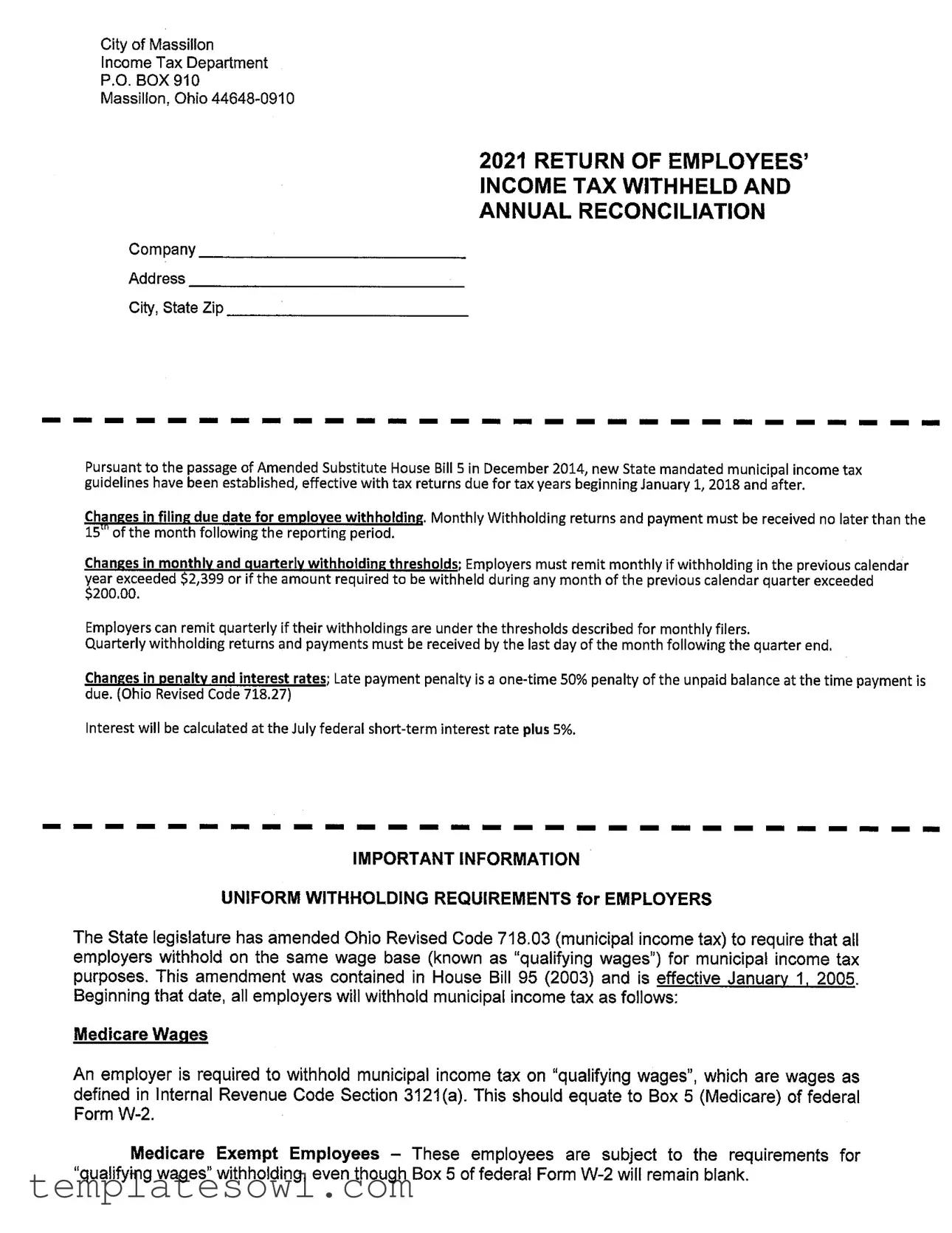

Fill Out Your City Of Massillon Income Tax Form

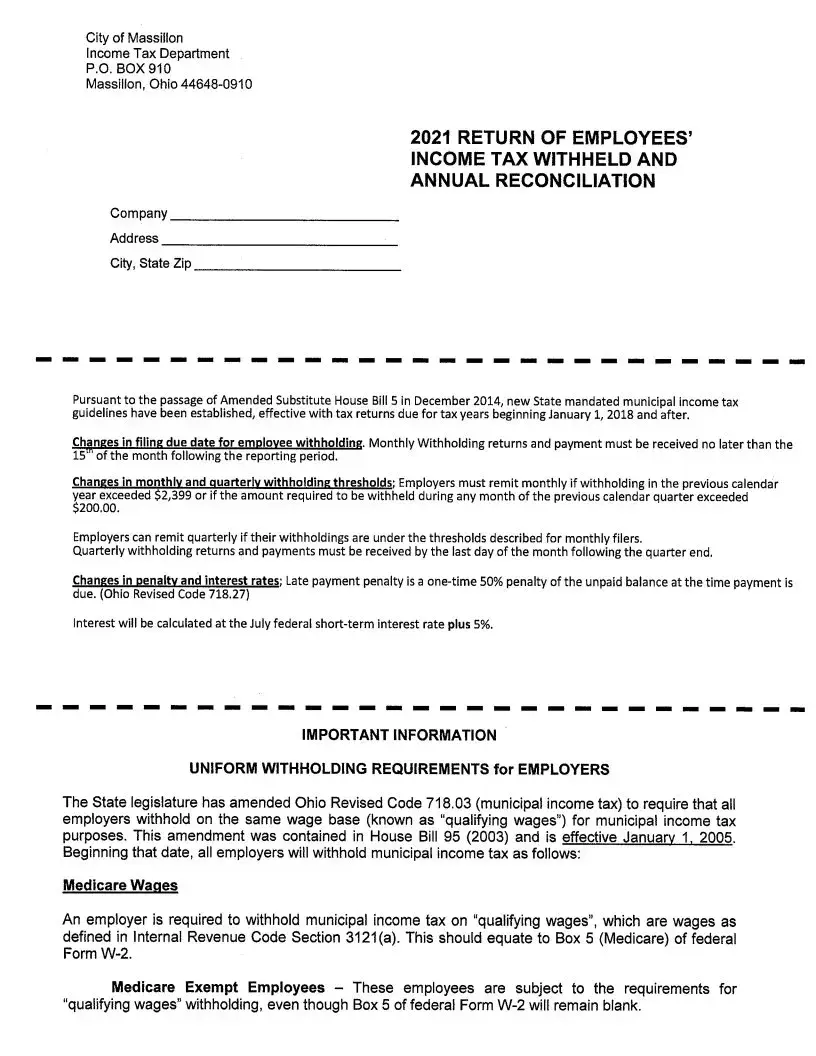

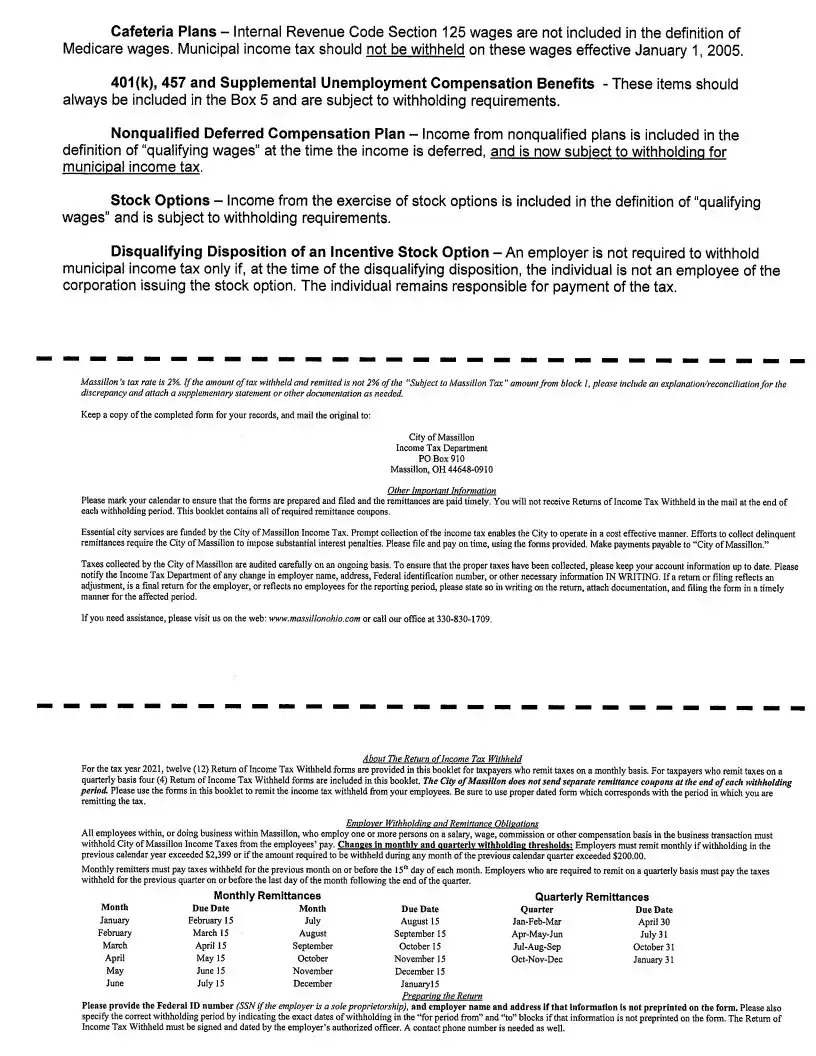

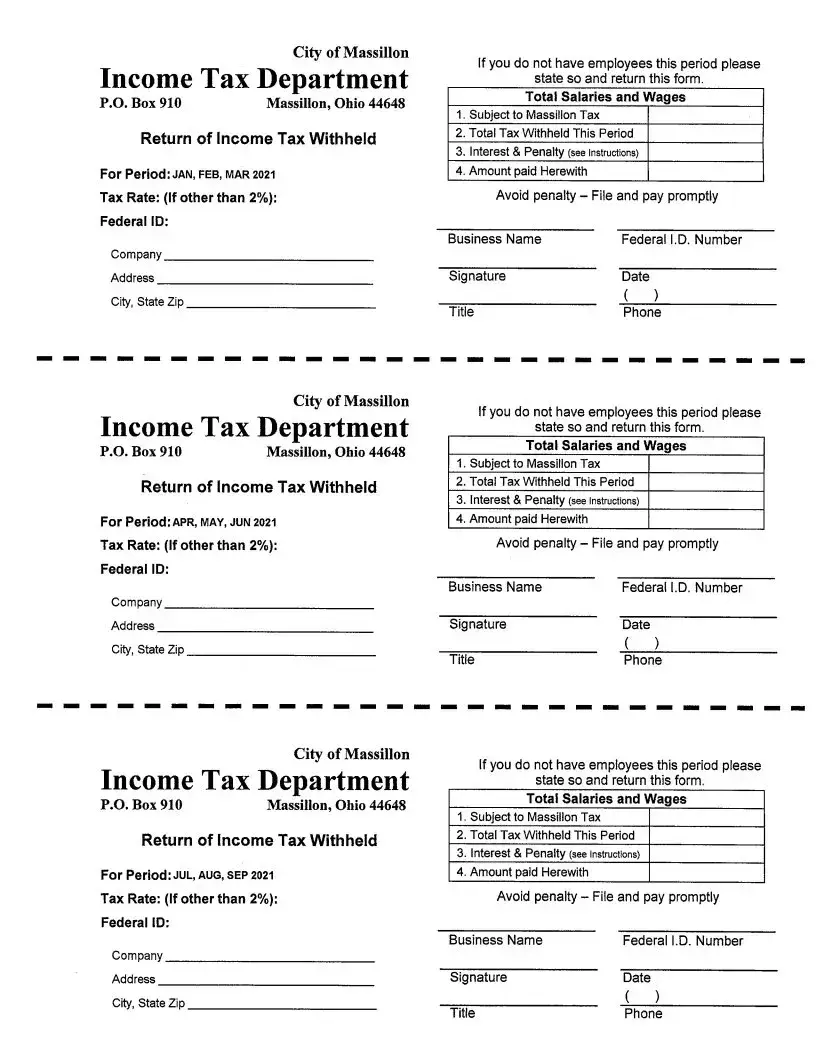

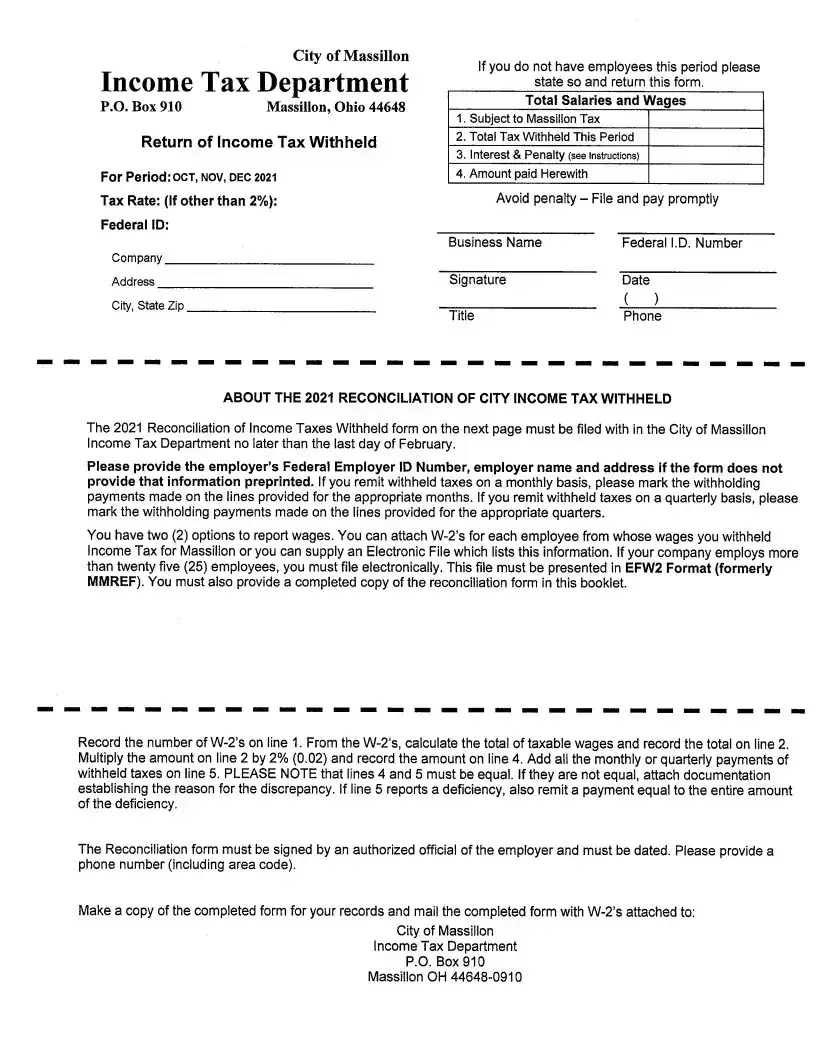

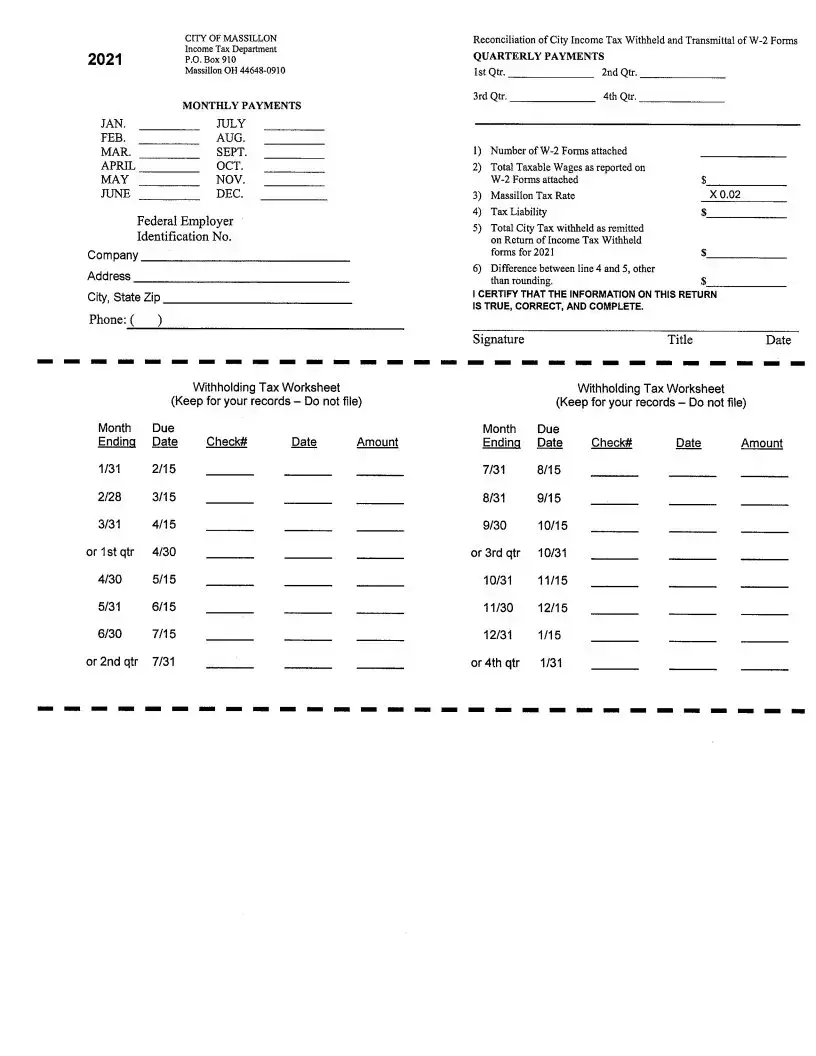

The City of Massillon Income Tax form is a critical document for employers tasked with withholding municipal taxes from employees' wages. This form includes essential information such as the employer's name, address, Federal ID number, and the applicable tax rate, which for Massillon is fixed at 2%. It requires employers to report monthly or quarterly withholding amounts based on specific thresholds. If an employer had over $2,399 in withholdings during the previous calendar year or if monthly amounts exceeded $200, they must remit taxes on a monthly basis. Conversely, quarterly remittance applies to those below these thresholds. The deadlines for timely submissions are clearly outlined, with monthly payments due by the 15th of each following month and quarterly payments due by the final day of the month after the quarter ends. Furthermore, the form addresses penalties and interest for late payments, emphasizing the importance of compliance. Accuracy is paramount; discrepancies between actual tax withheld and the stated 2% tax on the form must be reconciled and documented. Highlighting the importance of this tax for funding city services, it urges timely filings and updates on employer details to avoid accrued interest and penalties. Navigating these requirements carefully ensures that the process is smooth and that the city can maintain its essential functions effectively.

City Of Massillon Income Tax Example

Form Characteristics

| Fact Name | Fact Detail |

|---|---|

| City Information | City of Massillon Income Tax Department, P.O. Box 910, Massillon, Ohio 44648-0910 |

| Tax Rate | The current income tax rate for Massillon is 2%. |

| Filing Frequency | Employers must remit monthly if withholdings exceed $2,399 in the previous year or $200 in any month of the previous quarter. |

| Due Dates | Monthly: Due by the 15th of the following month; Quarterly: Due by the last day of the following month after the quarter ends. |

| Penalty for Late Payment | A one-time late payment penalty of 50% on the unpaid balance applies, as per Ohio Revised Code 718.27. |

| Interest Calculation | Interest is assessed at the July federal short-term interest rate plus 5% on unpaid balances. |

| Qualifying Wages | Employers must withhold tax on qualifying wages, as defined in Internal Revenue Code Section 3121(a). |

| Employer Responsibilities | All employers within Massillon must withhold and remit income tax from employees’ pay. |

| Assistance Contact | If assistance is needed, contact the City of Massillon Income Tax Department at 330-830-1709 or visit www.massillonohio.com. |

Guidelines on Utilizing City Of Massillon Income Tax

Filling out the City of Massillon Income Tax form requires attention to detail and organization. Following these steps will help ensure accuracy in your submission.

- Obtain the correct form for the relevant period from the provided booklet.

- Fill in your Federal ID number or Social Security Number if you operate as a sole proprietorship.

- Complete the employer's name and address fields if they are not preprinted on the form.

- Indicate the correct withholding period by entering the exact start and end dates in the “for period from” and “to” sections.

- In the "Total Salaries and Wages" section, report the total amount subject to Massillon tax.

- Calculate and enter the total tax withheld for the period in the appropriate field.

- Add any applicable interest and penalties as outlined in the instructions, if necessary.

- Enter the total amount being submitted with the form in the designated area.

- Ensure the form is signed and dated by an authorized officer of your company.

- Provide a contact phone number for any follow-up questions.

- Make a copy of the completed form for your records.

- Mail the original form to the City of Massillon Income Tax Department by the due date.

Once you have completed these steps, check your information carefully before mailing. Adhering to the deadlines will help avoid any potential penalties.

What You Should Know About This Form

What is the City of Massillon Income Tax form used for?

The City of Massillon Income Tax form is primarily used by employers to report and remit income tax withheld from their employees' wages. Employers within Massillon, or those conducting business in the city, must withhold municipal income tax from their employees and submit the appropriate forms to comply with local tax regulations.

What are the filing due dates for the Income Tax form?

Employers must submit monthly withholding returns by the 15th of the month following the reporting period if their previous year's withholding exceeded $2,399 or if the amount required to be withheld in any month exceeded $200. Employers who meet lower threshold limits can remit quarterly, due on the last day of the month following the end of the quarter.

What is the tax rate for Massillon?

The tax rate for the City of Massillon is 2%. Employers should ensure that the amount withheld from employees’ taxable wages corresponds to this rate. If there is a discrepancy, an explanation and any supporting documents should accompany the tax form.

Are there penalties for late payments or filing?

Yes, there is a one-time late payment penalty of 50% of the unpaid balance due at the time payment is required. Additionally, interest on late payments is computed at the July federal short-term interest rate plus 5%. Timely filing and payment are crucial to avoid these penalties.

How are “qualifying wages” defined for tax withholding?

Qualifying wages are defined as wages as specified in the Internal Revenue Code Section 3121(a). This includes Medicare wages reported in Box 5 of the federal Form W-2. Even if Box 5 is blank for certain Medicare-exempt employees, employers are still required to withhold municipal income tax based on qualifying wages.

What if an employer has no employees during a reporting period?

If there are no employees during a reporting period, the employer should still complete the form and indicate that there were no employees for that period. The completed form must still be submitted to the Income Tax Department.

What information must be provided on the tax form?

The tax form requires the Federal ID number (or SSN for sole proprietors), employer name and address, the exact withholding period, and a signature from an authorized officer. Including a contact phone number is also necessary. Ensuring this information is accurate helps facilitate the processing of the return.

How can employers ensure they are compliant with tax obligations?

Employers can maintain compliance by keeping up-to-date records, promptly filing the required tax forms, and remitting the correct amount of taxes withheld. Any changes to the employer's name, address, or Federal ID number should be reported in writing to the Income Tax Department to ensure records are correct.

Where should the completed forms be sent?

Completed forms should be mailed to the City of Massillon Income Tax Department at P.O. Box 910, Massillon, Ohio 44648-0910. It is advisable for employers to retain a copy of the submitted form for their own records.

How can I get assistance with the City of Massillon Income Tax form?

For assistance, you can visit the City of Massillon website or contact the Income Tax Department at 330-830-1709. They can provide support and answer any specific questions related to the form and tax obligations.

Common mistakes

Completing the City of Massillon Income Tax form can be a straightforward process, yet many individuals and businesses make common mistakes that can lead to complications or delays. Understanding these pitfalls is essential for ensuring a smooth filing experience.

One frequent error occurs when individuals neglect to include accurate employer details. It is vital to provide the Federal ID number, the company name, and the contact information clearly. Omitting or misrepresenting this information can result in processing delays. The form requires that employers specify the correct withholding period by indicating the exact dates of withholding. If this data is not preprinted, it is the responsibility of the filer to complete this information correctly.

Another mistake often seen is the failure to properly calculate the total tax withheld. The city's tax rate is set at 2%, but some filers mistakenly report amounts that do not match this percentage of the “Subject to Massillon Tax” total. In such instances, it is critical to provide a written explanation and documentation to reconcile any discrepancies. This lack of accuracy may lead to penalties, reinforcing the importance of diligent calculations.

Timeliness is also a significant factor. Many filers do not pay attention to the deadlines for monthly and quarterly remittances. If monthly withholding exceeds $2,399 or if the withholding for any month exceeded $200, it becomes necessary to remit on a monthly basis. Missing these deadlines may incur late fees. Understanding the due dates ensures that employers avoid costly penalties.

Another common blunder is forgetting to sign and date the form. The Return of Income Tax Withheld must be authorized by a representative of the business. A lack of signature can lead to a return being considered incomplete, thus delaying processing and payment. Filers should always double-check for this requirement before submission.

Some individuals mistakenly believe they do not need to file if they have no employees during the reporting period. However, the form still requires a return stating that there were no employees for that time. Failure to submit this information can create confusion and lead to unnecessary follow-up inquiries.

Lastly, not keeping a copy of the completed form can lead to complications in the future. Retaining a personal record aids in resolving any discrepancies or questions that may arise later. It serves as personal documentation should any audits occur. It is wise for anyone involved in this process to recognize the importance of their records.

By being aware of these common mistakes and taking proactive measures to avoid them, individuals and businesses can streamline their experience with the City of Massillon Income Tax form. Vigilance in completing the form ensures compliance and supports the continued funding of essential city services.

Documents used along the form

The City of Massillon Income Tax form serves as a crucial document for employers in fulfilling their tax obligations to the city. To ensure smooth compliance, several additional forms and documents are often utilized alongside this income tax form. Each of these documents plays a vital role in the overall tax filing process, providing necessary information and supporting evidence. Below is a list of these important forms and documents.

- Form W-2: This is the wage and tax statement provided by employers to their employees, detailing the total income earned and taxes withheld during the year. It is essential for employees when filing their own tax returns.

- Form 941: Employers use this quarterly tax return to report income taxes, Social Security tax, and Medicare tax withheld from employee’s paychecks. It ensures that employers are meeting their federal tax obligations.

- Form 1099: This form is used to report various types of income received by individuals who are not considered employees. It is vital for reporting payments made to independent contractors.

- Employer Identification Number (EIN): This unique number issued by the IRS is required for business tax filings and is used to identify the business entity in all tax matters.

- Ohio Business Tax Filing Form: Businesses operating in Ohio may need to complete this form to report various business taxes, including sales tax and employer withholding tax, ensuring compliance with state regulations.

- Monthly or Quarterly Tax Remittance Coupons: These coupons accompany payment for the taxes withheld from employees. They ensure proper allocation of payments to the corresponding reporting periods.

- Supplementary Statement for Reconciliation: This document is necessary if there is a discrepancy in tax amounts remitted versus the amount calculated, providing an explanation and additional details.

- Payroll Records: Detailed records of employee wages, hours worked, and taxes withheld must be kept on hand. These documents support the accuracy of the figures reported on all tax forms.

Incorporating these forms and documents during the tax preparation process not only facilitates accurate reporting but also helps avoid potential penalties related to late or incorrect filings. Being well-prepared allows employers to focus more on their business and less on compliance challenges. Timely and accurate tax reporting ultimately benefits both the City of Massillon and the employer’s enterprise.

Similar forms

The City of Massillon Income Tax form shares similarities with various other tax-related documents. Below is a list detailing these similarities:

- W-2 Form: Like the City of Massillon Income Tax form, the W-2 form provides information regarding wages paid to employees and taxes withheld from those wages. Both documents require accurate reporting of the taxable income and withholding amounts.

- IRS Form 941: This form is used to report employer's quarterly federal tax return, similar to the way the City of Massillon form reports local income tax withheld. Both require employers to track withholding amounts for specific periods and remit payment accordingly.

- State Income Tax Withholding Form: Many states require a form that outlines state income tax withholding rates, much like the City of Massillon's requirements for municipal income tax withholding. Both documents focus on calculating and reporting tax obligations based on employee earnings.

- 1099-MISC Form: This form is used to report payments made to non-employees, reflecting similar reporting requirements to the City of Massillon Income Tax form regarding compensation and tax responsibilities. Both documents need accuracy in reporting total payments and applicable withholding.

- Tax Returns (1040 Series): Individual tax returns also require reporting all sources of income and tax withholdings, as does the Massillon form for employees' income tax. Both processes are governed by deadlines for submission and payment of taxes owed.

- Employer’s Annual Federal Unemployment (FUTA) Tax Return (Form 940): This form is used to report and pay unemployment tax, akin to how the Massillon form handles local income tax obligations. Both necessitate an accurate calculation of applicable tax amounts based on employment data.

- Ohio Unemployment Compensation Form: Similar to the Massillon Income Tax form, this document reports employer contributions to state unemployment funds, focusing on the relationship between employment and tax compliance.

- Sales Tax Return: This form requires businesses to report sales tax collected from customers, analogous to the way employers report income tax withheld from employees. Both forms involve regular submissions to ensure compliance with tax laws.

- Quarterly Business Statement: This document reports a business's financial activity on a quarterly basis, resembling the way the Massillon Income Tax form captures income tax withholding for specific periods.

- State Quarterly Withholding Report: Similar to the City of Massillon form, this report outlines state-mandated tax withholding, focusing on the proper calculation and payment of taxes based on employee wages.

Each of these documents aims to ensure accurate reporting and timely payment of taxes, contributing to the maintenance of tax compliance at various levels of government.

Dos and Don'ts

When filling out the City of Massillon Income Tax form, it's essential to follow certain do's and don'ts to ensure smooth processing and compliance. Here is a helpful list:

- Do ensure that your Federal ID number is correctly provided if it’s not preprinted on the form.

- Do specify the exact dates of withholding in the “for period from” and “to” blocks if they are not already filled in.

- Do keep a copy of the completed form for your records after submission.

- Do make sure that the form is signed and dated by an authorized officer of your company.

- Do pay on time to avoid penalties; this means filing your taxes promptly on or before the due dates.

- Don't forget to mark the form if no employees were present for that reporting period; indicate this directly on the form.

- Don't use a form that is not dated correctly for the period in which you are remitting; each period needs its corresponding form.

Misconceptions

Misconception 1: The City of Massillon Income Tax form is only for businesses with employees.

This is not true. All businesses operating within the city, regardless of the number of employees, are required to file the form and report any income tax withheld, even if it is zero.

Misconception 2: I will receive a tax form in the mail at the end of each filing period.

The City of Massillon does not send out separate remittance coupons. It's essential to use the forms provided in the booklet for remitting the income tax withheld from your employees.

Misconception 3: I can submit my tax payment at any time during the month.

Timely filing is crucial. Monthly payments must be made by the 15th of the following month, while quarterly payments have specific due dates following the quarter's end.

Misconception 4: The tax rate can change based on employee type or compensation.

The City of Massillon has a fixed tax rate of 2%. This rate applies to all qualifying wages. Ensure that the amount withheld matches this percentage.

Misconception 5: Interest and penalties won’t apply if I miss the deadline occasionally.

Late payments incur a one-time 50% penalty on the unpaid balance and interest calculated at the federal short-term rate plus 5%. Filing and payment must be done promptly to avoid these consequences.

Misconception 6: I don’t need to update my information if my business details change.

This is incorrect. It's vital to keep your account information up to date, including any changes in the employer name, address, or Federal identification number. Notify the Income Tax Department in writing as soon as possible.

Misconception 7: I can file my return without documenting adjustments from previous periods.

All adjustments must be clearly stated in writing on your return, along with any necessary documentation. Failing to do so can delay processing and compliance with the tax obligations.

Key takeaways

Understanding how to fill out and use the City of Massillon Income Tax form is essential for compliance. Here are five key takeaways:

- File Timely: Employers must ensure that monthly withholding returns and payments are received by the 15th of the following month. For quarterly filers, returns are due by the last day of the month after the quarter ends.

- Know the Withholding Thresholds: Employers whose withholding exceeded $2,399 in the previous year or $200 in any month must remit taxes monthly. Others may remit quarterly.

- Understand Qualifying Wages: Municipal income tax must be withheld on qualifying wages as defined by the Internal Revenue Code. This includes Medicare wages and items like 401(k) contributions and stock options.

- Maintain Accurate Records: It is crucial to keep copies of the completed forms and documentation. Update the Income Tax Department with any changes to employer details in writing.

- Prepare for Penalties: Late payments incur a one-time 50% penalty of the unpaid balance. Interest is charged based on federal rates plus 5%, reinforcing the need for timely submissions.

Browse Other Templates

Da 3643 - It includes a section dedicated to documenting the resident's response to care.

Weblogic Server Tutorial - Get acquainted with the WebLogic Configuration Wizard for domain creation.

How Do I Get an Apostille in Ohio - This cover letter is designed to facilitate a smoother communication process with state officials.