Fill Out Your Cms R 131 Advance Abn Form

The CMS R-131 Advance Beneficiary Notice of Noncoverage (ABN) is an important document in the healthcare landscape for Medicare beneficiaries. This notice is issued when healthcare providers foresee a chance that Medicare may not cover a specific service or item a patient may require, helping patients make informed decisions about their healthcare options. Each ABN includes key information such as the name of the notifier, the patient's details, and a description of the services in question. Patients will find crucial sections outlining the expected costs, reasons Medicare may deny coverage, and detailed options for proceeding. Options range from wanting the service billed to Medicare despite potential non-coverage, to opting out of receiving that service altogether. As a beneficiary, understanding the ABN and its implications can ensure clearer communication with healthcare providers and better management of personal healthcare finances. The form is designed to be straightforward, ensuring patients have the necessary information to consider their choices without overwhelming complexity.

Cms R 131 Advance Abn Example

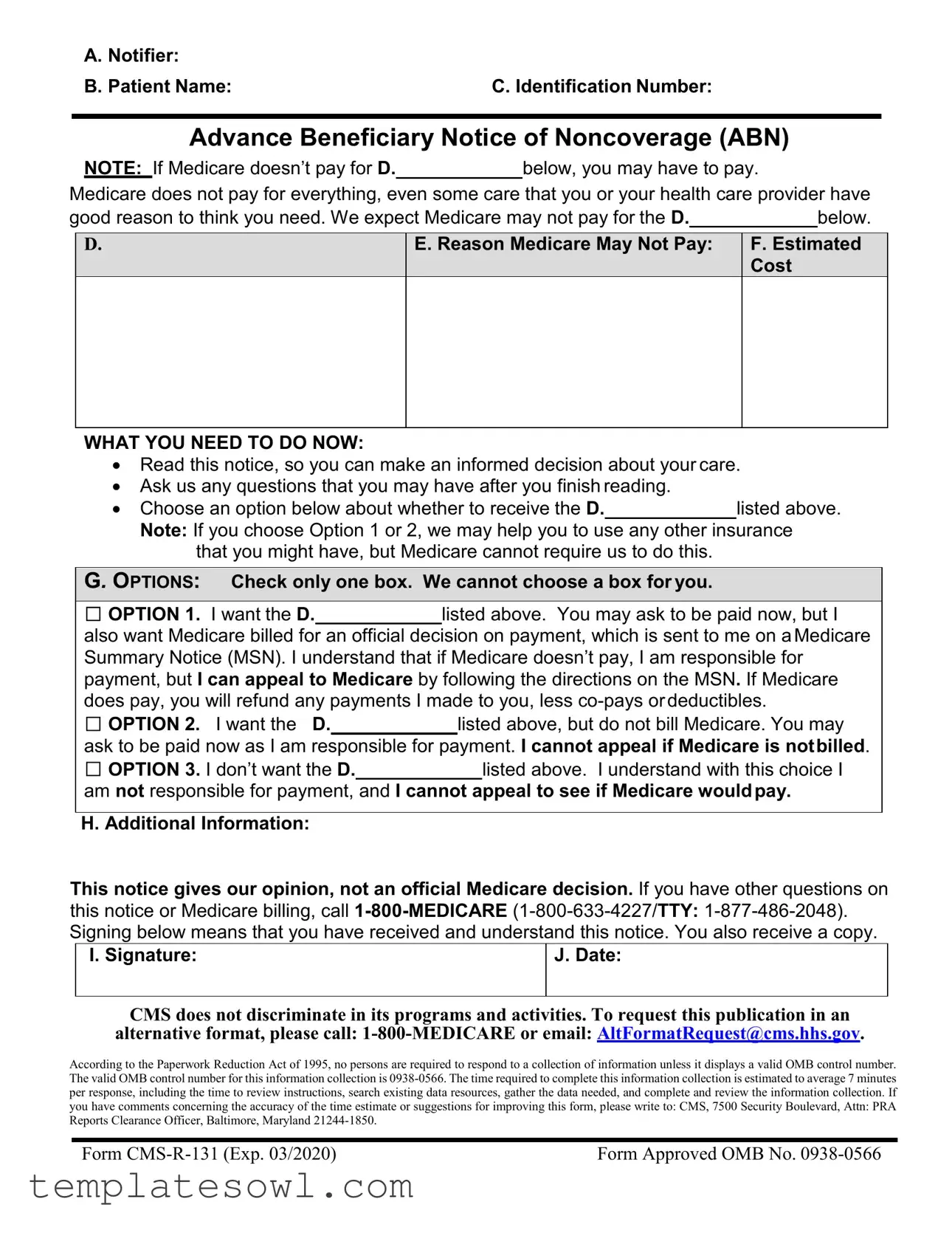

A. Notifier: |

|

B. Patient Name: |

C. Identification Number: |

Advance Beneficiary Notice of Noncoverage (ABN)

NOTE: If Medicare doesn’t pay for D. below, you may have to pay.

Medicare does not pay for everything, even some care that you or your health care provider have

good reason to think you need. We expect Medicare may not pay for the D. |

|

below. |

D.

E. Reason Medicare May Not Pay:

F.Estimated Cost

WHAT YOU NEED TO DO NOW:

•Read this notice, so you can make an informed decision about your care.

•Ask us any questions that you may have after you finish reading.

• Choose an option below about whether to receive the D.listed above.

Note: If you choose Option 1 or 2, we may help you to use any other insurance that you might have, but Medicare cannot require us to do this.

G. OPTIONS: Check only one box. We cannot choose a box for you.

□OPTION 1. I want the D. listed above. You may ask to be paid now, but I also want Medicare billed for an official decision on payment, which is sent to me on aMedicare Summary Notice (MSN). I understand that if Medicare doesn’t pay, I am responsible for payment, but I can appeal to Medicare by following the directions on the MSN. If Medicare does pay, you will refund any payments I made to you, less

□ OPTION 2. I want the D. listed above, but do not bill Medicare. You may

ask to be paid now as I am responsible for payment. I cannot appeal if Medicare is notbilled.

□ OPTION 3. I don’t want the D. listed above. I understand with this choice I

am not responsible for payment, and I cannot appeal to see if Medicare wouldpay.

H. Additional Information:

This notice gives our opinion, not an official Medicare decision. If you have other questions on this notice or Medicare billing, call

I. Signature:

J. Date:

CMS does not discriminate in its programs and activities. To request this publication in an alternative format, please call:

According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless it displays a valid OMB control number. The valid OMB control number for this information collection is

Form |

Form Approved OMB No. |

Form Instructions

Advance Beneficiary Notice of Noncoverage (ABN)

OMB Approval Number:

Overview

The ABN is a notice given to beneficiaries in Original Medicare to convey that Medicare is not likely to provide coverage in a specific case. “Notifiers” include physicians, providers (including institutional providers like outpatient hospitals), practitioners and suppliers paid under Part B (including independent laboratories), as well as hospice providers and religious

All of the aforementioned physicians, suppliers, practitioners, and providers must complete the ABN as described below, and deliver the notice to affected beneficiaries or their representative before providing the items or services that are the subject of the notice. Medicare inpatient hospitals and skilled nursing facilities (SNFs) use other approved notices for Part A items and services when notice is required; however, these facilities must use the ABN for Part B items and services.

The ABN must be reviewed with the beneficiary or his/her representative and any questions raised during that review must be answered before it is signed. The ABN must be delivered far enough in advance that the beneficiary or representative has time to consider the options and make an informed choice. Employees or subcontractors of the notifier may deliver the ABN. ABNs are never required in emergency or urgent care situations. Once all blanks are completed and the form is signed, a copy is given to the beneficiary or representative. In all cases, the notifier must retain a copy of the ABN delivered to the beneficiary on file.

The ABN may also be used to provide voluntary notification of financial liability for items or services that Medicare never covers. When the ABN is used as a voluntary notice, the beneficiary doesn’t choose an option box or sign the notice. CMS has issued detailed instructions on the use of the ABN in its

ABN Changes

The ABN is a formal information collection subject to approval by the Executive Office of Management and Budget (OMB) under the Paperwork Reduction Act of 1995 (PRA). As part of this process, the notice is subject to public comment and

been revised to include language informing beneficiaries of their rights to CMS nondiscrimination practices and how to request the ABN in an alternative format if needed.

Completing the Notice

ABNs may be downloaded from the CMS website at:

ABNs must be reproduced on a single page. The page may be either letter or

Sections and Blanks:

There are 10 blanks for completion in this notice, labeled from (A) through (J), with accompanying instructions for each blank below. We recommend that notifiers remove the lettering labels from the blanks before issuing the ABN to beneficiaries. Blanks

Header

Blanks

Blank (A) Notifier(s): Notifiers must place their name, address, and telephone number (including TTY number when needed) at the top of the notice. This information may be incorporated into a notifier’s logo at the top of the notice by typing,

If the billing and notifying entities are not the same, the name of more than one entity may be given in the Header as long as it is specified in the Additional Information (H) section who should be contacted for billing questions.

Blank (B) Patient Name: Notifiers must enter the first and last name of the beneficiary receiving the notice, and a middle initial should also be used if there is one on the beneficiary’s Medicare (HICN) card. The ABN will not be invalidated by a misspelling or missing initial, as long as the beneficiary or representative recognizes the name listed on the notice as that of the beneficiary.

Blank (C) Identification Number: Use of this field is optional. Notifiers may enter an identification number for the beneficiary that helps to link the notice with a related claim. The absence of an identification number does not invalidate the ABN. An internal filing number created by the notifier, such as a medical record number, may be used. Medicare numbers (HICNs) or Social Security numbers must not appear on the notice.

Body

Blank (D): The following descriptors may be used in the Blank (D) fields:

Item

Service

Laboratory test

Test

Procedure

Care

Equipment

The notifier must list the specific names of the items or services believed to be noncovered in the column directly under the header of Blank (D).

In the case of partial denials, notifiers must list in the column under Blank (D) the excess component(s) of the item or service for which denial is expected.

For repetitive or continuous noncovered care, notifiers must specify the frequency and/or duration of the item or service. See § 50.7.1 (b) of the MCPM, Chapter 30 for additional information.

General descriptions of specifically grouped supplies are permitted in this column. For example, “wound care supplies” would be a sufficient description of a group of items used to provide this care. An itemized list of each supply is generally not required.

When a reduction in service occurs, notifiers must provide enough additional information so that the beneficiary understands the nature of the reduction. For example, entering “wound care supplies decreased from weekly to monthly” would be appropriate to describe a decrease in frequency for this category of supplies; just writing “wound care supplies decreased” is insufficient.

Please note that there are a total of 7 Blank (D) fields that the notifier must complete on the ABN. Notifiers are encouraged to populate all of the Blank (D) fields in advance when a general descriptor such as “Item(s)/Service(s)” is used. All Blank

(D)fields must be completed on the ABN in order for the notice to be considered valid.

Blank (E) Reason Medicare May Not Pay: In the column under this header, notifiers must explain, in beneficiary friendly language, why they believe the items or services listed in the column under Blank (D) may not be covered by Medicare. Three commonly used reasons for noncoverage are:

“Medicare does not pay for this test for your condition.”

“Medicare does not pay for this test as often as this (denied as too frequent).”

“Medicare does not pay for experimental or research use tests.”

To be a valid ABN, there must be at least one reason applicable to each item or service listed in the column under Blank (D). The same reason for noncoverage may be applied to multiple items in Blank (D) when appropriate.

Blank (F) Estimated Cost: Notifiers must complete the column under Blank (F) to ensure the beneficiary has all available information to make an informed decision about whether or not to obtain potentially noncovered services.

Notifiers must make a good faith effort to insert a reasonable estimate for all of the items or services listed under Blank (D). In general, we would expect that the estimate should be within $100 or 25% of the actual costs, whichever is greater; however, an estimate that exceeds the actual cost substantially would generally still be acceptable, since the beneficiary would not be harmed if the actual costs were less than predicted. Thus, examples of acceptable estimates would include, but not be limited to, the following:

For a service that costs $250:

•Any dollar estimate equal to or greater than $150

•“Between

•“No more than $500”

For a service that costs $500:

•Any dollar estimate equal to or greater than $375

•“Between

•“No more than $700”

Multiple items or services that are routinely grouped can be bundled into a single cost estimate. For example, a single cost estimate can be given for a group of laboratory tests, such as a basic metabolic panel (BMP). An average daily cost estimate is also permissible for long term or complex projections. As noted above, providers may also

CMS will work with its contractors to ensure consistency when evaluating cost estimatesand determining validity of the ABN in general. In addition, contractors will provide ongoing education to notifiers as needed to ensure proper notice delivery. Notifiers should contact the appropriate CMS regional office if they believe that a contractor inappropriately invalidated an ABN.

Options

Blank (G) Options: Blank (G) contains the following three options:

□OPTION 1. I want the (D) listed above. You may ask to be paid now, but I also want Medicare billed for an official decision on payment, which is sent to me on a Medicare Summary Notice (MSN). I understand that if Medicare doesn’t pay, I am responsible for payment, but I can appeal to Medicare by following the directions on the MSN. If Medicare does pay, you will refund any payments I made to you, less

This option allows the beneficiary to receive the items and/or services at issue and requires the notifier to submit a claim to Medicare. This will result in a payment decision that can be appealed. See Ch. 30, §50.15.1 of the online Medicare Claims Processing Manual for instructions on the notifier’s obligation to bill Medicare. Suppliers and providers who don’t accept Medicare assignment may make modifications to Option 1 only as specified below under “D. Additional Information.”

Note: Beneficiaries who need to obtain an official Medicare decision in order to file a claim with a secondary insurance should choose Option 1.

□OPTION 2. I want the (D) listed above, but do not bill Medicare. You may ask to be paid now as I am responsible for payment. I cannot appeal if Medicare isnot billed.

This option allows the beneficiary to receive the noncovered items and/or services and pay for them out of pocket. No claim will be filed and Medicare will not be billed. Thus, there are no appeal rights associated with this option.

□OPTION 3. I don’t want the (D)listed above. I understand with this choice I am not responsible for payment, and I cannot appeal to see if Medicare wouldpay.

This option means the beneficiary does not want the care in question. By checking this box, the beneficiary understands that no additional care will be provided; thus, there are no appeal rights associated with this option.

The beneficiary or his or her representative must choose only one of the three options listed in Blank (G). Under no circumstances can the notifier decide for the beneficiary which of the 3 checkboxes to select.

If there are multiple items or services listed in Blank (D) and the beneficiary wants to receive some, but not all of the items or services, the notifier can accommodate this request by using more than one ABN. The notifier can furnish an additional ABN listing the items/services the beneficiary wishes to receive with the corresponding option.

If the beneficiary cannot or will not make a choice, the notice should be annotated, for

example: “beneficiary refused to choose an option.”

Additional Information

Blank (H) Additional Information: Notifiers may use this space to provide additional clarification that they believe will be of use to beneficiaries. For example, notifiers may use this space to include:

A statement advising the beneficiary to notify his or her provider about certain tests that were ordered, but not received;

Information on other insurance coverage for beneficiaries, such as a Medigap policy, if applicable;

An additional dated witness signature; or Other necessary annotations.

Annotations will be assumed to have been made on the same date as that appearing in Blank J, accompanying the signature. If annotations are made on different dates, those dates should be part of the annotations.

Special guidance ONLY for

Strike the last sentence in the Option 1 paragraph with a single line so that it appears like this: If Medicare does pay, you will refund any payments I made to you, less co- pays or deductibles.

This single line strike can be included on ABNs printed specifically for issuance when unassigned items and services are furnished. Alternatively, the line can be

The sentence must be stricken and can’t be entirely concealed or deleted.

There is no CMS requirement for suppliers or the beneficiary to place initials next to the stricken sentence or date the annotations when the notifier makes the changes to the ABN before issuing the notice to the beneficiary.

When this sentence is stricken, the supplier shall include the following

“This supplier doesn’t accept payment from Medicare for the item(s) listed in the table above. If I checked Option 1 above, I am responsible for paying the supplier’s charge for the item(s) directly to the supplier. If Medicare does pay, Medicare will pay me the

OThis statement can be included on ABNs printed for unassigned items and services, or it can be handwritten in a legible 10 point or larger font.

•An ABN with the Option 1 sentence stricken must contain the

B. Signature Box

Once the beneficiary reviews and understands the information contained in the ABN, the Signature Box is to be completed by the beneficiary (or representative). This box cannot be completed in advance of the rest of the notice.

Blank (I) Signature: The beneficiary (or representative) must sign the notice to indicate that he or she has received the notice and understands its contents. If a representative signs on behalf of a beneficiary, he or she should write out “representative” in parentheses after his or her signature. The representative’s name should be clearly legible or noted in print.

Blank (J) Date: The beneficiary (or representative) must write the date he or she signed the ABN. If the beneficiary has physical difficulty with writing and requests assistance in completing this blank, the date may be inserted by the notifier.

Disclosure Statement: The disclosure statements in the footer of the notice are required to be included on the document.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The CMS R 131 Advance Beneficiary Notice (ABN) informs Medicare beneficiaries about potential noncoverage of specific services. |

| Notifier Types | Notifiers include physicians, healthcare providers, and suppliers operating under Medicare Part B, as well as hospice and religious non-medical health care institutions paid under Part A. |

| Required Signatures | Beneficiaries must sign the ABN to acknowledge receipt and understanding. A copy is provided to them post-signature. |

| Delivery Timeline | ABNs must be delivered in advance of services provided to ensure beneficiaries have time to make informed decisions. |

| Options Available | Beneficiaries can choose between three options regarding coverage: to accept responsibility for payment, to refuse service, or to proceed while Medicare is billed for an official decision. |

| Cost Estimation Requirement | Notifiers must provide a reasonable estimate of costs associated with the items or services, ensuring clarity for beneficiaries. |

| Government Oversight | This form is part of the regulations governed by the Centers for Medicare & Medicaid Services (CMS), which regularly reviews its validity and updates as necessary. |

Guidelines on Utilizing Cms R 131 Advance Abn

Filling out the CMS R 131 Advance Beneficiary Notice of Noncoverage (ABN) is straightforward and requires attention to detail. It is essential to complete the form accurately to ensure that the patient understands their potential financial responsibility regarding Medicare coverage. Follow these steps carefully to complete the form.

- Notifier: Enter your name, address, and telephone number at the top of the notice. Make sure this information is clear and easily readable.

- Patient Name: Write the first name, last name, and middle initial (if applicable) of the beneficiary receiving the notice.

- Identification Number: Include an optional identification number that links to the beneficiary, such as a medical record number. Do not use Medicare numbers.

- Items or Services: Under Blank (D), list the specific items or services that may not be covered by Medicare. Be clear and concise.

- Reason Medicare May Not Pay: In Blank (E), provide reasons for the potential noncoverage in simple, patient-friendly language.

- Estimated Cost: For Blank (F), offer a good faith estimate of the costs associated with the services listed. Ensure the estimate is reasonable and within acceptable ranges.

- Options: Under Blank (G), check only one box according to the beneficiary's preference regarding Medicare billing for the services listed.

- Additional Information: In Blank (H), include any relevant information for the patient, such as who to contact for billing questions.

- Signature: Obtain a signature from the patient or their representative in Blank (I), confirming they have received and understood the notice.

- Date: Fill in the date of completion in Blank (J).

Following these steps will help you complete the form correctly. Once finalized, provide a copy to the beneficiary or their representative and keep a copy for your records. This process aids in ensuring that patients are informed and understand their potential financial responsibilities regarding Medicare coverage.

What You Should Know About This Form

What is the CMS R-131 Advance Beneficiary Notice (ABN)?

The CMS R-131 Advance Beneficiary Notice, commonly known as the ABN, is a form provided to Medicare beneficiaries to inform them that Medicare may not cover a specific healthcare item or service. This notice allows patients to make informed decisions regarding their care and financial responsibility. If Medicare denies coverage for the services listed, the beneficiary could be financially responsible for those costs.

Who issues the ABN?

The ABN can be issued by a variety of healthcare providers, including physicians, outpatient hospitals, and independent laboratories. Home health agencies now use this notice instead of the outdated Home Health Advance Beneficiary Notice (HHABN). It’s essential for the ABN to be delivered before the service is provided so that the patient has adequate time to consider their options.

What are the options available to beneficiaries when they receive an ABN?

Beneficiaries receiving an ABN have three options to choose from. They can: 1. Request the care listed and allow Medicare to be billed for a formal decision on payment. If Medicare denies coverage, the beneficiary accepts financial responsibility but may appeal the decision. 2. Opt to receive the care but choose not to bill Medicare, thereby accepting immediate financial liability. This option does not allow for an appeal. 3. Decline the care entirely. By doing this, the beneficiary will not be responsible for any related costs and cannot appeal Medicare’s potential coverage of the service.

What must be included in the ABN?

The ABN must include various details such as the notifier's information, the patient's name, identification number (optional), and specifics about the service (or item) that may not be covered. Additionally, the reason Medicare may not cover each item or service, along with an estimated cost, needs to be clearly outlined.

How does a beneficiary make an informed decision after receiving the ABN?

Upon receiving the ABN, beneficiaries must read the notice carefully. They also have the opportunity to ask questions to clarify any part of the notice or the associated costs. The goal is to ensure that they understand their options and the potential financial implications related to the care being offered.

What happens if a beneficiary chooses not to sign the ABN?

If a beneficiary decides not to sign the ABN, they will not be held financially responsible for the service in question. However, they may miss out on the opportunity to receive that potentially necessary care and the ability to appeal any potential coverage issues with Medicare. Signing the notice helps to clarify their decision regarding the proposed services.

Can the ABN be used for services that Medicare never covers?

Yes, the ABN can also serve as a voluntary notification of financial liability for services that Medicare does not cover at all. In such cases, the beneficiary will not be required to select an option or sign the notice. However, the notifier still provides an explanation regarding the lack of coverage.

What should be done if a beneficiary has further questions about the ABN or Medicare billing?

If beneficiaries have additional questions or need clarification, they can call Medicare directly at 1-800-MEDICARE (1-800-633-4227), where they can receive detailed assistance regarding their specific concerns and understand their rights.

Is there any consideration for beneficiaries with disabilities regarding the ABN?

The ABN includes provisions to ensure that beneficiaries with disabilities are informed of their rights under CMS nondiscrimination practices. They can request the ABN in alternative formats if needed, making it inclusive and accessible to all beneficiaries.

Common mistakes

Filling out the CMS R-131 Advance Beneficiary Notice of Noncoverage (ABN) form is a critical responsibility for healthcare providers. However, there are several common mistakes that can be made during this process, which may lead to confusion or invalidation of the notice. Understanding these pitfalls can help ensure the form is completed correctly and effectively communicates necessary information to patients.

One significant mistake is not providing clear information about the services or items listed in Blank D. This section requires specific details about what may not be covered by Medicare. Simply stating “services” or using vague descriptions can create ambiguity. Instead, it is essential to itemize the care being provided, such as “wound care supply” or “lab test,” so that patients clearly understand what is at stake.

Another frequent error occurs in the explanation of why Medicare may not cover the services, as indicated in Blank E. Providers often fail to provide beneficiary-friendly language that lays out the reasons in an understandable manner. Complex medical jargon could confuse patients, making it crucial to utilize straightforward terms and descriptions when explaining noncoverage. This clarity is necessary for patients to make informed decisions about their care options.

Completing the Estimated Cost section, labeled Blank F, is another area where mistakes are commonly made. Healthcare providers sometimes omit this information or present it inaccurately. It is vital not only to give an estimate but also to ensure that it is reasonably close to the actual cost. Providing a specific range or a dollar amount helps patients gauge their potential financial responsibility accurately.

It's also worth noting that an incomplete signature section can invalidate the entire notice. Blank I requires a cursive signature as well as the date. Failing to ensure that this is filled out entirely means the ABN might not hold up if there is a dispute regarding the services. A provider must verify that the patient's signature is present, noted with the date.

Some people struggle with selecting the correct option in Blank G. This section requires the patient or their representative to check one box according to their preference regarding receiving the services. Selecting more than one option or leaving it unchecked can also result in an ineffective notice. Encouraging beneficiaries to carefully consider their choices and assisting them in making a selection can help avoid this mistake.

Furthermore, providing incomplete contact information in Blank A can hinder patients from obtaining further assistance if they have questions. Notifying entities should provide their name, address, and relevant phone numbers, including TTY options if necessary. This information ensures that all communication channels are open for any follow-up inquiries about the services and the ABN itself.

Lastly, failing to retain a copy of the ABN for records can lead to problems later. The notifying entity must maintain a copy of the ABN for their files, as this serves as proof that the notice was delivered properly to the patient. Without this documentation, discrepancies or disputes regarding the notice may arise later, complicating the billing process.

By being aware of these mistakes and taking proactive steps to prevent them, healthcare providers can enhance their compliance with Medicare regulations and support patients in understanding their financial responsibilities regarding noncovered services.

Documents used along the form

The CMS R 131 Advance ABN form is crucial for informing Medicare beneficiaries about potential noncoverage of certain services. Alongside this form, other documents may be necessary for proper processing and communication. Here’s a list of related forms and documents commonly used in conjunction with the ABN.

- Medicare Summary Notice (MSN): A document that summarizes services billed to Medicare within a specific period, including details on payments and any patient obligations.

- Claim Form (CMS-1500): The standard form for billing Medicare and other health insurance programs for outpatient services provided by physicians or suppliers.

- Home Health Advance Beneficiary Notice (HHABN): A form used prior to 2013 to inform home health patients of potential Medicare noncoverage, now replaced by the ABN.

- Advance Directive: A legal document that outlines a patient's preferences for medical treatment in situations where they cannot communicate their wishes.

- Medical Records Release Form: A document that permits the sharing of a patient’s medical information with specified parties, often necessary for processing claims.

- Provider Enrollment Application (CMS-855): This form is used to enroll healthcare providers in Medicare, ensuring that they meet the necessary qualifications and standards.

- Patient Registration Form: Information collected from patients that may include personal details, insurance information, and medical history, usually required during the first visit.

- Financial Agreement Form: A contract between the healthcare provider and patient outlining financial responsibilities, payment plans, and insurance coverage details.

- Claim Appeal Form: A document used to request a reevaluation of a denied claim for services rendered, seeking to reverse the denial decision.

- Notice of Noncoverage (NOC): A form that notifies patients that Medicare will not cover certain services or items, similar to the ABN but specific to noncovered services.

Ensure that these documents are prepared and delivered alongside the ABN to facilitate clear communication of payment responsibilities and coverage options. Timely dissemination of this information is vital for patient understanding and compliance.

Similar forms

The CMS R-131 Advance Beneficiary Notice (ABN) form serves a specific purpose, but there are several other documents that are similar in function. Here’s how they compare:

- Home Health Advance Beneficiary Notice (HHABN) - This document was previously used to inform patients receiving home health care about the potential for noncoverage of specific services. It served much the same purpose as the ABN, letting patients know they might have to pay for certain services.

- Medicare Summary Notice (MSN) - An MSN is sent to beneficiaries detailing services billed to Medicare. While it is not a pre-warning like the ABN, it acknowledges items that Medicare has covered or denied, and helps beneficiaries understand their financial responsibilities.

- Notice of Medicare Noncoverage (NOMNC) - This notice is provided to beneficiaries when the provider intends to stop a service that Medicare has been covering. Similar to the ABN, it communicates the potential financial implications of service discontinuation.

- Important Message About Your Rights (IMAR) - This document informs patients about their rights related to hospital services and Medicare coverage. It shares some similarities with the ABN in that it explains possible financial responsibilities, particularly concerning hospital stays.

- Advance Directive - Although not specifically about coverage, advance directives inform patients about their medical care preferences. It serves as a crucial document that enables patients to understand their choices, akin to the way an ABN helps them understand financial choices.

- Outpatient Utilization Review (OUR) Notice - This notice educates beneficiaries about their outpatient services. Like the ABN, it advises patients on potential noncoverage and financial liability.

- Skilled Nursing Facility (SNF) Advanced Beneficiary Notice - This form is similar to the ABN but specifically used in a skilled nursing facility context to inform patients about services that may not be covered under Medicare.

Dos and Don'ts

When filling out the CMS R-131 Advance ABN form, consider the following important guidelines:

- Read Carefully: Always read through the form thoroughly before filling it out. Understanding the requirements will lead to fewer mistakes.

- Use Clear Language: Write reasons clearly in beneficiary-friendly language. Avoid technical terms that may confuse the beneficiary.

- Complete All Required Blanks: Ensure every relevant blank, particularly those labeled (D) through (F), is filled out completely to validate the notice.

- Provide Estimates: Include a good faith estimate of costs. Be realistic but also transparent about potential charges.

- Choose One Option: Make sure that the beneficiary selects only one option from the choices provided. This is crucial for clarity.

- Answer Questions: Be open to addressing any questions the beneficiary might have after reviewing the form. This promotes understanding.

- Deliver Copies: After signing, provide a copy of the form to the beneficiary. Retain a copy for your records as well.

Conversely, here are some things to avoid:

- Do Not Leave Blanks: Avoid submitting the form with incomplete sections, as this can invalidate the notice.

- Avoid Technical Jargon: Refrain from using complex medical terms. Use straightforward language that beneficiaries can easily understand.

- Do Not Rush the Process: Take the necessary time to explain the ABN to beneficiaries. Rushed interactions can lead to misunderstandings.

- Never Use Identifying Numbers: Do not include Social Security or Medicare numbers on the form to protect the beneficiary’s privacy.

- Do Not Skip Cost Estimates: Omitting a cost estimate can deny beneficiaries important information they need to make informed decisions.

- Avoid Ambiguity: Be specific when indicating potential noncoverage reasons. Vague statements can lead to confusion.

- Do Not Forget Signatures: Ensure that both the provider and the beneficiary sign the form. Missing signatures can render the form invalid.

Misconceptions

Misconceptions about the CMS R-131 Advance ABN form can lead to confusion regarding its use and implications. Understanding the truth behind these misconceptions is crucial for beneficiaries. Here are six common misunderstandings:

- Misconception 1: The ABN only applies to patients with private insurance.

- Misconception 2: Signing the ABN means I will definitely have to pay for the service.

- Misconception 3: Providers are obligated to bill Medicare even if they believe it won't cover the service.

- Misconception 4: I can appeal any decision regarding coverage if I sign the ABN.

- Misconception 5: The reason for denial must always be complex or lengthy.

- Misconception 6: The ABN must include an identification number to be valid.

The ABN is specifically designed for beneficiaries in Original Medicare. It helps them understand potential noncoverage of services, regardless of whether they have other insurance.

Signing the ABN does not guarantee payment. It indicates awareness of potential payment issues. If Medicare does cover the service after billing, beneficiaries can receive refunds for any payments made.

While providers must inform beneficiaries of noncoverage chances, they are not required to bill Medicare if the beneficiary opts for a service but waives billing.

An appeal is only possible if Medicare is billed. If a beneficiary chooses not to have Medicare billed, they cannot contest the coverage decision.

Notifiers should provide clear and straightforward reasons. Simple explanations such as “This service is not covered for your condition” are acceptable and can aid understanding.

Including an identification number is optional. The absence of one does not invalidate the ABN as long as the beneficiary recognizes their name on the notice.

Clarifying these misconceptions can empower beneficiaries to make informed decisions regarding their healthcare and anticipated costs.

Key takeaways

Here are some key takeaways regarding the CMS R 131 Advance Beneficiary Notice (ABN) form:

- Purpose of the ABN: The ABN informs Medicare beneficiaries that Medicare might not cover specific services or items.

- Who Gives the Notice: Notifiers can include physicians, hospital providers, and other healthcare practitioners.

- Understanding Coverage: Not all services are covered by Medicare, even if deemed necessary by your healthcare provider.

- Important Sections: The form includes sections for patient information, identified items/services, and estimated costs.

- Choosing Options: Beneficiaries must select one of three options regarding their treatment or service on the ABN form.

- Financial Liability: If Medicare does not pay, the beneficiary may be responsible for the associated costs.

- Signature Required: Signing the form signifies that the beneficiary understands the notice.

- Advance Delivery: Notifiers must provide the ABN far enough in advance for beneficiaries to make informed choices.

- Noteworthy Revisions: The form includes language about beneficiary rights and nondiscrimination practices under federal law.

- Cost Estimates: Notifiers should provide a reasonable estimate for services, helping beneficiaries understand potential financial obligations.

Using this form correctly can greatly improve communication regarding insurance coverage and patient rights.

Browse Other Templates

Mcp65 - All endorsements and documentation must match the details in the form.

Eoi Meaning Insurance - Ensure the Control Number and Social Security Number are correctly entered in Section A.

Seterus Mortgage Login - This form serves as a vital communication tool between the borrower and Seterus representatives.