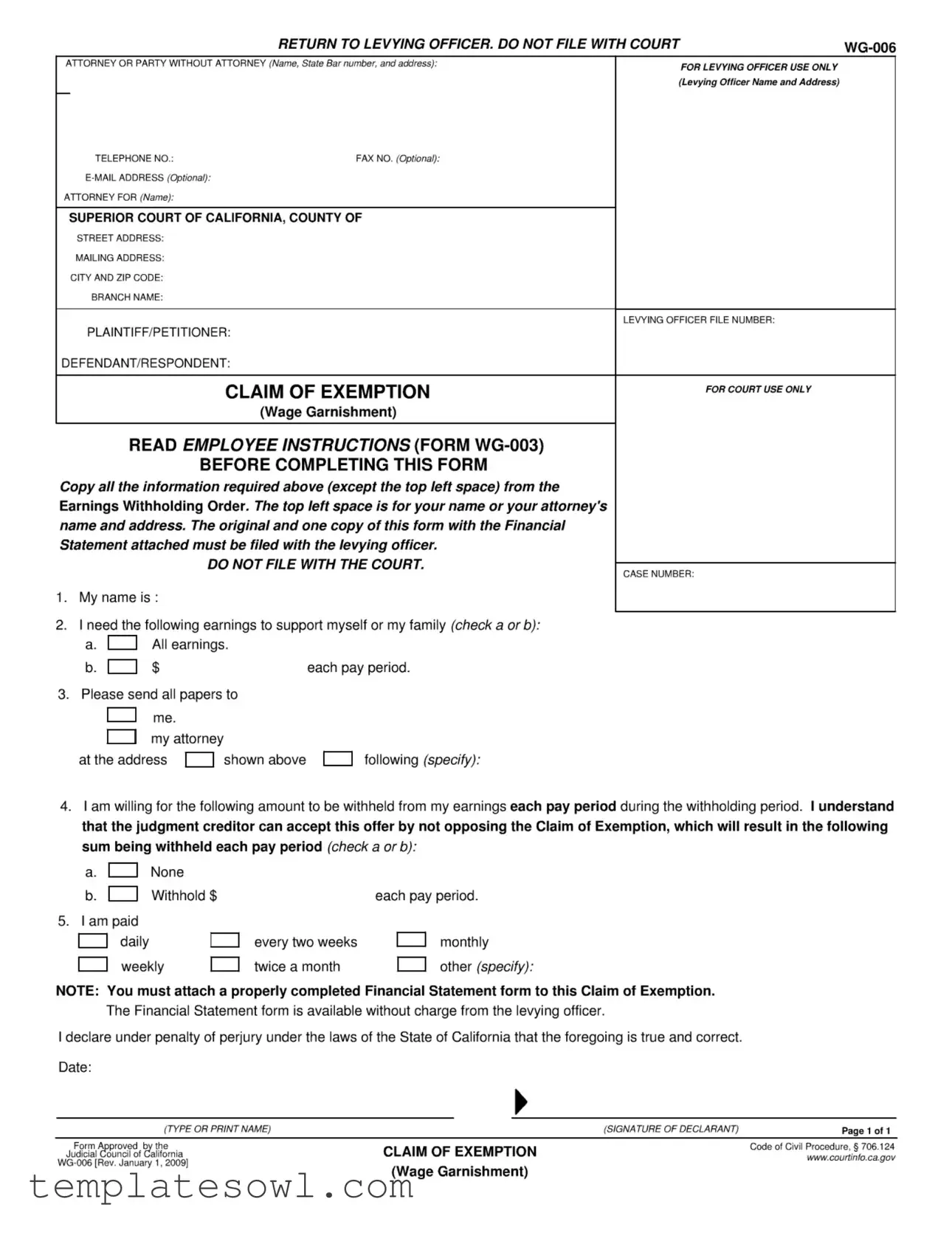

Fill Out Your Claim Of Exemption Wg 006 Form

The Claim of Exemption Wg 006 form serves as a key document for individuals facing wage garnishment in California. This form enables a person to claim an exemption from wage garnishment due to financial hardships. Primarily, it allows the individual to specify the amount of their earnings necessary for supporting themselves or their family. Detailed instructions are provided to ensure the accurate completion of the form, emphasizing the importance of attaching a Financial Statement. The form is structured to capture essential information, such as the individual’s name, contact details, and payment frequency. It requires the claimant to indicate their willingness to have a certain amount withheld from their earnings, thereby facilitating a potential agreement with the judgment creditor. The form outlines the stipulation that it should be filed with the levying officer, not the court, further clarifying the procedural requirements. Additionally, a declaration under penalty of perjury underscores the seriousness of the information provided. Understanding how to properly fill out and submit the Claim of Exemption Wg 006 form can significantly impact an individual’s financial wellbeing during garnishment proceedings.

Claim Of Exemption Wg 006 Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Claim of Exemption WG-006 form allows individuals to declare that a portion of their wages should be exempt from garnishment to support themselves or their family. |

| Required Attachments | This form must be accompanied by a properly completed Financial Statement form when filed with the levying officer. |

| Governing Law | The use of this form is governed by California Code of Civil Procedure, § 706.124, which outlines the rules for wage garnishment exemptions. |

| Filing Instructions | Individuals should submit the original and one copy of this form to the levying officer. It should not be filed with the court. |

Guidelines on Utilizing Claim Of Exemption Wg 006

Completing the Claim of Exemption WG-006 form is an important step in protecting your earnings from wage garnishment. After filling out the form, you will submit it to the levying officer, not the court. Be sure to follow the steps carefully to ensure your claim is valid.

- Personal Information: At the top left of the form, provide your name and address or your attorney's name and address.

- Copy Earnings Info: Gather the necessary information from the Earnings Withholding Order. Include it, excluding the top left space.

- Claim Your Needs: In the designated section, state your name. Then, indicate whether you require the earnings to support yourself or your family by checking the appropriate box.

- Communication Preference: Specify whether you want all papers sent to you or your attorney, or both, and provide the address if it’s different from above.

- Amount to Withhold: Decide how much you are willing to have withheld from your earnings each pay period. Indicate if you want to withhold none or specify an amount.

- Payment Schedule: Indicate how often you are paid (daily, weekly, bi-weekly, monthly, etc.). Check the appropriate box provided.

- Attach Financial Statement: Remember to attach the completed Financial Statement form, which you can obtain for free from the levying officer.

- Declaration: Finally, sign and date the form, declaring that all information is true and correct under penalty of perjury.

Once you have completed these steps, you should make a copy of everything for your records. Then, you will submit the original and one copy to the levying officer. Remember, this process is essential to help ensure that a portion of your wages remains protected if you qualify for an exemption.

What You Should Know About This Form

What is the Claim of Exemption WG-006 form?

The Claim of Exemption WG-006 form is used in California to request an exemption from wage garnishment. When a creditor seeks to garnish a person's wages, this form allows the individual to assert that their earnings should not be subject to garnishment due to financial hardship or other qualifying reasons.

Who should fill out this form?

This form should be completed by anyone who has received an Earnings Withholding Order and believes that their wages should be exempt from garnishment. If you are struggling to support yourself or your family, or if your earnings fall below certain thresholds, this form provides a way to claim those exemptions.

What information do I need to provide?

You must complete various sections of the form, including your name, your attorney’s name if applicable, and information about your earnings. This includes how often you are paid, the amount you are willing to have withheld, and your financial situation. It is crucial to attach a properly completed Financial Statement form as well.

What does it mean to declare under penalty of perjury?

By signing the form and declaring under penalty of perjury, you affirm that the information you provided is true and correct. This is a serious legal commitment. Providing false information can lead to legal repercussions and may negatively affect your claim for exemption.

What is the process after I submit this form?

Once you have filled out the Claim of Exemption WG-006 form, you must submit the original and one copy to the levying officer, not the court. The levying officer is responsible for reviewing the claim and will inform you of the next steps, which may involve your creditor being given the opportunity to respond to your claim.

What if the creditor opposes my claim?

If the creditor opposes your claim of exemption, a hearing may be scheduled to determine whether your wages should be garnished. It is advisable to gather evidence to support your claim and, if possible, enlist legal assistance to navigate the hearing process effectively.

Is there a fee for filing the Claim of Exemption?

No, there is no fee to file the Claim of Exemption WG-006 form with the levying officer. It’s intended to provide relief to individuals facing financial difficulties, so there should not be an additional burden of filing fees.

How can I contact the levying officer?

You can find the contact information for your specific levying officer in the Earnings Withholding Order you received. This information will typically include a name, phone number, and address where you can send your completed form.

Can I represent myself in this matter?

Yes, you are allowed to represent yourself when filing the Claim of Exemption. However, if you feel uncertain about the process or if your case involves complications, it may be beneficial to seek legal advice to ensure that your rights are fully protected.

What happens if my exemption is granted?

If your claim of exemption is granted, the levying officer will notify the creditor, and they will be required to adjust the garnishment accordingly. This means that either your wages will not be garnished, or only a smaller amount will be withheld each pay period, giving you some financial relief.

Common mistakes

Filling out the Claim Of Exemption WG-006 form can be a complex process, and there are common mistakes that individuals often make. These mistakes can lead to delays, rejections, or complications in the resolution of wage garnishment issues. Awareness of these pitfalls can assist in ensuring a smoother experience.

One significant error is failing to copy the information correctly from the Earnings Withholding Order. The form clearly states that all required information, except for the top left section, should be copied accurately. Any discrepancies or omissions can result in the form being deemed inadequate. Additionally, neglecting to attach a completed Financial Statement is another common issue. The instructions specify attaching this form, and absent documentation will hinder the exemption claim.

Another frequent mistake involves inaccuracies in selecting the frequency of payment. Respondents sometimes fail to mark the appropriate box indicating their payment schedule, such as daily, weekly, or monthly. This oversight creates ambiguity that can complicate the assessment of the claim. Furthermore, individuals neglecting to specify the amount they wish to have withheld can also create confusion. Clear articulation of the desired withholding amount is essential for proper review.

It is crucial to provide complete and correct contact details. Omitting vital information, such as a valid mailing address or telephone number, can delay communication. Submitting the form to the wrong location also presents a challenge. The instructions explicitly state that the form should not be filed with the court; it should be sent directly to the levying officer. Awareness of this guideline is paramount to ensuring the proper handling of claims.

Lastly, some individuals fail to understand the implications of their declarations. When signing the form, they assert that the information provided is true under penalty of perjury. This signifies that providing false information can lead to serious legal repercussions. Therefore, careful review and honest reporting must be prioritized. By avoiding these common mistakes, individuals can navigate the exemption process more smoothly and effectively.

Documents used along the form

When filing a Claim of Exemption (WG-006), various support documents enhance the process. Below is a list of several documents commonly used alongside this form. Each document serves a unique purpose in the exemption process and may be required for proper filing.

- Financial Statement (WG-003): This document outlines your financial situation. It includes details about your income, expenses, assets, and liabilities. A completed financial statement is necessary as it provides the context for why you are claiming an exemption.

- Earnings Withholding Order: This is the initial order issued by the court that directs an employer to withhold a portion of your wages to satisfy a debt. It contains the specifics of the garnishment that you are challenging through the Claim of Exemption.

- Proof of Income: This can include pay stubs, tax returns, or statements that verify your earnings. Submitting proof of income helps substantiate your financial situation and the need for an exemption.

- Notice of Exemption: This document is often sent by the creditor to notify you of the garnishment. Understanding the details within this notice can be vital in accurately completing your Claim of Exemption.

- Affidavit of Exemption: Sometimes, an affidavit may be used to declare that certain income or assets are exempt from garnishment. This can add an extra layer of protection for specific types of income, such as social security benefits.

- Correspondence with the Creditor: Any written communication between you and the creditor regarding the debt can be valuable. This documentation may provide insights into negotiations or agreements related to the debt and claim of exemption.

Being well-prepared with these documents can help clarify your financial situation and increase the likelihood of a successful exemption claim. Always ensure that all information provided is accurate and up to date to avoid complications in the process.

Similar forms

- Earnings Withholding Order (EWO): Similar in purpose, the EWO details how much money can be withheld from an employee's earnings. It serves as the initial authorization for garnishment, while the Claim of Exemption WG 006 allows the employee to assert their rights against it.

- Financial Statement: This document is necessary to support the Claim of Exemption. It provides the levying officer with a clear picture of the individual's financial situation, helping to determine the validity of the exemption claimed.

- Claim of Exemption (WG 003): While WG 006 directly addresses wage garnishment, WG 003 is focused on other types of levies. Both serve as mechanisms for individuals to protect their income or property from being seized under specific conditions.

- Judgment Debtor’s Statement of Assets (Form SC-133): This document provides a comprehensive overview of a debtor's assets, similar to the Financial Statement. It enables the court or levying officer to assess what can be claimed or exempted.

- Notice of Motion to Quash (Form FL-300): This form is utilized when a debtor or respondent challenges the enforcement of a judgment, similar to how the Claim of Exemption allows for a challenge against wage garnishment.

- Request for Hearing on Claim of Exemption: Similar in that it allows individuals to contest the validity of a wage garnishment, this document is filed to formally request a court hearing regarding the exemption claim.

- Application for Order for Examination (Form FL-158): This document is used to assess a debtor's financial situation, akin to the Financial Statement required with the Claim of Exemption. It may accompany the wage garnishment process.

- Declaration of Exemptions (Form WG-002): This is used by individuals to declare certain exemptions that would apply to their earnings. It serves a similar function by supporting claims against garnishments, alongside the Claim of Exemption WG 006.

- Request for Continuance of Exemption Hearing: This document allows a debtor to seek additional time for presenting their case regarding their exemptions, much like the Claim of Exemption, which is intended to provide protection from burdensome garnishment.

- Stipulation to Modify Earnings Withholding Order: This document could be used by parties to negotiate changes to the EWO. It reflects a similar intent of protecting one’s financial interests while allowing some flexibility regarding garnished amounts.

Dos and Don'ts

Here are nine important considerations when filling out the Claim of Exemption WG-006 form:

- Do read all instructions thoroughly before starting the form.

- Do accurately copy all necessary information from the Earnings Withholding Order.

- Do provide your name or your attorney's name and address in the designated space.

- Do submit the original and one copy of the form along with the Financial Statement to the levying officer.

- Do check the appropriate boxes regarding your earnings and exemptions.

- Don’t file this form with the court. It should only go to the levying officer.

- Don’t forget to attach the properly completed Financial Statement form.

- Don’t leave any required fields blank; all information must be complete.

- Don’t sign the form without ensuring that all information provided is accurate and truthful.

By following these guidelines, you can navigate the process more smoothly and increase the likelihood of a favorable outcome for your exemption claim.

Misconceptions

Misconceptions often arise about the Claim of Exemption WG 006 form, especially regarding its purpose and usage. Below are some common misbeliefs along with clarifications that can help individuals better understand this important document.

- Misconception 1: Filing the form with the court is necessary.

- Misconception 2: The financial statement is optional.

- Misconception 3: Claiming an exemption guarantees that all wages will be protected.

- Misconception 4: You can fill out the form without guidance.

Many people think they need to file the Claim of Exemption with the court. In reality, you do not file this form with the court. Instead, it should be returned to the levying officer, who is responsible for handling wage garnishments.

Some believe that the financial statement can be skipped. However, the Claim of Exemption WG 006 form must include a properly completed financial statement. This is essential to support your claim for exemptions from wage garnishment.

It's a common mistake to think that filing this claim will automatically secure all of your wages from garnishment. The process involves a review, and the judgment creditor may accept your offer or contest it. Thus, not all wage amounts may be fully exempt.

Some individuals feel confident filling out the Claim of Exemption without help. While the form may seem straightforward, it’s crucial to read the employee instructions carefully and, if needed, seek assistance to ensure accuracy and completeness.

Key takeaways

Filling out the Claim of Exemption WG 006 form is a critical step for those facing wage garnishment. Here are key takeaways to consider:

- Ensure you copy all required information accurately from the Earnings Withholding Order. This includes your personal details as well as the specifics of your financial situation.

- Submit the original form along with one copy and a Financial Statement to the levying officer. Remember, this form should not be filed with the court.

- Decide how much you need withheld from your earnings each pay period. Your offer must be clear, as the judgment creditor can agree to it by not opposing your Claim of Exemption.

- Attach a completed Financial Statement form. You can obtain this document free of charge from the levying officer, and it is necessary to support your claim.

Browse Other Templates

Service Member Loan Reimbursement Form - Inaccurate information may lead to delays or rejections of loan repayment requests.

Family Tree Format - Identify your great-grandparents and learn their stories.

How to Get a Hot Work Permit - This form serves as a study resource as well as an application guide.