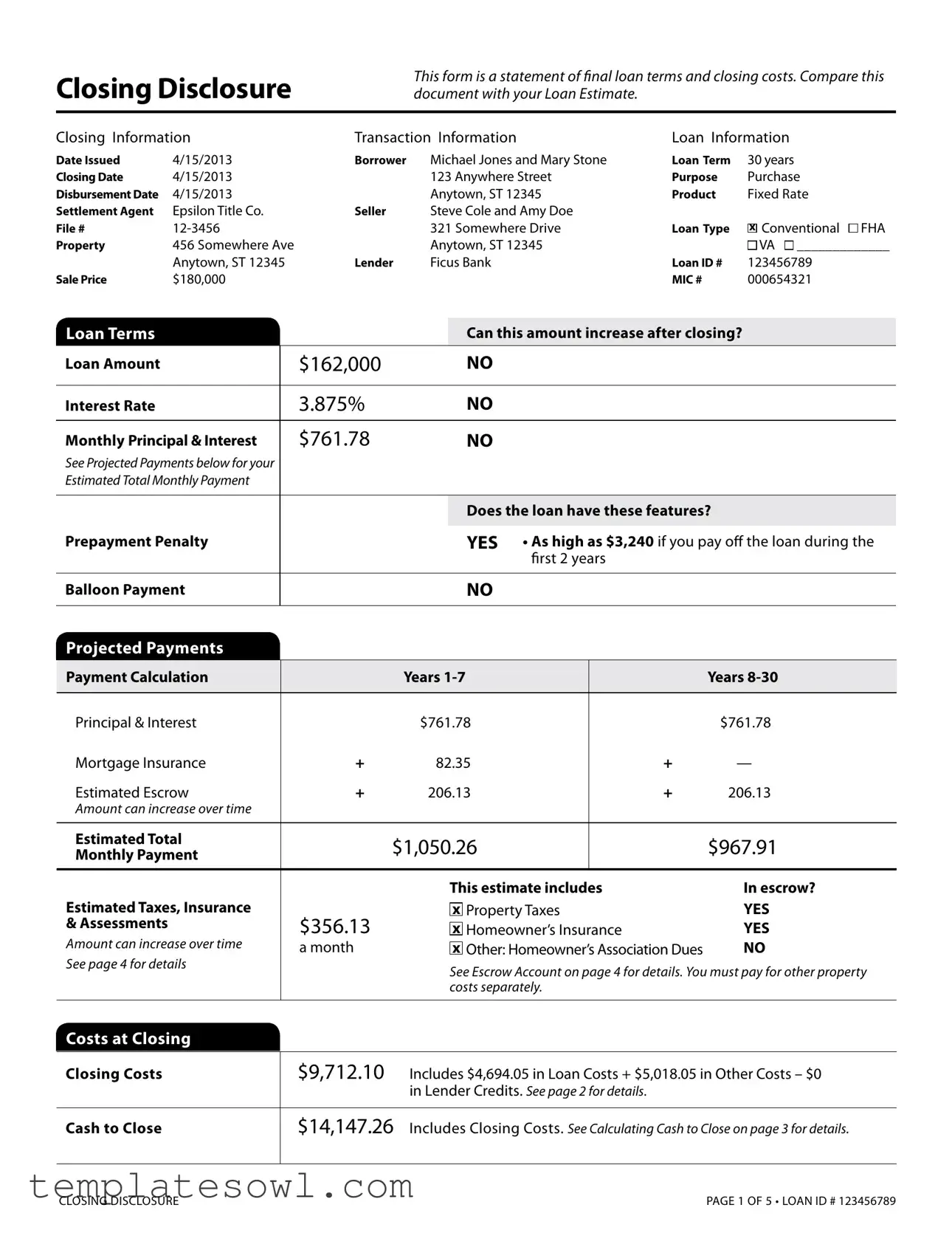

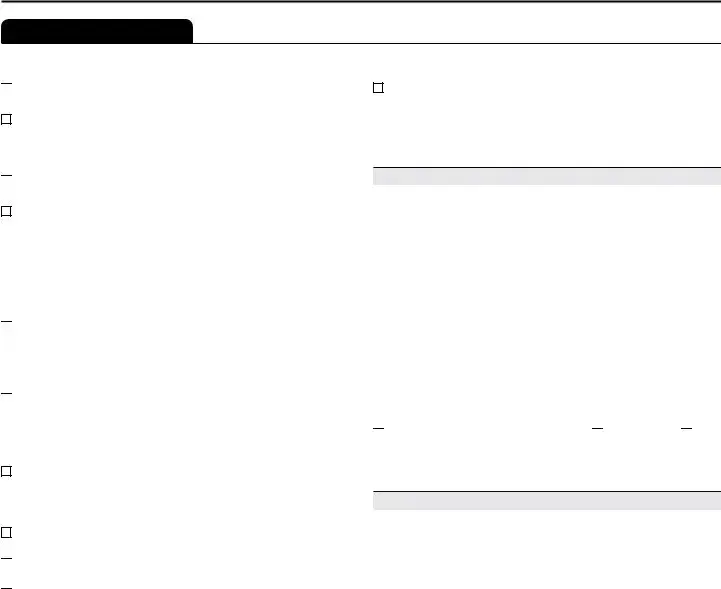

Fill Out Your Closing Disclosure Form

The Closing Disclosure form plays a crucial role in the mortgage process, serving as a detailed summary of final loan terms and closing costs for prospective homeowners. Issued at least three days before closing, this document enables borrowers to compare the final terms with the initial Loan Estimate, ensuring transparency and informed decision-making. The form includes critical information such as the loan amount, interest rate, and monthly payment figures, alongside essential closing dates and property addresses. It outlines specific costs associated with the mortgage, including origination fees, appraisal charges, and other expenses that borrowers may incur during the closing process. This comprehensive document also illustrates how much cash buyers need to bring to the table, detailing not just closing costs but any necessary deposits and credits. Additionally, borrowers are made aware of features like prepayment penalties and the existence of an escrow account for property taxes and insurance. By presenting these components clearly, the Closing Disclosure empowers homebuyers to understand their financial commitments before finalizing the transaction, making it an invaluable tool in the home-buying journey.

Closing Disclosure Example

Closing Disclosure

This form is a statement of inal loan terms and closing costs. Compare this document with your Loan Estimate.

Closing Information |

Transaction Information |

Loan Information |

Date Issued |

4/15/2013 |

Borrower |

Michael Jones and Mary Stone |

Loan Term |

Closing Date |

4/15/2013 |

|

123 Anywhere Street |

Purpose |

Disbursement Date |

4/15/2013 |

|

Anytown, ST 12345 |

Product |

Settlement Agent |

Epsilon Title Co. |

Seller |

Steve Cole and Amy Doe |

|

File # |

|

321 Somewhere Drive |

Loan Type |

|

Property |

456 Somewhere Ave |

|

Anytown, ST 12345 |

|

|

Anytown, ST 12345 |

Lender |

Ficus Bank |

Loan ID # |

Sale Price |

$180,000 |

|

|

MIC # |

30years Purchase Fixed Rate

x Conventional

FHA

FHA

VA

VA

_____________

_____________

123456789

000654321

Loan Terms |

|

|

Can this amount increase after closing? |

|||

Loan Amount |

$162,000 |

|

NO |

|

|

|

|

|

|

|

|

|

|

Interest Rate |

3.875% |

|

NO |

|

|

|

|

|

|

|

|

|

|

Monthly Principal & Interest |

$761.78 |

|

NO |

|

|

|

See Projected Payments below for your |

|

|

|

|

|

|

Estimated Total Monthly Payment |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Does the loan have these features? |

|||

|

|

|

|

|

|

|

Prepayment Penalty |

|

|

YES |

• As high as $3,240 if you pay of the loan during the |

||

|

|

|

|

irst 2 years |

|

|

|

|

|

|

|

|

|

Balloon Payment |

|

|

NO |

|

|

|

|

|

|

|

|

|

|

Projected Payments |

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment Calculation |

|

Years |

|

|

Years |

|

|

|

|

|

|

|

|

Principal & Interest |

|

$761.78 |

|

|

$761.78 |

|

Mortgage Insurance |

+ |

82.35 |

|

+ |

— |

|

Estimated Escrow |

+ |

206.13 |

|

+ |

206.13 |

|

Amount can increase over time |

|

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Total |

$1,050.26 |

|

|

$967.91 |

||

Monthly Payment |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This estimate includes |

In escrow? |

||

Estimated Taxes, Insurance |

|

|

x Property Taxes |

YES |

||

& Assessments |

$356.13 |

|

x Homeowner’s Insurance |

YES |

||

Amount can increase over time |

a month |

|

x Other: Homeowner’s Association Dues |

NO |

||

|

|

|||||

See page 4 for details |

|

|

See Escrow Account on page 4 for details. You must pay for other property |

|||

|

|

|

||||

|

|

|

costs separately. |

|

||

|

|

|

|

|

|

|

Costs at Closing |

|

|

|

|

|

|

|

|

|

||||

Closing Costs |

$9,712.10 |

Includes $4,694.05 in Loan Costs + $5,018.05 in Other Costs – $0 |

||||

|

|

in Lender Credits. See page 2 for details. |

|

|||

|

|

|

||||

Cash to Close |

$14,147.26 |

Includes Closing Costs. See Calculating Cash to Close on page 3 for details. |

||||

|

|

|

|

|

|

|

CLOSING DISCLOSURE |

PAGE 1 OF 5 • LOAN ID # 123456789 |

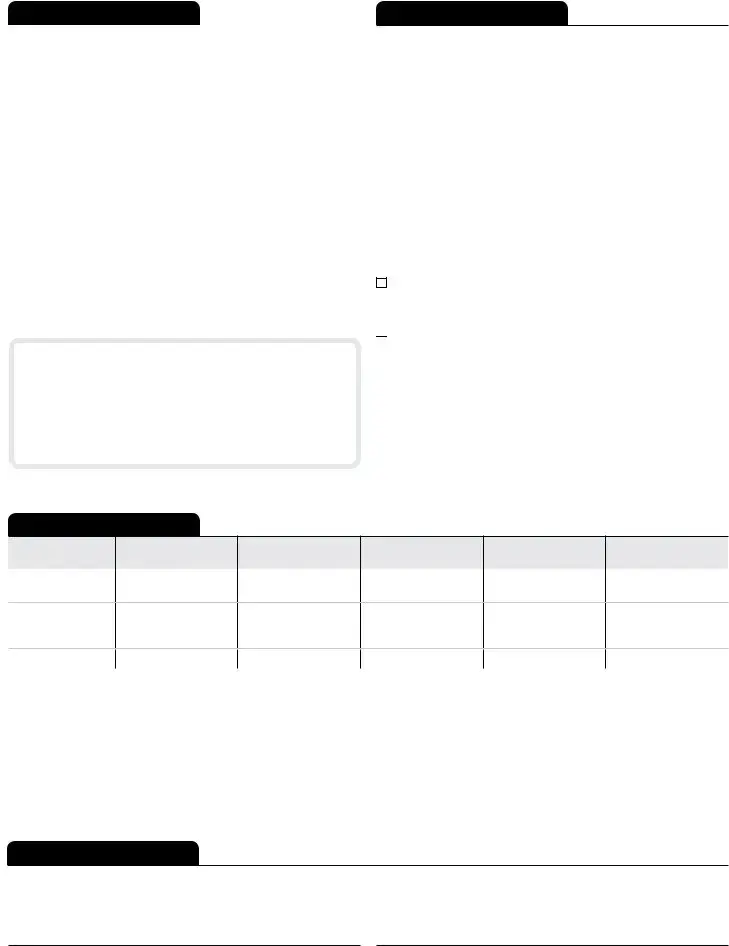

Closing Cost Details

Loan Costs

A. Origination Charges

010.25 % of Loan Amount (Points)

02Application Fee

03Underwriting Fee

B. Services Borrower Did Not Shop For

01 |

Appraisal Fee |

to John Smith Appraisers Inc. |

02 |

Credit Report Fee |

to Information Inc. |

03 |

Flood Determination Fee |

to Info Co. |

04 |

Flood Monitoring Fee |

to Info Co. |

05 |

Tax Monitoring Fee |

to Info Co. |

06 |

Tax Status Research Fee |

to Info Co. |

07 |

|

|

08 |

|

|

09 |

|

|

10 |

|

|

C. Services Borrower Did Shop For |

|

|

01 |

Pest Inspection Fee |

to Pests Co. |

02 |

Survey Fee |

to Surveys Co. |

03 |

Title – Insurance Binder |

to Epsilon Title Co. |

04 |

Title – Lender’s Title Insurance |

to Epsilon Title Co. |

05 |

Title – Settlement Agent Fee |

to Epsilon Title Co. |

06 |

Title – Title Search |

to Epsilon Title Co. |

07 |

|

|

08 |

|

|

D. TOTAL LOAN COSTS

Loan Costs Subtotals (A + B + C)

At Closing Before Closing

$1,802.00

$405.00

$300.00

$1,097.00

$236.55

$29.80

$20.00

$31.75

$75.00

$80.00

$2,655.50

$120.50

$85.00

$650.00

$500.00

$500.00

$800.00

$4,694.05

$4,664.25 |

$29.80 |

|

|

Paid by |

||

At Closing Before Closing |

Others |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$405.00

Other Costs

E. Taxes and Other Government Fees |

|

$85.00 |

|

|

|

||||

01 |

Recording Fees |

|

Deed: $40.00 |

Mortgage: $45.00 |

$85.00 |

|

|

|

|

02 |

Transfer Tax |

|

to Any State |

|

|

|

$950.00 |

|

|

F. Prepaids |

|

|

|

$2,120.80 |

|

|

|

||

01 |

Homeowner’s Insurance Premium ( 12 mo.) to Insurance Co. |

$1,209.96 |

|

|

|

|

|||

02 |

Mortgage Insurance Premium ( |

mo.) |

|

|

|

|

|

|

|

03 |

Prepaid Interest ( $17.44 per day from 4/15/13 to 5/1/13 ) |

$279.04 |

|

|

|

|

|||

04 |

Property Taxes ( 6 mo.) to Any County USA |

|

$631.80 |

|

|

|

|

||

05 |

|

|

|

|

|

|

|

|

|

G. Initial Escrow Payment at Closing |

|

$412.25 |

|

|

|

||||

01 |

Homeowner’s Insurance $100.83 |

per month for 2 mo. |

$201.66 |

|

|

|

|

||

02 |

Mortgage Insurance |

|

per month for |

mo. |

|

|

|

|

|

03 |

Property Taxes |

$105.30 |

per month for 2 mo. |

$210.60 |

|

|

|

|

|

04 |

|

|

|

|

|

|

|

|

|

05 |

|

|

|

|

|

|

|

|

|

06 |

|

|

|

|

|

|

|

|

|

07 |

|

|

|

|

|

|

|

|

|

08 |

Aggregate Adjustment |

|

|

|

– 0.01 |

|

|

|

|

H. Other |

|

|

|

$2,400.00 |

|

|

|

||

01 HOA Capital Contribution |

to HOA Acre Inc. |

|

$500.00 |

|

|

|

|

||

02 HOA Processing Fee |

|

to HOA Acre Inc. |

|

$150.00 |

|

|

|

|

|

03 Home Inspection Fee |

|

to Engineers Inc. |

|

$750.00 |

|

|

$750.00 |

|

|

04 Home Warranty Fee |

|

to XYZ Warranty Inc. |

|

|

$450.00 |

|

|

||

05 Real Estate Commission |

to Alpha Real Estate Broker |

|

|

$5,700.00 |

|

|

|||

06 Real Estate Commission |

to Omega Real Estate Broker |

|

|

$5,700.00 |

|

|

|||

07 Title – Owner’s Title Insurance (optional) to Epsilon Title Co. |

$1,000.00 |

|

|

|

|

||||

08 |

|

|

|

|

|

|

|

|

|

I. TOTAL OTHER COSTS |

|

$5,018.05 |

|

|

|

||||

|

|

|

|

|

|

|

|

||

Other Costs Subtotals (E + F + G + H) |

|

|

$5,018.05 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

J. TOTAL CLOSING COSTS

$9,712.10

Closing Costs Subtotals (D + I) |

$9,682.30 |

$29.80 |

$12,800.00 |

$750.00 |

$405.00 |

Lender Credits |

|

|

|

|

|

CLOSING DISCLOSURE |

|

|

PAGE 2 OF 5 • LOAN ID # 123456789 |

||

Calculating Cash to Close |

Use this table to see what has changed from your Loan Estimate. |

|

Loan Estimate |

Final |

Total Closing Costs (J) |

$8,054.00 |

$9,712.10 |

Closing Costs Paid Before Closing |

$0 |

– $29.80 |

Closing Costs Financed |

|

|

(Paid from your Loan Amount) |

$0 |

$0 |

Down Payment/Funds from Borrower |

$18,000.00 |

$18,000.00 |

Deposit |

– $10,000.00 |

– $10,000.00 |

Funds for Borrower |

$0 |

$0 |

Seller Credits |

$0 |

– $2,500.00 |

Adjustments and Other Credits |

$0 |

– $1,035.04 |

Cash to Close |

$16,054.00 |

$14,147.26 |

|

|

|

Did this change?

YES • See Total Loan Costs (D) and Total Other Costs (I)

YES • You paid these Closing Costs before closing

NO

NO

NO

NO

YES • See Seller Credits in Section L

YES • See details in Sections K and L

Summaries of Transactions |

Use this table to see a summary of your transaction. |

|

|

BORROWER’S TRANSACTION

K. Due from Borrower at Closing |

$189,762.30 |

01 Sale Price of Property |

$180,000.00 |

02Sale Price of Any Personal Property Included in Sale

03 |

Closing Costs Paid at Closing (J) |

$9,682.30 |

04 |

|

|

Adjustments

05

06

07

Adjustments for Items Paid by Seller in Advance

08 |

City/Town Taxes |

|

to |

|

09 |

County Taxes |

|

to |

|

|

|

|

|

|

10 |

Assessments |

|

to |

|

11 |

HOA Dues |

4/15/13 |

to 4/30/13 |

$80.00 |

12 |

|

|

|

|

|

|

|

|

|

13 |

|

|

|

|

14 |

|

|

|

|

15 |

|

|

|

|

|

|

|||

L. Paid Already by or on Behalf of Borrower at Closing |

$175,615.04 |

|||

01 |

Deposit |

|

|

$10,000.00 |

02 |

Loan Amount |

|

|

$162,000.00 |

03Existing Loan(s) Assumed or Taken Subject to

05 |

Seller Credit |

$2,500.00 |

Other Credits |

|

|

|

|

|

06 |

Rebate from Epsilon Title Co. |

$750.00 |

07 |

|

|

Adjustments

08

09

10

11

Adjustments for Items Unpaid by Seller

12 |

City/Town Taxes 1/1/13 |

to 4/14/13 |

$365.04 |

|

|

|

|

13 |

County Taxes |

to |

|

14 |

Assessments |

to |

|

15 |

|

|

|

|

|

|

|

16 |

|

|

|

17 |

|

|

|

CALCULATION |

|

|

|

|

|

||

Total Due from Borrower at Closing (K) |

$189,762.30 |

||

Total Paid Already by or on Behalf of Borrower at Closing (L) |

– $175,615.04 |

||

SELLER’S TRANSACTION

M. Due to Seller at Closing |

$180,080.00 |

01 Sale Price of Property |

$180,000.00 |

02Sale Price of Any Personal Property Included in Sale

Adjustments for Items Paid by Seller in Advance

09 |

City/Town Taxes |

|

to |

|

10 |

County Taxes |

|

to |

|

|

|

|

|

|

11 |

Assessments |

|

to |

|

12 |

HOA Dues |

4/15/13 |

to 4/30/13 |

$80.00 |

13 |

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

15 |

|

|

|

|

16 |

|

|

|

|

|

|

|

||

N. Due from Seller at Closing |

|

$115,665.04 |

||

01 |

Excess Deposit |

|

|

|

02 |

Closing Costs Paid at Closing (J) |

$12,800.00 |

||

03Existing Loan(s) Assumed or Taken Subject to

04 Payof of First Mortgage Loan |

$100,000.00 |

05Payof of Second Mortgage Loan

08 |

Seller Credit |

|

$2,500.00 |

09 |

|

|

|

|

|

|

|

10 |

|

|

|

11 |

|

|

|

12 |

|

|

|

|

|

|

|

13 |

|

|

|

Adjustments for Items Unpaid by Seller |

|

||

14 |

City/Town Taxes 1/1/13 |

to 4/14/13 |

$365.04 |

|

|

|

|

15 |

County Taxes |

to |

|

16 |

Assessments |

to |

|

17 |

|

|

|

|

|

|

|

18 |

|

|

|

19 |

|

|

|

CALCULATION |

|

|

|

|

|

|

|

Total Due to Seller at Closing (M) |

|

$180,080.00 |

|

Total Due from Seller at Closing (N) |

– $115,665.04 |

||

Cash to Close

x

From To Borrower |

$14,147.26 |

Cash From x |

To Seller |

$64,414.96 |

CLOSING DISCLOSURE |

PAGE 3 OF 5 • LOAN ID # 123456789 |

Additional Information About This Loan

Loan Disclosures

Assumption

If you sell or transfer this property to another person, your lender

will allow, under certain conditions, this person to assume this loan on the original terms.

will allow, under certain conditions, this person to assume this loan on the original terms.

xwill not allow assumption of this loan on the original terms.

Demand Feature

Your loan

has a demand feature, which permits your lender to require early repayment of the loan. You should review your note for details.

has a demand feature, which permits your lender to require early repayment of the loan. You should review your note for details.

xdoes not have a demand feature.

Late Payment

If your payment is more than 15 days late, your lender will charge a late fee of 5% of the monthly principal and interest payment.

Negative Amortization (Increase in Loan Amount) Under your loan terms, you

are scheduled to make monthly payments that do not pay all of the interest due that month. As a result, your loan amount will increase (negatively amortize), and your loan amount will likely become larger than your original loan amount. Increases in your loan amount lower the equity you have in this property.

are scheduled to make monthly payments that do not pay all of the interest due that month. As a result, your loan amount will increase (negatively amortize), and your loan amount will likely become larger than your original loan amount. Increases in your loan amount lower the equity you have in this property.

may have monthly payments that do not pay all of the interest due that month. If you do, your loan amount will increase (negatively amortize), and, as a result, your loan amount may become larger than your original loan amount. Increases in your loan amount lower the equity you have in this property.

may have monthly payments that do not pay all of the interest due that month. If you do, your loan amount will increase (negatively amortize), and, as a result, your loan amount may become larger than your original loan amount. Increases in your loan amount lower the equity you have in this property.

xdo not have a negative amortization feature.

Partial Payments

Your lender

xmay accept payments that are less than the full amount due (partial payments) and apply them to your loan.

may hold them in a separate account until you pay the rest of the payment, and then apply the full payment to your loan.

may hold them in a separate account until you pay the rest of the payment, and then apply the full payment to your loan.

does not accept any partial payments.

does not accept any partial payments.

If this loan is sold, your new lender may have a diferent policy.

Security Interest

You are granting a security interest in

456 Somewhere Ave., Anytown, ST 12345

You may lose this property if you do not make your payments or satisfy other obligations for this loan.

Escrow Account

FOR NOW, your loan

xwill have an escrow account (also called an “impound” or “trust” account) to pay the property costs listed below. Without an escrow account, you would pay them directly, possibly in one or two large payments a year. Your lender may be liable for penalties and interest for failing to make a payment.

Escrow

Escrowed |

$2,473.56 |

Estimated total amount over year 1 for |

Property Costs |

|

your escrowed property costs: |

over Year 1 |

|

Homeowner’s Insurance |

|

|

Property Taxes |

|

|

|

$1,800.00 |

Estimated total amount over year 1 for |

|

Property Costs |

|

your |

over Year 1 |

|

Homeowner’s Association Dues |

|

|

You may have other property costs. |

|

|

|

Initial Escrow |

$412.25 |

A cushion for the escrow account you |

Payment |

|

pay at closing. See Section G on page 2. |

|

|

|

Monthly Escrow |

$206.13 |

The amount included in your total |

Payment |

|

monthly payment. |

|

|

|

will not have an escrow account because

will not have an escrow account because  you declined it

you declined it  your lender does not ofer one. You must directly pay your property costs, such as taxes and homeowner’s insurance. Contact your lender to ask if your loan can have an escrow account.

your lender does not ofer one. You must directly pay your property costs, such as taxes and homeowner’s insurance. Contact your lender to ask if your loan can have an escrow account.

No Escrow

Estimated |

|

Estimated total amount over year 1. You |

Property Costs |

|

must pay these costs directly, possibly |

over Year 1 |

|

in one or two large payments a year. |

|

|

|

Escrow Waiver Fee |

|

|

|

|

|

IN THE FUTURE,

Your property costs may change and, as a result, your escrow pay- ment may change. You may be able to cancel your escrow account, but if you do, you must pay your property costs directly. If you fail to pay your property taxes, your state or local government may (1) impose ines and penalties or (2) place a tax lien on this property. If you fail to pay any of your property costs, your lender may (1) add the amounts to your loan balance, (2) add an escrow account to your loan, or (3) require you to pay for property insurance that the lender buys on your behalf, which likely would cost more and provide fewer beneits than what you could buy on your own.

CLOSING DISCLOSURE |

PAGE 4 OF 5 • LOAN ID # 123456789 |

Loan Calculations

Total of Payments. Total you will have paid after |

|

|

you make all payments of principal, interest, |

|

|

mortgage insurance, and loan costs, as scheduled. |

$285,803.36 |

|

|

|

|

Finance Charge. The dollar amount the loan will |

|

|

cost you. |

$118,830.27 |

|

|

|

|

Amount Financed. The loan amount available after |

|

|

paying your upfront inance charge. |

$162,000.00 |

|

|

|

|

Annual Percentage Rate (APR). Your costs over |

|

|

the loan term expressed as a rate. This is not your |

|

|

interest rate. |

4.174% |

|

|

|

|

Total Interest Percentage (TIP). The total amount |

|

|

of interest that you will pay over the loan term as a |

|

|

percentage of your loan amount. |

69.46% |

|

|

|

|

?loan terms or costs on this form, use the contact information below. To get more information or make a complaint, contact the Consumer

Financial Protection Bureau at

Other Disclosures

Appraisal

If the property was appraised for your loan, your lender is required to give you a copy at no additional cost at least 3 days before closing.

If you have not yet received it, please contact your lender at the information listed below.

Contract Details

See your note and security instrument for information about

•what happens if you fail to make your payments,

•what is a default on the loan,

•situations in which your lender can require early repayment of the loan, and

•the rules for making payments before they are due.

Liability after Foreclosure

If your lender forecloses on this property and the foreclosure does not cover the amount of unpaid balance on this loan,

xstate law may protect you from liability for the unpaid balance. If you reinance or take on any additional debt on this property, you may lose this protection and have to pay any debt remaining even after foreclosure. You may want to consult a lawyer for more information.

state law does not protect you from liability for the unpaid balance.

state law does not protect you from liability for the unpaid balance.

Reinance

Reinancing this loan will depend on your future inancial situation, the property value, and market conditions. You may not be able to reinance this loan.

Tax Deductions

If you borrow more than this property is worth, the interest on the loan amount above this property’s fair market value is not deductible from your federal income taxes. You should consult a tax advisor for more information.

Contact Information

Name

Lender

Ficus Bank

Mortgage Broker

Real Estate Broker

(B)

Omega Real Estate Broker Inc.

Real Estate Broker

(S)

Alpha Real Estate Broker Co.

Settlement Agent

Epsilon Title Co.

Address

4321 Random Blvd. Somecity, ST 12340

789 Local Lane Sometown, ST 12345

987 Suburb Ct. Someplace, ST 12340

123 Commerce Pl. Somecity, ST 12344

NMLS ID

ST License ID |

|

|

Z765416 |

Z61456 |

Z61616 |

Contact |

Joe Smith |

|

Samuel Green |

Joseph Cain |

Sarah Arnold |

Contact NMLS ID |

12345 |

|

|

|

|

Contact |

|

|

P16415 |

P51461 |

PT1234 |

ST License ID |

|

|

|

|

|

joesmith@ |

|

sam@omegare.biz |

joe@alphare.biz |

sarah@ |

|

|

icusbank.com |

|

|

|

epsilontitle.com |

Phone |

|

||||

|

|

|

|

|

|

Conirm Receipt

By signing, you are only conirming that you have received this form. You do not have to accept this loan because you have signed or received this form.

Applicant Signature |

Date |

Date |

CLOSING DISCLOSURE |

PAGE 5 OF 5 • LOAN ID # 123456789 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Closing Disclosure form provides a complete statement of final loan terms and closing costs for a mortgage transaction. |

| Comparison | Homebuyers should compare the Closing Disclosure with their Loan Estimate to ensure accuracy in the costs and terms of the mortgage. |

| Closing Date | The form lists the closing date, which is typically when the ownership of the property is transferred. |

| Loan Information | Key loan details, such as loan amount, interest rate, and monthly payment, are clearly outlined for borrower clarity. |

| Closing Costs | Total closing costs are provided, detailing various fees and charges that buyers need to pay when finalizing the loan. |

| Cash to Close | The form indicates the total amount of cash required to close the transaction, so borrowers know what to prepare. |

| Loan Features | Borrowers are notified if the loan includes features such as a prepayment penalty or balloon payment, which may impact future payments. |

| Projected Payments | The form breaks down estimated monthly payments, helping borrowers understand their future financial obligations. |

| Governing Laws | In states like California, the use of the Closing Disclosure is governed by the Dodd-Frank Act and regulations set by the Consumer Financial Protection Bureau. |

| Borrower Rights | Borrowers must sign to confirm receipt of the Closing Disclosure but are not obligated to proceed with the loan based on signing this document. |

Guidelines on Utilizing Closing Disclosure

Completing the Closing Disclosure form is an essential step in the home-buying process. This document outlines your final loan terms and closing costs, making it crucial for your understanding of the financial commitments involved. Make sure to have your loan estimate handy for comparison as you fill out this form.

- Date Issued: Write the date the form is issued, for example, 4/15/2013.

- Borrower: List the names of the borrowers, such as Michael Jones and Mary Stone.

- Closing Date: Fill in the date of the closing.

- Sale Price: Enter the agreed sale price for the property, which is $180,000 in this case.

- Loan Information: Include important details such as the loan amount ($162,000), interest rate (3.875%), and loan term (30 years).

- Total Closing Costs: Calculate the total closing costs, which is $9,712.10, and note any lender credits (in this case, $0).

- Monthly Payment: List the estimated monthly payment amounts for Years 1-7 and Years 8-30. For example, $1,050.26 and $967.91 respectively.

- Costs at Closing: Write down the cash needed to close, which is $14,147.26 in this example.

- Loan Costs Breakdown: Detail all loan costs, from origination charges to services not chosen by the borrower, totaling $4,694.05.

- Other Costs Breakdown: Include other costs like taxes and prepaids, amounting to $5,018.05.

- Calculating Cash to Close: Fill out this section to see how your final closing costs compare to the Loan Estimate.

- Transaction Summaries: Complete sections related to totals due from the borrower and amounts already paid at closing.

- Contact Information: Ensure the lender’s and broker's contact information is filled in correctly for any follow-up inquiries.

- Signatures: Finally, both borrowers must sign and date the form. This confirms receipt of the document but doesn’t obligate acceptance of the loan.

Once the form is filled out, review all entries for accuracy. If anything seems off or you have questions, reach out to your lender or real estate agent before the closing date. This will help avoid any surprises and ensure a smoother closing process.

What You Should Know About This Form

What is the Closing Disclosure form?

The Closing Disclosure is a crucial document that outlines the final terms of a loan and the total closing costs associated with it. Borrowers receive this form typically three days before closing. It allows you to compare these final terms with the loan estimate provided earlier. Key details include the loan amount, interest rate, monthly payments, and a breakdown of all closing costs, helping you understand what to expect during the closing process.

When do I receive the Closing Disclosure?

You should receive your Closing Disclosure at least three business days before your closing date. This advance notice gives you time to review the document and ask your lender any questions. If any changes occur, such as an increase in the fees or loan terms, your lender is required to provide a new disclosure and may extend this waiting period.

What information can I find on the Closing Disclosure?

The document contains various sections detailing the loan information and closing costs. It includes transaction information, loan terms, estimated monthly payments, a summary of transactions, and detailed closing cost breakdowns. You will also find information about any escrow accounts if applicable, along with additional information about your loan terms.

How do I compare the Closing Disclosure to the Loan Estimate?

The Closing Disclosure allows you to directly compare final costs and loan terms with the Loan Estimate you received earlier. Key figures to look at include the loan amount, interest rate, monthly payment, and total closing costs. Any significant discrepancies should prompt you to discuss them with your lender to ensure you understand the changes.

What should I do if I notice errors on my Closing Disclosure?

If you find any inaccuracies, it’s essential to address them immediately with your lender. You can contact them to discuss the errors, as correcting misinformation may affect your loan terms and closing costs. Open communication with your lender is vital to ensure that everything is accurate before you sign the final documents.

What are closing costs, and how are they calculated?

Closing costs encompass various fees that you need to pay at the closing of a property purchase. They can include loan origination fees, appraisal fees, title insurance, and government recording charges, among others. These costs can vary based on the loan type, property location, and other factors, and will be clearly listed in your Closing Disclosure. Generally, you should anticipate that closing costs will amount to 2-5% of the purchase price.

What is meant by "Cash to Close" on the Closing Disclosure?

"Cash to Close" refers to the total amount you will need to bring to the closing meeting. This sum includes your down payment, closing costs, and any other fees not covered by the seller or financed by the loan. The Closing Disclosure provides a detailed account of this amount, making it easier for you to prepare financially for closing day.

Can I still negotiate any of the costs listed on the Closing Disclosure?

While many of the costs may be fixed, it is possible to negotiate some items prior to closing. Items like lender fees, the settlement agent's charges, and even certain third-party fees can sometimes be discussed. If you have concerns about any particular charges, reach out to your lender as soon as possible to inquire about adjustments.

What happens if I miss a payment after closing?

If you miss a payment after closing, your lender may charge a late fee and report the missed payment to credit bureaus. According to your Closing Disclosure, if you're late by more than 15 days, a penalty of 5% of the monthly principal and interest may apply. Understanding your obligations and keeping an open line of communication with your lender is key to avoiding negative repercussions.

Common mistakes

When filling out the Closing Disclosure form, individuals often make several common mistakes that can lead to confusion or complications. One mistake is failing to compare the Closing Disclosure with the Loan Estimate. It is essential to ensure that the terms and costs match, as discrepancies may signal issues that need clarification.

Another error involves overlooking the cash to close section. Borrowers should carefully review all calculations related to closing costs, seller credits, and deposits. A misunderstanding in this area may result in underestimating the amount of money needed on the day of closing.

Inattention to the fees listed under closing costs can also create problems. Borrowers might neglect to examine the "Loan Costs" versus "Other Costs" sections closely. Such oversight could lead to unexpected expenses at closing. It is advisable to confirm which fees are necessary and differentiate between those that are required and those that are optional.

Some individuals mistakenly ignore the projected payments listed on the form. They may not fully grasp how interest rates and other fees affect monthly payments over time. This misunderstanding could lead to financial strain if expectations do not align with reality.

Moreover, individuals often misinterpret the prepayment penalty clause. Many borrowers assume that a prepayment penalty is standard for all loans. However, not all lenders impose this fee, and it's important to read this section thoroughly.

Another common mistake is misunderstanding the lender's obligations regarding the escrow account. Misbeliefs about whether an escrow account is part of the loan can prompt borrowers to mismanage their property taxes and insurance payments, resulting in financial issues down the line.

Finally, failing to sign and date the form correctly can invalidate the document. This oversight can lead to unnecessary delays and complications in the closing process. Properly signing the form confirms that the borrower has received the disclosure and agrees to the terms outlined.

Documents used along the form

The Closing Disclosure form is an essential document in the real estate transaction process, providing a detailed breakdown of loan terms and closing costs. Several other forms and documents accompany it, each serving a specific purpose to ensure clarity and protection for all parties involved. Below is a list of documents commonly used alongside the Closing Disclosure.

- Loan Estimate: This document provides an estimate of what the borrower will pay for the loan. It includes the loan terms, projected payments, and the estimated closing costs. Borrowers should compare this to the Closing Disclosure for discrepancies.

- Appraisal Report: This report assesses the property's value and is essential for the lender to determine the risk of the loan. Borrowers should receive a copy before closing.

- Settlement Statement (HUD-1): Although less common now, this form provides a detailed summary of all charges paid by the buyer and seller during the closing process. It is similar to the Closing Disclosure.

- Title Report: This document shows the ownership of the property and any claims or liens against it. It is important to verify that the seller has the right to sell the property.

- Deed: This legal document transfers ownership of the property from the seller to the buyer. It will need to be signed at closing and recorded with the local authorities.

- Loan Note: This is a contract that outlines the terms of the loan, including the repayment schedule. This document serves as a promise by the borrower to repay the loan under the specified terms.

- Government Identification: A valid form of identification is required for all parties involved in the transaction to confirm their identity during the closing process.

- Insurance Documents: Proof of homeowners’ insurance is often required at closing to protect the lender’s investment and provide coverage for the property.

- Power of Attorney (if applicable): If someone is representing the buyer or seller in the transaction, a power of attorney document may be needed to grant authority for that individual to sign documents on behalf of the parties involved.

Each of these documents plays a critical role in facilitating a smooth closing process. Understanding the purpose of each helps ensure that all parties are adequately informed and protected throughout the transaction.

Similar forms

-

Loan Estimate: This document provides an estimate of the loan terms and closing costs before the closing process. It outlines similar information, allowing borrowers to compare the initial estimates with the final amounts presented in the Closing Disclosure.

-

Settlement Statement (HUD-1): This document details the final settlement costs in a real estate transaction. It includes many of the same fees and expenses as the Closing Disclosure, ensuring transparency for both buyers and sellers at the closing table.

-

Good Faith Estimate (GFE): Primarily used for FHA loans, this document outlines the expected costs associated with obtaining a mortgage. Like the Closing Disclosure, it helps borrowers understand the financial obligations ahead of closing.

-

Mortgage Note: The Mortgage Note is a legal document that outlines the terms of the loan, including the interest rate and repayment schedule. It complements the Closing Disclosure by providing a more detailed understanding of the borrower's obligations.

-

Title Insurance Policy: This document protects the lender and sometimes the buyer against any issues related to the property title. Similar to the Closing Disclosure, it provides essential information about the financial aspects and costs associated with the property transaction.

Dos and Don'ts

Things to Do:

- Review the Closing Disclosure carefully against your Loan Estimate.

- Ensure all personal and property information is accurate and complete.

- Check that the loan terms, including interest rate and loan amount, match your expectations.

- Confirm all closing costs and fees are properly detailed and understood.

- Ask questions about any unclear terms or charges before signing.

- Keep a copy of the completed form for your records after signing.

Things to Avoid:

- Do not rush through the form without understanding each item.

- Avoid signing if you notice any discrepancies or errors.

- Do not ignore changes from your Loan Estimate that seem significant.

- Refrain from making assumptions about what costs may arise in the future.

- Do not hesitate to seek help from a professional if you feel overwhelmed.

- Avoid losing track of important documents related to your loan and closing process.

Misconceptions

Misconception 1: The Closing Disclosure is the same as the Loan Estimate.

While both documents provide important financial details about a loan, they serve different purposes. The Loan Estimate gives a snapshot of preliminary loan terms and estimated costs. In contrast, the Closing Disclosure outlines the final terms of the loan and actual closing costs, allowing borrowers to compare it to the Loan Estimate before closing.

Misconception 2: Closing costs can't be negotiated.

This is not true. Many closing costs can be discussed and negotiated with the seller or lender. Some fees, like lender credits, may help offset costs, while others can be adjusted based on the agreement between parties. It's always worth asking for a breakdown and discussing the costs.

Misconception 3: The amount listed in the Closing Disclosure is the only amount needed at closing.

The Closing Disclosure specifies cash to close, but buyers also need to consider additional costs that may arise, such as home inspections, repairs, or other last-minute fees. It’s essential to plan for these extra expenses to avoid surprises on closing day.

Misconception 4: The Closing Disclosure can be provided on the day of closing.

By law, the Closing Disclosure must be provided to borrowers at least three business days before the closing date. This time allows borrowers to review and ask questions about the terms, ensuring they understand all financial aspects before finalizing the loan.

Misconception 5: I can't question anything in the Closing Disclosure.

It's completely normal and encouraged to ask questions about any item in the Closing Disclosure. If something seems off or unclear, borrowers should reach out to their lender or settlement agent for clarification. Understanding this document is crucial for making informed financial decisions.

Key takeaways

Understanding the Closing Disclosure form is crucial for a smooth home-buying experience. Here are some key takeaways to keep in mind:

- Always compare the Closing Disclosure with your Loan Estimate to ensure accuracy. Any differences should be clarified with your lender.

- Review the costs at closing section carefully. This will show all expenses you need to pay when finalizing the loan.

- Take note of your projected payments listed in the form. This helps you prepare for ongoing monthly costs.

- Be aware of the loan features, such as prepayment penalties or the existence of an escrow account. Understanding these will help you make informed financial decisions.

- Ask questions if anything is unclear. It's essential to understand all terms and conditions before signing any documents.

Browse Other Templates

Texas Kidney Healthcare Application - The form also caters to individuals who require witness signatures.

Uhc Global Claims Address - Section E highlights the different types of lenses and their associated codes and costs.