Fill Out Your Colorado Cr 100 Form

The Colorado CR 100 form, officially known as the Colorado Sales Tax and Withholding Account Application, is crucial for various types of businesses operating within the state. This comprehensive form serves multiple functions, including the establishment of a sales tax account, as well as W-2 and 1099 withholding accounts. Businesses need to carefully complete sections that pertain to their specific circumstances, whether they are filing a new application or adding an additional location. Key components of the form include identifying the type of organization and the reasons for filing, which could range from starting a new venture to a change in ownership. Moreover, the form covers essential fee structures, such as costs related to trade name registrations, unemployment insurance, and specific licensing fees based on the nature of sales, whether retail or wholesale. Charitable organizations also benefit from a reduced fee structure. To streamline the process, applicants may choose to register online, mail in their applications, or visit a local service center for immediate assistance. Comprehension of the associated requirements, including identification protocols and filing frequencies, is essential for businesses to maintain compliance and ensure smooth operations. The CR 100 form is an indispensable toolkit for navigating the complexities of sales tax and withholding regulations in Colorado.

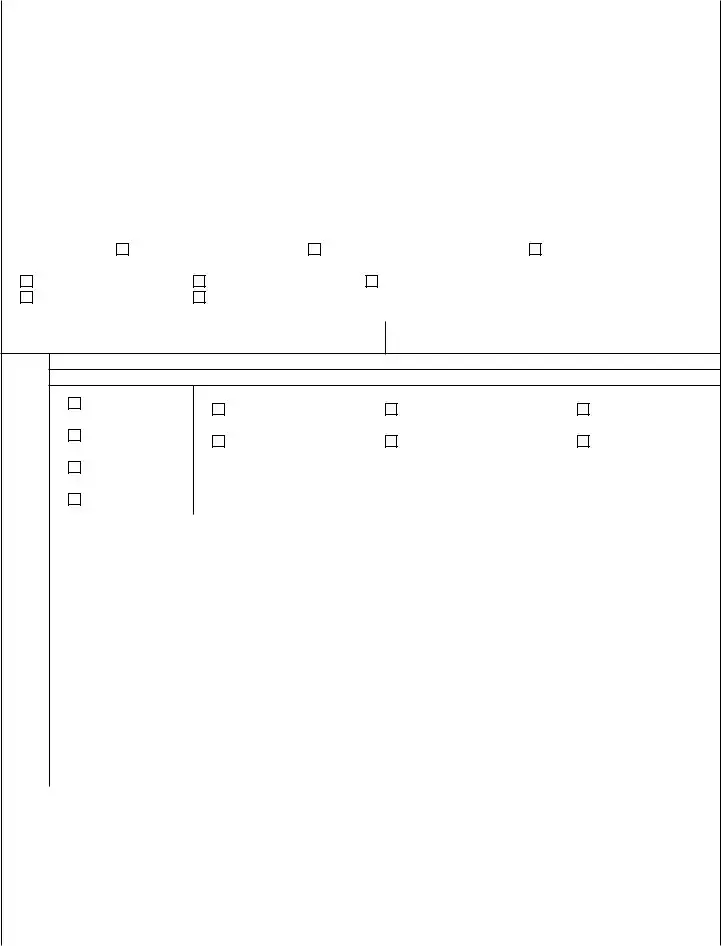

Colorado Cr 100 Example

CR 0100AP (11/02/20) |

Fee Schedule |

|

|

• Trade name registration: |

• Unemployment insurance: |

Trade name registrations must be done with the Colorado Secretary of State at www.sos.state.co.us.

Colorado unemployment insurance tax is administered by the Colorado Department of Labor and Employment.

•Wholesale and retail license

If first day of sales is:

|

January to June |

$16.00 |

|

2020, 2022, 2024 |

|

|

July to December |

$12.00 |

|

2020, 2022, 2024 |

|

|

January to June |

$8.00 |

|

2021, 2023, 2025 |

|

|

July to December |

$4.00 |

|

2021, 2023, 2025 |

|

• |

Charitable License |

|

|

(copy of 501(c)(3) required) |

$8.00 |

|

|

|

• |

A deposit |

|

|

is required on a retail sales tax license only |

$50.00 |

Fee Notes

•The $50 deposit will be refunded automatically after a business has collected and paid $50 in state sales taxes. Do not deduct the deposit on your sales tax return. The deposit is only required on the first business location.

•There is no charge for a multiple or single event license if a business has a current wholesale or retail sales tax license.

•For single and multiple event licenses complete the DR 0589 “Sales Tax Special Event Application.”

•All licenses except the single event license are valid through December 31 of each

Instructions

1. Apply Online and Save Time!

Visit mybiz.colorado.gov to register through MyBizColorado and receive your license number the same day. A license will be mailed to you after any fees have been posted to your account. Allow 2 to 3 weeks to receive your paper license. If you are unable to register online, see the instructions below.

2. Mailing the CR 0100AP to the Department of Revenue:

Download the form from the department’s Taxation Website at Tax.Colorado.gov. Complete the form and make a copy for your records before mailing the original to the Department of Revenue at the following address:

Colorado Department of Revenue

Service Center Section

PO Box 17087

Denver, CO

Allow four to six weeks for processing

3. Visiting a

Bring the completed CR 0100AP Colorado Sales Tax and Withholding Account Application to a service center location listed below along with a valid picture ID of

business owner who signed the application and a check or money order for the license fees. You will receive your license immediately.

For

Locations subject to change, please verify location address.

Lakewood Service Center

1881 Pierce St - Entrance B

Lakewood CO 80214

Colorado Springs Service Center

2447 N Union Blvd

Colorado Springs CO 80909

Pueblo Service Center 827 W 4th St

Pueblo CO 81003

Grand Junction Service Center 222 S 6th St, Room 208 Grand Junction CO 81501

Fort Collins Service Center

3030 S College Ave

Fort Collins CO 80525

Taxpayer ID Requirements: |

or Military Identification Card. If the application is walked |

All |

in by any individual other than an owner, partner or officer |

for a Sales Tax, 1099 or W2 Wage Withholding account |

of the business, a photo copy of a valid ID for the owner, |

with the Colorado Department of Revenue must provide |

officer or partner who signed the application must be |

valid proof of identification. Valid proof includes Colorado |

submitted. If applicant is from another state, a valid driver’s |

Driver’s License, Colorado Identification Card, United |

license or other picture ID from that state is required. |

States Passport, Resident Alien Card (including eligibility |

If you have any questions, visit Tax.Colorado.gov, call |

for employment), United States Naturalization Papers and/ |

Page 1 of 4

Colorado Sales Tax and Withholding Account Application

CR 0100AP

General Information

The CR 0100AP is used to open a sales tax,

•To apply for a state sales tax license, complete sections A, B, C, E, F and G.

•To apply for a withholding account, complete sections A, B, D, E, F and G. If you require both licenses, complete all sections.

•To electronically open an account, go to MyBiz Colorado at mybiz.Colorado.gov

Refer to the following definitions.

•

•1099 Withholding. Payers who withhold tax on Colorado income reported on 1099 forms. (example: contract labor)

•Oil and Gas Withholding. Every producer of crude oil, natural gas or oil shale shall withhold one percent from the amount owed to any person owning a working interest, a royalty interest, a production payment or any interest in carbon dioxide or oil and gas production in Colorado. No withholding is required from payments made to Colorado or the U.S. Government (see Department of Revenue publication FYI Withholding 4).

•Trade Names are registered with the Colorado Secretary of State. A trade name is not required to obtain a tax account.

•State Sales Tax License. A state sales tax license is required for any person that sells tangible personal property regardless of whether selling retail or wholesale. A license is not required for persons engaged exclusively in the business of selling commodities or services which are exempt from taxation.

•State and Local Sales. Colorado has a 2.9 percent sales tax. Additionally, many cities and counties impose their own local sales tax on purchases and transactions within their boundaries. There are also special district taxes that apply in certain boundaries.

For a complete listing of all applicable tax rates and exemption information, please see “Colorado Sales/Use Tax Rates” DR 1002 on our website at Tax.Colorado.gov. The DR 1002 is revised in January and July each year.

You may also visit Colorado.gov/RevenueOnline to find tax rates by city, county and business account number through Revenue Online.

Due to the complexities surrounding the laws on the collection and remittance of sales/use tax in Colorado, it is recommended that you attend a live class or take an online tax class offered by the department after opening

your business and/or obtaining a sales tax license. Visit Colorado.gov/pacific/tax/education for class schedule and registration.

Section A

Box 1. Reasons for filing this application.

•Original Application. A new

•Change of ownership. An existing business that changes its legal structure. Does not include changes of stockholders of corporations and members in limited liability companies. If you purchase an existing business and have a new FEIN, you must apply for a new license and complete a DR 0100A.

•Additional Location. The business already has a Colorado account number but is adding a new business location.

•Do you have a Department of Revenue Account Number? If your business or organization currently has a Colorado Account Number (CAN), enter it here. A sales tax deposit is required on a business’ first retail sales tax location only as long as each additional location uses the same account number.

Box 2. Type of Organization. Check the box that indicates the legal structure for your business/organization.

Note: Married couples must register as a general partnership if both spouses are owners of the business. General partnerships require a FEIN.

Section B

Line 1a. Taxpayer Name. The name should be

entered as follows:

•Individual (sole proprietorship). Last name, first name and middle name or initial.

•General Partnership, Association or Joint Venture.

The last name, first name and middle initial of two principal partners. If there are additional partners, attach a separate sheet.

•Corporation, Limited Partnership, Limited Liability Company (LLC), Limited Liability Partnership (LLP) or Limited Liability Limited Partnership (LLLP). The legal name of the business must match exactly as filed with the Colorado Secretary of State and IRS.

• Government. Enter the legal name of the government agency.

•Nonprofit. Enter the name of the nonprofit organization. If applying for a charitable license, a copy of 501(c)(3) is required.

Line 1b. Social Security Number (SSN). Enter the Social Security number of the owner if this is an application for an individual (Sole Proprietor). If the Sole Proprietor has an FEIN number, complete Line 1d.

Page 2 of 4

Line 1c. Business Name. If operating as any other type of organization other than Individual/Sole Proprietor, enter business name here as registered with Colorado Secretary of State and IRS.

Line 1d. Federal Employer Identification Number (FEIN). An FEIN is required to open a new account with the Colorado Department of Revenue. FEINs are issued by the Internal Revenue Service, IRS.gov. Individuals (Sole Proprietors) can use their social security numbers. All other entities must have a FEIN number.

Line 2a. Trade Name/Doing Business As. If the taxpayer will be doing business under any name other than the name on Line 1, the “trade name” should be entered here. Trade names must be registered with the Colorado Secretary of State.

Line 2b. Proof of Identification/Taxpayer ID Requirements: All applicants for a sales tax or withholding account with the Colorado Department of Revenue must provide valid proof of identification at the time of application. Valid proof includes a legible copy of a Colorado Driver’s License, Colorado Identification Card, United States Passport, Resident Alien Card (indicating eligibility for employment), United States Naturaliza- tion Papers and/or Military Identification Card. If the application is being walked in by any individual other than an owner, partner or officer of the business, a photo copy of a valid ID for the owner, officer or partner who signed the application must be submitted. If the applicant is from another state, a valid driver’s license or other picture ID from that state is required. Do not enter a social security number here.

Line 3a. Principal Address. This is the address of the orga- nization’s/entity’s principle place of business in Colorado. If you are located outside the state and do not have a physical location in Colorado, your main address in a different state is acceptable. Do Not use a post office box.

•If a business will have multiple fixed locations, a separate application must be filed for each location.

•If you are a mobile vendor (example: food truck or tool sales) indicate MOBILE. You are required to give the address, warehouse or office of the location you park and store the vehicle.

Line 3b. County. Enter the county in which your principal place of business is located. If you are not sure which county, refer to the DR 1002 available on the department’s Web site at Tax.Colorado.gov under “Forms & Instructions”

Line 3c. City. Enter the city in which your principal place of business is located.

Line 3d. Phone Number. Enter the telephone number for your business.

Line

Line 4c. Telephone. Enter the telephone number for the mailing address. If you would like to receive text notifications for due date reminders and the like, check the mobile text box ‘Yes’. If you would not like text notifications, select ‘No’.

Line 4d. Mailing Address. Enter the street address, city, state and zip code where the business or organization will receive mail from the department.

Line 5. Email Address. Please enter the email address you would like on file. Indicate on the application if you would like email correspondence from the state. The emails could be account specific or updates to sales tax collection.

Line 6a and 6b. If you acquired the business, please provide the prior business name, address, date of acquisition and the prior owner’s first and last name.

Line 7. List Specific products and/or Services you provide and explain in detail on Line 8. Check the applicable boxes in section 7 on the form:

Do you sell alcohol? |

Yes |

No |

Do you sell tobacco products? |

Yes |

No |

Do you sell prepaid wireless? |

Yes |

No |

Do you sell medical marijuana? |

Yes |

No |

Do you sell recreational marijuana? |

Yes |

No |

Do you sell EXCLUSIVELY through the |

Yes |

No |

marketplace? |

|

|

Do you rent motor vehicles for 30 days |

Yes |

No |

or less? |

|

|

Do you rent out items for 30 days or less? |

Yes |

No |

Do you rent out rooms for 30 days or less? |

Yes |

No |

Is your business in a special taxing |

Yes |

No |

district? |

|

|

Are you a Market Place Facilitator? |

Yes |

No |

If yes - As a Market Place Facilitator, do |

Yes |

No |

you also sell products? |

|

|

Write a brief description of products, services and/ or function of the business/organization on line 8. The information you provide will help us determine the appropriate North American Industry Classification System (NAICS) code for your business. It will also help us get tax information and updates to you, depending on your business type.

Lines 8a through 8d. Owner/Partner/Corp. Officer. All organizations, including sole proprietors, must complete these lines. Type/print the name, title, FEIN (Federal Employer Identification Number), social security number, and home address of each individual, partner, corporate officer or member. If there are more than two owners, attach a separate sheet and provide the same information for additional owners. For a partnership between corporations or limited liability companies, list each legal name, address, and FEIN separately.

Page 3 of 4

Section C — Sales Tax

Line 1. Type of sales which applies to your business.

•Wholesaler. A business that sells to retail merchants, jobbers, dealers, or other wholesalers for the purpose of resale. This license cannot be used to purchase items for personal use.

•Retail Sales. A retailer is a business that sells products to final purchasers and is required to collect the appropriate sales taxes. A retailer may also sell wholesale, but is not required to have a separate wholesale license. RTD/CD and local taxes must also be collected, if applicable.

•Charitable. If your organization has been designated as “charitable 501(c)(3),” the organization will be exempt from paying the $50 deposit for a retail sales tax license. Your license fee is $8. Please attach a copy of the IRS 501(c)(3) letter.

•Note on Special Events. Must apply for this separate license on form DR 0589, Sales Tax Special Event Application. This license is required if you sell at special events. There is no additional fee for businesses that already have a sales tax license.

Line 2a. Filing Frequency. Select the filing frequency based on the amount of anticipated sales tax collection.

Line 2b. First Day of Sale. You may wish to start your license prior to the first day of sales in order to make purchases for producing products to sell.

Section E - Fees

Do not enter Period Covered From and To (Dept. Use Only)

•Sales Tax Deposit. A deposit is required on a retail license. Charitable organizations are exempt. The deposit is refunded automatically after a business collects and remits $50 in state sales taxes. Do not deduct the deposit from your sales tax return. The deposit is only required on a business’s first location if each additional location uses the same account number. (See instructions for Section A, Box 1.)

•Sales Tax License. Standard Colorado Sales tax License is $16 for a

•Wholesale License is $16 for a

•Charitable License. The fee is $8.

•Note: The withholding license has no fee for registration and no renewal is required.

Section D — Withholding

Line 1. Type of Withholding account. Indicate which type of withholding account: W2, 1099, or Oil/Gas withholding. A 1099 withholding account is only needed when you withhold from 1099 payments.

Gaming Establishments

Complete the Sales Tax/Withholding Account Application (CR 0100AP) to apply for a 1099 or

Line 2. Filing frequency. If you will have employees, estimate how much wage withholding you expect to pay for all your employees in one year. Your required filing frequency will be based on your estimated annual wage withholding. Businesses with annual wage withholding of $50,000 or more must file and remit withholding taxes by Electronic Funds Transfer (EFT). For more information, print the publication “Colorado Department of Revenue Electronic Funds Transferred (EFT) Program For Tax Payments” (DR 5782) from our website at Tax.Colorado.gov. Frequency for Oil/Gas is monthly. See FYI Withholding 4 for schedule.

Line 4b. First Day of Payroll. List the month and year you anticipate payroll to begin. Normally, start dates begin with a quarter, e.g., 1/20, 4/20, 7/20, or 10/20, but you can start your payroll anytime.

Section F — Points of Compliance

•Licensed retailers are required to renew their licenses every two years

•Licensed retailers are required to file monthly, quarterly, or annual returns based on the sales tax collected.

•Licensed retailers are required to file returns for each tax period even if they had no sales and collected no tax.

•Licensed retailers understand their license is only used to purchase items they resell.

•Licensed retailers understand sales tax rates are subject to change twice a year (January & July).

•Licensed retailers can close their account or change their address utilizing the DR 1102.

Section G — Signature

•A signature must be on this document or it will not be processed.

•Please include the title of the person signing and the date signed.

Allow four to six weeks to receive a license by mail when completing and sending in a CR 0100AP form. If you apply for a license through mybiz.Colorado.gov you will receive your license number the same day. Allow two to three weeks to receive your paper license. If you apply for your license at a service center you will receive your account number and license immediately. This concludes the application.

Page 4 of 4

CR 0100AP (11/02/20)

COLORADO DEPARTMENT OF REVENUE

Service Center Section

PO Box 17087

Denver CO

Colorado Sales Tax and

Withholding Account Application

|

|

|

|

Reason for Filing This Application |

|

||

A |

|

1. |

|

|

|

|

|

|

Original Application |

|

Change of Ownership |

Additional Location |

|||

|

|

|

|

|

|

|

|

|

|

Do you have a Colorado Account Number? |

|

If Yes, the Account Number |

|

||

|

|

Yes |

No |

|

|

|

|

2. Indicate |

Type of Organization. If you are not an individual, you |

must have a FEIN number. |

|

||||

|

Individual/Sole Proprietor |

Limited Liability Company (LLC) |

Corporation/S Corp |

Government |

|||

|

General Partnership |

Limited Liability Partnership (LLP) |

Association |

Joint Venture |

|||

|

Limited Partnership |

Limited Liability Limited Partnership (LLLP) |

Estate/Trust |

Nonprofit (Charitable) |

|||

|

|

|

|

|

|

|

Business Information |

|

|

|

|

|

|||||

B |

1a. Last Name (If registering as SSN) |

|

|

|

First Name |

|

|

|

|

|

1b. SSN (Required) |

|

|

||||

|

|

1c. Business Name (If registering as FEIN) |

|

|

|

|

|

|

|

|

1d. FEIN (Required) |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

2a. Trade |

Name / Doing Business As (If applicable and for informational purposes only) |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2b. |

Proof of Identification |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

State DL/ID |

|

|

Passport |

|

|

|

Other |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Physical Place of Business |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

3a. |

Principal Address |

|

|

|

|

City |

|

|

|

|

|

State |

Zip |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3b. |

County |

|

|

|

|

3c. If business is within city limits, what city? |

|

3d. Phone |

Number |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Mailing Address (If different than the physical address) |

|

|

|

|

|

|

|

|

|

||||||||

4a. |

Last Name |

|

|

|

|

|

First Name |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4b. |

Business Name |

|

|

|

|

|

4c. Phone Number |

|

Mobile Text (Data Rates May Apply) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|

4d. |

Mailing Address |

|

|

|

|

City |

|

|

|

|

|

State |

Zip |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. Email Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email Opt In For |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Return Filing |

Tax Updates |

Revenue Online Instructions |

Tax Rate Changes (2x/Year) |

|

Marketplace Information |

|||||||||||

If you acquired or purchased the business, complete the following: |

|

|

|

|

|

||||||||||||

6a. |

Business Name and Prior Owner’s First and Last Name |

|

|

|

|

|

|

6b. Date of Acquisition (MM/YYYY) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

6c. Address (Street, City, State, Zip) |

|

|

|

|

|

|

|

|

6d. Prior Owner’s FEIN |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7. Complete the questions below |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Do you sell alcohol? |

|

Yes |

No |

|

Do you rent motor vehicles for 30 days or less? |

Yes |

No |

||||||||||

Do you sell tobacco products? |

Yes |

No |

|

Do you rent out items for 30 days or less? |

|

|

Yes |

No |

|||||||||

Do you sell Prepaid Wireless? |

Yes |

No |

|

Do you rent out rooms for 30 days or less? |

|

|

Yes |

No |

|||||||||

Do you sell Medical Marijuana? |

Yes |

No |

|

Do you sell EXCLUSIVELY through the marketplace? |

Yes |

No |

|||||||||||

Do you sell Recreational Marijuana? |

Yes |

No |

|

Are you a Marketplace Facilitator? |

|

|

Yes |

No |

|||||||||

Is your business in a Special taxing district? |

Yes |

No |

|

As a Marketplace Facilitator, do you also sell products? |

Yes |

No |

|||||||||||

8. List specific products and/or services you provide and explain in detail (Required)

(Form continued on page 2)

9a. |

Owner/Partner/Corp Officer Last Name |

|

|

Owner/Partner/Corp Officer First Name |

||

|

|

|

|

|

|

|

Job Title |

|

|

|

9b. Phone Number |

||

|

|

|

|

|

|

|

9c. Address (Street, City, State, Zip) |

|

|

|

9d. SSN |

||

|

|

|

|

|

||

10a. Owner/Partner/Corp Officer Last Name |

|

Owner/Partner/Corp Officer First Name |

||||

|

|

|

|

|

|

|

Job Title |

|

|

|

10b. Phone Number |

||

|

|

|

|

|

|

|

10c. Address (Street, City, State, Zip) |

|

|

|

10d. SSN |

||

|

|

|

|

|||

Additional Owner/Partner/Corp Officers on a separate paper |

|

|

|

|||

C |

|

Sales Tax Account (Fees Apply) |

||||

1. Indicate Type of Sale: |

|

|

|

|

||

|

|

Wholesaler |

|

Charitable |

||

2a. |

Filing |

Frequency: If SALES TAX collected is: |

|

|

|

|

|

Wholesale Only - Annually |

Under $300/month - Quarterly |

Seasonal, write in the months in business |

|||

|

$15/month or less - Annually |

$300/month or more - Monthly |

|

|

|

|

|

|

|

|

|

|

|

2b. |

License Start Date Required (MM/YYYY) |

|

CO Account Number - Site (Dept Use Only) |

|||

Withholding Tax Account (No Fees Apply)

1.Indicate which you are applying for:

2.Filing Frequency: If W2 wage withholding tax amount is

|

W2 Withholding |

|

$1 - $6,999/Year - Quarterly |

$7,000 - $49,999/Year - Monthly |

||||||

|

|

|

|

|||||||

|

1099 Withholding |

3. Filing Frequency: If 1099 withholding tax amount is |

|

|

||||||

D |

|

$1 - $6,999/Year - Quarterly |

$7,000 - $49,999/Year - Monthly |

|||||||

|

|

|

||||||||

|

Monthly |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Oil/Gas Withholding |

4a. Payroll Company, if applicable |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

|

4b. First Day of Payroll Required (MM/YYYY) |

4c. Payroll Company Phone Number |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Period Covered |

|

|

|

FEES (see fees on page 1 of instructions) |

|

||||

|

(Dept Use Only) |

|

|

|

|

|||||

|

From |

To |

|

|

|

|

|

|

|

|

|

MM/YY |

|

|

|

State Sales Tax Deposit |

(355) |

$ |

|

||

|

|

|

|

|

|

|||||

|

MM/YY |

MM/YY |

|

|

Sales Tax License |

|

(999) |

|

|

|

E |

|

|

|

|

|

$ |

|

|||

MM/YY |

MM/YY |

|

|

Wholesale License |

|

(999) |

$ |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

MM/YY |

MM/YY |

|

|

Charitable License |

|

(999) |

|

|

|

|

|

|

|

|

|

$ |

|

|||

|

Mail to and Make Checks Payable to: |

|

|

|

|

|

||||

|

Colorado Department of Revenue |

|

|

|

|

|

|

|||

|

PO Box 17087 |

|

|

|

|

|

|

|

|

|

|

Denver, CO |

|

|

|

Amount Owed |

$ |

|

|||

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same day received by the State. If converted, your check will not be returned. If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from your bank account electronically.

|

|

Points of Compliance |

|||

F |

• Renew sales tax license on |

|

• Sales tax license is only used for wholesale purchase for resale |

||

• Returns filing frequency is based on tax amount |

|

• Sales tax rates may change twice per year |

|||

|

• Required to file, even if zero sales tax due |

|

• Business account closure or address changes by filing DR 1102 |

||

|

|

||||

|

I declare under penalty of perjury in the second degree that the statements made in this application are true and complete to the |

||||

G |

best of my knowledge. |

|

|

|

|

Signature of Owner, Partner, or Corporate Officer |

|

Job Title |

|

Date (MM/DD/YYYY) |

|

|

|

|

|

|

|

|

|

|

|

(See fee and additional information on page 1 of instructions) |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Colorado CR 100 form is used to apply for a sales tax license, W-2 withholding, 1099 withholding, or oil/gas withholding account. |

| Trade Name Registration | Trade names must be registered with the Colorado Secretary of State. This can be completed online at www.sos.state.co.us. |

| Fee Structure | Fees vary based on the type of license. For example, a standard sales tax license costs $16 for a two-year period. |

| Filing Frequency | Filing frequency for sales tax returns depends on the amount of sales tax collected. It can be monthly, quarterly, or annually. |

| Identification Requirements | Applicants must provide valid proof of identification, such as a Colorado driver’s license or a U.S. passport. |

| Processing Time | Mailing the completed CR 100 form may take four to six weeks for processing. An online application can yield a license number the same day. |

| Governing Law | The CR 100 form is governed by the Colorado Revised Statutes related to taxation and business licenses, specifically Title 39 related to tax. |

Guidelines on Utilizing Colorado Cr 100

Completing the Colorado CR 100 form is essential for those looking to establish a sales tax and withholding account in the state. Once filled out, you can submit it either online, via mail, or in person at a service center. The licensing process will allow you to conduct business in compliance with state regulations.

- Determine Your Reason for Filing: Choose whether you are making an original application, changing ownership, or adding a location. Indicate if you already have a Colorado Account Number.

- Select Your Type of Organization: Mark the appropriate box based on your business structure, such as Individual/Sole Proprietor, LLC, Corporation, etc.

- Enter Taxpayer Information: Fill in the name, Social Security Number (or FEIN if applicable), and business name.

- Provide Trade Name: If your business operates under a different name, list it here.

- Prove Your Identity: Attach valid identification proof, which could be a driver's license or passport.

- Principal Address: Provide the physical address of your business in Colorado. Avoid using a P.O. box.

- Mailing Address: If different from your principal address, enter the mailing address where you wish to receive correspondence.

- Email Address: Enter the email for notifications and updates from the Colorado Department of Revenue.

- Business Acquisition Information: If you acquired an existing business, complete the fields related to the prior owner and acquisition date.

- Business Activities: Answer questions regarding the specific activities your business engages in, such as selling alcohol or renting vehicles.

- List Products and Services: Describe the specific products and/or services you provide. This helps in identifying your business sector for tax purposes.

- Owner/Partner Information: List the names, titles, and relevant identification for each owner or partner involved in the business.

- Complete Sections for Sales Tax and Withholding: Based on your business type, indicate whether you need a sales tax license or a withholding account. Fill in frequency and first day of sales or payroll.

- Review and Sign: Ensure that all information is complete, then sign the document, including your title and date.

Once completed, you may submit the application online through MyBizColorado, mail it to the Department of Revenue, or bring it in person to a designated service center. Allow approximately four to six weeks for processing if mailed, or receive an immediate license when applying in person.

What You Should Know About This Form

What is the Colorado CR 100 form?

The Colorado CR 100 form, formally known as the Colorado Sales Tax and Withholding Account Application (CR 0100AP), is used for several purposes. It helps businesses apply for a state sales tax license, a withholding tax account for employees, or to open an oil/gas withholding account. Additionally, the form can be used to add new locations to an existing account within Colorado.

Who needs to

Common mistakes

Filling out the Colorado CR 100 form, which is essential for obtaining various business licenses, can be daunting. Unfortunately, many applicants make common mistakes that can delay the approval process or lead to complications. One significant mistake is failing to provide accurate information about the taxpayer name. If you are applying as a sole proprietor, the name must include the last name followed by the first and middle names or initials. If the business is a partnership or a corporation, the name has to match exactly as registered with the Colorado Secretary of State. Discrepancies can lead to rejection or additional processing time.

Another common error stems from the misunderstandings related to identification requirements. All applicants must submit a valid proof of identification. Failing to include this documentation or submitting an incorrect type, such as a social security number, often causes delays. Remember, if someone other than the business owner submits the form, they need to provide a copy of the ID of the actual owner or authorized signer.

In addition, not selecting the correct type of organization can pose issues. Choosing the wrong box on the form regarding your legal structure — whether it's a sole proprietorship, LLC, or corporation, for instance — can lead to complications. It's essential to carefully review which type reflects your business to ensure compliance with Colorado law.

Many applicants overlook the importance of providing both the physical and mailing addresses correctly. A common error involves using a post office box for the principal address; this is not permitted. If your business is mobile, clarifying that status is important as well. Providing a detailed address ensures prompt communication and accurate placement within the state's records.

Moreover, individuals frequently neglect to specify the nature of their business accurately. When asked about the products and services offered, vague or incomplete responses can hinder the approval process. It's beneficial to provide a comprehensive description, including any relevant codes or classifications, which can assist in determining the appropriate categorization for your business.

Another mistake involves assuming that all licenses will be valid indefinitely. Applicants sometimes forget to note the expiration dates or the renewal requirements for their licenses. Colorado’s sales tax licenses typically need renewal every odd-numbered year, and individuals must remain vigilant about when to file for renewal to avoid any lapses in compliance.

Additionally, when entering the business owner's information, applicants sometimes provide incomplete or incorrect details, such as wrongly entered social security numbers or FEINs. It's vital that this information is accurate because it directly affects the establishment of the account.

Finally, perhaps one of the most avoidable mistakes is not taking the time to review the entirety of the form before submission. Failing to sign the document, or not including a date, may lead to rejection, leaving the prospective business owner in limbo. A thorough check can ensure that all critical elements are completed, which can expedite the approval process.

Learning from these common errors can facilitate a smoother application process for anyone looking to start a business in Colorado. Attention to detail and ensuring accuracy at every step will greatly enhance the likelihood of a successful application.

Documents used along the form

Filing for a Colorado CR 100 form is just the beginning of registering your business for tax-related processes in the state. As you navigate this essential paperwork, several other forms and documents frequently accompany the CR 100. Understanding these can streamline your registration experience and ensure that you remain in compliance with Colorado’s regulations. Here’s a list of key documents you’ll want to be aware of:

- CR 0100AP: This form is used for opening or updating a sales tax or withholding account, essential for tax compliance. It is often submitted alongside or as part of your application when you file the CR 100.

- DR 1002: This document provides details on various sales and use tax rates applicable in Colorado. It helps businesses understand the tax burdens they will incur based on their location and products sold.

- DR 0589: If you plan to sell at special events, this form is mandatory for obtaining a Sales Tax Special Event License. It complements the sales tax registration by covering temporary sales activities.

- 501(c)(3) Documentation: Required for organizations seeking a Charitable License, this IRS form proves your nonprofit status, allowing for specific tax exemptions.

- DR 0100A: This is necessary when an existing business undergoes a change in ownership and needs to register a new license or account under the new structure.

- DR 1102: Use this form to inform the Colorado Department of Revenue of any changes such as account closures or address updates, helping ensure that your business is correctly registered.

- EFT Registration: Businesses needing to remit substantial wage withholdings must register for Electronic Funds Transfer (EFT). This simplifies tax payments and compliance with regulations.

- Business License Application: Depending on your locality, this could be required to legally operate your business in Colorado. It ensures compliance with local regulations in addition to state laws.

- Proof of Identification: Valid identification must be provided when filing various forms, serving as an assurance of identity verification for business owners.

- Taxpayer Identification Number (TIN): This is vital for completing many tax-related forms, particularly for entities requiring an FEIN.

Each of these forms adds a layer of protection, compliance, and clarity to your business operations in Colorado. Be proactive in gathering these documents to avoid delays in your registration process. The sooner you complete your filings, the sooner you can focus on running your business effectively.

Similar forms

- Colorado CR 0100: This form registers a business for a sales tax license in Colorado, similar to the CR 100. Both forms are aimed at ensuring that businesses comply with state tax obligations and provide necessary information about the business's operation and location.

- DR 0589 – Sales Tax Special Event Application: This document is used for businesses conducting sales at special events, paralleling the registration purpose of the CR 100. Just like the CR 100, the DR 0589 gathers critical information needed for tax collection during specific events.

- DR 1102 – Change of Address/Account Closure: This form allows businesses to change their address or close their tax account. Similar to the CR 100, it facilitates updates to a business's information within the Colorado Department of Revenue system.

- CR 100A – Colorado State Sales Tax License Renewal: This is essential for current license holders needing to maintain compliance. It mirrors the CR 100 by requiring updated business information and ensuring that the business continues to meet regulatory standards.

- DR 0200 – Sales Tax Exemption Certificate: This form enables certain businesses to apply for sales tax exemptions. Like the CR 100, it addresses specific scenarios concerning tax obligations and compliance within the Colorado tax system.

Dos and Don'ts

- Do verify that you have the correct form, CR 0100AP, for your application.

- Do complete all required fields accurately.

- Do provide valid identification as specified, such as a Colorado Driver’s License or Passport.

- Do use the legal name of your business as filed with the Colorado Secretary of State.

- Do make a copy of the completed form for your records before mailing.

- Don't enter a Social Security number where it is not required.

- Don't use a Post Office box for your principal address; provide a physical address instead.

- Don't forget to sign the application. An unsigned form will not be processed.

- Don't submit incomplete applications. Ensure all relevant sections are filled out correctly.

Misconceptions

Many people hold incorrect beliefs about the Colorado CR 100 form. It’s important to clarify these misconceptions to ensure proper understanding and compliance. Here are six common misconceptions:

- The CR 100 form is only for new businesses. Some think this form is exclusively for startups. In reality, it’s also used for existing businesses that undergo changes, such as a change of ownership or adding a new location.

- Trade names must be registered on the CR 100 form. While some believe they need to register their trade name here, trade names should actually be registered with the Colorado Secretary of State, not on the CR 100 form itself.

- Every business needs a sales tax license. Not all businesses require a sales tax license. Businesses that exclusively sell exempt items or services, for example, do not need a license.

- The CR 100 form guarantees immediate processing. Many expect quick processing upon submission. However, processing can take four to six weeks if mailed, or longer depending on other factors.

- A deposit for sales tax licenses is required for all locations. Some individuals think they need to pay a deposit for every business location, but the deposit is only necessary for the first location when using the same account number.

- You don't need to provide identification if applying by mail. Another misconception is that valid identification isn’t necessary when submitting by mail. However, all applicants must provide proof of identification, regardless of their submission method.

Key takeaways

The CR 100 form is essential for opening sales tax and withholding accounts in Colorado. It can also be used to add locations to existing accounts.

Applications can be submitted online through MyBizColorado for quicker processing. This option typically provides a same-day license number.

If applying by mail, send the completed form to the Colorado Department of Revenue and allow four to six weeks for processing.

Those opting for in-person application at a service center can receive their license immediately upon submission, along with the required fees.

Ensure that full identification proof is included. This may range from a driver’s license to a passport, depending on the applicant's status.

The application fee for a retail sales tax license can vary depending on the time of year it is filed, with rates being lower in odd-numbered years.

Businesses must indicate the type of establishment and the appropriate sales tax treatment on the form. Different licenses pertain to wholesale or retail operations.

Be aware that all licenses are valid until December 31 of each odd-numbered year, at which point renewals are required.

Licensing is non-transferable, meaning if a business changes ownership, a new application must be submitted.

Browse Other Templates

Schwab Simple Ira - Authorized signatures and dates are critical components of the form to finalize the process.

Quest Transport Tube - Gray tubes with sodium fluoride are primarily used for glucose testing and preventing glycolysis.

G 28 - The form serves both the attorney's interests and the represented party’s rights during proceedings.