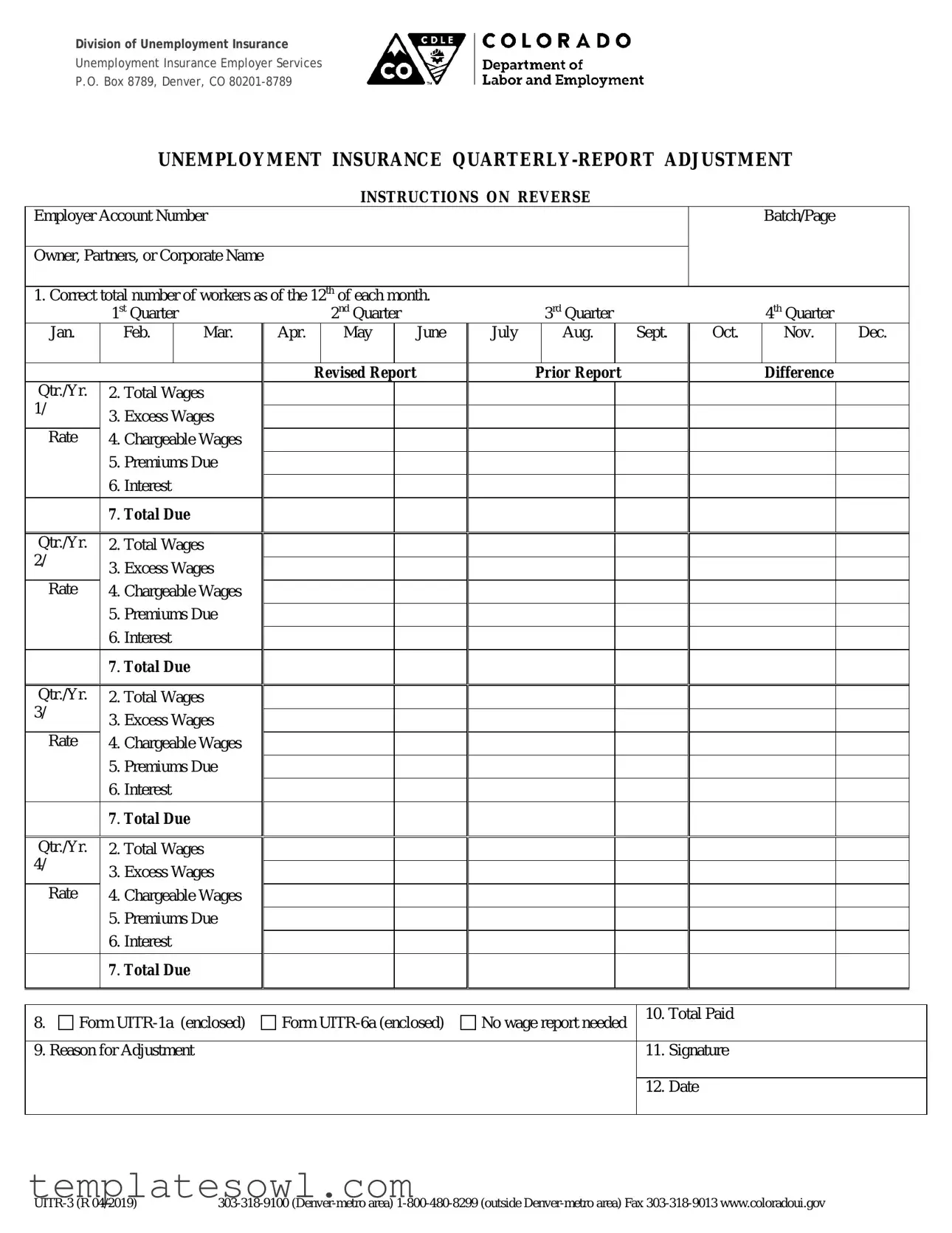

Fill Out Your Co Uitr 1 Form

The Co Uitr 1 form plays a crucial role in the management of unemployment insurance within Colorado, detailing the necessary adjustments that employers must report on a quarterly basis. Employers are required to provide accurate information regarding the number of employees, total wages, chargeable wages, and any interest due related to unemployment insurance premiums. The form includes sections for reporting adjustments from previous reports, allowing for corrections to both the number of workers and wages as needed. Employers should also calculate their premiums due based on chargeable wages, which refer to the first $13,100 of wages paid to each worker in the calendar year. With distinct categories for each quarter—first to fourth—employers must meticulously report the appropriate numbers and ensure they address any excess wages that fall beyond established limits. Additionally, specific instructions guide users on how to complete accompanying forms, such as UITR-1a or UITR-6a, depending on the nature of the adjustments being made. Understanding these components of the Co Uitr 1 form is essential for employers to remain compliant and to accurately reflect their financial obligations within the unemployment insurance framework.

Co Uitr 1 Example

Division of Unemployment Insurance

Unemployment Insurance Employer Services

P.O. Box 8789, Denver, CO

UNEMPLOYMENT INSURANCE

|

|

|

|

INSTRUCTIONS ON REVERSE |

|

|

|

|

|||

Employer Account Number |

|

|

|

|

|

|

|

Batch/Page |

|

||

|

|

|

|

|

|

|

|

|

|

||

Owner, Partners, or Corporate Name |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||||

1. Correct total number of workers as of the 12th of each month. |

|

|

|

|

|

|

|||||

|

1st Quarter |

|

|

2nd Quarter |

|

|

3rd Quarter |

|

|

4th Quarter |

|

Jan. |

Feb. |

Mar. |

Apr. |

May |

June |

July |

Aug. |

Sept. |

Oct. |

Nov. |

Dec. |

|

|

|

|

Revised Report |

|

Prior Report |

|

Difference |

Qtr./Yr. |

2. Total Wages |

|

|

|

|

|||

1/ |

|

|

|

|

|

|

|

|

3. |

Excess Wages |

|

|

|

|

|

||

|

|

|

|

|

||||

Rate |

4. |

Chargeable Wages |

|

|

|

|

||

5.Premiums Due

6.Interest

|

7. Total Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Qtr./Yr. |

2. Total Wages |

|

|

|

|

|

|

2/ |

3. |

Excess Wages |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

||

Rate |

4. Chargeable Wages |

|

|

|

|

|

|

|

5. |

Premiums Due |

|

|

|

|

|

|

6. |

Interest |

|

|

|

|

|

|

7. Total Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Qtr./Yr. |

2. Total Wages |

|

|

|

|

|

|

3/ |

3. |

Excess Wages |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Rate |

4. Chargeable Wages |

|

|

|

|

|

|

|

5. |

Premiums Due |

|

|

|

|

|

|

6. |

Interest |

|

|

|

|

|

|

7. Total Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Qtr./Yr. |

2. Total Wages |

|

|

|

|

|

|

4/ |

3. |

Excess Wages |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

||

Rate |

4. Chargeable Wages |

|

|

|

|

|

|

|

5. |

Premiums Due |

|

|

|

|

|

|

6. |

Interest |

|

|

|

|

|

|

7. Total Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

Form |

Form |

No wage report needed |

10. Total Paid |

|

|

|

||||

|

|

|

|

|

|

9. Reason for Adjustment |

|

|

11. |

Signature |

|

|

|

|

|

|

|

|

|

|

|

12. |

Date |

|

|

|

|

|

|

INSTRUCTIONS FOR THE UNEMPLOYMENT INSURANCE

1.Number of

2.Total

NOTE: Form

3.Excess

Chargeable wage limits: 2019: |

$13,100 |

2017: |

$12,500 |

2015: |

$11,800 |

2018: |

$12,600 |

2016: |

$12,200 |

2014: |

$11,700 |

4. Chargeable

EXAMPLE OF COMPUTING CHARGEABLE WAGES FOR 2019

|

1st Quarter |

2nd Quarter |

3rd Quarter |

4th Quarter |

Gross Wages |

$6,000 |

$6,000 |

$4,000 |

$6,000 |

Excess of $13,100 |

$4,900 |

$6,000 |

||

Chargeable Wages |

$6,000 |

$6,000 |

$1,100 |

5.Premiums

6.Interest

7.Check the appropriate box as described below:

Form

Form

No Wage Report

8.Reason for

If you have any questions, please call Unemployment Insurance Employer Services at

www.coloradoui.gov |

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Title | Unemployment Insurance Quarterly Report Adjustment |

| Issuing Authority | Division of Unemployment Insurance, Colorado Department of Labor and Employment |

| Form Number | UITR-3 |

| Adjustment Purpose | Used to correct previously filed quarterly unemployment insurance reports. |

| Contact Information | 303-318-9100 (Denver-metro); 1-800-480-8299 (outside Denver-metro) |

| Submission Address | P.O. Box 8789, Denver, CO 80201-8789 |

| Attachments Required | Form UITR-1a or Form UITR-6a if applicable. |

| Interest Rate for Late Payment | 1.5 percent per month on unpaid premiums. |

| Chargeable Wage Limit | For 2019, the chargeable wage limit is $13,100. |

| Reason for Adjustment | Must include a description on the form for changes to the original report. |

Guidelines on Utilizing Co Uitr 1

After you have gathered all the necessary information, you can begin filling out the Co Uitr 1 form. Follow these steps carefully to ensure that you complete the form accurately and submit it on time.

- Locate your Employer Account Number and write it at the top of the form.

- Enter the name of the Owner, Partners, or Corporate Name as applicable.

- Fill in the correct total number of workers as of the 12th of each month for every quarter (1st through 4th).

- Complete the Total Wages section by entering the wages paid during the quarter, minus allowable deductions.

- In the Excess Wages section, enter the wages exceeding the chargeable wage limit for each applicable year.

- Write the Chargeable Wages, which include the first $13,100 of wages paid to an employee during the reporting year.

- Calculate and enter the Premiums Due by multiplying the employer’s rate by the chargeable wages.

- Determine the Interest due, calculated at 1.5 percent per month for late payments.

- Check the appropriate box regarding the types of wage reports attached, based on whether you are submitting Form UITR-1a, UITR-6a, or confirming that no wage report is needed.

- Provide a Reason for Adjustment, explaining why you are changing the original report.

- Finally, sign and date the form in the designated areas.

Once you have completed the form, review all entries for accuracy. A careful review can help prevent any delays in processing your report. After ensuring everything is correct, submit the form to the address provided on the form.

What You Should Know About This Form

What is the Co Uitr 1 form?

The Co Uitr 1 form is used for filing adjustments related to Unemployment Insurance Quarterly Reports in Colorado. Employers must submit this form if they need to correct any aspect of their previously filed quarterly reports, such as the number of workers or total wages reported.

When should I use the Co Uitr 1 form?

You should use the Co Uitr 1 form whenever you discover inaccuracies in your previously submitted Unemployment Insurance Quarterly Report (UITR-1). This could include errors like the wrong total number of employees or incorrect wage amounts. It's essential to address these discrepancies promptly to avoid any penalties.

How do I fill out the Co Uitr 1 form?

To fill out the Co Uitr 1 form, start by entering your Employer Account Number and your business name. Then, under each quarter, provide the correct total of workers, total wages paid, excess wages, chargeable wages, and any premiums due. Ensure you also document the reason for the adjustment in the designated space. It’s important to refer to the guidelines for entering specific amounts to ensure accuracy.

What is the difference between chargeable wages and excess wages?

Chargeable wages refer to the wages paid to an employee that are subject to unemployment insurance premiums, which has a limit per worker. For 2019, the chargeable wage limit is $13,100. Excess wages are those that exceed this limit during the calendar year. Only chargeable wages count toward your unemployment insurance premiums.

What if I report wages for multiple quarters?

If you are correcting wage reports for multiple quarters, you will need to fill out and attach Form UITR-6a, which allows you to report adjustments across more than one quarter. This form must accompany your Co Uitr 1 form to properly document the changes.

Is there a penalty for late adjustments?

Yes, if your adjustments result in an increase in premiums, interest may be charged on late payments. The interest rate is 1.5 percent per month or any part of a month for premiums paid after their due date. It’s advisable to handle adjustments and payments promptly to avoid these additional costs.

Who can I contact for help if I have questions about the Co Uitr 1 form?

If you have any questions regarding the Co Uitr 1 form or the adjustment process, you can contact Unemployment Insurance Employer Services at 303-318-9100 for those in the Denver-metro area or at 1-800-480-8299 for those outside that area. They are well-equipped to assist you.

Do I need to include supporting documentation with my Co Uitr 1 form?

Yes, if you are correcting wages, you should attach Form UITR-6a if adjustments are necessary for multiple quarters. Ensure that you keep a copy of any communications and documents submitted for your records.

What happens after I submit the Co Uitr 1 form?

After you submit the Co Uitr 1 form, it will be processed by the Division of Unemployment Insurance. If they need additional information or clarification, they may contact you. It’s important to monitor your correspondence and ensure you respond promptly to any follow-up queries.

Can I submit the Co Uitr 1 form electronically?

Currently, the submission process for the Co Uitr 1 form may vary. It is advisable to check the Division of Unemployment Insurance's website or contact their office for the most current submission procedures, including options for electronic filing, if available.

Common mistakes

Filling out the Co Uitr 1 form can be straightforward, but mistakes are common. Understanding these pitfalls can save you time and reduce stress. One frequent error is failing to accurately report the number of workers. This section requires the correct total as of the 12th of each month. Omitting this or providing an incorrect number can lead to significant adjustments.

Another common mistake involves the total wages. Individuals often enter figures that are higher than what was actually paid. Remember, only include wages that have been paid during the relevant quarter. Misreporting can lead to complications that might take time to resolve.

Many people overlook the excess wages calculation. This section is crucial because it details wages that exceed the chargeable limit. If you skip this or miscalculate it, you may face penalties. Ensure you refer to the correct limits and use the Premiums Calculator available online to assist with these computations.

Another area where errors frequently occur is in identifying chargeable wages. Failing to accurately compute this section can impact your premium calculations heavily. Remember, the chargeable wage limit varies by year, and accurate reporting is essential to avoid issues with the Department of Labor.

Also, don't forget to calculate the premiums due accurately. Multiplying the employer's rate by the chargeable wages seems simple, but many make errors here. A small miscalculation can result in a larger sum owed than necessary, leading to financial strain.

Another common error pertains to interest due. Many people overlook this and fail to report interest charged on late payments. This omission can lead to additional complications and unexpected costs down the line.

Check off the correct box in section seven regarding reporting forms. Individuals often fail to indicate whether they are using Form UITR-1a or Form UITR-6a, or if no wage report is needed. Mislabeling these forms can cause adjustments to be delayed or rejected.

Equally important is providing a complete and clear reason for adjustment. Many submitters provide vague explanations, which can lead to confusion and additional questions from the review team. A clear and detailed reason enhances transparency and accelerates the process.

A final common oversight involves signature and date. This may seem trivial, but forms submitted without a signature or date can be considered invalid. Remember to double-check your form before submission to ensure all required fields are complete.

Avoiding these common mistakes will help you navigate the Co Uitr 1 form process more efficiently. Take the time to review your entries thoroughly to ensure accuracy and compliance with the requirements set forth by the Division of Unemployment Insurance.

Documents used along the form

When dealing with the Co Uitr 1 form, there are several other documents that may be required or helpful to complete the process. Each of these forms serves a specific purpose related to unemployment insurance. Below is a list of relevant forms.

- Form UITR-1a: This form is used to report an individual employee's wages for a single quarter. It helps clarify wage information for specific employees.

- Form UITR-6a: This form is needed when there are wage adjustments or corrections for multiple quarters. It can be used if wages were incorrectly reported under the wrong unemployment insurance account.

- Form UITR-4: This is the Unemployment Insurance Quarterly Report. It summarizes the total wages and number of workers throughout the quarter.

- Form UITR-5: Used for reporting any exemptions that may apply, this form details specific categories of workers who may not be covered under typical unemployment insurance regulations.

- Form UITR-6: This document may include additional information or clarification about previously reported data, especially if there have been significant changes.

- Form UITR-7: Employers use this form to report any overpayments or adjustments necessary for collected unemployment insurance premiums.

- Form UITR-8: This form provides information about audits or other inquiries related to unemployment insurance compliance.

- Form UITR-9: This is a general notice about unemployment insurance claims or potential eligibility for unemployment benefits. It is useful for informing employees about their rights and options.

These documents are essential for maintaining accurate records and ensuring compliance with unemployment insurance regulations. It is important to select the appropriate forms based on specific circumstances and needs.

Similar forms

The Co Uitr 1 form is related to several other unemployment insurance documents. Each serves a distinct purpose but shares similarities, particularly in reporting wage information or adjustments. Here's a list of seven similar forms:

- Form UITR-1a: This form is used for reporting individual employee wages for a specific quarter. It allows employers to break down wage information more granularly, similar to the Co Uitr 1, which deals with total wages for the quarter.

- Form UITR-6a: This form allows for multiple quarter adjustments of previously reported worker wages. Like the Co Uitr 1, it focuses on correcting wage-related errors but spans multiple quarters.

- Form UITR-3: This form is used for filing the Unemployment Insurance Quarterly Report. While the Co Uitr 1 is an adjustment form, UITR-3 is typically the initial reporting document for employers each quarter.

- Form UITR-1: This is the standard Unemployment Insurance Quarterly Report. It's similar to the Co Uitr 1 but does not involve adjustments, focusing instead on reporting wages and workers for the quarter.

- Form UITR-4: This form is for reporting claims for unemployment insurance. While it serves a different purpose, it too contains wage data that can affect future adjustment filings like the Co Uitr 1.

- Form UITR-5: Employers submit this form to report layoffs and separations. While not a direct wage report, it often impacts how unemployment claims and adjustments, such as those on the Co Uitr 1, are processed.

- Form UITR-7: This document is for reporting adjustments to benefits already paid. Like the Co Uitr 1, it allows for adjustments to previously submitted information, ensuring accurate accounting of unemployment benefits and claims.

Dos and Don'ts

Do's and Don'ts for Filling Out the Co Uitr 1 Form

- Do double-check the number of workers you reported, ensuring it's accurate for each month.

- Do only include wages that were actually paid during the quarter.

- Do refer to the chargeable wage limits to ensure correct calculations for excess wages.

- Do attach Form UITR-6a if any wage adjustments are made across multiple quarters.

- Don't leave any required fields blank; incomplete information can delay processing.

- Don't forget to enter the reason for the adjustment to clarify changes made.

- Don't ignore contact information for assistance if you have questions while filling out the form.

Misconceptions

Understanding unemployment insurance and its related forms can be complicated. The Co Uitr 1 form, in particular, is often surrounded by misconceptions. Here are five common misunderstandings about this important document:

- All adjustments are automatic. Many people believe that once they submit the Co Uitr 1 form, all adjustments related to unemployment insurance will occur automatically. In reality, adjustments require careful completion and may necessitate additional documentation. It's crucial to provide accurate information to ensure that no extra steps are needed.

- Only large businesses need to file. There's a common notion that only large corporations must submit this form. However, any employer who pays unemployment insurance premiums, regardless of size, is required to submit the Co Uitr 1 form. Small businesses are just as obligated to maintain accurate accounts.

- Corrections can be made later without consequence. Some employers think they can file the Co Uitr 1 form with inaccurate figures and fix them at any point afterward without any repercussions. This is misleading. If an employer realizes that their original submission was incorrect, it is vital to submit an adjustment form promptly to avoid potential penalties.

- Wages must always be reported every quarter. Another misconception is that wages need to be reported each quarter without exception. In certain situations, if no wages were paid during a quarter, the form designated as "No Wage Report Needed" can be checked, avoiding unnecessary report generation.

- Only wage discrepancies require filing. It is mistakenly believed that the Co Uitr 1 form is solely for wage discrepancies. However, it is also used for various adjustments beyond wages, such as reporting the number of workers or changes in chargeable wages. The form serves multiple purposes, which should not be overlooked.

By grasping these clarifications, employers can navigate the requirements around the Co Uitr 1 more effectively and ensure compliance with unemployment insurance regulations.

Key takeaways

Filling out the Co Uitr 1 form correctly is vital for meeting unemployment insurance requirements. Here are some key takeaways to ensure a smooth process:

- Accurate Worker Count: Always double-check the total number of workers for each month. This number should reflect any changes since your original submission.

- Report Actual Wages: Only include wages you actually paid during the quarter. Be sure to account for any allowable deductions when calculating total wages.

- Chargeable Wage Limits: Be aware of the chargeable wage limits for each calendar year. Reporting wages exceeding these limits correctly can impact your premiums.

- Use the Right Forms: If adjustments span multiple quarters, use Form UITR-6a. If you are correcting a single quarter, use Form UITR-1a. Make sure to check the appropriate box to indicate the correct form has been used.

- Calculate Premiums: To find premiums due, multiply your rate by the chargeable wages. Be careful to calculate this correctly to avoid penalties.

- Detail Adjustment Reasons: Clearly list the reasons for any adjustments. This can help clarify your changes and support your case if questions arise later.

For any uncertainties while filling out the form, don't hesitate to contact Unemployment Insurance Employer Services for guidance. Keeping everything accurate will save you time and potential headaches in the future.

Browse Other Templates

Pub Sub Delivery - Indicate if there are specific ingredients you want to avoid for dietary restrictions.

Medicare 855s - The CMS 855A is mandatory for organizations wanting to start billing Medicare.