Fill Out Your Colorado 26 Form

The Colorado 26 Form, commonly known as the Writ of Continuing Garnishment, serves a pivotal role in helping creditors recover money owed to them from judgment debtors. Once a judgment has been entered in favor of a creditor, this legal document allows for the garnishment of nonexempt earnings directly from the debtor’s paycheck. The process begins by the creditor completing the form, where they provide essential information including the case number, the debtor’s details, and the total amount due. This includes not only the original judgment amount but also any accrued interest and taxable costs. The form outlines a timeframe in which the garnishment remains effective, with specific instructions for the garnishee—typically the debtor’s employer—who is required to respond under oath about the earnings owed to the debtor. Failure to comply with the requirements may lead to legal consequences. In addition, both the judgment creditor and debtor have rights detailed in the document, reminding all parties of the necessary procedures to follow. Understanding this form is essential for both creditors seeking to collect owed funds and debtors looking to navigate the intricacies of wage garnishment effectively.

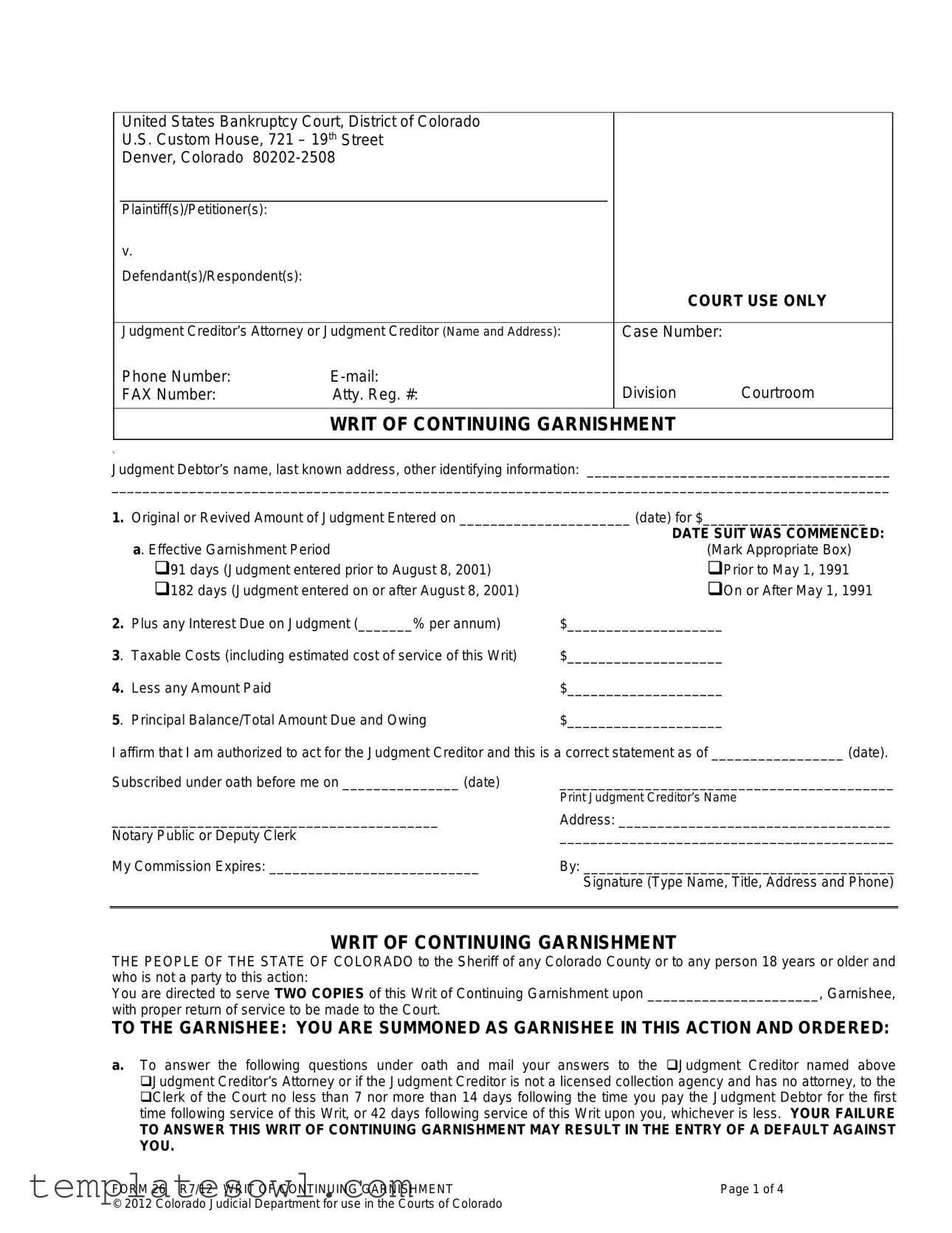

Colorado 26 Example

United States Bankruptcy Court, District of Colorado U.S. Custom House, 721 – 19th Street

Denver, Colorado

Plaintiff(s)/Petitioner(s):

v.

Defendant(s)/Respondent(s):

Judgment Creditor’s Attorney or Judgment Creditor (Name and Address):

Phone Number: |

|

FAX Number: |

Atty. Reg. #: |

COURT USE ONLY

Case Number:

Division Courtroom

WRIT OF CONTINUING GARNISHMENT

`

Judgment Debtor’s name, last known address, other identifying information: _______________________________________

____________________________________________________________________________________________________

1.Original or Revived Amount of Judgment Entered on ______________________ (date) for $_____________________

DATE SUIT WAS COMMENCED:

|

a. Effective Garnishment Period |

(Mark Appropriate Box) |

|

91 days (Judgment entered prior to August 8, 2001) |

Prior to May 1, 1991 |

|

182 days (Judgment entered on or after August 8, 2001) |

On or After May 1, 1991 |

2. |

Plus any Interest Due on Judgment (_______% per annum) |

$____________________ |

3. |

Taxable Costs (including estimated cost of service of this Writ) |

$____________________ |

4. |

Less any Amount Paid |

$____________________ |

5. Principal Balance/Total Amount Due and Owing |

$____________________ |

|

I affirm that I am authorized to act for the Judgment Creditor and this is a correct statement as of _________________ (date).

Subscribed under oath before me on _______________ (date) |

___________________________________________ |

|

Print Judgment Creditor’s Name |

__________________________________________ |

Address: ___________________________________ |

Notary Public or Deputy Clerk |

___________________________________________ |

My Commission Expires: ___________________________ |

By: ________________________________________ |

|

Signature (Type Name, Title, Address and Phone) |

|

|

WRIT OF CONTINUING GARNISHMENT

THE PEOPLE OF THE STATE OF COLORADO to the Sheriff of any Colorado County or to any person 18 years or older and who is not a party to this action:

You are directed to serve TWO COPIES of this Writ of Continuing Garnishment upon ______________________, Garnishee,

with proper return of service to be made to the Court.

TO THE GARNISHEE: YOU ARE SUMMONED AS GARNISHEE IN THIS ACTION AND ORDERED:

a.To answer the following questions under oath and mail your answers to the Judgment Creditor named above Judgment Creditor’s Attorney or if the Judgment Creditor is not a licensed collection agency and has no attorney, to the Clerk of the Court no less than 7 nor more than 14 days following the time you pay the Judgment Debtor for the first time following service of this Writ, or 42 days following service of this Writ upon you, whichever is less. YOUR FAILURE

TO ANSWER THIS WRIT OF CONTINUING GARNISHMENT MAY RESULT IN THE ENTRY OF A DEFAULT AGAINST YOU.

FORM 26 R7/12 WRIT OF CONTINUING GARNISHMENT |

Page 1 of 4 |

© 2012 Colorado Judicial Department for use in the Courts of Colorado |

|

b.To pay any nonexempt earnings to the party designated in “e” below no less than 7 nor more than 14 days following each time you pay the Judgment Debtor during the effective Garnishment Period of this Writ and attach a copy of the Calculation of the Amount of Exempt Earnings used (the Calculation under “Questions to be Answered by Garnishee” should be used for the first pay period, and one of the multiple Calculation forms included with this Writ should be used for all subsequent pay periods).

c.To deliver a copy of this Writ, together with the Calculation of the Amount of Exempt Earnings and a blank Objection to Calculation of the Amount of Exempt Earnings form, the first time you pay the Judgment Debtor.

d.To deliver to the Judgment Debtor a copy of each subsequent Calculation of the Amount of Exempt Earnings each time you pay the Judgment Debtor for earnings subject to this Writ.

e.MAKE CHECKS PAYABLE AND MAIL TO: Judgment Creditor named above; Judgment Creditor’s Attorney or if the Judgment Creditor is not a licensed collection agency and has no attorney; to the Clerk of the _______________ Court Name: __________________________________________________________________________________________

Address: ___________________________________________________________________________________________________

PLEASE PUT THE CASE NUMBER (shown above) ON THE FRONT OF THE CHECK.

CLERK OF THE COURT |

By Deputy Clerk: ________________________________ |

Kenneth S. Gardner |

Date: ______________________________________ |

NOTICE TO GARNISHEE

a.This Writ applies to all nonexempt earnings owed or owing during the Effective Garnishment Period shown on Line 1a on the front of this Writ or until you have paid to the party, designated in paragraph “e” on the front of this Writ, the amount shown on Line 5 on the front of this Writ, whichever occurs first. However, if you have already been served with a Writ of Continuing Garnishment for Child Support, this new Writ is effective for the Effective Garnishment Period after any prior Writ terminates.

b.“Earnings” includes all forms of compensation for Personal Services. Also read “Notice to Judgment Debtor” below.

c.In no case may you withhold any amount greater than the amount on Line 5 on the front of this Writ.

QUESTIONS TO BE ANSWERED BY GARNISHEE

Judgment Debtor’s Name: |

|

Case Number: |

The following questions MUST be answered by you under oath:

a.On the date and time this Writ of Continuing Garnishment was served upon you, did you owe or do you anticipate owing any of the following to the Judgment debtor within the Effective Garnishment Period shown on Line 1a on the front of this Writ? (Mark appropriate box(es)):

1.WAGES/SALARY/COMMISSIONS/BONUS/OTHER COMPENSATION FOR PERSONAL SERVICES (Earnings)

2.Health, Accident or Disability Insurance Funds or Payments

3.Pension or Retirement Benefits (for suits commenced prior to 5/1/91 ONLY - check front of Writ for date)

If you marked any box above, indicate how the Judgment debtor is paid: weekly

monthly other The Judgment Debtor will be paid on the following dates during the Effective Garnishment Period shown on Line 1a (front of this Writ):________________________________________________________________

b.Are you under one or more of the following writs of garnishment? (Mark appropriate box(es)):

4.Writ of Continuing Garnishment (Expected Termination Date: ___________________________________)

5.Writ of Garnishment for Support (Expected Termination Date: ___________________________________)

c.If you marked Box 1 and you did NOT mark either Box 4 or 5, complete the Calculation below for the “First Pay Period” following receipt of this Writ. If you marked either Box 4 or 5, you must complete Calculations beginning with the first pay period following termination of the prior writ(s).

FORM 26 R7/12 WRIT OF CONTINUING GARNISHMENT |

Page 2 of 4 |

© 2012 Colorado Judicial Department for use in the Courts of Colorado |

|

d.If you marked Box 2 or 3 and you did NOT mark either Box 4 or 5, complete the Calculation below for the “First Pay Period” following receipt of this Writ. If you marked either box 4 or 5, you must complete Calculations beginning with the first pay period following termination of the prior writ(s). However, there are a number of total exemptions, and you should seek legal advice about such exemptions. If the earnings are totally exempt, please mark box 6 below:

6. The earnings are totally exempt because:

CALCULATION OF THE AMOUNT OF EXEMPT EARNINGS (First Pay Period)

Gross Earnings for the First Pay Period from ______________ thru _______________ |

$ ___________________ |

||||

Less Deductions Required by Law (For Example, Withholding Taxes, FICA) |

- $ ____________________ |

||||

Disposable Earnings (Gross Earnings less Deductions) |

|

= $ ____________________ |

|||

Less Statutory Exemption (Use Exemption Chart Below) |

|

- $ ____________________ |

|||

Net Amount Subject to Garnishment |

|

|

= $ ____________________ |

||

Less Wage/Income Assignment(s) During Pay Period (If Any) |

- $ ____________________ |

||||

Amount to be withheld and paid |

|

|

= $ ___________________ |

||

|

|

|

|

|

|

|

EXEMPTION CHART |

PAY PERIOD |

AMOUNT EXEMPT IS THE GREATER OF: |

|

|

|

(“Minimum Hourly Wage” means |

Weekly |

30 x Minimum Hourly Wage or 75% of Disposable Earnings |

|

|

|

state or federal minimum wage, |

60 x Minimum Hourly Wage or 75% of Disposable Earnings |

|

||

|

whichever is greater.) |

65 x Minimum Hourly Wage or 75% of Disposable Earnings |

|

||

|

|

Monthly |

130 x Minimum Hourly Wage or 75% of Disposable Earnings |

|

|

I certify that I am authorized to act for the Garnishee; that the above answers are true and correct; and that I have delivered a copy of this Writ, together with the Calculation of the Amount of Exempt Earnings and a blank Objection to Calculation of the Amount of Exempt Earnings form to the Judgment Debtor at the time earnings were paid for the “First Pay Period” (if earnings were paid).

Name of Garnishee (Print) ________________________________

Address Phone Number

Subscribed under affirmation or oath before me on __________________ (date)

_________________________________________________

Notary Public/Deputy Clerk

My Commission Expires: ___________________________

Name of Person Answering (Print)

________________________________________________________

Signature of Person Answering

NOTICE TO JUDGMENT DEBTOR

a.The Garnishee may only withhold nonexempt earnings from the amount due you, but in no event more than the amount on Line 5 on the front of this Writ, UNLESS YOUR EARNINGS ARE TOTALLY EXEMPT, in which case NO EARNINGS CAN BE WITHHELD. You may wish to contact a lawyer who can explain your rights.

b.If you disagree with the amount withheld, you must talk with the Garnishee within 7 days after being paid.

c.If you cannot settle the disagreement with the Garnishee, you may complete and file the attached Objection with the Clerk of the Court issuing this Writ within 14 days after being paid. YOU MUST USE THE FORM ATTACHED or a copy of it.

d.You are entitled to a court hearing on your written objection.

e.Your employer cannot fire you because your earnings have been garnished. If your employer discharges you in violation of your legal rights, you may, within 91 days, bring a civil action for the recovery of wages lost because you were fired and for an order requiring that you be reinstated. Damages will not exceed 6 weeks’ wages and attorney fees.

FORM 26 R7/12 WRIT OF CONTINUING GARNISHMENT |

Page 3 of 4 |

© 2012 Colorado Judicial Department for use in the Courts of Colorado |

|

RETURN OF SERVICE

Judgment Debtor’s Name: ___________________________________ Case Number: ___________________

I certify that I am 18 years or older; that I am not a party to the action; and that I have served two copies of the Writ of Continuing Garnishment, together with a blank Objection to Calculation of the Amount of Exempt Earnings on

________________________ (name of party) in _______________________ (County) ___________________ (State) on

___________________________ (date) __________ (time) at the following location:

____________________________________________________________________________________________________

By (Check one):

By handing it to a person identified to me as ______________________________ (name of garnishee).

By leaving it with _________________________________________ (Type or write name legibly), who is designated to

receive service because of a legal relationship with _______________________ (name of garnishee) as provided for in

C.R.C.P. 4(e).

I attempted to serve ___________________________ (name of garnishee) on _______ occasions but have not been able

to locate him/her/it. Return to the Judgment Creditor is made on ___________________ (date).

I attempted to leave it with __________________________ (name of person) who refused service.

Private process server |

___________________________________ |

Sheriff, _________________________County |

Signature of Process Server |

Fee $ ____________ Mileage $ ________ |

___________________________________ |

|

|

|

Name (Print or type) |

Subscribed under affirmation or oath before me in the County of ______________________, State of ________________,

this ___________ day of _______________, 20 _______.

Note: Notarization is not required for service by a sheriff or deputy.

My Commission Expires: ________________________ |

___________________________________ |

|

Notary Public/Clerk |

FORM 26 R7/12 WRIT OF CONTINUING GARNISHMENT |

Page 4 of 4 |

© 2012 Colorado Judicial Department for use in the Courts of Colorado |

|

|

County Court |

District Court |

|

|

|

______________________County, Colorado |

|

|

|

|

Court address: |

|

|

|

|

|

|

|

|

|

Plaintiff(s):__________________________________ |

|

|

|

|

v. |

|

|

|

|

Defendant(s):__________________________________ |

|

COURT USE ONLY |

|

|

|

|

|

|

|

|

|

Case Number: |

|

|

Judgment Debtor’s Attorney or Judgment Debtor (Name and Address): |

|

||

Phone Number: |

|

|

|

FAX Number: |

Atty.Reg. #: |

Division |

Courtroom |

OBJECTION TO CALCULATION OF THE AMOUNT OF EXEMPT EARNINGS

Instructions to Judgment Debtor: Use this form to object to the calculations of your exempt earnings.

Name: ______________________________________________________Phone Number: _________________________

Street Address: _________________________________________________________________________________

Mailing Address, if different: _____________________________________________________________________________

City: ____________________________ State: _______________________________ Zip Code: ______________________

1.I object to the Garnishee’s Calculation of the Amount of Exempt Earnings because I believe that the correct calculation is:

Gross Earnings for My Pay Period from ___________________thru _________________ |

$ ____________ |

Less Deductions Required by Law (For Example, Withholding Taxes, FICA) |

- $ ____________ |

Disposable Earnings (Gross Earnings Less Deductions) |

= $ ____________ |

Less Statutory Exemption (Use Exemption Chart on Writ) |

- $ ____________ |

Net Amount Subject to Garnishment |

= $ ____________ |

Less Wage/Income Assignment(s) During Pay Period (If Any) |

- $ ____________ |

Amount which should be withheld |

= $ ____________ |

OR |

|

2.The earnings garnished are pension or retirement benefits/deferred compensation/health, accident or disability insurance

and they are totally exempt because:

_________________________________________________________________________________________________

I understand that I must make a good faith effort to resolve my dispute with the Garnishee.

I |

have |

have not attempted to resolve this dispute with the Garnishee. |

Name of Person I Talked to: _________________________________________________

Position: _________________________________________ Phone Number: __________________________________

FORM 28 R11/10 OBJECTION TO CALCULATION OF THE AMOUNT OF EXEMPT EARNINGS

Debtor’s Notice to Garnishee: Even though I am filing this Objection, you are directed to send my nonexempt earnings to the Court at the address noted instead of to the party designated in paragraph “e” on the front of the Writ of Continuing Garnishment. The Court will hold my nonexempt earnings in its registry until my Objection is resolved.

I certify that the above is correct to the best of my knowledge and belief and that I sent a copy of this document by

certified mail (return receipt requested) to both the Garnishee and to the Judgment Creditor, or if the Judgment Creditor is represented by Counsel,

certified mail (return receipt requested) to the Judgment Creditor’s Attorney or

Garnishee |

Judgment Creditor or Attorney |

Address: ________________________________________ |

Address: ___________________________________ |

________________________________________________ |

___________________________________________ |

Subscribed under affirmation or oath |

|

before me on ______________________(date) |

|

|

___________________________________________ |

|

Signature of Judgment Debtor or |

My Commission Expires: ____________________________ |

Judgment Debtor’s Counsel and Reg. Number |

|

|

________________________________________________ |

|

Notary Public/Deputy Clerk |

|

FORM 28 R11/10 OBJECTION TO CALCULATION OF THE AMOUNT OF EXEMPT EARNINGS

Form Characteristics

| Fact Title | Description |

|---|---|

| Governing Law | This form is governed by the Colorado Revised Statutes, specifically sections pertaining to garnishments (C.R.S. § 13-54-101 et seq.). |

| Purpose | The Colorado 26 form is used to initiate a continuing garnishment against a judgment debtor's earnings to satisfy a debt. |

| Filing Requirements | Parties must file this form with the appropriate District Court in Colorado. Two copies of the writ must also be served to the garnishee. |

| Garnishment Period | The effective garnishment period may vary, lasting either 91 or 182 days based on the date the judgment was entered. |

| Judgment Amount | The form requires the original judgment amount, any accrued interest, and costs to be filled out, detailing the total amount owed. |

| Notice Given | Garnishee receives notices on their responsibilities. Failure to comply may result in a default judgment being entered against them. |

Guidelines on Utilizing Colorado 26

When filling out the Colorado 26 form, it's important to carefully provide all necessary information to ensure proper processing. The form itself serves specific legal purposes, so accuracy is paramount. Below are the steps to guide you through the completion of the form.

- Begin by entering the name and address of the Plaintiff(s)/Petitioner(s) in the designated area.

- Next, enter the name and address of the Defendant(s)/Respondent(s).

- Provide the name, address, and contact information (phone, email, fax, Atty. Reg. #) of the Judgment Creditor’s Attorney or of the Judgment Creditor themselves.

- Fill in the “Court Use Only” section with the Case Number, Division, and Courtroom information as applicable.

- In the “Judgment Debtor’s name, last known address, other identifying information,” include the relevant details of the Judgment Debtor.

- State the Original or Revived Amount of the Judgment entered, along with the date of entry.

- Select the appropriate box for the Effective Garnishment Period based on the date the judgment was entered.

- Calculate and enter any Interest Due on the Judgment.

- Include any Taxable Costs in the next section, ensuring they are accurate.

- Subsequently, enter any Amount Paid to the Judgment Debtor.

- Sum up the Principal Balance/Total Amount Due and Owing and write this amount in the designated section.

- Ensure to affirm authorization to act for the Judgment Creditor and fill in the date of affirmation.

- A notary or deputy clerk needs to sign to subscribe this section, filling in their commission expiration date.

- Complete the sections regarding payment instructions to the Garnishee, ensuring that all necessary contact information is included.

- Review the entire form for completeness and accuracy before submission.

After finishing the form, submit it to the appropriate court, along with any required copies. It's advisable to retain a copy for your records. This ensures you have a clear reference should any questions arise regarding the garnishment process.

What You Should Know About This Form

What is the Colorado 26 form?

The Colorado 26 form, also known as the Writ of Continuing Garnishment, is a legal document used in Colorado to collect money owed from a judgment debtor. This form authorizes a garnishee, often an employer or a financial institution, to withhold a portion of the debtor’s earnings or assets to satisfy a legal judgment. It ensures that the creditor can access payments directly as they are earned rather than relying solely on the debtor to repay their debts.

Who needs to fill out the Colorado 26 form?

The form must be completed by the judgment creditor or their attorney when seeking to garnish an individual’s wages or assets. This individual is the person or entity that has obtained a court judgment against the debtor, typically due to some form of unpaid debt. The information required includes details about the judgment, the debtor, and the garnishee.

What information is required on the form?

To complete the Colorado 26 form, you need to provide several crucial pieces of information, such as the names and addresses of the plaintiff and defendant, the judgment creditor’s details, and the case number. Additionally, you will need to state the amount of the original judgment, any interest due, taxable costs, and the total amount owed. The garnishee will also be required to answer specific questions regarding the debtor’s earnings or assets.

What happens if the garnishee does not respond to the Writ?

If the garnishee fails to respond appropriately to the Writ of Continuing Garnishment, there could be serious consequences. The court may enter a default judgment against the garnishee, essentially siding with the judgment creditor by assuming the garnishee has the necessary funds available. It’s important for the garnishee to comply and respond within the specified time frame to avoid these potential issues.

How long does the garnishment period last?

The effective garnishment period indicated in the Colorado 26 form generally lasts for either 91 or 182 days, depending on when the judgment was entered. This time frame allows creditors to collect the maximum amount owed. However, if a new garnishment writ for child support takes precedence, the new writ will take effect immediately after the existing one terminates.

What can a judgment debtor do if they believe their earnings are wrongfully being garnished?

Judgment debtors have the right to object to the calculations provided by the garnishee. If they believe that their exempt earnings are being incorrectly calculated, they must act quickly. The debtor can file a formal objection with the court, detailing their concerns about the garnishment. This objection must be filed within 14 days after being paid to seek a hearing on the matter.

Common mistakes

Filing the Colorado 26 form can be a complex process that requires attention to detail. Many individuals make common mistakes that can affect the outcome of their garnishment orders. These errors often stem from misunderstandings about the form’s requirements or a lack of familiarity with the associated legal procedures.

One significant mistake is failing to provide accurate information regarding the judgment debtor's details. Incomplete or incorrect names, addresses, or other identifying information can lead to delays or even invalidation of the garnishment. It is essential to double-check that all provided information is both current and precise to avoid these potential pitfalls.

Additionally, another error involves improperly marking the effective garnishment period. The form includes options that depend on specific judgment dates. If someone marks the wrong box regarding when the judgment was entered, it can lead to incorrect calculations for amounts due, impacting both the creditor and the debtor.

Many individuals also overlook the requirement to calculate and report taxable costs accurately. Skipping this section or providing an inaccurate figure can mislead the court regarding the total amount owed. It is critical to include any estimated costs related to the service of the writ to ensure a correct total is presented.

Another mistake involves insufficient attention given to the interest calculations. Parties must not only state the annual percentage of interest but also ensure they apply it accurately over the specified time period. An incorrect or missing interest figure can alter the amount due significantly, creating further complications in enforcement.

Lastly, neglecting to properly complete the affirmations and signatures can invalidate the document. Both the judgment creditor and the notary public must ensure that all signatures are present and that the form is notarized correctly. This requirement confirms the authority to act on behalf of the creditor, establishing the authenticity of the complaint.

Documents used along the form

The Colorado 26 form, known as the Writ of Continuing Garnishment, is often used in conjunction with several other documents that facilitate the process of garnishment. Each document serves a distinct purpose and is crucial for complying with legal procedures. Below are key forms that are commonly associated with the Colorado 26 form.

- Objection to Calculation of the Amount of Exempt Earnings: This form allows a judgment debtor to formally dispute the garnishee's calculations regarding exempt earnings. It includes sections for the debtor to present their own calculations and assert their rights.

- Garnishee Answer Form: A garnishee must complete this form to respond to the writ. It includes questions about whether the garnishee owes money to the judgment debtor and requires specific financial details.

- Notice of Garnishment: This document notifies the judgment debtor and garnishee of the garnishment proceedings. It highlights the rights of the debtor regarding potential exemptions and objecting to the garnishment.

- Exemption Claim Form: This form enables a judgment debtor to assert exemption claims from garnishment. It lists specific types of income or assets that may be protected under state law.

- Return of Service: This document serves to confirm that the writ of garnishment has been properly served to the garnishee. It includes details of the service date and method used.

- Request for Hearing: In cases where a debtor disputes the garnishment, this form may be used to request a hearing before a court to resolve the issue. It includes spaces for detailed information about the dispute.

These forms and documents collectively ensure that the garnishment process adheres to the legal framework established in Colorado. Understanding each document’s role can help both judgment creditors and debtors navigate the complexities of garnishment effectively.

Similar forms

Writ of Garnishment: Similar to the Colorado 26 form, a Writ of Garnishment is issued by a court to collect money from a debtor’s wages or bank account. It specifies the amount due and the timeframe for response, just like the 26 form.

Writ of Attachment: This document permits a creditor to seize a debtor’s property before a judgment is made. Both forms involve legal authority to recover debts and outline specific instructions for compliance.

Judgment Against Debtor: A judgment tells the debtor what they owe. The Colorado 26 form relies on an existing judgment to enforce collection, making both related in addressing unpaid debts.

Subpoena Duces Tecum: This type of subpoena requests documents from a third party. Much like the 26 form, it seeks compliance from parties that hold information relevant to the debtor's finances.

Motion for Contempt: This legal request is made when a party fails to comply with a court order, similar to enforcement actions outlined in the 26 form, reflecting consequences for non-compliance.

Notice of Garnishment: This document notifies the garnishee about their obligations regarding the garnishment. It aligns with the 26 form's requirement to inform about garnishments and the garnishee’s responsibilities.

Notice of Default: Issued when a debtor fails to meet their financial obligations, this notice can initiate actions like those described in the Colorado 26 form regarding ongoing collections and payments.

Request for Hearing: In the event a debtor wishes to contest the garnishment, a request for a hearing is filed. This complements the 26 form’s provision for objections to the calculation of amounts owed.

Dos and Don'ts

Do be thorough when providing the Judgment Debtor’s name and address. Ensure that this information is accurate to avoid any delays or issues with the garnishment process.

Don’t leave any sections blank. Completing every part of the form is important, even if a particular section does not apply to your situation.

Do accurately calculate any interest due on the judgment. Ensure that this is reflected correctly to provide an accurate total amount due.

Don’t forget to sign and date the form. Missing signatures can lead to the garnishment being deemed invalid.

Do keep copies of the completed form and any related documents for your records. This will be helpful should any questions arise in the future.

Misconceptions

-

Misconception 1: The Colorado 26 form is only for income garnishment.

Many assume that the Colorado 26 form, known as the Writ of Continuing Garnishment, applies exclusively to wages and salaries. However, it also covers other forms of earnings. This includes bonuses, commissions, as well as pension or retirement benefits, highlighting the broader scope of garnishable income beyond just regular paychecks.

-

Misconception 2: The garnishee has unlimited time to respond.

Some believe that garnishees can take their time answering the Writ of Continuing Garnishment. In reality, they are required to respond within a specific window—no less than 7 days and no more than 14 days after paying the judgment debtor. This urgency helps protect the rights of the judgment creditor.

-

Misconception 3: Judgments must be fully paid before garnishment can begin.

It’s a common belief that a debtor must pay off the entire judgment amount before garnishment can occur. This is not the case. Garnishment begins once the court issues the writ, but it can only take a non-exempt portion of the debtor’s earnings until the judgment is satisfied.

-

Misconception 4: Garnishment is only for individual debtors.

Many think that garnishment through a Colorado 26 form only applies to individual judgment debtors. Yet, businesses can also be subject to garnishment, particularly if they owe money to a creditor. This means that both individuals and entities can face garnishment actions when unpaid debts exist.

Key takeaways

When filling out and using the Colorado 26 form, there are several critical factors to keep in mind:

- The form is used to initiate a Writ of Continuing Garnishment, which allows for the collection of a judgment debt directly from a debtor's wages or earnings.

- Accurate completion of the form is essential. Include the original or revived amount of the judgment, interest owed, and any taxable costs to avoid potential delays.

- Understand the effective garnishment period. This form allows for either a 91-day or 182-day garnishment period, depending on the date of the judgment.

- It is crucial to serve the Garnishee. Two copies of the writ must be provided to the Garnishee, who is obligated to respond under oath within the specified time frame.

- If you are the Garnishee, answering the required questions under oath is not optional. Failure to respond may result in a default judgment.

- Always ensure compliance with the exemption rules. Certain earnings may be exempt from garnishment, and understanding these exemptions is vital.

- Filing an objection to the calculation of exempt earnings is an option. If discrepancies arise, a formal objection can be submitted within the specified time limits to protect your rights.

Browse Other Templates

Texas Vehicle Information Request,Motor Vehicle Records Access Form,TxDMV Record Inquiry Form,Vehicle Title and Registration Request,Personal Vehicle Information Application,Motor Vehicle Data Request Form,Texas Driver Privacy Record Request,Vehicle - Other than private vehicle owners or lienholders, written authorization must accompany the request.

Lawn Service Invoice - Clearly stated account type for billing reference.

Photosynthesis Diagram Blank - Recognize mesophyll cells, where most of the photosynthesis occurs.