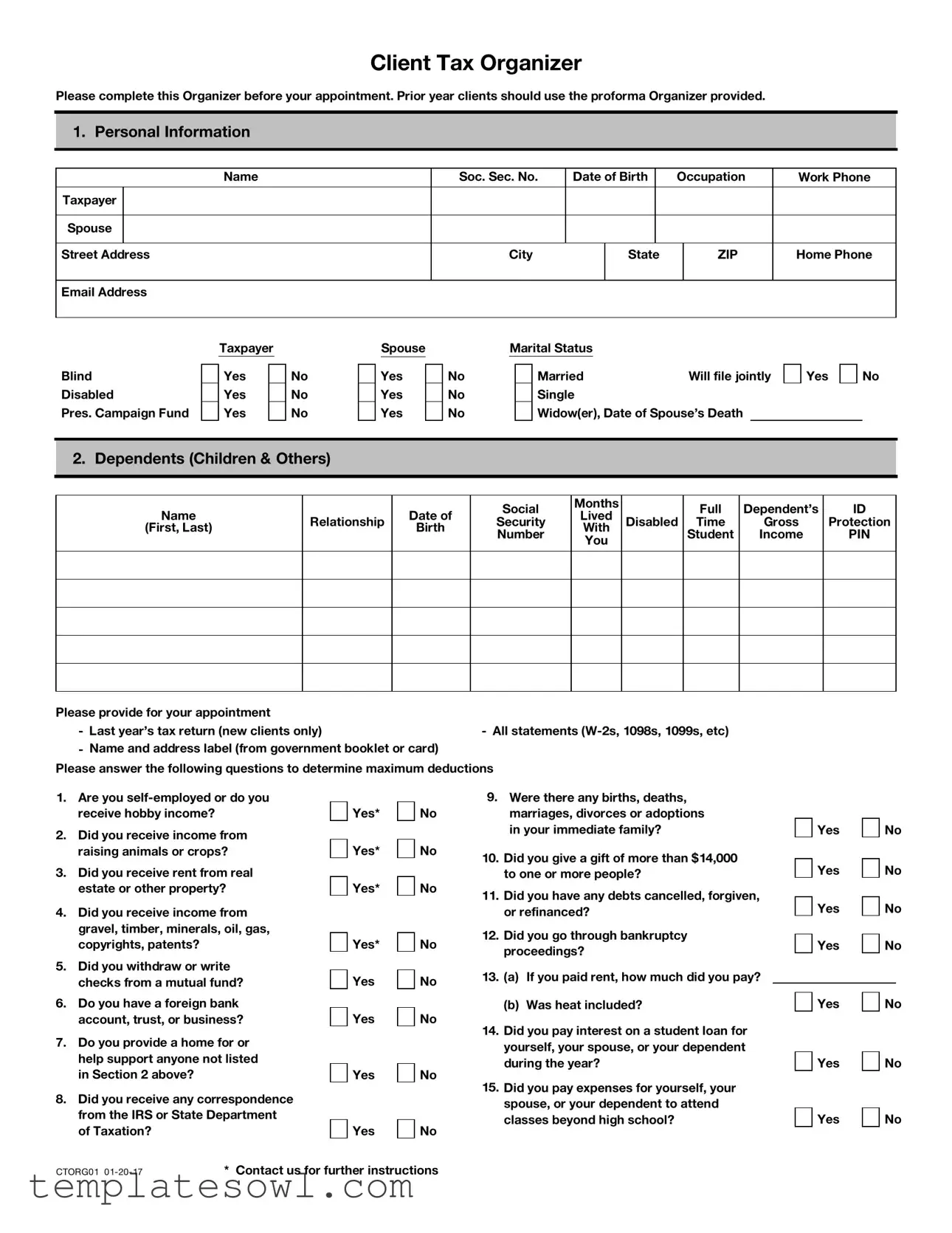

Fill Out Your Client Tax Organizer Form

The Client Tax Organizer form serves as an essential tool for taxpayers preparing for their tax appointment. By gathering important personal information such as names, Social Security numbers, and contact details, this form helps establish a clear understanding of the taxpayer's circumstances. It requires details about dependents, including their relationships and income specifics, ensuring every potential deduction is considered. The Organizer also prompts critical questions regarding various income sources, including self-employment and rental income, as well as potential deductions for medical expenses, charitable contributions, and education costs. Additionally, it inquires about tax-related events like bankruptcy or identity theft, enhancing the accuracy of the tax return. Gathering these details not only streamlines the tax preparation process but significantly increases the likelihood of maximizing eligible deductions and credits. Clients are advised to attach relevant documents, such as W-2s and previous tax returns, to facilitate a comprehensive review. Completing this form before your appointment helps tax professionals provide tailored advice and support, allowing you to navigate the complexities of tax season with confidence.

Client Tax Organizer Example

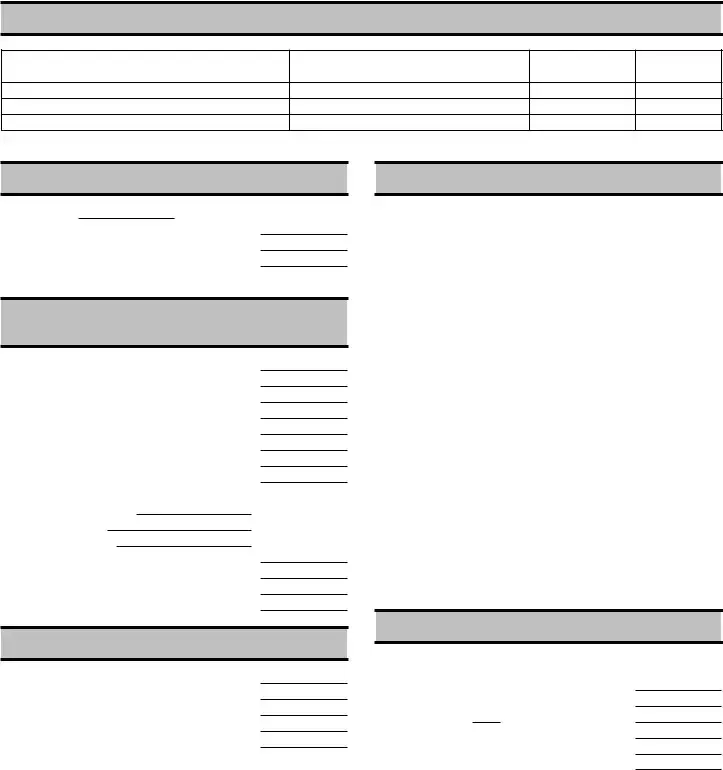

Client Tax Organizer

Please complete this Organizer before your appointment. Prior year clients should use the proforma Organizer provided.

1. Personal Information

|

Name |

Soc. Sec. No. |

Date of Birth |

|

Occupation |

Work Phone |

||

|

|

|

|

|

|

|

|

|

Taxpayer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address |

City |

|

State |

|

ZIP |

Home Phone |

||

|

|

|

|

|

|

|

|

|

Email Address

Blind

Disabled

Pres. Campaign Fund

Taxpayer

Yes

Yes

Yes

No

No

No

Spouse

Yes

Yes

Yes

|

Marital Status |

|

||

No |

|

|

Married |

Will file jointly |

|

|

|||

No |

|

|

Single |

|

No |

|

|

Widow(er), Date of Spouse's Death |

|

Yes

No

2. Dependents (Children & Others)

Name

(First, Last)

Relationship

Date of

Birth

Social

Security

Number

Months

Lived

With

You

Disabled

Full

Time

Student

Dependent's

Gross

Income

ID

Protection

PIN

Please provide for your appointment

- |

Last year's tax return (new clients only) |

- All statements |

- |

Name and address label (from government booklet or card) |

|

Please answer the following questions to determine maximum deductions

1.Are you

2.Did you receive income from raising animals or crops?

3.Did you receive rent from real estate or other property?

4.Did you receive income from gravel, timber, minerals, oil, gas, copyrights, patents?

5.Did you withdraw or write checks from a mutual fund?

6.Do you have a foreign bank account, trust, or business?

7.Do you provide a home for or help support anyone not listed in Section 2 above?

8.Did you receive any correspondence from the IRS or State Department of Taxation?

Yes*

Yes*

Yes*

Yes*

Yes

Yes

Yes

Yes

No

No

No

No

No

No

No

No

9.Were there any births, deaths, marriages, divorces or adoptions in your immediate family?

10.Did you give a gift of more than $14,000 to one or more people?

11.Did you have any debts cancelled, forgiven, or refinanced?

12.Did you go through bankruptcy proceedings?

13.(a) If you paid rent, how much did you pay?

(b)Was heat included?

14.Did you pay interest on a student loan for yourself, your spouse, or your dependent during the year?

15.Did you pay expenses for yourself, your spouse, or your dependent to attend classes beyond high school?

|

Yes |

No |

|

|

Yes |

No |

|

|

Yes |

No |

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|

Yes |

No |

|

|

Yes |

No |

|

CTORG01 |

* Contact us for further instructions |

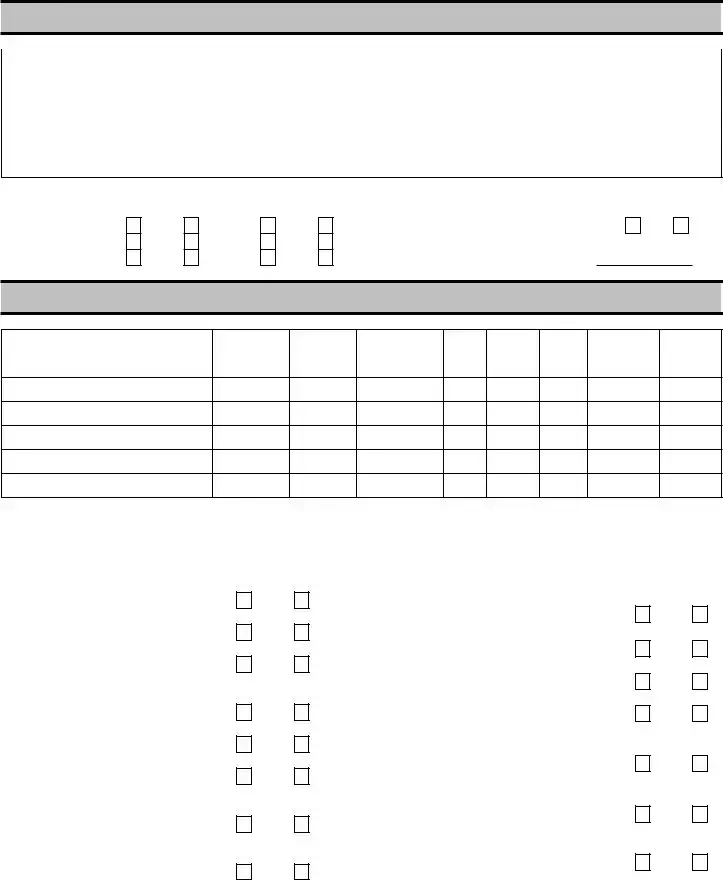

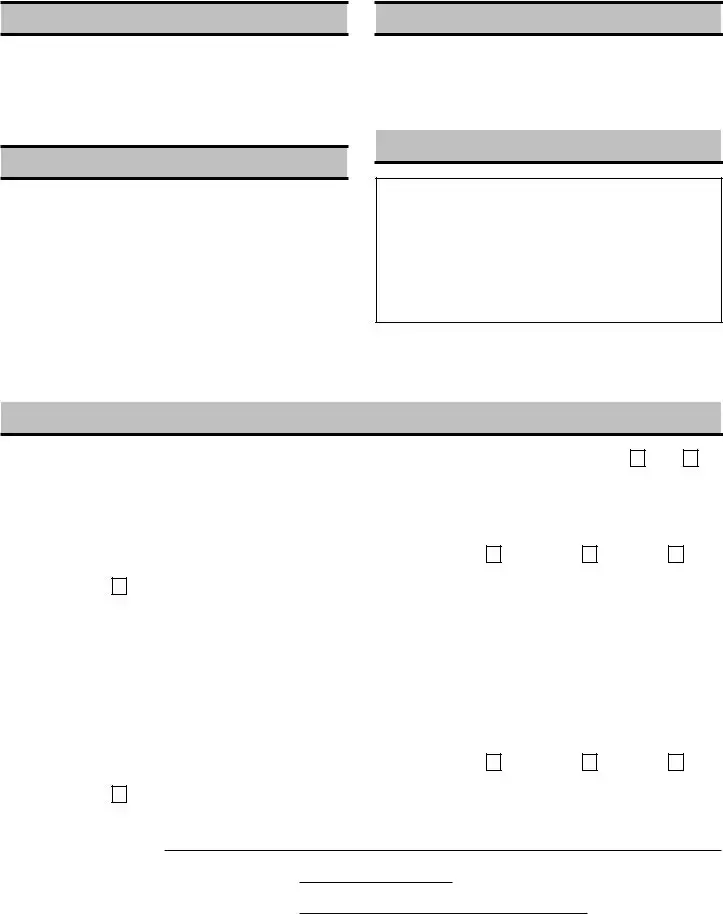

16. Did you have healthcare coverage (health |

|

|

|

|

insurance) for you, your spouse and |

|

|

|

|

dependents during this tax season? If yes, |

|

Yes |

|

No |

include Forms |

|

|

|

|

17.Did you apply for an exemption through the Marketplace /Exchange? If so, provide the exemption certificate number.

18.Did you have any children under the age of

19 or 19 to 23 year old students with |

|

Yes |

|

No |

unearned income of more than $1050? |

|

|

||

|

|

|

|

19.Did you purchase a new alternative technology vehicle or electric vehicle?

20.Did you install any energy property to your residence such as solar water heaters, generators or fuel cells or energy efficient improvements such as exterior doors or windows, insulation, heat pumps, furnaces, central air conditioners or water heaters ?

21.Did you own $50,000 or more in foreign financial assets?

Yes

Yes

Yes

No

No

No

3. Wage, Salary Income

Attach |

|

Employer |

Taxpayer Spouse |

22.Have you or your spouse been a victim of identity theft and given an identity theft protection PIN by the IRS? If yes, enter the six digit identity protection PIN number.

TaxpayerSpouse

4. Interest Income

Attach |

|

Payer |

Amount |

Tax Exempt

5. Dividend Income

From Mutual Funds & Stocks - Attach |

|

||

|

|

Capital |

Non- |

Payer |

Ordinary |

Gains |

Taxable |

7. Property Sold

Attach

Property |

Date Acquired |

Cost & Imp. |

|

|

|

Personal Residence* |

|

|

Vacation Home |

|

|

Land |

|

|

Other |

|

|

*Provide information on improvements, prior sales of home, and cost of a new residence. Also see Section 17

8. I.R.A. (Individual Retirement Acct.)

Contributions for tax year income |

|

|

|

|

U for |

||||

|

|

|

|

|

|

|

|

||

|

Amount |

Date |

Roth |

||||||

|

|

|

|||||||

Taxpayer |

|

|

|

|

|

|

|

|

|

Spouse |

|

|

|

|

|

|

|

|

|

Amounts withdrawn. Attach |

|

|

|

|

|

|

|||

Plan |

|

Reason for |

|

|

|

|

|

|

|

Trustee |

|

Withdrawal |

|

|

Reinvested? |

||||

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. Pension, Annuity Income

6. Partnership, Trust, Estate Income

List payers of partnership, limited partnership,

CTORG02

Attach |

Reason for |

Payer* |

Withdrawal |

|

|

|

|

|

|

|

|

|

|

*Provide statements from employer or insurance company with information on cost of or contributions to plan.

Did you receive: |

|

Taxpayer |

|

|

|

|

|

|

|

Social Security Benefits |

|

Yes |

|

No |

Railroad Retirement |

|

Yes |

|

No |

Attach SSA 1099, RRB 1099 |

|

|

|

|

Reinvested?

Yes |

|

No |

Yes |

|

No |

Yes |

|

No |

Yes |

|

No |

Spouse |

|

|

|

|

|

Yes |

|

No |

Yes |

|

No |

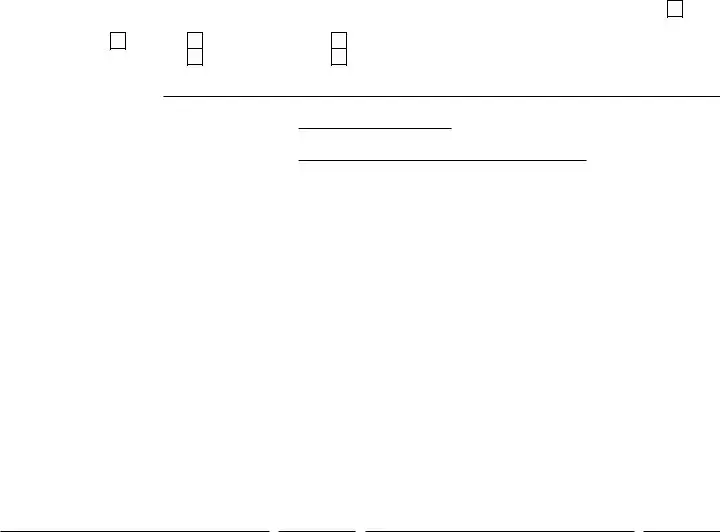

10. Investments Sold

Stocks, Bonds, Mutual Funds, Gold, Silver, Partnership interest - Attach

Investment |

|

|

Date Acquired/Sold |

Cost |

Sale Price |

|

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. Other Income

List All Other Income (including

Alimony Received Child Support Scholarship (Grants)

Unemployment Compensation (repaid) Prizes, Bonuses, Awards

Gambling, Lottery (expenses) Unreported Tips

Director / Executor's Fee Commissions

Jury Duty

Worker's Compensation Disability Income Veteran's Pension

Payments from Prior Installment Sale State Income Tax Refund

Other

Other

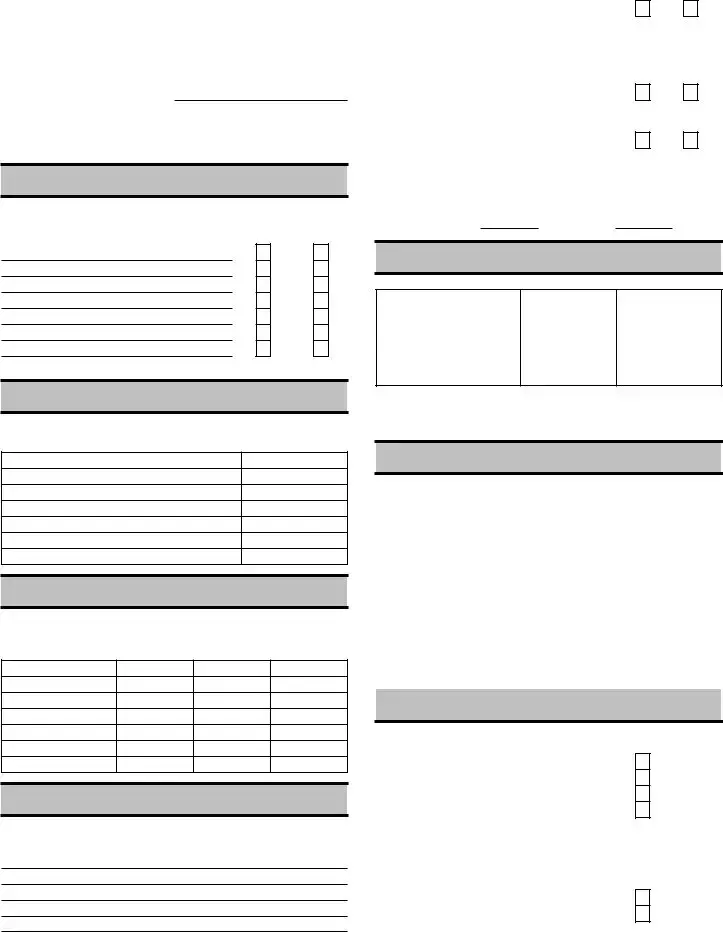

12. Medical/Dental Expenses

Medical Insurance Premiums (paid by you)

Prescription Drugs Insulin Glasses, Contacts Hearing Aids, Batteries Braces

Medical Equipment, Supplies Nursing Care

Medical Therapy Hospital Doctor/Dental/Orthodontist Mileage (no. of miles)

13. Taxes Paid

Real Property Tax (attach bills)

Personal Property Tax

Other

14. Interest Expense

Mortgage interest paid (attach 1098) Interest paid to individual for your home (include amortization schedule)

Paid to: Name Address

Social Security No.

Investment Interest

Premiums paid or accrued for qualified mortgage insurance

15. Casualty/Theft Loss

For property damaged by storm, water, fire, accident, or stolen. Location of Property

Description of Property

Other |

Federally Declared |

|

Disaster Losses |

||

|

Amount of Damage

Insurance Reimbursement

Repair Costs

Federal Grants Received

16. Charitable Contributions

Other

Church

United Way

Scouts

Telethons

University, Public TV/Radio

Heart, Lung, Cancer, etc.

Wildlife Fund

Salvation Army, Goodwill

Other

Volunteer (no. of miles) |

|

@ .14 |

$0.00 |

CTORG03

17. Child & Other Dependent Care Expenses

Name of Care Provider

Address

Soc. Sec. No. or

Employer ID

Amount

Paid

Also complete this section if you receive dependent care benefits from your employer.

18.

Date of move

Move Household Goods

Lodging During Move

Travel to New Home (no. of miles)

19.Employment Related Expenses That You Paid (Not

Dues - Union, Professional Books, Subscriptions, Supplies Licenses

Tools, Equipment, Safety Equipment Uniforms (include cleaning)

Sales Expense, Gifts Tuition, Books (work related) Entertainment

Office in home:

In Square a) Total home

Feet b) Office c) Storage

Rent Insurance Utilities Maintenance

20.

Tax Preparation Fee

Safe Deposit Box Rental

Mutual Fund Fee

Investment Counselor

Other

21. Business Mileage

Do you have written records? |

|

Yes |

|

No |

|

Did you sell or trade in a car used |

|

|

|

|

|

for business? |

|

Yes |

|

No |

|

If yes, attach a copy of purchase agreement |

|

|

|

|

|

Make/Year Vehicle |

|

|

|

|

|

Date purchased |

|

|

|

|

|

Total miles (personal & business) |

|

|

|

|

|

Business miles (not to and from work) |

|

|

|

|

|

From first to second job |

|

|

|

|

|

Education (one way, work to school) |

|

|

|

|

|

Job Seeking |

|

|

|

|

|

Other Business |

|

|

|

|

|

Round Trip commuting distance |

|

|

|

|

|

Gas, Oil, Lubrication |

|

|

|

|

|

Batteries, Tires, etc. |

|

|

|

|

|

Repairs |

|

|

|

|

|

Wash |

|

|

|

|

|

Insurance |

|

|

|

|

|

Interest |

|

|

|

|

|

Lease payments |

|

|

|

|

|

Garage Rent |

|

|

|

|

|

22. Business Travel

If you are not reimbursed for exact amount, give total expenses.

Airfare, Train, etc.

Lodging

Meals (no. of days )

Taxi, Car Rental

Other

Reimbursement Received

CTORG04

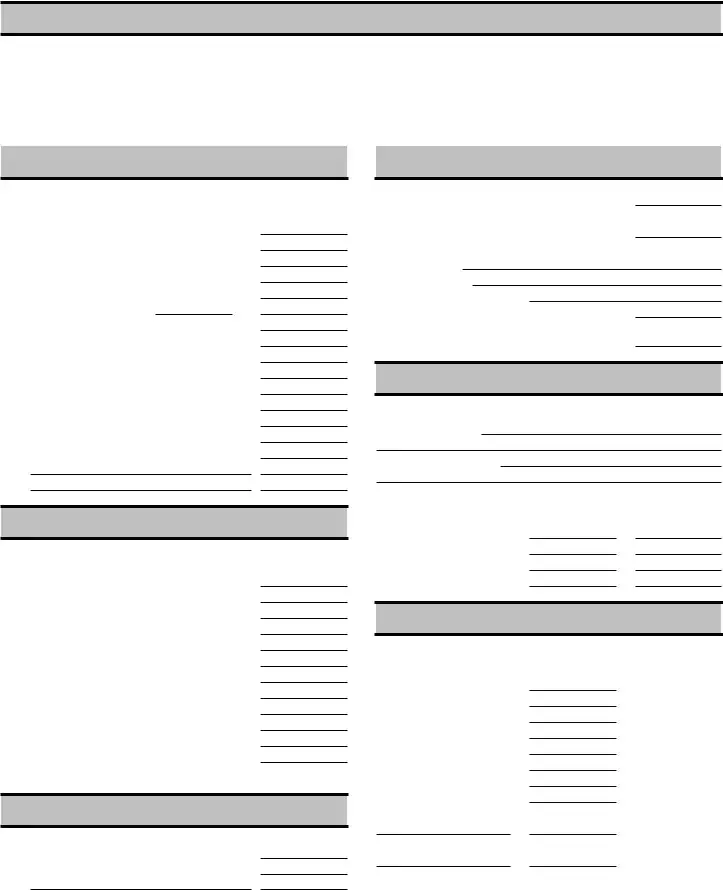

23. Estimated Tax Paid

Due Date |

Date Paid |

Federal |

State |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24. Other Deductions

Alimony Paid to |

|

|

|

|

|

Social Security No. |

|

|

$ |

|

|

Student Interest Paid |

$ |

|

|||

Health Savings Account Contributions |

$ |

|

|||

Archer Medical Savings Acct. Contributions |

$ |

|

|||

|

|

|

|

|

|

25. Education Expenses

Student's Name |

Type of Expense |

Amount |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26. Questions, Comments, & Other Information

Residence: |

|

|

|

|

||

Town |

|

|

County |

|

||

Village |

|

|

School District |

|

||

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

27. Direct Deposit of Refund / or Savings Bond Purchases

Would you like to have your refund(s) directly deposited into your account?

(The IRS will allow you to deposit your federal tax refund into up to three different accounts. If so, please provide the following information.)

Yes

No

ACCOUNT 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owner of account |

|

|

|

|

|

|

|

|

Taxpayer |

Spouse |

Joint |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type of account |

MyRA |

|

Checking |

|

Traditional Savings |

|

|

Traditional IRA |

|

Roth IRA |

||||

Name of financial institution |

|

|

Archer MSA Savings |

|

Coverdell Education Savings |

|

|

HSA Savings |

|

SEP IRA |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Financial Institution Routing Transit Number (if known) |

|

|

|

|

|

|

|

|

|

|

||||

Your account number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACCOUNT 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owner of account |

|

|

|

|

|

|

|

|

Taxpayer |

Spouse |

Joint |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Type of account |

MyRA |

|

Checking |

|

Traditional Savings |

|

|

Traditional IRA |

|

Roth IRA |

||||

|

|

|

|

Archer MSA Savings |

|

Coverdell Education Savings |

|

|

HSA Savings |

|

SEP IRA |

|||

Name of financial institution

Financial Institution Routing Transit Number (if known)

Your account number

CTORG05

ACCOUNT 3 Owner of account Type of account

MyRA

Checking

Archer MSA Savings

|

|

|

Taxpayer |

|

Spouse |

|||

|

|

|

|

|

|

|

||

Traditional Savings |

|

|

Traditional IRA |

|

||||

Coverdell Education Savings |

|

|

HSA Savings |

|

||||

Joint

Roth IRA SEP IRA

Name of financial institution

Financial Institution Routing Transit Number (if known)

Your account number

Would you like to purchase Series I Savings bonds with a portion of your refund? If so, please answer the following:

Amount used for bond purchases for yourself (and spouse if filing jointly). |

|

|

|

|

|

|

Amount used to buy bonds for someone else (or yourself only or spouse only if filing jointly). |

|

|

|

|

||

|

|

|

|

|||

Owner's name |

X if name is for |

Bond purchase Amount |

||||

|

name if applicable |

a beneficiary |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To the best of my knowledge the information enclosed in this client tax organizer is correct and includes all income, deductions, and other information necessary for the preparation of this year's income tax returns for which I have adequate records.

Taxpayer |

Date |

Spouse |

Date |

CTORG06

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Client Tax Organizer helps clients collect necessary information before a tax appointment, ensuring a streamlined process. |

| Required Information | Clients must provide personal details, dependent information, and various income sources, along with documents like W-2s and other relevant forms. |

| Tax Filing Status | Clients indicate their marital status and intended filing method, such as joint or single filing, which impacts tax calculations. |

| Dependent Details | Information about dependents must include names, relationships, and Social Security numbers, crucial for claiming deductions. |

| State-Specific Requirements | Solely for states like California, adherence to state tax laws concerning personal exemptions and deductions is essential. |

| Healthcare Coverage | Clients must clarify healthcare coverage for themselves and their dependents, including required documentation like Forms 1095-A, 1095-B, and 1095-C. |

Guidelines on Utilizing Client Tax Organizer

Completing the Client Tax Organizer form is an essential step in ensuring accurate tax preparation. It collects important personal, financial, and dependent information necessary for your tax filings. Before you begin filling it out, gather relevant documents such as last year’s tax return and income statements. By following these steps, you can ensure that your information is complete and ready for your appointment.

- Personal Information: Fill out your name, Social Security number, date of birth, occupation, work phone, street address, city, state, ZIP code, home phone, and email address. Indicate if either you or your spouse are blind or disabled. Mark your marital status and whether you will file jointly.

- Dependents: List the names, relationships, dates of birth, Social Security numbers, and months lived with you for each dependent. Note if they are disabled or full-time students and provide any income or ID Protection PIN if applicable.

- Documents: Prepare to bring last year’s tax return and all relevant income statements, such as W-2s and 1099s, to your appointment.

- Questions for Deductions: Answer the provided questions about income sources and any changes in your family, including births, deaths, or divorces. Your responses will help determine maximum deductions.

- Income Details: Report wages and salary by attaching W-2s. Include any interest, dividends, or other income with the appropriate supporting documents like 1099 forms.

- Other Income Sources: List various types of income you received, including alimony, child support, or unemployment compensation.

- Medical and Dental Expenses: Track and input your medical insurance premiums, prescription costs, and any significant medical expenses incurred.

- Tax Paid: Document any real property tax, personal property tax, or other taxes paid throughout the year.

- Expenses: Enter information regarding necessary expenses, including job-related costs, investment-related fees, or business travel if applicable.

- Educational Expenses: Provide details on education-related expenses for dependents, including type and amount paid.

- Direct Deposit: If you prefer, fill out the required bank information for the direct deposit of your refund or savings bond purchases.

By carefully following these steps, you can complete the Client Tax Organizer form efficiently. This initiative is an important part of the tax preparation process, ensuring that every detail relevant to your financial situation is captured accurately.

What You Should Know About This Form

What is the purpose of the Client Tax Organizer form?

The Client Tax Organizer form is designed to help taxpayers gather the necessary information needed for tax preparation. Completing this form before your appointment ensures that your tax preparer has all the relevant information to maximize your deductions and credits. It serves as a comprehensive checklist that covers personal information, income sources, deductions, and other essential details that will help in accurately filing your tax return.

Who needs to fill out the Client Tax Organizer?

All clients who are preparing for their tax appointment should complete the Client Tax Organizer. This includes both new clients and returning clients. Previous clients should use the proforma Organizer provided to ensure they include all relevant updates and changes from the past year.

What information is required in the Personal Information section?

In the Personal Information section, you will need to provide your name, Social Security number, date of birth, occupation, work phone number, and other contact details. If applicable, you should also include information about your spouse, such as their name and Social Security number. This information is vital for accurately reporting your taxes and verifying your identity with tax authorities.

What should I bring to the appointment along with the completed Organizer?

When you attend your appointment, please bring last year's tax return if you are a new client. Additionally, gather all income statements, such as W-2s, 1098s, and 1099s. Providing these documents will facilitate a more efficient tax preparation process and will ensure that your preparer has all necessary information at their disposal.

Why do I need to provide Social Security numbers for my dependents?

Social Security numbers for dependents are crucial for accurately claiming them on your tax return. This information is used by the IRS to verify the qualifications for deductions and credits related to dependents, such as the Child Tax Credit. Failing to provide this information could result in delays or issues with your tax filing.

What types of income are important to report in the Organizer?

The Organizer covers various types of income that should be reported, including wages, self-employment income, rental income, interest, dividends, and any other income sources. It is essential to fully disclose all forms of income to avoid potential issues or audits by tax authorities.

How do I know if I qualify for any deductions or credits?

The questions in the Organizer are designed to help identify potential deductions or credits you may qualify for. Areas include self-employment income, student loan interest payments, childcare expenses, and medical expenses. Reviewing these sections thoroughly before your appointment will help maximize your tax benefits.

What if I have recently experienced a major life change, like marriage or divorce?

Major life changes can significantly impact your tax situation. Be sure to indicate any changes, such as births, deaths, marriages, or divorces, in the Organizer. Your tax preparer will take these factors into consideration to ensure your tax return accurately reflects your current circumstances.

Do I need to report health insurance information in the Organizer?

Yes, it is essential to provide information regarding your healthcare coverage in the Organizer, including any Forms 1095-A, 1095-B, or 1095-C you may have received. Health insurance information can affect your eligibility for specific tax credits and penalties, making it an important element of your tax filing.

What should I do if I have lost my Social Security card?

If you have lost your Social Security card, you can still indicate your Social Security number on the Organizer. However, it is recommended that you apply for a replacement card to prevent complications with your tax filing and to keep your personal information secure. You may contact the Social Security Administration for guidance on obtaining a new card.

Common mistakes

Filling out the Client Tax Organizer form can be a daunting task, and mistakes can easily happen. One common error is failing to provide complete personal information. Individuals might overlook filling in their full name, Social Security number, or date of birth. This information is crucial for the tax filing process, and leaving any section blank can delay the preparation of taxes or, worse, lead to penalties. Always double-check each entry to ensure accuracy.

Another frequent mistake involves incorrectly listing dependents. People sometimes provide insufficient information about their dependents, such as missing Social Security numbers or not specifying the correct relationship. An incomplete listing can complicate claims for credits and deductions related to dependents. To avoid problems, verify every dependent's details, including dates of birth and living arrangements, before submitting the form.

Many also forget to include necessary documents alongside the form. Common omissions include W-2s, 1099s, or prior year tax returns. Not having these documents can hinder effective tax preparation and may even require individuals to file for extensions. It's best to gather all necessary paperwork well in advance of the appointment to ensure a smoother filing process.

Additionally, some clients do not answer all the questions provided in the organizer. Sections asking about self-employment income, healthcare coverage, and other potential deductions are often ignored, leading to missed opportunities for tax savings. Each question is designed to extract vital information necessary for maximizing deductions. Therefore, answering every question is essential.

Finally, individuals may neglect to indicate their preference for direct deposit or savings bond purchases. This oversight can affect how quickly they receive their tax refunds. Checking the appropriate boxes helps ensure faster, more convenient processing of any refunds owed from the tax filings. Ensuring these details are correct can make a significant difference in the taxpayer's experience.

Documents used along the form

The Client Tax Organizer is a key document for anyone preparing their taxes. To ensure a smooth and successful filing process, there are several other important forms and documents that are typically used in conjunction with this organizer. Each of these forms serves a specific purpose and helps gather necessary information for tax preparation.

- W-2 Form: This form is provided by employers to report annual wages and the taxes withheld from employee paychecks. It is essential for accurately reporting income.

- 1099 Forms: These forms report income from sources other than regular employment, such as freelance work, dividends, or interest. Common types include 1099-MISC and 1099-INT.

- Schedule A: This form is used to itemize deductions, such as medical expenses, mortgage interest, and charitable contributions. It can potentially lower your taxable income significantly.

- Form 1040: This is the main individual income tax form used in the United States. It's where taxpayers report their income, deductions, and tax liability.

- Schedule C: Self-employed individuals use this form to report income or loss from their business. It details expenses and net profit or loss.

- Form 1098: This document is used to report mortgage interest paid, which may be deductible. It's important for homeowners to keep track of this information.

- Form 8862: Taxpayers who have previously been denied the Earned Income Tax Credit must use this form to qualify for the credit in future tax years.

Gathering these forms will help present a complete financial picture to your tax preparer, ensuring you claim all deductions and credits available to you. Proper documentation leads to a smoother filing process and can maximize your potential refund.

Similar forms

- Tax Preparation Checklist: This document helps clients gather necessary information for their tax preparation. Like the Client Tax Organizer, it prompts clients to collect financial documents, ensuring nothing is overlooked.

- Personal Financial Statement: A personal financial statement outlines a client’s financial position, listing assets and liabilities. Similar to the Client Tax Organizer, it provides a comprehensive view of one’s financial situation.

- Income and Expense Report: This report tracks all sources of income and expenses for a specific period. Both documents help individuals analyze their financial health, making it easier to file taxes accurately.

- Form 1040: This is the standard federal income tax form used by individuals. The Client Tax Organizer collects the necessary details that will be reported on the 1040, ensuring proper completion.

- W-2 Form: The W-2 form provides details on wages and taxes withheld. It is crucial for tax filing, much like the Client Tax Organizer, which helps clients organize this information ahead of time.

- 1099 Forms: These forms report various types of income outside of regular employment. The Client Tax Organizer captures this income, encouraging clients to gather related documents before their appointment.

- Tax Deduction Guide: This guide outlines eligible expenses that can be deducted when filing taxes. Both documents serve to inform clients and maximize their tax benefits.

- Client Intake Form: This initial form collects personal information necessary for providing services. Similar to the Client Tax Organizer, it gathers foundational knowledge to streamline the process.

- Financial Statement for Business Owners: For self-employed individuals, this document summarizes the financial activities of their businesses. Both forms assist in organizing financial information crucial for tax filings.

Dos and Don'ts

Filling out the Client Tax Organizer form can feel overwhelming, but with a few tips, you can make the process smoother. Here’s a list of things to consider when preparing this form:

- Do read through the entire form before you start, so you understand what information is needed.

- Do provide accurate personal information to avoid delays in processing your tax return.

- Do gather all necessary documents, such as W-2s and 1099s, before filling out the form.

- Do answer all questions honestly and thoroughly to ensure you qualify for the right deductions.

- Do double-check your Social Security Number and other identifying information for accuracy.

- Don't skip questions, even if they seem irrelevant; they might impact your tax return.

- Don't rush through the form. Take your time to provide clear and complete answers.

- Don't provide estimates where exact figures are required; this can lead to issues later.

- Don't forget to sign and date the form once you've completed it.

- Don't ignore the importance of organizing your documents; it saves time in the long run.

Misconceptions

Understanding the Client Tax Organizer form can be challenging, and there are several misconceptions that people often have about it. Here’s a breakdown of eight common misunderstandings.

- It’s Optional for Returning Clients: Many think that returning clients can skip the Organizer if they filed previously. However, prior year clients are encouraged to use the proforma Organizer provided for a smoother process.

- All Information Is Already Available: Some believe their previous year's information is automatically transferred. It’s essential to verify and provide accurate details on the current form.

- Only Taxpayers Need to Complete It: People often think just the taxpayer should fill out the Organizer. Spouses and any dependents must also provide their information for a complete picture.

- It’s Just for Income Reporting: Many assume the Organizer focuses solely on income. In fact, it also covers deductions, credits, and specific life events like marriages or births that may affect tax filings.

- Providing Prior Year’s Tax Return Isn’t Necessary: New clients sometimes think they don’t need to bring last year’s return. It is actually crucial as it helps the preparer understand your tax history and identify any missing information.

- Questions Don’t Need Answers: Some people overlook the questions listed in the Organizer, thinking they’re not important. Answering these questions thoroughly helps maximize deductions and provides valuable context.

- Only Financial Documents Are Required: A common belief is that financial records such as W-2s and 1099s are the only necessary items. However, other documents such as healthcare coverage forms and proof of deductions are also vital.

- It Will Be Completed During the Appointment: Lastly, some clients think they can fill out the Organizer during the meeting. Completing it beforehand is essential for a more efficient appointment.

By addressing these misconceptions, clients can better prepare for their appointments, ensuring that all necessary information is provided for accurate tax filings.

Key takeaways

Ensure you complete the Client Tax Organizer before your appointment. This preparation will help maximize your tax benefits.

Gather important documents. New clients should include last year's tax return and all necessary statements like W-2s and 1099s.

Pay special attention to personal information. Accurate entries here lay the foundation for your tax filing.

Consider your dependents carefully. Properly listing everyone you support can significantly affect your tax deductions.

Answer all questions honestly. Sections regarding income sources, healthcare coverage, and significant life events matter for tax calculations.

Don't skip sections related to potential deductions, such as medical expenses or educational costs. These can lead to substantial savings.

Remember to explore direct deposit options for any refunds. This convenient option can expedite your access to funds.

Browse Other Templates

Tsa Notification Card - Travelers should consider having the card ready before arriving at the airport.

Travel Risk Assessment - Utilizing this worksheet is a key step in responsible travel behavior.