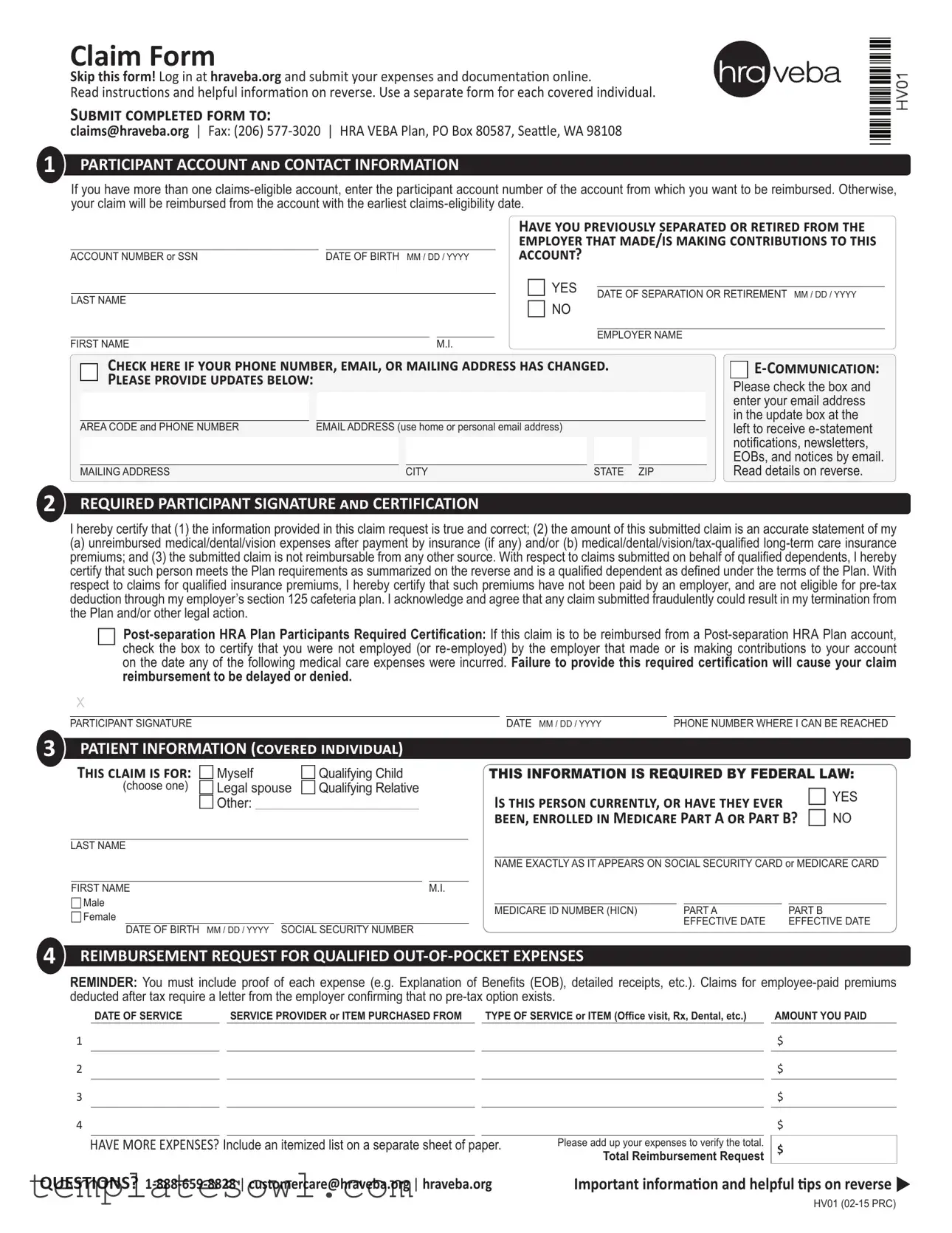

Fill Out Your Claim Hv01 Form

The Claim Hv01 form is an essential document for participants in the HRA VEBA Plan seeking reimbursement for qualified medical, dental, and vision expenses. This form guides users through the necessary steps to get their money back efficiently and correctly. It covers vital participant information, including account numbers, contact details, and a required signature that certifies the accuracy of the claim. The form emphasizes the importance of providing proof of expenses, ensuring that all submitted claims reflect costs that have not been reimbursed through other means. Participants must carefully outline expenses incurred, include detailed receipts, and confirm information relating to covered individuals, including dependents. Additionally, the form also contains a checklist to aid in the smooth submission of claims, which aids in preventing delays caused by missing information. The clarity of the instructions is designed to promote a streamlined process, allowing participants to navigate their reimbursement requests with confidence.

Claim Hv01 Example

Claim Form

Skip this form! Log in at hraveba.org and submit your expenses and documentaion online.

Read instrucions and helpful informaion on reverse. Use a separate form for each covered individual.

Submit completed form to:

claims@hraveba.org | Fax: (206)

1PARTICIPANT ACCOUNT and CONTACT INFORMATION

If you have more than one

ACCOUNT NUMBER or SSN |

DATE OF BIRTH MM / DD / YYYY |

|||

|

|

|

|

|

LAST NAME |

|

|

|

|

|

|

|

|

|

FIRST NAME |

|

M.I. |

||

Have you previously separated or retired from the employer that made/is making contributions to this account?

c YES |

|

|

DATE OF SEPARATION OR RETIREMENT MM / DD / YYYY |

||

|

||

c NO |

|

|

|

|

|

|

EMPLOYER NAME |

Check here if your phone number, email, or mailing address has changed. Please provide updates below:

AREA CODE and PHONE NUMBER |

EMAIL ADDRESS (use home or personal email address) |

|

|

|

|

||

|

|

|

|

|

|

|

|

MAILING ADDRESS |

|

|

CITY |

|

STATE ZIP |

||

Please check the box and enter your email address in the update box at the

left to receive

2REQUIRED PARTICIPANT SIGNATURE and CERTIFICATION

I hereby certify that (1) the information provided in this claim request is true and correct; (2) the amount of this submitted claim is an accurate statement of my

(a) unreimbursed medical/dental/vision expenses after payment by insurance (if any) and/or (b)

c

X

|

|

|

|

|

PARTICIPANT SIGNATURE |

DATE MM / DD / YYYY |

PHONE NUMBER WHERE I CAN BE REACHED |

||

3PATIENT INFORMATION (covered individual)

This claim is for: |

c Myself |

c Qualifying Child |

(choose one) |

c Legal spouse |

c Qualifying Relative |

|

c Other: ___________________________________ |

|

LAST NAME

THIS INFORMATION IS REQUIRED BY FEDERAL LAW:

Is this person currently, or have they ever |

c YES |

been, enrolled in Medicare Part A or Part B? |

c NO |

NAME EXACTLY AS IT APPEARS ON SOCIAL SECURITY CARD or MEDICARE CARD

FIRST NAME |

|

|

|

M.I. |

|

|

|

|

|

|

|

|

c Male |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MEDICARE ID NUMBER (HICN) |

PART A |

PART B |

|||||

c Female |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

EFFECTIVE DATE |

EFFECTIVE DATE |

||||

|

DATE OF BIRTH MM / DD / YYYY |

SOCIAL SECURITY NUMBER |

||||||||||

|

|

|

|

|

||||||||

4REIMBURSEMENT REQUEST FOR QUALIFIED

REMINDER: You must include proof of each expense (e.g. Explanation of Beneits (EOB), detailed receipts, etc.). Claims for

DATE OF SERVICE |

|

SERVICE PROVIDER OR ITEM PURCHASED FROM |

|

TYPE OF SERVICE or ITEM (Ofice visit, Rx, Dental, etc.) |

|

AMOUNT YOU PAID |

1

2

3

4

HAVE MORE EXPENSES? Include an itemized list on a separate sheet of paper.

Please add up your expenses to verify the total.

Total Reimbursement Request

$

$

$

$

$

QUESTIONS? |

Important informaion and helpful ips on reverse u |

HV01

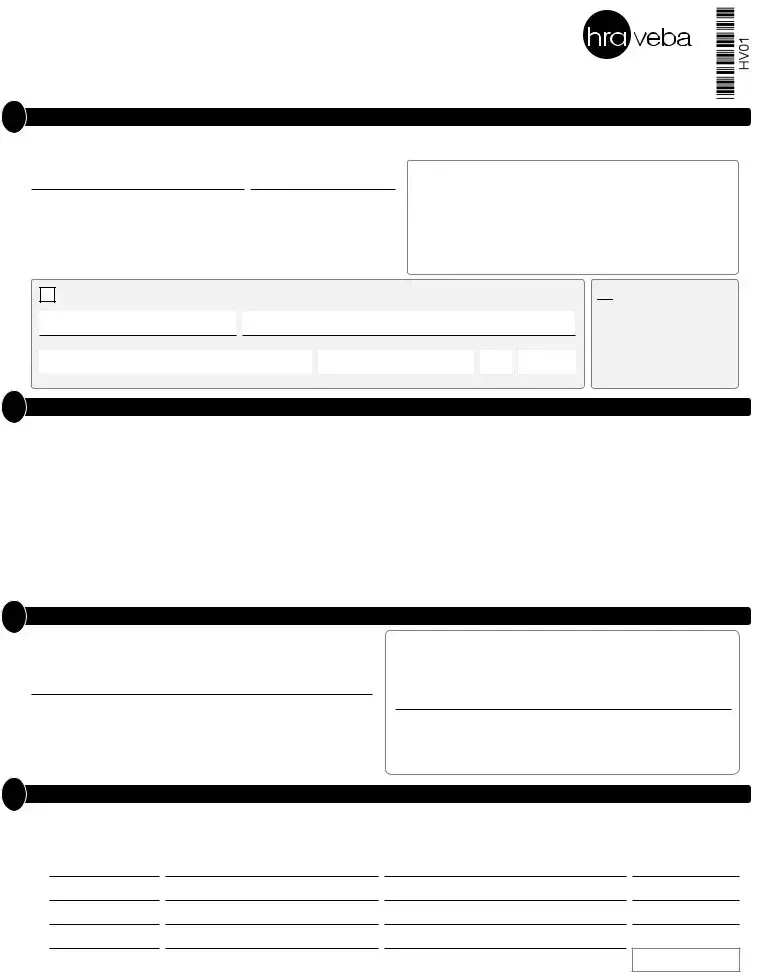

Claim Form |

Page 2 of 2 |

Want to know more? First ime submiing a claim?

Get your money back fast

Following the ips and instrucions below will help you submit “clean” claims for faster processing. For more detailed guidelines, read How to File a Claim available online ater logging in at hraveba.org. Standard processing ime is ive business days from the date received. If you’re not signed up for direct deposit, remember to allow addiional ime to receive your paper checks in the mail. Email (recommended), fax, or mail your completed Claim Form and proof of expense(s) to the Plan as indicated at the top of the Claim Form.

Enter your participant account number

If you have more than one

Fully complete each section of the Claim Form

Missing informaion, paricularly in secion 3, will likely result in denied claims. Federal law requires the Plan to have on ile the full name, Social Security number, gender, and date of birth of all covered individuals.

Submit proof of expense

Make sure you atach proof of each expense. Missing, incomplete, or illegible forms of documentaion are the most common reasons claims are denied. You can help avoid denied claims by making sure the proof you submit is legible and contains all of the following:

1.Name of covered individual who received the item or service;

2.Date item was purchased or service was provided;

3.Service Provider name (e.g. doctor, pharmacy, hospital, etc.);

4.Descripion of the item purchased or service received; and

5.Amount of

Cancelled checks, carbon copy checks, credit or debit card receipts, bank statements and balance forward or payment on account statements are not acceptable. Proper proof includes:

1.Explanaion of beneits (EOB) from your insurance company (recommended);

2.Itemized statement of services from your doctor or other service provider;

3.Stub from a prescripion (not the cash register receipt); or

4.Detailed receipt and prescripion for

Certain claims, such as insurance premiums, dental/orthodonia, and massage therapy require addiional proof. For more details read the How to File a Claim handout available online ater logging in at hraveba.org or upon request from the customer care center.

Reimburse your qualified insurance premiums automatically

You don’t have to submit a Claim Form every month for your qualiied insurance premiums. Auto premium reimbursement is available. Simply complete and submit an Auto Premium Reimbursement form. Forms are available online ater logging in at hraveba.org or upon request from the customer care center.

HELPFUL CHECkLIST:

Atach legible proof of each expense - use an EOB whenever possible.

Enter the correct account number.

Sign your Claim Form.

Keep copies of completed Claim Form and atachments for your iles.

Do not submit more than one receipt for each expense.

Handwriten receipts must have provider informaion stamped on them.

If you want to note certain items on your receipts, circle the items - do not use a highlighter.

Important Informaion

If you have elected

Qualified expenses and premiums:

Medical expenses you submit for reimbursement must be incurred ater you become and remain

Legal spouse and dependent coverage:

The HRA VEBA plan covers you, your legal spouse, and qualiied dependents.

A legal spouse includes anyone you have legally married, so long as the marriage occurred in any U.S. or foreign jurisdicion that recognized the marriage, regardless of where you live now. Generally, dependents must saisfy the IRS deiniion of “qualifying child” or “qualifying relaive” as of the end of the calendar year in which expenses were incurred. Efecive September 1, 2010, your young adult children’s expenses incurred through the end of the calendar year in which they turn age 26 are eligible for reimbursement. See Deiniion of Dependent at hraveba.org for more details.

Multiple investment funds:

If your account is allocated among muliple investment funds, withdrawals (claims) will be deducted pro rata based on your balance in each fund at the ime of withdrawal unless you request otherwise in wriing.

Medicare coordination:

Secion 111 of the Medicare, Medicaid and SCHIP Extension Act of 2007 (MMSEA) requires HRA VEBA Trust to report speciic informaion about Medicare beneiciaries covered under the Plan. The purpose of this reporing is to assist the Centers for Medicare & Medicaid Services (CMS), the federal agency that oversees the Medicare program, coordinate the payment of beneits with other group health plans, such as your HRA VEBA. Federal rules determine whether Medicare or HRA VEBA should pay irst. Generally, your HRA VEBA account is primary to Medicare if you’re sill employed by the employer that made (or is making) contribuions to your HRA VEBA account. For more details, read Who pays irst, HRA VEBA or Medicare? available online ater logging in at hraveba.org or upon request from the customer care center.

QUESTIONS?

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Claim Hv01 form is designed for participants to submit reimbursement requests for qualified medical expenses and insurance premiums. |

| Submission Methods | Completed forms can be submitted via email, fax, or traditional mail to specified addresses provided on the form. |

| Eligibility Requirement | Participants must have a claims-eligible account and the expenses submitted must be incurred after becoming eligible. |

| Coverage for Dependents | The form allows claims for legal spouses and qualified dependents, as defined under IRS regulations. |

| Proof of Expense | Participants must attach appropriate proof for each claimed expense, such as receipts or Explanation of Benefits (EOB). |

| Certification Requirement | Participants must sign and certify that the information provided is accurate and that claims have not been submitted elsewhere. |

| Direct Deposit | Participants not enrolled in direct deposit should allow extra time for reimbursement checks to be mailed. |

| Processing Time | Typical processing time for claims is five business days from the date the form is received. |

| Invalid Documentation | Submission of illegible or incomplete documentation is a leading cause of claims denial. |

| Medicare Coordination | Section 111 of the Medicare, Medicaid, and SCHIP Extension Act requires reporting of Medicare beneficiaries for coordination of benefits. |

Guidelines on Utilizing Claim Hv01

Filling out the Claim Hv01 form is an important step to ensure you are reimbursed for your qualified medical expenses. To expedite the process, it’s essential to pay attention to each section and provide accurate information. Following these steps will help you complete the form correctly and submit it seamlessly for reimbursement.

- Visit hraveba.org to log in or create an account if you haven’t done so already.

- Fill out your Participant Account and Contact Information:

- Enter your participant account number or Social Security Number (SSN) if applicable.

- Provide your date of birth in MM/DD/YYYY format.

- Enter your last name, first name, and middle initial.

- Indicate whether you have separated or retired from your employer and provide relevant dates.

- Update your contact information if necessary (phone number, email address, and mailing address).

- Sign the Required Participant Signature and Certification section:

- Carefully read and certify the statements by checking the appropriate boxes.

- Sign and date the form.

- Provide a phone number where you can be reached.

- Complete the Patient Information section, indicating whether the claim is for you or a qualifying individual:

- Fill out the necessary details for the individual, including their Medicare information and Social Security Number.

- In the Reimbursement Request for Qualified Out-of-Pocket Expenses section:

- List each expense by date, service provider, type of service, and amount paid.

- Add up the total of your expenses.

- If you have additional expenses, prepare a separate sheet with those details.

- Compile your proof of expenses. Attach the necessary documentation for each expense, such as:

- Explanation of Benefits (EOB).

- Itemized statements or detailed receipts.

- Keep copies of the completed Claim Form and the attached documentation for your records.

- Submit the completed form and documentation via email, fax, or mail to the addresses provided at the top of the form.

After submitting your Claim Hv01 form, you can expect standard processing time to be around five business days. If you're not registered for direct deposit, allow additional time for receiving your reimbursement check in the mail. For any questions or concerns, the customer support team is available to assist you.

What You Should Know About This Form

What is the Claim Hv01 form used for?

The Claim Hv01 form is used to request reimbursement for qualified medical, dental, vision expenses, and certain insurance premiums from your HRA VEBA account. It allows participants to document expenses incurred after they became claims-eligible and those that have not been reimbursed by other sources.

How do I submit the Claim Hv01 form?

You can submit the completed Claim Hv01 form online by logging into hraveba.org. Alternatively, you can email it to claims@hraveba.org, fax it to (206) 577-3020, or mail it to HRA VEBA Plan, PO Box 80587, Seattle, WA 98108. Make sure to include proof of each expense.

What information is required to complete the Claim Hv01 form?

You'll need to provide your participant account number or Social Security number, date of birth, last name, first name, and other relevant contact information. Additionally, you must include details of the medical expenses, including service date, provider, type of service, and total amount paid. Federal law requires the full name, Social Security number, gender, and date of birth of all covered individuals.

What types of expenses can I claim with this form?

You can claim qualified out-of-pocket expenses that include co-pays, deductibles, and prescriptions. Also eligible are certain insurance premiums like medical, dental, vision, and long-term care insurance premiums, as long as they were not reimbursed or funded pre-tax through an employer's section 125 cafeteria plan.

What happens if I forget to include proof of my expenses?

Missing, incomplete, or illegible documentation is one of the most common reasons for claims being denied. To avoid delays, make sure to attach proof of each expense, such as an Explanation of Benefits (EOB) or detailed receipts. Always retain copies of your submitted documents for your own records.

Can I submit a Claim Hv01 form for multiple expenses at once?

Yes, you can submit multiple expenses on the same Claim Hv01 form. Ensure you provide detailed descriptions for each expense. If necessary, also include an itemized list on a separate sheet of paper. Make sure to sum up your expenses correctly.

Is there a deadline for submitting claims?

While specific deadlines may vary by plan, it is generally advisable to submit your claims as soon as expenses are incurred. Refer to the guidelines available on hraveba.org or contact customer care for detailed deadlines related to your specific plan.

What should I do if my contact information has changed?

If your phone number, email address, or mailing address has changed, it’s essential to update this information on the claim form. Check the designated box on the form and provide accurate and updated details to ensure you receive all communications promptly.

What if I have issues or questions while filling out the form?

If you encounter any issues or have questions while filling out the Claim Hv01 form, you can reach customer service at 1-888-659-8828 or email customercare@hraveba.org. They can assist you with any inquiries related to your claim submission.

How long does it take to process the claims?

The standard processing time for claims is five business days from the date the completed form is received. If you’re not enrolled in direct deposit, remember that mailing a paper check may add extra time to receive your reimbursement.

Common mistakes

Filling out the Claim Hv01 form is essential to ensure the reimbursement of qualified expenses. However, numerous individuals encounter pitfalls during this process. A frequent mistake involves failing to provide the correct account information. Those with multiple claims-eligible accounts must clearly state the account number they wish to use. If this crucial step is overlooked, reimbursement will default to the earliest claims-eligible date, potentially resulting in delays or complications.

Another common error is the omission of critical information about the covered individual. This form necessitates complete patient data, which includes their full name, date of birth, and Social Security number. Insufficient details in Section 3 can lead to claim denials. It is vital to ensure that all sections are meticulously filled out and verified.

Proof of expense is also a frequent stumbling block. Many people neglect to attach appropriate documentation to validate their claims. Acceptable proof includes items such as explanations of benefits from insurance companies or detailed receipts from service providers. Lack of this documentation, or submission of illegible forms, is one of the most prevalent causes of claims being denied.

In addition, individuals might not sign the Claim Form, which is a necessary step to certify the accuracy of the information provided. A missing signature can delay the processing of a claim. Fortunately, this is an easily avoidable mistake, requiring only a quick review before submitting the form.

Moreover, many applicants submit more than one receipt for the same expense. This approach can confuse processing staff and result in the rejection of claims. Each expense should be documented with a single receipt or itemized on a separate sheet, making it straightforward for reviewers to understand.

Lastly, some submitters fail to distinguish between what qualifies as a reimbursable expense and what does not. Familiarizing oneself with the definition of qualified expenses can save time and effort. Expenses that have already received reimbursement from another source, such as employer-paid premiums or funds deducted pre-tax, are not eligible. Knowing these details before filling out the form can greatly enhance the chance for a successful claim submission.

Documents used along the form

The Claim HV01 form is a crucial document used for submitting claims for reimbursement of qualified medical expenses. It ensures that participants can efficiently process their claims and receive the benefits to which they are entitled. Along with this claim form, several other documents can be helpful during the reimbursement process. Below is a list of common forms and documents that may be used alongside the Claim HV01 form.

- Explanation of Benefits (EOB): This document is provided by your insurance company and outlines what services were covered, the total cost, and any amount you are responsible for after insurance has paid. It serves as important proof for your claim.

- Itemized Statement from Service Providers: This statement details the services rendered by a healthcare provider, including dates of service, diagnostic codes, and specific treatments received. It is vital for substantiating your claim for reimbursement.

- Auto Premium Reimbursement Form: If you are seeking automatic reimbursement for qualified insurance premiums, this form allows you to set up a routine payout without having to submit a claim each month.

- Claim Submission Checklist: This handy checklist helps you ensure that all necessary documents are included with your claim submission. It reduces the risk of omitted details that could lead to claim denial.

- Medicare Enrollment Documentation: If any covered individual is enrolled in Medicare, providing documentation of enrollment may be required to determine the primary payer for medical expenses.

- Letter from Employer: When claiming premiums for health insurance that cannot be reimbursed through a cafeteria plan, a letter from your employer confirming this is necessary.

- Proof of Payment: This could include receipts, bank statements, or credit card statements that demonstrate payment for medical services. These documents reinforce the legitimacy of your claim.

- Dependent Eligibility Verification: Documentation that verifies the relationship of any dependents for whom claims are being submitted. This helps confirm that they meet eligibility requirements.

- Personal Verification Documents: Additional identity verification documents may be needed for accurate processing of claims, especially in cases of legal name changes or address updates.

Understanding these various forms and documents will assist you in compiling everything needed for a successful claim. Keeping this information organized can speed up your reimbursement process, allowing you to focus on what really matters - your health and well-being.

Similar forms

The Claim Hv01 form is designed for individuals seeking reimbursement for qualified medical expenses. Several similar documents serve the same purpose of submitting claims, each with unique features. Here’s a comparison of four such documents:

- Standard Health Insurance Claim Form (CMS-1500): This form is primarily used by healthcare providers to bill for services rendered to patients. It requires detailed information regarding the patient, services provided, and the costs incurred. Like the Claim Hv01, it necessitates proof of service but is typically submitted by providers rather than patients.

- Patient Reimbursement Request Form: This document allows patients to request reimbursement directly from their health insurance provider after paying for services out-of-pocket. Similar to the Claim Hv01, it requires the patient’s information, details about the services, and proof of payment, facilitating a straightforward reimbursement process.

- Flexible Spending Account (FSA) Reimbursement Form: This is used by individuals with an FSA to claim reimbursement for eligible medical expenses. It shares similarities with the Claim Hv01 in terms of requiring detailed expense documentation and participant certification, ensuring that submitted claims fall within allowable expenses.

- Health Savings Account (HSA) Distribution Request Form: This form is for requesting distributions from an HSA for qualified expenses. Just like the Claim Hv01 form, it requires detailed expense information and ensures the request aligns with IRS guidelines for qualified medical costs, helping avoid delays in processing.

Dos and Don'ts

When filling out the Claim Hv01 form, follow these essential guidelines to streamline your submission and ensure a successful outcome. Here’s a helpful list of what to do and what to avoid:

- Do: Log in to hraveba.org and submit your expenses and documentation online for faster processing.

- Do: Use a separate form for each covered individual to avoid complications.

- Do: Ensure that all required fields are fully completed, especially the contact information sections.

- Do: Attach legible proof for each expense, such as Explanation of Benefits (EOB) or detailed receipts.

- Do: Familiarize yourself with the Plan requirements for qualified dependents before submitting claims.

- Do: Sign and date the form to certify that all information provided is accurate and truthful.

- Do: Maintain copies of the completed form and all attached documents for your records.

- Don’t: Submit more than one receipt for the same expense, as this can lead to confusion and delays.

- Don’t: Use non-legible documentation such as handwritten receipts without provider information stamped on them.

- Don’t: Highlight items on receipts; instead, circle them using a pen to avoid any confusion.

- Don’t: Forget to check for any changes in your contact information before submitting the form.

- Don’t: Ask for reimbursement of claims that have already been paid by another source.

- Don’t: Delay in sending the form and documentation, as prompt submission can lead to faster processing times.

- Don’t: Assume all expenses are automatically covered; check your plan specifics to confirm eligibility.

By adhering to these guidelines, you can make the process of filling out the Claim Hv01 form more efficient and increase the likelihood of your claim being processed smoothly.

Misconceptions

Misconception 1: The Claim Hv01 form is the only way to submit a claim.

This is incorrect. You can also log in at hraveba.org to submit your expenses and documentation online. Using the online portal may expedite your claim process.

Misconception 2: Claims can be submitted for any type of medical expense, regardless of eligibility.

Not all medical expenses are eligible for reimbursement. Only qualified expenses, as defined by the plan, can be submitted. It's essential to review what qualifies before submitting a claim.

Misconception 3: You do not need to provide proof of expenses when submitting the form.

This is false. Proof of each expense is required, such as Explanation of Benefits (EOB) or detailed receipts. Claims submitted without appropriate documentation may be denied.

Misconception 4: All insurance premiums can be reimbursed automatically without additional paperwork.

This is misleading. While some insurance premiums can be reimbursed automatically, you must complete a separate Auto Premium Reimbursement form to set it up.

Misconception 5: Once a claim is submitted, it will be processed immediately.

Claims are not processed instantly. Standard processing time is five business days from the date the claim is received. If additional information is required, this may further delay reimbursement.

Key takeaways

Filling out and using the Claim Hv01 form can be straightforward if you keep a few key points in mind. Here are some important takeaways to help you navigate the process.

- Complete Each Section: Ensure that every section of the form is filled out completely. Missing information can lead to claims being denied.

- Provide Accurate Documentation: Attach proof of each expense, such as Explanation of Benefits (EOB) or detailed receipts. Inadequate documentation is a common reason for denied claims.

- Account Selection Matters: If you have multiple eligible accounts, specify which account you wish to use for reimbursement. Otherwise, the claim will be processed from the earliest established account.

- Keep Personal Details Updated: Update your contact information, including email and phone number. This ensures you receive important notices and statements promptly.

- Sign and Certify: Remember to sign the form. Your signature confirms that all information is truthful, and that you understand the implications of fraudulent claims.

- Utilize Auto Premium Reimbursement: For recurring qualified insurance premiums, consider using the Auto Premium Reimbursement option. This saves time and ensures consistent reimbursement without the need for repeated claims.

By following these guidelines, you can make the claims process smoother and more efficient. Don’t hesitate to reach out with questions if you need further assistance. Understanding the details can significantly ease your experience.

Browse Other Templates

Loan Request Form - Please ensure all required fields in the Client Information section are completed accurately.

Hole-in-One Insurance Application,Golf Event Coverage Form,Tournament Prize Insurance Request,Hole-in-One Coverage Quote,Golf Tournament Insurance Application,Prize Insurance Application for Golf Tournaments,Event Hole-in-One Insurance Request,Golf H - No practice shots are allowed under the terms specified in the form.