Fill Out Your Colorado Exemption Form

The Colorado Exemption form, officially known as DR 0563, plays a crucial role in the state's sales tax system, specifically for transactions that fall under exemption criteria. This form serves as a certification tool for buyers, allowing them to claim exemption from sales tax on purchases intended for resale, lease, or other applicable uses within the bounds of Colorado law. Buyers must accurately complete sections detailing both their name and business information, as well as the nature of their business—identifying themselves as wholesalers, retailers, manufacturers, or eligible governmental entities. The form requires buyers to list the states and cities where they will deliver purchases, ensuring compliance with multi-jurisdictional tax regulations. Importantly, the form stipulates that it must accompany each relevant order and remains in effect until revoked in writing, establishing a clear record of the buyer's tax-exempt status. Misuse of the form can lead to severe penalties, including fines or imprisonment, emphasizing the need for accurate and honest completion. Furthermore, sellers are advised to exercise caution and ensure that the items sold meet the criteria for tax exemption to avoid liability for unpaid sales tax. Additional guidance is provided regarding the treatment of purchases used inappropriately, reinforcing the importance of compliance with tax laws. As businesses navigate the complexities of tax exemptions, understanding the provisions of the Colorado Exemption form is essential for maintaining lawful and effective operations.

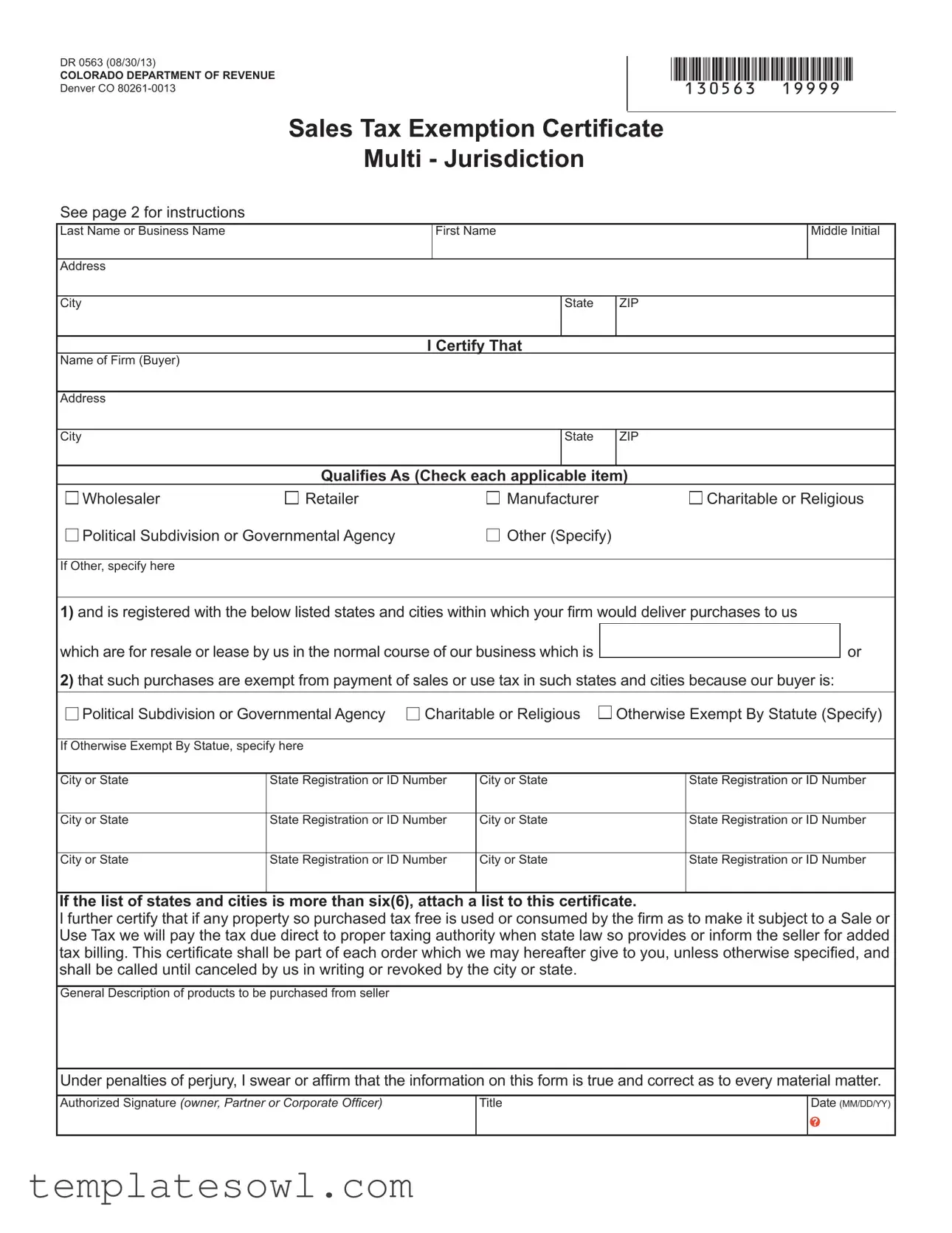

Colorado Exemption Example

DR 0563 (08/30/13)

COLORADO DEPARTMENT OF REVENUE

Denver CO

*130563==19999*

Sales Tax Exemption Certiicate

Multi - Jurisdiction

See page 2 for instructions

Last Name or Business Name |

First Name |

|

|

|

Address |

|

|

|

|

|

|

|

|

|

City |

|

State |

|

ZIP |

|

|

|||

|

|

|

|

|

Middle Initial

I Certify That

Name of Firm (Buyer)

Address

City |

State |

ZIP |

Qualiies As (Check each applicable item)

Wholesaler |

Retailer |

Manufacturer |

Charitable or Religious |

Political Subdivision or Governmental Agency |

Other (Specify) |

|

|

If Other, specify here

1)and is registered with the below listed states and cities within which your irm would deliver purchases to us

which are for resale or lease by us in the normal course of our business which is |

|

or |

2)that such purchases are exempt from payment of sales or use tax in such states and cities because our buyer is:

Political Subdivision or Governmental Agency

Charitable or Religious |

Otherwise Exempt By Statute (Specify) |

If Otherwise Exempt By Statue, specify here

City or State |

State Registration or ID Number |

City or State |

State Registration or ID Number |

|

|

|

|

City or State |

State Registration or ID Number |

City or State |

State Registration or ID Number |

|

|

|

|

City or State |

State Registration or ID Number |

City or State |

State Registration or ID Number |

If the list of states and cities is more than six(6), attach a list to this certiicate.

I further certify that if any property so purchased tax free is used or consumed by the irm as to make it subject to a Sale or

Use Tax we will pay the tax due direct to proper taxing authority when state law so provides or inform the seller for added tax billing. This certiicate shall be part of each order which we may hereafter give to you, unless otherwise speciied, and shall be called until canceled by us in writing or revoked by the city or state.

General Description of products to be purchased from seller

Under penalties of perjury, I swear or afirm that the information on this form is true and correct as to every material matter.

Authorized Signature (owner, Partner or Corporate Oficer)

Title

Date (MM/DD/YY)

To Our Customers:

In order to comply with the majority of state and local sales

tax law requirements, it is necessary that we have in our iles a properly executed exemption certiicate from all of our customers who claim sales tax exemption. If we do not have this certiicate, we are obligated to collect the tax for the state in which the property is delivered. If you are entitled to sales tax exemption, please complete the certiicate and send it to us at your earliest convenience. If you purchase tax free for

a reason for which this form does not provide, please send us your special certiicate or statement.

*Lessor: A form DR0440, “Permit to Collect Sales Tax

on the Rental or Lease Basis” must be completed and submitted to the Department of Revenue for approval.

Caution To Seller: In order for the certiicate to be

accepted in good faith by the seller, the seller must exercise care that the property being sold is of a type normally sold wholesale, resold, leased, rented , or utilized as an

ingredient or component part of a product manufactured by the buyer in the usual course of his business. A seller failing

to exercise due care could be held liable for the sales tax due in some states or cities.

Misuse of this certiicate by the seller, lessor, buyer, les- see, or the representative thereof may be punished by ine, imprisonment or loss of right to issue certiicates in some states or cities.

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Identifier | The Colorado Sales Tax Exemption Certificate is identified as DR 0563. |

| Purpose | This form allows purchasers to claim exemption from paying sales tax on items that are intended for resale or lease. |

| Governing Law | The use of this certificate is governed by Colorado Revised Statutes, Section 39-26-102. |

| Required Information | Completing the form requires the buyer’s name, address, and the nature of their business (e.g., wholesaler, retailer). |

| Tax Responsibility | If items purchased tax-free are used by the buyer in a taxable manner, the buyer must pay the applicable sales tax directly to the appropriate authority. |

| Exemption Types | The form allows buyers to indicate various exemption categories, such as Charitable or Religious exemptions. |

| Validity Duration | The certificate remains in effect until it is canceled by written notice from the buyer or if revoked by the city or state. |

| Potential Consequences | Misuse of the certificate may lead to fines, imprisonment, or the loss of the right to issue certificates in some jurisdictions. |

Guidelines on Utilizing Colorado Exemption

Completing the Colorado Exemption form is essential for ensuring compliance with state tax regulations. This process requires specific information about your business and the nature of your purchases. Accurate submission of this form helps avoid unnecessary tax liabilities.

- Begin by entering your last name or business name in the appropriate field.

- Fill in your first name and middle initial, if applicable.

- Provide your complete address, including city, state, and ZIP code.

- Identify the name of your firm in the designated space.

- Repeat the address process for your firm, ensuring all details are accurate.

- Check all applicable boxes that qualify your firm (e.g., Wholesaler, Retailer, Manufacturer, etc.).

- If your firm qualifies under “Other,” specify the reason in the space provided.

- List the states and cities where your firm is registered. Include state registration or ID numbers for each jurisdiction.

- If you have more than six jurisdictions, attach an additional list to the form.

- Provide a general description of the products to be purchased from the seller.

- Attach the authorized signature of the owner, partner, or corporate officer.

- Include the title of the signatory and the date in the format MM/DD/YY.

Upon completing the form, it is crucial to send it to the seller promptly to ensure proper tax exemption. Keep a copy for your records. Ensure that your information is truthful and accurate as any misrepresentation could lead to penalties.

What You Should Know About This Form

What is the Colorado Exemption Form?

The Colorado Exemption Form, formally known as DR 0563, is a certificate that allows qualifying buyers to make tax-exempt purchases under specific conditions. This form is essential for retailers, wholesalers, and certain government or charitable entities that intend to purchase items without paying sales tax. By completing the form, buyers certify that their purchases are exempt from sales or use tax in the applicable jurisdictions.

Who is eligible to use the Colorado Exemption Form?

Eligibility for the Colorado Exemption Form typically includes wholesalers, retailers, manufacturers, and certain charitable or religious organizations. Additionally, government entities such as political subdivisions can utilize the form to claim exemption from sales tax. Each business must meet the criteria outlined in the certificate and provide details about their purpose and registration in relevant states or municipalities.

How do I complete the Colorado Exemption Form?

To fill out the form, provide your name or business name, address, and details about your firm. You will also need to indicate whether you qualify as a wholesaler, retailer, manufacturer, or other specified category. Make sure to list the states and cities you are registered in, including any state registration or ID numbers. Finally, an authorized individual must sign and date the form to certify that the information is accurate and true.

What happens if I do not provide the exemption certificate?

If a seller does not receive a completed Colorado Exemption Form from a buyer, they are legally obligated to collect sales tax on the sale. Without this certificate, the buyer may be charged sales tax, which they would otherwise be able to avoid through a valid exemption claim. It is important for both buyers and sellers to maintain appropriate documentation to comply with tax regulations.

Can I use the Colorado Exemption Form for purchases in other states?

The Colorado Exemption Form is specifically designed for use within Colorado and may not be valid for purchases in other states. However, if you plan to make tax-exempt purchases in other states, you must follow that state's sales tax exemption procedures. It’s advisable to check with the relevant state tax authority for specific requirements and forms that need to be completed.

What types of products can be purchased using the exemption form?

The Colorado Exemption Form can be used to purchase a variety of products that fall under wholesale or resale categories. This can include goods intended for resale in retail operations, items for manufacturing, or goods used by charitable organizations. However, it must be established that the purchases are necessary for the business or organization’s operational activities.

What should I do if I make a taxable use of the purchased property?

If you use or consume property purchased with an exemption, you may become liable for the sales or use tax associated with that property. In such cases, the buyer is required to pay the tax directly to the proper taxing authority or inform the seller for an additional tax billing. Keeping accurate records of purchases can help avoid potential tax complications.

How long is the Colorado Exemption Form valid?

The Colorado Exemption Form remains in effect for as long as the buyer maintains their tax-exempt status and until it is canceled in writing by the buyer or revoked by the state or city. It is essential for sellers to keep this form on file and obtain a new one if the buyer's situation changes or if the current form is outdated.

What are the consequences of misuse of the exemption certificate?

Misuse of the Colorado Exemption Form can lead to serious penalties, including fines, imprisonment, or the loss of the right to issue exemption certificates in certain jurisdictions. Both buyers and sellers should exercise due diligence to ensure the information provided is accurate and the form is used in the manner intended. Protecting against misuse is crucial for compliance with state tax laws.

Common mistakes

Filling out the Colorado Exemption Form (DR 0563) correctly is essential to ensure compliance and avoid complications. Many individuals and businesses make common mistakes that can jeopardize their sales tax exemption status. Here are ten mistakes to watch out for.

Firstly, incomplete information is a significant issue. Many users forget to fill out essential fields such as the last name or business name, address, or state. Ensure that every item, especially your name and address, is fully completed to avoid any delays in processing the exemption.

Another common mistake is not checking qualifying categories. The form requires the buyer to check all applicable categories, such as wholesaler, retailer, or manufacturer. Failing to do so can lead to the form being rejected, as it undermines the buyer's claim for exemption.

Many people also neglect to list all relevant states and cities where their business operates. The instructions indicate that if more than six states or cities are applicable, an additional list must be attached. Missing this step can raise red flags with tax authorities.

Failing to specify the reason for exemption is another frequent oversight. Whether it’s for political subdivisions or other exempt statuses, this section must be completed accurately. Incomplete information can lead to questions about the legitimacy of the exemption claim.

It’s crucial to ensure that you provide valid registration or ID numbers for each listed state or city. Many individuals mistakenly enter incorrect or outdated numbers or leave this field blank. Double-check these details to avoid problems.

Another error often made is not providing a general description of the products to be purchased. This section is vital for the seller to understand what items will benefit from the exemption. Without this detail, exemptions may be questioned.

Signatures should not be overlooked. Some individuals submit the form without an authorized signature, title, or date. This omission can render the entire certification invalid. Always ensure the form is signed and dated appropriately.

Be aware of the consequences of the misuse of the exemption form. Failure to understand the implications can lead to serious legal issues, including fines or imprisonment. Understanding the responsibilities that come with the exemption is crucial.

Lastly, delaying submission can cause significant complications. It is vital for buyers to submit the completed form to sellers as soon as possible. Not doing so leaves sellers obligated to collect sales tax, which may lead to additional costs for the buyer.

Being mindful of these common mistakes can streamline the process and ensure that you maintain your sales tax exemption efficiently. Always review the completed form thoroughly before submission.

Documents used along the form

The Colorado Exemption form is essential for businesses seeking to make tax-exempt purchases. Often used in conjunction with other documents, these forms help ensure compliance with state and local tax laws. Below is a list of commonly associated forms that support the exemption process.

- Form DR 0440 - Permit to Collect Sales Tax on the Rental or Lease Basis: This form is required for businesses that lease or rent out property. By completing this form and submitting it for approval, a lessor can legally collect sales tax on rental or lease transactions, ensuring clarity and compliance with tax regulations.

- Form DR 0564 - Sales Tax Exemption Certificate for Agricultural Purposes: This certificate is specifically designed for buyers engaged in agriculture. It allows farmers and ranchers to purchase certain goods and services without paying sales tax, provided that the items purchased are used exclusively for agricultural purposes.

- Form DR 0689 - Exemption Certificate for Educational Institutions: This form is available for educational institutions to claim sales tax exemption on purchases made for educational purposes. Schools and universities can utilize this certificate to avoid paying sales tax on materials necessary for their educational programs.

- Form DR 0950 - Sales Tax Exemption Certificate for Nonprofit Organizations: Nonprofit organizations can use this form to verify their tax-exempt status. This document helps nonprofits procure items essential for their operations without the burden of sales tax.

These documents play a vital role in the tax exemption process, facilitating smooth transactions for businesses and organizations. Ensuring that the proper paperwork is completed and filed correctly helps maintain compliance and fosters trust between buyers and sellers.

Similar forms

-

Uniform Sales and Use Tax Exemption Certificate: This form serves a similar purpose across multiple states. It allows buyers to claim exemption from sales and use tax. Just like the Colorado Exemption form, it requires the buyer to indicate the reason for the exemption and includes information about the buyer's registration with relevant states. Both documents aim to facilitate compliance with tax regulations.

-

IRS Form W-9: This form is used for taxpayer identification. While its primary function is to provide the taxpayer's correct name and Taxpayer Identification Number (TIN), just as the Colorado Exemption form requires identification details, both forms restrict certain individuals from taxes based on their status (e.g., exempt organizations). They also demand accuracy and truthfulness in the provided information.

-

State-Specific Exemption Certificates: Many states have their own exemption forms that buyers must fill out to avoid sales tax on specified purchases. Like the Colorado Exemption form, these state-specific documents require bidders to specify their qualification for exemption. The format and necessary information may vary, but their intent remains the same—to facilitate tax compliance.

-

Form ST-2, Sales Tax Exemption Certificate (New York): This document allows buyers to exempt certain purchases from sales tax in New York. Much like the Colorado form, it requires the buyer to affirm their status as a wholesaler, retailer, or governmental agency. Both forms ensure correct identification and compliance to avoid tax liability.

Dos and Don'ts

When filling out the Colorado Exemption form, keep the following guidelines in mind:

- Do provide accurate and complete information.

- Do ensure that the name and address of both the buyer and the seller are correctly filled out.

- Do check all applicable items that describe the buyer's qualifications.

- Do attach any necessary additional lists if you have more than six states or cities.

- Don't sign the form unless you can confirm that all information is true.

- Don't forget to keep a copy of the completed form for your records.

Misconceptions

The Colorado Exemption form, known as DR 0563, serves an important role in sales tax exemptions, yet several misconceptions can cloud its true purpose and function. Understanding these misunderstandings can help individuals and businesses navigate the requirements effectively.

- 1. The form guarantees sales tax exemption. Many believe that simply filling out the exemption form automatically grants them exemption from sales tax. However, the form only certifies that the buyer qualifies for an exemption. Each situation must be evaluated on its own merits.

- 2. It is only for nonprofit organizations. While charities and religious groups often use this form, it is also available for wholesalers, retailers, governmental agencies, and others who meet specific criteria.

- 3. You can use the form for any purchase. The form is intended exclusively for purchases related to the buyer's business operations, specifically for resale or lease. Using it for personal purchases is not permissible.

- 4. Once submitted, the form never expires. The exemption certificate remains valid until canceled by the buyer or revoked by the state. Regular updates may be needed to reflect accurate business information.

- 5. Sellers have no responsibilities when accepting the form. Sellers must exercise due diligence to ensure the property sold qualifies under the exemption. Ignoring this responsibility can lead to tax liabilities.

- 6. All states accept the Colorado form. The DR 0563 form is specific to Colorado. Buyers purchasing out-of-state may need to use different forms or meet other requirements according to the local laws of that state.

- 7. Businesses with tax-exempt status don't need to complete the form. Even entities that hold a tax-exempt status must complete the exemption form to provide the seller with the necessary documentation to avoid charging sales tax.

- 8. This form is only needed at the time of purchase. Buyers should keep a copy of the exemption certificate for their records and may need to produce it during audits, making recordkeeping essential.

- 9. Misuse of the form has no consequences. Misuse can lead to severe penalties, including fines or even imprisonment. Ensuring honest and correct use of the form is vital for all parties involved.

By addressing these misconceptions, businesses can better understand how to utilize the Colorado Exemption form responsibly and effectively. This knowledge aids in compliance and the promotion of fair trading practices.

Key takeaways

Filling out and using the Colorado Exemption form (DR 0563) effectively can save businesses time and money. Here are some key takeaways to keep in mind:

- Understanding Eligibility: Ensure that your business qualifies for sales tax exemption. Check boxes for wholesaler, retailer, manufacturer, or other categories as applicable.

- Complete the Form Accurately: Provide accurate information about your business, including the name, address, and registration numbers for each applicable state or city.

- Seller’s Responsibility: Sellers must verify buyers’ exemption status. Take care to ensure the products sold meet the exemption criteria to avoid liability for sales tax.

- Certification Requirement: The certificate is part of each order. A new certificate is not required for every transaction unless you cancel or modify it.

- Notification of Changes: If any details about your business change, notify the seller with an updated certificate to maintain your tax-exempt status.

- Multiple Registrations: If your business operates in multiple states or cities, list each one, and attach additional sheets if necessary, to ensure clear documentation.

- Tax Payment Obligation: Be aware that if the purchased items are used in a way that triggers tax liability, you must pay the tax directly to the appropriate taxing authority.

- Authorized Signature Required: An authorized representative must sign the form. Ensure that the signature is provided by someone with the authority to do so.

- Potential Consequences: Misusing the exemption certificate carries serious risks, including penalties, fines, or loss of the right to issue certificates.

By following these guidelines, businesses can better navigate the complexities of sales tax exemption in Colorado. Always stay informed and consult with a professional if unsure about specific situations regarding tax exemption.

Browse Other Templates

Maintenance Work Order Form - Request updates on the status of the maintenance request as needed.

Movers Contract Template - Timely payments help maintain smooth operations and service continuity.

Risk Management Basic Course - Engage with your peers to share insights and enhance learning outcomes.