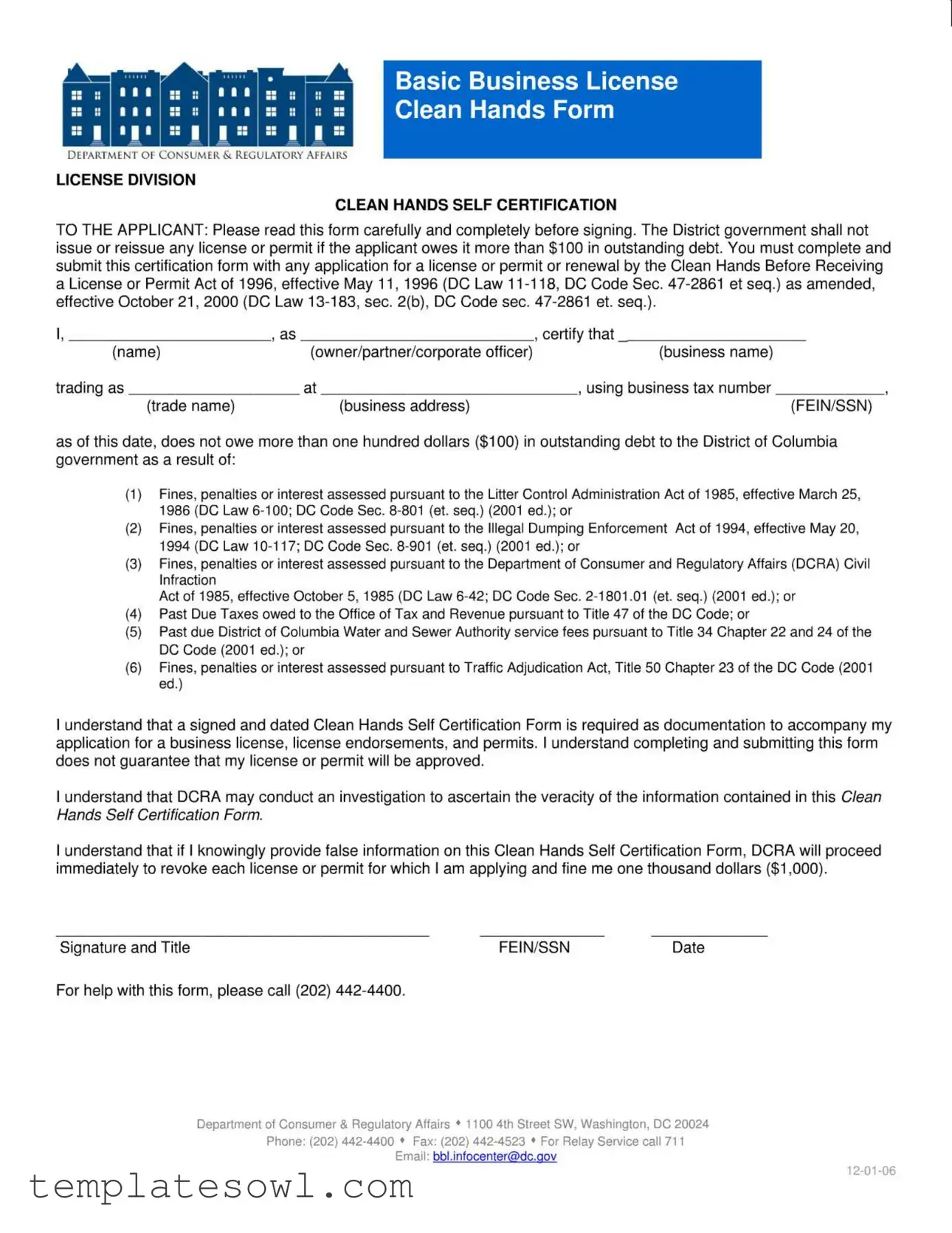

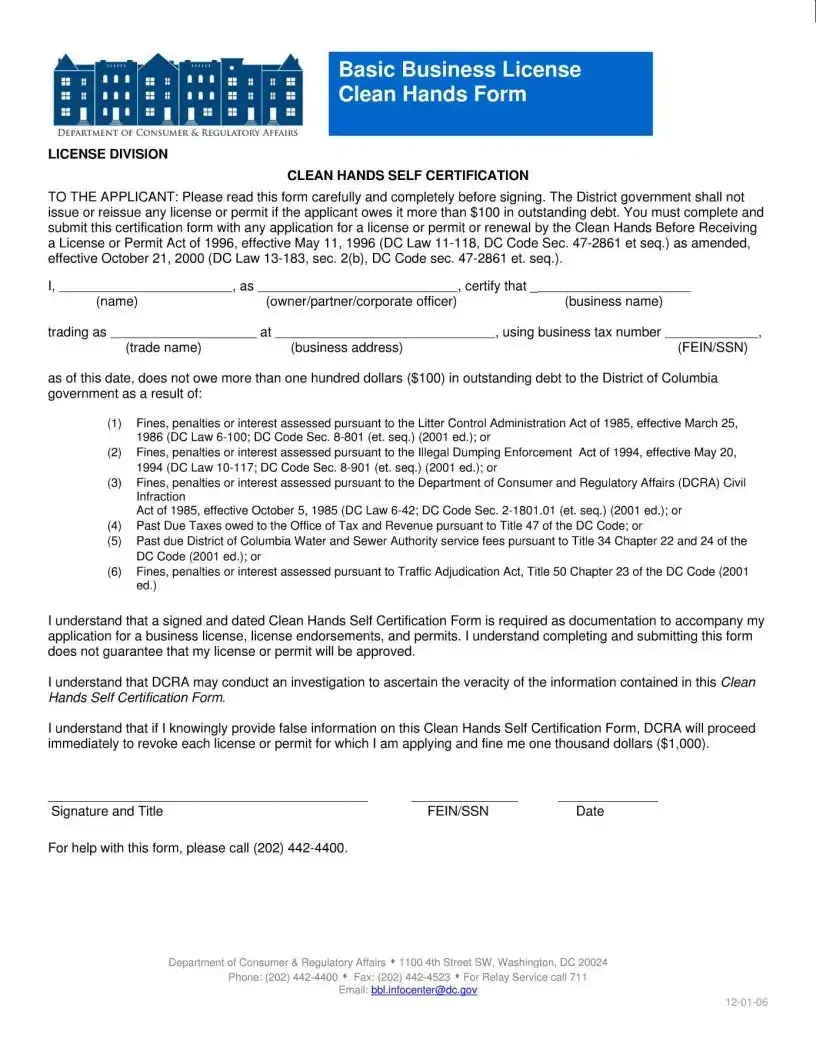

Fill Out Your Clean Hands Certification Form

When applying for any business license or permit in Washington, D.C., you will encounter the Clean Hands Certification form, a key requirement established to promote fiscal responsibility among applicants. This form is part of the Clean Hands Before Receiving a License or Permit Act of 1996, and it mandates that applicants verify they do not owe more than $100 in outstanding debt to the District of Columbia government. The debts in question may arise from various sources, including fines associated with litter control, illegal dumping, civil infractions, past due taxes, or service fees. Each applicant is required to complete and submit this certification form alongside their application or renewal request, affirming their compliance. It's essential to read the form thoroughly since providing false information can lead to serious penalties, including immediate revocation of licenses and heavy fines. Understanding the implications of this certification not only aids in smooth approval of licensing requests but also fosters accountability within the local business community.

Clean Hands Certification Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Form | This form certifies that the applicant does not owe more than $100 in outstanding debt to the District of Columbia government. |

| Governing Law | The form is governed by the Clean Hands Before Receiving a License or Permit Act of 1996, DC Law 11-118. |

| Outstanding Debt Limit | Applicants are ineligible for a license or permit if they owe more than $100 in debt. |

| Applicable Debts | The certification covers debts from fines, penalties, past due taxes, and service fees owed to the District. |

| Form Submission Requirement | A signed Clean Hands Self Certification Form must accompany business license and permit applications. |

| Investigation Disclaimer | DCRA may investigate the information provided in the certification to ensure its accuracy. |

| False Information Consequences | Providing false information can lead to license or permit revocations and a $1,000 fine. |

| Signature Requirement | The form must be signed and dated by the applicant for the certification to be valid. |

| Office Address | The form is submitted to the Department of Consumer & Regulatory Affairs at 1100 4th Street SW, Washington, DC 20024. |

Guidelines on Utilizing Clean Hands Certification

Completing the Clean Hands Certification form is an essential part of applying for or renewing certain licenses and permits in Washington, D.C. Before proceeding, make sure you have all relevant information ready, including your business details and applicable identification numbers. Follow these steps carefully to fill out the form correctly.

- Begin by reading the instructions on the form. Familiarize yourself with the requirements.

- Fill in your name in the designated space provided at the top of the form.

- Identify and write your title, whether you are the owner, partner, or corporate officer.

- Provide the business name you are trading under in the area labeled "trading as."

- Enter your business address. This should be the physical location of your business.

- Input your business tax number, which could be your FEIN or SSN based on your business type.

- Carefully read through the statements regarding outstanding debts to the District of Columbia government. Ensure you understand the implications.

- Confirm that you do not owe more than $100 in debt for the specified reasons. Check all relevant items.

- Sign and date the form in the designated area at the end. Ensure that all information is correct before signing.

- After completing the form, submit it along with your application for a business license or permit to the Department of Consumer & Regulatory Affairs at 1100 4th Street SW, Washington, DC 20024.

Review your submission for accuracy. Misrepresentation or inaccuracies could have serious consequences, including fines and revocation of your license. It's important to ensure everything is in order before you submit your application.

What You Should Know About This Form

What is the Clean Hands Certification form?

The Clean Hands Certification form is a requirement for individuals or businesses applying for a license, permit, or renewal in the District of Columbia. It certifies that the applicant does not owe more than $100 in outstanding debts to the District government. This includes debts from fines, penalties, past due taxes, or service fees. It aims to ensure accountability and compliance among businesses operating within the District.

Who needs to complete the Clean Hands Certification form?

Any individual or business owner seeking a business license or permit in the District of Columbia must complete this form. It applies to new applications, renewals, and endorsements. The requirement aims to ensure that applicants are in good standing with the District government before they can receive or renew a license.

What happens if I do not complete the Clean Hands Certification form?

If you fail to complete the Clean Hands Certification form, your application for a license or permit will not be processed. The Department of Consumer and Regulatory Affairs (DCRA) requires this form as part of the application package. Neglecting this requirement can lead to delays or denials in obtaining the necessary licensing to operate your business.

What are the consequences of providing false information on the form?

Providing false information on the Clean Hands Certification form can have serious consequences. If it is discovered that you knowingly submitted inaccurate data, DCRA will take immediate action. This includes revoking any licenses or permits granted and imposing a fine of $1,000. It is crucial to provide truthful and accurate information to avoid these penalties.

Common mistakes

Completing the Clean Hands Certification form can seem straightforward, yet many people overlook important details that can lead to delays or denials. One common mistake is failing to read the instructions thoroughly. The form includes specific requirements and clarifications that applicants must understand before attempting to fill it out. Skipping this step can result in missing crucial information and submitting an incomplete form.

An additional error often encountered is incorrect personal information. Applicants sometimes provide inaccurate names, titles, or business addresses. Minor spelling errors or incorrect numbers can lead to significant complications. It is important to double-check all entries for accuracy to avoid processing setbacks.

Another frequent oversight involves neglecting to sign and date the form. A valid signature is crucial for the certification to be accepted. Without this, the application will not proceed, and the applicant may face additional delays. This step is often rushed but should be given the attention it deserves.

Some individuals fail to verify their outstanding debts. Applicants may mistakenly believe they owe less than $100, only to discover later that they are ineligible. It is critical to check any outstanding fines or debts owed to the District of Columbia government prior to submitting the form. Only then can applicants certify that they meet the requirements.

Additionally, using the wrong business tax number can cause discrepancies in the application. The form asks for the business tax number, whether it is a FEIN or SSN. Making sure the number corresponds with what the government has on file is essential to avoid rejection of the application.

A lack of understanding about the Clean Hands Act can also lead to errors. Many people do not realize that even minor debts can impact their certification. The act encompasses a range of fines and fees, meaning applicants must be aware of all potential liabilities that could disqualify them.

Furthermore, applicants sometimes fail to keep a copy of the completed form for their own records. Having a record is important in case there are any questions or disputes later in the process. It provides proof of what has been submitted and the date of submission.

Applicants often confuse the Clean Hands Certification with other forms or permits, leading to errors in submission. It's essential to ensure that the right document is being filled out for the intended purpose. A mix-up in forms can lead to further complications and delays.

One last mistake is ignoring the warning regarding false information. Some may take this lightly, thinking it won’t matter. However, providing false information can result in hefty fines and immediate revocation of licenses or permits. The potential consequences highlight the importance of honesty and accuracy in the application process.

Documents used along the form

The Clean Hands Certification form is an essential part of the licensing process in the District of Columbia. Several other forms and documents accompany it to ensure compliance with regulations. Below is a list of related documents that individuals may encounter when applying for a business license or permit.

- Basic Business License Application: This is the primary form required to initiate the application for a business license. It collects essential information about the business, including its purpose, structure, and ownership details.

- Partnership Agreement: If the business is a partnership, this document outlines the roles and responsibilities of each partner. It is critical for clarifying obligations and profit-sharing arrangements.

- Corporate Bylaws: For businesses structured as corporations, this set of rules governs the corporation's operations. Bylaws typically cover management, duties of officers, and procedures for meetings.

- Tax Clearance Certificate: This certificate confirms that a business has no outstanding tax obligations to the District of Columbia. It must be submitted to show fiscal responsibility and compliance with tax regulations.

- Occupancy Permit: Before beginning operations, businesses may need an occupancy permit that verifies the locality complies with zoning laws and building regulations. This document indicates that the space is suitable for the intended use.

- Employee Identification: Businesses must provide identification documents for employees, ensuring compliance with labor laws and regulations. This usually includes verification of eligibility to work in the U.S.

These documents play a crucial role in the licensing process. Each serves a specific purpose to ensure compliance with local laws and to protect both the business and its consumers.

Similar forms

The Clean Hands Certification form serves an important purpose in ensuring that individuals or entities fulfill their financial obligations to the District of Columbia before obtaining licenses or permits. It is similar to several other documents required in various regulatory contexts. Below are eight documents that share similarities with the Clean Hands Certification form, highlighting their purposes and functions:

- Business License Application: This document collects necessary information about the business and certifies that the applicant meets all legal requirements before a business can operate. Like the Clean Hands form, it includes checks for compliance with financial responsibilities.

- Tax Clearance Certificate: This certificate confirms that a business or individual has paid all necessary taxes owed. The evaluation of outstanding debts is a primary concern, similar to the provisions of the Clean Hands Certification.

- Occupational License Form: Required for specific professions, this form also mandates that applicants prove they are in good financial standing regarding relevant fines or fees. It mirrors the Clean Hands Certification's debt verification process.

- Permit Application: Just as the Clean Hands form is required for license applications, this application demands financial compliance checks to ensure all applicable fines or fees have been addressed before granting access to operate in particular sectors.

- Lease Agreement: Landlords often require potential tenants to submit a form that includes a certification of good financial standing. This helps landlords mitigate risks, much like how the Clean Hands form helps the government ensure compliance.

- Vendor Registration Form: Businesses seeking to work with government entities must often present proof of financial responsibility. This requirement aligns with the Clean Hands Certification, ensuring that no debts are owed to the governing body.

- Certification of Good Standing: This document is used by corporations to confirm that they are in compliance with all relevant laws and regulations, including financial obligations. It serves a similar verification function as the Clean Hands Certification.

- Professional License Renewal Application: Professionals must often submit documents ensuring they have no outstanding debts or penalties when renewing their licenses. Similarly, the Clean Hands Certification assesses compliance before licensing is issued or renewed.

It is essential to recognize these documents' interconnected relevance, especially for businesses aiming to navigate regulatory requirements smoothly.

Dos and Don'ts

When filling out the Clean Hands Certification form, here are some important things to keep in mind.

- Do read the entire form carefully before starting.

- Do ensure that all personal and business information is accurate and complete.

- Do verify that you do not owe more than $100 in outstanding debt to the District government.

- Do include your business tax number and FEIN/SSN.

- Do sign and date the form before submitting it.

- Don’t ignore any section of the form; every part is important.

- Don’t provide false information, as it can lead to severe penalties.

- Don’t submit the form without reviewing it thoroughly.

- Don’t assume that submission guarantees approval of your license or permit.

Following these guidelines can help ensure a smooth application process.

Misconceptions

Many people have misconceptions about the Clean Hands Certification form, which can lead to confusion when applying for permits or licenses. Here are five common misconceptions:

- It guarantees approval of my license or permit. Completing the form does not assure that your application will be approved. It merely confirms that you meet the requirement of not owing more than $100 in outstanding debts to the District.

- Only certain types of businesses need this certification. In truth, all applicants for a business license, including renewals and endorsements, must submit this form, regardless of the nature of their business.

- My debts will not affect my license application. This is incorrect. If you owe more than $100 to the District, your application may be denied. It is crucial to settle any outstanding debts before applying.

- Only fines and penalties are considered outstanding debts. Aside from fines, the form also accounts for past due taxes and unpaid utility fees. All debts owed to the District must be clear for your application to proceed.

- Submitting the form is a one-time requirement. This is a misconception. You need to provide the Clean Hands Certification with each application or renewal, as the situation concerning debts can change.

Understanding these misconceptions can help streamline the application process and ensure compliance with the law.

Key takeaways

When completing the Clean Hands Certification form, there are several important points to keep in mind to ensure a smooth application process for your business license or permit.

- Understand the Requirements: This form is mandatory for anyone applying for a business license, permit, or renewal in Washington, D.C. Ensure you meet the requirements before proceeding.

- Check Your Debt Status: The District government will not issue a license or permit if you owe more than $100 in outstanding debt. This includes fines, penalties, or any past due fees.

- Provide Accurate Information: When filling out the form, double-check that all the information you provide, such as your business name and address, is correct and up to date.

- Signature Matters: A signed and dated Clean Hands Self Certification Form is essential. This signature verifies the truthfulness of the information presented.

- Be Aware of Investigations: The DCRA may conduct an investigation to confirm the accuracy of the details provided in your application, so honesty is crucial.

- Know the Consequences: If false information is supplied on the form, not only can your application be denied, but you could also face a fine of up to $1,000 and have licenses revoked.

By keeping these takeaways in mind, you can navigate the application process more effectively and ensure compliance with local regulations.

Browse Other Templates

Sf-50 Form - It provides a snapshot of an employee's career progression within the federal system.

Visitor Privileges Application,Inmate Visitation Approval Form,Florida Visitation Privileges Request,Request for Inmate Visiting Rights,Inmate's Visitor Information Form,Application for Inmate Visit Approval,Florida Department of Corrections Visitor - The application is designed to ensure the safety and security of all involved.

What Is Business Debt Schedule - Clarity in business debts can foster confidence from lenders and investors alike.