Fill Out Your Co 1049A Form

The CO-1049A form, also known as the Limited Durable Power of Attorney (LDPOA) for Post-Retirement, plays a crucial role for members of the State Employees Retirement System (SERS) in Connecticut. This form allows retired members to designate someone they trust, known as an Attorney-In-Fact, to handle specific transactions related to their retirement benefits on their behalf. It is an essential tool for ensuring that your financial matters can be managed smoothly, particularly if you are unable to do so yourself. The document outlines the powers granted to the Attorney-In-Fact, which can include changing tax withholding, updating address information, and designating beneficiaries for remaining contributions after death. However, it’s important to note that certain decisions, such as altering payment elections or survivor annuitants, cannot be modified post-retirement. Additionally, this form must be executed with care; it requires signatures from both the member and witnesses, along with notarization, to ensure its validity. While this LDPOA remains effective even if you become incapacitated, it will automatically terminate upon your death or if you revoke it in writing. Given the significance of this document, it is highly recommended to seek legal advice before signing, ensuring that your wishes are well understood and protected.

Co 1049A Example

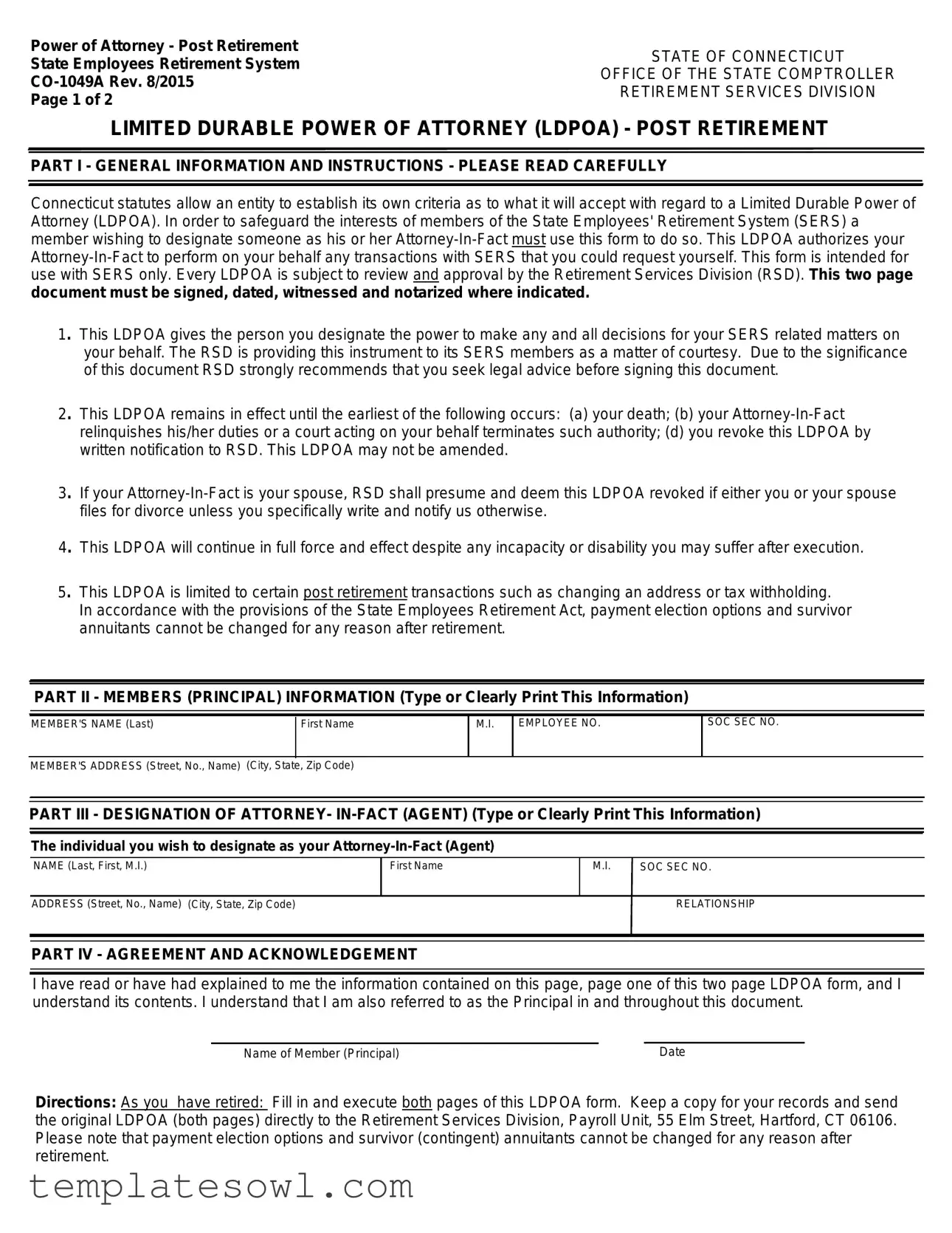

Power of Attorney - Post Retirement |

STATE OF CONNECTICUT |

|

State Employees Retirement System |

||

OFFICE OF THE STATE COMPTROLLER |

||

RETIREMENT SERVICES DIVISION |

||

Page 1 of 2 |

||

|

LIMITED DURABLE POWER OF ATTORNEY (LDPOA) - POST RETIREMENT

PART I - GENERAL INFORMATION AND INSTRUCTIONS - PLEASE READ CAREFULLY

Connecticut statutes allow an entity to establish its own criteria as to what it will accept with regard to a Limited Durable Power of Attorney (LDPOA). In order to safeguard the interests of members of the State Employees' Retirement System (SERS) a member wishing to designate someone as his or her

1. This LDPOA gives the person you designate the power to make any and all decisions for your SERS related matters on your behalf. The RSD is providing this instrument to its SERS members as a matter of courtesy. Due to the significance of this document RSD strongly recommends that you seek legal advice before signing this document.

2. This LDPOA remains in effect until the earliest of the following occurs: (a) your death; (b) your

3. If your

4. This LDPOA will continue in full force and effect despite any incapacity or disability you may suffer after execution.

5. This LDPOA is limited to certain post retirement transactions such as changing an address or tax withholding.

In accordance with the provisions of the State Employees Retirement Act, payment election options and survivor annuitants cannot be changed for any reason after retirement.

PART II - MEMBERS (PRINCIPAL) INFORMATION (Type or Clearly Print This Information)

MEMBER'S NAME (Last)

First Name

M.I.

EMPLOYEE NO.

SOC SEC NO.

MEMBER'S ADDRESS (Street, No., Name) (City, State, Zip Code)

PART III - DESIGNATION OF ATTORNEY-

The individual you wish to designate as your

NAME (Last, First, M.I.)

First Name

M.I. |

SOC SEC NO. |

ADDRESS (Street, No., Name) (City, State, Zip Code) |

RELATIONSHIP |

PART IV - AGREEMENT AND ACKNOWLEDGEMENT

I have read or have had explained to me the information contained on this page, page one of this two page LDPOA form, and I understand its contents. I understand that I am also referred to as the Principal in and throughout this document.

Name of Member (Principal) |

Date |

Directions: As you have retired: Fill in and execute both pages of this LDPOA form. Keep a copy for your records and send the original LDPOA (both pages) directly to the Retirement Services Division, Payroll Unit, 55 Elm Street, Hartford, CT 06106. Please note that payment election options and survivor (contingent) annuitants cannot be changed for any reason after retirement.

Power of Attorney - |

STATE OF CONNECTICUT |

||

OFFICE OF THE STATE COMPTROLLER |

|||

State Employees Retirement System |

|||

RETIREMENT SERVICES DIVISION |

|||

|

|||

Page 2 of 2 |

|

||

|

LIMITED DURABLE POWER OF ATTORNEY (LDPOA) - POST RETIREMENT |

||

I hereby give |

|

(name of |

|

on the first page of this two page form, the full power and authority to represent me in the following post retirement plan transactions on my behalf with SERS to the extent that I could do myself as a member of SERS. My

Responding to SERS request for information or documents or representing me in any request for information or forms.

Designate a beneficiary to receive remaining contributions and interest (if any) after my death and the death of any contingent annuitant.

Changing my tax withholding.

Changing the address or bank to which my SERS payments are sent: however SERS will not make the check payable to my

Important Note For Direct Deposit & Direct Deposit Changes Only: A power of attorney may not be necessary to make changes to direct deposits. For direct deposit and direct deposit changes only, RSD will accept a copy of the Representative Payee designation made by the Commissioner of Social Security. There are two such types of payees: an individual representative payee who could be a family member or friend or a lawyer, a legal guardian, or a volunteer for a government or

By signing this form. I am granting(name of

authority to act on my behalf with regard to the SERS transactions I have marked above. I understand the legal impact in executing this LDPOA and hereby agree to hold SERS, the State of Connecticut and its employees harmless for any alleged misuse, mismanagement or malfeasance by the

IN WITNESS WHEREOF, I have signed this Limited Durable Power of Attorney on |

, 20 |

|

|

|||

|

|

|

|

|

|

|

Signature of Member (Principal) |

|

Address (Street/Town/State) Where Signed |

|

|||

Statement of Witnesses: I declare that the Principal has identified himself or herself to me, that the Principal signed or acknowledged this LDPOA in my presence, that I believe the Principal to be of sound mind, that the Principal has affirmed that the Principal is aware of the nature of the document and is signing it voluntarily and free from duress.

1. Witness Signature: |

|

|

2. Witness Signature: |

|

|

||

Date signed: |

|

|

Date signed: |

|

|||

Address: |

|

|

|

Address: |

|

||

Acknowledgement: On this day before me, a Notary Public or Commissioner of the Superior Court, authorized to administer

oaths in the State that the Member resides, personally appeared |

|

|

(Member/Principal) who is personally |

known to me or proved to me on the basis of satisfactory evidence |

to be the person whose name is subscribed as the Principal |

||

within this instrument, executed this document in my presence, and personally acknowledged to me that he/she executed this LDPOA for the purposes herein stated.

Signed and sworn before me this |

|

day of |

|

, 20 |

|

|

|

||

Signature of Notary Public or Commissioner of the Superior Court: |

|

|

|

|

|

||||

State: |

Town: |

|

My commission expires |

|

|

SEAL HERE |

|||

Form Characteristics

| Fact Name | Description |

|---|---|

| Document Purpose | This form is used to grant someone the authority to act on behalf of a retiree for specific transactions with the State Employees Retirement System (SERS). |

| Required Approval | Any Limited Durable Power of Attorney (LDPOA) submitted must be approved by the Retirement Services Division (RSD). |

| Effective Period | The LDPOA remains effective until the death of the retiree, if the attorney-in-fact relinquishes their duties, or if revoked by the retiree. |

| Revocation During Divorce | If the attorney-in-fact is the retiree's spouse, the LDPOA is automatically revoked if either party files for divorce. |

| Allowed Transactions | This LDPOA covers certain post-retirement actions like changing tax withholding or updating a mailing address. |

| State Law Reference | This form operates under the Connecticut State Employees Retirement Act, connecting directly to the rules governing SERS. |

Guidelines on Utilizing Co 1049A

Filling out the CO-1049A form is a critical step in empowering someone to act on your behalf regarding your retirement benefits with SERS. This document allows you to designate an Attorney-In-Fact who can manage, change, or update certain aspects of your post-retirement transactions. The following steps will guide you through the process of completing the form correctly.

- Gather your information: Collect all personal details needed to fill out the form, including your name, employee number, Social Security number, and contact information.

- Fill in your details: In the MEMBER INFORMATION section, clearly print your full name, employee number, and address.

- Designate your Attorney-In-Fact: In the ATTORNEY-IN-FACT section, write down the name, address, and relationship of the person you are appointing. Ensure this person is aware and agrees to take this responsibility.

- Initial the transactions you authorize: Review the list of transactions and initial next to each one that you allow your Attorney-In-Fact to manage on your behalf, such as changing your tax withholding or address.

- Sign and date the form: At the bottom of the second page, sign the document and write the date of signing. Ensure you are in a sound state of mind when you do this.

- Have witnesses sign: Two witnesses must sign the document in the provided spaces to confirm that you are willingly signing the form.

- Notarize the document: Finally, take the completed form to a Notary Public. They will verify your identity and seal the document, ensuring it is legally binding.

- Make copies: Keep a copy of the completed form for your own records.

- Submit the original: Mail the original filled-out form (both pages) to the Retirement Services Division at the provided address in Hartford, CT.

By following these steps closely, you ensure that your Power of Attorney is executed properly. Double-check your entries and signatures, as any errors could delay processing or invalidate your wishes. Taking this proactive approach helps your designated Attorney-In-Fact effectively manage your retirement transactions when needed.

What You Should Know About This Form

What is the CO-1049A form?

The CO-1049A form is a Limited Durable Power of Attorney (LDPOA) specifically designed for members of the State Employees Retirement System (SERS) in Connecticut. It allows you to designate someone as your Attorney-In-Fact, giving them the authority to manage certain retirement-related transactions on your behalf post-retirement.

Who can I designate as my Attorney-In-Fact?

You can choose anyone as your Attorney-In-Fact as long as they are capable of making informed decisions. This could be a family member, a friend, or even a legal representative. The important factor is that the person you choose should understand your interests and be trustworthy to act in your best interests regarding your retirement matters.

What powers does this form grant to my Attorney-In-Fact?

This form gives your Attorney-In-Fact significant powers regarding your SERS transactions. They can respond to requests for information, change your address or tax withholding, and designate a beneficiary for remaining contributions after your death. However, certain decisions, like changing payment election options, cannot be made after retirement.

How long does the power of attorney remain in effect?

Your Limited Durable Power of Attorney remains effective until one of several conditions occurs: your death, a formal revocation by you, your Attorney-In-Fact resigns, or a court terminates the authority. It's important to note that this LDPOA does not expire automatically just because you become incapacitated.

Can I revoke the CO-1049A form?

Yes, you can revoke the CO-1049A by providing written notice to the Retirement Services Division. It’s essential to follow the proper procedure to ensure that the revocation is acknowledged and any transactions made after your notification are not authorized by your Attorney-In-Fact.

What happens if my Attorney-In-Fact is my spouse and we get divorced?

If your Attorney-In-Fact is your spouse, the form is automatically deemed revoked if either you or your spouse files for divorce. This ensures that the authority does not continue under circumstances that may be contrary to your wishes. If you want it to remain enforceable post-divorce, you must inform the Retirement Services Division in writing.

Are there any limitations to the powers granted?

Yes, while your Attorney-In-Fact can manage many affairs related to your SERS benefits, certain limitations apply. For example, they cannot change payment election options after your retirement. Furthermore, your Attorney-In-Fact cannot receive checks or deposits in their name; any payment must be directed to you directly.

Do I need to have the form notarized?

Yes, the CO-1049A form must be signed, dated, witnessed, and notarized. This additional layer of verification helps ensure the authenticity of the document and protects against misuse.

Should I seek legal advice before completing this form?

It is strongly recommended that you seek legal advice before signing the CO-1049A form. Given the significance of granting someone authority over your retirement matters, understanding the implications is crucial for your peace of mind and financial security.

Common mistakes

Filling out the Co 1049A form can seem daunting, but it’s vital to ensure it’s done correctly. One common mistake is failing to provide complete and accurate information. In the sections requesting your name, Social Security number, and address, any absence of detail can lead to delays or rejection of the form. It’s essential to double-check all entries to avoid these pitfalls.

Another critical mistake occurs when individuals neglect the witnessing requirement. The form mandates that it be signed in the presence of witnesses, and this step is non-negotiable. If this detail is overlooked, the form may not be valid, possibly complicating your post-retirement transactions. Ensure that the witnesses sign and include their details exactly as required.

Many people underestimate the importance of notarization. Failing to have the document notarized can render it useless. This step verifies the identities of everyone involved and confirms that they are signing willingly. Skipping this process can lead to significant issues when attempting to use the power of attorney later.

A common oversight involves misunderstanding the scope of the power granted. The form allows the Attorney-In-Fact to handle specific SERS transactions, but not all financial matters. Clear awareness of what is permitted is necessary to avoid any actionable missteps. Always read the sections regarding the authorities granted carefully to ensure compliance with the intended use.

Finally, individuals sometimes forget to retain a copy of their completed form. Keeping a record of what was submitted is crucial for reference and future use. If questions arise or if the form needs to be verified, having that copy ensures you have all the information at hand. It’s easy to overlook this, but it can save time and confusion later.

Documents used along the form

The CO-1049A form is essential for establishing a Limited Durable Power of Attorney related to post-retirement matters within the Connecticut State Employees Retirement System. When filling out this form, it's important to consider additional documents that may be necessary or helpful in conjunction with it.

- CO-1049B - Limited Durable Power of Attorney (LDPOA) Revocation: This form allows a member to revoke a previously established Limited Durable Power of Attorney. It must be completed and submitted to the Retirement Services Division to ensure that any prior authority granted to an Attorney-In-Fact is officially canceled.

- CO-401 - Change of Address Form: Use this document to update contact information with the State Employees Retirement System. Members should submit this form to ensure that all future correspondence is sent to the correct address.

- Application for Payment Election Options: Although you cannot change this after retirement, submitting this application is necessary for those who have yet to finalize their payment options. It outlines the choices, including lump-sum payments or monthly annuity distributions.

- Beneficiary Designation Form: This document enables members to designate beneficiaries for their retirement benefits. Members should ensure this information is up-to-date to avoid any complications after death regarding the distribution of benefits.

These forms and documents usually accompany the CO-1049A form, facilitating smoother transactions and updates with the retirement system. It is important for members to understand and manage their documents appropriately to ensure their wishes are honored.

Similar forms

- General Power of Attorney: Similar to the Co 1049A form, a General Power of Attorney allows an individual to designate another person to make decisions on their behalf. However, the General Power of Attorney can cover a wider range of matters beyond just retirement transactions.

- Limited Power of Attorney: This document is more specific than the General Power of Attorney. Like the Co 1049A, it grants authority for particular tasks but does not encompass all areas of decision-making.

- Durable Power of Attorney: This type ensures that the authority granted remains effective even if the principal becomes incapacitated. The Co 1049A is also designed to stay in effect despite any incapacity, emphasizing its durability.

- Advance Healthcare Directive: While primarily focused on healthcare decisions, this document allows individuals to appoint someone to make medical choices on their behalf, similar to how the Co 1049A permits decisions regarding retirement matters.

- Living Will: Although it focuses on medical care preferences, a Living Will can work in conjunction with a Power of Attorney. Both documents empower an individual’s designated agent to act in accordance with their wishes.

- Beneficiary Designation Form: Used to designate individuals who will receive benefits upon the principal’s death, this form parallels the Co 1049A by allowing a member to assign authority concerning their retirement benefits, specifically who will receive remaining contributions.

Dos and Don'ts

When filling out the CO-1049A form, there are important actions to consider. The following is a list of things you should and shouldn’t do during this process:

- Do read all instructions carefully before starting to ensure understanding of the requirements.

- Do provide complete and accurate information in all fields on the form.

- Do have the document signed, dated, witnessed, and notarized where indicated.

- Do keep a copy for your records after completing the form.

- Don’t attempt to change any part of the form once it has been signed.

- Don’t submit the form without ensuring that all parties have signed and witnessed it appropriately.

- Don’t assume the form is valid without notarization; this step is crucial for legality.

Following these guidelines can help ensure a smooth process in managing your retirement matters.

Misconceptions

There are several misconceptions surrounding the CO-1049A form, which is essential for post-retirement transactions under the Connecticut State Employees Retirement System. Understanding these misconceptions can help in making informed decisions.

- Misconception 1: The CO-1049A can be used for all types of Power of Attorney transactions.

- Misconception 2: Once the CO-1049A is signed, it cannot be revoked.

- Misconception 3: You do not need a witness or notary to validate the CO-1049A.

- Misconception 4: A spouse automatically retains authority after a divorce.

- Misconception 5: The Attorney-In-Fact can make any changes to pension plans.

- Misconception 6: This form can be used for direct deposit changes.

- Misconception 7: Signing the CO-1049A is a simple, risk-free process.

This form is specifically meant for limited durable power of attorney transactions related to SERS. It does not cover other financial or legal transactions.

While the form does remain in effect until certain conditions are met, such as death or formal revocation, you can revoke it by providing a written notification to the Retirement Services Division.

This form requires both a witness and a notary to be validly executed. Failing to include these could lead to complications.

If either spouse files for divorce, the CO-1049A is presumed revoked unless notified otherwise. This is an important detail for both parties.

The authority granted through the CO-1049A is limited. For instance, changes to payment election options and survivor annuitants cannot be made after retirement.

A power of attorney may not be necessary for direct deposit changes. Instead, a copy of the Representative Payee designation from the Commissioner of Social Security is sufficient.

Due to the legal implications of a Power of Attorney, it is strongly advised to seek legal counsel before signing the CO-1049A. This can prevent misunderstandings and protect your interests.

Key takeaways

Filling out the CO-1049A form, which is the Limited Durable Power of Attorney (LDPOA) for post-retirement in Connecticut, is an important step for members of the State Employees Retirement System (SERS). Here are some key takeaways to consider:

- Purpose of the Form: This form allows you to appoint someone as your Attorney-In-Fact so they can manage your SERS-related transactions on your behalf.

- Legal Advice Recommended: Given the significant authority this document grants, it’s wise to seek legal counsel prior to signing the form.

- Revocation Conditions: The power granted via this LDPOA remains effective unless you revoke it in writing, your Attorney-In-Fact relinquishes their duties, or upon your death.

- Spousal Considerations: If your Attorney-In-Fact is your spouse, the form is automatically revoked in the event of divorce unless you notify SERS otherwise.

- Scope of Authority: The LDPOA is limited to specific post-retirement transactions, including address changes and tax withholding. However, significant decisions like beneficiary designations are permitted.

- Notarization Required: For the form to be valid, it must be signed, dated, witnessed, and notarized. Each step is crucial for ensuring the document's legality.

Understanding these points can help ensure that your interests are protected and that the process goes smoothly. Always keep a copy of the completed form for your records after sending the original to the Retirement Services Division.

Browse Other Templates

Section 1035 - For other products, enter code 004 on the form.

Estimated Taxes 2023 - Payments can also be made by card or phone through approved methods.

Intent to Purchase Letter - Buyers are encouraged to document the condition of the personal property at the time of sale.