable de actuar de acuerdo con dicha solicitud. Si su pedido de transferencia de fondos fue ejecutada por Citibank, el pedido puede ser anulado y modificado únicamente si el banco beneficiario acepta dicha solicitud. Citibank no será responsable ante usted por ninguna pérdida resultante del hecho de que el banco beneficiario no anule o modifique su pedido de transferencia de fondos.

If you decide you want to recall your funds transfer order and your order has already been executed by us, we will first have to check with the beneficiary bank to determine whether the beneficiary bank can return your funds. If the beneficiary bank confirms that the funds are returnable and the funds are returned to Citibank by the beneficiary bank, Citibank will return the funds to you./Si usted decide que desea anular su pedido de transferencia de fondos y su pedido ya fue ejecutado por nosotros, primero tendremos que verificar con el banco beneficiario para determinar si el banco beneficiario puede devolver sus fondos. Si el banco beneficiario confirma que los fondos son retornables y los fondos son devueltos a Citibank por el banco beneficiario, Citibank le devolverá los fondos.

The amount that is returned to you may be less than you originally transferred because of service charges of the beneficiary bank or Citibank. Your refund will be in U.S. dollars. If your funds transfer was in a foreign currency, your U.S. dollar refund will be at the exchange rate on the date of the refund./El monto que se le devuelve puede ser inferior al que usted transfirió originalmente debido a los cargos por servicio del banco beneficiario o de Citibank. Su reembolso será en dólares estadounidenses. Si su transferencia de fondos fue en una moneda extranjera, su reembolso en dólares estadounidenses será al tipo de cambio de la fecha del reembolso.

Rejection of an Order. We reserve the right to reject your funds transfer order. We may reject your order if you have insufficient available funds in your account, if your order is incomplete or unclear, or if we are unable to fulfill your order for any other reason./Rechazo de un pedido. Nos reservamos el derecho de rechazar su pedido de transferencia de fondos. Podemos rechazar su pedido si usted no tiene fondos suficientes disponibles en su cuenta, si su pedido está incompleto o es poco claro o si no estamos en condiciones de cumplir su pedido por algún otro motivo.

WTRF0710E/S |

2 |

TERMS AND CONDITIONS/TÉRMINOS Y CONDICIONES

Delays,

Claims. You agree that within thirty days after you receive notification that your funds transfer order has been executed, you will tell us of any errors, delays or other problems related to your order. If your funds transfer order is delayed or erroneously executed as a result of Citibank’s error, Citibank’s sole obligation to you is to pay or refund such amounts as may be required by applicable law. In no event shall Citibank be responsible for any consequential or incidental damages or expenses in connection with your order. Any claim for interest payable by Citibank shall be at Citibank’s published savings account rate in effect within the state of execution of the funds transfer./Reclamos. Usted acuerda que dentro de los treinta días de recibir notificación de que su pedido de transferencia de fondos ha sido ejecutado, nos informará acerca de cualesquiera errores u otros problemas relacionados con su pedido. Si su pedido de transferencia de fondos es demorado o ejecutado en forma errónea como resultado de un error de Citibank, la única obligación de Citibank hacia usted es pagar o reembolsar dichos montos según lo requiere la ley aplicable. En ningún caso Citibank será responsable de los daños o gastos indirectos o incidentales que surjan en relación con su pedido. Cualquier reclamo por intereses pagaderos por Citibank será a la tasa de cuenta de ahorros publicada por Citibank vigente en el estado de ejecución de la transferencia de fondos.

In any event, if you fail to notify us of any claim concerning your funds transfer order within one year from the date that you receive notification that your order has been executed, any claim by you will be barred under applicable law./En cualquier caso, si usted no nos notificara acerca de cualquier reclamo relacionado con su transferencia de fondos dentro de un año de la fecha en que recibe notificación de que la transferencia de fondos fue ejecutada, cualquier reclamo realizado por usted será prohibido conforme a las leyes aplicables.

Governing Law. The Agreement will be governed by the laws of the state in which the branch through which you initiated this funds transfer is located and United States federal law as applicable./Ley Aplicable. El Contrato será regido por las leyes del estado en el cual está ubicada la sucursal a través de la cual usted inició esta transferencia de fondos y la ley federal de los Estados Unidos es aplicable.

Indemnity. In consideration of the agreement by Citibank to act upon funds transfer instructions in the manner provided in this Agreement, you agree to indemnify and hold Citibank harmless from and against any and all claims, suits, judgments, executions, liabilities, losses, damages, costs, and expenses – including reasonable attorney’s fees – in connection with or arising out of Citibank acting upon those funds transfer instructions pursuant to this Agreement. This indemnity will not be effective to relieve and indemnify Citibank against its gross negligence, bad faith, or willful misconduct./Indemnidad. En consideración del acuerdo por parte de Citibank de ejecutar instrucciones de transferencia de fondos en la forma establecida en el presente Contrato, usted acepta indemnizar y mantener indemne a Citibank contra cualquier reclamo, juicio, sentencia, ejecución, obligación, perdida, daños y perjuicios, costos y gastos incluyendo honorarios razonables de abogados en relación con o como resultado de la ejecución por parte de Citibank de dichas instrucciones de transferencia de fondos conforme al presente Contrato. Esta compensación no tendrá validez para liberar y compensar a Citibank contra culpa grave, mala fe o dolo.

WTRF0710E/S |

3 |

SPECIAL FUND TRANSFER REQUIREMENTS FOR INTERNATIONAL TRANSFERS/REQUISITOS ESPECIALES DE TRANSFERENCIA DE FONDOS PARA TRANSFERENCIAS INTERNACIONALES

AUD |

Australian Dollar/Dólares australianos |

6 digit Bank/State/Branch (BSB) routing code/Código de ruta de banco/estado/sucursal (BSB) de 6 dígitos |

||

|

|

|

|

|

EUR |

Euro/Euros |

International Bank Account Number (IBAN)/Número de cuenta bancaria internacional (IBAN) |

||

|

|

|

|

|

INR |

Indian Rupee/Rupias indias |

Full bank name and Address including PIN (postal code) 11 digit Indian Financial System Code (IFSC) (when clearing is |

||

|

|

done via Real Time Gross Settlement System (RTGS))/Nombre y dirección completa del banco incluyendo PIN (código |

||

|

|

postal) Código del sistema financiero indio de 11 dígitos (IFSC) (cuando se hace la compensación a través del Sistema de |

||

|

|

Liquidación Bruta en Tiempo Real (RTGS)) |

||

|

|

|

|

|

ILS |

Israeli Shekel/Siclos israelíes |

Full bank name and address or SWIFT (Society for Worldwide Interbank Financial Telecommunication) address |

||

|

|

2 digit Bank number code |

||

|

|

3 digit Branch number code |

||

|

|

/Nombre y dirección completa del banco o dirección SWIFT (Sociedad para las telecomunicaciones financieras |

||

|

|

interbancarias mundiales) |

||

|

|

Código de número de banco 2 dígitos |

||

|

|

Código de número de sucursal de 3 dígitos |

||

|

|

|

|

|

MXN |

Mexican Peso/Pesos mexicanos |

Beneficiary's |

||

|

|

|

|

|

KRW |

South Korean Won/Wons coreanos |

Beneficiary's South Korean telephone number Beneficiary bank’s full Address/Número de teléfono en Corea del Sur |

||

|

|

del beneficiario. Dirección completa del banco beneficiario. |

||

|

|

|

|

|

RUB |

Russian Ruble/Rublos rusos |

Beneficiary's name |

||

|

|

Beneficiary's 20 character account number |

||

|

|

Beneficiary Bank’s full name and address or SWIFT code |

||

|

|

9 digit Beneficiary Bank’s BIK (in Russian Domestic Clearing) and 20 digit correspondent account number with |

||

|

|

Central Bank of Russia |

||

|

|

Beneficiary INN code (Tax Payer ID Code) |

||

|

|

Individuals have a |

||

|

|

Companies have a |

||

|

|

Beneficiary's KPP (Tax code assigned by tax authorities). |

||

|

|

It is mandatory to add the appropriate VO code to the details (reason) for payment. This is a requirement of the |

||

|

|

Central Bank of Russia. |

||

|

|

Note: Reason for payment MUST accompany VO code and VO code must be labeled and placed between double |

||

|

|

parentheses |

||

|

|

/Nombre del beneficiario |

||

|

|

Número de cuenta de 20 caracteres del beneficiario |

||

|

|

Nombre completo y dirección del banco beneficiario o código SWIFT |

||

|

|

BIK del banco beneficiario de 9 dígitos (en la compensación local rusa) y número de cuenta del corresponsal de 20 |

||

|

|

dígitos en el Banco Central de Rusia |

||

|

|

Código INN del beneficiario (código de identificación del contribuyente). Los particulares tienen un INN de 12 dígitos. |

||

|

|

Las empresas tienen un INN de10 dígitos y las entidades extranjeras tienen un INN de 5 dígitos. |

||

|

|

KPP del beneficiario (código fiscal asignado por las autoridades fiscales). |

||

|

|

Es obligatorio agregar el código VO adecuado a los detalles (motivo) para el pago. Esto es un requisito del Banco Central |

||

|

|

de Rusia. |

||

|

|

Nota: El motivo del pago DEBE acompañar al código VO y el código VO debe estar marcado y colocado entre paréntesis |

||

|

|

dobles |

||

|

|

|

|

|

GBP |

British Pound/Libras esterlinas |

6 digit Clearing House Automated Payment System (CHAPS) sort code/Código de entidad de 6 dígitos del Sistema |

||

|

|

Automatizado de Compensación de Pagos (CHAPS) |

||

|

|

|

|

|

|

|

|

|

® |

|

|

|

|

|

|

|

© 2010 Citibank, N.A. Member FDIC/© 2010 Citibank, N.A., miembro de la FDIC. |

||

|

|

Citibank with Arc Design is a service mark of Citigroup Inc. or Citibank N.A., used and registered throughout the world./ |

||

|

|

Citibank con un diseño de arco en el logo es una marca de servicio de Citigroup, Inc. o Citibank, N.A., usada y registrada en todo el mundo. |

||

WTRF0710E/S |

4 |

Form Characteristics

| Fact Name | Description |

|---|---|

| 1. Purpose | The Citibank Wire form is used to authorize and process electronic wire transfers from the customer’s account. |

| 2. Required Information | Customers must provide detailed information, including the account holder's name, account type, and beneficiary bank information, to complete the transfer. |

| 3. Currency Specifications | Transfers made within the United States are conducted in U.S. dollars. International transfers may be converted to the local currency of the recipient's country unless stated otherwise. |

| 4. Governing Laws | The agreement is governed by the laws of the state where the Citibank branch initiated the transfer and applicable U.S. federal law. |

| 5. Intermediary Banks | If necessary, Citibank may use intermediary banks to process the wire transfer, especially for international transactions. |

| 6. Cut-off Time | The execution of wire transfer orders is subject to a cut-off time. Orders received after this designated time will be processed on the next banking day. |

| 7. Indemnification | Customers agree to indemnify Citibank against claims or losses related to the execution of wire transfers, except in cases of gross negligence or misconduct. |

Guidelines on Utilizing Citibank Wire

Completing the Citibank Wire Transfer form is essential for ensuring your transfer is processed accurately. Follow these steps to fill out the form properly, ensuring all required fields are completed to avoid delays.

- Start with the Originator Information section. Provide your Account Holder Name and select the Account Type (Checking, Savings, or Money Market).

- Fill in your Account Number and state your Country of Residence. Also, select your branch from the options provided: New York, Miami, or San Francisco.

- Move to the Wire Transfer Information section. Enter the Transfer Amount and indicate the Currency you wish to send.

- Write the Amount in words for clarity next to the numeric value.

- In the Beneficiary (Receiver) Information section, fill in the Name, Telephone Number, Street Address, City, State/Province, Zip Code, and Country of the beneficiary.

- Provide the Beneficiary Account Number and, if necessary, the International Bank Account Number (IBAN) for transfers to Europe.

- Proceed to the Beneficiary Bank Information. State the Bank Name, Street Address, City, State/Province, Zip Code, and Country of the beneficiary bank.

- Check the appropriate box for the bank type and include the required bank details: ABA Sort Code, SWIFT, or CHIPS UID.

- If using an intermediary bank, provide the Intermediary Bank Information, filling out the same details as the beneficiary bank.

- Include any Special Instructions if applicable.

- Finally, sign and date the Originator Authorization section, giving Citibank permission to process your request.

Review your form to confirm all information is entered accurately. Once completed, you can submit the form according to the instructions provided by Citibank.

What You Should Know About This Form

What is the Citibank Wire form used for?

The Citibank Wire form is primarily used to authorize the transfer of funds from your Citibank account to a designated beneficiary. Whether you're making a payment for goods or services, sending money to friends or family, or transferring funds for business purposes, this form is central to ensuring that the transaction is executed smoothly and accurately.

What information do I need to provide when filling out the form?

When completing the Citibank Wire form, you'll need to provide specific details about both the sender (you) and the recipient. This includes your account information, the transfer amount, and the beneficiary’s name, address, and account details. If the funds are being sent internationally, additional information such as an International Bank Account Number (IBAN) may also be required, depending on the destination country.

Can I use the Wire form for transfers to any country?

Yes, you can use the Citibank Wire form for sending money to various countries. However, specific rules and requirements may apply based on the destination. For international transfers, it’s particularly important to check the special fund transfer requirements listed on the form to ensure that you include all necessary information. Failure to provide adequate information may delay the processing of your transfer.

What happens if there is an error in the information I provide?

If there is a mistake in the information on your form—like an incorrect account number or misspelled name—Citibank may process the transfer based on the details you provided, rather than on what you intended. This means it’s essential to double-check all entries on the form for accuracy to avoid any potential issues.

What fees can I expect when using the Wire form?

When you authorize a wire transfer, Citibank typically charges a service fee, which can vary based on whether the transfer is domestic or international. It’s a good idea to review Citibank’s current fee schedule before initiating a wire transfer, as knowing the potential charges upfront can help you avoid any surprises later.

How can I track the status of my wire transfer?

Once you submit your wire transfer request, Citibank will typically provide you with a receipt or confirmation that includes a tracking number. You can use this number to follow up with Citibank about the status of your transfer. If there are any delays or issues, customer service can help clarify the situation and assist you in resolving it.

Common mistakes

Filling out the Citibank Wire Transfer form might seem straightforward, but many common mistakes can lead to complications. One prevalent error is failing to clearly write the transfer amount in both numerical and written form. While providing the amount in numbers is common practice, neglecting to convert that figure into words can cause delays or even rejection of the transfer.

Another mistake occurs when individuals skip required fields, particularly those marked with an asterisk. All key details must be filled out correctly and completely to ensure that the transfer is processed without hitches. Omitting critical information, such as the International Bank Account Number (IBAN) for transfers to Europe, can also derail the entire process.

Many people inaccurately fill in the beneficiary's information. Misspellings in the beneficiary's name or incorrect account numbers can lead to funds being sent to the wrong recipient. It is essential to double-check all entries, as Citibank may rely entirely on the information provided in the form.

Inaccurate banking details of the beneficiary's bank constitute a further common issue. Filling out the name, address, and SWIFT code can seem tedious, but getting these wrong can prevent the transfer from occurring. Always verify that this information is up-to-date and accurate to avoid unnecessary complications.

Another significant blunder is not respecting the cut-off time for wire transfers. If the form is submitted after Citibank's established cut-off time, the transfer may not be executed until the next business day. Being mindful of these timings is crucial when transferring funds that need to be delivered promptly.

Some individuals fail to sign the authorization section. Without a valid signature, Citibank cannot process the transfer order, rendering all prior efforts moot. Remember, a signature is a vital piece of authorization in this context.

Lastly, users may neglect to read and understand the specific terms and conditions associated with international funds transfers. Each country has unique requirements, and misunderstanding these can lead to unwanted fees or the inability for the beneficiary to receive their funds. Familiarizing oneself with these nuances can prevent a lot of headaches down the line.

By being aware of these common pitfalls, individuals can ensure that their wire transfer requests are executed smoothly and efficiently. Taking time to verify every detail minimizes the risk of errors and ensures that funds arrive at their intended destination without delay.

Documents used along the form

When using the Citibank Wire form, certain other documents often accompany the authorization for a smooth transaction. Each document serves a specific purpose in ensuring that the wire transfer process is completed accurately and securely.

- Identification Documents: Valid identification, such as a driver's license or passport, may be required to verify the identity of the account holder before executing a wire transfer.

- Account Statement: Recent account statements can be used to confirm available funds and account ownership, providing proof that the account holder can fund the wire transfer.

- Beneficiary Details Form: This form collects additional information about the recipient, ensuring all necessary details are provided for the wire transfer.

- Bank Details Confirmation: A document which verifies the beneficiary's bank information, including SWIFT codes, helps to prevent errors during the transfer.

- Wire Transfer Agreement: This agreement outlines terms and conditions specific to wire transfers, providing clarity on the responsibilities of both the sender and the bank.

- Source of Funds Declaration: In cases involving large transfers, a declaration may be required to affirm the legitimacy of the funds being transferred.

- Power of Attorney (if applicable): If someone is acting on behalf of the account holder, a Power of Attorney document is necessary to authorize the transaction.

Being prepared with the correct forms and documents can streamline the wire transfer process. Always ensure that all information is accurate and complete to avoid any potential delays.

Similar forms

- Direct Deposit Authorization Form: Similar to the Citibank Wire form, this document is used to authorize the deposit of funds directly into a bank account. Both require account holder information and bank details for processing payments.

- ACH Transfer Form: This form facilitates automated clearing house (ACH) transfers, allowing electronic payments between bank accounts. Both forms gather similar information about the sender, recipient, and amount being transferred.

- International Funds Transfer Form: Like the Citibank Wire form, this document is used to send funds internationally. It collects details such as recipient information, currency type, and bank information, ensuring proper processing of the transfer.

- Bank Account Opening Form: When opening a new bank account, an account holder must provide personal details and financial information. This form shares similarities in required data, such as identification and account type selection.

- Payment Authorization Form: Used to authorize payments for bills or services, this form also requires information about the payer, payee, and amount, resembling the structure of the Wire Transfer Authorization.

- Transfer of Funds Request Form: When requesting the transfer of funds between accounts, this form asks for both origin and destination account details. It parallels the Wire Transfer Authorization in its collection of essential banking information.

- Loan Application Form: This document requests details related to personal and financial information. Both require significant data about the applicant to evaluate eligibility, although the purpose differs.

- Wire Transfer Instructions Form: Used specifically for wire transfers, this form is closely aligned with the Citibank Wire form. Both are concerned with securely transferring funds with attention to specific details of the transfer.

- Funds Disbursement Request Form: This form facilitates the release of funds from a bank or trust account. It shares vital similarities in needing information about the account holder, the recipient, and the requested amount.

- Refund Request Form: Used to request a refund from a financial institution, this document typically includes information about the transaction being refunded, akin to the details required in the Citibank Wire Authorization.

Dos and Don'ts

When filling out the Citibank Wire form, keeping track of a few important dos and don'ts can help ensure a smooth process. Below are essential tips to follow to avoid unnecessary complications.

- Do double-check all information before submission, including account numbers and beneficiary details to ensure accuracy.

- Do use clear and concise language when filling out any special instructions to avoid misunderstandings.

- Do sign and date your authorization section to confirm that Citibank has your permission to proceed with the transfer.

- Do ensure that the transfer amount is written both numerically and in words to prevent any confusion.

- Don't leave any required fields blank; incomplete forms may result in delays or rejections.

- Don't send sensitive information through unsecured channels, as fax transmissions can be intercepted.

- Don't expect immediate execution if your form is submitted after the bank’s cut-off time; processing will occur on the next business day.

Misconceptions

- All Wire Transfers Are Instant: A common belief is that wire transfers are executed immediately. While transfers within the U.S. can be relatively quick, they are not instant. Depending on the time of day and the bank’s cut-off times, execution may not occur until the next banking day.

- Fax Transmissions Are Secure: Some individuals think that sending wire transfer instructions via fax is secure. However, the fact is that fax transmissions can be intercepted. Citibank explicitly states that they do not guarantee the security of faxed instructions.

- Errors in Benefit Information Can Be Easily Corrected: Many assume that any mistakes made in beneficiary information can be quickly fixed after submission. In reality, if a wire transfer has already been executed, correcting such errors can be very complicated and may require the beneficiary bank’s consent.

- Citibank Is Accountable for Delays: A misconception exists that Citibank is always liable for delays in wire transfers. However, the bank states clearly that it is not responsible for delays or failures caused by circumstances beyond its control, such as technical issues at intermediary banks.

- Currency Conversion Always Benefits the Sender: Some individuals think that converting U.S. dollars to foreign currency through Citibank will always yield favorable results. This is misleading, as conversion rates may include additional fees, and the amount received by the beneficiary can be lower than expected due to these charges.

- Wire Transfer Instructions Are Confidential: Many believe that all instructions related to wire transfers are completely confidential. In reality, after sending instructions to an intermediary bank, there may be multiple parties involved that can access this information during the transfer process, potentially compromising privacy.

Key takeaways

When filling out the Citibank Wire form, keep the following key points in mind:

- Accurate Information: Ensure that all information provided, such as account numbers and names, is correct to avoid any errors during processing.

- Required Fields: Pay attention to fields marked with an asterisk (*), as these are mandatory for a successful wire transfer.

- Signature Required: Your authorization signature is essential. Without it, the bank cannot process the transfer.

- Transfer Amount: Clearly state both the numeric amount and the amount written out in words to minimize confusion.

- Currency Options: For transfers outside the U.S., be aware that the transfer will occur in the local currency unless specified otherwise.

- Intermediary Banks: Sometimes, intermediary banks are used to process the transfer. Ensure that the correct details for these banks are included if applicable.

- Timing Matters: Be mindful of cut-off times for processing orders. Transfers submitted after the cut-off do not get executed until the next business day.

- Know the Risks: Be aware of potential risks involved with facsimile transmissions and ensure you understand the implications of sending sensitive information via fax.

Browse Other Templates

California Coe Benefits - The form will help veterans navigate the loan application process.

How to Fill Claim Form - Part a - A clear understanding of the conditions and instructions can aid in successful submissions.