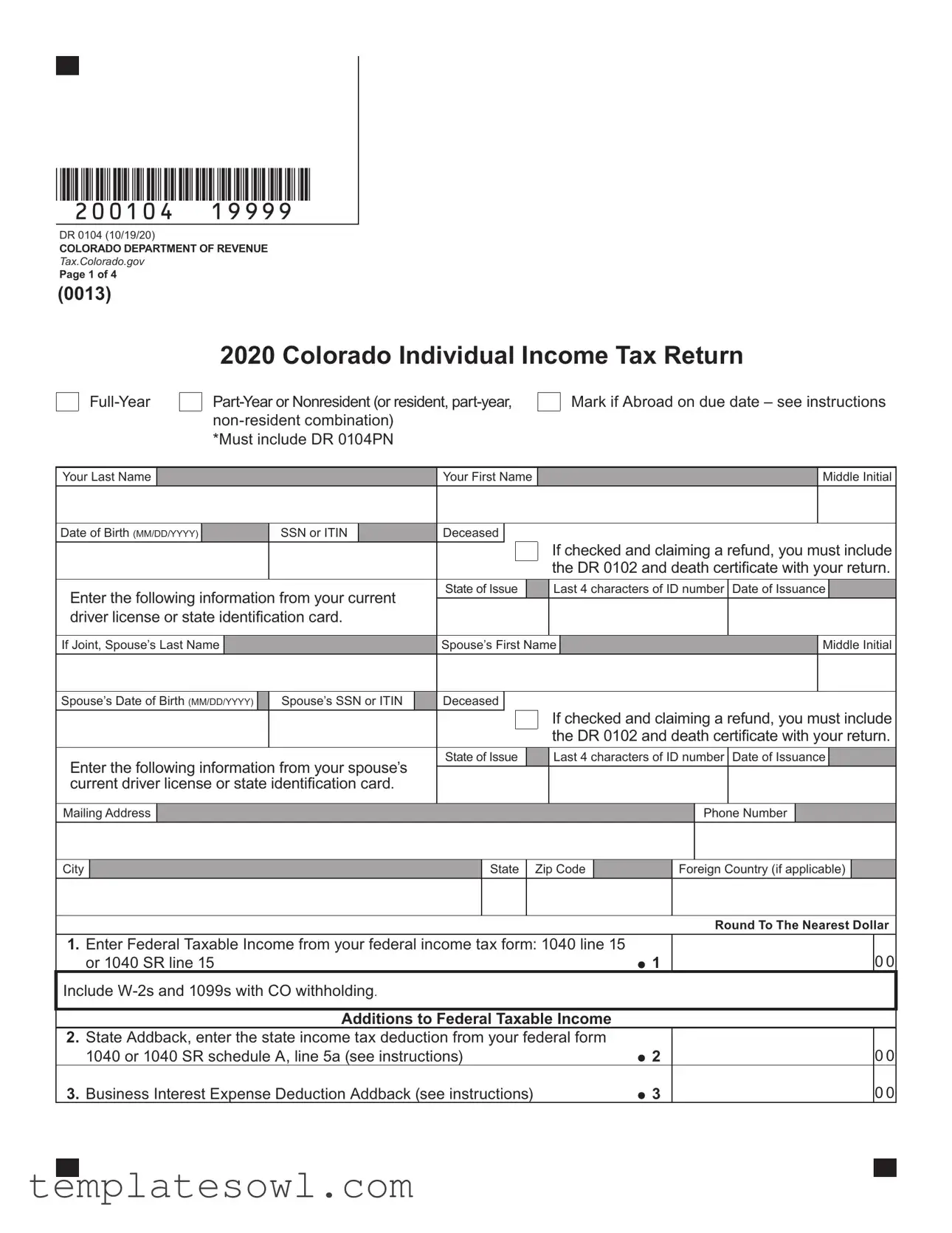

Fill Out Your Colorado 104 Form

The Colorado 104 form, officially known as the DR 0104, serves as the state's individual income tax return and is essential for residents as well as those engaging with Colorado's economy. This form accommodates full-year residents, part-year residents, and non-residents alike, helping to streamline the tax filing process for a diverse group of taxpayers. At the heart of the Colorado 104 is the requirement to report federal taxable income, which is the starting point for calculating state tax obligations. Taxpayers are required to provide personal information, including names, Social Security numbers, and other identifying details, ensuring accuracy in processing. Notably, the form features sections for calculating state income tax deductions and various adjustments, which can influence overall taxable income. Additionally, it allows for the inclusion of credits such as those derived from enterprise zones or innovative motor vehicle initiatives, helping to lower tax liability. Crucially, the form also addresses the need for supporting documentation, like W-2s and other 1099s, which can substantiate any claimed withholding amounts or credits. Whether filing a joint return or as an individual, understanding the nuances of the Colorado 104 is key to ensuring compliance and maximizing potential refunds.

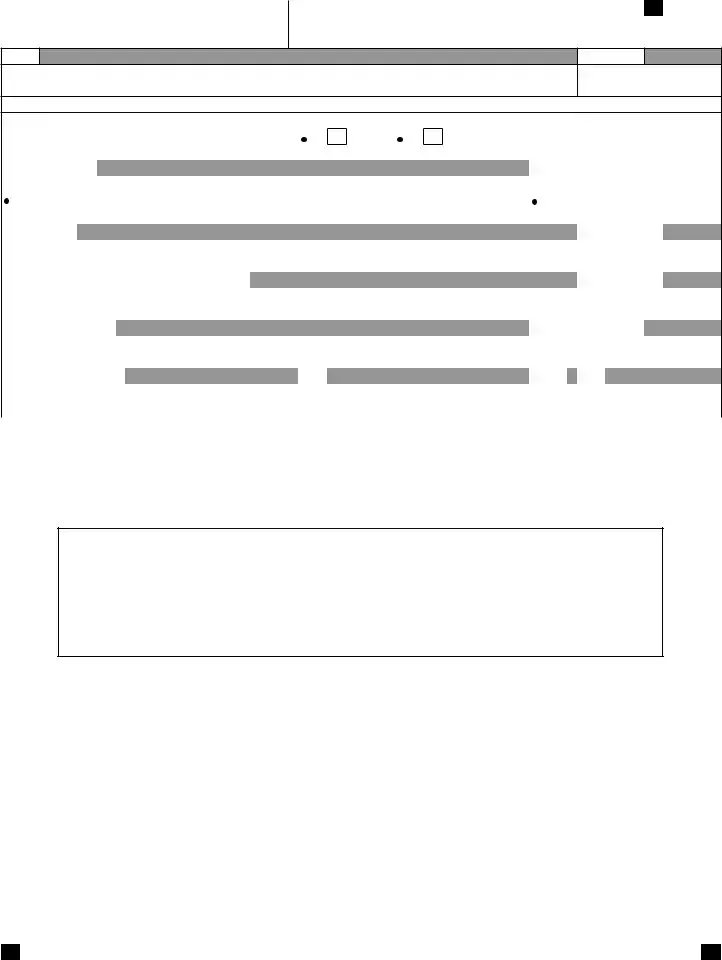

Colorado 104 Example

*200104==19999*

DR 0104 (10/19/20)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

Page 1 of 4

(0013)

2020 Colorado Individual Income Tax Return

*Must include DR 0104PN

Mark if Abroad on due date – see instructions

Your Last Name |

|

|

|

|

|

|

|

Your First Name |

|

|

|

|

Middle Initial |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth (MM/DD/YYYY) |

|

|

SSN or ITIN |

|

|

Deceased |

|

|

|

|

If checked and claiming a refund, you must include |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

the DR 0102 and death certificate with your return. |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Enter the following information from your current |

State of Issue |

|

|

Last 4 characters of ID number |

Date of Issuance |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

driver license or state identification card. |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If Joint, Spouse’s Last Name |

|

|

|

|

|

Spouse’s First Name |

|

|

Middle Initial |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s Date of Birth (MM/DD/YYYY) |

|

Spouse’s SSN or ITIN |

|

Deceased |

|

|

|

|

If checked and claiming a refund, you must include |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

the DR 0102 and death certificate with your return. |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Enter the following information from your spouse’s |

State of Issue |

|

|

Last 4 characters of ID number |

Date of Issuance |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

current driver license or state identification card. |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address

City

|

|

|

|

Phone Number |

State |

|

Zip Code |

|

Foreign Country (if applicable) |

|

|

|||

|

|

|

|

|

Round To The Nearest Dollar

1.Enter Federal Taxable Income from your federal income tax form: 1040 line 15

or 1040 SR line 15 |

1 |

Include

Additions to Federal Taxable Income

2.State Addback, enter the state income tax deduction from your federal form

|

1040 or 1040 SR schedule A, line 5a (see instructions) |

2 |

3. Business Interest Expense Deduction Addback (see instructions) |

3 |

|

|

|

|

|

|

|

0 0

00

00

*200104==29999* |

|

DR 0104 (10/19/20) |

|

|

|

||

|

|

|

|

||||

|

Page 2 of 4 |

|

|

|

|||

|

|

|

|

COLORADO DEPARTMENT OF REVENUE |

|

|

|

|

|

|

|

Tax.Colorado.gov |

|

|

|

|

|

|

|

|

|

||

Name |

|

|

|

|

SSN or ITIN |

||

|

|

|

|

|

|

||

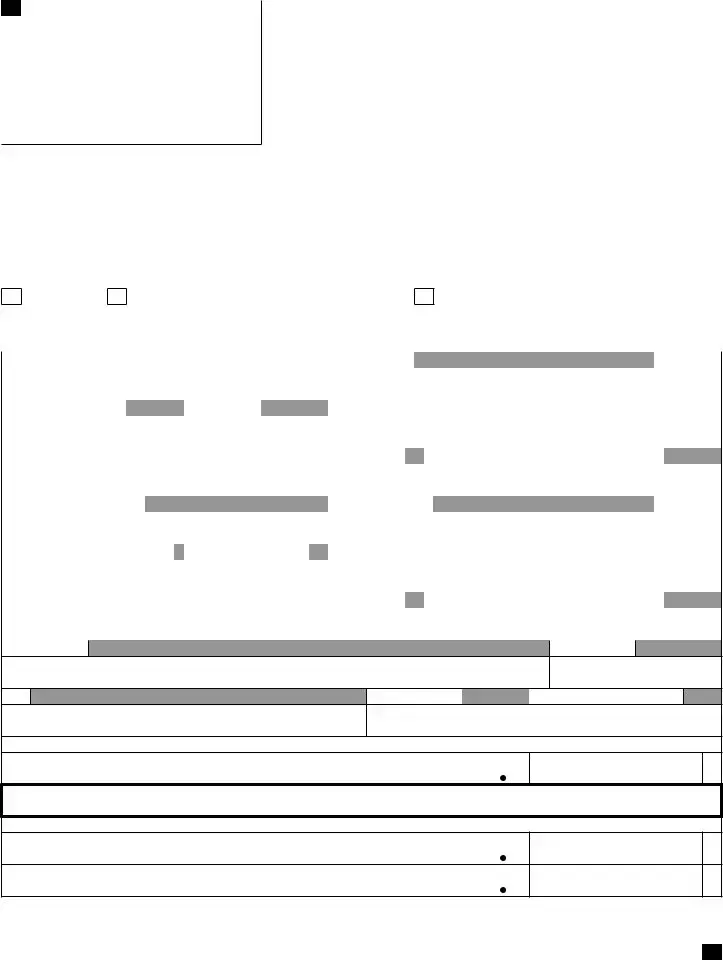

4. |

Excess Business Loss Addback (see instructions) |

4 |

|

|

|||

5. |

Net Operating Loss Addback (see instructions) |

5 |

|

|

|||

6. |

Other Additions, explain (see instructions) |

|

|

6 |

|

|

|

Explain:

7. Subtotal, sum of lines 1 through 6 |

7 |

Colorado Subtractions

8.Subtractions from the DR 0104AD Schedule, line 20, you must submit the

DR 0104AD schedule with your return. |

8 |

9. Colorado Taxable Income, subtract line 8 from line 7 |

9 |

Tax, Prepayments and Credits: see 104 Book for

10.Colorado Tax from tax table or the DR 0104PN line 36, you must submit

the DR 0104PN with your return if applicable. |

10 |

11.Alternative Minimum Tax from the DR 0104AMT line 8, you must submit the

|

DR 0104AMT with your return. |

11 |

12. |

Recapture of prior year credits |

12 |

13. |

Subtotal, sum of lines 10 through 12 |

13 |

14.Nonrefundable Credits from the DR 0104CR line 43, the sum of lines 14, 15, and 16

cannot exceed line 13, you must submit the DR 0104CR with your return. |

14 |

15.Total Nonrefundable Enterprise Zone credits used – as calculated,

or from the DR 1366 line 87, the sum of lines 14, 15, and 16 cannot exceed line 13,

you must submit the DR 1366 with your return. |

15 |

16.Strategic Capital Tax Credit from DR 1330, the sum of lines 14, 15, and 16 cannot

exceed line 13, you must submit the DR 1330 with your return. |

16 |

17. Net Income Tax, sum of lines 14, 15, and 16. Subtract that sum from line 13. |

17 |

18.Use Tax reported on the DR 0104US schedule line 7, you must submit

the DR 0104US with your return. |

18 |

19. Net Colorado Tax, sum of lines 17 and 18 |

19 |

20.CO Income Tax Withheld from

and/or 1099s claiming Colorado withholding with your return. |

20 |

21. |

21 |

22.Estimated Tax Payments, enter the sum of the quarterly payments

|

remitted for this tax year |

|

|

|

|

22 |

|

23. Extension Payment remitted with the DR |

|

|

23 |

||||

24. Other Prepayments: |

|

DR 0104BEP |

|

DR 0108 |

|

DR 1079 24 |

|

|

|

|

|||||

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00

00

00

0 0

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

0 0

*200104==39999* |

|

DR 0104 (10/19/20) |

|

|

|||

|

Page 3 of 4 |

||

|

|

|

COLORADO DEPARTMENT OF REVENUE |

|

|

|

Tax.Colorado.gov |

Name |

|

|

SSN or ITIN |

|

|

||

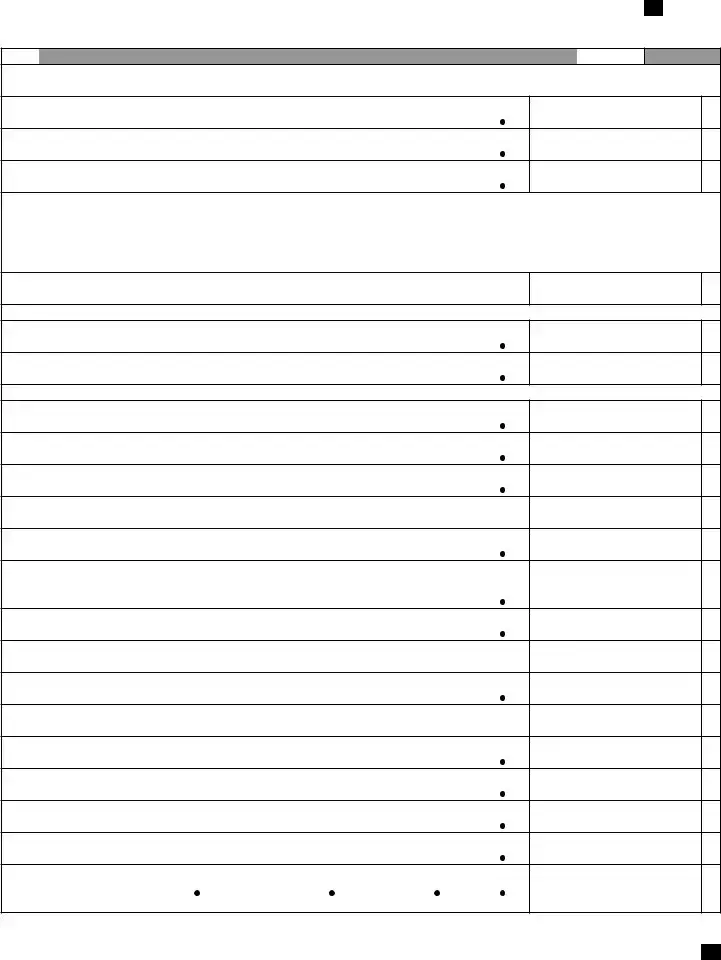

25.Gross Conservation Easement Credit from the DR 1305G line 33, you must

submit the DR 1305G with your return. |

25 |

26.Innovative Motor Vehicle Credit from the DR 0617, you must submit each

DR 0617 with your return. |

26 |

27.Refundable Credits from the DR 0104CR line 9, you must submit the

DR 0104CR with your return. |

27 |

28. Subtotal, sum of lines 20 through 27 |

28 |

29.Federal Adjusted Gross Income from your federal income tax form: 1040 line 11,

|

or 1040 SR line 11 |

29 |

30. |

Overpayment, if line 28 is greater than line 19 then subtract line 19 from line 28 |

30 |

31. |

Estimated Tax Credit Carryforward to 2021 first quarter, if any. |

31 |

00

00

00

00

00

00

00

If you have an overpayment on line 32 below and would like to donate all or a portion of your overpayment to a qualified Colorado charity, include Form DR 0104CH to contribute.

32. Refund, subtract line 31 from line 30 (see instructions) |

32 |

0 0

Direct Deposit

Routing Number

Account Number

Type:

Checking

Savings

CollegeInvest 529

For questions regarding CollegeInvest direct deposit or to open an account, visit CollegeInvest.org or call

33. |

Net Tax Due, subtract line 28 from line 19 |

33 |

34. |

Delinquent Payment Penalty (see instructions) |

34 |

35. |

Delinquent Payment Interest (see instructions) |

35 |

36.Estimated Tax Penalty, you must submit the DR 0204 with your return.

(see instructions) |

36 |

37. Amount You Owe, sum of lines 33 through 36 |

37 |

00

00

00

00

The State may convert your check to a

*200104==49999*

DR 0104 (10/19/20)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

Page 4 of 4

Name

SSN or ITIN

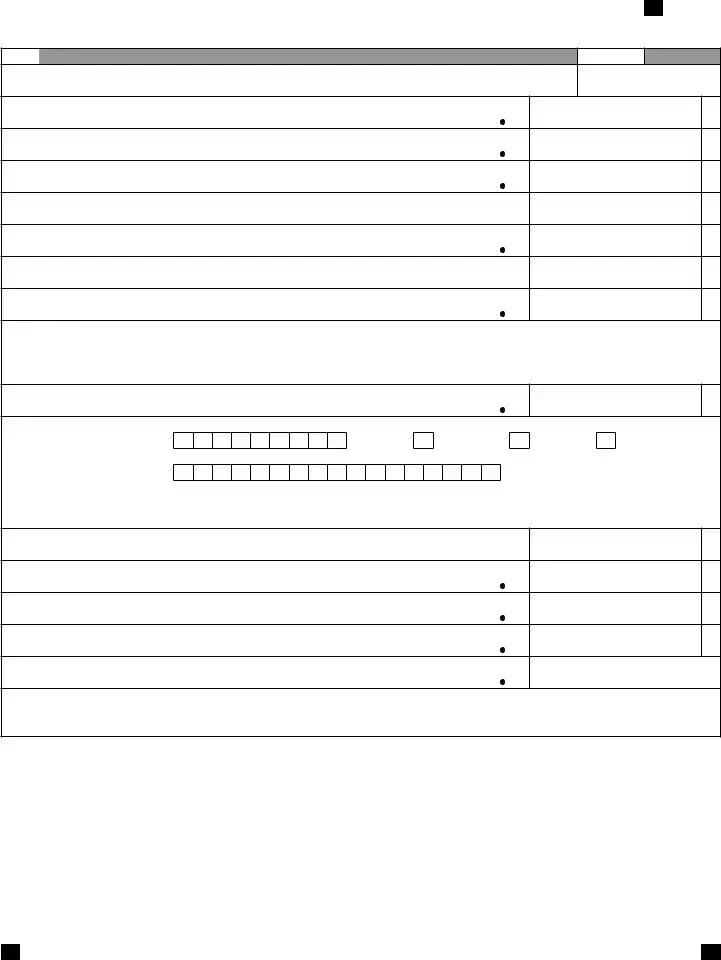

Third Party Designee

Do you want to allow another person to discuss this return and any related information with the Colorado Department of Revenue? See the instructions.

No

Yes. Complete the following:

Designee’s Name |

|

|

|

|

|

|

Phone Number |

|

|

|

||||

|

|

|||||||||||||

Sign Below Under penalties of perjury, I declare that to the best of my knowledge and belief, this return is true, correct and complete. |

||||||||||||||

Your Signature |

|

|

|

|

|

|

|

|

|

Date (MM/DD/YY) |

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||

Spouse’s Signature. If joint return, BOTH must sign. |

|

|

|

|

|

Date (MM/DD/YY) |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|||||

Paid Preparer’s Name |

|

|

|

|

|

Paid Preparer’s Phone |

|

|

||||||

|

|

|

|

|

|

|

|

|||||||

Paid Preparer’s Address |

|

|

City |

|

State |

|

Zip |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

File and pay at: Colorado.gov/RevenueOnline

If you are filing this return with a check or payment, please mail the return to:

COLORADO DEPARTMENT OF REVENUE Denver, CO

If you are filing this return without a check or payment, please mail the return to:

COLORADO DEPARTMENT OF REVENUE Denver, CO

These addresses and zip codes are exclusive to the Colorado Department of Revenue, so a street address is not required.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Colorado DR 0104 form is used for filing the Colorado Individual Income Tax Return for full-year, part-year, or nonresident individuals. |

| Filing Requirements | Taxpayers must submit this form by the due date, including any relevant schedules like the DR 0104PN if applicable. |

| Income Disclosure | Taxpayers must report their Federal Taxable Income and include W-2s and 1099s with Colorado withholding. |

| Subtractions | Subtractions from the income can be reported on the DR 0104AD schedule, which must also be included with the return. |

| Governing Law | This form is governed by the Colorado Revised Statutes, Title 39, Article 22. |

| Refund Process | If eligible for a refund, taxpayers can choose to donate part of it to a qualified Colorado charity by including Form DR 0104CH. |

Guidelines on Utilizing Colorado 104

Once the Colorado 104 form is completed, it must be submitted to the Colorado Department of Revenue. Be sure to include all required schedules and documentation, such as W-2s or any applicable credit forms.

- Enter your last name, first name, and middle initial.

- Provide your date of birth in MM/DD/YYYY format.

- Input your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Check the box if you are deceased and, if claiming a refund, attach the DR 0102 and a death certificate.

- Fill in the information from your current driver’s license or state ID, including the last four characters of the ID number and the date of issuance.

- If filing jointly, enter your spouse’s last name, first name, middle initial, date of birth, and SSN or ITIN.

- Provide your spouse's driver’s license or state ID details as requested.

- Enter your mailing address, city, state, and zip code. Include the foreign country if applicable.

- Report your federal taxable income from your federal income tax form (1040 line 15 or 1040 SR line 15).

- Document any additions to federal taxable income: state addback, business interest expense deduction addback, excess business loss addback, and net operating loss addback.

- Provide the subtotal of lines 1 through 6.

- Report Colorado subtractions from the DR 0104AD schedule and submit it with your return.

- Calculate Colorado taxable income by subtracting line 8 from line 7.

- Determine your Colorado tax from the tax table or DR 0104PN. Submit DR 0104PN if applicable.

- Include any alternative minimum tax from DR 0104AMT, with that form submitted as well.

- Sum the tax, prepayments, and credits from lines 10 through 12 to get a subtotal.

- Note any nonrefundable credits and submit DR 0104CR.

- Report additional nonrefundable Enterprise Zone credits and submit DR 1366.

- Calculate the net income tax by subtracting the sum of lines 14, 15, and 16 from line 13.

- Report use tax indicated on the DR 0104US schedule and submit that form.

- Sum lines 17 and 18 to determine net Colorado tax.

- Input Colorado income tax withheld and submit W-2s and/or 1099s.

- Document any estimated tax payments made during the year.

- Include any payments made with extension forms.

- Detail other prepayments, if applicable.

- Calculate the gross conservation easement credit and the innovative motor vehicle credit, submitting the necessary forms.

- Calculate the subtotal from lines 20 through 27.

- Report your federal adjusted gross income from your federal form (1040 line 11 or 1040 SR line 11).

- Calculate any overpayment, if applicable.

- Deduct any estimated tax credit carryforward for the first quarter of the following year.

- Report your refund by subtracting line 31 from line 30.

- If applicable, indicate if you want to contribute your overpayment to a qualified charity with Form DR 0104CH.

- Calculate the net tax due by subtracting line 28 from line 19.

- Include any applicable penalties or interests related to delinquent payments.

- Sum lines 33 through 36 to determine the total amount owed.

- If a third party will assist you, provide their name and phone number as requested.

- Sign and date the form, along with your spouse if filing jointly.

- If applicable, complete and provide details for your paid preparer.

- Submit the completed form either electronically through Colorado.gov/RevenueOnline or by mailing it to the appropriate address as outlined.

What You Should Know About This Form

What is the purpose of the Colorado 104 form?

The Colorado 104 form is essential for individuals filing their state income taxes. It allows residents, part-year residents, and nonresidents to report their income and determine the amount of state tax owed or refunded. It includes sections for adding or subtracting specific income adjustments that align with federal guidelines. Completing this form accurately ensures compliance with state tax laws and helps individuals take advantage of potential deductions and credits available to them.

Who needs to file the Colorado 104 form?

Any individual who has earned income in Colorado during the tax year must file the Colorado 104 form. This includes full-year residents, part-year residents, and nonresidents who received income from sources within Colorado. If your income meets the taxable threshold, filing the 104 is not just recommended, it is required. Furthermore, if you are claiming a refund or any tax credits, you must submit this form to the Colorado Department of Revenue to process your claims.

What documents should I include with my Colorado 104 form?

To ensure your Colorado 104 form is processed without delays, several documents should accompany your submission. Primarily, you must include your W-2s and 1099s that report Colorado withholdings. If applicable, you should also attach schedules such as DR 0104PN for part-year residents, DR 0104AD for subtractions, and DR 0104CR for credits. Additional forms may be required for specific situations, such as the DR 0102 and death certificate if claiming a refund for a deceased individual. Review the instructions provided with the form closely to avoid any mistakes.

How can I file the Colorado 104 form?

Filing the Colorado 104 form can be done in several ways, allowing you flexibility based on your preferences. You can file electronically using the Colorado Department of Revenue’s online platform, which is often faster and more convenient. Alternatively, if you prefer traditional methods, you can print the completed form and mail it to the appropriate addresses provided on the form. It’s crucial to ensure you select the correct address depending on whether you are submitting a payment with your return or not. Be mindful of deadlines to avoid unnecessary penalties.

Common mistakes

Filling out the Colorado 104 form can be a daunting task for many. One frequent mistake is not including all the required documents. For example, if you are claiming a refund for a deceased taxpayer, you must attach the appropriate death certificate and the DR 0102 form. Missing these items can delay your refund or even lead to a rejection of your return.

Another error often made is miscalculating the federal taxable income. This figure is crucial as it impacts several other parts of your form. Entering the wrong amount from your federal income tax return can throw off your entire calculation. Take the time to double-check this number to avoid complications down the line.

People frequently forget to sign the form. This may seem trivial, but without a signature, the return is not valid. Both spouses need to sign if it's a joint return. Neglecting this step can cause unnecessary delays in processing your tax return.

Additionally, individuals sometimes fail to submit required schedules that accompany the Colorado 104 form. For instance, the DR 0104AD schedule for Colorado subtractions or the DR 0104CR for credits must be supplied. Not submitting these schedules can result in lost deductions or credits, which ultimately affects the total tax liability.

Documents used along the form

The Colorado 104 form is an essential document used for filing an individual's income tax return in the state of Colorado. Several other forms and documents often accompany it. Each of these documents serves a particular purpose in the tax filing process, ensuring compliance with state tax laws and helping to accurately report income and deductions.

- DR 0104PN: This is the Colorado Part-Year Resident Income Tax Form. Taxpayers who lived in Colorado for part of the year must use this document to report income earned while residing in the state. It helps calculate the proportion of income that is taxable in Colorado.

- DR 0104AD: The Colorado Additions and Subtractions Schedule is necessary for reporting adjustments to the federal income reported on the Colorado 104 form. This document outlines any income that should be added to or subtracted from federal taxable income.

- DR 0104CR: The Colorado Nonrefundable and Refundable Credit Schedule allows taxpayers to claim eligible credits. This could reduce the overall tax liability or, in the case of refundable credits, result in a refund from the state.

- DR 0204: The Estimated Tax Penalty form is required if there is a tax penalty due to underpayment of estimated taxes. This form aids in calculating any penalties incurred for underpayment.

Gathering and submitting these forms alongside the Colorado 104 form is crucial for a smooth tax filing experience. Each document contributes important information that ensures accurate reporting and compliance with Colorado tax regulations.

Similar forms

Form 1040: The Colorado 104 form is similar to the federal Form 1040, as both are used to report individual income for tax purposes. They require personal information, income details, and deductions to arrive at the taxable income.

Form 1040-SR: This form is designed for seniors. Like the Colorado 104, it captures income and deductions. Both forms offer similar layouts and instructions, catering to specific populations regarding age and taxation.

Form 1040X: For those who need to amend their tax returns, the Colorado 104 is akin to Form 1040X. Both enable taxpayers to correct errors or adjust their income and deductions after the initial filing.

Form 4868: This document is for filing an extension for federal tax returns. It resembles the Colorado 104 in that both can adjust submission deadlines while ensuring that taxpayers provide necessary income estimates.

State Form 1040NR: This form is used by non-residents filing taxes in the state and mirrors the Colorado 104 in terms of layout and essential information required to determine tax obligations.

DR 0104PN: The Part-Year Resident form is a complementary document to the Colorado 104. Both require similar financial information but distinguish based on residency duration within the state.

DR 0102: This form, used for those claiming a refund after a taxpayer's death, parallels the Colorado 104 in ensuring the eligibility of someone making claims for a deceased individual’s tax return.

DR 0104US: This is the Use Tax form relevant for purchases made outside the state. It connects to the Colorado 104 by addressing additional tax obligations that may be incurred outside standard reporting.

Dos and Don'ts

When filling out the Colorado 104 form, attention to detail is crucial. Below is a list of things to keep in mind to ensure the form is completed accurately.

- Do carefully read the instructions. Understanding the requirements can prevent errors and omissions.

- Do double-check your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Ensure that it is accurate to avoid delays in processing.

- Do submit all required documentation. Attach W-2s, 1099s, and any necessary schedules relevant to your filing.

- Do account for any dependencies or deductions. Make sure to include any possible addbacks or subtractions accurately.

- Do keep a copy of your completed form. Retaining a copy for your records can be helpful in the future.

- Don't rush through the form. Take your time to ensure all information is filled out completely and accurately.

- Don't forget to sign your return. An unsigned return may lead to processing delays and could be considered incomplete.

- Don't ignore the due date. Timely submission of the form will help avoid penalties.

- Don't omit your direct deposit information if you expect a refund. Providing this information can expedite the refund process.

- Don't submit the form without checking calculations. Verify that all numbers are correct to prevent possible discrepancies.

Misconceptions

Misunderstandings can create unnecessary stress, especially when it comes to filing taxes. Here are seven common misconceptions about the Colorado 104 form, along with clarifications to help individuals navigate their tax responsibilities effectively.

- All taxpayers need to file a Colorado 104 form. Many people believe that anyone who earns income in Colorado must submit a state tax return. However, only those whose income exceeds certain thresholds are required to file. Always check the latest guidelines to determine your filing necessity.

- Filing the Colorado 104 automatically means you owe taxes. It is a common belief that submitting the form immediately results in a tax liability. In reality, the filing may show a refund due depending on your withholdings and credits applied.

- Only residents need to file the Colorado 104. This assumption overlooks that part-year residents and non-residents earning income in Colorado must also complete this form. Ensure you understand your residency status when filing.

- You do not need to include documentation with your Colorado 104 form. Some people think they can submit just the form without supporting documents, such as W-2s or 1099s. In fact, these forms must be attached to verify the information reported.

- Using tax preparation software guarantees error-free submission. While software can streamline the process, users should still review their entries carefully. Mistakes can be made, potentially leading to underpayments or audits down the line.

- Any refund will be processed immediately. Many taxpayers assume their refund will arrive shortly after filing. In reality, processing can take time, especially during peak tax season. Patience is essential in these instances.

- You can amend the Colorado 104 form without any repercussions. While it's true that individuals can amend returns, they should be aware that doing so can attract scrutiny. Amendments should be approached thoughtfully and backed by substantial documentation.

Understanding these misconceptions can alleviate worries and ensure compliance with tax obligations. Staying informed is key to a smooth filing season.

Key takeaways

- Complete Information Accurately: Fill in all required fields, including your full name, date of birth, and Social Security Number or Individual Taxpayer Identification Number. Ensure that your spouse's details are included if filing jointly.

- Status Matters: Indicate if you are a full-year resident, part-year resident, or non-resident. The form accommodates different statuses, impacting your tax calculations.

- Submit Necessary Schedules: If applicable, remember to include additional forms such as the DR 0104PN for part-year residents or the DR 0104CR for claiming credits. Missing forms can delay processing.

- Review for Refunds: If you expect a refund, ensure to check the corresponding box and attach any necessary documents, like the DR 0102 if claiming as deceased.

Browse Other Templates

Lease Renewal Letter to Landlord - Provisions for additional deposits are outlined as necessary.

Sf-50 Form - The form includes a block for legal authorization codes, ensuring proper compliance with federal regulations.