Fill Out Your Cms 855A Form

The CMS 855A form serves as a crucial tool for institutional providers seeking to enroll in the Medicare program or to amend their existing enrollment details. This application, alongside the Internet-based Provider Enrollment, Chain and Ownership System (PECOS), allows healthcare organizations such as hospitals, skilled nursing facilities, and community health centers to initiate their Medicare involvement. If you represent one of the specified organizations or wish to bill Medicare for Part A services, completing the CMS 855A form is necessary. The document encompasses essential sections where accurate and comprehensive information is vital. Submit the application with supporting documentation to avoid delays. Notably, providers must also secure a National Provider Identifier (NPI) before or during the enrollment process. Additionally, various scenarios necessitate the completion of this document, including reactivating billing privileges or reporting changes in ownership. Understanding the steps involved, from application submission to final approval, is essential for a seamless enrollment experience. Providers are encouraged to keep abreast of requirements and recommended practices for efficient service delivery to Medicare beneficiaries.

Cms 855A Example

MEDICARE ENROLLMENT APPLICATION

INSTITUTIONAL PROVIDERS

SEE PAGE 1 TO DETERMINE IF YOU ARE COMPLETING THE CORRECT APPLICATION

SEE PAGE 3 FOR INFORMATION ON WHERE TO MAIL THIS APPLICATION.

SEE PAGE 52 TO FIND A LIST OF THE SUPPORTING DOCUMENTATION THAT MUST BE SUBMITTED WITH THIS APPLICATION.

DEPARTMENT OF HEALTH AND HUMAN SERVICES |

Form Approved |

CENTERS FOR MEDICARE & MEDICAID SERVICES |

OMB No. |

WHO SHOULD COMPLETE THIS APPLICATION

Institutional providers can apply for enrollment in the Medicare program or make a change in their enrollment information using either:

•The

•The paper enrollment application process (e.g., CMS 855A).

For additional information regarding the Medicare enrollment process, including

go to www.cms.gov/MedicareProviderSupEnroll.

Institutional providers who are enrolled in the Medicare program, but have not submitted the CMS 855A

г2003, are required to submit a Medicare enrollment application (i.e.,

following health care organizations must complete this application to initiate the enrollment process:

• |

Community Mental Health Center |

• |

Hospital |

• Comprehensive Outpatient Rehabilitation Facility • Indian Health Services Facility |

|||

• |

Critical Access Hospital |

• |

Organ Procurement Organization |

• |

• |

Outpatient Physical Therapy/Occupational |

|

• |

Federally Qualified Health Center |

|

Therapy /Speech Pathology Services |

• |

Histocompatibility Laboratory |

• |

Religious |

• |

Home Health Agency |

• |

Rural Health Clinic |

• |

Hospice |

• |

Skilled Nursing Facility |

If your provider type is not listed above, contact your designated

Complete this application if you are a health care organization and you:

•Plan to bill Medicare for Part A medical services, or

•Would like to report a change to your existing Part A enrollment data. A change must be reported within 90 days of the effective date of the change; per 42 C.F.R. 424.516(e), changes of ownership or control must be reported within 30 days of the effective date of the change.

BILLING NUMBER INFORMATION

The National Provider Identifier (NPI) is the standard unique health identifier for health care providers and is assigned by the National Plan and Provider Enumeration System (NPPES). Medicare healthcare

providers, except organ procurement organizations, must obtain an NPI prior to enrolling in Medicare or before submitting a change to your existing Medicare enrollment information. Applying

for an NPI is a process separate from Medicare enrollment. To obtain an NPI, you may apply online at https://NPPES.cms.hhs.gov. As an organizational health care provider, it is your responsibility to determine if you have “subparts.'' A subpart is a component of an organization that furnishes healthcare and is not itself a legal entity. If you do have subparts, you must determine if they should obtain their own unique NPIs. Before you complete this enrollment application, you need to make those determinations and obtain NPl(s) accordingly.

IMPORTANT: For NPI purposes, sole proprietors and sole proprietorships are considered to be

“Type 1” providers. Organizations (e.g., corporations, partnerships) are treated as “Type 2” entities. When reporting the NPI of a sole proprietor on this application, therefore, the individual’s Type 1 NPI should be reported; for organizations, the Type 2 NPI should be furnished.

For more information about subparts, visit www.cms.gov/NationalProvldentStand to view the “Medicare

Expectations Subparts Paper.”

The Medicare Identification Number, often referred to as the CMS Certification Number (CCN) or Medicare “legacy” number, is a generic term for any number other than the NPI that is used to identify a Medicare provider.

1 |

INSTRUCTIONS FOR COMPLETING AND SUBMITTING THIS APPLICATION

•Type or print all information so that it is legible. Do not use pencil.

•Report additional information within a section by copying and completing that section for each additional entry.

•Attach all required supporting documentation.

•Keep a copy of your completed Medicare enrollment package for your records.

•Send the completed application with original signatures and all required documentation to your designated Medicare

AVOID DELAYS IN YOUR ENROLLMENT

To avoid delays in the enrollment process, you should:

•Complete all required sections.

•Ensure that the legal business name shown in Section 2 matches the name on the tax documents.

•Ensure that the correspondence address shown in Section 2 is the provider’s address.

•Enter your NPI in the applicable sections.

•Enter all applicable dates.

•Ensure that the correct person signs the application.

•Send your application and all supporting documentation to the designated

OBTAINING MEDICARE APPROVAL

The usual process for becoming a certified Medicare provider is as follows:

1.The applicant completes and submits a

2.The

3.The State agency or approved accreditation organization conducts a survey. Based on the survey results, the State agency makes a recommendation for approval or denial (a certification of compliance or noncompliance) to the CMS Regional Office. Certain provider types may elect voluntary accreditation by a

4.A CMS contractor conducts a second contractor review, as needed, to verify that a provider continues to meet the enrollment requirements prior to granting Medicare billing privileges.

5.The CMS Regional Office makes the final decision regarding program eligibility. The CMS Regional Office also works with the Office of Civil Rights to obtain necessary Civil Rights clearances. If approved, the provider must typically sign a provider agreement.

2 |

ADDITIONAL INFORMATION

For additional information regarding the Medicare enrollment process, visit www.cms.gov/

MedicareProviderSupEnroll.

The

The information you provide on this application will not be shared. It is protected under 5 U.S.C. Section 552(b)(4) and/or (b)(6), respectively. For more information, see the last page of this application for the Privacy Act Statement.

MAIL YOUR APPLICATION

The Medicare

MedicareProviderSupEnroll.

3 |

SECTION 1: BASIC INFORMATION

NEW ENROLLEES

If you are:

•Enrolling with a particular

•Undergoing a change of ownership where the new owner will not be accepting assignment of the Medicare assets and liabilities of the seller/former owner.

ENROLLED MEDICARE PROVIDERS

The following actions apply to Medicare providers already enrolled in the program:

Reactivation

To reactivate your Medicare billing privileges, submit this enrollment application. In addition, you must be able to submit a valid claim and meet all current requirements for your provider type before reactivation can occur.

Voluntary Termination

A provider should voluntarily terminate its Medicare enrollment when:

•It will no longer be rendering services to Medicare patients,

•It is planning to cease (or has ceased) operations,

•There has been an acquisition/merger and the new owner will not be using the identification number of the entity it has acquired,

•There has been a consolidation and the identification numbers of the consolidating providers will no longer be used, or

•There has been a change of ownership and the new owner will not be accepting assignment of the Medicare assets and liabilities of the seller/former owner, meaning that the number of the seller/former owner will no longer be used.

NOTE: A voluntary identification number termination cannot be used to circumvent any corrective action plan or any pending/ongoing investigation, nor can it be used to avoid a period of reasonable assurance, where a provider must operate for a certain period without recurrence of the deficiencies that were the basis for the termination. The provider will not be reinstated until the completion of the reasonable assurance period.

Change of Ownership (CHOW)

A CHOW typically occurs when a Medicare provider has been purchased (or leased) by another organization. The CHOW results in the transfer of the old owner's Medicare Identification Number and provider agreement (including any outstanding Medicare debt of the old owner) to the new owner. The regulatory citation for CHOWs can be found at 42 C.F.R. 489.18. If the purchaser (or lessee) elects not to accept a transfer of the provider agreement, then the old agreement should be terminated and the purchaser or lessee is considered a new applicant.

4 |

SECTION 1: BASIC INFORMATION (Continued)

Acquisition/Merger

An acquisition/merger occurs when a currently enrolled Medicare provider is purchasing or has been purchased by another enrolled provider. Only the purchaser’s Medicare Identification Number and tax identification number remain.

Acquisitions/mergers are different from CHOWs. In the case of an acquisition/merger, the seller/former owner’s Medicare Identification Number dissolves. In a CHOW, the seller/former owner’s provider number typically remains intact and is transferred to the new owner.

Consolidation

A consolidation occurs when two or more enrolled Medicare providers consolidate to form a new business entity.

Consolidations are different from acquisitions/mergers. In an acquisition/merger, two entities combine but the Medicare Identification Number and tax identification number (TIN) of the purchasing entity remain intact. In a consolidation, the TINs and Medicare Identification Numbers of the consolidating entities dissolve and a new TIN and Medicare Identification Number are assigned to the new, consolidated entity.

Because of the various situations in which a CHOW, acquisition/merger, or consolidation can occur, it is recommended that the provider contact its

Change of Information

A change of information should be submitted if you are changing, adding, or deleting information under your current tax identification number. Changes in your existing enrollment data must be reported to the Medicare

NOTE: Ownership changes that do not qualify as CHOWs, acquisitions/mergers, or consolidations should be reported here. The most common example involves stock transfers. For instance, assume that a business entity’s stock is owned by A, B, and C. A sells his stock to D. While this is an ownership change, it is generally not a formal CHOW under 42 C.F.R. 489.18. Thus, the ownership change from A to D should be reported as a change of information, not a CHOW. If you have any questions on whether an ownership change should be reported as a CHOW or a change of information, contact your

If you are already enrolled in Medicare and are not receiving Medicare payments via EFT, any change to your enrollment information will require you to submit a

Revalidation

CMS may require you to submit or update your enrollment information. The

5 |

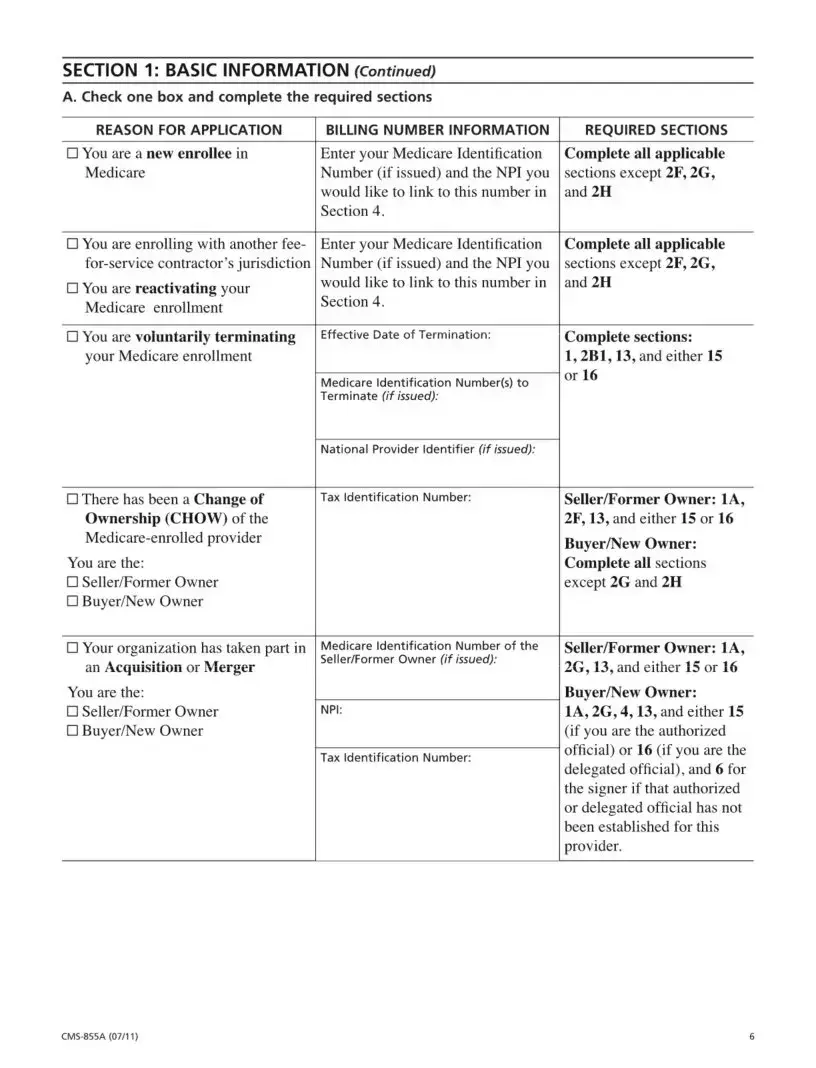

SECTION 1: BASIC INFORMATION (Continued)

A. Check one box and complete the required sections

REASON FOR APPLICATION |

BILLING NUMBER INFORMATION |

□ You are a new enrollee in |

Enter your Medicare Identification |

Medicare |

Number (if issued) and the NPI you |

|

would like to link to this number in |

|

Section 4. |

REQUIRED SECTIONS

Complete all applicable

sections except 2F, 2G, and 2H

□You are enrolling with another fee-

□You are reactivating your

Medicare enrollment

□You are voluntarily terminating

your Medicare enrollment

□There has been a Change of

Ownership (CHOW) of the

You are the:

□Seller/Former Owner

□Buyer/New Owner

□Your organization has taken part in an Acquisition or Merger

Enter your Medicare Identification Number (if issued) and the NPI you would like to link to this number in Section 4.

Effective Date of Termination:

Medicare Identification Number(s) to

Terminate (if issued):

National Provider Identifier (if issued):

Tax Identification Number:

Medicare Identification Number of the Seller/Former Owner (if issued):

Complete all applicable

sections except 2F, 2G, and 2H

Complete sections:

1,2B1,13, and either 15 or 16

Seller/Former Owner: 1A,

2F, 13, and either 15 or 16

Buyer/New Owner: Complete all sections

except 2G and 2H

Seller/Former Owner: 1A,

2G, 13, and either 15 or 16

You are the: |

|

□ Seller/Former Owner |

NPI: |

□ Buyer/New Owner |

|

|

Tax Identification Number: |

Buyer/New Owner:

1A, 2G, 4,13, and either 15 (if you are the authorized official) or 16 (if you are the delegated official), and 6 for the signer if that authorized or delegated official has not been established for this provider.

6 |

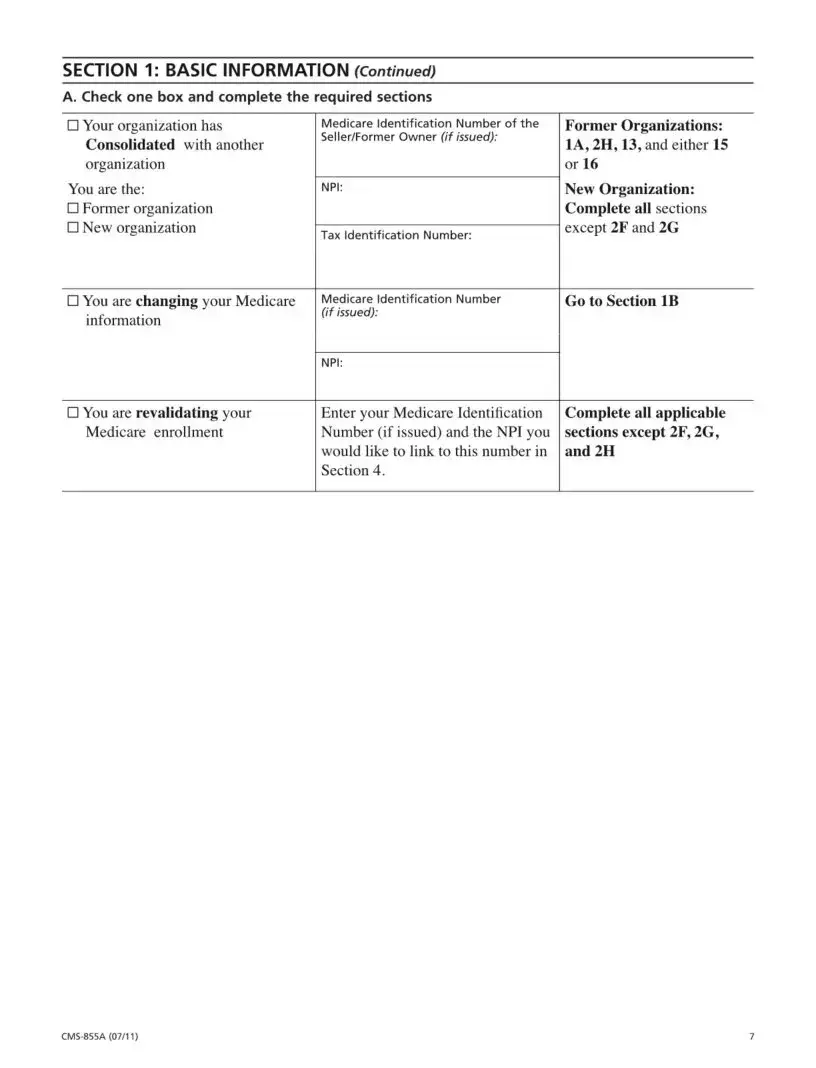

SECTION 1: BASIC INFORMATION (Continued)

A. Check one box and complete the required sections

□ Your organization has |

Medicare Identification Number of the |

Former Organizations: |

Consolidated with another |

Seller/Former Owner (if issued): |

1 A, 2H, 13, and either 15 |

|

||

organization |

|

or 16 |

You are the: |

NPI: |

New Organization: |

□ Former organization |

|

Complete all sections |

□ New organization |

Tax Identification Number: |

except 2F and 2G |

|

|

|

□ You are changing your Medicare |

Medicare Identification Number |

Go to Section IB |

information |

(if issued): |

|

|

|

|

|

NPI: |

|

□ You are revalidating your |

Enter your Medicare Identification |

Complete all applicable |

Medicare enrollment |

Number (if issued) and the NPI you |

sections except 2F, 2G, |

|

would like to link to this number in |

and 2H |

|

Section 4. |

|

7 |

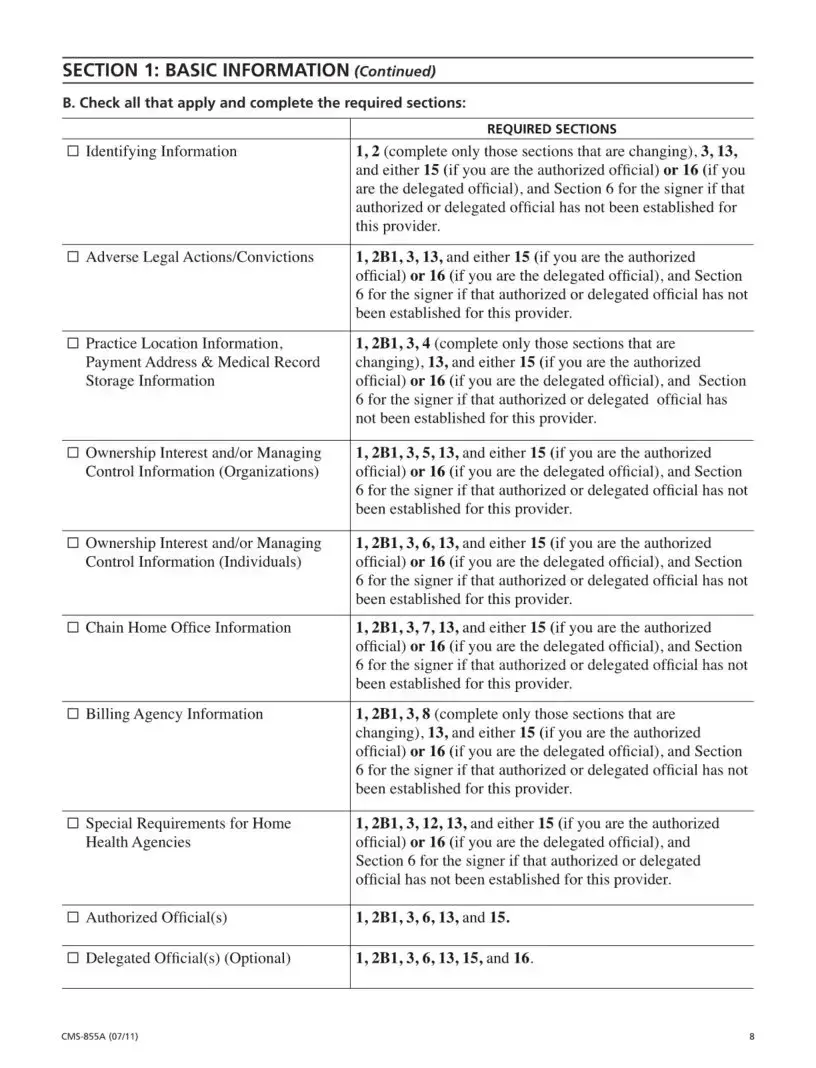

SECTION 1: BASIC INFORMATION (Continued)

B. Check all that apply and complete the required sections:

REQUIRED SECTIONS

□Identifying Information1,2 (complete only those sections that are changing), 3,13, and either 15 (if you are the authorized official) or 16 (if you are the delegated official), and Section 6 for the signer if that authorized or delegated official has not been established for this provider.

□Adverse Legal Actions/Convictions 1,2B1,3,13, and either 15 (if you are the authorized official) or 16 (if you are the delegated official), and Section 6 for the signer if that authorized or delegated official has not been established for this provider.

□Practice Location Information, 1,2B1,3,4 (complete only those sections that are

Payment Address & Medical Record |

changing), 13, and either 15 (if you are the authorized |

Storage Information |

official) or 16 (if you are the delegated official), and Section |

|

6 for the signer if that authorized or delegated official has |

|

not been established for this provider. |

□ Ownership Interest and/or Managing |

1,2B1,3,5,13, and either 15 (if you are the authorized |

Control Information (Organizations) |

official) or 16 (if you are the delegated official), and Section |

|

6 for the signer if that authorized or delegated official has not |

|

been established for this provider. |

□ Ownership Interest and/or Managing |

1,2B1,3,6,13, and either 15 (if you are the authorized |

Control Information (Individuals) |

official) or 16 (if you are the delegated official), and Section |

|

6 for the signer if that authorized or delegated official has not |

|

been established for this provider. |

□Chain Home Office Information 1,2B1,3,7,13, and either 15 (if you are the authorized official) or 16 (if you are the delegated official), and Section 6 for the signer if that authorized or delegated official has not been established for this provider.

□Billing Agency Information1,2B1,3,8 (complete only those sections that are changing), 13, and either 15 (if you are the authorized official) or 16 (if you are the delegated official), and Section 6 for the signer if that authorized or delegated official has not been established for this provider.

□Special Requirements for Home 1,2B1,3,12,13, and either 15 (if you are the authorized

Health Agencies |

official) or 16 (if you are the delegated official), and |

|

Section 6 for the signer if that authorized or delegated |

|

official has not been established for this provider. |

□ Authorized Official(s) |

1,2B1,3,6,13, and 15. |

□ Delegated Official(s) (Optional) |

1,2B1,3,6,13,15, and 16. |

8 |

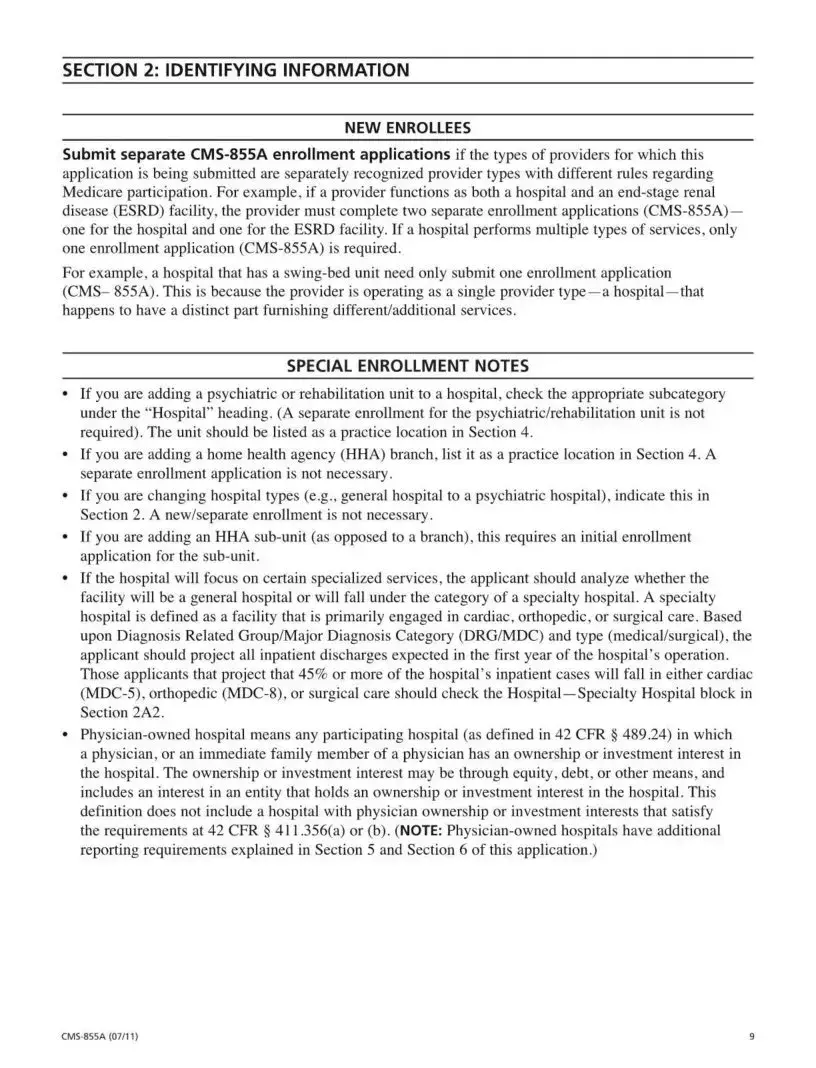

SECTION 2: IDENTIFYING INFORMATION

______________________________________ NEW ENROLLEES_____________________________________

Submit separate

application is being submitted are separately recognized provider types with different rules regarding Medicare participation. For example, if a provider functions as both a hospital and an

For example, a hospital that has a

SPECIAL ENROLLMENT NOTES

•If you are adding a psychiatric or rehabilitation unit to a hospital, check the appropriate subcategory under the “Hospital” heading. (A separate enrollment for the psychiatric/rehabilitation unit is not required). The unit should be listed as a practice location in Section 4.

•If you are adding a home health agency (HHA) branch, list it as a practice location in Section 4. A separate enrollment application is not necessary.

•If you are changing hospital types (e.g., general hospital to a psychiatric hospital), indicate this in Section 2. A new/separate enrollment is not necessary.

•If you are adding an HHA

•If the hospital will focus on certain specialized services, the applicant should analyze whether the facility will be a general hospital or will fall under the category of a specialty hospital. A specialty hospital is defined as a facility that is primarily engaged in cardiac, orthopedic, or surgical care. Based upon Diagnosis Related Group/Major Diagnosis Category (DRG/MDC) and type (medical/surgical), the applicant should project all inpatient discharges expected in the first year of the hospital's operation. Those applicants that project that 45% or more of the hospital's inpatient cases will fall in either cardiac

•

9 |

Form Characteristics

| Fact Title | Fact Description |

|---|---|

| Who Should Use CMS-855A | This form is specifically designed for institutional providers seeking to enroll in the Medicare program or change their existing enrollment details. |

| Provider Types | Various health care organizations, such as hospitals and skilled nursing facilities, must complete this application to bill Medicare for services. |

| Initial Enrollment Requirement | New providers need to submit the CMS-855A when reporting a change in ownership or control for the first time. |

| NPI Requirement | Providers must obtain a National Provider Identifier (NPI) prior to submitting the CMS-855A, distinguishing between organizational and individual providers. |

| Timeliness of Changes | Any changes to enrollment information should be reported within 90 days; however, changes in ownership must be reported within 30 days. |

| Application Submission | Completed applications and all required supporting documents must be sent to the appropriate Medicare fee-for-service contractor for processing. |

| Avoiding Delays | To prevent delays, ensure all sections of the application are complete and that signatures are from the correct individuals. |

| Approval Process | The approval process involves several steps, including reviews by contractors and state agencies, culminating in a final decision from the CMS Regional Office. |

| Privacy Protection | The information provided in the application is protected under federal laws, ensuring confidentiality of sensitive data. |

| Legislation Reference | Changes in provider ownership, referred to as Change of Ownership (CHOW), are governed under 42 C.F.R. 489.18. |

Guidelines on Utilizing Cms 855A

Completing the CMS 855A form is an essential step for institutional providers looking to enroll in the Medicare program or make changes to their existing enrollment information. Following the correct steps will ensure that your application is processed efficiently and without unnecessary delays.

- Gather necessary documents and information, including your National Provider Identifier (NPI) and Medicare Identification Number (CCN).

- Type or print all information clearly on the form. Avoid using pencil.

- Fill out Section 1 with your basic information. Indicate if you are a new enrollee or an enrolled Medicare provider.

- Complete Section 2, ensuring the legal business name matches tax documents and the correspondence address is accurate.

- Provide all required information related to your NPI, ensuring you enter the correct Type 1 or Type 2 information as appropriate.

- Follow the prompts in the subsequent sections, adding entries where necessary by copying relevant sections if you have multiple items to report.

- Attach all necessary supporting documentation as detailed on page 52 of the application.

- Review the form thoroughly for accuracy and completeness, making sure all applicable dates and signatures are included.

- Keep a copy of the completed application for your records before submission.

- Mail the form with original signatures and all supporting documents to your designated Medicare fee-for-service contractor. Find the address at www.cms.gov/MedicareProviderSupEnroll.

What You Should Know About This Form

What is the CMS 855A form used for?

The CMS 855A form is an essential application for institutional providers seeking enrollment in the Medicare program. This form is used to apply for Medicare Part A billing privileges or to update enrollment information. It is particularly relevant for a variety of health care organizations, such as hospitals, skilled nursing facilities, and home health agencies, among others.

Who is required to complete the CMS 855A form?

Institutional providers must complete the CMS 855A form if they are looking to enroll in Medicare or amend their existing enrollment data. This applies to numerous health care organizations, including Critical Access Hospitals and Federally Qualified Health Centers. If your organization type is not listed, it's advisable to consult your designated fee-for-service contractor before proceeding with the application.

How can I avoid delays when submitting the CMS 855A form?

To minimize any potential delays in the enrollment process, ensure that all required sections of the form are completed accurately. Check that the legal business name matches the name on tax documents and that the correspondence address reflects the provider’s address. Also, include your National Provider Identifier (NPI) and make sure the appropriate person signs the application. Failing to meet these requirements could result in processing delays.

What should be included with the CMS 855A application?

When submitting the CMS 855A application, it is crucial to attach all required supporting documentation. A checklist of these documents can usually be found on page 52 of the application itself. Keeping a copy of your completed application for your records is also a thoughtful way to maintain your documentation trail.

What happens after I submit the CMS 855A form?

After submission, the fee-for-service contractor will review the application and recommend approval or denial to the State survey agency. A survey may be conducted to ensure compliance, after which the CMS Regional Office makes the final determination regarding program eligibility. If approved, you will need to sign a provider agreement to begin billing Medicare.

What is the difference between applying for an NPI and the CMS 855A form?

Applying for a National Provider Identifier (NPI) is a separate process that must be completed before applying for Medicare enrollment using the CMS 855A form. The NPI serves as a unique health identifier for providers, while the CMS 855A form is specifically for submitting Medicare enrollment applications or changes. Ensuring that you have the correct NPI before filling out the CMS 855A form is essential for a smooth enrollment process.

Common mistakes

Filling out the CMS 855A form accurately is essential for institutional providers seeking enrollment in the Medicare program. However, several common mistakes can lead to unnecessary delays or denial of the application. Awareness of these pitfalls can streamline the process and ensure a smoother experience.

One frequent error involves failing to complete all required sections of the form. Incomplete applications often lead to delays, as Medicare contractors must contact the provider for the missing information. Every section must be filled out, even if certain areas are not applicable. This attention to detail prevents interruptions in the processing of the application.

Another mistake is not matching the legal business name with the name on tax documents. It is vital that the name on the application is consistent with the name identified by the Internal Revenue Service. Discrepancies can trigger additional scrutiny, potentially causing the application to be set aside for further review.

Providing the wrong National Provider Identifier (NPI) is also a common issue. Applicants must ensure that the NPI is entered correctly and reflects either the Type 1 identifier for sole proprietors or the Type 2 identifier for organizations. Misidentifying these numbers leads to confusion and may result in denial of the application.

Further, some applicants neglect to include necessary supporting documentation. Every application must be accompanied by required documents outlined on Page 52 of the CMS guidelines. Failure to attach these materials not only delays processing but can also lead to outright denial of the enrollment request.

It is also important that the correct person signs the application. Each application must have an authorized individual sign it to ensure accountability. Without the proper signature, the application may be rejected outright, requiring resubmission and prolonging the approval process.

Another common error is neglecting to send the application to the appropriate Medicare fee-for-service contractor. Each state has designated contractors responsible for processing applications. Inaccurate mailing can cause delays as the application may be routed incorrectly, leading to confusion about its status.

Omitting to keep a copy of the completed application for record-keeping is also a mistake that can create issues. Having a copy provides a reference point for both the provider and the contractor and ensures that any discrepancies can be addressed promptly.

Lastly, applicants may overlook the importance of timely reporting changes. Changes in ownership or control must be reported within specific timeframes to avoid complications. If a change occurs, it is critical that the provider completes the necessary forms within the required period to maintain their Medicare status.

By avoiding these common mistakes, institutional providers can enhance their chances of a successful application process, minimizing delays and ensuring seamless participation in the Medicare program.

Documents used along the form

The CMS 855A form is crucial for institutional providers seeking to enroll in the Medicare program or update their enrollment information. While this application stands out, it often requires several other forms and documents to ensure a smooth enrollment process. The following list highlights essential supporting materials, each playing a specific role in the application process.

- National Provider Identifier (NPI) Application: This document is necessary for all healthcare providers before they enroll in the Medicare program. The NPI serves as a unique identifier that streamlines billing processes.

- Medicare Certification Number (CCN): Often utilized in conjunction with the CMS 855A, the CCN allows providers to be recognized within the Medicare system. It helps identify the specific provider's facility and its Medicare status.

- Bios and Organizational Information: This document includes essential background details about the institution applying for Medicare enrollment. It may cover previous ownership, organizational structure, and services offered.

- Documentation of Compliance with Medicare Standards: Providers must submit evidence demonstrating adherence to Medicare regulations. This can involve presenting certification from approved accreditation organizations or documentation from state agencies.

- Tax Documents: These documents validate the legal business name and address under which the provider operates. They ensure that the information submitted matches with what the Internal Revenue Service recognizes.

- Patient Care and Reporting Policies: This outlines the policies the organization adheres to concerning patient care and reporting practices, showing compliance with Medicare standards.

Each of these documents is vital in supporting the CMS 855A application. Together, they help ensure that the enrollment process is efficient and meets the necessary regulatory requirements. By preparing all required materials in advance, providers can minimize delays and focus on delivering exceptional care to their patients.

Similar forms

- CMS 855B: Similar to the CMS 855A, this form is used by non-institutional providers, such as physicians or suppliers, to enroll in Medicare. It serves a parallel purpose of reporting enrollment data and changes for these types of healthcare providers.

- CMS 855I: This application is specifically for individual practitioners to enroll in Medicare. Like the 855A, it facilitates the initial enrollment and any changes in enrollment status or information for healthcare professionals.

- CMS 855R: Unlike the 855A, which is for organizations, the 855R allows reassignments of benefits to organizations or individuals, streamlining the payment process for providers who are collaborating.

- CMS 855S: This form is designed for OASIS data collection in Home Health agencies. It shares the common goal of ensuring compliance and maintaining accurate enrollment details within Medicare.

- Medicare Enrollment Application for Reentry (CMS 883): This document is relevant for providers who have previously been enrolled but are reapplying. It functions similarly to the CMS 855A by facilitating enrollment and ensuring that all necessary information is collected.

- Annual Update Form (CMS 855A annual updates): After initial enrollment with the CMS 855A, providers must provide annual updates of their enrollment information—a similar process aimed at maintaining current and accurate records.

- Medicaid Enrollment Application: While specific to Medicaid, this application shares similar functions to the CMS 855A in terms of gathering necessary information for enrollment and changes within the Medicaid program.

- CLIA Certification Application: This form is required for laboratories seeking certification under CLIA. It shares the objective of ensuring valid operational details for entities providing health services.

- Provider Enrollment in Managed Care Plans: This process closely resembles the CMS 855A, where providers must submit information to be enrolled in managed care networks, ensuring compliance and proper enrollment.

- Marketplace Application for Health Coverage: Similar to the provider enrollment application, this document is used by providers seeking certification to offer services in a Health Insurance Marketplace, aiming to maintain valid provider details within the healthcare system.

Dos and Don'ts

When completing the CMS 855A form for Medicare enrollment, it is essential to follow certain guidelines to ensure a smooth application process. Below is a list of six things you should and shouldn't do while filling out the form:

- Do type or print all information clearly. Avoid using pencil or illegible handwriting.

- Do carefully attach all required supporting documentation to your application.

- Do keep a copy of your completed application and documentation for your records.

- Do make sure that the legal business name matches the name on your tax documents.

- Don't leave fields blank. Complete all required sections to avoid delays.

- Don't forget to ensure the correct person signs the application. An inaccurate signature can lead to rejection.

By adhering to these guidelines, you can mitigate the risk of processing delays and potential complications in the enrollment process.

Misconceptions

The CMS 855A form is vital for institutional providers wanting to enroll in the Medicare program. However, many misconceptions surround this application process. Here are ten common misunderstandings:

- Only new providers need to complete the CMS 855A form. Existing Medicare providers who experience changes, like ownership or billing information, are also required to submit this form.

- The CMS 855A form is optional. It is mandatory for institutional providers to complete this form when enrolling or changing their information. Failing to submit it can lead to enrollment issues.

- You cannot submit the CMS 855A form online. While the Internet-based PECOS system is available, providers still have the option to submit the CMS 855A in paper form.

- You don’t need an NPI to complete the CMS 855A form. Obtaining a National Provider Identifier (NPI) is required before enrolling in Medicare or making changes to existing information.

- Filing the CMS 855A guarantees quick approval. The approval process can take time, as the fee-for-service contractor and state survey agencies must review and verify the application.

- Supporting documentation isn’t necessary. To prevent delays, all required supporting documents must be attached with the CMS 855A when submitting the application.

- All types of healthcare organizations use the same application. The CMS 855A is for institutional providers only. Different forms are used for different provider types.

- If your application is denied, you cannot reapply. Providers can address the reasons for denial and reapply, ensuring all issues are resolved beforehand.

- There is no consequence for late submissions. A report of a change must occur within specific timelines: 90 days for most changes and 30 days for changes of ownership or control.

- Once you submit the CMS 855A, your work is done. Providers must remain compliant with any requests for additional documentation throughout the enrollment process.

Understanding these misconceptions can help institutional providers navigate the CMS 855A form more effectively, ensuring a smoother enrollment process.

Key takeaways

Identify the correct application: Ensure that you are using the CMS-855A form for institutional providers. Review the guidelines on page 1 to confirm it is the right application for your needs.

Complete all necessary sections: Fill in every required field clearly and accurately. Missing or incorrect information can lead to delays in processing your application.

Submit supporting documentation: Along with the CMS-855A form, attach all necessary documents as listed on page 52. This helps validate the information provided and speeds up the approval process.

Follow up on the submission: After mailing your application, keep copies for your records. Be prepared to provide additional documentation if requested by the fee-for-service contractor.

Browse Other Templates

Employment Application,Job Application Form,Candidate Information Sheet,Staffing Request Form,Application for Employment,Job Seeker's Form,Hiring Application,Employee Registration Form,Work Opportunity Application,Candidate Profile Form - Describe your methods for managing equipment misuse at our facilities.

Delaware Unclaimed Property Report,Delaware Abandoned Property Declaration,Delaware Escheatment Filing,Unclaimed Funds Form DE,Delaware Holder Report,Delaware Revenue Division Submission,Delaware Financial Asset Reporting,Abandoned Assets Notificatio - The form demands detailed holder information, including the company’s EIN and contact details.